Why the Drivers of Lower Inflation Matter

Competing effects of central banks, healing supply chains affect recession odds

Recent good news on inflation has ignited a debate over how much central banks’ interest-rate increases are responsible.

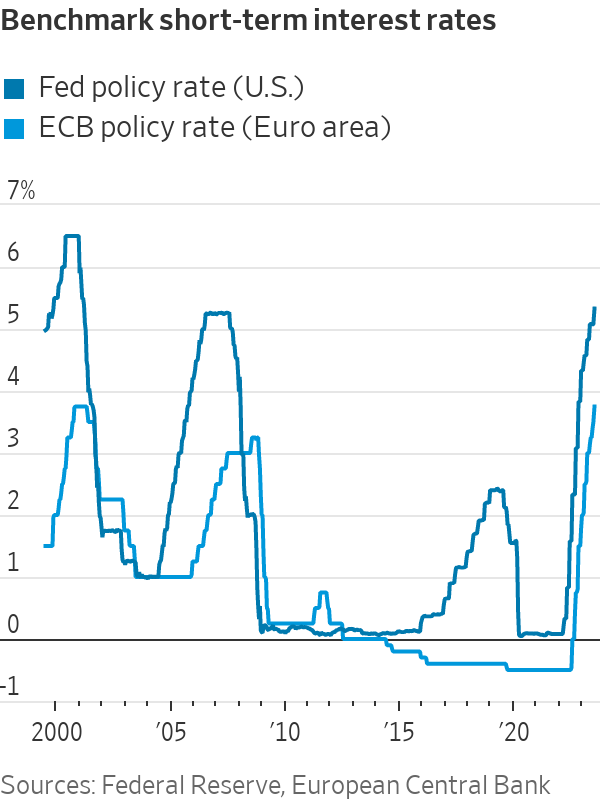

The answer matters for where inflation and interest rates are headed. The Federal Reserve and the European Central Bank in the past week lifted their benchmark interest rates to 22-year highs and left the door open to additional increases.

If higher rates weren’t responsible for the progress on inflation to date, that suggests central banks may be able to lower them before a painful recession sets in.

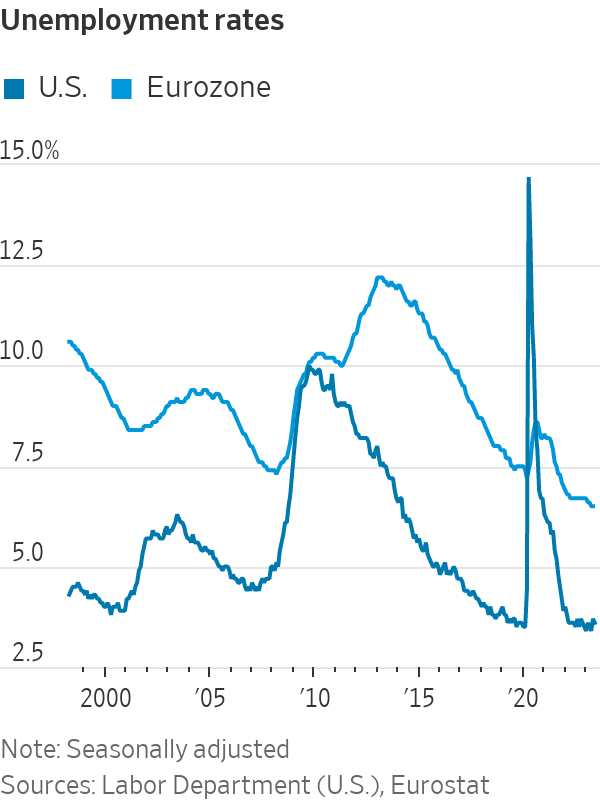

Central banks generally see their influence on inflation coming through higher rates damping the demand for goods, services and workers, which leads to higher unemployment. That in turn puts downward pressure on prices and wages.

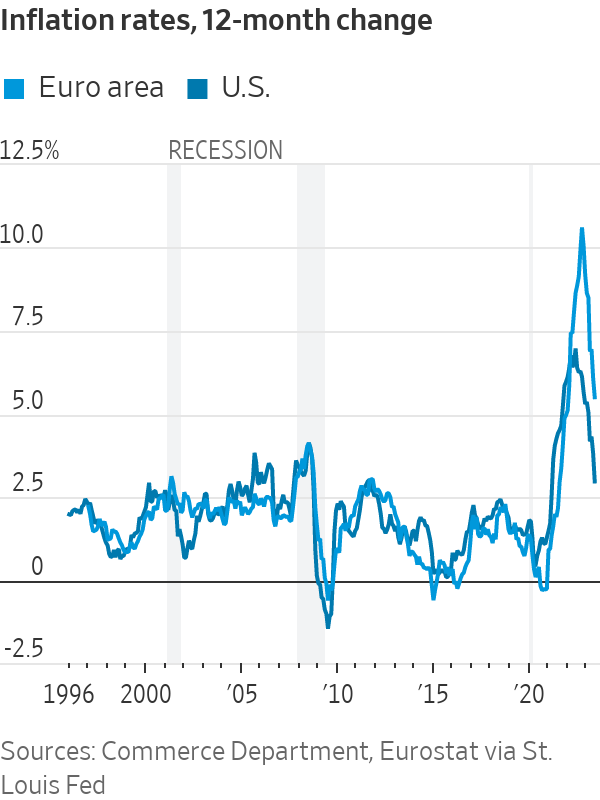

Only the second part of that sequence has occurred. Inflation fell to 3% in the U.S. in June, according to the Fed’s preferred gauge, the personal-consumption expenditures price index, down from 7% one year earlier. Yet the unemployment rate, at 3.6% in June, has held steady for the past year.

In the eurozone, inflation declined to 5.5% in June, the lowest level in nearly 18 months, and unemployment has drifted to the lowest in more than 25 years.

There are competing explanations for this.

One camp argues that inflation has been mostly driven by supply shocks that are going away on their own—much as a postwar surge in the late 1940s unwound by itself. The ripple effects gave the illusion of broader, more persistent price increases.

Take the auto market. Sellers weren’t able to meet pent-up demand two years ago, leading to huge price increases, which in turn spawned higher prices later on for car repairs and auto insurance.

Similarly, a surge in household formation during the pandemic sent up housing prices and rents.

The first camp attributes most of the recent decline in inflation to the ebbing of these one-time supply disruptions, not rate increases, which are supposed to work through the labor market. “It’s calling into question a lot of the old assumptions,” said Lindsay Owens, executive director at the Groundwork Collaborative, a liberal think tank.

A second camp, which includes most economists, disagrees. They say monetary policy kept demand for goods, services, and labor lower than otherwise, taking pressure off strained supply chains and allowing price pressures to ease.

Interest rates can also influence behaviour. The prospect that central bankers would risk a recession to bring down inflation may have influenced expectations of price- and wage-setters, including corporate executives who plan annual budgets for investment and hiring.

Jamie Dimon, chief executive of JPMorgan Chase, warned one year ago of an economic “hurricane” as central banks accelerated rate increases. “You’d better brace yourself,” he said in June 2022, and pledged the bank would be “very conservative” with its balance sheet.

“Inflation is coming down precisely because the Fed avoided more excess demand growth, and they anchored inflation expectations,” said Angel Ubide, head of economic research for global fixed income at Citadel, a hedge-fund firm.

Inflation would be higher now if not for Fed rate increases, “and maybe still rising,” said Karen Dynan, an economist at Harvard University.

In 2021, supply-chain constraints meant even marginal increases in demand led to unusually large price increases. The reverse might be true now: Marginal decreases in demand can bring down prices faster, particularly if more supply is becoming available.

The car market illustrates how monetary policy has been transmitted. Rising rates raised monthly payments, damping demand and robbing sellers of pricing power. In addition, since March, banks appear to be rejecting more car-loan applications.

“That’s leading to a new group of people getting squeezed out of the market, and therefore, it’s playing a role putting downward pressure on prices,” said Julia Coronado, founder of economic-advisory firm MacroPolicy Perspectives.

In Europe, economic growth has stalled since late last year. Business surveys in the past week suggest that growth is weakening sharply, especially in manufacturing, which is most sensitive to interest rates.

The net share of banks reporting increased loan demand declined to a record low in the three months through June, according to an ECB survey of banks. Credit growth to households is the lowest since mid-2016.

Asked at a news conference on Thursday about the transmission of ECB rate increases to growth and inflation, President Christine Lagarde said that in the financial system, “a lot has been transmitted. A lot. We know that. In the economy at large, not as much yet.”

A report published by German insurer Allianz identifies three different forces on the U.S. inflation rate since the second quarter of 2022. Higher inflationary pressures from consumption growth, strong labor markets and government spending added 4 percentage points; fading supply-chain disruptions subtracted five points, and Federal Reserve actions subtracted another five. The net impact was that inflation fell 6 percentage points, whereas it would have fallen only one point without the Fed’s actions.

Fed Chair Jerome Powell said rate increases are “working about as we expect, and we think it’ll play an important role going forward” in bringing down prices for the most labor-intensive services.

Monetary policy has also affected the labor market, but this has shown up in declining job-vacancy rates rather than rising unemployment, some economists say.

Hiring plans in the eurozone services sector are dropping rapidly, according to a survey this month by the European Commission, the European Union’s executive body.

“The labor market is normalising on both sides of the Atlantic, reflecting the impact of higher rates,” said Stefan Gerlach, a former deputy governor of Ireland’s central bank.

The debate over the effect of rate increases also matters for how much further, if at all, central banks need to lift them. Optimists underestimated how much strong demand lifted inflation two years ago. Pessimists may be overestimating the importance of constraining demand to bring it down now.

Gerlach expects inflation to continue declining as higher rates sap demand. “I’m worried central banks have done too much,” he said. “They may have felt embarrassed about having misunderstood inflation the first time.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Highlighting a significant recovery and robust growth across all key performance metrics.

Bank of Sharjah has released its results for the period ending 30 June 2024, showcasing robust performance and strong momentum since the beginning of the year. The Bank reported a net profit of AED 171 million, a significant turnaround from the AED 144 million loss in the same period last year.

This remarkable improvement is attributed to a substantial increase in net interest income, stringent credit underwriting, and reduced operating costs, marking a 233% increase over the previous year when excluding the one-time impairment charge from de-linking its Lebanese subsidiary.

The Bank’s exceptional financial results highlight the effectiveness of its strategic focus on sustainable growth, with notable improvements across all major performance metrics. Funded and unfunded income both saw increases, with net interest income rising by 108% and operating income growing by 34%.

Additionally, the cost-to-income ratio improved significantly to 40.1% due to cost discipline measures. The balance sheet remains strong with a loans-to-deposits ratio of 86.63%, indicating comfortable liquidity. The Bank also maintains strong capitalization, with a regulatory capital adequacy ratio exceeding 15% and Tier 1 and CET1 capital ratios around 14%. These positive results underscore the Bank’s underlying strength, operational efficiency, prudent risk management, and ongoing enhancement of shareholder value.

Commenting on the Bank’s results, Sheikh Mohammed bin Saud Al Qasimi, Chairman of Bank of Sharjah, stated: “We are pleased with our outstanding performance in the first half of 2024, which reflects our commitment to adding value to our customers, supporting our communities, and rewarding our shareholders. Despite the challenging geopolitical situation in the region, the UAE economy has remained resilient and continues to register healthy growth following various economic diversification initiatives that provide consistent impetus for trade, investment, and wealth creation. Bank of Sharjah has entered a new chapter with a new leadership team, focused on building new business streams, expanding our reach across the UAE and the region, and delivering exceptional service to our customers.”

He added: “Our performance in the first half of the year demonstrates the effectiveness of our new strategy, and we look forward to delivering continued growth in the years to come.”

The CEO, Mr. Mohamed Khadiri, commented “2024 has begun exceptionally well for Bank of Sharjah, with the bank achieving a record year-on-year profit. I am delighted with our stellar performance as we continue to strengthen the bank’s fundamentals. Our outstanding results reaffirm that our new business strategy is on track to deliver sustainable revenue growth, driven by business expansion, operational efficiency, prudent risk management, and talent development. This achievement is also a testament to the Bank’s success in providing high-quality financial services that meet the aspirations and growing needs of our customers.”

He further added: “Bank of Sharjah is a strong and respected brand within the local community. We are leveraging our core strengths to build a platform that will operate at its full potential across the UAE and the region. The Bank remains focused on executing our strategy and is well-positioned to maintain strong performance throughout 2024 and beyond.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual