NINE-FIGURE HOME SALES ARE SKYROCKETING. ‘SOON $100 MILLION WILL BE $200 MILLION.’

The ultraluxury market has seen a surge in megadeals in recent years, as the ranks of wealthy buyers grew across the world.

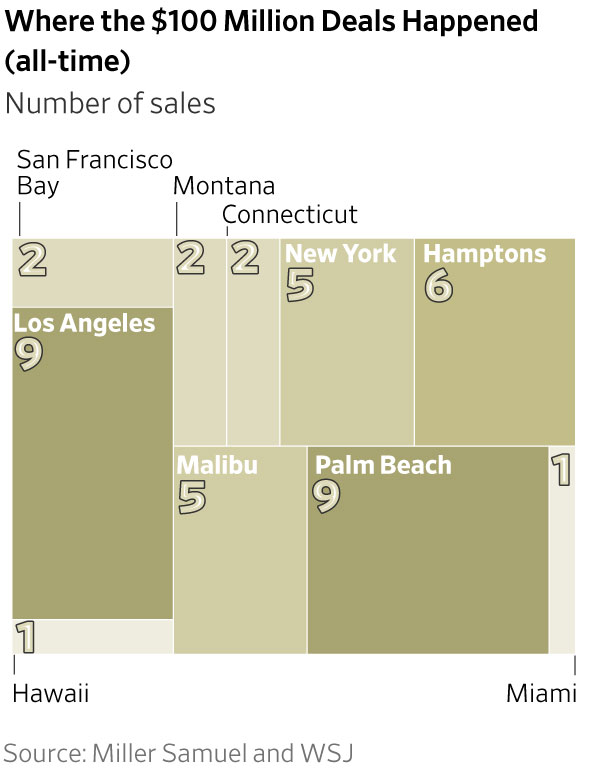

It has been nearly 20 years since the country’s first $100 million home sale, but in some ways the market is just taking off: Since 2020, at least 24 homes nationwide have traded for $100 million and up, more than the total number of nine-figure sales during the entire prior decade combined.

The 24 homes, and their uber-wealthy owners, also tell the compelling story of massive wealth creation and migration in the U.S. since the onset of the pandemic, with a dramatic surge in nine-figure deals in Florida in recent years. Since 2020, three homes over $100 million have changed hands in New York City compared with six in and around Palm Beach, including a $170 million deal in 2023 that set a Florida sales record.

“People’s wealth has grown so substantially and there’s such limited product,” said Chris Leavitt of Douglas Elliman in Palm Beach. “There are more billionaires than there are oceanfront, sprawling estates.”

Los Angeles and Malibu, Calif., have also notched a string of major transactions, gaining steam as the wealthy sought space and privacy during the pandemic or picked up second homes. Last year, entertainment power couple Beyoncé and Jay-Z paid $190 million for a mansion in Malibu that set a California sales record—and sparked predictions that the $200 million threshold is within reach.

“Soon $100 million will be $200 million, that’s the way it’s going,” said Drew Fenton of Carolwood Estates in Beverly Hills. “We’re inching closer to it.”

Nationwide, the number of mega deals skyrocketed as the ranks of ultra wealthy individuals swelled around the globe. There were 3,194 billionaires in 2023, up from 2,170 in 2013, according to wealth research firm Wealth-X.

Meanwhile, luxury home prices nationwide have soared. In 2023, the median sale price for a luxury home nationwide—defined as homes in the top 5% of the market—was $1.14 million, up 75% compared with 2013, according to real-estate brokerage Redfin.

In the past few years, the values of trophy homes around the country—disconnected as they might be from the rest of the market—also skyrocketed. So did the number of deals. In the 10 years between 2011 and 2020, there were 19 deals at or above $100 million. There were 22 deals over $100 million between 2021 and 2023. Those deals included properties that roughly doubled in value in a short amount of time.

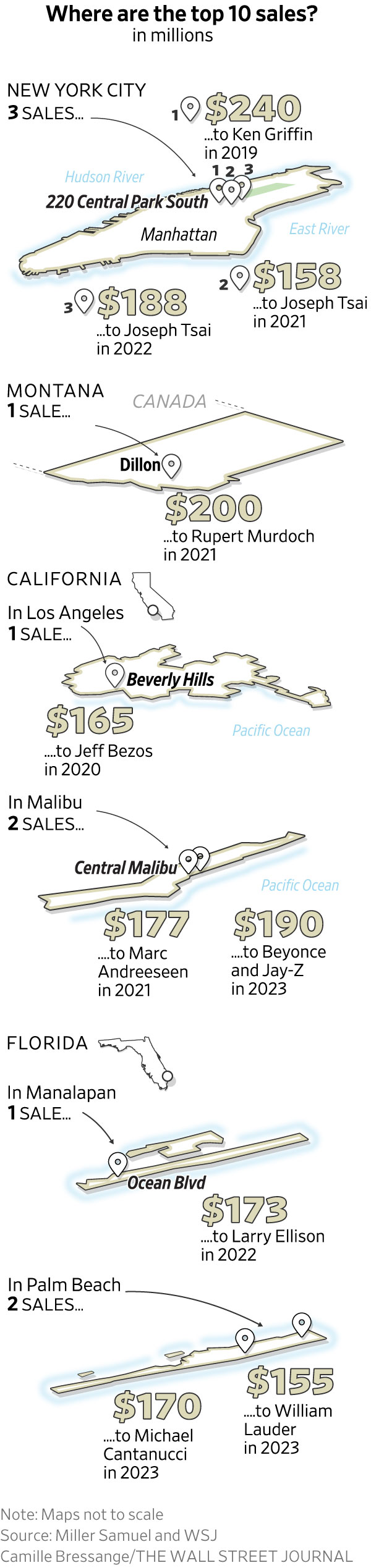

For example, Alibaba Group co-founder and Brooklyn Nets owner Joseph Tsai paid $188 million in 2022 for a penthouse at 220 Central Park South, the Robert A.M. Stern Architects-designed condo tower on Manhattan’s Billionaires’ Row. The seller was billionaire investor Daniel Och, who purchased the property for $95 million in 2019. Also in 2022, Oracle co-founder Larry Ellison bought an oceanfront estate near Palm Beach for $173 million. Seller Jim Clark, a co-founder of Netscape, paid just over $94 million for the property in 2021.

Although Ken Griffin’s roughly $240 million penthouse buy in Manhattan in 2019 is still the country’s most expensive sale, nine-figure deals have surged in Malibu and South Florida.

Florida, which had an influx of wealthy residents during Covid, had one deal above $100 million in 2013 and two in 2019. Since 2020, there have been seven—including six in and around Palm Beach, where the city’s sales record was shattered twice in 2023. In March, billionaire William Lauder bought the late Rush Limbaugh’s longtime Palm Beach estate for $155 million. The next month, luxury car dealership owner Michael Cantanucci paid $170 million for an oceanfront estate from Green Mountain Coffee Roasters founder Robert Stiller.

Miami, which courted the tech industry and others during the pandemic, also saw record sales in quick succession. In January 2022, Griffin paid a record $75 million for a mansion on Star Island, besting the prior Miami sales record of $60 million for two penthouses at Miami’s Faena House condominium. (The Citadel founder was also the buyer of those units, which he has since sold.) Then in June 2022, Phillip Ragon, founder of software company InterSystems, purchased three homes in Golden Beach—about 20 miles from downtown Miami—for a combined $93 million. In September 2022, Griffin struck again and handed Miami its first nine-figure deal with his $106.875 million purchase of a 4-acre estate from philanthropist Adrienne Arsht.

“That was a new frontier for Miami, but it was such a stupendous property,” said Jill Hertzberg of the Jills Zeder Group at Coldwell Banker Realty, who represented Griffin in the deal with colleague Jill Eber. Hertzberg said unlike Miami’s last real-estate boom in the early 2000s, which was fuelled by foreign buyers, domestic buyers are driving up prices for luxury properties.

With buyers from America’s 1% focused elsewhere, New York City logged fewer $100 million-plus deals by comparison. In 2023, Manhattan had no nine-figure deals. In 2022, it had two, including Tsai’s $188 million purchase and philanthropist Julia Koch’s purchase of two Upper East Side penthouses from the estate of the late Paul Allen for a combined $101 million. In 2024, real-estate developer Extell inked a deal to sell a penthouse at Central Park Tower for around $115 million. The deal hasn’t yet closed.

Local real-estate agents said the city’s biggest sales have taken place within a roughly 1-mile radius, where there are a limited number of properties that can fetch $100 million or more. “Everybody wants the Central Park view,” said Pam Liebman of the Corcoran Group. “There’s only a handful of buildings that could ever warrant that price,” she said. “It’s just a scarcity thing.”

But Jonathan Miller of real-estate appraisal firm Miller Samuel said developers sold off many of their biggest units over the past few years, and new inventory is skewing smaller. “The odds of having a lot more 10,000-square-foot transactions—those are the ones that are going to break the $100 million threshold—seem limited,” he said.

Covid also altered the city’s luxury market permanently. “Everybody needs to be here, it’s still the finance capital of the world, but they’re spending less time here,” said Tal Alexander of real-estate brokerage Official. He said buyers who want a sprawling apartment overlooking Central Park can get one for $40 million to $50 million. For that reason, he thinks buyers are more likely to spend $100 million for oceanfront land with multiple structures in Palm Beach than they are on a condominium in Manhattan, he said.

The reality is that many $100 million-plus properties rarely come to market, said Corcoran’s Tim Davis, who works in the Hamptons. “We’ve got low inventory,” he said. In 2023, a roughly 8-acre Hamptons estate sold for $112.5 million, the priciest Hamptons sale of the year.

Historically, California’s largest trades have also involved a small collection of trophy estates in Los Angeles, and to a certain degree, new spec homes. The size, provenance and location of L.A.’s iconic estates makes them rare commodities, Fenton said.

Among them is Casa Encantada, a roughly 8.5-acre estate owned by late billionaire Gary Winnick and his wife, Karen Winnick. After setting a U.S. sales record when it sold in 1980 and again in 2000, Casa Encantada hit the market in 2023 asking $250 million. It is now listed for $195 million.

Kurt Rappaport of Westside Estate Agency, who is marketing Casa Encantada with Fenton, said the price is justified by how infrequently properties of this caliber come to market. “There are a lot of people who own these properties who don’t want to sell,” he said. He pointed to Bezos’s 2020 purchase of the Warner Estate in Beverly Hills for $165 million, and Lachlan Murdoch’s purchase of Chartwell, an estate in Bel-Air, for roughly $150 million in 2019. (Murdoch is executive chairman of News Corp which owns Dow Jones & Co., publisher of The Wall Street Journal.) “If you look at who owns these great houses, some of them are generational,” Rappaport said.

Given the scarcity of singular trophy homes, savvy buyers have scooped up multiple properties in prime markets in recent years. Griffin, for example, has spent more than $250 million assembling land to build a mansion in Palm Beach over the past few years. In 2023, Bezos paid a combined $147 million for adjacent properties in Miami’s Indian Creek Village. “People have realized how precious land is in cities—there’s not a lot of land so if you find a particular piece that’s gorgeous, and you have the opportunity to buy next to you, why not?” Hertzberg said.

Buyers have also paid a premium for more space and privacy. In Malibu, WhatsApp founder Jan Koum spent a combined $187 million for neighbouring properties that he bought in two transactions in 2019 and 2021. Likewise, venture-capitalist Marc Andreessen and his wife, Laura Arrillaga-Andreessen, paid $177 million for a Malibu compound in 2021; a year later, they paid $44.5 million for another trophy home nearby.

Real-estate agents said there are also some properties that have been built over time that would likely fetch $100 million if they were ever sold. In Manhattan’s Greenwich Village, for instance, Chipotle Mexican Grill founder Steve Ells paid close to $32 million in two transactions in 2014 and 2015 to buy neighbouring townhouses. He later filed for permission from the New York City Landmarks Preservation Commission to combine the two buildings—spanning almost 16,000 square feet combined—into a mansion. In recent months, Ells has quietly been shopping the property, according to people familiar with the offer. The asking price? $125 million.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

This collaboration will extend into the fourth phase of Azizi’s Riviera project in MBR City, with Cummins supplying top-tier power generators.

Azizi Developments, a prominent private developer in the UAE, and Cummins Inc., a global leader in power solutions design, manufacturing, distribution, and supply, are extending their partnership into the fourth phase of the large-scale Riviera project. Cummins, known for its diverse range of products including diesel, natural gas, electric, and hybrid powertrains, as well as powertrain-related components, like filtration, after-treatment, turbochargers, fuel systems, control systems, air handling systems, automated transmissions, electric power generation systems, batteries, hydrogen generation, and fuel cell products. The manufacturer is globally renowned for its excellence in both innovation and sustainability.

Mr. Farhad Azizi, CEO of Azizi Developments, said: “As we continue our collaboration with Cummins Inc. for the fourth phase of our flagship project, Riviera, we reaffirm our commitment to procuring and utilizing only the highest quality materials. This partnership highlights our dedication to providing exceptional lifestyles for our investors and end-users through the careful selection of premium components. We are confident that our now-broadened alliance with Cummins Inc. will help in maintaining the high standards established for Riviera and further elevate the benchmarks of quality and excellence.”

Riviera is part of Azizi Developments’ award-winning portfolio. It is a stylish waterfront lifestyle destination that comprises 75 mid- and high-rise buildings with approximately 16,000 residences.

Designed to introduce the French-Mediterranean lifestyle to Dubai, which is not merely about architectural art, but also about a certain ‘joie de vivre’ — a celebration of life, an exultation of spirit, Riviera represents a new landmark destination that is both residential and commercial, with an abundance of retail space. Riviera features three districts: an extensive retail boulevard, a lagoon walk on the shores of its 2.7 km-long swimmable crystal lagoon with artisan eateries and boutiques, and Les Jardins — a vast, lush-green social space.

With its strategic location near the upcoming Meydan One Mall and the Meydan Racecourse — home of the Dubai World Cup — as well as Dubai’s most noteworthy points of interest, Riviera represents one of Azizi Developments’ most coveted projects.

Azizi Developments’ Sales Gallery can be visited on the 13th floor of the Conrad Hotel on Sheikh Zayed Road.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual