Americans in Their Prime Are Flooding Into the Job Market

Share of people between 25 and 54 working or seeking jobs rose this year to highest level since 2002

The core of the American labour force is back.

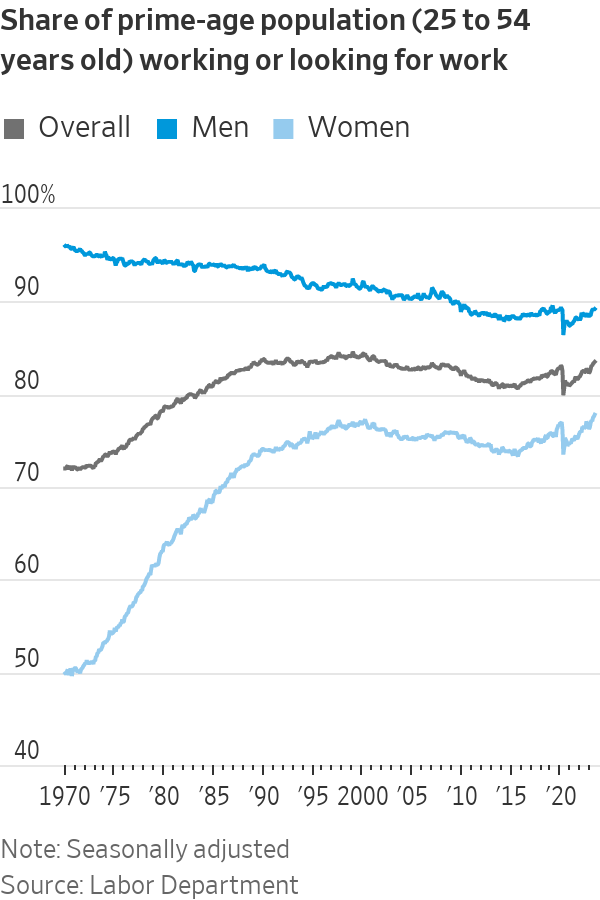

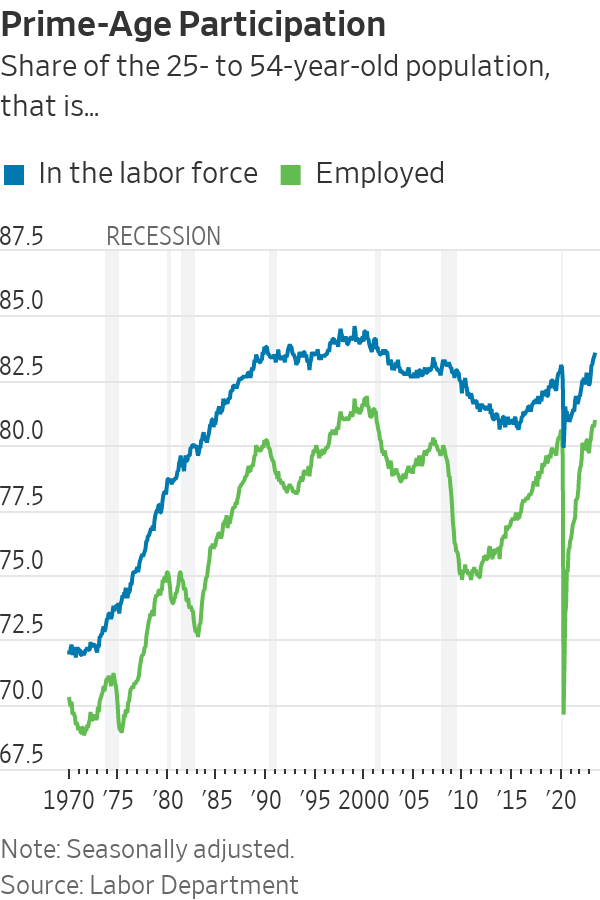

Americans between 25 and 54 years of age are either employed or looking for jobs at rates not seen in two decades, a trend helping to counter the exodus of older baby boomers from the workforce. Economists define that age range as in their prime working years—when most Americans are done with their formal education, aren’t ready to retire and tend to be most attached to the labor force.

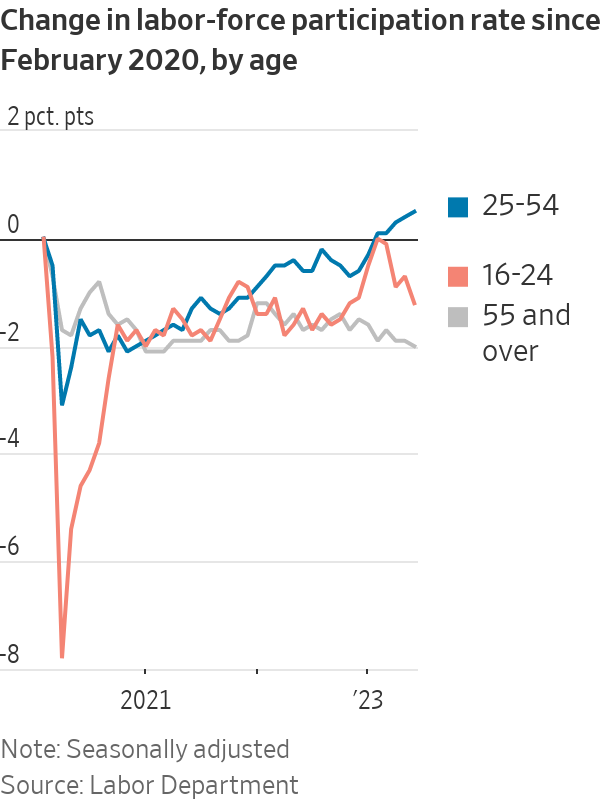

In the first months of the pandemic, nearly four million prime-age workers left the labor market, pushing participation in early 2020 to the lowest level since 1983—before women had become as much of a force in the workplace. Prime-age workers now exceed pre pandemic levels by almost 2.2 million.

That growth is taking a little heat out of the job market and could help the Federal Reserve’s efforts to tamp down inflation by keeping wage growth in check.

Women lead the way

The resurgence of mid career workers is driven by women taking jobs.

The labor-force participation rate for prime-age women was the highest on record, 77.8% in June. That is well up from 73.5% in April 2020.

Men, however, tend to be employed at higher rates. The overall prime-age participation rate rose in June to 83.5%, the highest since 2002.

The big draw: a tight labor market. The unemployment rate has hovered near a half-century low for more than a year, and job openings outnumber the ranks of unemployed. Employers can’t be as choosy or selective, William Rodgers, vice president and director of the Institute for Economic Equity at the St. Louis Fed, said earlier this month.

Employers “are more apt to be willing to work with candidates—in this case it’s working with moms, or parents in general,” he said. “Tight labor markets can help to punish those who discriminate in hiring and compensation.”

Other factors are also at play. Women aren’t having as many children—there were about 3.66 million births in 2022, 655,000 fewer than the peak in 2007—so child-care responsibilities have decreased.

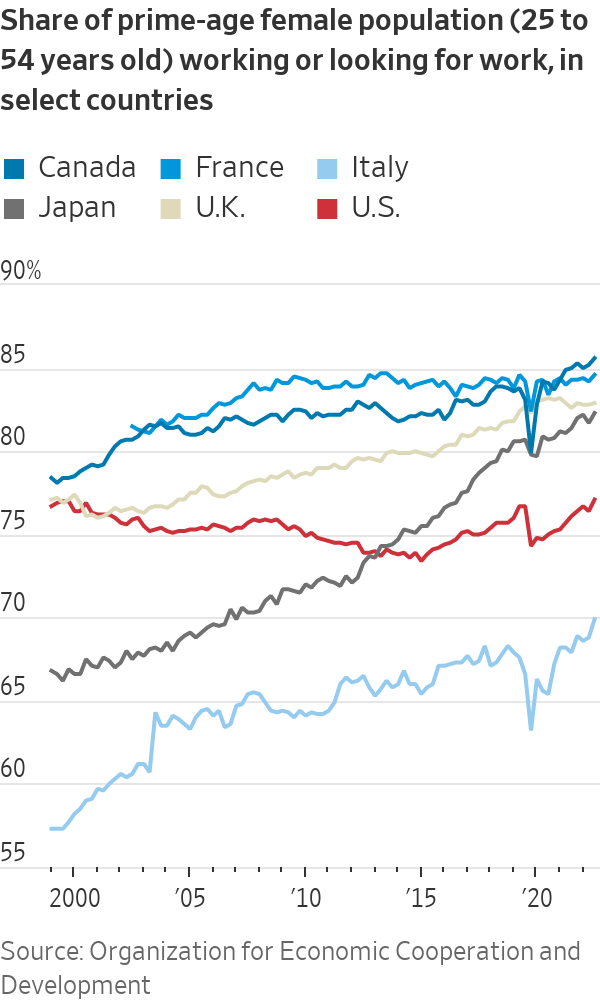

Julia Pollak, chief economist at ZipRecruiter, said it is possible for women’s participation to rise further if employers adopt or the government requires additional family-friendly policies. U.S. female participation lags behind that of other industrialised economies in part because of the cost of child care, which is subsidised elsewhere.

Rising wages lure workers, counter demographic shifts

Employers raised wages, offered employees more flexibility and improved benefits in recent years.

Average wage gains remain elevated this year and have recently surpassed inflation. And Americans are logging more hours of work from home than they did before the pandemic.

Employer recruitment efforts helped offset some broader demographic shifts, including an ageing population and rise in retirements.

The share of the population age 55 and over in the labor force climbed steadily from the mid-1990s through the 2008 financial crisis and remained elevated for more than a decade. The Covid-19 pandemic pushed many out of the workforce, and some older workers haven’t returned, particularly those over 65.

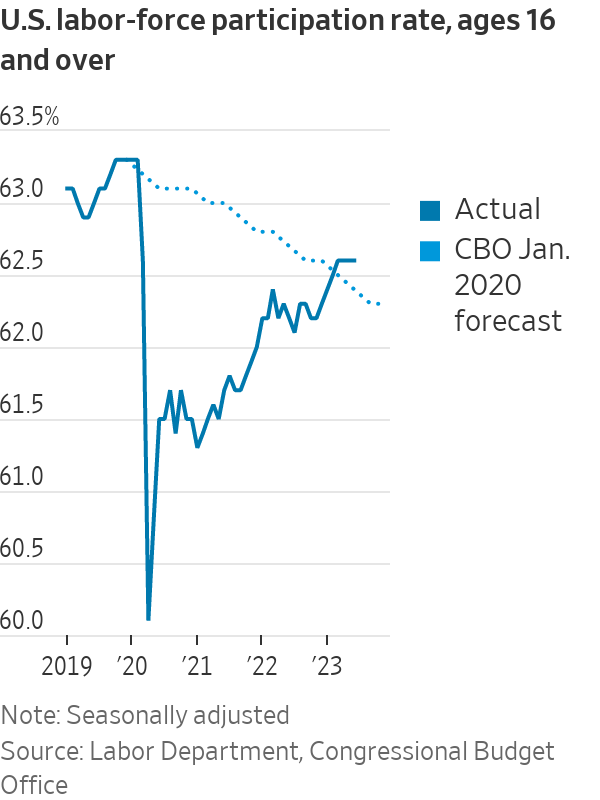

Much of the decline in the overall participation rate was anticipated as baby boomers aged out of the workforce, but the rise in prime-age workers meant the drop wasn’t as steep.

The Congressional Budget Office in January 2020, just before the pandemic hit, forecast the overall participation rate to deteriorate steadily through the 2020s, moving down to 62.4% in the second quarter of this year.

Instead, the rate was a couple of ticks higher in June at 62.6%, supported by prime-age workers.

“It seems like there is almost no cap on the supply of workers, only a speed limit on how fast we can bring them in,” Pollak said, referring to both rising prime-age participation and an influx of immigrants into the workforce.

Trends could turn if the economy cools

There are concerns that the Fed’s campaign to bring down inflation through higher interest rates will cause unemployment to rise too much and push some of the most vulnerable workers back to the sidelines.

The median forecast among Fed officials shows the unemployment rate rising to 4.1% by the end of this year and 4.5% next year from 3.6% in June, suggesting the economy will shed tens of thousands of jobs.

Labor-force participation tends to be cyclical, rising when the economy is strong and falling during downturns. A weaker labor market combined with structural barriers to employment could cap further gains.

With “current strength of labor demand set to fade, further progress from here will probably be more gradual,” Andrew Hunter, deputy chief U.S. economist at Capital Economics, said in a research note.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Highlighting a significant recovery and robust growth across all key performance metrics.

Bank of Sharjah has released its results for the period ending 30 June 2024, showcasing robust performance and strong momentum since the beginning of the year. The Bank reported a net profit of AED 171 million, a significant turnaround from the AED 144 million loss in the same period last year.

This remarkable improvement is attributed to a substantial increase in net interest income, stringent credit underwriting, and reduced operating costs, marking a 233% increase over the previous year when excluding the one-time impairment charge from de-linking its Lebanese subsidiary.

The Bank’s exceptional financial results highlight the effectiveness of its strategic focus on sustainable growth, with notable improvements across all major performance metrics. Funded and unfunded income both saw increases, with net interest income rising by 108% and operating income growing by 34%.

Additionally, the cost-to-income ratio improved significantly to 40.1% due to cost discipline measures. The balance sheet remains strong with a loans-to-deposits ratio of 86.63%, indicating comfortable liquidity. The Bank also maintains strong capitalization, with a regulatory capital adequacy ratio exceeding 15% and Tier 1 and CET1 capital ratios around 14%. These positive results underscore the Bank’s underlying strength, operational efficiency, prudent risk management, and ongoing enhancement of shareholder value.

Commenting on the Bank’s results, Sheikh Mohammed bin Saud Al Qasimi, Chairman of Bank of Sharjah, stated: “We are pleased with our outstanding performance in the first half of 2024, which reflects our commitment to adding value to our customers, supporting our communities, and rewarding our shareholders. Despite the challenging geopolitical situation in the region, the UAE economy has remained resilient and continues to register healthy growth following various economic diversification initiatives that provide consistent impetus for trade, investment, and wealth creation. Bank of Sharjah has entered a new chapter with a new leadership team, focused on building new business streams, expanding our reach across the UAE and the region, and delivering exceptional service to our customers.”

He added: “Our performance in the first half of the year demonstrates the effectiveness of our new strategy, and we look forward to delivering continued growth in the years to come.”

The CEO, Mr. Mohamed Khadiri, commented “2024 has begun exceptionally well for Bank of Sharjah, with the bank achieving a record year-on-year profit. I am delighted with our stellar performance as we continue to strengthen the bank’s fundamentals. Our outstanding results reaffirm that our new business strategy is on track to deliver sustainable revenue growth, driven by business expansion, operational efficiency, prudent risk management, and talent development. This achievement is also a testament to the Bank’s success in providing high-quality financial services that meet the aspirations and growing needs of our customers.”

He further added: “Bank of Sharjah is a strong and respected brand within the local community. We are leveraging our core strengths to build a platform that will operate at its full potential across the UAE and the region. The Bank remains focused on executing our strategy and is well-positioned to maintain strong performance throughout 2024 and beyond.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual