A Significant Increase in Middle East Dealmaking for 2024

The Middle East is on the brink of a dealmaking renaissance in 2024, propelled by an increase in investor interest and a strategic shift towards economic diversification and decarbonization.

This insight comes from PwC‘s most recent TransAct report, titled: “Strategic growth beyond oil: Economic diversification and decarbonisation expected to boost deal making in the region.” The forecast points to a region resilient against global economic challenges, maintained by robust economic fundamentals and government initiatives that encourage investor confidence.

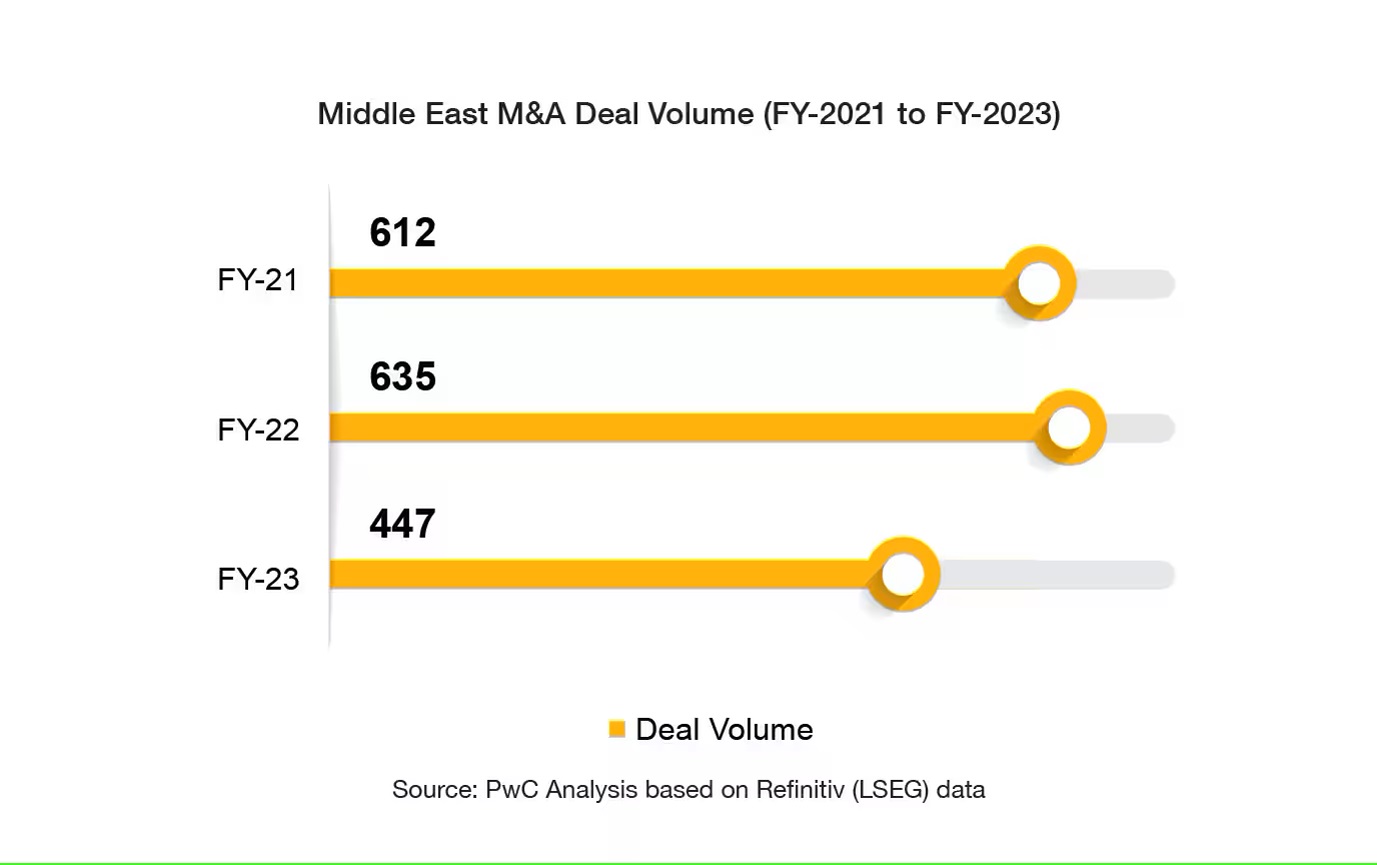

Compared to other global markets, the Middle East is anticipated to experience a notably active dealmaking scene.

Economic Resilience and Strategic Initiatives

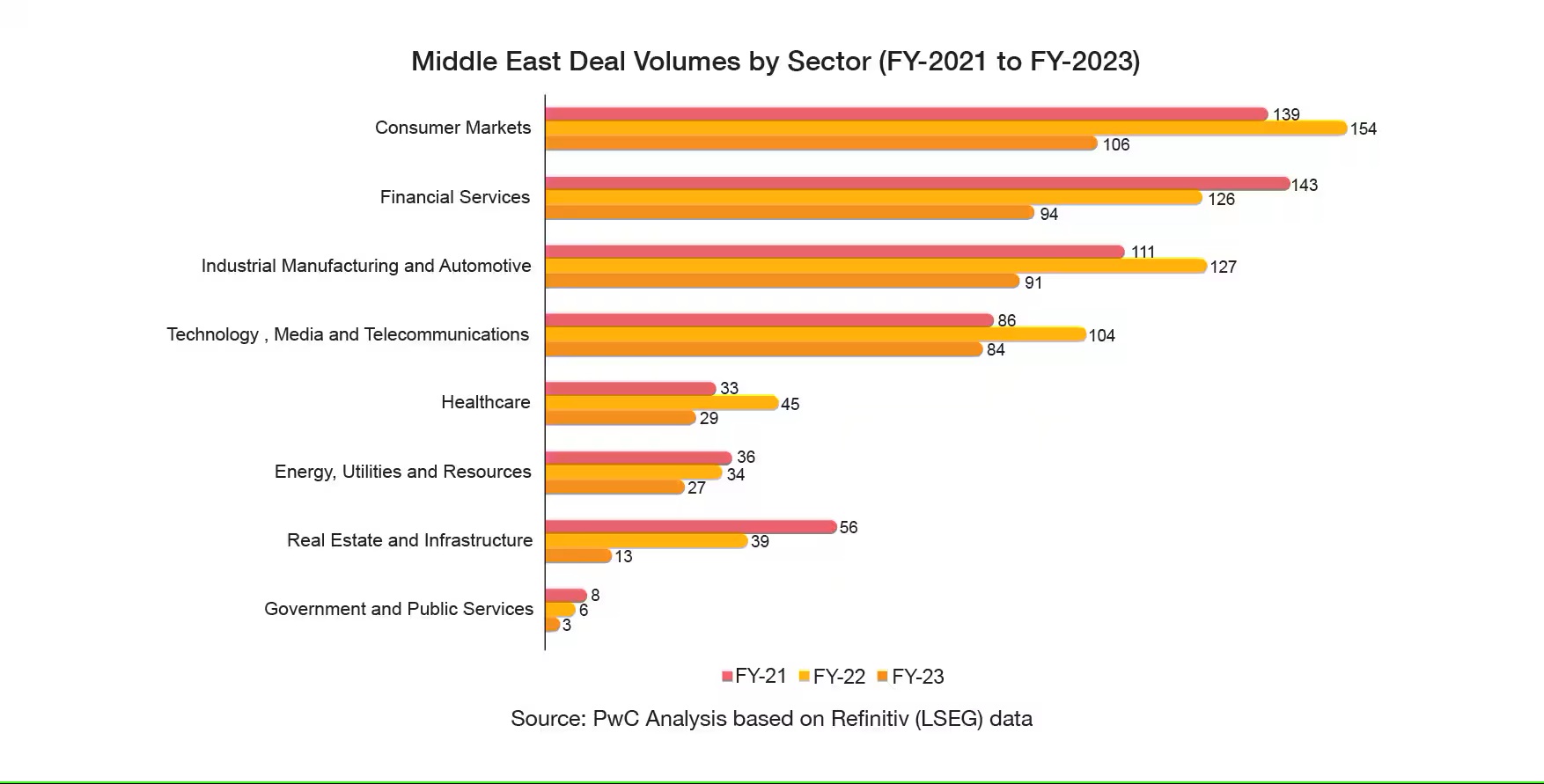

The Middle East’s economic stability and growth are attributed to several key factors including digital transformation efforts, expansion of the non-oil sector, and energy transition projects.

Companies are increasingly turning to mergers and acquisitions (M&A), divestitures, joint ventures, and refinancing as strategies to spur growth, enhance capabilities, or consolidate market presence.

Romil Radia, Regional Deals Clients & Markets Leader at PwC Middle East, comments on the region’s M&A market’s resilience, projecting 2024 as a year of substantial growth driven by diversification, decarbonization, localization, and value creation efforts.

A Testament to Developmental Commitment

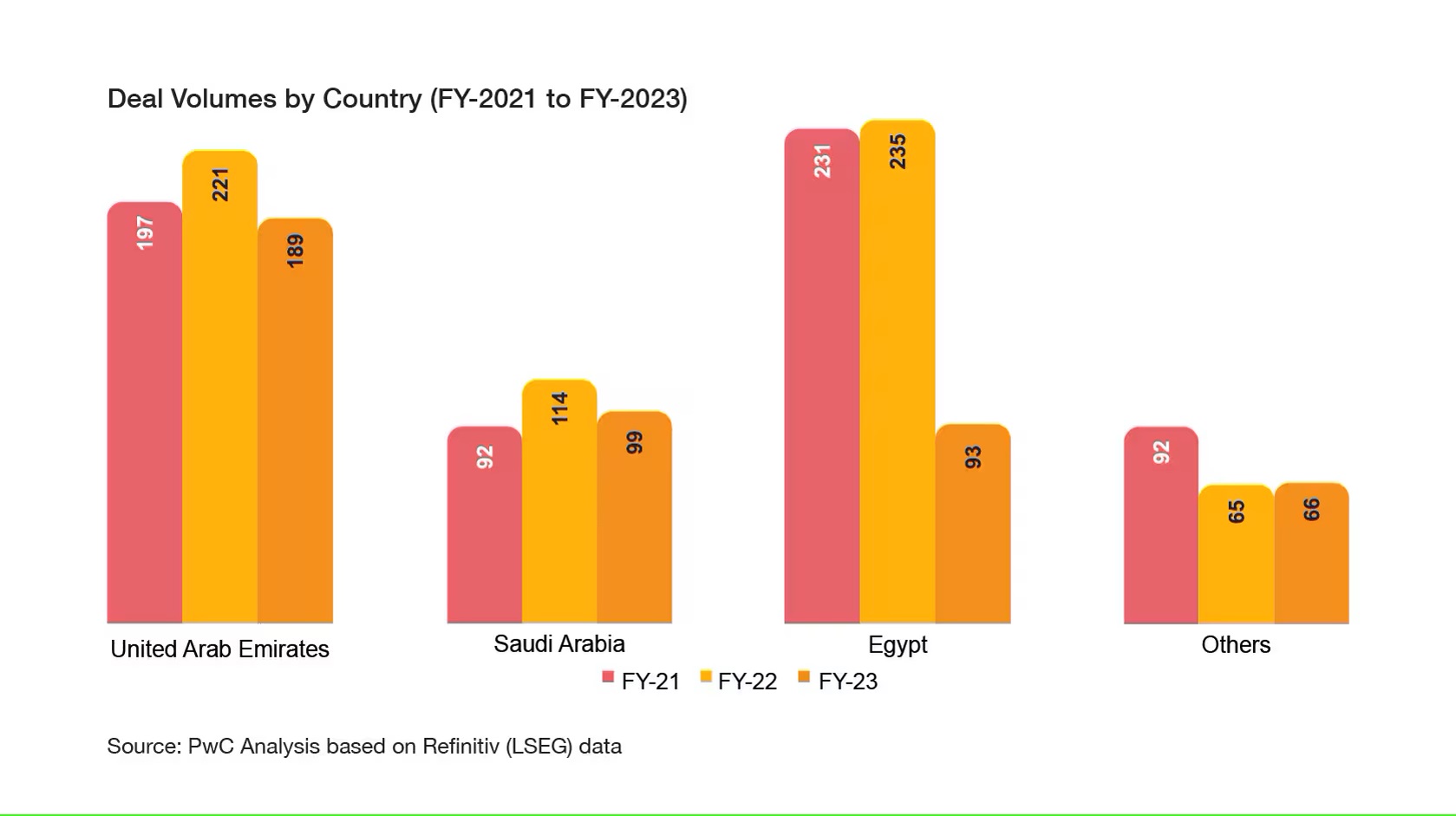

The report pays special attention to Saudi Arabia‘s dynamic dealmaking landscape, powered by the country’s steadfast dedication to its developmental goals. This dedication has seen a flurry of activities in non-oil sectors such as infrastructure, manufacturing, and clean technology, with Saudi Arabia experiencing a less significant dip in deal volumes in comparison to 2022 and a strong IPO market that enhances the sector’s prospects.

Imad Matar, Transaction Services Leader at PwC Middle East, anticipates the continuation of this positive trend, supported by government initiatives aimed at privatizing assets, encouraging private sector listings, and reducing fossil fuel dependency.

Clean Energy and Technology: Frontiers for Investment

This momentum towards sustainable energy goals and the shift towards eco-friendly solutions are central to drawing investments into vital areas such as renewable resources and innovative green technologies. The alignment with investors’ shifting focus to the clean energy market fosters a promising scenario for growth within this domain.

Moreover, sectors like cybersecurity, cloud services, and online commerce are poised to play pivotal roles in the dealmaking landscape of 2024. The Middle East’s swift move to incorporate digital advancements, underscored by the aggressive adoption of artificial intelligence across key nations including Saudi Arabia, the UAE, Qatar, and Bahrain, emphasizes the region’s commitment to digital transformation.

PwC Middle East’s experts underscore the critical role of skill development and education in attracting and retaining talent to meet the demands of an evolving business landscape. Companies and wealth funds are advised to remain agile, utilizing strategic dealmaking to navigate market shifts with an emphasis on technology, innovation, infrastructure, and renewable energy sectors.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Saudi Arabia ranked first among countries for the non-oil exports of national origin with BD201 million (22%)

Bahrain’s non-oil exports of national origin decreased by 6% to BD894 million ($2.37 billion) in Q2 2024 compared to the same period in 2023. The top 10 countries accounted for 64% of the total export value.

According to the Information & eGovernment Authority (iGA) in its Q2 2024 Foreign Trade report, Saudi Arabia was the leading destination for these exports, totaling BD201 million (22%). The US followed with BD75 million (8.4%), and the UAE with BD73 million (8.2%).

Unwrought aluminum alloys were the top exported product in Q2 2024, amounting to BD267 million (30%), followed by agglomerated iron ores and concentrates alloyed at BD159 million (18%) and non-alloyed aluminum wire at BD49 million (5%).

Non-oil re-exports

Non-oil re-exports increased by 4% to reach BD206 million during Q2 2024, compared to BD198 million for same quarter in 2023. The top 10 countries accounted for 86% of the re-exported value. The UAE ranked first with BD58 million (28%) followed by Saudi Arabia with BD39 million (19%) and UK with BD17 million (8%).

As per the report, turbo-jets worth BD65 million (32%) were the top product re-exported from Bahrain, followed by private cars with BD11 million (5%) and four-wheel drive with BD9 million (4%).

The value of non-oil imports has decreased by 4% reaching to BD1.41 billion in Q2 2024 in comparison with BD1.47 billion for same quarter in 2023. The top 10 countries for imports recorded 68% of the total value of imports.

China Bahrain’s biggest importer

China ranked first for imports to Bahrain, with a total of BD191 million (14%), followed by Brazil with BD157 million (11%) and Australia with BD112 million (8%).

Non-agglomerated iron ores and concentrates were the top product imported to Bahrain worth BD200 million (14%), followed by other aluminum oxide with BD101 million (7%) and parts for aircraft engines with BD41 million (3%).

As for the trade balance, which represents the difference between exports and imports, the deficit logged was BD310 million in Q2 2024 compared to BD322 million in Q2 2023.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual