Why Businesses Can’t Stop Asking for Tips

Employers far beyond restaurants rely on the practice to avoid paying higher wages; testing customer limits

American businesses have gotten hooked on tipping.

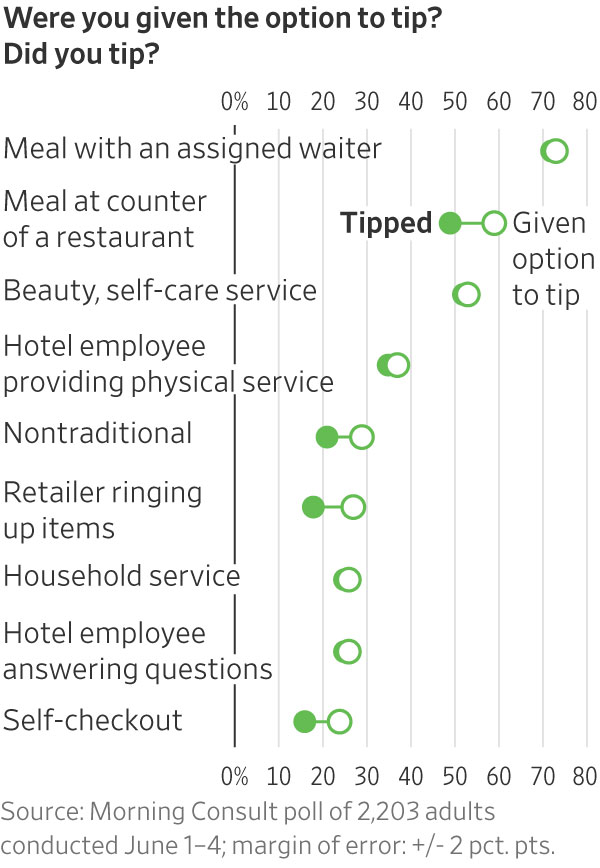

Tip requests have spread far beyond the restaurants and bars that have long relied on them to supplement employee wages. Juice shops, appliance-repair firms and even plant stores are among the service businesses now asking customers to hand over some extra money to their workers.

“The U.S. economy is more tip-reliant than it’s ever been,” said Scheherezade Rehman, an economist and professor of international finance at George Washington University. “But there’s a growing sense that these requests are getting out of control and that corporate America is dumping the responsibility for employee pay onto the customer.”

Some businesses that are new to tipping said they have turned to the practice to try to retain workers in a competitive job market while also keeping their prices low. Asking for tips allows them to increase worker pay without raising their wages.

Consumers seeing tip prompts at every turn say they are overwhelmed—and that worker wages should be business owners’ responsibility, not theirs.

Sixteen percent of the 517 small businesses surveyed by employee-management software company Homebase for The Wall Street Journal ask customers to leave a tip at checkout, up from 6.2% in 2019.

Payroll company Paychex, which provides software for thousands of businesses in leisure, hospitality, retail and other service industries, said more employees are receiving tips as a portion of their pay than at any time since the company started tracking tipping in 2010. As of May, 6.3% of workers whose employers used the software earned tips, compared with 5.6% in 2020. The number remained relatively flat between 2016 and 2020.

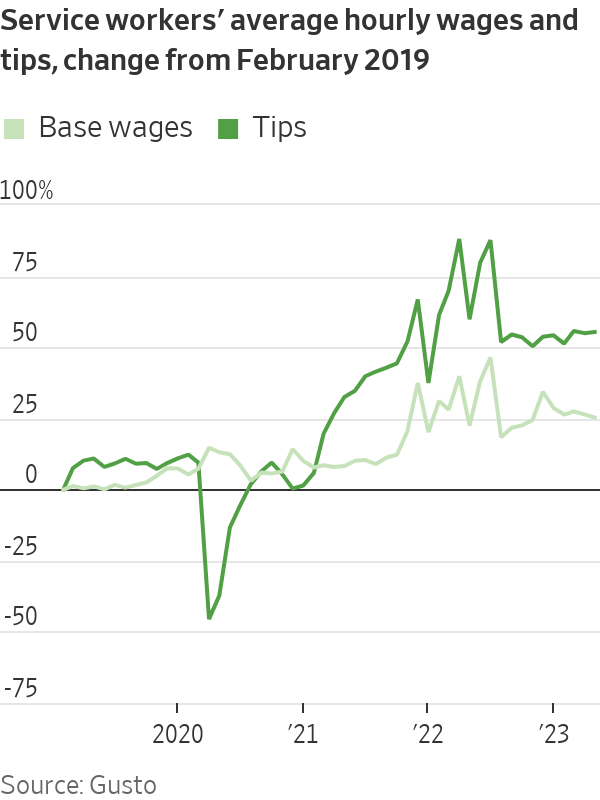

As of June, service-sector workers in non-restaurant leisure and hospitality jobs made $1.35 an hour in tips, on average, up 30% from the $1.04 an hour they made in 2019, according to an analysis of 300,000 small and midsize businesses by payroll provider Gusto.

Tips now increase wages for service workers by an average of 25%, compared with 20% between 2019 and 2020, according to Gusto. In May, the average hourly service-industry worker earned $16.64 an hour in base wages and $4.23 an hour in tips.

During pandemic lockdowns, customers of many service businesses began tipping to acknowledge workers who put themselves at risk. Rehman said that made businesses reliant on the practice. Employers with already tight margins say there’s no going back.

“With businesses still preparing for the possibility of a recession, they don’t want to lock into higher wages,” said Jonathan Morduch, a professor of public policy and economics at New York University. “Tipping gives them more flexibility.” He said the practice pushes the financial risk that employers would ordinarily shoulder onto workers.

“Businesses are happy to let workers earn more from tips, especially when there’s no pressure to raise the tipped minimum,” he said, referring to the $2.13 an hour plus tips many bar and restaurant workers across the country earn.

Holding on to workers has been especially difficult in the services sector, particularly since the pandemic. Lodging and food service have had the highest quit rate for workers since July 2021, consistently above 4.9% per three months, the U.S. Chamber of Commerce said in a May 2023 report. The quit rate for the retail trade industry isn’t far behind, around 3.3% so far in 2023. In May 2023, the overall quit rate for workers was 2.6%, according to the Bureau of Labor Statistics.

Dan Moreno, founder of Miami-based Flamingo Appliance Service, decided in 2020 to add an option for customers to tip his employees, reasoning that his home-repair technicians were taking health risks by entering customers’ homes during the pandemic.

About one-third of customers now leave a tip of between 10% and 20%, Moreno said. The requests add an average of $650 a year to his 182 technicians’ salaries, about 1% of their total yearly income.

Rising costs, he said, persuaded him to retain the option after the pandemic abated.

“You wouldn’t believe the margins we operate with,” he said. Competition for workers is fierce. Were he to eliminate the gratuity prompt, he said, he would have to raise prices beyond the 18% he already has, on average, since 2019—likely costing him clients.

He knows the requests might turn off some customers, but as the son of a repair technician and a former technician himself, he said, he tries to do as much as he can for his workers.

Within the food-service industry, tips as a share of compensation are rising faster at limited-service establishments such as bakeries and coffee shops than at full-service ones, according to Gusto.

At the Main Squeeze Juice Co. in Mandeville, La., tips add $3 to $5 to workers’ hourly pay, which starts at $10. Owner Zachary Cheaney said he added the option when he opened the location in 2020.

“We can’t just say, ‘Oh, we’re going to charge $2 extra’ instead of having tips, because we have a duty to our customers to have a very fair price point,” said Cheaney, who also consults for Main Squeeze’s corporate office. If customers think the price is too high, he said, they won’t return. Asking them to tip, he said, is different because it’s optional.

“If customers completely stopped tipping, we would be forced to pay employees more, and it would be hard on us as business operators in this crazy environment of rising costs,” he said.

The juice bar’s general manager, Tiffany Naquin, said tips make up about one-tenth of her $46,000 annual pay. Workers like tips, she said, “in all industries. It’s that little extra.” Knowing a customer will see a gratuity screen at the end motivates employees, she said. “If you give employees incentives, they are going to give you better work,” she said.

Checkouts that include a tip screen are more awkward for customers than for workers, she said. She understands if someone declines to tip, she said, and she wouldn’t let that affect the quality of service.

Morduch, the New York University economics professor, said that while most people tend to think of tips as steady income, many businesses fluctuate seasonally—which means employee pay goes up and down. Service workers who receive tips, he added, are often lower income and struggle to deal with such volatility.

Saru Jayaraman, a labor advocate and director of the Food Labor Research Center at the University of California, Berkeley, said that boosting tips without increasing base pay is bad for workers. If customers stop tipping, she said, worker pay effectively declines, which it wouldn’t if employees got a raise.

“Employers think they’re being smart by using tipping instead of raising wages,” she said. “But really they’re risking losing staff, because it’s pissing consumers off and the employees are the ones who have to deal with it.”

A May survey of about 2,400 Americans by financial services company Bankrate found that consumers are tipping less often than they did at the height of the pandemic. Forty-one percent of respondents said businesses should pay their employees better rather than rely so much on tips. Roughly a third said tipping culture is out of hand.

Denver retiree Mary Medley, though, said she sees being a generous tipper as part of her economic responsibility. For her, it isn’t about how difficult a task was, but whether she can lighten someone else’s financial burden, even a little.

“It’s not my job to figure out where it goes or how it gets distributed,” she said. “But if they’re giving me the opportunity to participate in supporting a business in a tangible way, I’ll do so.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Saudi Arabia ranked first among countries for the non-oil exports of national origin with BD201 million (22%)

Bahrain’s non-oil exports of national origin decreased by 6% to BD894 million ($2.37 billion) in Q2 2024 compared to the same period in 2023. The top 10 countries accounted for 64% of the total export value.

According to the Information & eGovernment Authority (iGA) in its Q2 2024 Foreign Trade report, Saudi Arabia was the leading destination for these exports, totaling BD201 million (22%). The US followed with BD75 million (8.4%), and the UAE with BD73 million (8.2%).

Unwrought aluminum alloys were the top exported product in Q2 2024, amounting to BD267 million (30%), followed by agglomerated iron ores and concentrates alloyed at BD159 million (18%) and non-alloyed aluminum wire at BD49 million (5%).

Non-oil re-exports

Non-oil re-exports increased by 4% to reach BD206 million during Q2 2024, compared to BD198 million for same quarter in 2023. The top 10 countries accounted for 86% of the re-exported value. The UAE ranked first with BD58 million (28%) followed by Saudi Arabia with BD39 million (19%) and UK with BD17 million (8%).

As per the report, turbo-jets worth BD65 million (32%) were the top product re-exported from Bahrain, followed by private cars with BD11 million (5%) and four-wheel drive with BD9 million (4%).

The value of non-oil imports has decreased by 4% reaching to BD1.41 billion in Q2 2024 in comparison with BD1.47 billion for same quarter in 2023. The top 10 countries for imports recorded 68% of the total value of imports.

China Bahrain’s biggest importer

China ranked first for imports to Bahrain, with a total of BD191 million (14%), followed by Brazil with BD157 million (11%) and Australia with BD112 million (8%).

Non-agglomerated iron ores and concentrates were the top product imported to Bahrain worth BD200 million (14%), followed by other aluminum oxide with BD101 million (7%) and parts for aircraft engines with BD41 million (3%).

As for the trade balance, which represents the difference between exports and imports, the deficit logged was BD310 million in Q2 2024 compared to BD322 million in Q2 2023.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual