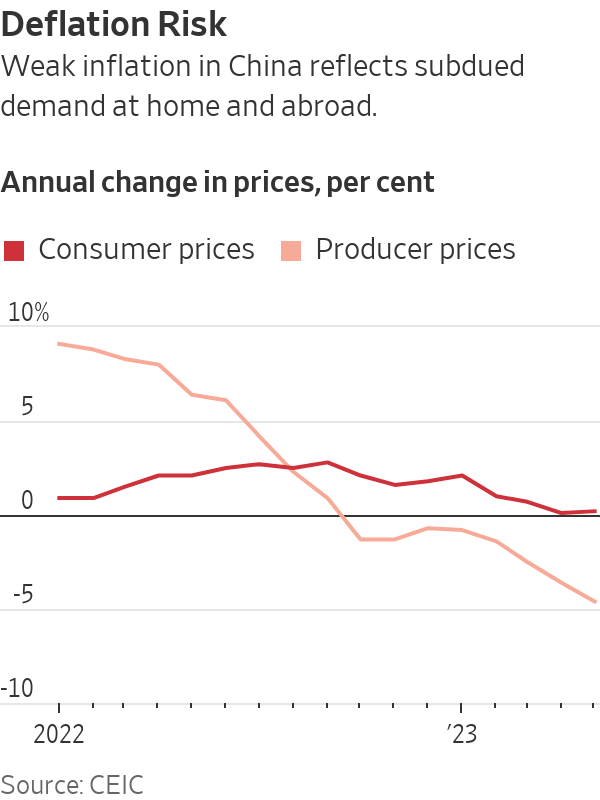

China’s Inflation Problem? It Has None

Falling prices at the factory gate and subdued increases in the costs of consumer goods contrast with searing inflation in many countries

SINGAPORE—As Western central banks continue to jack up interest rates in an effort to douse stubbornly high inflation, China faces a growing risk of the opposite problem—deflation.

Prices charged by Chinese factories tumbled in May at their steepest annual pace in seven years, while consumer prices barely budged, fresh signs of the challenges faced by the world’s second-largest economy both at home and abroad.

Economists say the absence of inflationary pressure means China could experience a spell of deflation—a widespread fall in prices—if the economy doesn’t pick up soon.

Persistent deflation tends to throttle growth and can be difficult to escape. While a prolonged period of falling prices probably isn’t in the cards, Chinese policy makers will nonetheless need to do more to stave off that risk and get the economy motoring again, economists say, perhaps by trimming interest rates, weakening the currency or offering cash or other spending inducements to households and businesses.

Ting Lu, chief China economist at Nomura in Hong Kong, said in a note to clients Friday that he expects local banks to cut key lending rates as soon as next week.

In remarks made at a meeting Wednesday and published by China’s central bank after the release of monthly inflation data Friday, central-bank Gov. Yi Gang said he expects consumer-price inflation to edge up in the second half of the year and exceed 1% in December. He said the People’s Bank of China would use its tools to support the economy and promote employment.

Falling prices in China aren’t necessarily bad news for the global economy, as lower costs to import Chinese goods should help bring down inflation rates that for many economies are still uncomfortably high.

“In a sense, China is already exporting deflation to the world,” said Carlos Casanova, senior Asia economist at Union Bancaire Privée in Hong Kong. That could help ease the pressure on the U.S. Federal Reserve and other central banks that are battling to bring down inflation, he said.

China’s producer prices—what companies charge at the factory gate—fell 4.6% from a year earlier in May, the weakest reading since early 2016 and the eighth straight month of declines.

Consumer prices rose just 0.2%, China’s National Bureau of Statistics said Friday, slightly higher than the 0.1% annual gain recorded in April but still well below the 3% ceiling for annual inflation set by the government and central bank.

In the U.S., consumer-price inflation in April slowed to a 4.9% annual rate, but that was still more than double the Federal Reserve’s 2% goal. In the 20 nations that use the euro, annual inflation was 6.1% in May.

After soaring last year in the wake of Russia’s invasion of Ukraine, prices of crude oil, food and some other commodities have pulled back, partly leading to China’s subdued inflation.

But also behind China’s predicament, which stands in contrast to the experience of most other economies as they emerged from the Covid-19 pandemic, is a shortfall in spending both domestically and from overseas.

Chinese factories are cutting prices because foreigners aren’t buying their goods with the same gusto as before central banks started ratcheting up borrowing costs. A hoped for consumer spending binge that was supposed to propel growth in China hasn’t materialised. Real estate is in the doldrums, crushing investment.

Western policy makers and economists are exploring whether fat corporate profit margins are stoking inflation in their economies. In China, industrial profits are sinking.

The inflation data adds to a string of disappointing signals on the strength of China’s recovery, which had been expected to power global growth this year after Beijing ditched its draconian Covid controls at the close of 2022.

Chinese exports fell in May from a year earlier, the first annual decline in overseas shipments in three months. Business surveys showed factory activity shrank in May and services-sector activity softened. More than a fifth of young people are unemployed.

Still, most economists think China will meet or exceed the government’s goal of growing the economy by 5% or more this year, given the weak base of comparison with 2022, when sporadic lockdowns in major cities hammered the economy.

Zichun Huang, China economist at Capital Economics, said she doesn’t think China will experience broad deflation and expects consumer price growth to pick up in the coming months thanks to support from policy makers and an improving labor market.

—Grace Zhu in Beijing contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Gargash Group has partnered with Adyen to upgrade its payment ecosystem, with the solution now live at Sixt UAE, enabling seamless and secure transactions across channels. The unified platform boosts efficiency, transparency, and reporting accuracy, supporting the group’s push toward scalable, future-ready operations.

While many Americans feel pessimistic about the economy, a small but vocal minority remains optimistic — not because of perfect conditions, but because of mindset. From immigrants who built wealth from scratch to entrepreneurs leveraging AI and investing, these optimists credit personal agency, adaptability and long-term thinking — not headlines — for their confidence in the future.

Saudi Venture Capital Company (SVC) has launched Aian, an AI-powered intelligence platform designed to enhance transparency, data integrity and decision-making across Saudi Arabia’s private capital ecosystem.

Oil prices jumped as Middle East tensions escalated, with Brent briefly topping $80 amid fears of supply disruption. Brent traded near $79 and WTI above $72, with analysts warning prolonged instability could push prices toward $100 despite planned OPEC+ output hikes.

Oil prices spiked early Monday with Brent crude briefly hitting $80 a barrel as the conflict in the Middle East widened and escalated.

Israel launched strikes on Hezbollah targets in Lebanon after the Iran-backed militant group fired its own rockets overnight in retaliation over the death of Iran’s Supreme Leader Ali Khamenei, The Wall Street Journal reported.

Brent crude futures BRN00 +7.68% were trading at $79.23 a barrel, up 8.8% from Friday’s close. Earlier on Monday, Brent futures climbed to over $82 a barrel.

West Texas Intermediate futures WBS00 +6.11% rose 7.9% to $72.32 a barrel. WTI also pared back some earlier gains, when futures hit $75.33.

Missile strikes continued into a third day Monday as the escalation threatened global oil supply. Saudi Aramco’s Ras Tanura oil refinery was partially closed after being hit by debris following the interception of two drones, Saudi Press Agency reported, citing a source at the Ministry of Energy.

It added that some units were shut down as a precautionary measure “without any impact on the supply of petroleum.” However, the damage done by Iranian drones is a warning of the potential disruption to oil markets.

The Strait of Hormuz, a vital maritime chokepoint that transports roughly 20% of the world’s oil, is effectively closed amid the conflict. Iran has reportedly said ships are “not allowed” to pass through it, while insurers have vowed to cancel policies for tanker who do.

If the strait remains closed for a prolonged period, $100 a barrel could soon be a reality.

The OPEC+ cartel of oil-producing nations agreed to hike output by 206,000 barrels a day from April, following a virtual meeting on Sunday.

The organization, which includes Saudi Arabia, U.A.E. and Russia among others, did not reference the conflict in its statement but said it will “continue to closely monitor and assess market conditions.”

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

New research suggests that bonuses make employees feel more like a mere cog in a wheel.

Memories of 2008 are fading — but as crypto and prediction markets grow with limited oversight, some warn the next crisis may already be taking shape.

Fewer than 20 years have passed since the 2008-09 global financial crisis, but the memory of the disaster is fading fast. Even the language we use today to describe it betrays our forgetfulness; the devolutions of that troubled time are usually remembered, generically, as “the financial crisis,” as if there hadn’t been any other financial crises in America’s past from which the most recent one needed to be distinguished. But the record of the dark days that followed the collapse of Bear Stearns and Lehman Brothers is still there for anyone to read.

I witnessed the fallout from the 2008 market collapse from within the Commodity Futures Trading Commission, one of the federal government agencies tasked with preventing such disasters. I fear now that the CFTC and its sister agency, the Securities and Exchange Commission, aren’t paying close enough attention to similar vulnerabilities that exist in financial markets today. I worry regulators within those agencies have forgotten the lessons we learned in 2008 and the panic that paralyzed the world at the time.

The introduction into mainstream finance of exotic assets like cryptocurrencies and options traded on prediction markets should recall the 2008-09 financial crisis to the minds of bankers, asset managers, lawyers, and politicians who were there to witness it. So should the absence of meaningful regulatory oversight of those assets. Taken together, the increasing market presence of untested financial instruments and the lack of will to police them has set the stage for another financial crisis.

One of the primary catalysts of the 2008-09 financial crisis was a complicated financial product called mortgage-backed securities, in which risky home loans were repackaged and resold to passive investors. At the time, MBS were lightly regulated and not well understood, but their reach was global. Banks, investment funds, governments, and insurance companies bought them by the fistful. When homeowners defaulted on their mortgages, MBS investors were brought down with them.

There were other casualties tied to the fate of mortgages in the less-well-understood byways of the financial system, such as the over-the-counter market for credit default swaps. CDS are basically insurance policies for investors who buy bonds, which is what a MBS is. Someone who wanted protection against a default on their MBS paid a regular premium to a seller of CDS. In return for the premium, the CDS seller agreed to reimburse the CDS buyer the value of the MBS if and when it defaults.

But like an insurance company, if a CDS seller has many claims to pay and not enough money to pay them, it becomes insolvent. That’s what happened to American International Group in 2008. Shortly after Lehman folded, AIG found itself obligated to pay, all at once, the parties to whom it had sold CDS on MBS. But AIG was about $12 billion short of the necessary cash.

What was most startling was that no one saw this coming. CDS, like MBS, weren’t regulated by the financial regulators at the time AIG went under. No one in a position to insist on safeguards actually knew how they would perform under stress.

There are clear corollaries between then and now. Despite the increasing popularity of cryptocurrencies and prediction markets, both are still largely unregulated. The CFTC, which until recently had the lion’s share of the regulatory authority over these assets, has become muted over the past 13 months.

In 2024, the CFTC’s Enforcement Division brought 58 enforcement actions. That number dwindled to 13 in 2025. Many ongoing crypto investigations have been closed without any claims being filed, and CFTC management appears to be discouraging new crypto investigations. From what I gather from discussions with my former colleagues at the CFTC, staff members who managed to survive the multiple rounds of layoffs that occurred in 2025 got the message: Even modest efforts to regulate burgeoning digital asset or prediction markets could cost you your job.

Also like MBS and CDS, new financial assets have begun to interlock in odd, hard-to-understand ways with traditional financial products. Crypto and other digital assets are now being tied into agricultural futures and options contracts, for example. Agricultural futures and options are often used by farmers in the real economy to ensure a predictable cash flow from the sale of their crops. In a paper released on Feb. 6, the CFTC affirmed its approval of the use of “stablecoins and other non-securities digital assets as customer margin collateral” for traditional derivatives transactions, including agricultural futures and options.

Margin collateral is the amount of money brokerage customers must give their broker to guarantee that the customers are able to pay for their losing trades. Customer margin, in turn, protects not only the counterparty to a trade, but also financial institutions. If a customer’s trading losses are insufficiently collateralized, they can harm the brokerage firms where the trades are executed and, at a higher level, the clearinghouses whose primary purpose is to ensure the stability and solvency of the derivatives markets. The fates of farmers, investment managers, banks and governments are indirectly tethered to the quality of the assets held as margin by brokerage and clearing firms.

With their long history of trading and regulation, the performance of traditional financial products like agricultural futures contracts is as predictable as any market performance can be. By contrast, the lack of meaningful historical data on, and regulatory oversight of, digital assets and prediction markets makes their potential knock-on effects in the greater economy a vast unknown.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

The global Islamic fintech market is set to reach $341bn by 2029, growing 11.5% annually, led by strong GCC momentum. Saudi Arabia, the UAE, Kuwait and Qatar rank among the top markets, with Saudi Arabia projected to hit $120.9bn by 2029.

The global Islamic fintech market is forecast to reach $341 billion by 2029, driven by rising appetite for digital assets and robust activity in the Middle East.

The sector, valued at $198 billion in 2024/25 in terms of transaction volume, is poised to grow at an annual rate of 11.5%, according to US-based DinarStandard and UK-based Elipses, both advisory firms that conducted a study on Islamic fintech in partnership with the Qatar Financial Centre and the Islamic Development Bank Institute (IsDBI).

The market is dominated by several countries in the Gulf Cooperation Council (GCC) region, including Saudi Arabia, the UAE, Kuwait and Qatar, which are among the top 10 Islamic fintech markets.

These countries, along with their global peers like Malaysia, Indonesia, Iran, Turkey, Bangladesh and Pakistan together control 93% of the total global Islamic fintech market.

Within the GCC, Saudi Arabia ranks first with an estimated market size of $77.2 billion, which is forecast to reach $120.9 billion in 2029; followed by the UAE with a market size of $10.5 billion that is projected to hit $15.6 billion.

Kuwait’s $8.9 billion market is expected to grow to $16.8 billion, while Qatar’s $3.1 billion is likely to rise to $4.8 billion by 2029.

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

Parts for iPhones to cost more owing to surging demand from AI companies.

Gargash Group has partnered with Adyen to upgrade its payment ecosystem, with the solution now live at Sixt UAE, enabling seamless and secure transactions across channels. The unified platform boosts efficiency, transparency, and reporting accuracy, supporting the group’s push toward scalable, future-ready operations.

Taking a strategic step forward in its digital evolution, Gargash Group has partnered with Adyen, the global financial technology platform for leading businesses, to enhance its payment ecosystem. The partnership was officially announced during a signing ceremony at the Mercedes-Benz Brand Center in Dubai Design District, reinforcing Gargash Group’s commitment to adopting advanced technologies that elevate customer experience while empowering employees and partners.

As the first phase of this collaboration, Adyen’s payment solution has been successfully implemented at Sixt UAE, part of the Gargash Group portfolio. The new system delivers a seamless, secure, and frictionless payment experience across online, in-store, and mobile channels, supporting a wide range of transactions, including deposit payments, pre authorizations, chargebacks, refunds, fines, and toll payments, while providing complete control and oversight of all activities.

Since its implementation, the solution has achieved meaningful operational improvements. Staff now spend significantly less time on repetitive payment tasks, allowing them to focus on higher-value activities. The centralized platform provides a 360-degree view of transactions, improving data quality, reporting, and reconciliation accuracy, while enhanced control and audit capabilities increase transparency, security, and accountability.

This strategic partnership with Adyen marks a key milestone in Gargash Group’s ongoing digital transformation efforts. The group continues to invest in technology – from deploying OpenAI for Enterprise and introducing a cutting-edge retail audit platform, to expanding its enterprise-grade productivity and project management capabilities and hosting an AI hackathon for the local community. Together, these initiatives reflect a proactive approach to innovation and sustaining competitive advantage in an evolving market landscape.

Walid Hizaoui, Group Chief Strategy Officer at Gargash Group, said: “This partnership with Adyen reflects our broader digital transformation agenda, focused on driving operational efficiency through automation, stronger systems, and data integrity at scale. By investing in the right infrastructure, we are streamlining processes, enhancing accuracy, and building a connected ecosystem powered by reliable data. It is a deliberate step in advancing our AI and digital capabilities while reinforcing scalable, future-ready operations across the group”.

Daumantas Grigaravicius, Head of Middle East, Adyen, said: “In the automotive sector, payments are often high-value and operationally complex – from deposits and pre-authorizations to refunds and reconciliations. Gargash Group recognized the need for a more connected and transparent approach. By unifying these processes on a single platform, we’re helping reduce friction, improve control, and create a smoother experience for both customers and teams. This is about enabling innovation behind the scenes, so the buying journey feels seamless from start to finish.”

Building on this success, Gargash Group is evaluating the phased expansion of Adyen’s platform across additional business lines within the group. Future initiatives under consideration include enhanced POS integration to support pre-authorization payments, as well as greater automation of fines, toll processing, and reconciliation to further streamline operations and strengthen financial oversight.

With a strong focus on governance, sustainable partnerships, Emiratization, digital enablement, and community engagement, the Group continues to align its operations with the UAE’s broader sustainability and economic development goals. By embedding technology, efficiency, and social impact into its business strategy, Gargash Group is building a resilient, forward-looking enterprise designed to create lasting value for stakeholders and the wider community.

New research suggests that bonuses make employees feel more like a mere cog in a wheel.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

While many Americans feel pessimistic about the economy, a small but vocal minority remains optimistic — not because of perfect conditions, but because of mindset. From immigrants who built wealth from scratch to entrepreneurs leveraging AI and investing, these optimists credit personal agency, adaptability and long-term thinking — not headlines — for their confidence in the future.

Americans offer plenty of reasons for pessimism about the economy. Housing is expensive, and home-owning is often out of reach. A college degree doesn’t carry the competitive edge it once did. Many believe hard work isn’t rewarded as it once was.

One group of Americans isn’t buying it.

They are the economic optimists, a breed that polling shows to be a distinct minority amid the pervasive pessimism. They feel the same forces as the pessimists—housing and grocery prices are rising for many of them, too.

But when The Wall Street Journal asked its readers to write to us about their views of the economy, many of the 1,800 responses included a surprising answer from the optimists. Their upbeat outlook didn’t rest primarily on having the financial resources to handle inflation or other turbulence in the economy. Few cited the macroeconomic data that shows the economy to be robust by traditional measures.

Instead, they cited their internal resources: a sense of personal agency or independence—often gained by facing tough life challenges—that allows them to handle uncertainty.

Among all Americans, some 77% have pessimistic views of the economy, leaving fewer than one-quarter with an upbeat outlook, polling by the Journal and NORC, a research group, found last year. The optimists tend to be male, older, married and Republican, the survey found. And while those in the highest income range are more likely to be optimistic, being middle income or having a bachelor’s degree isn’t much of a signifier of optimism or pessimism.

Here’s what Journal readers told us about how they became optimists.

When Rossana Ivanova came to the U.S. from communist Bulgaria, she didn’t know what stocks and bonds were, or the difference between interest and capital gains. She had never filed a tax return. “In our world, there were not tax returns,” she said. “You get your salary from the state, and if you had other income it was illegal.” Her grandparents, she said, got in trouble for selling honey from their beehives to make extra money.

Leaving Bulgaria after the Berlin Wall fell, at age 29, she and her physicist husband first lived in France—he had only $10 when he arrived—then Canada, where she became a receptionist and taught herself to type after work hours. A few jobs later, the couple moved to the U.S., where Ivanova took jobs handling grants and fundraising for various nonprofits, a role she still fills part time. Along the way, she and her husband saved consistently for their daughter’s education—for which they also borrowed heavily—and for retirement.

Today, they live near a nature reserve, where lately they have been snowshoeing. Ivanova’s husband is retired, and the couple enjoys taking motorcycle trips. Their daughter has an M.B.A. and a daughter of her own. “We have a totally middle-class, 1,800-square-foot house. One-car garage,” she said. “We feel really rich, because we are so happy with what we achieved.” The couple lives on about $120,000 annually, drawn from retirement savings, Social Security and Ivanova’s part-time job.

Ivanova said her optimism comes from the perspective of moving to a free-market economy. “I believe in personal agency and personal responsibility in choosing the path that will bring you to success,” she said. “In America, you don’t need to be a genius or very lucky or a star. You just need to work hard, apply yourself, live within your means, and you’ll be OK. In socialism, that isn’t the case. They’ll push you down.”

Mark Myshatyn uses his 3-D printer to create things he needs around the home, such as a light diffuser for photography. When he needed a steel bracket for a household chore, he designed one and sent the plans to Sendcutsend, an on-demand manufacturer, which quickly turned it into a physical product.

But he’s thinking bigger. To help his 3-year-old son with a medical challenge, he invented a product that makes it easier to travel with temperature-sensitive medication. A patent is pending, he said.

The ability to create new things is the root of his optimism. “We have a lot of headwinds and challenges as an economy. But if you want to make your own opportunity, it’s never been easier,” he said. “As an average consumer, I have access to rapid prototyping equipment that costs millions of dollars and takes specialty training to operate.”

And he is enthusiastic about artificial intelligence. “The advent of consumer AI platforms is a chance to put an expert-level sidekick on your computer or phone, 24/7,” he said.

“We as Americans have always prioritized ‘Go build something,’ make something of yourself. And there are more tools available today than ever before,” said Myshatyn, who said his income places him among the top 5% of New Mexico residents. “You don’t need access to deep financing to stand up the tooling for your factory. You don’t have to hire a fleet of lawyers to incorporate your LLC. It’s very easy to learn the skills that you need to learn.”

Zhengbang Liu was working at an Apple store to make money for college when he struck up a friendship with a frequent customer, a stockbroker who worked across the street. Liu taught him about Apple products; the broker, who was in his 70s, taught Liu about high-tech stocks such as Nvidia, which hadn’t yet entered the AI space.

Liu was hooked.

Today, Liu is a stockbroker—and a market evangelist. He insists on showing off a spreadsheet he created that shows how investing $10,000 a year, starting at age 25, can grow into $4.4 million by age 65.

“I want the whole world, especially young people, to see this spreadsheet,” he said, his voice rising with enthusiasm. “The more people understand the concept we’re looking at here, the more I’m willing to bet that they will be optimistic about their future.”

Liu believes that compound interest and the financial markets create opportunities for anyone. An immigrant from China who arrived at age 7, he worked a minimum-wage job as a grocery-bagger in high school and went to college on a state scholarship. “I was never a straight-A student. I was never one that excelled,” he said. “I didn’t start at the starting line—I was 100 yards behind the starting line.”

But a good attitude carried him, along with an aversion to social media. (“It just sets very high expectations and it’s very different than reality,” he said.) So does his amazement that someone like himself can make a living through long-term investing and helping others to do so. Last year, he said, he earned about $550,000. “You’ve got to make the best of what you’re given, and that’s what has defined me over the years,” he said.

Branden Alsbach is carrying about $40,000 in debt from the bachelor’s degree he earned in 2021 and his master’s in industrial pharmacy. He knows the economy has changed since his parents started their careers: His father earned a pension early on, a rarity these days.

“A college degree used to be much more competitive in the job market,” he said.

But he doesn’t agree that his generation has it harder than those before it. “Things have been changing, but I don’t think it means you have no more options any more. It may feel that way. But every single generation is going to have to adapt and carve out its own path,” he said.

Alsbach said he can’t do anything about housing prices, but he has the ability to focus on what he can control. “My budget is something that I can control very tightly. How hard I work in my career, I can control very tightly,” he said. He said he earns about $65,000 a year, before bonus, as a research associate.

“I think what makes me more optimistic is that I’m trying to be pragmatic about the economy,” he said. “You’re the captain of your own ship. I guess you could sit and wait for it to sink, but I don’t see the point of that. You have to sail the high seas.”

Gary Durst dropped out of college after three weeks and enlisted as a Marine. Twenty-five years later, he left the military as an Air Force major with a master’s degree, a record as a logistics officer and a set of skills that serve him well in the private sector.

He credits his parents, neither of whom went to college, and the military for giving him a strong sense of self-control. “If you’re a young person who’s physically fit and have a basically sound mind, the Marine Corps will teach you things about yourself that will let you succeed and go anywhere you want to go,” he said.

He has always been strategic in pursuing education, getting the degrees and certifications most likely to help his career. “I appreciate art history as much as anyone else, but I’m not going to pay an art historian a lot of money to put a roof on my house,” he said.

Durst, who now earns about $275,000 annually before bonus at one of the nation’s big consulting firms, said the military also gave him a helpful perspective on the nation. “Are there people who have it rough? You bet. But there is no place on the planet Earth, and no better time in history, than to be in the United States of America in 2026,” he said. “Period.”

“If you watch the news, you’d believe America is in chaos right now,” he said. “But if you didn’t turn on the TV for a week and focused on your family and on learning something new and your community, you’d find that life is pretty good.”

New research suggests that bonuses make employees feel more like a mere cog in a wheel.

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Saudi Venture Capital Company (SVC) has launched Aian, an AI-powered intelligence platform designed to enhance transparency, data integrity and decision-making across Saudi Arabia’s private capital ecosystem.

Saudi Venture Capital Company (SVC) has announced the launch of Aian, a pioneering proprietary intelligence platform that further strengthens SVC’s role as a market maker for Saudi Arabia’s private capital ecosystem.

Aian is a custom-built AI market-intelligence capability, developed internally with Saudi national expertise, that transforms SVC’s unmatched private market data and deep institutional knowledge into timely, structured insight on market dynamics, sector evolution, and capital formation.

As a cognitive institutional capability, it converts institutional memory into compounding intelligence, ensuring decisions reflect both current market signals and long-term historical insight.

Nora Alsarhan, Deputy CEO and Chief Investment Officer of SVC, said: “As Saudi Arabia’s private capital market scales, clarity, transparency, and data integrity become as critical as capital itself. Aian represents a new layer of national market infrastructure, strengthening institutional confidence, enabling evidence-based decision-making, and supporting sustainable growth. By transforming data into actionable intelligence, Aian reinforces the Kingdom’s position as a leading regional private-capital hub under Vision 2030.”

Alsarhan said: “Market making is not only about deploying capital; it is about shaping the conditions in which capital flows efficiently. The next phase of market development will be driven by intelligence, not just investment. With Aian, we are building the data backbone of Saudi Arabia’s private capital ecosystem allowing us to see the market with clarity, act with precision, and ensure capital formation is guided by insight, not assumption.”

Athary Almubarak, SVC’s Chief Strategy Officer, said: “In private capital markets, access to capital is rarely the binding constraint. Access to reliable insight increasingly is. This is particularly true in emerging and fast-scaling markets, where transactions are reported inconsistently, and institutional knowledge is fragmented across organizations and individuals.”

Almubarak said: “For Development Finance Institutions operating in private capital markets, the lack of clear, consistent data is a structural challenge. It directly affects capital allocation efficiency and the ability to crowd in private investment at scale.”

“SVC was established precisely to address these market frictions. As a government-backed investor with an explicit market-making mandate, our role extends beyond capital deployment to shaping the conditions under which private capital can grow sustainably,” he added.

By integrating SVC’s proprietary portfolio data with selected external market sources, Aian enables continuous consolidation and validation of market activity. The platform produces a living representation of the market that reflects how capital is actually deployed over time, rather than how it may be imperfectly reported at any single moment.

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

Interior designer Thomas Hamel on where it goes wrong in so many homes.

U.S. inflation has eased to 2.5% while unemployment holds at 4.3%, bringing the economy closer to a long-sought soft landing, though the Federal Reserve remains cautious as tariff pressures and resilient consumer spending could keep inflation above its 2% target.

The vital signs of the American economy are pointing in the same, favorable direction more convincingly than at any point since before the pandemic. Inflation is falling. The labor market is holding. Growth has been solid.

It is a snapshot, not a verdict—but it is the closest the economy has come to achieving a soft landing, a moderation in inflation without recession. Just four years ago, many economists said that was impossible. This past April, as the economy closed in on a soft landing, steep tariffs had forecasters bracing for a new surge in inflation.

Now, it again looks plausible that inflation could return to the Federal Reserve’s 2% goal without a recession.

Friday’s inflation report showed so-called core prices, which strip out volatile food and energy costs, rose 2.5% in January from a year earlier—the lowest since the pandemic price surge began in 2021. While that number has been held down artificially by a data gap from last fall’s government shutdown, it nonetheless showed less of the start-of-the-year price pressure that tripped up the falling-inflation story in each of the past three years.

Meanwhile, separate data Wednesday showed the unemployment rate ticked down to 4.3% in January, with employers adding a larger-than-anticipated 130,000 jobs.

“The worst calamity that everyone had in mind didn’t happen,” said Jeffrey Cleveland, chief economist at Payden & Rygel. “People would say to me, ‘The only way you’ll get to 2% inflation is the unemployment rate has to spike.’”

Even if oxygen masks weren’t needed, it is too soon to remove the seat belts. Core prices as measured by the Fed’s preferred inflation gauge, which differs from the consumer-price index released Friday, are rising nearly 3%, up from the recent low of 2.6% recorded this past April and well above the 2% target. Several forecasters expect little progress this year as tariff-related price increases work their way from ports to store shelves.

Fed officials worry less that inflation will surge again than that it will stall at recent levels.

“You’re not going to get me to declare victory on ‘soft landing,’” said Anna Paulson, the president of the Philadelphia Fed, in an interview last month. “Inflation needs to be at 2%. So we haven’t finished the job.” Her forecast pencils in monthly inflation readings consistent with 2% by year’s end.

The labor market, meanwhile, might be less sturdy than the report this past week suggested. Annual revisions showed the economy added an average of 15,000 jobs a month in all of 2025, lower than in almost any year outside of recessions since World War II. Job growth has been narrowly concentrated in healthcare and education.

“The labor market has been objectively weak,” said Cleveland. He added that the unemployment rate is more likely to rise than fall this year and that core inflation, using the Fed’s preferred gauge, will drop to 2.1% by year-end.

Unemployment has been stable because even though employers aren’t adding many workers, they aren’t cutting many either. It wouldn’t take much to shatter that fragile equilibrium.

Another risk is that household wealth has been buoyed by years of equity gains, and a sustained selloff could cause consumers to pull back, undermining an engine of economic growth.

Others think the bigger risk to the soft landing comes not from the labor market but from resilient consumers keeping inflation stuck above 2%.

“I’m a little nervous about the whole soft landing here because households are overall in good financial shape,” said Marc Giannoni, chief U.S. economist at Barclays. “Wealth has gone up pretty much across the board.” Giannoni sees unemployment decreasing to 4% this year with inflation holding around 2.8%—the mirror image of Cleveland’s forecast.

He said the popular narrative of a K-shaped economy in which wealthy households drive disproportionate growth in spending, masking broader fragilities among savings-depleted, lower-income consumers, has been exaggerated. That is good news for the expansion. It is less good news for getting inflation back to 2%.

Capital spending on AI contributed nearly a full percentage point to economic output last year and could do so again this year, said Daleep Singh, chief global economist at PGIM Fixed Income.

Fiscal policy might add another tailwind. Ahead of this fall’s midterm elections, the Trump administration has reason to pursue expansive fiscal policies and to be more careful about trade actions that, after steep tariff increases this past April, added to the cost-of-living pressures the president had promised to fix, said Singh, a former economic adviser to President Joe Biden. He sees inflation ending the year at around 3%.

A closer look at Friday’s report revealed inflation challenges lurking under the surface. Shelter costs, which had been the single largest driver of elevated inflation in recent years, have finally cooled meaningfully.

But prices for services outside of housing remained firm, and tariff-sensitive goods prices accelerated. Stripping out used cars, core-goods prices rose at a 4.4% annualized rate in January, the fastest pace in three years. Analysts said that report also suggested that automakers, who absorbed tariff-related costs throughout 2025, passed more of them along to buyers.

Parts for iPhones to cost more owing to surging demand from AI companies.

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

Alphabet’s 100-year bond may sound futuristic, but the real risks aren’t about the 22nd century — they’re about AI spending, rising Big Tech debt, and investor appetite today. As money flows into the sector, the question isn’t whether Google will exist in 100 years, but whether its AI bet will pay off long before then.

Lending money to Alphabet for a century might seem to raise some serious questions. Will we still use Google to search the internet in the 22nd century? Will the internet even exist? Will America make it to its 350th birthday?

In fact these are risks investors in the rare century bond issued on Tuesday can safely ignore, thanks to the mathematics of bonds (more on that later). The risks investors should be focused on are more mundane, but also closer to hand: The prospects for artificial intelligence, the increasing debt load of Big Tech and the risks that come with joining a crowd throwing money at a fashionable industry.

Start with the crowd. Century bonds get issued when money is easy. The first wave came in the mid to late 1990s, when companies had a lower yield compared with safe Treasurys than any time since. Coca-Cola issued the last of these 100-year bonds in May 1998, not long after the last technology 100-year issue, from Motorola. The cost of corporate debt compared with Treasurys jumped after hedge fund Long-Term Capital Management imploded.

The second wave came when money was actually free during the period of zero interest rates. Austria managed to issue zero-coupon 100-year bonds in 2020, while in the late 2010s investors started by lending to universities and Mexico, but eventually were willing to lend for 100 years to flaky sovereigns including Argentina, attracted by what seemed like high yields compared with earning nothing on cash.

It didn’t end well, with Argentina defaulting after just three years and Austria’s bonds now worth just 5% of what they were worth at issue, as zero rates proved temporary.

We’ll have to wait to see if Alphabet’s GOOGLE -2.39%decrease; red down pointing triangle sterling century bond yielding 6.05% is the harbinger of another wave of issues, but it is certainly tapping the markets when money is cheap for companies.

The spread of corporate yields over Treasurys last month hit the lowest since just after Coke’s 1998 bond, amid strong demand for the safety of high-quality issuers. This is a great time for companies to borrow; it isn’t obviously a great time to lend to them.

Ordinary credit risks are easy to dismiss for Alphabet. It is sitting on $126 billion of cash and marketable securities, borrows less than half that and is rated AA+. That doesn’t mean its debt is safe for investors, though, because Alphabet is engaged in a race to spend as much as possible as fast as possible on AI.

Alphabet’s AI chatbot, Gemini, has proved popular, but is up against OpenAI’s ChatGPT, Anthropic’s Claude, Chinese developers and others to grab market share—and this is before it is able to charge anything like the cost of running it to customers.

The business model of AI remains, to be polite, in flux. If businesses and individuals eventually prefer low-cost open-source AI models, or demand collapses when prices are raised to cover costs, all the current leaders might suffer.

Alternatively, if one proves far better than the others it might grab most of the market, as Google did with search engines. For Alphabet, there’s also the danger that AI replaces traditional web search, undermining its core cash engine.

If it goes wrong, the wasted cash will mostly be a problem for shareholders. But bondholders are still exposed, as less of a cash cushion means weaker credit quality, and higher yields.

The final risk is the borrowing to come. Big Tech firms are pouring cash into AI and data centers, and raising hundreds of billions of dollars in debt to finance them. As well as changing the nature of the companies from capital-light software toward capital-heavy AI infrastructure providers, it will test the willingness of lenders.

Alphabet’s oversubscribed issue shows that for now investors are quite happy to finance its AI spending spree, but as the industry borrows more, it may hit a limit and lift yields across the tech sector.

Back to the mathematics. Investors know that what matters isn’t whether they will get their money back in 100 years’ time, but the interest payments over the next few decades. The final payment of principal, if it happens, will be just 0.28% of the present value of all the payments Alphabet is promising on the bonds. They should behave very like a conventional 40-year bond, available from tech companies including Oracle, Cisco Systems, Intel and Apple in recent years.

One way bond investors measure risk is duration, the time it takes for a bond to pay back the original investment. For Alphabet’s 100-year bond, that’s just under 17 years. If it was a 40-year bond with the same terms, it would still be more than 15 years, not a huge difference.

We should know long before then if Alphabet’s heavy spending has paid off and made it an AI winner. Investors should worry about that, not the state of the world in 100 years.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

While markets chase AI hype, dividend giants are quietly outperforming. As the Nasdaq slips, McDonald’s is up 8% and Coca-Cola has gained 14% — proof that resilience pays. For UAE investors seeking diversification, defensive stocks deserve renewed focus. They may not be flashy, but in volatile times, predictability wins.

While global markets remain heavily focused on artificial intelligence and technology stocks, this enthusiasm has shifted attention away from steady performers that continue to offer reliability during uncertain times.

After a strong start to the year, the Nasdaq has turned negative, yet McDonald’s shares have risen 8% and Coca-Cola has gained 14%. Both companies have demonstrated resilience across multiple market cycles, supported by strong brand power and consistent demand.

“In volatile markets, dividend-paying stocks offer something precious: stability,” said Zavier Wong, Market Analyst at eToro. “These are mature, financially sound businesses that continue to reward shareholders even when markets pull back.”

For investors in the UAE, where diversification across global markets is a growing priority, defensive and income-generating stocks deserve renewed attention. While recent investor enthusiasm has largely centered on high-growth sectors such as AI and crypto, reliable dividend payers continue to play an important role in building balanced portfolios.

Both McDonald’s and Coca-Cola report earnings this week, offering valuable insight into the health of the consumer and discretionary spending trends.

For McDonald’s, investor focus will be on its ability to maintain margins while driving customer traffic, particularly as lower-income consumers scale back spending. Value-focused offerings have been key to sustaining demand. The company also maintains a significant presence across the Middle East, operating more than 2,000 locations in the region.

Coca-Cola, which controls around 45% of the global carbonated soft drink market and owns five of the world’s top ten beverage brands, including Sprite and Fanta, is expected to demonstrate continued resilience. Fourth-quarter revenue is forecast to grow by 5%, with margins remaining stable.

Both companies continue to offer defensive qualities in today’s volatile market environment. If earnings results confirm resilient demand, it reinforces the case for holding these stocks as stabilizing positions. McDonald’s has increased its dividend for nearly 50 consecutive years, while Coca-Cola has done so for more than 60.

“They may not be the flashiest names in the market,” Wong added, “but in turbulent times, they’re the kind of stocks that help keep portfolios steady. Sometimes, boring is brilliant.”

Many of the most-important events have slipped from our collective memories. But their impacts live on.

Bitcoin prices may be down, but miners are finding new growth as AI data centers. According to Morgan Stanley, companies like Terawulf and Cipher Mining could more than double in value by pivoting from crypto mining to power-hungry AI infrastructure—turning access to electricity into their most valuable asset and reshaping the sector’s long-term outlook.

Bitcoin prices have fallen 44% since October, but Bitcoin miners have found a new lease on life—as AI data centers. It’s a trend that’s already lifted several Bitcoin miner stocks over the past two years, but it’s far from over, says Morgan Stanley analyst Stephen Byrd. He thinks at least two stocks in the industry could more than double over the next year.

Byrd initiated coverage on Terawulf and Cipher Mining on Monday, projecting that they can rise 159% and 158% respectively. Both stocks rose by double-digit percentages on Monday, even though the price of Bitcoin was down.

It isn’t like these companies have been in the dumps lately. Terawulf has already tripled in the past year, and Cipher is up by nearly that much.

But Byrd thinks their run is far from over, because their most important asset isn’t the crypto they earn—it’s their access to electricity. It takes a lot of electricity to power the computer chips that mine Bitcoin, and Bitcoin miners went through the trouble of hooking up to the grid and finding ways to lower their electricity bills. AI companies are scrambling to find enough electricity for their machines too, and have shown a willingness to pay up to secure that power. Bitcoin miners that can retool their warehouses to serve as AI data centers have signed contracts to earn premium returns from tech companies, Byrd said in an interview. The economics of AI would be better than crypto mining even if the price of Bitcoin was going up instead of down.

“There’s a fundamentally better story” in AI data centers, Byrd said. “That was still true even six months ago when Bitcoin was a lot higher.”

Tech companies are running out of easy options to get power. Despite efforts to fund their own power plants, it still looks like they will end up nine to 18 gigawatts short of power by 2028, Byrd said—equivalent to 10 to 15 nuclear reactors.

That makes them open to partnering with Bitcoin mining sites, which have already gone through the trouble of securing access to power. Terawulf has already made deals for 510 megawatts of power with companies like Google, and Cipher has a similarly large pipeline of deals, with partners like Amazon.

Byrd says the economics have lately gotten even better for Bitcoin mining companies who have been able to sign deals of 15 years or more with tech companies for power. That makes their stocks more like real estate investment trusts than risky crypto enterprises.

Not all miners will do well. Byrd also initiated coverage of MARA Holdings with an Underweight rating. He thinks the company’s strategy isn’t focused enough on maximizing its AI opportunity, and it’s also looking to add more Bitcoin to its balance sheet.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

Dyna.Ai, with GXS Partners and Smartkarma, has released a new report showing why most banks fail to turn AI into revenue—while a select few succeed. The research finds banks scaling AI personalization are achieving up to 6% revenue uplift, as BFSI AI spend accelerates globally. The difference lies in moving beyond pilots to production, with clear revenue ownership and accountability.

Dyna.Ai, a global provider of AI solutions, today released a new executive insights report, developed in collaboration with GXS Partners and Smartkarma, examining why most banks struggle to translate AI investment into revenue, and how a small group is breaking through. The report highlights how financial institutions across Southeast Asia, Latin America, and the Middle East are unlocking revenue through a small number of AI capabilities, while emphasizing the operational conditions required to scale these in production.

The research finds that banks successfully operationalizing AI personalization are achieving up to a 6% revenue uplift in the banking, financial services, and insurance (BFSI) sector. With BFSI AI spend projected to surge over 10x from $35 billion in 2023 to $368 billion by 2032, success will not be determined by the most pilots, but by those that move fastest to production-scale deployment with accountability for measurable outcomes.

Despite growing BFSI AI investments, most financial institutions remain in the pilot phase. New research confirms that while 77% of financial services executives report positive ROI within the first year, meaningful enterprise-wide impact remains elusive with accountability for operational outcomes lacking. Leading financial institutions across emerging markets are now closing this gap by anchoring AI to specific revenue outcomes, building responsibility from deployment to operational results, structuring partnerships for shared accountability and measurable impact.

“Most banks believe they are progressing with AI, yet research shows only 10% of the organizations using agentic AI are seeing significant, measurable ROI,” said Tomas Skoumal, Chairman and Co-founder of Dyna.Ai. “This report shows where revenue is being created, and why many institutions are still stuck despite years of pilots — a gap that is far wider than most executives expect.”

“One thing that kept coming up in our executive interviews was how hard it is to scale AI entirely in-house,” said William Hahn, Director at GXS Partners. “Many executives told us they underestimated the effort required beyond the pilot stage, and were increasingly open to partnering where execution and ownership could be shared.”

Mobile-first markets and AI-driven wealth management in Southeast Asia

In Southeast Asia, a young mobile-first population and supportive regulatory frameworks are translating AI investment into measurable revenue impact. DBS Singapore generated $565M from 350 AI use cases in 2024, targeting $745M by 2025. Across the region, banks are applying AI across revenue-generating activities through mobile and digital customer channels, supported by the scale of the region’s $300B MSME financing gap.

Sovereign AI ambitions and cross-border payments in the Middle East

Sovereign-led AI ambition and fintech momentum are accelerating AI adoption across financial services in the Middle East. PwC estimates AI could add $320 billion to the Middle East economy by 2030, with financial services at the core. Early impact is emerging in wealth management and cross-border payments, where financial institutions are deploying AI to scale relationship management, strengthen compliance, and enable faster, more reliable regional transactions.

Alternative data and fraud prevention unlocking Latin America inclusion

In Latin America, scale and risk remain the greatest constraint as financial exclusion and fraud risk continue to rise. With over 200 million adults remaining outside formal financial services in Latin America, AI-driven credit decisioning and fraud prevention are increasingly being applied to extend access to lending while maintaining risk discipline. Institutions such as BBVA Mexico demonstrate how AI-enabled decisioning can support broader inclusion without compromising risk controls.

Emerging market BFSIs are already unlocking AI revenue at scale

Across all three regions, organizational challenges such as data fragmentation, governance uncertainty, and adoption friction plague most BFSI implementations. Financial institutions that anchor AI to revenue outcomes and embed governance from day one are moving past experimentation into production-scale impact. BFSI organizations are now partnering on a Results-as-a-Service model where providers are paid for outcomes, not tools. As a global provider, Dyna.Ai operates with full-stack execution responsibility from domain-specific AI models through agentic AI agents and applications to operational results.

“The issue isn’t experiments, it’s accountability,” said Tomas Skoumal. “Results-as-a-Service means tying AI deployments to measurable business outcomes, not tool adoption. That shift changes how enterprises think about execution when moving from pilots to production.”

New research suggests that bonuses make employees feel more like a mere cog in a wheel.

Parts for iPhones to cost more owing to surging demand from AI companies.

Apple has dominated the electronics supply chain for years. No more.

Artificial-intelligence companies are writing huge checks for chips, memory, specialised glass fibre and more, and they have begun to out-duel Apple in the race to secure components.

Suppliers accustomed to catering to Apple’s every whim are gaining the leverage to demand that the iPhone maker pay more.

Apple’s normally generous profit margins will face pressure this year, analysts say, and consumers could eventually feel the hit.

Chief Executive Tim Cook mentioned the problem in a Thursday earnings call, saying Apple was seeing constraints in its chip supplies and that memory prices were increasing significantly.

Those comments appeared to weigh on Apple shares, which traded flat despite blowout iPhone sales and record company profit.

“Apple is getting squeezed for sure,” said Sravan Kundojjala, who analyses the industry for research firm SemiAnalysis.

AI chip leader Nvidia recently became the largest customer of Taiwan Semiconductor Manufacturing , or TSMC, Nvidia Chief Executive Jensen Huang said on a podcast.

Apple had been TSMC’s biggest customer by a wide margin for years. TSMC is the world’s leading manufacturer of advanced chips for AI servers, smartphones and other computing devices.

Spokesmen for Apple and TSMC declined to comment.

The big computers that handle AI tasks don’t look like the smartphones consumers own, but many companies supply components for both. In particular, memory chips are in short supply as companies such as OpenAI, Alphabet’s Google, Meta , Microsoft and others collectively spend hundreds of billions of dollars to build AI computing capacity.

“The rate of increase in the price of memory is unprecedented,” said Mike Howard , an analyst for research firm TechInsights.

That applies both to the flash memory chips that store photos and videos, called NAND, as well as the memory used to run apps quickly, called DRAM.

By the end of this year, the price of DRAM will quadruple from 2023 levels, and NAND will more than triple, estimates TechInsights.

Howard estimates that Apple could pay $57 more for the two types of memory that go into the base-model iPhone 18 due this fall compared with the base model iPhone 17 currently on sale. For a device that retails for $799, that would be a big hit to profit margins.

Apple’s purchasing power and expertise in designing advanced electronics long made it an unrivaled Goliath among the Asian companies that make most of the iPhone’s parts and assemble the device.

Apple spends billions of dollars a year on NAND, for instance, according to people familiar with the figures, likely making it the single biggest buyer globally. Suppliers flocked to win Apple’s business, hoping to leverage its know-how and prestige to attract other customers.

These days, however, “the companies now pushing the boundaries of human‑scale engineering are the ones like Nvidia,” said Ming-chi Kuo, an analyst with TF International Securities.

Demand for AI hardware is poised to keep growing rapidly. Apple’s spending growth is modest in comparison with what is being spent to fill up AI data centers, even though it is breaking records with huge sales of the iPhone 17.

Samsung Electronics and SK Hynix are raising the price of a type of DRAM chip for Apple, according to people familiar with Apple’s supply chain.

Big AI companies pay generously and are willing to lock in supply and make upfront payments, giving the South Korean chip makers leverage against the iPhone maker.

Apple signs long-term contracts for memory, but it has used its heft to squeeze suppliers.

Its contracts have empowered it to negotiate prices as often as weekly, and to even refuse to buy any memory from a supplier if Apple didn’t view the price as favorable, according to people familiar with its memory purchases.

To boost leverage with suppliers, Apple even began stocking more inventory of memory. That was atypical for Cook, who normally cuts inventory to the bone to maximize Apple’s cash flow.

Apple is fighting not only for current deliveries but also for the attention of engineers at suppliers.

Glass scientists who worked on developing the smoothest and lightest smartphone displays are now also spending time on specialised glass for packaging advanced AI processing chips, according to industry executives.

Makers of sensors and other gizmos inside the iPhone are winning new business from AI companies such as OpenAI that are developing their own hardware.

Still, suppliers said they were far from giving up on business with Apple. Working with Apple is a form of education, they said, because it remains one of the most demanding and disciplined customers in the industry.

TSMC, the Taiwanese chip manufacturer, has built successive generations of its most advanced chips with Apple as its lead customer, relying on the big predictable demand for iPhones.

Now that TSMC is doing more business with Nvidia and other AI companies, people with knowledge of the chip supply chain said Apple was exploring whether some lower-end processors could be made by someone other than TSMC.

One of Apple’s biggest profit-spinners is selling extra memory for far more than the memory chips cost the company.

Last fall Apple discontinued the iPhone Pro model with 128 gigabytes of storage.

Customers who want that model must now start at 256 gigabytes and pay $100 more—the type of move that could be repeated this year to help Apple offset higher costs, wrote Craig Moffett, an analyst at Moffett Nathanson, in an investor note.

However, Apple isn’t expected to raise the price of its next iPhone models over similarly equipped iPhone 17s, said Kuo, the analyst.

News Corp, owner of The Wall Street Journal, has a commercial agreement to supply news through Apple services.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

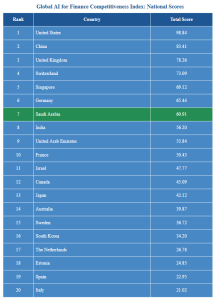

Saudi Arabia ranked 7th globally in the GAICI, emerging as the Gulf’s fastest-scaling AI-for-finance market, with Riyadh positioning itself as a regional hub for AI-driven financial services.

Saudi Arabia has been ranked 7th in the Global AI for Finance Competitiveness Index (GAICI), which was released today by Deep Knowledge Group with the Hong Kong Financial Services Development Council (FSDC) serving as an observer.

The index provides a benchmark analyzing AI competitiveness from a finance, economy and financial services perspective. It combines a global landscape overview of AI adoption in finance with an indicator-based competitiveness index that ranks 20 countries and 15 city-level finance hubs on AI-for-Finance capability and maturity.

Saudi Arabia has emerged as the Gulf’s fastest-scaling contender in AI-enabled finance, securing a remarkable 7th place globally in the index. This achievement underscores the country’s ambitious drive to integrate AI within its financial systems, fueled by state-led investments and a strategic focus on modernizing its financial infrastructure. While not yet a mature global finance hub, Saudi Arabia is quickly building the capabilities to become a key player in AI for finance. The nation’s rapid AI adoption is propelled by its institutional commitment and capital investment, positioning it as a major force in shaping the future of finance in the Gulf region.

At the heart of this transformation is Riyadh, which is fast becoming a central hub for AI-driven finance in the region. Leveraging substantial state-backed capital and a growing institutional framework, Riyadh is creating the infrastructure necessary for large-scale AI deployment across the financial services sector. From AI-enabled risk management systems to portfolio analytics, Saudi Arabia is prioritizing the development of tools that meet the demanding standards of regulated finance environments. The country’s rapid progress can be attributed to a combination of national-scale digitization programs and targeted initiatives that drive innovation while ensuring the resilience and security of financial systems.

Saudi Arabia’s AI-for-finance story is one of transformation through institutional commitment and high-impact investments. The Kingdom’s focus on building out a robust ecosystem for AI deployment, coupled with its massive capital investments, makes it a formidable competitor in the global race for AI-driven financial competitiveness. With its vast ambitions and capacity for acceleration, Saudi Arabia is carving a unique path that differentiates it from other financial hubs. While it continues to build a sustainable ecosystem of AI vendors and financial technology startups, the country is poised to become a major player in the global AI finance landscape, offering innovative solutions for risk modeling, regulatory compliance, and more.

“Saudi Arabia’s rapid scaling in AI-driven finance is a testament to its strategic vision and ability to turn ambition into action,” said Dmitry Kaminskiy, General Partner of Deep Knowledge Group. “The Kingdom’s strong institutional backing and focus on infrastructure development are setting the stage for long-term success. Prioritizing AI adoption in critical financial services, Saudi Arabia is positioning itself to become an essential player in the global AI finance ecosystem.”

The index is led by the United States (98.84) and China (83.41), followed by the United Kingdom (78.26) and Switzerland (73.09), with Singapore (69.12) next. The leaders are not defined by a single strength, but by multi-pillar performance that supports production-grade AI in finance—including deployment readiness, institutional capacity, and ecosystem breadth. The U.S. leads with large-scale capability across AI, capital markets, and financial services adoption. China ranks second on the strength of ecosystem scale and rapid implementation dynamics in AI-enabled financial services. The U.K. and Switzerland follow as high-performing financial centers where strong institutional environments and finance-grade expectations—governance, accountability, and risk discipline—support consistent AI adoption. Singapore rounds out the top tier, reflecting strong ecosystem coordination and high deployment readiness relative to its size.

“The leaders in this index are not simply ‘AI-strong’; they are strong at converting AI capacity into deployed financial systems—where governance, resilience, and market integrity are non-negotiable,” Kaminskiy continued.

Meanwhile, city-hub ranking places New York (99) and London (81) first and second, with Hong Kong (76) third—reflecting their combined advantages in market connectivity, institutional concentration, and capital formation for AI-enabled financial activity. The next positions—San Francisco (70) and Shanghai (67)—reflect the interaction between AI capability and financial-market pull. Mid-table hubs (e.g., Toronto, Singapore, Tokyo, Chicago, Riyadh) typically show strengths in one or two dimensions but less complete end-to-end breadth. Lower-ranked hubs are often constrained by thinner ecosystem density, fewer scalable deployment pathways into regulated institutions, or weaker global market connectivity. Moving up the ranking generally requires (i) strengthening capital-formation and listing pathways, (ii) expanding production-grade adoption mechanisms across regulated institutions, and (iii) increasing ecosystem breadth so that AI capabilities translate into repeatable, auditable deployments rather than isolated pilots.

Dr. King Au, Executive Director of the FSDC, remarked, “Hong Kong’s ranking among leading global finance hubs reflects the city’s excellent market connectivity and top-notch institutional quality—two conditions that matter when AI for finance must operate under finance-grade expectations.”

Dr. Patrick Glauner, Professor of AI at Deggendorf Institute of Technology, a co-author of the report, noted, “In finance, competitive advantage comes from trustworthy AI—models that are explainable, auditable, and robust under real-world constraints. The index makes clear that deployment quality matters as much as innovation.”

Additional Key Findings

- AI for finance is shifting from novelty to infrastructure: competitive advantage now reflects repeatable deployment in regulated workflows.

- Top-ranked countries pair ecosystem scale with execution capacity: strong performance typically requires strength across multiple pillars, not one-off advantages.

- The hub ranking underscores concentration: AI-for-finance activity clusters in a limited set of global financial centers with strong market infrastructure.

- Model governance and assurance are central: monitoring, auditability, and operational resilience are becoming baseline expectations.

- Data exchange and interoperability remain most common bottlenecks in mid-tier markets.

- Strategic takeaway: the next phase of competition is about institutionalization—turning tools into operating systems.

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

Sharjah Islamic Bank closed 2025 with a strong financial performance, posting a net profit of AED 1.32 billion, up 26% year on year. Growth was driven by solid expansion across core activities, higher income from Islamic financing and sukuk, and a steady increase in customer deposits. The Bank maintained strong liquidity and proposed a higher cash dividend, reflecting its focus on sustainable growth, income stability, and long-term value for shareholders.

Sharjah Islamic Bank delivered a strong financial and operational performance during 2025, supported by balanced growth across its core activities. Net profit after tax reached AED1.32 billion, representing an increase of 26% compared to AED1.05 billion recorded in 2024.

Income from Islamic financing investments and sukuk increased by AED175.0 million, representing a growth rate of 4.7%, reaching approximately AED3.9 billion in 2025, compared to AED3.7 billion in the previous year.

Meanwhile, distributions to depositors and sukuk holders amounted to AED2.3 billion, compared to AED2.2 billion in 2024. This reflects the Bank’s ability to maintain a sustainable balance between financing growth and fair Shariah-compliant returns, while preserving income stability despite fluctuations in funding costs and competitive pricing pressures.

Customer deposits reached AED55.7 billion, compared to AED51.8 billion at the end of 2024, resulting in a financing-to-deposit ratio of 81.8%, compared to 73.6% in the previous year. The Bank also maintained strong liquidity levels of 22.3% of total assets, amounting to AED20.2 billion, compared to 21.6% at the end of the previous year.

In line with its commitment to delivering sustainable shareholder returns, the Board of Directors proposed an increase in cash dividend distribution to 20%, compared to 15% in the previous year, subject to shareholders’ approval at the upcoming General Assembly.

The Board also approved a proposal to increase the Bank’s capital, subject to regulatory approvals and shareholders’ consent. This capital increase will provide existing shareholders with the opportunity to subscribe to new shares, strengthen the Bank’s capital base, support future growth plans, ensure ongoing compliance with regulatory requirements, and deliver sustainable long-term returns to shareholders.

New research suggests that bonuses make employees feel more like a mere cog in a wheel.

A new study by Stitch finds that fragmented systems and outdated infrastructure are holding back financial innovation across Saudi Arabia and the UAE — even as the region’s digital banking market accelerates. With 84% of Saudi banks planning to modernize their technology within 12 months, the shift toward unified platforms is becoming a necessity, not a choice.

Stitch, the unified platform for launching and scaling financial products globally, today released a comprehensive study examining the technology infrastructure barriers constraining financial innovation across Saudi Arabia and the United Arab Emirates.

The GCC digital banking market is set to grow from USD 12.7 billion in 2025 to USD 47.6 billion by 2032, reflecting expanding opportunities across payments, lending, deposits and related services. Yet fragmented technology infrastructure and persistent reliance on legacy systems are preventing financial institutions across the GCC from capitalizing on growth prospects.

Fragmented legacy technology is leading to missed opportunities for majority financial institutions

While vendor adoption has grown with 87% of banks now relying on external platforms, this shift has not eliminated legacy systems. Instead, modern capabilities have been layered on top of older architectures, creating increasingly complex and unmanageable technology environments. In the UAE specifically, 94% of financial institutions use external vendors, the highest adoption rate in the region, yet this proliferation has increased operational complexity.

Over half of financial institutions in Saudi Arabia and the UAE report that their current technology stack has caused them to miss business opportunities. Across institution types, 70% of exchange houses and financing companies, 76% of fintechs, 50% of banks, and 45% of other financial institutions have reported that their current technology setup has caused them to miss business opportunities. This data reveals how technology infrastructure is creating disadvantages across institutions instead of accelerating innovation.

1 in 5 describe systems as outdated, thus slowing fintech innovation

Financial institutions cite slow implementation of product launches and updates, integration challenges across vendors and systems, high costs and lack of flexibility. More than one in five institutions describe their systems as outdated or difficult to upgrade.

Across the gulf, 73% of Saudi Arabian institutions and 66% of UAE institutions report being heavily dependent on third parties for product launches and updates. This dependency is most pronounced among fintechs (80%), who rely on vendor release cycles rather than internal roadmaps. Over 60% of institutions that offer lending products currently operate exclusively on legacy systems. Lending remains one of the most risk sensitive and infrastructure heavy functions within financial institutions and modernization challenges explain why vendor adoption and cloud adoption alone have not resolved challenges.

“Everyone talks about digitization and AI adoption across the sector, but the reality is that legacy and fragmented systems still sit at the heart of all institutions. They slow things down, limit progress, and drain budgets; the hidden culprit. As the MENA region continues its unprecedented progress, modern stacks and a unified operating system unlock a new dimension of opportunity and growth,” said Mohamed Oueida, Founder & CEO of Stitch.

Technology upgrades are a priority in Saudi Arabia and UAE but barriers remain

The challenges between modernization ambition and execution constraint are visible in Saudi Arabia as companies progress to meet ambitions central to Vision 2030 economic diversification goals. The Saudi Arabian digital banking market generated revenue of USD 1,094.1 million in 2025 and is expected to reach USD 3,591.9 million by 2033. Yet 84% of Saudi Arabian financial institutions plan to modernize or upgrade their technology within the next 12 months, suggesting that current infrastructure cannot support the speed and innovation the market requires. In the UAE 78% of institutions are planning modernization within the same timeframe. However, high switching costs, long term contracts, regulatory and compliance concerns, and downtime risks are constraining the transition to modern technology platforms.

GCC financial institutions are choosing to shift to homegrown unified platforms

73% of Saudi Arabian institutions and 66% of UAE institutions agree that a single unified vendor would deliver more value than managing multiple disconnected platforms. Regional decision makers increasingly view unification as essential with a focus on outcomes rather than features.

Benefits include easier management in a single place (50%), improved customer experience (52%), faster product launches (50%) and lower running and maintenance costs (42%). For exchange houses and financing companies, 65% expect easier management and 59% specifically expect faster product launches. Among fintechs and exchange houses, which report the highest rates of missed opportunities and vendor dependency, modernization commitment reaches 93%. This suggests that institutions facing the sharpest competitive pressures are the most willing to pursue substantial infrastructure change.

Unification consolidates complexity into single platforms giving product control back to enterprises and replaces fragmented legacy systems with integrated infrastructure to prioritise innovation.

Operating globally, Stitch’s clients include MENA regional leaders such as Lulu Exchange, Alamoudi Exchange, Foodics, Yanal, Raya Financing and Tanmeya Capital, which are already leveraging unified infrastructure to accelerate product launches and reduce operational complexity across the region. Stitch enables global financial institutions to launch products in under 90 days, an 80% reduction in implementation time compared to industry norms.

Many of the most-important events have slipped from our collective memories. But their impacts live on.