Wall Street’s Next Big Play Is Garbage

Landfill firms are investing in trash-gas production and recycling technology

The green push by the U.S. and state governments is turning trash into treasure and boosting the firms that handle America’s garbage.

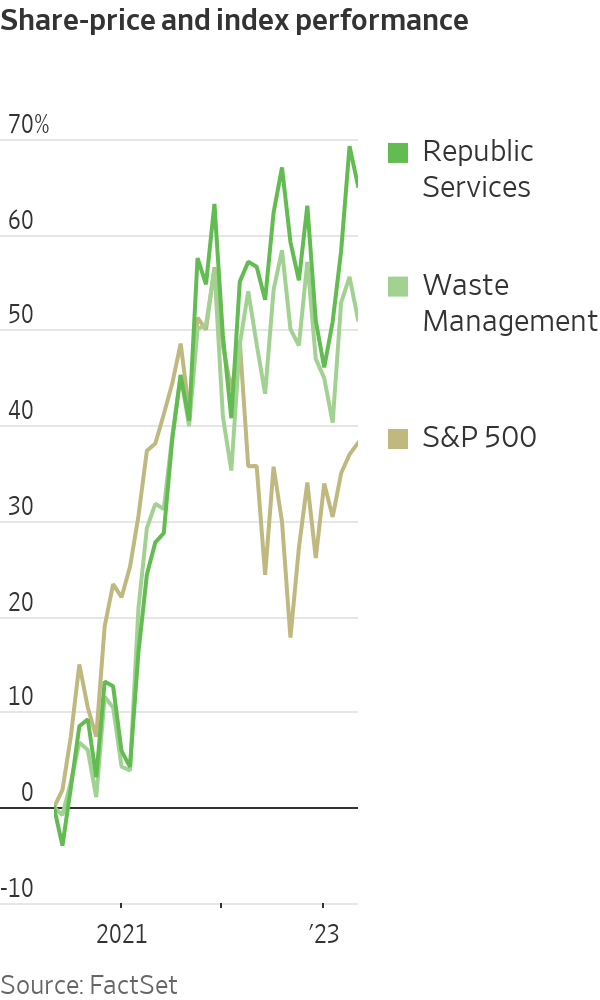

Shares of the biggest players in the U.S. trash business, Waste Management and Republic Services, have traded at record highs since President Biden signed the climate, tax and healthcare bill in August. A recent decline notwithstanding, the stocks are popular picks on Wall Street to ride the sustainability boom higher.

“They’re sitting in this extraordinary position,” said Michael Hoffman, an analyst at investment bank Stifel. “Garbage will be on the forefront.”

Efforts to reduce greenhouse-gas emissions and to reuse materials are making it more profitable to mine landfills for energy and sift through refuse for the hot commodities of the green economy, such as detergent bottles and cardboard boxes.

WM and Republic are building plants to isolate methane from the fumes emitted by rotting garbage and pipe it into the natural-gas grid to be burned in power plants, furnaces and kitchens. They are also equipping recycling facilities with the latest in automation to better sort and process materials for the consumer-goods companies that are under pressure to keep their packaging out of landfills and the ocean.

Landfill owners are forecasting hundreds of millions of dollars in additional profit from rising demand for recycled materials and tax incentives for making energy from emissions that would otherwise seep into the atmosphere.

“We’re blessed to be sitting right in the middle of a megatrend,” Republic Chief Executive Jon Vander Ark said. “We used to think about getting 5% top-line growth a year; now we’re in double-digit top-line growth mode.”

Republic, which has 206 active landfills, has a joint venture with a unit of BP to install gasworks at 43 of its dumps. The Phoenix firm has 65 landfill-gas plants. Some feed utility pipelines. Others generate electricity on site.

Republic is also spending about $275 million to build four polymer-processing facilities that will sort the plastic it collects kerbside and turn it into flakes for new bottles and jugs.

Vander Ark said consumer-product companies face minimum post-consumer-content mandates in California, Washington and other states, as well as their own sustainability goals. Republic’s first plastics plant is scheduled to open later this year in Las Vegas. Customers lined up.

“There’s fighting among customers about who gets what,” Vander Ark said.

Analysts say one risk is that adding exposure to volatile markets for commodities and renewable-fuel credits might spook investors interested in the steady and predictable profits involved in dumping garbage into landfills. Executives say the sustainability businesses are supplementary and moneymakers even when commodity prices are low, like now.

“Yes, there’s a year-over-year impact, but recycling is still profitable,” said Tara Hemmer, WM’s chief sustainability officer. “It still is one of our highest return-on-capital investments.”

WM, which operates more than 250 landfills, is in the second year of a four-year plan to spend $1.2 billion adding 20 trash-gas plants as well as $1 billion expanding and automating its recycling business.

The Houston company expects new and upgraded facilities to increase its recovery of reusable materials 25% by 2025. Having machines do the dirty work also cuts labor costs, executives say.

A lot of hard-to-fill jobs will be replaced by optical sorters, which use infrared cameras to spot valuable materials in the jumble and blow the desirable bits into separate bins with pinpoint puffs of air, Hemmer said.

“In the past we might have had mixed-paper bales that had cardboard embedded in them,” she said. “Now we’re able to pull more of that cardboard out, it goes in the cardboard bale, and the price point on cardboard is much higher than mixed paper.”

WM says the blended commodity value from its automated material recovery facilities is about 15% higher per ton. Not only do the machines amass more of the valuable stuff, the company says the material emerges cleaner and can fetch more than messy bales.

The recycling investments will add $240 million to its bottom line over the next four years, WM says. It has higher expectations for its gas business.

WM says it will boost landfill-gas output eightfold and generate more than $500 million in additional earnings before interest, taxes, depreciation and amortisation through 2026.

That profit forecast assumes two prices associated with every million British thermal units of gas. WM is counting on the actual fuel selling for $2.50, which is lately about the price of gas from geologic wells. Another $23.50 is anticipated from renewable-fuel credits, which is in line with recent trading, according to energy-information firm Platts.

The outlook doesn’t count the $250 million or more of tax credits WM expects for building new gas plants.

Last year’s climate bill sweetened the economics of trash gas. A federal proposal to offer additional credits for biogas projects that produce power for electric vehicles could make the incentives even stronger.

Waste-company executives and analysts say that many are worth building anyway and that the incentives make it economical to install gasworks at smaller, less-gassy landfills.

“Landfill gas is essentially the only scalable biofuel that doesn’t have a food-for-fuel trade-off,” said Goldman Sachs analyst Jerry Revich. “These projects don’t need any subsidies, but they will take the free money.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Saudi Arabia ranked first among countries for the non-oil exports of national origin with BD201 million (22%)

Bahrain’s non-oil exports of national origin decreased by 6% to BD894 million ($2.37 billion) in Q2 2024 compared to the same period in 2023. The top 10 countries accounted for 64% of the total export value.

According to the Information & eGovernment Authority (iGA) in its Q2 2024 Foreign Trade report, Saudi Arabia was the leading destination for these exports, totaling BD201 million (22%). The US followed with BD75 million (8.4%), and the UAE with BD73 million (8.2%).

Unwrought aluminum alloys were the top exported product in Q2 2024, amounting to BD267 million (30%), followed by agglomerated iron ores and concentrates alloyed at BD159 million (18%) and non-alloyed aluminum wire at BD49 million (5%).

Non-oil re-exports

Non-oil re-exports increased by 4% to reach BD206 million during Q2 2024, compared to BD198 million for same quarter in 2023. The top 10 countries accounted for 86% of the re-exported value. The UAE ranked first with BD58 million (28%) followed by Saudi Arabia with BD39 million (19%) and UK with BD17 million (8%).

As per the report, turbo-jets worth BD65 million (32%) were the top product re-exported from Bahrain, followed by private cars with BD11 million (5%) and four-wheel drive with BD9 million (4%).

The value of non-oil imports has decreased by 4% reaching to BD1.41 billion in Q2 2024 in comparison with BD1.47 billion for same quarter in 2023. The top 10 countries for imports recorded 68% of the total value of imports.

China Bahrain’s biggest importer

China ranked first for imports to Bahrain, with a total of BD191 million (14%), followed by Brazil with BD157 million (11%) and Australia with BD112 million (8%).

Non-agglomerated iron ores and concentrates were the top product imported to Bahrain worth BD200 million (14%), followed by other aluminum oxide with BD101 million (7%) and parts for aircraft engines with BD41 million (3%).

As for the trade balance, which represents the difference between exports and imports, the deficit logged was BD310 million in Q2 2024 compared to BD322 million in Q2 2023.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual