WELL INTO ADULTHOOD AND STILL GETTING MONEY FROM THEIR PARENTS

Nearly 60% of parents provide financial help to their adult kids, a new study finds.

Parents have always supported their children into adulthood, from funding weddings to buying a home. Now the financial umbilical cord extends much later into adulthood.

About 59% of parents said they helped their young adult children financially in the past year, according to a report released Thursday by the Pew Research Center that focused on adults under age 35. (This question hadn’t been asked in prior surveys.) More young adults are also living with their parents. Among adults under age 25, 57% live with their parents, up from 53% in 1993.

Parental support is continuing later in life because younger people now take longer to reach many adult milestones—and getting there is more expensive than it has been for past generations, economists and researchers said. There is also a larger wealth gap between older Americans and younger ones, giving some parents more means and reason to help. In short, adulthood no longer means moving off the parental payroll.

“That transition has gotten later and later, for a lot of different reasons. Now it’s age 25, 30, 35, 40,” said Sarah Behr, founder of Simplify Financial Planning in San Francisco.

Kami Loukipoudis, a 39-year-old director of design, and husband Adam Stojanik, a 39-year-old high-school teacher, knew they would need parental assistance to buy in New York’s expensive home market.

“We could pay a mortgage, but that down payment was the absolute crusher,” Stojanik said. “The idea of trying to save up on our own—as long as we were paying rents in NY, would’ve taken 300 years.”

Loukipoudis’s mother gave them the money for a 10% down payment on a two-bedroom apartment in the New York borough of Queens.

The young-adult allowance

Adult children aren’t necessarily getting larger checks from their parents, but they are staying on the parental payroll for longer than previous generations, according to Marla Ripoll, professor of economics at the University of Pittsburgh who studied the trend by analyzing payments from parents to adult children over a 20-year span.

Ripoll found that 14% of adult children receive a transfer of money from their parents at least once in any given year, and roughly half get financial help at some point within that period. Those rates have been stable for years. What has changed is that the transfers now continue for much longer, she found. This longer-term help might be a drag on social mobility, as it becomes even harder for young people from lower-income families to catch up, researchers said.

Of the young adult children who said they received financial help from a parent in the past year, most said they put it toward day-to-day household expenses, such as phone bills and subscriptions to streaming services like Netflix, according to the Pew survey.

The amount of money and the frequency of help varies by age; those on the older end of the 18-to-34 cohort are far likelier to say they are completely financially independent from their parents compared with younger adult children, as many in the latter group are completing their education. Nearly a third of young adult children between the ages of 30 and 34 say they still get parental help.

Heather McAfee, a 33-year-old physical therapist in Austin, Texas, said she lived at home between 2019 and 2021; otherwise she wouldn’t have been able to make progress paying down her student loans while rent prices in her area remained so high. The plan worked—she has since reduced her student-debt balance from $83,000 to $15,000.

“It helped tremendously,” she said. “I didn’t have to take out more loans to pay for apartment living or anything like that. That stress was gone.”

Setting limits on financial help

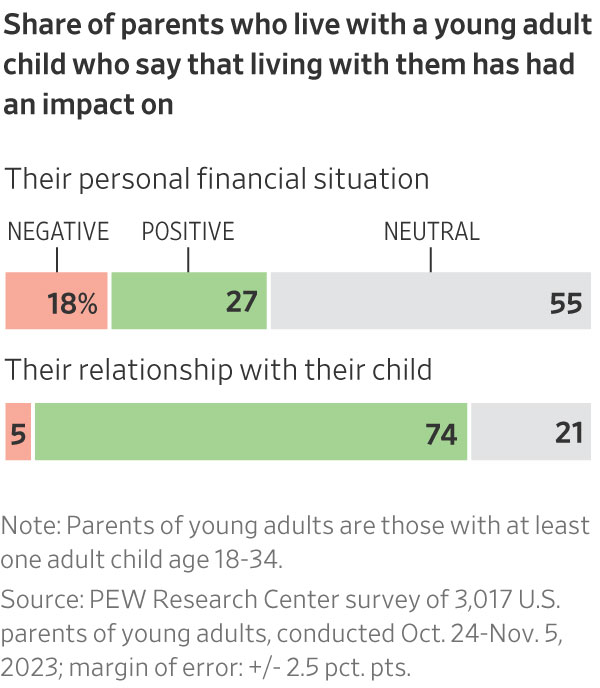

A little more than half of parents surveyed said that having their adult children home brought them closer together or improved their relationship, but nearly 20% said it dented their personal finances.

Financial advisers often find themselves in the tricky position of speaking to both ends of the equation: adult children who need assistance and the parents determined to help children well into middle age, within limits.

Whereas previous generations would step into a greater sense of financial independence in their early 20s, young adult children today are often unable to reach similar markers of such independence—living on their own or buying their first home, for example—without greater financial resources.

Families typically don’t set concrete rules around when financial help will happen and what the money is used for, which can result in surprises down the road, Behr said.

In one case, Behr’s clients received the down payment they needed to purchase a condo from a generous mother-in-law. Years later, that same mother-in-law told them she expected a payout once the couple sold the home.

The hand-me-down payment

Down-payment help from parents—a given for many first-time home buyers—is growing thanks to higher home prices and elevated mortgage rates.

About a fifth of first-time home buyers said they got help from a relative or friend when pulling together the money needed for a down payment, according to a 2023 survey of home buyers and sellers from the National Association of Realtors. And 38% of home buyers under age 30 received help with the down payment from their parents, according to a survey this spring by Redfin.

Wealthy families often go further than helping with the down payment. They become a true bank of mom and dad and write a mortgage. The Internal Revenue Service sets minimum levels of interest for such loans, which remain significantly cheaper than current mortgage rates.

Timothy Burke, chief executive at National Family Mortgage, which facilitates such loans, said parents are often frustrated on behalf of their house-hunting children. High interest rates and the cutthroat housing market are holding their children back from reaching a milestone the parents themselves were more easily able to access.

Mei Chao, a 41-year-old stay-at-home mom, and her husband, William Chao, a 44-year-old information-technology specialist, bought their first house as a couple in 2017. They relied on financial help from her husband’s two sisters and his mother to help them bridge a gap in their house-buying timeline. While they waited to sell William’s Manhattan condo, they used the money from the family to purchase the new house in Queens.

The structure of the agreements got tricky. After selling the condo in Manhattan, Mei and her husband were able to repay his sisters in full. But they didn’t have enough money left over from the sale to do the same for Mei’s mother-in-law. So they kept the mother-in-law’s name on the deed to the house—a concession Mei said they were both more than happy to make.

“Ultimately, it all worked out. I’m glad his mother pushed us,” Mei said. “Without her help, I could not say we would have this home.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Highlighting a significant recovery and robust growth across all key performance metrics.

Bank of Sharjah has released its results for the period ending 30 June 2024, showcasing robust performance and strong momentum since the beginning of the year. The Bank reported a net profit of AED 171 million, a significant turnaround from the AED 144 million loss in the same period last year.

This remarkable improvement is attributed to a substantial increase in net interest income, stringent credit underwriting, and reduced operating costs, marking a 233% increase over the previous year when excluding the one-time impairment charge from de-linking its Lebanese subsidiary.

The Bank’s exceptional financial results highlight the effectiveness of its strategic focus on sustainable growth, with notable improvements across all major performance metrics. Funded and unfunded income both saw increases, with net interest income rising by 108% and operating income growing by 34%.

Additionally, the cost-to-income ratio improved significantly to 40.1% due to cost discipline measures. The balance sheet remains strong with a loans-to-deposits ratio of 86.63%, indicating comfortable liquidity. The Bank also maintains strong capitalization, with a regulatory capital adequacy ratio exceeding 15% and Tier 1 and CET1 capital ratios around 14%. These positive results underscore the Bank’s underlying strength, operational efficiency, prudent risk management, and ongoing enhancement of shareholder value.

Commenting on the Bank’s results, Sheikh Mohammed bin Saud Al Qasimi, Chairman of Bank of Sharjah, stated: “We are pleased with our outstanding performance in the first half of 2024, which reflects our commitment to adding value to our customers, supporting our communities, and rewarding our shareholders. Despite the challenging geopolitical situation in the region, the UAE economy has remained resilient and continues to register healthy growth following various economic diversification initiatives that provide consistent impetus for trade, investment, and wealth creation. Bank of Sharjah has entered a new chapter with a new leadership team, focused on building new business streams, expanding our reach across the UAE and the region, and delivering exceptional service to our customers.”

He added: “Our performance in the first half of the year demonstrates the effectiveness of our new strategy, and we look forward to delivering continued growth in the years to come.”

The CEO, Mr. Mohamed Khadiri, commented “2024 has begun exceptionally well for Bank of Sharjah, with the bank achieving a record year-on-year profit. I am delighted with our stellar performance as we continue to strengthen the bank’s fundamentals. Our outstanding results reaffirm that our new business strategy is on track to deliver sustainable revenue growth, driven by business expansion, operational efficiency, prudent risk management, and talent development. This achievement is also a testament to the Bank’s success in providing high-quality financial services that meet the aspirations and growing needs of our customers.”

He further added: “Bank of Sharjah is a strong and respected brand within the local community. We are leveraging our core strengths to build a platform that will operate at its full potential across the UAE and the region. The Bank remains focused on executing our strategy and is well-positioned to maintain strong performance throughout 2024 and beyond.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual