How to Play the Property Meltdown in Five Charts

Savvy buyers made a fortune after the 2008 crash, picking up real estate at distressed prices. Investors hoping to spot bargains in the latest slump can watch these trends.

Is the pain over yet for U.S. commercial real estate? The answer might be yes for stocks but no for the assets they own.

A record $205.5 billion of cash is earmarked for investment in U.S. commercial real estate, according to dry-powder data from Preqin. But good deals may not be available for another six to 12 months. Here are some trends investors can watch for signs of when it is the right time to buy.

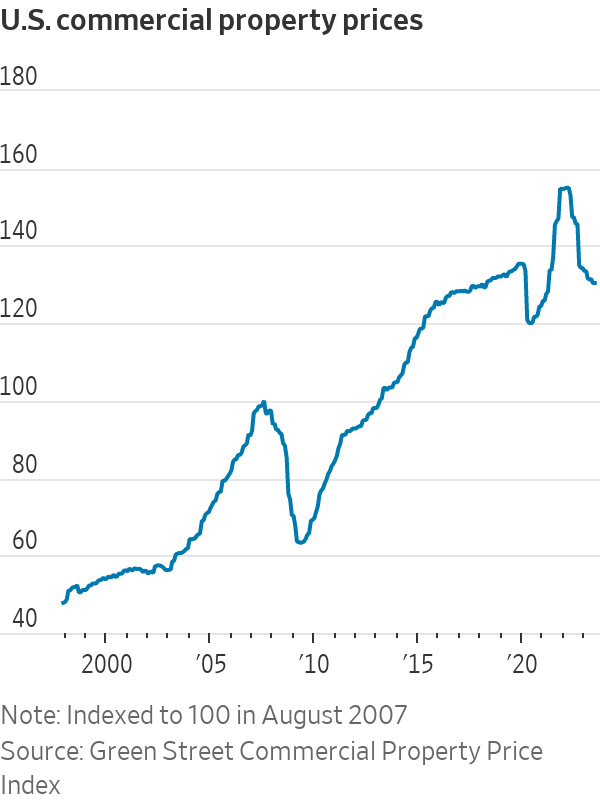

How Much Are Values Down Already?

U.S. commercial property prices have fallen 16% on average since their peaks in March 2022, according to real-estate research firm Green Street. Unlike the 2008 crisis, when a lack of credit hurt the value of all real estate, today’s downturn has hit some types of properties much harder than others.

Unsurprisingly given remote working, offices are the worst performers, having lost 31% of their value since the Fed first began raising interest rates. The discount isn’t as enticing as it sounds, as troubled buildings need heavy investment to bring them up to a standard that will attract tenants, or to be redeveloped for new uses.

Meanwhile, prospects for snapping up America’s e-commerce warehouses at knockdown prices look slim. Warehouse values are down just 8% from peaks to reflect higher financing costs, and top industrial stocks like Prologis don’t look cheap either, trading close to net asset value.

Apartments might be a better bet for those hunting for distressed assets. Prices for multifamily apartment buildings have fallen by a fifth since March 2022. Some owners who paid top dollar for properties during the pandemic using short-term, floating-rate debt may be forced to sell if mortgage repayments become unmanageable when their interest rate hedges expire.

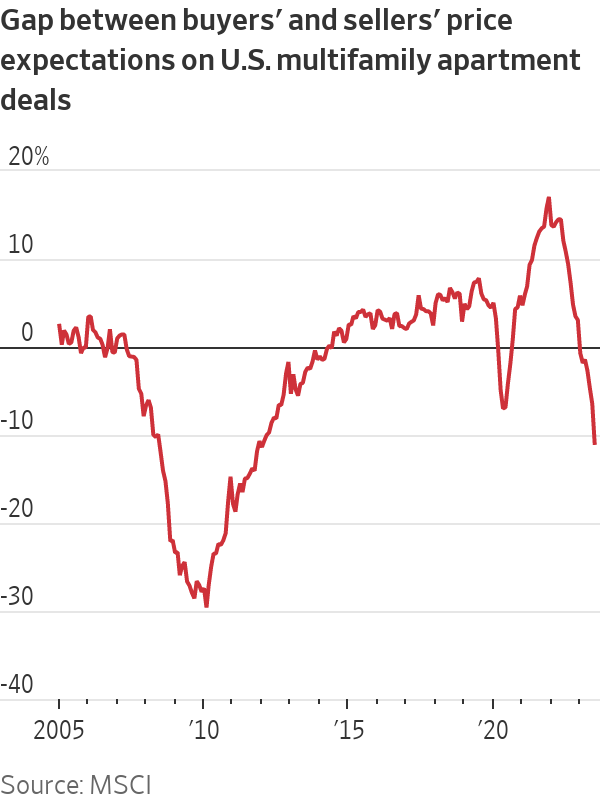

Property Sellers Are Still Demanding Yesterday’s Prices

Sellers are holding out for prices that are no longer realistic. MSCI’s bid-ask spread reflects the difference between what U.S. property owners are asking for and what buyers are willing to pay.

As of July, the gap for multifamily apartments was 11%, the widest it has been since early 2012, when the property market was still recovering from the 2008 crash. The gap for office and retail is a bit narrower at around 8%. Price expectations are closest for industrial warehouses, where sellers want just 2% more than buyers are willing to pay.

The market will be sluggish until one side caves. In the second quarter of 2023, investment in U.S. commercial real estate was down 64% compared with a year earlier, according to data from CBRE.

As the bid-ask gap narrows, it will signal that valuations are approaching more sustainable levels. But this will take some time. It was five years after the 2008 crash before buyers and sellers saw eye to eye on prices on the hardest-hit assets like apartments—although the adjustment should be much faster this time.

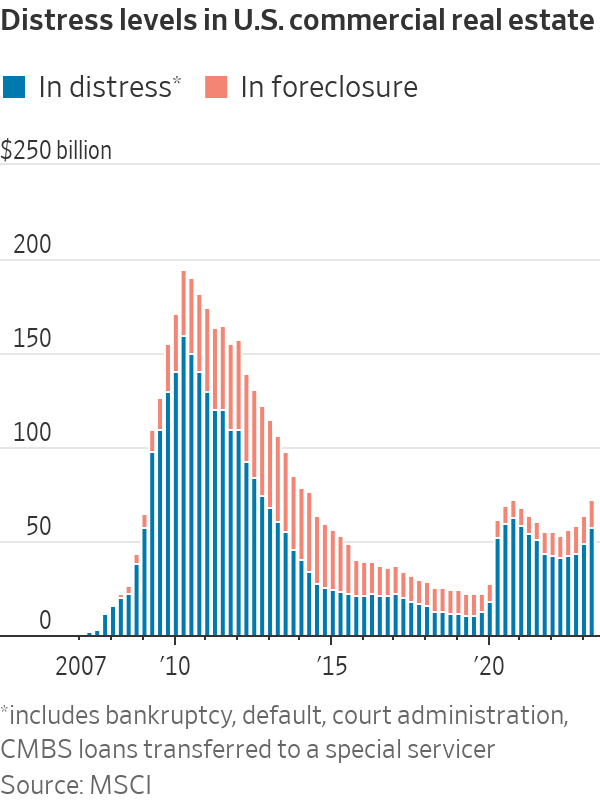

What Could Force Sellers to Slash Prices?

The number of properties that slip into distress will be key for bargain-hunters.

So far, there haven’t been many forced sales. Only 2.8% of all office deals in the U.S. in the second quarter were distressed, according to MSCI.

This may be because loans haven’t matured yet. “Owners don’t want to take a loss but once there are refinancing issues, they will have that come-to-Jesus moment with lenders,” says Jim Costello, chief economist at MSCI Real Assets.

Even if forced sales are still rare, the value of U.S. property in distress—in default or special servicing—is rising. In the second quarter, an additional $8 billion of assets got into distress, bringing the total to $71.8 billion, according to MSCI. Including properties that look at risk, the pool of potentially troubled assets is more than double this amount.

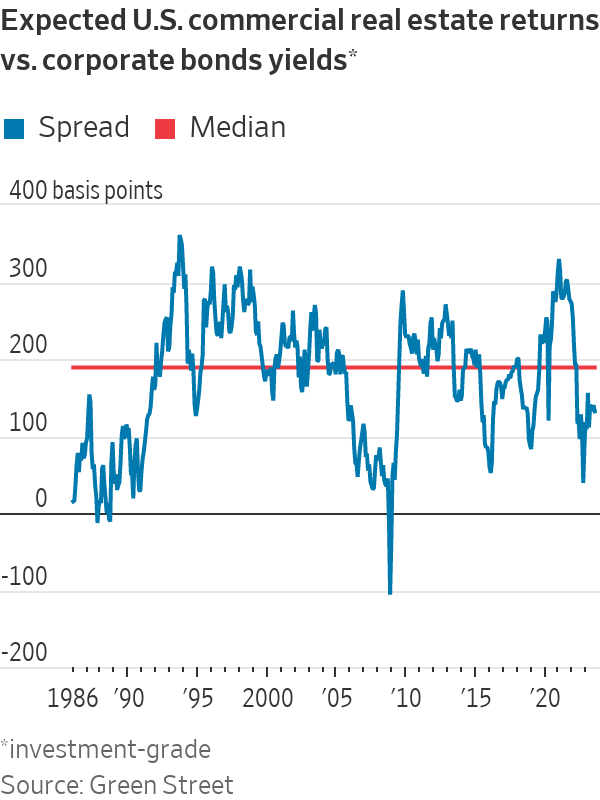

Investment-grade corporate bond yields suggest that property prices have further to fall

Owning commercial property is a bit like owning a corporate bond, only slightly riskier: You bet on the solvency of a tenant, with more uncertainty about the value of the capital you’ll get back. For at least the past 20 years, investors in U.S. real estate have required a return premium of 1.9 percentage points over the yield on investment-grade corporate debt, according to Green Street’s director of research, Cedrik Lachance.

Right now, real estate only offers a 1.3 percentage point premium. For the relationship to return to normal and make property attractive again, U.S. real-estate prices need to fall a further 10% to 15%.

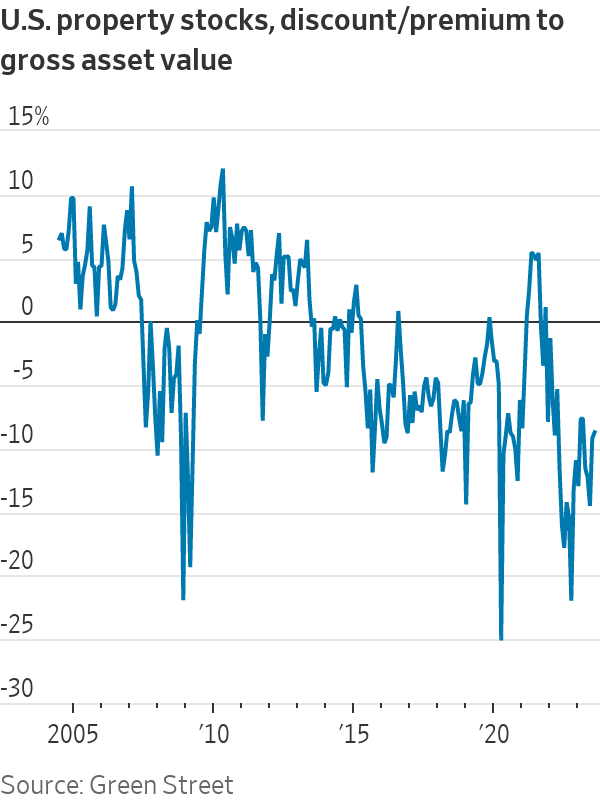

The share prices of listed property companies also point to further falls

Publicly traded real-estate stocks provide a live read of sentiment toward property markets. In the U.S., listed property companies currently trade at a 10% discount to gross asset values, based on Green Street data. This is a good proxy for the size of the price falls that investors still expect in private real-estate values.

Investors can also keep an eye on property stocks for signs of improvement. “Listed real estate is a leading indicator for private in downturns and also recoveries,” says Rich Hill, head of real estate strategy and research at Cohen & Steers, who points out that there are already green shoots. At the end of June, REITs had risen in value for three consecutive quarters and were 13% above their lowest point in the third quarter of last year. Based on how long it usually takes for a recovery to feed through to the private market, property values could hit the bottom within six to 12 months.

All this suggests the best strategy is to buy property stocks but to wait to purchase physical real estate. “If you want to bottom fish in real estate now, do it in the public markets,” says Green Street’s Lachance.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

The G80 Sport makes its entrance, displaying dynamic design details and elevated automative capabilities.

Juma Al Majid LLC, the exclusive dealer for Genesis in the UAE, has launched the G80 – a cutting-edge luxury sedan. Merging tradition with innovation, this model embodies Genesis‘ relentless pursuit of superior design, state-of-the-art technology, and unmatched luxury.

The new G80 marks a significant milestone in introducing Korean automotive excellence to the UAE, highlighting the brand’s commitment to providing exceptional experiences.

Meticulously crafted, the redesigned G80 adheres to the ‘Athletic Elegance’ design philosophy synonymous with Genesis. This luxury vehicle features refined details and cutting-edge specifications, combining comfort and style to elevate every driving experience to new heights.

“The debut of the all-new G80 in the UAE market propels our vision to converge advanced technology and refined elegance”, stated Suliman Al Zaben, Director of Genesis, UAE. “This launch is a step forward for Genesis in the UAE market and strengthens our efforts to offer ultimate luxury, innovation, and unique design to our incisive customer base.”

With a new dual-mesh design, the G80’s exterior enhances the sophisticated appearance of the Two-Line Crest Grille, paired with iconic Two-Line headlamps featuring Micro Lens Array (MLA) technology. This highlights Genesis’ commitment to harmonizing advanced technology with elegant design. The five 20-inch double-spoke wheels exude a dynamic aesthetic, resembling sleek aircraft lines, complementing the car’s parabolic side profile. Rear diffusers conceal mufflers adorned with distinctive V-shaped chrome trim inspired by the Crest Grille, embodying an eco-conscious ethos in today’s technology-driven era.

The G80 reinforces Genesis’ design philosophy in its interiors, inspired by the uniquely Korean concept of the Beauty of White Space, integrated with state-of-the-art technology to create cosmetic brilliance for users. The 27-inch-wide OLED display seamlessly combines the cluster and AVN (Audio, Video, Navigation) screen in a horizontal layout, extending to the center fascia, showcasing its flair for innovative technology. The touch-based HVAC (Heating, Ventilation, and Air Conditioning) system offers ease of control, while the redesigned crystal-like Shift By Wire (SBW) ensures a comfortable grip, infusing a sense of luxurious convenience.

With its dual-layered Crest Grille and expanded air intakes, the G80 Sport package delivers a dynamic and sporty spirit. Exclusive interior options, such as a D-cut steering wheel and carbon accents, enhance its sporty allure. Equipped with Rear Wheel Steering (RWS) and Electronic Limited Slip Differential (E-LSD), the G80 Sport 3.5 twin turbo model is built for stable control during high-speed maneuvers.

Fitted with advanced safety and convenience features, this luxury sedan includes Remote Smart Parking Assist 2, Lane Following Assist 2, and a Fingerprint Authentication System. The three-zone HVAC system provides customized climate control for all passengers. With two powertrain options – a 2.5 turbo engine delivering 300 horsepower and 43.0 kgf·m of torque, and a 3.5 twin turbo engine producing 375 horsepower and 54.0 kgf·m of torque – superior driving dynamics ensure a silent and luxurious driving experience.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual