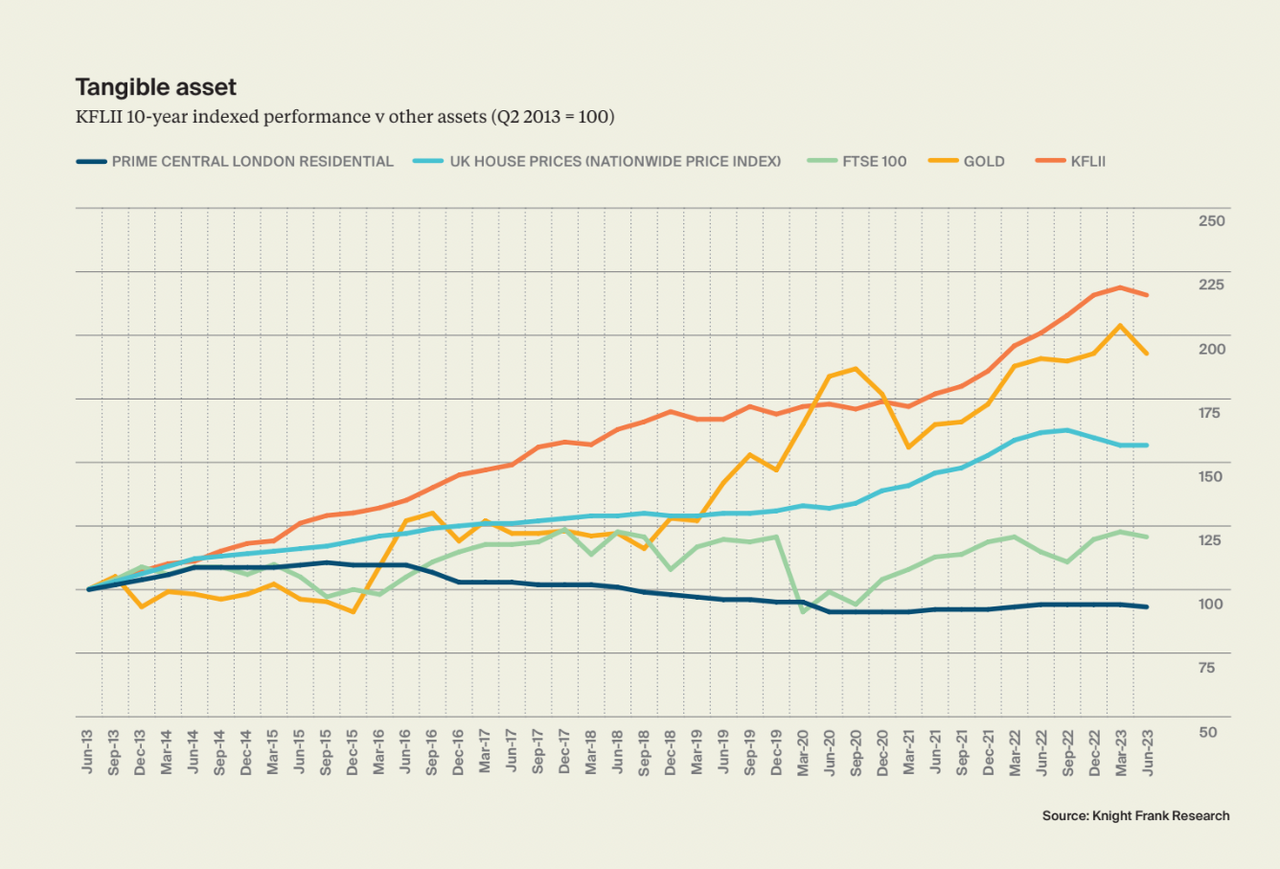

From Handbags to Classic Cars—the Value of Collectibles Is up 7% Annually

Novice collectors should focus their investing efforts on what brings them happiness amid wider economic uncertainty and unpredictable returns, according to Knight Frank’s Luxury Investment Index, released Tuesday.

The index—which tracks 10 luxury collectibles: art, watches, jewellery, coins, wine, classic cars, coloured diamonds, handbags, furniture, and rare whisky—found that as a whole, the value of these collectibles rose 7% in the 12 months to the end of June.

While that outpaces the returns on some other assets, including prime property in central London (down 1% over the same time), the FTSE 100 Index (up by 5%), and gold (up 1%), it was the weakest annual performance for collectibles since the second quarter of 2021, Knight Frank said.

“Economic uncertainty and higher interest rates will cast a long shadow on luxury collectibles,” said Knight Frank’s Andrew Shirley, editor of the index. “Novice collectors should focus on what brings them joy, perhaps that’s more important now that value appreciation is far from guaranteed in these asset classes.”

Art topped the index by a long shot, growing in value by 30% in the year through the end of June, according to Art Market Research’s (AMR) All Art index, which uses data from auction sales worldwide.

However, those gains may have already peaked.

“The auction season’s spring sales are the first measure of market confidence and recent results suggest growth is already starting to slow,” AMR’s Sebastien Duthy said.

Following art, watches (10%), and jewellery (10%) rounded out the top-three best-performing collectibles of the past year.

Rare bottles of whisky were the only asset in the index to see values drop in the short term—down 4%—but collectible tipples ranked as the strongest 10-year performer, with prices rising 322% over the last decade.

“Bottles of rare whisky have had a far more sedate time from a performance perspective over the past three years,” industry consultant Andy Simpson, of Rare Whisky 101, said in the report. “Higher value (more than £5,000 (US$6,370)) bottles have re-traced recently due to a myriad of geo-political, social, and economic reasons.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Highlighting a significant recovery and robust growth across all key performance metrics.

Bank of Sharjah has released its results for the period ending 30 June 2024, showcasing robust performance and strong momentum since the beginning of the year. The Bank reported a net profit of AED 171 million, a significant turnaround from the AED 144 million loss in the same period last year.

This remarkable improvement is attributed to a substantial increase in net interest income, stringent credit underwriting, and reduced operating costs, marking a 233% increase over the previous year when excluding the one-time impairment charge from de-linking its Lebanese subsidiary.

The Bank’s exceptional financial results highlight the effectiveness of its strategic focus on sustainable growth, with notable improvements across all major performance metrics. Funded and unfunded income both saw increases, with net interest income rising by 108% and operating income growing by 34%.

Additionally, the cost-to-income ratio improved significantly to 40.1% due to cost discipline measures. The balance sheet remains strong with a loans-to-deposits ratio of 86.63%, indicating comfortable liquidity. The Bank also maintains strong capitalization, with a regulatory capital adequacy ratio exceeding 15% and Tier 1 and CET1 capital ratios around 14%. These positive results underscore the Bank’s underlying strength, operational efficiency, prudent risk management, and ongoing enhancement of shareholder value.

Commenting on the Bank’s results, Sheikh Mohammed bin Saud Al Qasimi, Chairman of Bank of Sharjah, stated: “We are pleased with our outstanding performance in the first half of 2024, which reflects our commitment to adding value to our customers, supporting our communities, and rewarding our shareholders. Despite the challenging geopolitical situation in the region, the UAE economy has remained resilient and continues to register healthy growth following various economic diversification initiatives that provide consistent impetus for trade, investment, and wealth creation. Bank of Sharjah has entered a new chapter with a new leadership team, focused on building new business streams, expanding our reach across the UAE and the region, and delivering exceptional service to our customers.”

He added: “Our performance in the first half of the year demonstrates the effectiveness of our new strategy, and we look forward to delivering continued growth in the years to come.”

The CEO, Mr. Mohamed Khadiri, commented “2024 has begun exceptionally well for Bank of Sharjah, with the bank achieving a record year-on-year profit. I am delighted with our stellar performance as we continue to strengthen the bank’s fundamentals. Our outstanding results reaffirm that our new business strategy is on track to deliver sustainable revenue growth, driven by business expansion, operational efficiency, prudent risk management, and talent development. This achievement is also a testament to the Bank’s success in providing high-quality financial services that meet the aspirations and growing needs of our customers.”

He further added: “Bank of Sharjah is a strong and respected brand within the local community. We are leveraging our core strengths to build a platform that will operate at its full potential across the UAE and the region. The Bank remains focused on executing our strategy and is well-positioned to maintain strong performance throughout 2024 and beyond.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual