Get Ready for the Full-Employment Recession

Job growth is soaring yet output is falling, by one measure. Blame a historic slump in productivity.

You would think from May’s blowout jobs report the economy was booming.

Here’s the puzzle: Other recent data suggest it is in recession.

The dichotomy emerges from the divergent behaviour of employment and output, two key indicators of economic activity.

In May, employers added 339,000 jobs, bringing the total number of jobs added this year to nearly 1.6 million, a gain of 2.5% annualised.

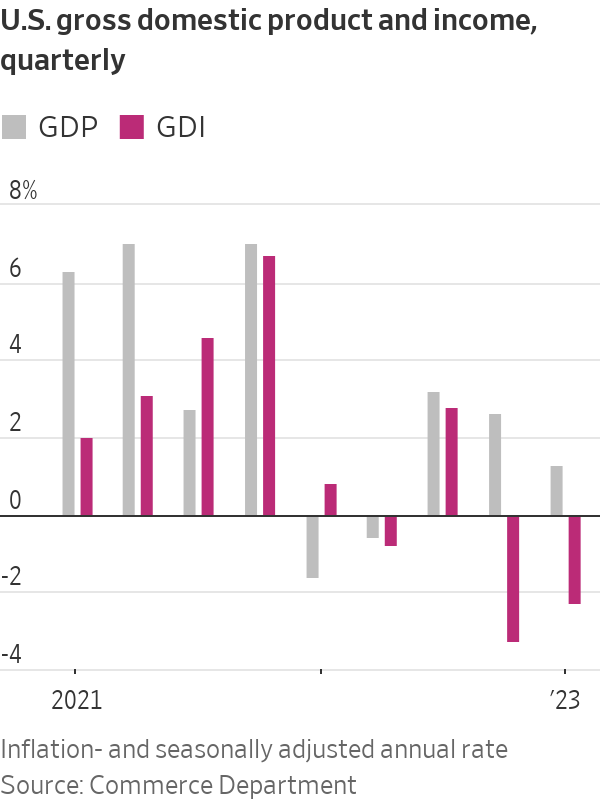

But real gross domestic income, a measure of total economic activity, shrank in both the fourth quarter and the first quarter. Two negative quarters of output growth are one indicator of a recession.

The economy has gone through periods where output has expanded faster than employment, but seldom the other way around, said Ryan Sweet, chief U.S. economist at Oxford Economics.

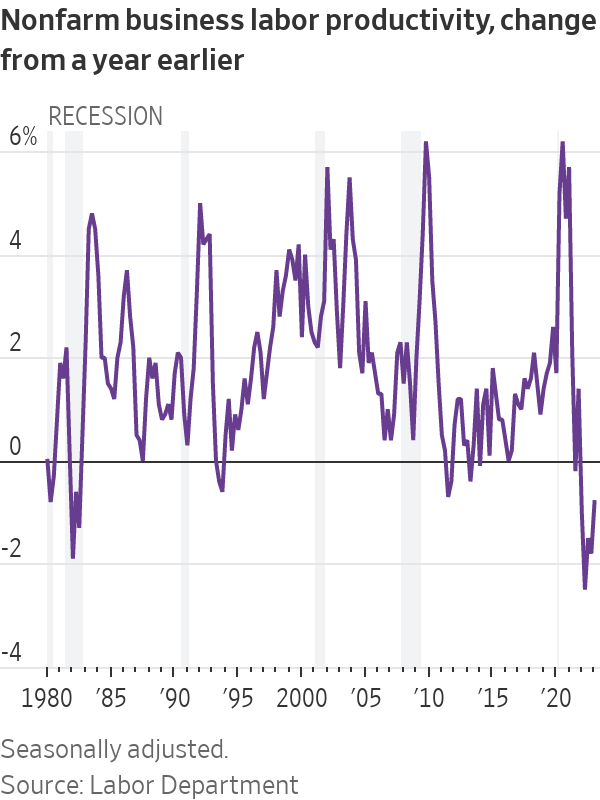

What explains these dissonant signals is productivity, or output per hour worked: It is cratering. That raises questions about whether the much-hyped technology adoption during the pandemic and, more recently, artificial intelligence are making a difference. It also raises the risk that the Federal Reserve will have to raise interest rates more to tame inflation.

Labor productivity fell 2.1% in the first quarter from the fourth at an annual rate, and was down 0.8% in the first quarter from a year earlier, the Labor Department said Thursday. That is the fifth-straight quarter of negative year-over-year productivity growth—the longest such run since records began in 1948.

Those calculations are derived from gross domestic product, which shows output rising at a 1.3% annualised rate in the first quarter. But another key measure—gross domestic income—declined, implying an even bigger productivity collapse.

GDI is the yin to GDP’s yang, measuring incomes earned in wages and profits, while GDP tallies up purchases of goods and services produced. In theory, the two should be equal, since someone’s spending is another’s income.

They never exactly match because of statistical challenges. Lately, though, the divergence is dramatic. “Over the past two quarters, real GDP shows the economy expanding by 1.0%, not far off potential growth, whereas GDI shows it contracting by 1.4%, which amounts to a decent-sized recession,” said Paul Ashworth, chief U.S. economist at Capital Economics. The divergence is ominous: GDI previously undershot GDP dramatically during the 2007-09 financial crisis and in the early 1990s recession, Ashworth said.

The second quarter is also shaping up to be weak. S&P Global Market Intelligence sees second-quarter real GDP expanding at a 0.8% annual rate; Morgan Stanley projects 0.3%. The Atlanta Fed’s GDPNow model estimates 2%. Most economists don’t forecast GDI.

Usually, employment plummets during recessions because as factories, offices and restaurants produce less, they need fewer workers. That clearly isn’t happening. “If you look at the early 2000s, that was what was called a ‘jobless recovery,’ because employment took a long time to come back even though the economy was growing,” said Sweet. “This time around it could be the opposite—the economy could be contracting, but you’re not seeing job losses.”

One reason could be labor hoarding. After struggling to hire and train workers during the pandemic-induced labor crunch, employers are now balking at letting them go, even as sales slip, given the labor market’s unusual tightness. There were 10.1 million vacant jobs in April, well above the 5.7 million people looking for work that month. Some firms—particularly services such as restaurants and travel-related businesses—ran short-staffed for the past couple of years and are still catching up.

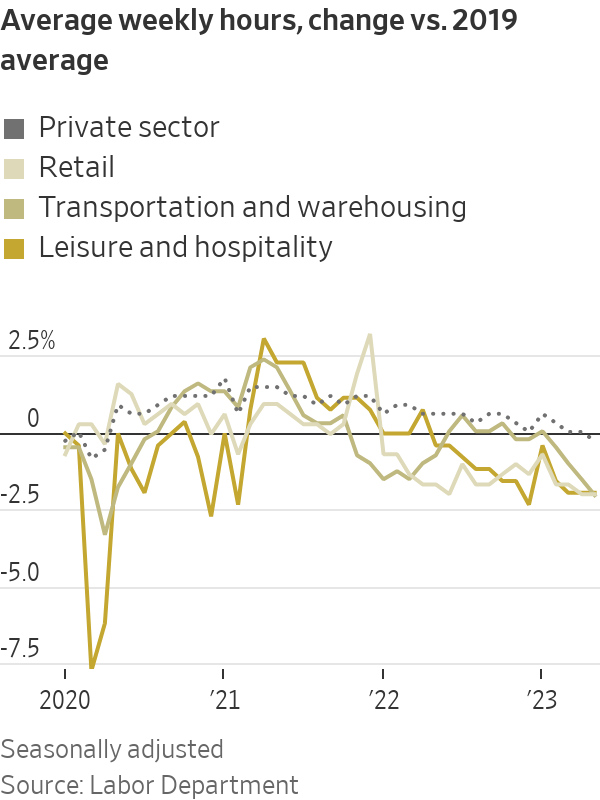

A possible sign of this is hours worked per week, which in May fell slightly below the 2019 average, after having surged during the pandemic. This drop has been particularly sharp in retail and leisure-and-hospitality—industries that have been especially strapped for workers. The unemployment rate also rose in May, one sign of a potential cooling in the labour market.

It’s “not that technology got worse in the last year, but that businesses were selling less stuff and they’re nervous about their ability to attract employees, so they’re holding on to their employees,” said Jason Furman, an economist at Harvard University who served in the Obama administration. It is also plausible, he said, that the shift to working from home generated a hit to productivity, whose impact grows with the cumulative loss of creative exchange and mentoring.

Productivity growth is important in the long run because it is one of two engines of economic growth, the other being an expanding workforce. Sweet, the Oxford Economics economist, notes businesses have been spending on equipment, software and intellectual property, investments that should eventually raise productivity. Though it may take many years, so should recent advances in artificial intelligence.

A more imminent concern is that when workers produce more, companies can raise wages without increasing prices. When productivity falls, it is harder to keep inflation in check.

This could make things even more challenging for the Fed. “Companies probably have the ability to pass on higher prices to consumers if they want to,” said Neil Dutta, head of economic research at Renaissance Macro Research. “That would be problematic for the Fed.”

Moreover, if GDI is a better indicator of output than GDP, “it would mean that the economy has slowed more than we had thought, without bringing down inflation that much,” Furman said. That might mean it will ultimately take an even bigger economic pullback “to bring inflation down.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

eToro has partnered with Lean Technologies to offer UAE customers instant AED bank transfers directly within the app, making funding faster and more secure. Regulated by ADGM, the service builds on eToro’s localization efforts and comes with zero AED-to-USD conversion fees until 31 December 2025.

ADCCI hosted a Balkan delegation in Abu Dhabi to boost trade and investment, with talks on clean energy, technology, agriculture, and logistics. With non-oil trade at US$1.9bn in 2024, both sides highlighted Abu Dhabi’s role as a global hub and gateway for sustainable growth.

Invest Saudi will attend Expo Real 2025 in Munich (6–8 Oct) to showcase major real estate opportunities ahead of Saudi’s new foreign ownership law in Jan 2026, supporting Vision 2030 projects and events like Riyadh Expo 2030 and the FIFA World Cup 2034.

Emirates NBD Securities has expanded its services to offer direct trading access across all GCC markets, becoming the UAE’s only bank-backed broker with full regional coverage. The move supports growing cross-border investment amid strong IPO activity, as Emirates NBD reported a 12% rise in net income to AED 23.9 billion in H1 2025.

Emirates NBD Securities, a subsidiary of Emirates NBD, has expanded its trading services, giving investors direct access to key GCC financial markets.

This expansion provides investors with a single and seamless entry point into some of the region’s most active exchanges, according to a press release.

Operating on the Dubai Financial Market (DFM), Abu Dhabi Securities Exchange (ADX), and Saudi Exchange (Tadawul), the unit is extending its platform to Oman, Qatar, Kuwait, and Bahrain.

The move comes as Gulf capital markets are gaining significant traction, driven by strong economic activity.

Economic diversification initiatives, regulatory reforms, and relaxed foreign ownership rules secure new opportunities and attract strong interest from both local and international investors.

The Gulf region’s initial public offerings (IPO) activity has also stayed strong, enhancing liquidity, widening participation, and making cross-border investment easier than ever.

Ahmed Al Qassim, Group Head of Wholesale Banking, Emirates NBD, said: “Being the UAE’s only bank-backed broker to offer full GCC access sets us apart and gives clients confidence that their investments are supported by one of the region’s strongest financial institutions.”

Hessa Al Mulla, General Manager, Emirates NBD Securities, added: “With this expansion, they can reach every major market in the GCC through a single app and a dedicated brokerage team.”

During the first half (H1) of 2025, Emirates NBD posted 12% year-on-year (YoY) higher net income valued at AED 23.90 billion.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

National Bank of Kuwait (NBK) won two awards at the MEIRA Awards in Oman — Leading Corporate for Investor Relations in Kuwait and Best Investor Relations Professional in Kuwait for Amir Hanna. The recognition highlights NBK’s commitment to transparency, strong governance, and world-class investor communication.

Amir Hanna was named Best Investor Relations Professional in Kuwait.

This recognition underscores NBK’s leadership in advancing professional standards and best practices in the field of investor relations.

The award reaffirms the Bank’s commitment to delivering transparent, timely, and value-driven disclosures to all stakeholders.

National Bank of Kuwait (NBK) was distinguished with two prestigious accolades from the Middle East Investor Relations Association (MEIRA) during its annual awards ceremony in Oman. The event, sponsored by the Muscat Stock Exchange, brought together leaders of GCC stock exchanges, decision-makers from global investment funds, and a wide network of investor relations professionals and experts from around the world.

NBK received the award for Leading Corporate for Investor Relations in Kuwait, while Mr. Amir Hanna, Group Chief Communications Officer at NBK, was named Best Investor Relations Professional in Kuwait.

This recognition underscores NBK’s leadership in adopting world-class standards of transparency and professionalism in investor relations, reinforcing its position as a leading financial institution in the local and regional banking sector, while further strengthening the confidence of the investment community and stakeholders in the Bank as a trusted partner.

The awards recognize companies and individuals who excel in investor communication and uphold the highest standards of corporate governance. Winners are selected through a rigorous evaluation of their investor relations programs, and based on a comprehensive survey of analysts and professional money managers.

Transparency and disclosure are measured by the clarity and comprehensiveness of information shared with investors and the public, adherence to corporate governance best practices, and the quality of annual and quarterly reports and investor presentations. They also encompass the effectiveness of communication channels with investors, ranging from conferences with investors and analysts to the use of digital platforms.

The criteria also cover the responsiveness to investor inquiries, the ease of access to information and the investor relations team, the integration of environmental, social, and governance (ESG) considerations into disclosure and strategy, as well as the adoption of innovative communication methods aimed at enhancing the overall investor experience.

These awards reaffirm NBK’s unwavering commitment to adopting best practices in investor relations and stand as a testament to its leadership in delivering transparent, high-quality disclosures to all stakeholders. The recognition by the investment community highlights the Bank’s ongoing efforts to enhance communication with shareholders and analysts, while reinforcing market confidence and strengthening trust within the investor community.

NBK has consistently upheld the highest standards of governance and transparency, demonstrating clear excellence in investor relations through its ongoing efforts. The Bank maintains an open and continuous dialogue with investors, organizes regular presentations, and is committed to publishing comprehensive financial, annual, and sustainability reports that offer clear insights into its performance and strategic direction.

As a non-profit organization, MEIRA is dedicated to promoting best practices in investor relations while enhancing the reputation, efficiency, and appeal of capital markets across the Middle East.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

Arthur D. Little (ADL) urges GCC countries to adopt economic valuation of water as a policy tool to boost resilience and sustainability. Case studies worldwide show how valuing water guides smarter crop choices, conservation, and tariff setting. Saudi Arabia’s national model is a regional benchmark, proving that measuring water’s true value drives efficiency, investment, and long-term access.

Arthur D. Little (ADL) has released new findings demonstrating that water must be recognized not only as a natural resource but as a key driver of economic activity and national resilience. With the Middle East home to 6% of the global population but holding less than 1% of the world’s renewable water resources, adopting economic valuation methodologies as part of broader

water management strategies to ensure lasting access for generations to come is becoming increasingly important particularly for GCC countries facing decline in non-renewable water resources.

International case studies illustrate the practical impact of using economic valuation of water in making policy decisions. In Jordan, agriculture consumes nearly 60% of water resources, yet a comprehensive water valuation study showed that prioritizing high-value crops such as cucumbers and strawberries over low-value, water-intensive crops like alfalfa could raise the average economic value of water nearly threefold, from JD 0.40 per cubic meter to JD 1.10.

Cyprus provides another example, where the economic value of water of the critical water resource; Akrotiri aquifer, was calculated at CYP 4.07 million annually vastly exceeded the cost of conservation measures required. These findings supported the decision to replenish the aquifer with treated wastewater, validating a significant investment in long-term supply security.

In South Africa, valuation of industrial water use calculated an average value of ZAR 369.10 per cubic meter, far higher than prevailing tariffs. This insight encouraged policymakers to consider tariff adjustments that promote efficiency without undermining industry. In Australia, the impact of groundwater usage on the national economy was quantified at AUD 6.8 billion annually using the economic value of water, underscoring water’s role as an economic enabler of national prosperity.

Of particular relevance to the Gulf is Saudi Arabia’s comprehensive national water valuation model, which incorporates both use and non-use values across all water sources; groundwater, surface water, desalinated water, and treated wastewater. This framework has become a cornerstone for national planning, awareness raising, and conservation decisions, providing a benchmark for the wider region as it balances growth ambitions with resource stewardship.

“Assigning measurable value to water enables leaders to make informed decisions that deliver the greatest benefit to both people and economies,” said Nick Strange, Principal in the Energy, Utilities & Resources practice at Arthur D. Little Middle East. “For the GCC countries, adopting these methodologies can strengthen national resilience, foster innovation in alternative water sources such as; desalination and reuse, and ensure that every cubic meter contributes to sustainable growth.”

The findings emphasize that water valuation is not a theoretical exercise but a practical policy tool. By embedding it into decision-making, GCC countries can align raw water tariffs with true resource costs, improve water efficiency in agriculture and industry, and prioritize conservation and infrastructure projects that deliver the highest long-term returns. Embracing the economic value of water in this way can help guarantee lasting access to the fresh water needed to sustain industries, economies, and entire populations.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

eToro has partnered with Lean Technologies to offer UAE customers instant AED bank transfers directly within the app, making funding faster and more secure. Regulated by ADGM, the service builds on eToro’s localization efforts and comes with zero AED-to-USD conversion fees until 31 December 2025.

Trading and investing platform eToro announces today that it has partnered with Lean Technologies, a fintech infrastructure platform, to provide instant AED bank transfers to customers based in the United Arab Emirates.

This partnership makes eToro one of the first global multi-asset investment platforms in the UAE to leverage a locally regulated open-banking provider to offer secure, instant AED funding. By linking their eToro account to their local bank, UAE-based users can securely deposit funds in seconds without leaving the eToro app. This eliminates tedious steps like filling in card details and switching between apps, reducing unnecessary friction and the risk of manual error, significantly streamlining the funding process.

Doron Rosenblum, EVP Business Solutions at eToro, said: “We’re proud to be one of the first global investing platforms to bring instant bank transfers to customers in the UAE. Open banking is a powerful innovation that’s transforming how people move and manage their money. By integrating this capability, our users will benefit from a faster, easier, and safer funding experience. It’s another key milestone in our mission to make investing simple and transparent for everyone.”

George Naddaf, Managing Director at eToro MENA, added: “eToro and Lean are both regulated by Abu Dhabi Global Market (ADGM). The partnership reinforces eToro’s commitment to working with trusted, locally regulated partners to enhance the user experience for customers, as well as reinforcing the UAE’s rapidly growing fintech ecosystem.”

Omar Hamada, VP of Sales & Partnerships, said: “Our partnership with eToro ensures that their customers in the UAE can fund their accounts instantly and securely, without the friction or cost of traditional payment methods. By embedding Lean’s infrastructure, eToro has streamlined the entire process, giving users a faster and safer way to move money. It’s exactly the kind of impact we aim to create; empowering leading platforms to deliver simpler, more reliable financial journeys to their customers.”

This initiative adds to eToro’s broader localization initiatives in the region, including the opening of its Abu Dhabi office, the addition of stocks listed on the Abu Dhabi Securities Exchange and Dubai Financial Market, and integrating the national identity platform UAE PASS into its onboarding process – all aimed at providing a tailored, relevant experience for investors in the UAE and across the MENA region.

From now until 31 December 2025, customers who use instant bank transfers to deposit AED into their trading account will enjoy zero conversion fees when converting AED into USD on their deposit.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

ADCCI hosted a Balkan delegation in Abu Dhabi to boost trade and investment, with talks on clean energy, technology, agriculture, and logistics. With non-oil trade at US$1.9bn in 2024, both sides highlighted Abu Dhabi’s role as a global hub and gateway for sustainable growth.

In line with its commitment to strengthening Abu Dhabi’s role as a leading global trade and investment hub, the Abu Dhabi Chamber of Commerce and Industry (ADCCI) hosted a high-level delegation of heads of chambers of commerce from the Balkan region at a meeting at Grand Hyatt Abu Dhabi. The interactions focused on reviewing opportunities for economic and trade cooperation and broadening investment partnerships that support sustainable bilateral growth.

Strengthening Economic Relations

The delegation engaged in discussions with ADCCI on ways to enhance bilateral cooperation in trade and investment. Both sides agreed on the importance of joint efforts to open new markets, launch future projects, and consolidate partnerships that serve shared interests and support sustainable growth.

The meeting was attended by His Excellency Ali Mohamed Al Marzooqi, Director-General of the Abu Dhabi Chamber of Commerce and Industry, alongside representatives from key national entities and private sector. The Balkan delegation included presidents of the chambers of commerce from Albania, Serbia, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, North-West Macedonia, American Balkan, and Western Balkans 6 Chamber Investment Forum (WB6 CIF).

The Balkans stand as a key partner for the UAE in its journey toward sustainable development. Non-oil trade between both sides has expanded at a compound annual growth rate of 8.7% over the past five years, reaching nearly US$1.9 billion in 2024.

Imports from the region reached an impressive US$1.3 billion, reflecting the strength of enduring partnerships with Romania, Slovenia, and Bulgaria. These nations continue to play a pivotal role in supplying the UAE market with essential commodities, including wheat, timber, and vital medicines. Meanwhile, the UAE’s non-oil exports have demonstrated exceptional growth, recording a remarkable compound annual growth rate (CAGR) of 20.5%. Albania, Romania, and Croatia have emerged as key destinations for UAE exports, particularly aluminum, and steel products. Additionally, re-exports have experienced robust expansion, rising at a CAGR of 9%, fueled by dynamic trade in vehicles and advanced technology.

This strong performance underscores the resilience of the economic partnership and sets the stage for even deeper collaboration across a range of sectors, including agriculture, clean energy, technology, and logistics. Such progress further cements Abu Dhabi’s position as a strategic gateway for trade and investment, both within the region and on the global stage.

Leaders Remarks

His Excellency Ali Mohamed Al Marzooqi, Director-General of the Abu Dhabi Chamber of Commerce and Industry: “This meeting embodies Abu Dhabi’s commitment to building strategic partnerships around the world. Abu Dhabi has become a global hub for trade and investment, and a prime destination for companies and entrepreneurs. Cooperation with the Balkan countries is fully aligned with our vision to diversify the economy and reinforce Abu Dhabi’s position as a leading business center.”

H.E Al Marzooqi highlighted the emirate’s flexible, diversified economy and its competitive, world-class business environment built on sustainability, innovation, and openness to international collaboration. These advantages, he noted, have made Abu Dhabi an attractive destination for quality investments and a driver of growth in renewable energy, advanced industries, technology, and the knowledge economy.

He pointed out that Balkan markets represent promising ground for expanding and diversifying UAE exports, offering national businesses greater access to new consumer markets in Europe. He underlined the Chamber’s role as a strategic enabler of economic development by promoting competitiveness, opening new markets, and attracting foreign direct investment. He explained that ADCCI’s 2025-2028 roadmap is designed to empower entrepreneurs and SMEs and enhance their contribution to the national economy in line with government strategies.

New Horizons for Cooperation

Valentina Marku, President of Albanian Business Council Abu Dhabi, and head of the Balkan delegation described the visit as the beginning of a new stage in cooperation with ADCCI, affirming that Balkan countries view Abu Dhabi as a strategic partner and a leading investment destination. He noted that the participation of chambers from across the region highlighted the UAE’s strong reputation in the Balkans and underscored Abu Dhabi’s pivotal role in deepening bilateral economic relations. He expressed optimism about advancing cooperation in sectors such as agriculture, clean energy, technology, and healthcare, emphasizing that the UAE’s diversified and resilient economy serves as a model capable of inspiring growth throughout Balkan markets.

Sectoral Presentations

The forum also featured presentations by national institutions, Abu Dhabi Investment Office (ADIO), and Emirates Development Bank (EDB). These partners showcased Abu Dhabi’s business environment, investment opportunities, and growth enablers for international companies.

Discussions covered emerging areas of cooperation such as advanced industries, automotive and auto components, AI-driven innovations, renewable energy (with emphasis on solar potential in the Balkans), digital technologies, blockchain, biotechnology, medical sciences, food and water security, and organic agriculture.

Towards Long-Term Partnerships

Both sides agreed that the meeting represented a significant step towards establishing long-term partnerships that will benefit both parties and create new opportunities for collaboration. The Balkan delegation praised Abu Dhabi’s advanced investment climate, while ADCCI leaders described the relationship as a model of economic integration and effective diplomacy.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Invest Saudi will attend Expo Real 2025 in Munich (6–8 Oct) to showcase major real estate opportunities ahead of Saudi’s new foreign ownership law in Jan 2026, supporting Vision 2030 projects and events like Riyadh Expo 2030 and the FIFA World Cup 2034.

Invest Saudi is returning to Expo Real in Munich this October to showcase billions of dollars worth of new investment opportunities in the Kingdom.

As KSA continues its unprecedented real estate transformation in line with Vision 2030, Invest Saudi will back in Munich, Germany from 6 to 8 October reconnect with the global real estate fraternity to further boost foreign direct investment into the country.

Joining the Invest Saudi delegation are the Real Estate General Authority (REGA) and Diriyah Company, with Smart Accommodation for Residential Complexes Company (sarcc) and Ajdan Real Estate Development Company making their Expo Real debut.

Invest Saudi’s participation at Expo Real 2025 comes three months before a new law allowing foreigners to buy property in the Kingdom comes into effect. From January, under the Law of Real Estate Ownership, non-Saudi companies and individuals can purchase residential, commercial, industrial and agricultural assets in designated zones.

KSA has an extensive construction spending plan as the country undertakes a wide range of new projects, including 2.5 million new homes and numerous world-class tourism, hospitality, and commercial developments to meet investor demand.

Almost 100 investor meetings took place with Invest Saudi and participating developers at Expo Real last year.

Fahad Al Hashem, Deputy Assistant Minister of Investment Development at the Ministry of Investment Saudi Arabia (MISA), said: “The Kingdom continues to redefine urban development with world-class destinations and awe-inspiring projects that set new standards in design, construction, and sustainability – unleashing investment opportunities worth billions of dollars.

“The updated law regarding non-Saudis owning property represents a significant shift towards greater investment openness. It has removed traditional restrictions that previously limited non-Saudis’ ability to own and benefit from properties within the Kingdom. This expansion allows non-Saudis to acquire property rights, whether through ownership or usufruct, within specific geographic areas, creating numerous opportunities that align with various objectives of property ownership.

“Upcoming global events like Riyadh Expo 2030 and the FIFA World Cup 2034 are boosting already unprecedented demand for real estate, creating a wealth of exciting opportunities for investors to become part of KSA’s future. The new foreign ownership law is a landmark development set to further deepen investor appetite. We look forward to returning to Munich in October to reconnect with the global real estate fraternity, build new partnerships, and create long-term collaborations that are pivotal to realizing Vision 2030.”

The Saudi Talks series of live seminars – now a regular feature of Invest Saudi’s participation at Expo Real and MIPIM – is also back on the agenda, bringing together government representatives, industry leaders and experts to discuss KSA real estate across a two-day program on 6 and 7 October.

Expo Real’s conference, running alongside the exhibition, also features a dedicated session on KSA’s evolving real estate landscape. The session is at 3pm on Tuesday, 7 October, with participation from Invest Saudi and representatives from real estate developers, consultants and giga projects.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Saudi Arabia’s net FDI rose 14.5% year-on-year in Q2 2025 to SR22.8bn, though it slipped 3.5% from Q1. Inward flows reached SR24.9bn, down 11.5% YoY, while outward flows fell sharply to SR2.1bn, a 74.5% YoY drop. Despite the quarterly dip, net inflows remain stronger than last year.

The net foreign direct investment (FDI) flows into Saudi Arabia recorded an increase of 14.5 percent, reaching approximately SR 22.8 billion during the second quarter of 2025 compared to the same quarter of the previous year, when it recorded SR 19.9 billion.

However, net flows posted a decline of 3.5 percent compared to the first quarter of 2025, which amounted to SR 23.7 billion, the General Authority for Statistics (GASTAT) announced on Sunday.

The value of inward FDI flows in the second quarter of 2025 amounted to SR24.9 billion, a 11.5 percent decrease compared to the same quarter of 2024, when it recorded SR28.2 billion. It also declined by 4.1 percent compared to the first quarter of 2025, which amounted to SR 26.0 billion.

Regarding outward FDI flows, they reached approximately SR2.1 billion during the second quarter of 2025, a 74.5 percent decrease compared to the second quarter of 2024, which amounted to SR8.2 billion.

Outward flows also recorded a decline of 10.5 percent compared to the first quarter of 2025, which amounted to SR 2.3 billion.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Global debt hit a record $337.7T in Q2 2025, rising $21T in six months, per the IIF. Canada, China, Saudi Arabia, and Poland saw the sharpest debt-to-GDP jumps, while emerging markets’ debt reached $109T. The U.S.’s growing reliance on short-term borrowing raises risks for monetary independence.

Global debt hit a record high of $337.7 trillion at the end of the second quarter, driven by easing global financial conditions, a softer U.S. dollar and a more accommodative stance from major central banks, a quarterly report showed.

The Institute of International Finance, a financial services trade group, said that global debt rose over $21 trillion in the first half of the year to $337.7 trillion.

China, France, the United States, Germany, Britain, and Japan recorded the largest increases in debt levels in U.S. dollar terms, though some of that was due to a waning dollar, the IIF found. The U.S. currency has weakened 9.75% since the start of the year against a basket of major trading partners.

GLOBAL DEBT SURGE COMPARABLE TO COVID-ERA INCREASE

“The scale of this increase was comparable to the surge seen in H2 2020, when pandemic-related policy responses drove an unprecedented buildup in global debt,” the IIF said in its Global Debt Monitor.

Looking at debt-to-GDP ratios – an indicator of the ability to repay debt by comparing to what is being produced – Canada, China, Saudi Arabia and Poland saw the sharpest increases. The ratio declined in Ireland, Japan, and Norway, the report found.

Overall, the global debt-to-output ratio continued to move slowly lower, standing just above 324%. However, in emerging markets the ratio hit 242.4% – a new record after a downward revision on the last report in May.

Total debt in emerging markets rose by $3.4 trillion in the second quarter to a record high of more than $109 trillion.

BOND MARKET PRESSURES

Emerging markets face a record high of nearly $3.2 trillion in bond and loan redemptions in the remainder of 2025, the IIF said.

It warned that fiscal strains could intensify in countries such as Japan, Germany, and France, urging caution over so-called “bond vigilantes” – referring to investors who sell off bonds of countries whose finances they deem unsustainable.

“While government debt ratios rose sharply across emerging markets in H1 — most notably in Chile and China — market reaction has been stronger in mature markets this year,” the IIF said.

IIF WARNS OF RISING SHORT-TERM BORROWING

The report also highlighted concerns over U.S. debt, noting that short-term borrowing now accounts for about 20% of total government debt and roughly 80% of Treasury issuance.

That rising reliance on short-term debt could heighten political pressure on central banks to keep rates low, potentially threatening monetary policy independence, the report said.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Daman UAE IPO Fund, the country’s only IPO-focused fund, is now open to retail investors with a minimum of AED 1,000, offering access to UAE, MENA, and global IPOs. Backed by Daman’s strong equity track record, it is well-positioned to benefit from robust regional IPO growth.

The Daman UAE IPO Fund (“Fund”), the only fund in the UAE established to exclusively target IPOs and recently IPOed companies listed on regulated stock exchanges in the UAE and globally, is entering a new phase of growth and accessibility.

Originally launched in 2022 by Daman Investments PSC for institutions and qualified investors only, the Fund has now been restructured to welcome retail investors with a significantly reduced minimum subscription amount of just AED 1,000 (or equivalent in other currencies). This evolution opens the door for a broader investor base to capitalize on the UAE’s dynamic IPO market and be part of the nation’s remarkable growth story, while also gaining selective exposure to other MENA countries and global IPOs and companies that have gone public on regulated stock exchanges over the past five years.

For retail investors, this also represents an excellent opportunity to tap into Daman Investments’ UAE and MENA expertise.

From its earliest days, Daman Investments has stood at the forefront of innovation in the UAE’s financial landscape. Founded with a vision to combine institutional discipline with entrepreneurial agility, Daman Investments quickly set itself apart as a firm willing to chart new paths for regional investors.

In 2001, it introduced the Daman UAE Value Fund, one of the first investment vehicles to offer structured access to the domestic equity markets at a time when such opportunities were limited. The closed-ended fund delivered exceptional results, officially closing its extended period of operation on June 30, 2006, with a closing ex-dividend NAV of AED 273.84. This represented a total return of 273.84% over the fund’s life, equivalent to an internal rate of return of 34.76% per annum. The fund’s remarkable performance solidified Daman Investments’ reputation as a pioneer in equity-focused investment solutions and a trusted partner in the region’s financial evolution.

Building on this success, Daman Investments launched the Daman Second Emirates Fund in 2007, further broadening investor access to UAE equities with a disciplined, long-term approach. In 2010, the firm broadened its investment horizon beyond the UAE with the launch of the Daman Fifth Fund, focused on undervalued blue-chip companies across the GCC.

The launch of the Daman UAE IPO Fund marks a continuation of this journey. With deep regional expertise, a strong track record in equity-focused strategies, and enduring trust in the UAE’s growth potential, Daman Investments remains committed to empowering investors to participate in the country’s dynamic economic future.

“I am particularly proud to present our UAE and regional markets to the retail investor. We launched Daman 27 years ago on the back of our belief in our equity markets and extending it to retail investors is a natural progression of this long-term mission of Daman”. said Shehab Gargash, Founder & Chairman, Daman Investments.

Since its inception, the Daman UAE IPO Fund has successfully secured allocations in multiple high-profile IPOs across industries, ensuring investors gain exposure to some of the country’s most promising enterprises.

“The Daman UAE IPO Fund is a very distinctive product in the highly competitive IPO subscription market. It not only gives investors convenient access to IPOs but also provides the added benefit of portfolio diversification by offering exposure to a carefully managed basket of opportunities with higher return potential,” said Ahmed Khizer Khan, Chief Executive Officer, Daman Investments.

MENA recorded its strongest first-half IPO performance since 2008, with 28 listings raising $4.9 billion—marking a 29% increase in proceeds compared to H1 2024. This growth was driven by key listings in Saudi Arabia and the UAE, including Umm Al Qura, Dubai Residential REIT, Flynas, and Almoosa Health.

Over the last four years, the UAE IPO market has been one of the most active in the region, raising $28.8 billion in proceeds through listings on the Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX). Landmark IPOs such as DEWA, Americana, ADNOC Gas, Salik, Empower, ADNOC Logistics Services, ADNOC Drilling, Parkin, TECOM, and Spinneys have attracted record levels of oversubscription and investor demand.

With global IPO markets remaining muted, MENA continues to stand out as a beacon of opportunity. The consistent oversubscription of IPOs reflects strong investor confidence, and the Daman UAE IPO Fund is well-positioned to capitalize on this momentum, creating long-term value for investors across all segments.

Daman Investments believes that the outlook remains robust across the UAE and broader MENA region IPO markets, supported by a strong pipeline of companies preparing to go public.

To gain access to the Daman UAE IPO Fund, investors can open an account directly with Daman Investments or through select partner banks.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Rupert Murdoch has reached a deal with his children that will pass control of his media assets to his eldest son, Lachlan.

The Murdoch family has reached a deal to end its yearslong battle over control of its media empire.

Lachlan Murdoch is set to take control of his father’s media assets as part of an agreement announced Monday between the patriarch and his children. Lachlan will control all the votes in a new trust that will hold sizable stakes in Fox Corp. and News Corp once the deal is completed.

The Murdoch trust, which currently holds roughly 40% voting stakes in Fox and Wall Street Journal parent News Corp, was initially designed to give each of his four oldest children an equal voting share.

As part of the settlement announced Monday, Rupert Murdoch’s children James, Elisabeth and Prudence will give up their claims to the existing trust. They will instead receive new trusts with cash funded in part by sales of some of the existing trust’s Fox and News Corp stock.

The three children will also be subject to a long-term agreement preventing them from buying shares in the companies.

Fox and News Corp shares fell slightly in after market trading.

The new agreement caps a tumultuous succession drama atop media companies whose holdings include cable giant Fox News, major newspapers in the U.S., U.K. and Australia; digital real-estate companies and HarperCollins Publishers. It also brings to a close a conflict that potentially threatened the futures of both News Corp and Fox Corp.

Murdoch, 94 years old, had sought to amend the family trust to put control in the hands of Lachlan. James, Elisabeth and Prudence opposed the change.

Clockwise from top left: Lachlan Murdoch, James Murdoch, Prudence MacLeod and Elisabeth Murdoch arriving for a hearing in Nevada in September 2024.

Clockwise from top left: Lachlan Murdoch, James Murdoch, Prudence MacLeod and Elisabeth Murdoch arriving for a hearing in Nevada in September 2024.

Fred Greaves/Reuters

An acrimonious family battle has played out largely behind closed doors and in sealed court proceedings in recent years. Last December, a Nevada probate commissioner ruled against Murdoch’s efforts to amend terms of the trust and give control to Lachlan.

Murdoch sought the change, in part , because Lachlan is the one most aligned with his conservative political views as well as the best manager to run the companies.

New trusts will also be created for Lachlan, who is executive chair and chief executive officer of Fox Corp. and chair of News Corp, as well as the two children that Rupert Murdoch had with Wendi Deng. Grace and Chloe Murdoch are beneficiaries of the original trust .

A holding company owned by Lachlan, Grace and Chloe Murdoch’s new trusts will control about 36% of Fox and 33% of News Corp.

Rupert and Lachlan Murdoch had no comment beyond the announcement. A spokesman for Elisabeth Murdoch and Prudence MacLeod declined to comment. Deng and a representative for James Murdoch couldn’t be reached for comment.

A spokesman for Anna dePeyster, mother of Elisabeth, James and Lachlan, declined to comment.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Saudi stocks closed higher after a rate cut aligned with the Fed, with TASI up 0.3% on energy-led gains and MBC surging 10% post-PIF deal. Aramco rose 1.9% and Ma’aden over 2%. Qatar (-0.4%) and Egypt (-0.4%) slipped on profit-taking, while Bahrain gained 0.7%, Oman fell 0.3%, and Kuwait eased 0.2%.

Saudi Arabia’s stock market closed higher on Sunday after the Saudi Central Bank matched the U.S. Federal Reserve with a quarter percentage-point interest rate cut, while Qatar and Egypt slipped as traders cashed in profits from recent gains.

The Fed cut its policy rate by 25 basis points on Wednesday and indicated that more cuts would follow as it responded to signs of weakness in the U.S. jobs market.

Saudi Arabia’s benchmark index <.TASI> rose 0.3%, consolidating three days of gains on energy-led buying.

Oil behemoth Saudi Aramco <2222.> jumped 1.9% to a level last seen more than two months ago. Saudi Arabian Mining <1211.SE> advanced more than 2%.

MBC Group <4072.SE> surged 10%, mirroring the previous session’s strength after its unit Istedamah Holding sold its entire stake in MBC to the Public Investment Fund (PIF), the kingdom’s sovereign wealth fund.

Qatar’s benchmark index <.QSI> edged lower by 0.4%, ending a four-day winning streak with selling concentrated in energy and financial shares.

Qatar Islamic Bank <QISB.QA> declined nearly 2%, while Qatar Fuel <QFLS.QA> slid 1%.

Crude – a key catalyst to Gulf economies – slipped on robust supply and weakening demand, with Brent crude futures <LCOc1> settling at $66.68 a barrel, down 76 cents, or 1.1%.

Outside the Gulf, Egypt’s blue-chip index <.EGX30> also finished the session 0.4% lower, hit by a 2% fall in Commercial International Bank <COMI.CA>.

Orascom Construction <ORAS.CA>, however, jumped 3.7% for a third straight session after recently debuting its primary listing on Abu Dhabi’s main index <.FTFADGI>, while retaining its secondary listing on the Egyptian exchange.

| SAUDI ARABIA | <.TASI> climbed 0.3% to 10,809 |

| QATAR | <.QSI> shed 0.4% to 11,267 |

| EGYPT | <.EGX30> slipped 0.4% to 35,247 |

| BAHRAIN | <.BAX> rose 0.7% to 1,937 |

| OMAN | <.MSX30> fell 0.3% to 5,110 |

| KUWAIT | <.BKP> declined 0.2% to 9,417 |

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

UAE aims to grow its companies to over 2 million and create 10 unicorns by 2031, said Economy & Tourism Minister Abdullah bin Touq. Entrepreneurs already own 94% of firms, with SMEs contributing 63.5% to non-oil GDP.

Abdullah bin Touq Al Marri, Minister of Economy and Tourism, affirmed that startups and entrepreneurs constitute a fundamental pillar in the UAE’s economic growth journey, noting that the country aims to increase the number of companies to more than two million by 2031.

In a press conference announcing the details of the national campaign ‘The Emirates: The Startup Capital of the World’, Al Marri added that the UAE also aims to see 10 unicorns emerge during the same period, with about five unicorn companies having already originated from the country.

He pointed out that the campaign supports these national goals by providing an enabling environment that empowers youth to launch their entrepreneurial ventures and achieve growth and expansion.

He explained that the UAE possesses comprehensive strategies that encompass economic clusters, food security, economic openness through Comprehensive Economic Partnership Agreements, as well as strategies for innovation and intellectual property protection, affirming the readiness of the national infrastructure to support the growth of startups at both the federal and local levels.

He noted that the UAE today hosts more than 1.2 million companies, of which around one million are owned by entrepreneurs, representing nearly 94% of the total. This, he emphasized, reflects the pivotal role of entrepreneurs in strengthening the national economy.

The small and medium-sized enterprises (SMEs) contributed 63.5% to the non-oil GDP of the national economy by mid-2022, while SMEs account for 95% of the total number of companies operating in the UAE markets.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

Women in the UAE are emerging as a driving force in financial markets — leading in savings, pensions, and long-term investments while diversifying across real estate, financial services, and emerging sectors.

Women are no longer on the sidelines of the UAE’s financial markets. Far from being cautious newcomers, women in the UAE are building diversified portfolios, aligning with growth sectors, and showing striking confidence in both the local economy and the long-term outlook of UAE companies.

eToro’s latest survey reveals that among UAE investors, women are leading in savings and pensions, with higher participation rates than men in both areas. 81% have a savings account (vs. 74% of men), and 26% invest in pensions (vs. 12% of men). More than half (54%) also hold crypto, highlighting their openness to emerging asset classes.

Dr Heloise Greeff, Popular Investor at eToro, remarks that women are also seasoned participants. More than 70% have been investing for more than three years, and a small but notable proportion (5%) have more than a decade of experience. They are also much more likely than men to hold their investments for years (43% of women vs. 30% of men), reinforcing their steady, long-term commitment.

This aligns closely with their primary financial goals. While women share the same top ambition as men — achieving financial independence (52% women vs. 51% men) — they are more likely to invest with long-term security in mind (49% women vs. 46% men).

Real estate (44%) and financial services (54%) dominate their sector allocations, but their ambitions extend further. In the next three months, many women investors plan to increase their allocations in renewables (39%), healthcare (38%), technology (36%), and discretionary consumer goods (38%). This approach aligns closely with the UAE’s broader growth agenda, signaling that women are proactively and strategically anticipating its next moves.

Women investors in the UAE are also responsive to market developments. Results show that a combined 91% have already adjusted (46%) or are planning to adjust (45%) their portfolios in response to global trade tensions and tariff announcements.

Both women and men view gold (50% vs. 49%) and real estate (44% vs. 45%) as reliable assets during periods of volatility. However, differences emerge in asset classes: men are notably more likely to favor crypto (52% vs. 38% of women), while women show greater preference for local equities (35% vs. 26% of men) and cash holdings (26% vs. 19%). These patterns suggest that in a volatile market environment, women tend to prioritize relatively stable or familiar asset classes, whereas men demonstrate a stronger inclination toward higher-risk digital assets.

What clearly unites both genders, however, is their overwhelming confidence in the local economy. 92% of both men and women are confident in the current UAE economy, with similar trust in the long-term performance of UAE-listed companies (92% men, 91% women). Optimism is firm across everyone, with 81% of women and 82% of men expecting significant market gains in the next 12 months.

These insights challenge long-standing stereotypes. Women in the UAE are showing they are comfortable blending traditional and alternative assets, adept at identifying growth sectors, and willing to commit to a long-term view. They are experienced, empowered, and increasingly influential in setting the tone for the UAE’s investment future.

This evolution is not happening in isolation. National initiatives such as the UAE Gender Balance Council and the National Financial Inclusion Strategy are enabling an environment for women to expand their financial literacy, access investment opportunities, and secure their independence. The result is a growing cohort of female investors who are not only managing their personal wealth but also contributing to the resilience and dynamism of the UAE’s financial markets.

In short, women investors are a driving force in the UAE’s retail investment landscape.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

The OpEx First KSA 2025 Summit concluded in Riyadh, bringing together leaders to advance efficiency, sustainability, and innovation in line with Vision 2030. Highlights included the launch of OELeap, AI and digital transformation sessions, and awards honoring excellence in driving Saudi Arabia’s transformation.

The inaugural OpEx First KSA 2025 Summit concluded in Riyadh with resounding success, uniting senior government officials, industry leaders, and global innovators to chart the next phase of Saudi Arabia’s transformation journey. As the Kingdom accelerates efforts to realize ambitions, the event served as the nation’s first dedicated platform for operational excellence, setting the tone for a future built on efficiency, sustainability, and innovation.

The summit opened with the Saudi national anthem and welcome remarks before delegates were introduced to a thought-provoking keynote on industrial automation and the role of advanced technologies in scaling efficiency across vital industries.

Eng. AbdulRazzag Al Aujan, H.E. Ministry of Finance Advisor added, “Operational Excellence is not a passing administrative practice. It is a structured philosophy and a deep-rooted organizational culture founded on discipline, mastery, and excellence in execution. It seeks to maximize efficiency, enhance effectiveness, and create value at every level. It is a continuous journey of improvement and innovation that places customer experience and service quality at the heart of decision-making. It inspires teams to embrace creativity, ownership, and agility in adapting to challenges and opportunities alike. OpexFirst KSA 2025 is a dedicated platform for discussing all the current trends and challenges and uniting the leaders and visionaries of continuous improvement.”

From the outset, discussions underscored the importance of operational excellence as a catalyst for achieving economic diversification, enhancing competitiveness, and strengthening public-private synergies.

Throughout the day, sessions delved into data-driven decision-making, digital transformation, and the integration of artificial intelligence and automation into core operations.

At the event, Kafaa, a leading Saudi consulting firm in Operational Excellence, announced a strategic partnership with Team Assurance to launch OELeap, a next-generation platform designed to transform the way factories achieve operational excellence in the Kingdom.

“This partnership with Team Assurance brings together global best practices and local expertise to empower Saudi factories with tools that drive efficiency, competitiveness, and sustainable excellence,” said Eng. Majed Almeleak, CEO and Board Member at Kafaa.

Yasmin Bin Mobki, General Manager of Privatization, and PMO, Ministry of Human Resources and Social Development reiterated, “The OpEx First KSA 2025 Summit was an excellent platform for exchanging knowledge and experiences on operational excellence. I was pleased to contribute to the panel discussion on how organizations can embed innovation and empower their people to sustain transformation. Summits like this are vital for driving collective learning and accelerating progress toward Vision 2030”

The conference also spotlighted awards and a workshop by the King Saud University on Business Process Improvement. Other topics covered are sustainability, examining how Saudi Arabia’s giga-projects are embedding green innovation in line with the Saudi Green Initiative and the nation’s net-zero 2060 targets.

Distinguished speakers from leading organizations such as Ministry of Finance, HRSD, SIPCHEM, Roads General Authority, EXPRO, Red Sea Global, Ma’aden amongst many other renowned entities and ministries, contributed insights on how operational excellence principles are shaping workforce transformation, strengthening supply chains, and ensuring long-term resilience in an evolving global economy.

In addition to the strategic sessions, the summit offered delegates an exclusive exhibition tour and networking opportunities, fostering partnerships designed to accelerate transformation and unlock new opportunities for growth.

For instance, as Gold Sponsor of OpEx First KSA 2025, Cyborg Automation Hub is proud to help organizations advance Saudi Vision 2030 by uniting AI, automation at scale, and process intelligence into real operational results. Together with their ecosystem partners, they are enabling transparent, sustainable, and resilient automation across Saudi industry

OpEx First KSA 2025 closed with an awards ceremony recognizing the leaders in operational excellence in the Saudi, followed by a strong call to action, affirming that operational excellence is not only a management framework but a national imperative for achieving Vision 2030 and positioning Saudi Arabia as a global hub for innovationand sustainable development.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Fitch Ratings lifted its 2025 global growth forecast to 2.4% (up from 2.2%), with upgrades for China (4.7%), the eurozone (1.1%), and the US (1.6%). Still, growth remains well below trend as US tariffs weigh heavily on outlook, consumer spending slows, and inflation pressures persist.

Fitch Ratings has raised its world growth forecasts for 2025 moderately since the June Global Economic Outlook (GEO) on better-than-expected incoming data for 2Q25. But there is now evidence of an underlying US slowdown in ‘hard’ economic data and positive surprises on eurozone growth have partly reflected US tariff front-running. Fitch still expects world GDP to slow significantly this year.

Global growth is now forecast to be 2.4% in 2025, up 0.2pp since June but a sizeable slowdown from 2.9% last year and below trend. China’s forecast has been raised to 4.7% from 4.2%, the eurozone’s to 1.1% from 0.8% and the US’s to 1.6% from 1.5%. World growth for 2026 is 0.1pp higher at 2.3%.

There has been a reduction in uncertainty over US tariff policy after a flurry of announcements. Our latest estimate of the average US effective tariff rate (ETR) is 16%, very close to the rate assumed in June. Mexico and Canada face lower ETRs, due to better USMCA compliance and Europe’s ETR is also slightly lower, but this is offset by higher-than-expected rates for Asia excluding China.

“Greater clarity about US tariff hikes does not alter the fact that they are huge and will reduce global growth. And evidence of a slowdown in the US is now appearing in the hard data; it’s no longer just in the sentiment surveys,” said Brian Coulton, Chief Economist at Fitch.

Pass-through from this huge jump in the ETR to US CPI inflation has so far been modest. There is some evidence in the US national accounts that the tariff shock has been absorbed partly by downward pressures on corporate profits, but we expect pass-through to accelerate later this year.

Higher inflation will dampen real wage growth and weigh on US consumer spending, which has already slowed notably in 2025. Job growth has also decelerated markedly, partly reflecting the impact of the immigration squeeze on labour force growth. A widening fiscal deficit should support demand in 2026, but Fitch expects the US annual average GDP growth rate to remain well below trend at 1.6% next year.

China’s export growth has held up well in the face of the US tariff shock as a depreciating nominal effective exchange rate and falling export prices have helped a redirection of foreign sales. Fiscal easing is supporting growth, but private domestic demand growth seems to be weakening, and deflation is increasingly entrenched.

Eurozone exports are unlikely to sustain their 1H25 pace and, with the consumer recovery fading, we do not expect GDP to expand in 2H25. German fiscal easing will provide more support next year.

The weakening in the US job market should persuade the Federal Reserve to cut rates more quickly than we previously anticipated. We expect cuts of 25bp in September and December, with three more in 2026.

With the ECB now looking unlikely to lower rates again, we see little prospect of a rebound in the dollar after the broad-based depreciation in 1H25. Long-term 30-year government bond yields in the US, UK, Germany and Japan continue to see upward pressure, possibly reflecting concerns about supply.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.