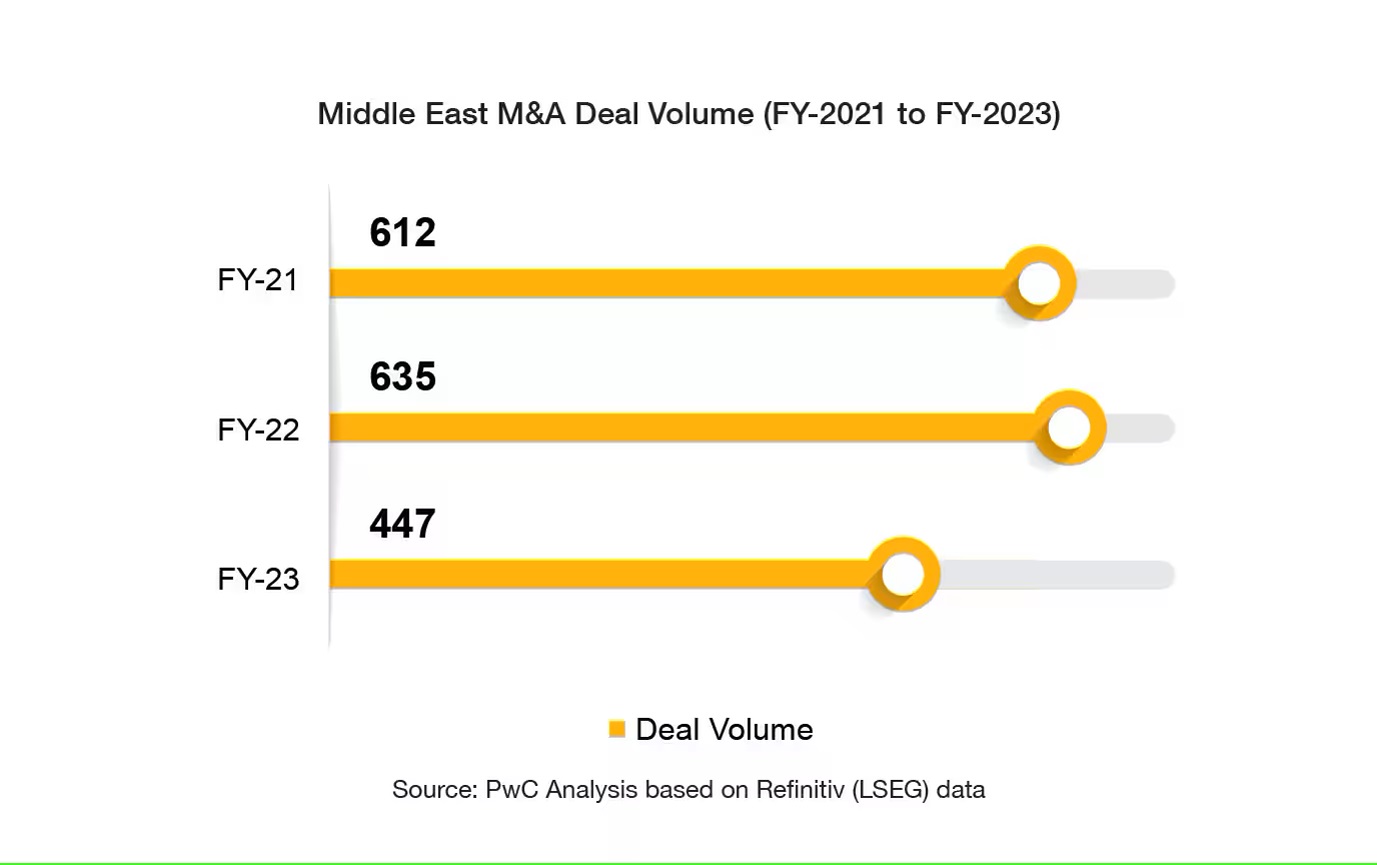

A Significant Increase in Middle East Dealmaking for 2024

The Middle East is on the brink of a dealmaking renaissance in 2024, propelled by an increase in investor interest and a strategic shift towards economic diversification and decarbonization.

This insight comes from PwC‘s most recent TransAct report, titled: “Strategic growth beyond oil: Economic diversification and decarbonisation expected to boost deal making in the region.” The forecast points to a region resilient against global economic challenges, maintained by robust economic fundamentals and government initiatives that encourage investor confidence.

Compared to other global markets, the Middle East is anticipated to experience a notably active dealmaking scene.

Economic Resilience and Strategic Initiatives

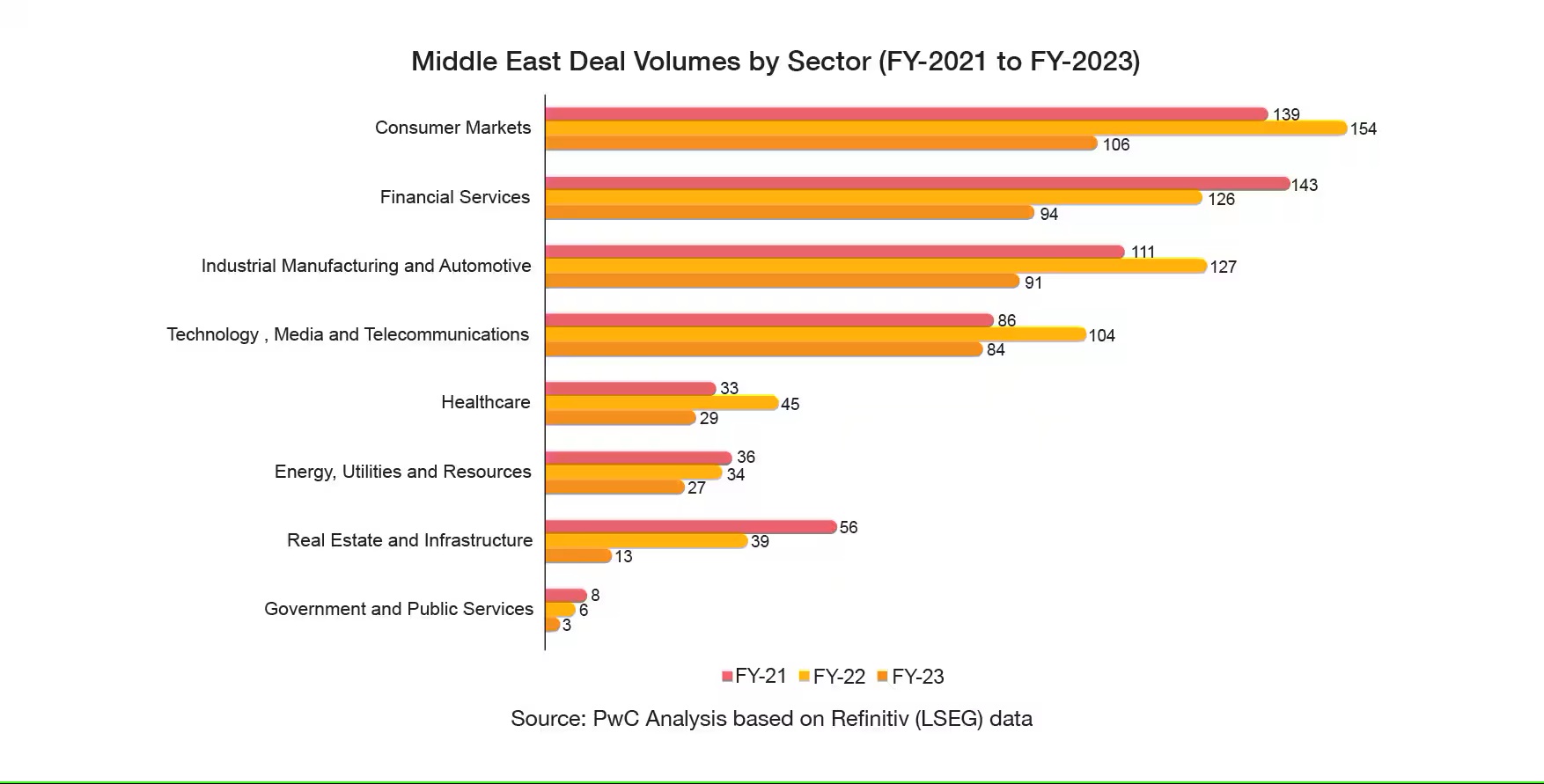

The Middle East’s economic stability and growth are attributed to several key factors including digital transformation efforts, expansion of the non-oil sector, and energy transition projects.

Companies are increasingly turning to mergers and acquisitions (M&A), divestitures, joint ventures, and refinancing as strategies to spur growth, enhance capabilities, or consolidate market presence.

Romil Radia, Regional Deals Clients & Markets Leader at PwC Middle East, comments on the region’s M&A market’s resilience, projecting 2024 as a year of substantial growth driven by diversification, decarbonization, localization, and value creation efforts.

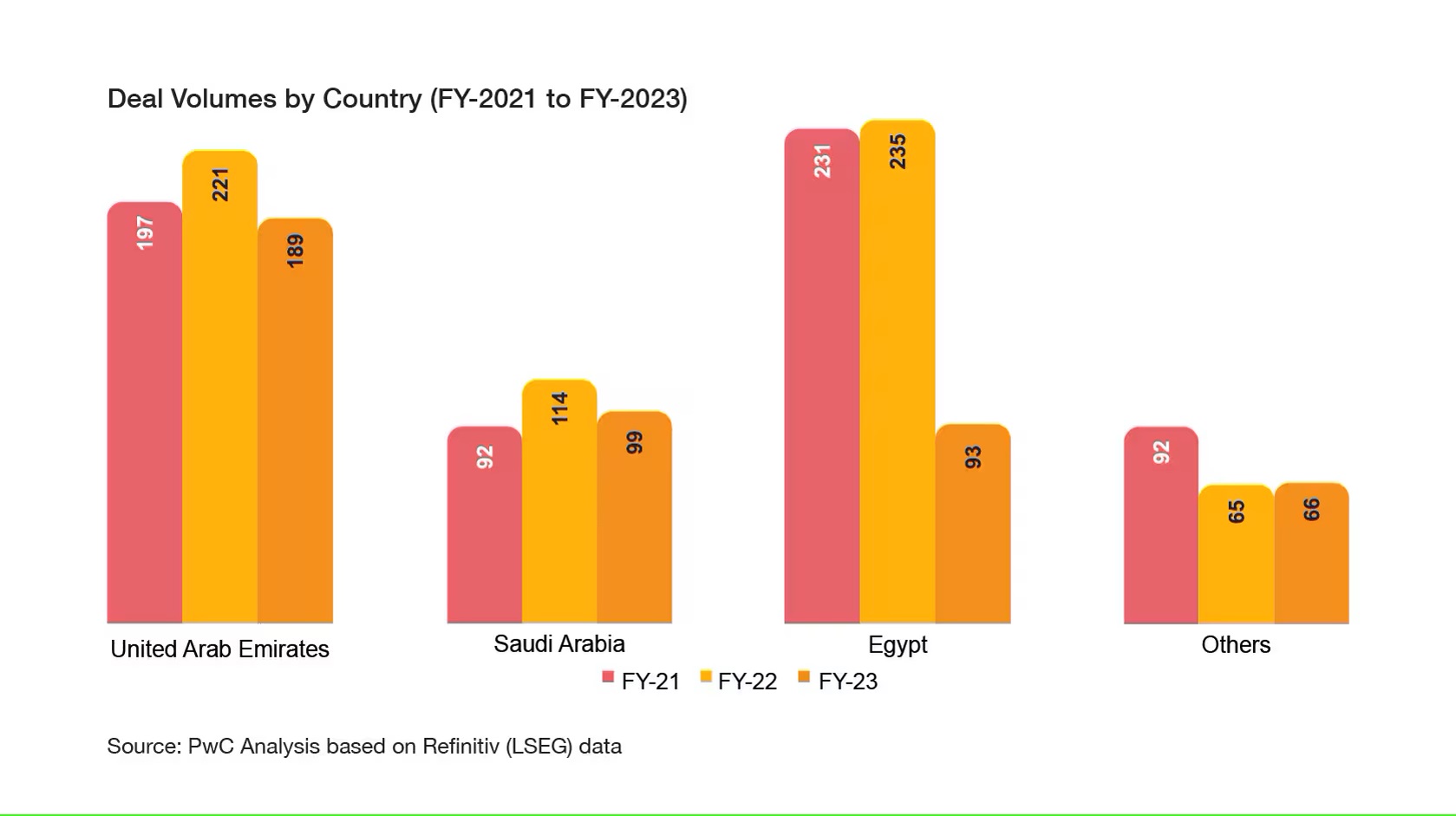

A Testament to Developmental Commitment

The report pays special attention to Saudi Arabia‘s dynamic dealmaking landscape, powered by the country’s steadfast dedication to its developmental goals. This dedication has seen a flurry of activities in non-oil sectors such as infrastructure, manufacturing, and clean technology, with Saudi Arabia experiencing a less significant dip in deal volumes in comparison to 2022 and a strong IPO market that enhances the sector’s prospects.

Imad Matar, Transaction Services Leader at PwC Middle East, anticipates the continuation of this positive trend, supported by government initiatives aimed at privatizing assets, encouraging private sector listings, and reducing fossil fuel dependency.

Clean Energy and Technology: Frontiers for Investment

This momentum towards sustainable energy goals and the shift towards eco-friendly solutions are central to drawing investments into vital areas such as renewable resources and innovative green technologies. The alignment with investors’ shifting focus to the clean energy market fosters a promising scenario for growth within this domain.

Moreover, sectors like cybersecurity, cloud services, and online commerce are poised to play pivotal roles in the dealmaking landscape of 2024. The Middle East’s swift move to incorporate digital advancements, underscored by the aggressive adoption of artificial intelligence across key nations including Saudi Arabia, the UAE, Qatar, and Bahrain, emphasizes the region’s commitment to digital transformation.

PwC Middle East’s experts underscore the critical role of skill development and education in attracting and retaining talent to meet the demands of an evolving business landscape. Companies and wealth funds are advised to remain agile, utilizing strategic dealmaking to navigate market shifts with an emphasis on technology, innovation, infrastructure, and renewable energy sectors.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

This agreement aims to foster the development of robust partnerships between the communities of both regions.

The Australian Chamber of Commerce and Industry has recently signed a Memorandum of Understanding (MoU) with the Dubai Chambers, marking a significant step towards enhancing cooperation and strengthening economic and trade relations between Dubai and Australia. This strategic agreement aims to foster the development of robust partnerships between the business communities in both regions.

In today’s interview, we will delve with Mr. Lyall Gorman, Vice President of the Australian Chamber of Commerce and Industry, into the objectives and anticipated impacts of this MoU, explore the key initiatives and projects that will arise from this collaboration, and discuss the potential challenges and strategies for overcoming them.

We will also look into how this agreement aligns with the broader strategic goals of the Australian Chamber of Commerce and Industry and the future of trade relations between Australia and the Middle East.

Can you give us a brief overview of the MoU signed with the Dubai Chamber? What are the main objectives?

The MoU we signed is designed for the two chambers to collaborate for mutual benefit and interest, focusing on business-to-business interactions. We are currently exploring opportunities around delegations, information sharing, trade, commerce, and e-commerce. The main goal is to bring businesses together in a structured manner to share ideas and encourage positive outcomes.

This partnership aims to increase the understanding of each other’s economies, recognize opportunities in each other’s regions, and work together to create mutual benefits. By doing that, we hope to enhance the economic ties between Dubai and Australia, leveraging each other’s strengths to create a more dynamic and prosperous business environment.

How do you see this MoU impacting trade relations between Australia and Dubai in the short and long term?

In the short term, we are expecting to generate a significant increase in awareness. By sharing information, data, and demographic insights, we will gain a better understanding of each other’s economic environments. This will help us identify existing opportunities for collaboration and potential mutual investment. From a trade perspective, we anticipate increased exports from Australia to Dubai and vice versa. This could include areas such as disruptive technology, medical research, education, construction, and agriculture—sectors that are currently emerging and critical.

In the long term, this enhanced understanding and collaboration will allow us to identify and capitalize on more opportunities. It’s about recognizing what’s happening in each other’s regions, understanding potential opportunities, and working together to create economic value. By fostering a deeper economic connection, we aim to create sustainable growth and mutual benefits over time.

What sectors or industries do you see as the primary beneficiaries of this partnership?

There are several mutual opportunities we aim to explore. Dubai has evolved incredibly over the last 20 years, achieving remarkable growth. However, there are still areas where further cooperation can drive growth. Some of the key initiatives will focus on sectors such as AI, digital disruptive technologies, smart technologies, financial services, education, construction, and advanced technologies.

Australia is highly regarded for its building codes and manufacturing capacity, especially in the construction sector. Additionally, I believe food security presents an interesting opportunity. As a major exporter of meat and other food products, Australia can contribute significantly to food security discussions, which is particularly relevant for Dubai.

Education is another area with significant potential for collaboration. By exploring these sectors, we aim to implement projects that not only address current challenges but also pave the way for sustainable development and innovative solutions in both regions.

What challenges do you foresee in the implementation of this MoU, and how do you plan to address them?

The cultural differences can impact how business is conducted, and this requires careful navigation. To address this, we need open and transparent communication, fostering a spirit of collaboration and mutual respect. It’s essential to have a genuine desire to embrace each other’s cultural differences and find common ground.

Another potential challenge is ensuring that both sides fully understand and adapt to each other’s regulatory environments and market dynamics. Dubai has matured significantly into a global business and corporate hub, which helps, but there are still differences to consider.

By prioritizing understanding and respect, and committing to ongoing learning from each other, we can effectively manage these challenges. Working together in a considerate and respectful manner will be crucial in overcoming any hurdles that may arise during the implementation of this MoU.

How does this MoU align with ACCI’s broader strategic goals for international trade and collaboration?

This MoU aligns closely with ACCI’s broader strategic goals by emphasizing the importance of fostering and diversifying economic partnerships on a global basis. The current global geopolitical situation has underscored the need for diversifying our supply chains and business relationships.

From an Australian perspective, the lessons learned during the COVID-19 pandemic and the evolving geopolitical environment have further highlighted the necessity of expanding our economic partnerships.

The Middle East, including the GCC, are regions where Australia already has strong relationships that can be further strengthened. Therefore, by working together, collaborating, and sharing knowledge and forward-thinking ideas, this MoU will help us identify and shape initiatives that add value and align with our strategic goals for international trade and collaboration.

How do you envision the future of trade relations between Australia and the Middle

I believe it will become stronger, more robust, and more regular, all for mutual benefit. There is a genuine willingness between both regions to grow and expand this relationship through a partnership model rather than a transactional one. This approach involves setting short, medium, and long-term goals, fostering a thriving and enduring relationship.

We have already established a strong partnership with Dubai Chambers and maintain a good relationship with the Dubai International Chamber here in Australia, led by Sophia Demetriades Toftdahl. This aligns with our strategic goal of global diversification in business.

Additionally, we recently signed an MoU with the Qatar Chamber and are about to sign with the Abu Dhabi Chamber as well.

Engaging with Saudi Arabia also makes sense, as it is a significantly emerging country. The last few years under new leadership have brought clarity to its economic, political, and social future and a strong passion and drive to become a major player in the region and global stage

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual