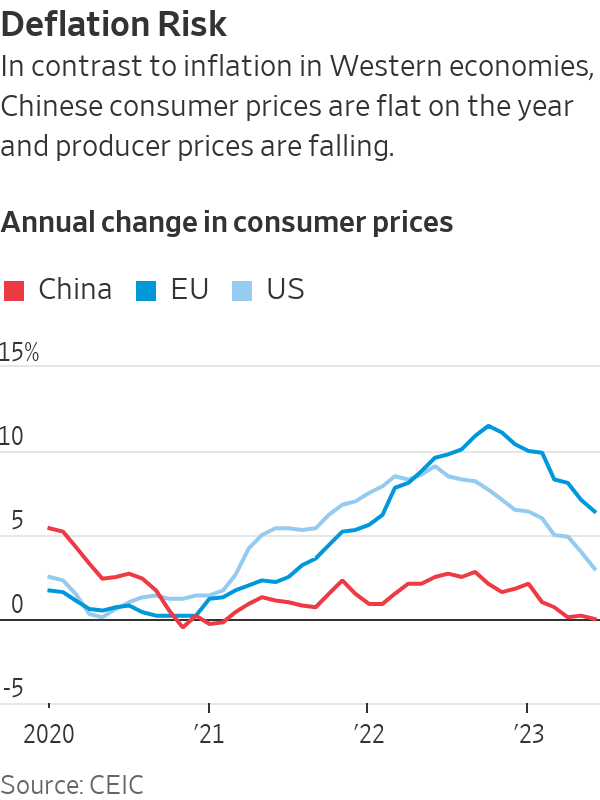

While Everyone Else Fights Inflation, China Deflation Fears Deepen

Some economists see parallels between China and Japan, where growth stagnated and prices fell for years

Signs of deflation are becoming more prevalent across China, heaping extra pressure on Beijing to reignite growth or risk falling into an economic trap it could find hard to escape.

While the rest of the world tussles with inflation, China is at risk of experiencing a prolonged spell of falling prices that—if it takes root—could eat into corporate profits, sap consumer spending and push more people out of work. Its effects would ripple across the globe, easing prices for some products that countries like the U.S. buy from China, but would also deprive the world of important Chinese demand for raw materials and consumer goods, while also creating other problems.

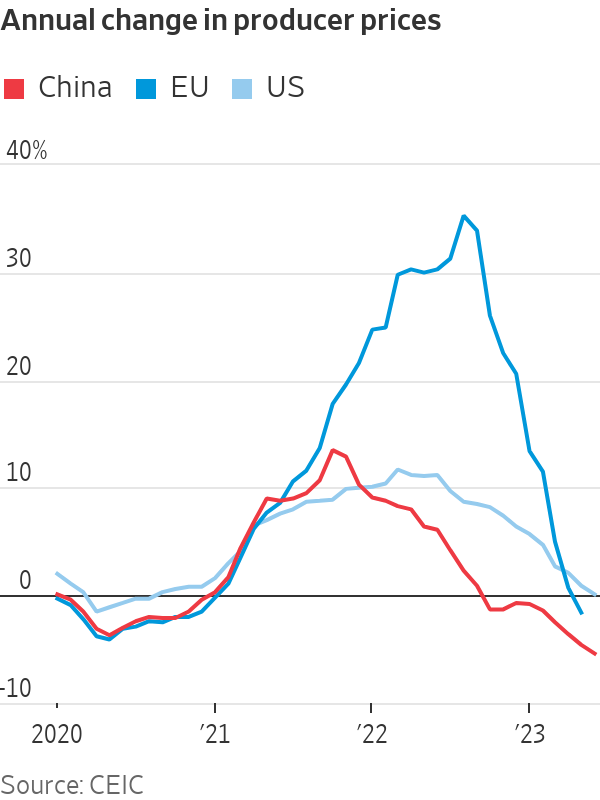

Prices charged by Chinese factories that make products ranging from steel to cement to chemicals have been falling for months. Consumer prices, meanwhile, have gone flat, with prices for certain goods—including sugar, eggs, clothes and household appliances—now falling on a month-over-month basis amid weak demand.

Most economists think China will probably avoid a deep and lasting period of deflation. Its economy is growing, albeit sluggishly, and the government has unveiled a variety of small stimulus measures that could help more. Earlier in July, Liu Guoqiang, a Chinese central bank official, dismissed concerns that China is slipping toward deflation.

But some economists see alarming parallels between China’s current predicament and the experience of Japan, which struggled for years with deflation and stagnant growth.

In the 1990s, a collapse in stock markets and real-estate values in Japan pushed companies and households to drastically cut back spending to service burdensome debts—a so-called balance-sheet recession that some see taking shape in China today.

Data released Thursday showed industrial profits are sinking and average new home sale prices fell in June.

If China were to tip into protracted deflation, it has another big problem: Traditional methods of fighting it are either unpopular in Beijing, or lack potency due to the country’s heavy debt load and other issues. Beijing is wary of large deficit-financed spending programs that could juice growth and push prices higher, while big debts mean consumers and businesses are reluctant to borrow and spend.

“The big concern is whether the policy tools that they have will have much traction in terms of trying to avert deflation, or deal with deflationary pressures once they arrive,” said Eswar Prasad, a professor of trade policy and economics at Cornell University and a former head of the International Monetary Fund’s China division.

For the global economy, extended deflation in China might help cool inflation elsewhere, including the U.S., since its factories make up such a large share of the world’s goods.

However, a flood of cut-price Chinese exports on global markets could squeeze out rival exporters in some countries, hurting jobs and investment in those economies. Chinese export prices for steel and chemicals fell by about a third over the 12 months through June.

A deflationary spell in China would also likely mean weaker Chinese demand for food, energy and raw materials, which big chunks of the world rely on for export earnings.

“The market is underestimating the deflationary impact on the global economy,” said Frederic Neumann, chief Asia economist at HSBC in Hong Kong.

Consumer prices in the U.S. rose 3% in June from a year earlier, a sharp slowdown from the 8% annual rate a year earlier but still above the 2% rate targeted by the Federal Reserve. Annual inflation in the European Union last month was 6.4% as the region continues to feel the squeeze from high energy and food prices.

In China, annual consumer-price inflation in June was zero. Producer prices fell in China last month by 5.4% from a year earlier.

Subdued consumer spending is one big reason. Some idiosyncratic factors are also at play, including a steep rise last year in the price of pork—a staple in the Chinese diet—that hasn’t been repeated.

But weak price pressures are also a payback of sorts for China’s experience during the Covid-19 pandemic, when exports rocketed thanks to Western demand for gym equipment, home improvement supplies and other goods.

The demand surge helped push Chinese producer prices up 12% between the start of 2020 and their peak in April last year, according to an index calculated by Moody’s Analytics.

When governments lifted lockdowns and Western demand eased, the trend reversed. Producer prices began falling on a year-over-year basis in October and have kept falling every month since.

Chinese factories, which expanded to meet Western demand during the pandemic, now face overcapacity. The hope was that Chinese consumers would step into the breach and soak up excess inventories as export markets dried up. But that hasn’t happened, and as more businesses pivot toward selling into the domestic market, the downward pressure on prices is building.

With global energy and food prices also weaker than before, economists expect overall consumer prices in China to stay nearly flat, or even fall, in the coming months. In addition to many foodstuffs and clothing items, prices have also been falling for electric vehicles, as Chinese automakers and Tesla have slashed prices amid slower sales growth and in an effort to win more share in a crowded market.

China could escape further deflation if growth regains momentum later this year, helped by government stimulus, as some economists anticipate. Nomura economists expect annual consumer-price inflation in China of negative 0.2% in the third quarter, with inflation eventually turning positive again toward the end of the year.

The risk for China is that deflation proves more persistent than expected. Falling prices tend to squeeze spending as consumers await a better deal tomorrow, reinforcing a downward spiral.

The longer it lasts, the more severe its effects become. Entrenched deflation means debts become harder to bear as profits and incomes fall. Companies shed workers to fatten shrinking margins.

In Shanghai, Liu Wang has held off on plans to upgrade his apartment because he is worried about sinking more money into a property whose value he believes could keep dropping.

“The economic condition is highly uncertain now,” said Liu, who works at a logistics firm that is shifting its focus toward domestic business after its export business weakened. In his hometown of Qufu in China’s northeastern Shandong province, demand for homes has been tepid despite a drop in prices, he said.

“The housing bubble is still quite large,” Liu added. “I don’t see any reason why prices will go up.”

In Japan, deflation first appeared in 1995. Excluding a few respites, it more or less stuck around until the 2008-09 financial crisis. Even today, Japan is battling to sustain higher rates of price growth with ultraloose central bank policies.

One textbook response is a massive monetary expansion, lowering interest rates and printing money to spur borrowing and spending, which in theory should trigger more inflation.

But data show Chinese companies are reluctant to take on new debt to expand production, while droves of homeowners are choosing to repay mortgages early. Both are signs of weak demand for loans, muffling the effectiveness of interest-rate cuts.

A major reason is that many companies and households already have such large debts that they don’t want to add more. Household debt has surged to 1.5 times that of income, far above the level of most developed countries, including the U.S., according to calculations by Jens Presthus, associate director of Global Counsel, an advisory firm.

Deflation, or even just the fear of deflation, can make the problem worse. Borrowers worry the cost of servicing their debts is going to rise, so they respond by saving more and spending less.

“Deflation is particularly dangerous when there’s a lot of debt,” said Arthur Budaghyan, chief emerging markets economist at BCA Research.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Providing a high-end smart living experience for residents

In a groundbreaking move, Batelco, a subsidiary of the Beyon Group, has entered a strategic partnership with Grnata, a renowned real estate group, to integrate advanced smart solutions into the Golden Gate residential towers in Bahrain Bay.

The formal agreement was signed at Beyon’s headquarters by Hassan Al Mushaima, Chairman of Grnata Real Estate Group, and Maitham Abdulla, Chief Executive Officer of Batelco, witnessed by representatives from both companies.

This collaboration aims to transform the Golden Gate towers, among Bahrain’s tallest residential structures, into a high-tech haven. Batelco will deploy state-of-the-art technology solutions to enhance residents’ living experience.

A standout feature of this project is the implementation of a bespoke In-Building Solution (IBS), designed to boost wireless signal quality and coverage across all floors, ensuring seamless connectivity. Additionally, cutting-edge video surveillance (CCTV) systems will be installed to enhance security, providing residents with increased peace of mind.

Furthermore, the Golden Gate towers will be equipped with the latest technology systems, enabling residents to remotely control various aspects of their apartments. This includes managing lighting, air conditioning, windows, curtains, and main door access. The system is designed to be future proof, allowing integration with upcoming advancements in home automation, thus ensuring residents benefit from emerging smart home capabilities.

Hassan Al Mushaima, Chairman of Grnata Real Estate Group said: “We are pleased to announce our new strategic partnership with Batelco, Bahrain’s leading telecommunications provider.”

“Batelco’s extensive expertise in smart and digital solutions will be invaluable in equipping the towers with best-in-class connectivity, automation, and intelligent building management solutions. We are excited to leverage Batelco’s innovative capabilities to create a sophisticated and future-ready smart infrastructure for the Golden Gate Towers and provide our customers with the very best modern apartments in the market,” he added.

Maitham Abdulla, Batelco CEO, stated: “We are delighted to partner with Grnata to deliver apartments that match the evolving demands of modern-day living. We are confident that Batelco’s solutions, designed for a contemporary lifestyle, will offer convenience and efficiency, elevating the overall living experience for the Golden Gate towers residents.”

Mr. Abdulla further emphasized, “By integrating the latest smart home features and connectivity throughout the towers, we can provide residents with a lifestyle that is not only luxurious, but also highly convenient, efficient, and secure.” “Batelco is eager to expand its presence within the real estate sector and redefine the standards of contemporary urban living. This partnership with Grnata marks the beginning of an exciting journey, and Batelco looks forward to future collaborations and projects,” he concluded.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual