Wages and salaries fall in April: ABS

There was less in employee paypackets last month, new figures show

Monthly wages in Australia have fallen over the past month, data from the Australian Bureau of Statistics shows.

The figures released today reveal total wages and salaries paid to employees across Australia fell by 1.7 percent, or $1.6 billion during April.

Western Australia saw the largest decline, with a drop of -3.7 percent over the month, which is a result of the high number of mining industry employees and cyclical bonuses in March. The next greatest fall was in NSW, where wages and salaries declined by -1.8 percent, followed by Tasmania (-1.6 percent) and Victoria (-1.5 percent).

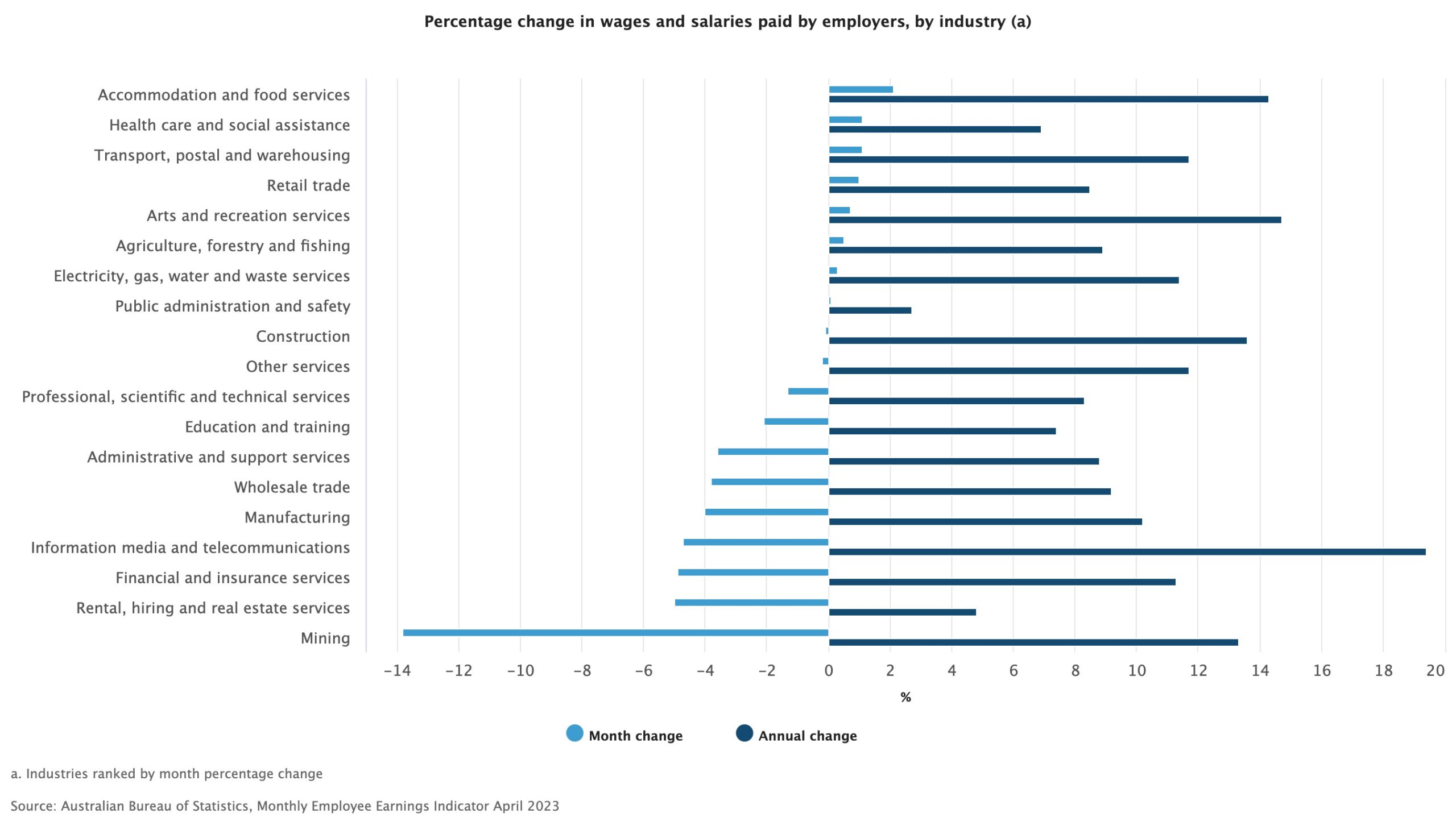

Across industries, mining recorded the biggest fall, down -13.8 percent, followed by the rental, hiring and real estate services sector (-5 percent), the financial and insurance services sector (-4.9 percent) and information media and telecommunications (-4.7 percent). Other industries fared better, with wages and salaries growth in accommodation and food services, up 2.1 percent, while transport, postal and warehousing and healthcare and social assistance industries both up by 1.1 percent.

In signs that medium sized businesses are starting to tighten their belts, those working for businesses between 20 and 199 employees saw a -2.4 percent drop in wages, the largest fall by employment size.

In annual terms, wages have increased nationally by 9.3 percent. Western Australian employees saw the greatest growth, with their paypackets increasing by 11.6 percent, followed by Queensland (10.3 percent) and NSW (9.5 percent).

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Compliance with these deadlines is crucial to avoid administrative penalties.

The UAE’s Federal Tax Authority (FTA) is urging Corporate Taxpayers to adhere to submission deadlines to avoid fines. Specifically, Resident Juridical Persons with licenses issued in May (regardless of the year) must submit their Corporate Tax registration applications by July 31, 2024, in line with Federal Tax Authority Decision No. 3 of 2024.

This decision aligns with the Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments, effective from March 1, 2024. The FTA stresses the importance of meeting these registration deadlines, which have been communicated through various media channels and direct outreach to registered company owners in the UAE.

Utilizing the EmaraTax Platform

Compliance with these deadlines is crucial to avoid administrative penalties. The deadlines apply to both juridical and natural persons, including Resident and Non-Resident Persons in the UAE. Detailed information on these deadlines and other relevant issuances can be found on the FTA’s official website.

According to the FTA’s Public Clarification, Resident Juridical Persons established or recognized before March 1, 2024, must submit their tax registration applications based on the month their license was issued. Those with expired licenses as of March 1, 2024, should submit their applications based on the original issuance month. For those holding multiple licenses, the earliest issuance date applies.

Administrative penalties for corporate tax violations have been in effect since August 1, 2023. To facilitate the registration process, taxpayers must use the “EmaraTax” digital platform, available 24/7, or seek assistance from accredited tax agents and government service centers.

The FTA has also emphasized the importance of providing accurate information and submitting updated supporting documents correctly with the electronic registration application, noting that registering for Corporate Tax for a juridical person requires uploading various documents, including the commercial license, the Emirates ID card, the passport of the authorized signatory, and proof of authorization for the authorized signatory.

A comprehensive video explaining the registration process through the “EmaraTax” platform is available on the FTA’s website. This platform, designed according to international best practices, aims to streamline the registration journey, submission of periodic returns, and payment of due taxes for all UAE taxpayers.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual