The Luxury Tower Built for New York’s Elite Still Sits Half Empty

Related Companies has struggled to unload its most expensive units at 35 Hudson Yards. Now the developer is offering deep discounts.

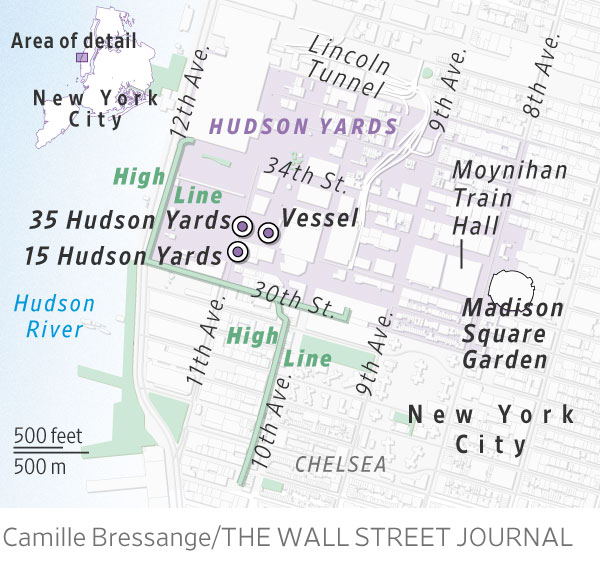

When the Related Companies set out to build Hudson Yards, a roughly 28-acre mega-project on Manhattan’s far west side, its goal was lofty: The developer wanted to turn a windswept railyard into the next hot destination for the global elite. That meant building and marketing a brand new neighbourhood with office towers, luxury stores, restaurants and high-end amenities.

The project’s condominium towers—15 and 35 Hudson Yards—were designed to lure moneyed buyers further west than ever before, and set a new benchmark for pricing outside of traditional high-end enclaves, with executives at Related promoting the neighbourhood as “the new Park Avenue.”

Now, roughly a decade after Related broke ground on Hudson Yards, it has struggled to make that vision a reality. At the luxury glass-and-limestone tower 35 Hudson Yards, approximately 50% of the units were still unsold as of the last week of June, more than four years after sales launched, according to an analysis by The Wall Street Journal based on sales recorded with the city’s Department of Finance. Related is slashing prices and offering incentives at the condominium, such as covering buyers’ taxes and closing costs, local agents said.

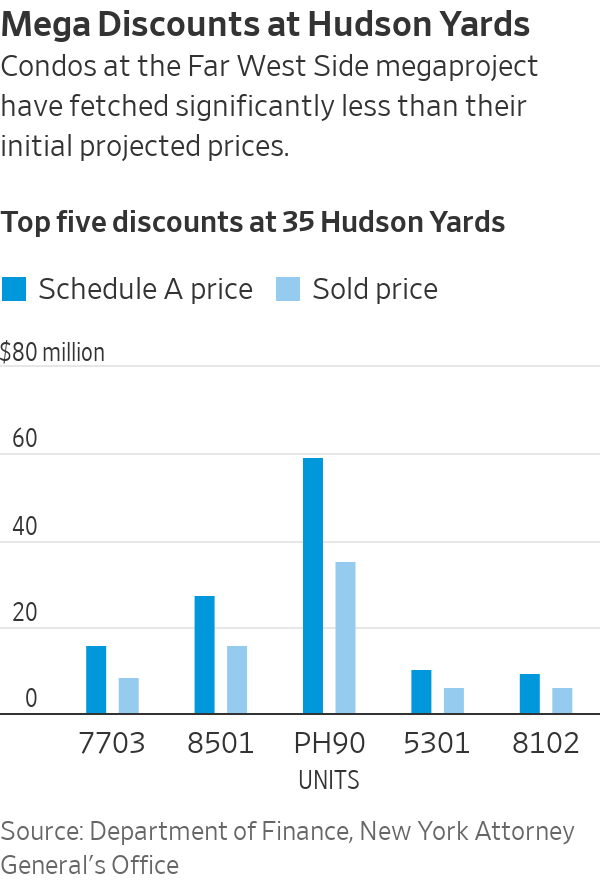

Recorded sales at 35 Hudson as of late June had closed for an average of 30% less than the original prices filed with the New York state Attorney General’s office, and active listings were discounted by up to 50%, the analysis shows. At least four large units at the building have sold for more than 40% off, records show. A four-bedroom apartment recently traded for $8.5 million, about 46% less than its projected asking price of $15.725 million, records show.

Related’s Sherry Tobak, who heads sales for the two condominiums alongside new development marketing firm Corcoran Sunshine, said the developer had been forced to reassess its expectations at 35 Hudson Yards.

“When we first opened the job, we thought we’d be able to get a higher price,” she said. “The message [from the market] was that we were overreaching a little bit.”

While many developers across the city are cutting prices amid higher interest rates, the discounts being offered at 35 Hudson Yards are bigger than developer concessions in other areas of Manhattan, according to appraiser Jonathan Miller of Miller Samuel.

“The actual housing market is not seeing anywhere near that kind of discount,” Miller said. Related disputed that characterisation, saying the building is performing in line with “its competitive set.”

Priced slightly lower than 35 Hudson, 15 Hudson Yards originally fared better, and is about 90% sold after almost seven years of marketing. Still, some 15 Hudson homeowners are listing their units for less than they paid as they look to resell in a shifting market.

In all, Related still has more than a billion dollars worth of condos left to sell at Hudson Yards, based on the initial pricing, the Journal analysis shows.

The Hudson Yards condos were always going to be a tough sell for Related, which secured the rights to develop the massive railyard site through a roughly $1 billion lease deal with the Metropolitan Transportation Authority in 2010. The far-west location—between 10th Avenue and the West Side Highway—was untested for luxury housing, and required creating an entirely new neighbourhood out of whole cloth. Retail at Hudson Yards now includes high-end stores such as Cartier, Coach and Dior and restaurants including chef José Andrés’ Mercado Little Spain. The project’s more than 10 million square feet of office space is home to tenants such as L’Oréal and Facebook parent company Meta.

To help sell the new neighbourhood it created, Related promised safety—the developer works with a private security firm to police Hudson Yards.

The reception to the new Hudson Yards neighbourhood has been mixed. While some flock there for the shopping, restaurants and tourist destinations like the Edge observatory, others have described the glass skyscrapers as soulless, with little authentic personality.

“It’s a very dramatic area that’s sprung out of nothing,” said Manhattan real-estate agent Donna Olshan. “It’s high-rise buildings, commercial real estate and a mall. It has less of a residential feeling.”

A number of suicides at the Vessel, a tourist attraction that sits at the centre of Hudson Yards, have generated negative press coverage and resulted in the closure of the walkable sculpture. A spokeswoman for Related said the company is evaluating solutions that would allow it to reopen the Vessel.

The first Hudson Yards condo tower, 15 Hudson Yards, was designed to have a downtown feel, said Tobak. Designed by Diller Scofidio + Renfro and Rockwell Group, the 88-story, 285-unit building resembles four interconnecting arcs of glass. The property has about 40,000 square feet of amenities, including a fitness centre, a pool and an open-air terrace wrapped in a 60-foot glass screen wall. Sales launched at the project in September 2016. Initial pricing filed with the attorney general’s office started at $1.92 million for a one-bedroom unit and rose to $32 million for a four-bedroom penthouse.

By contrast, 35 Hudson Yards was designed for a more uptown audience, and is “a little more classic,” Tobak said. Indeed, Related’s own founder and chairman, Stephen Ross, relocated there from another of the company’s projects, the former Time Warner Center at Columbus Circle. Designed by Skidmore Owings & Merrill, 35 Hudson Yards is 92 stories with 143 units. The building has interiors by Tony Ingrao, who also designed Ross’s Time Warner Center penthouse, and comes with amenities such as a private gym and access to the offerings of the Equinox Hotel, which is also in the building. Initial pricing filed with the attorney general started at $5 million for a two-bedroom unit and rose to $59 million apiece for a pair of penthouses.

When 15 Hudson Yards launched sales, it benefited from an upswing in the New York condo market. By the end of the first year of sales, Related had signed contracts for more than $500 million worth of apartments, nearly a third of its projected sellout for the whole tower, property records show. Foreign buyers, particularly from Asia, were a strong component of the buyer pool, thanks to marketing and trade shows Related did there, Tobak said. A large number of those buyers have since rented their units out, according to StreetEasy.

Today, about 30 units remain unsold, recorded sales show, with the building’s higher-priced apartments making up the majority of the leftover inventory. Tobak noted that that number is closer to 25 if signed contracts are factored in.

Some buyers who purchased early on are now struggling to unload their units in the current market. Ann Cutbill Lenane, a Douglas Elliman real-estate agent who has sold multiple units at Hudson Yards, signed a contract in 2017 to buy a $4.84 million condo for herself at 15 Hudson Yards. Now, with her children out of the house and a need to downsize, she has accepted that she’s unlikely to find a buyer willing to match that price on a resale. She has the unit listed for $4.495 million and said she expects to sell for a loss, especially since Related is currently listing units at a discount, undercutting the price she paid.

She said she feels embarrassed to be a real-estate agent losing money on a piece of property. Still, “I can’t beat myself up,” she said. “You always take a risk when you step into a new product. That’s just the nature of the beast.”

Tobak said that buyers who purchased at the height of the market at 15 Hudson Yards are now facing inevitable market realities, but recommended that they try to wait out the current cycle. “If you hold on for a little while, you’re going to make money,” she said.

When 35 Hudson Yards launched sales in March 2019, it debuted at a higher price point than 15 Hudson in a much less favourable market. “By the time 35 came up, the bloom was off the rose,” said Olshan.

Related signed contracts on about 15 of the 143 units at 35 Hudson in the first year, records show. Then, its efforts were further hampered by the pandemic, which temporarily shut down sales offices across the city. To generate activity, Related temporarily rented units at the building with an option to buy, Tobak said.

Still, Related has struggled to build the momentum needed to meet sales targets at 35 Hudson. Agents said one factor is Related’s proposal to bring a casino to Hudson Yards, which potential buyers worry could draw large crowds and make the area feel tacky. “I’m sure whatever gets built is going to be very tasteful,” said Dan Gotlieb of Digs Realty Group, who has done business at 35 Hudson. “But it’s just an uncertainty right now that’s probably also contributing to the sluggish sales.”

In response to criticism of the casino plan, Related said in a statement: “If we are fortunate enough to be one of the successful bidders for a gaming license, we will deliver a world-class resort with amenities, restaurants, retail and entertainment that will even further elevate the offerings at Hudson Yards and make the experience for the neighbourhood, residents and office tenants even greater than it is today.”

Of the 35 Hudson units currently listed on StreetEasy, many are asking significantly less than the initial pricing. A five-bedroom, roughly 4,600-square-foot unit is asking $13.85 million, 49% less than its original $27 million offering-plan price, records show. A four-bedroom, roughly 3,800-square-foot unit is asking $9.995 million, 43% less than its original projected price.

Olshan likened 35 Hudson to “a big Broadway show that just never took off.”

Real-estate agents with recent deals at 35 Hudson said they have been pleasantly surprised by Related’s level of negotiability. Alex Carini of the Carini Group said his firm recently helped a Brazilian family purchase a $9.95 million condo at the tower, a 37.5% discount from the offering-plan pricing. Related also covered the client’s closing costs, he said. In this market, he said, sellers often give a discount or cover closing costs, but rarely both.

Gotlieb said his clients, onetime renters at 15 Hudson, sat on the sidelines for years as they waited for prices to fall at 35 Hudson. “They wanted a certain kind of product and they weren’t willing to pay $10 million for it,” he said. Ultimately, they secured a four-bedroom, roughly 3,400-square-foot unit for $8.5 million, nearly 46% off the offering plan price, records show.

Retired corporate attorney Grace Kim, 50, said she felt she had “room to negotiate” when she purchased a three-bedroom apartment for her family at 35 Hudson last year.

“Mortgage rates were so high,” Kim said. “Everyone was kind of afraid to jump into the buyer’s market.”

Kim declined to comment on what she paid, but a Related spokesperson said that her unit type typically ranges in price from $6 million to $7.5 million. It is not clear what the apartment was originally priced at.

Kim said she feels comfortable with the investment, given that she plans on living there long term. “I feel like the market is going to come back eventually,” she said.

In the luxury segment of the Manhattan market—the top 10% of deals—the number of closed sales fell 39.6% in the second quarter from the same period of last year, according to a recent report prepared by Miller for Douglas Elliman. The median sales price held relatively steady, ticking up by 3.9% to $6.7 million, during that same period.

Tobak remains optimistic. She said she sees foot traffic picking up at 35 Hudson and has sent contracts out on multiple units in the past few weeks. Factoring in contracts signed, the building is closer to 60% sold, she said. Still, the developer has “less wiggle room than before” in terms of profitability.

“We’re at a decent point,” she said. “Are we making a ton of money? I don’t know.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

The G80 Sport makes its entrance, displaying dynamic design details and elevated automative capabilities.

Juma Al Majid LLC, the exclusive dealer for Genesis in the UAE, has launched the G80 – a cutting-edge luxury sedan. Merging tradition with innovation, this model embodies Genesis‘ relentless pursuit of superior design, state-of-the-art technology, and unmatched luxury.

The new G80 marks a significant milestone in introducing Korean automotive excellence to the UAE, highlighting the brand’s commitment to providing exceptional experiences.

Meticulously crafted, the redesigned G80 adheres to the ‘Athletic Elegance’ design philosophy synonymous with Genesis. This luxury vehicle features refined details and cutting-edge specifications, combining comfort and style to elevate every driving experience to new heights.

“The debut of the all-new G80 in the UAE market propels our vision to converge advanced technology and refined elegance”, stated Suliman Al Zaben, Director of Genesis, UAE. “This launch is a step forward for Genesis in the UAE market and strengthens our efforts to offer ultimate luxury, innovation, and unique design to our incisive customer base.”

With a new dual-mesh design, the G80’s exterior enhances the sophisticated appearance of the Two-Line Crest Grille, paired with iconic Two-Line headlamps featuring Micro Lens Array (MLA) technology. This highlights Genesis’ commitment to harmonizing advanced technology with elegant design. The five 20-inch double-spoke wheels exude a dynamic aesthetic, resembling sleek aircraft lines, complementing the car’s parabolic side profile. Rear diffusers conceal mufflers adorned with distinctive V-shaped chrome trim inspired by the Crest Grille, embodying an eco-conscious ethos in today’s technology-driven era.

The G80 reinforces Genesis’ design philosophy in its interiors, inspired by the uniquely Korean concept of the Beauty of White Space, integrated with state-of-the-art technology to create cosmetic brilliance for users. The 27-inch-wide OLED display seamlessly combines the cluster and AVN (Audio, Video, Navigation) screen in a horizontal layout, extending to the center fascia, showcasing its flair for innovative technology. The touch-based HVAC (Heating, Ventilation, and Air Conditioning) system offers ease of control, while the redesigned crystal-like Shift By Wire (SBW) ensures a comfortable grip, infusing a sense of luxurious convenience.

With its dual-layered Crest Grille and expanded air intakes, the G80 Sport package delivers a dynamic and sporty spirit. Exclusive interior options, such as a D-cut steering wheel and carbon accents, enhance its sporty allure. Equipped with Rear Wheel Steering (RWS) and Electronic Limited Slip Differential (E-LSD), the G80 Sport 3.5 twin turbo model is built for stable control during high-speed maneuvers.

Fitted with advanced safety and convenience features, this luxury sedan includes Remote Smart Parking Assist 2, Lane Following Assist 2, and a Fingerprint Authentication System. The three-zone HVAC system provides customized climate control for all passengers. With two powertrain options – a 2.5 turbo engine delivering 300 horsepower and 43.0 kgf·m of torque, and a 3.5 twin turbo engine producing 375 horsepower and 54.0 kgf·m of torque – superior driving dynamics ensure a silent and luxurious driving experience.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual