Middle East Economy: Strong Despite Oil Reductions and Instability

Amid oil cutbacks and geopolitical tensions, the Middle East’s economy stays resilient, driven by strong non-oil sector growth in the UAE and Saudi Arabia.

Despite facing setbacks from oil production cuts and ongoing geopolitical conflicts, the Middle East’s economy demonstrates resilience, particularly due to significant growth in the non-oil sectors of the United Arab Emirates (UAE) and Saudi Arabia. Economists point to a robust performance in these sectors as a key factor in maintaining regional economic stability.

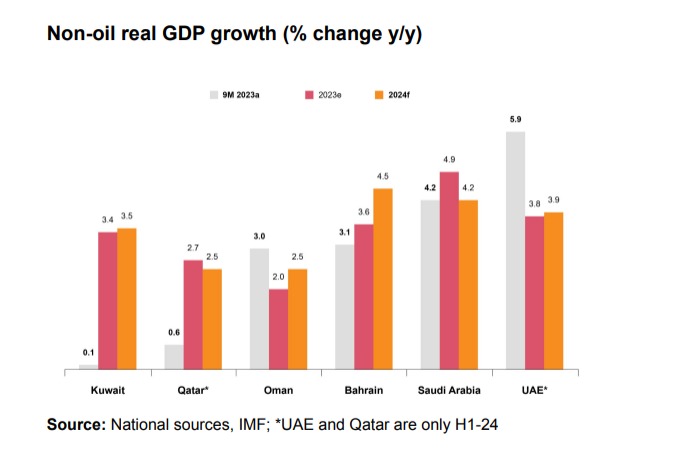

According to the “Middle East Economy Watch” report by PwC, the strength of the Middle East economy can largely be attributed to the solid growth in the non-oil GDP of Saudi Arabia and the UAE, alongside positive Purchasing Manager Indices (PMI) in these countries. These indicators suggest continued expansion in the early parts of 2024, signaling a robust economic trajectory.

Milestones in Economic Diversification

The UAE has marked a groundbreaking achievement in its economic diversification efforts, with its non-oil sector now comprising 73% of the nation’s total GDP—a historic first for the country. Abdullah bin Touq Al Marri, the Minister of Economy, highlighted this milestone as a testament to the global private sector and investors’ trust in the UAE’s investment climate. He further projected that the economy of the Arab world’s second-largest nation is set to expand by as much as 5.0% in 2024.

Saudi Arabia, as the world’s leading oil exporter, is actively reshaping its economy through the Vision 2030 diversification agenda. Despite a contraction last year due to oil output cuts, the kingdom’s economy is forecasted to grow, thanks to initiatives aimed at reducing oil dependency and bolstering non-oil sectors like technology and tourism.

The Role of Green Finance in Regional Development

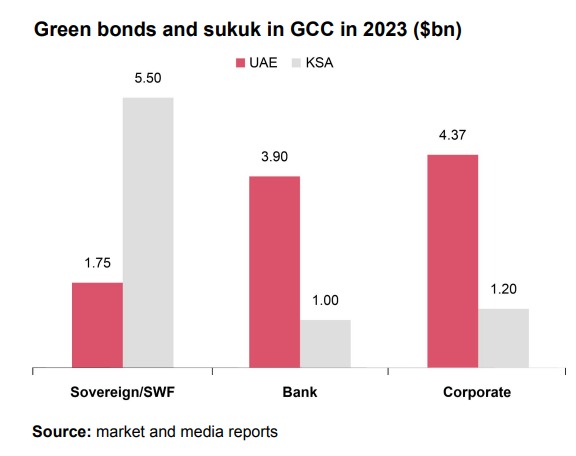

Stephen Anderson, partner, Middle East Strategy leader at PwC Middle East mentioned that the region’s focus on sustainability and economic diversification has led to a surge in green finance, enhancing its attractiveness to foreign investors.

The report also highlighted that the success of events like COP28 and the introduction of green finance frameworks have further accelerated this trend, doubling the issuance of green bonds and sukuk in the Middle East in 2023.

With countries like Oman and Qatar introducing sustainable finance frameworks and green bond initiatives, the Middle East continues to build momentum in green financing. This shift not only supports economic diversification and job creation but also draws significant Foreign Direct Investment (FDI).

Navigating Oil Cuts and Sector Growth

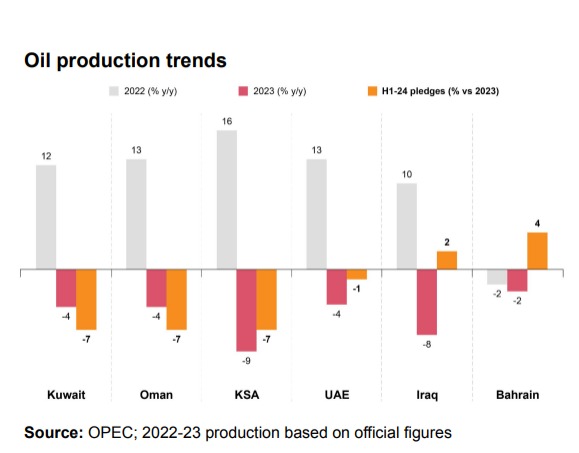

Production reductions in the oil sector have been prolonged, yet the non-oil industries continue to thrive: OPEC+ nations have consented to carry forward the cuts in oil production into the year’s second quarter, acknowledging the decelerated demand growth for oil as well as the potential for heightened supply from countries outside the OPEC+ alliance. These continued cuts suggest a probable contraction in the oil sector for 2024 relative to the previous year.

Meanwhile, Saudi Arabia has decided to temporarily pause its ambition to boost oil production capabilities, considering the current supply and demand scenario. This decision, however, is expected to redirect funds towards investments in alternative energy initiatives, including those in gas and renewable energy sectors.

Qatar’s ambitious plans to expand its liquefied natural gas (LNG) production capacity and the exploration of alternative trade routes highlight the region’s strategic adaptations to global energy and trade dynamics. These developments indicate a broader shift towards more sustainable and diversified economic practices.

According to PwC economists, despite oil market fluctuations and geopolitical concerns, the Middle East’s economy is poised for growth, driven by robust non-oil sectors, significant strides in economic diversification, and a growing emphasis on sustainable finance.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Total income was higher by 10% year-on-year (YoY) at AED 300 million in the six-month period

United Arab Bank PJSC (UAB or “the Bank”) has announced its financial results for the six months ended 30th June 2024. UAB reported a net profit before tax of AED 152 million for H1 2024, a 26% increase compared to AED 121 million for H1 2023. The net profit after tax for H1 2024 stood at AED 139 million, up 15% from AED 121 million in the same period last year. Earnings per share rose to AED 0.07 in H1 2024 from AED 0.06 in H1 2023.

Total income increased by 10% year-on-year to AED 300 million for H1 2024, compared to AED 273 million for H1 2023, driven by a 26% increase in net interest income. The Bank’s capital position remains strong with a CET1 ratio of 13% and a total capital adequacy ratio (CAR) of 18%.

UAB‘s liquidity profile is robust, with advances to stable resources ratio of 75% and an eligible liquid asset ratio of 19%, both comfortably above regulatory thresholds. The Bank’s credit ratings were affirmed by Fitch and Moody’s at BBB+/Ba1, with stable and positive outlooks respectively.

UAB’s performance in the first half of 2024 demonstrates significant growth in total assets, increasing by 12% compared to December 2023, and reflects a strategic focus on quality and farsighted risk management. These results indicate that the Bank is well-positioned to continue its growth trajectory.

Commenting on the Bank’s performance, H.H. Sheikh Mohammed bin Faisal bin Sultan Al Qassimi, Chairman of the Board of Directors of United Arab Bank, said: “UAB’s strong performance in the first half of 2024 reflects the successful implementation of our growth strategy and reinforces our commitment to delivering sustainable value to our shareholders. We are confident that our prudent business model shall continue to deliver a solid performance and deal with the opportunities and challenges that will present themselves.”

He added: “As we move ahead into the second half of the year, we remain committed to enhancing our customers’ banking experience and contributing to the growth and prosperity of the UAE’s economy.

Shirish Bhide, Chief Executive Officer of United Arab Bank, commented: Our customer-centric approach and sustainable growth model has led to a 15% increase in net profit and a 12% growth in total assets. Our positive performance is a testament to the successful execution of our strategic priorities and clear evidence of the success of the many initiatives that have been implemented at the Bank. Going forward, we will continue investing in our growth strategy and digital capabilities, while equally focusing on developing innovative products and services that meet our customers aspirations whilst upholding the highest standards of compliance and internal controls.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual