America’s Hot Labour Market Fuels Job Growth in Unexpected Places

Payroll increase extends to building, home selling and auto making

The U.S. labor market is showing surprising pockets of strength as companies directly in the crosshairs of rising interest rates hold on to or add workers.

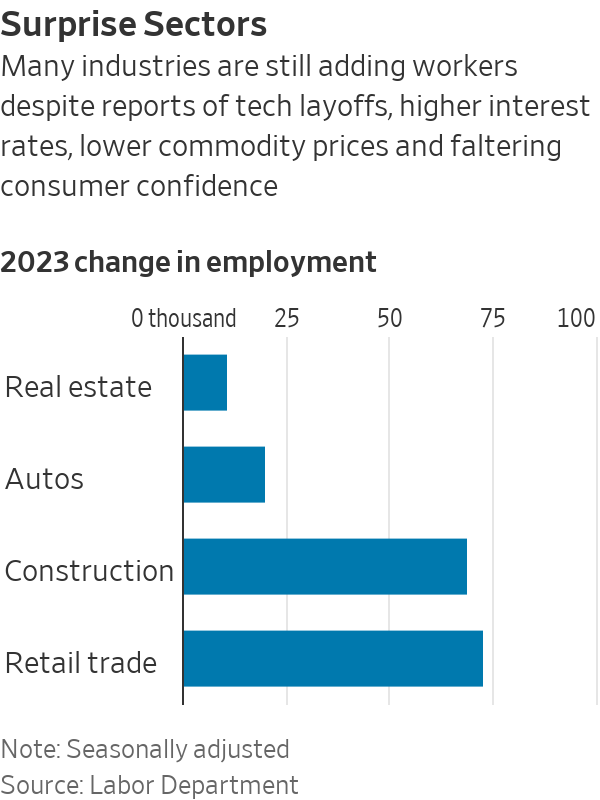

Builders, architects and engineers, real-estate agents, vehicle manufacturers and other businesses typically sensitive to higher borrowing costs have increased employment during the opening months of 2023.

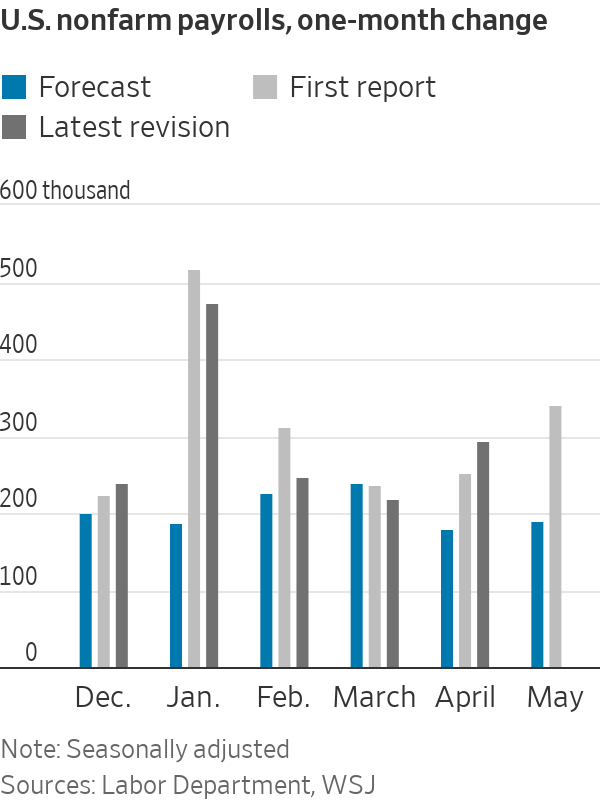

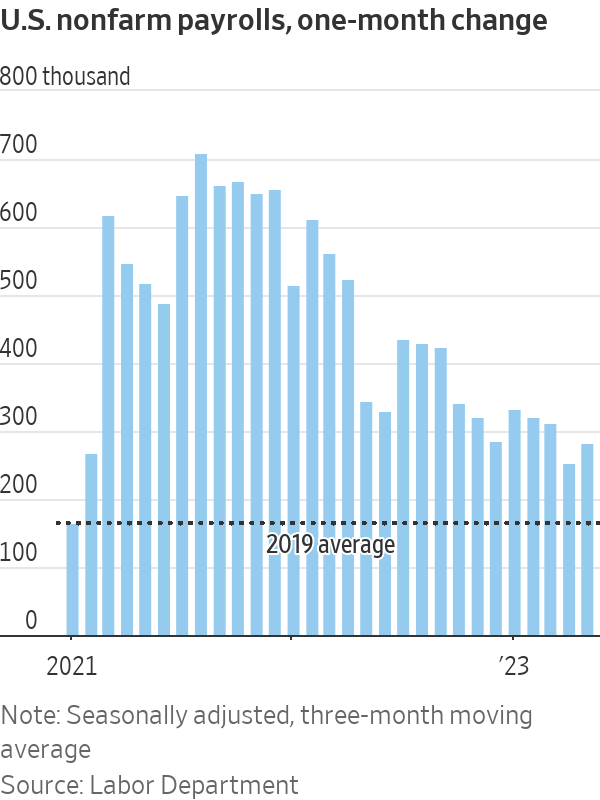

Those job gains, along with much larger increases in industries still trying to claw back workers lost during the pandemic, have added up to almost 1.6 million jobs in the first five months of 2023, outpacing economists’ forecasts.

The Labor Department will release June jobs figures on Friday.

“The labor market has continually surprised,” said Daniel Zhao, lead economist for the research team at Glassdoor, an online employment site.

Robust hiring defies theFederal Reserve

The strong job gains come despite companies and consumers facing higher borrowing costs.

The Federal Reserve raised interest rates to a 16-year high in 2023. And it is expected to increase them further later this year as part of a campaign to slow the economy, cool the labor market and tamp down inflation that is running too hot.

Some industries are defying the Fed’s efforts.

Construction employment has been one of the biggest surprises in recent months. In the past, builders have been hit especially hard when interest rates rose.

But employment in residential construction has merely levelled off in 2023, while industrial and infrastructure businesses gallop ahead.

Projects related to electric-vehicle batteries and semiconductors are driving much of the growth, spurred in part by the Chips and Science Act of 2022, which set aside $52.7 billion for financial assistance for the construction and expansion of semiconductor manufacturing facilities and other programs.

“Many of these were announced or broke ground before the Chips Act, but that added fuel to the bonfire,” said Kenneth Simonson, chief economist at Associated General Contractors of America.

Architectural and engineering firms have also added workers. The real-estate industry hasn’t shed any jobs this year despite a slowdown in single-family home sales.

American factories also often get caught in the Fed’s crosshairs when costs go up for auto loans and other personal loans. But auto and parts manufacturers have added almost 20,000 workers so far in 2023, helping to offset losses at makers of furniture, plastics and paper products.

According to Commerce Department data, car sales are still below pre pandemic levels, held back by limited supplies and high prices. But figures from the Fed show factories are trying to catch up. Auto and light-truck assemblies were above an annual pace of 11 million in April and May, the first time that number has been topped in back-to-back months since 2018.

Some employers stabilise, others heat up

The story is similar in other corners of the economy. Home-improvement and furniture stores have shed workers, for example, but department stores and warehouse clubs have added them. The final result: Overall retail employment has grown slightly so far this year.

The financial sector has also posted growth despite banking sector turmoil, with gains at insurers, brokers and financial advisers outpacing losses in banking.

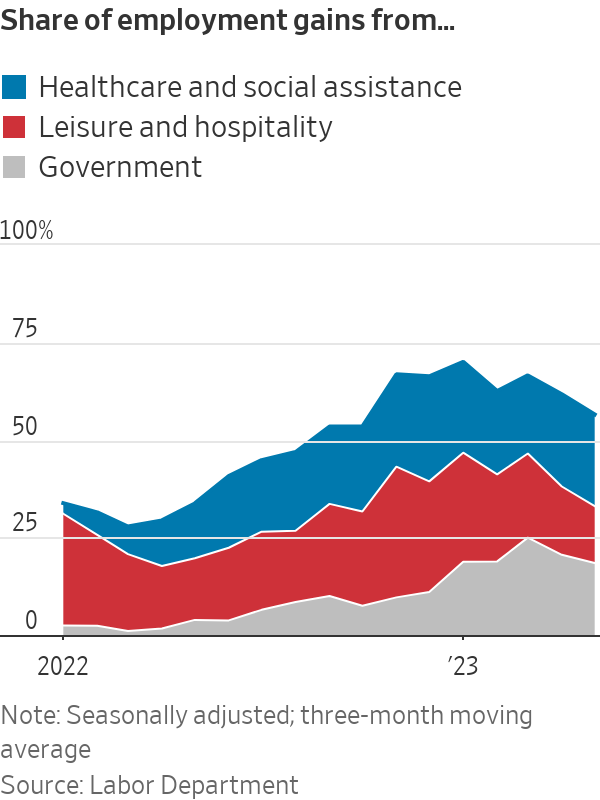

Other sectors aren’t merely holding up—they are rapidly hiring. Government, leisure and hospitality and healthcare account for about 60% of all employment gains so far in 2023. The first two categories are still playing Covid-19 catch-up: Employment at restaurants, hotels, schools and in other municipal services are still below pre pandemic levels.

The picture isn’t entirely rosy.

Tech layoffs are well documented. Some economists worry that residential construction employment could be headed for a fall as a big run-up in apartment projects leads to an oversupply of units and signs of falling rents.

The number of hours people are spending on the job is declining, a possible sign that employers have less work for them. Wage growth remains strong but has eased, suggesting that demand for workers is cooling. And job growth has become more concentrated in fewer industries, possibly indicating that the breadth of the economic expansion is also narrowing.

“There are signals on the periphery that the labor market is slowing,” said Brett Ryan, senior U.S. economist at Deutsche Bank.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Employment grew for the 16th consecutive month as companies expanded.

According to a recent PMI report, Qatar experienced its fastest non-energy sector growth in almost two years in June, driven by surges in both existing and new business activities.

The Purchasing Managers’ Index (PMI) headline figure for Qatar reached 55.9 in June, up from 53.6 in May, with anything above 50.0 indicating growth in business activity. Employment also grew for the 16th month in a row, and the country’s 12-month outlook remained robust.

The inflationary pressures were muted, with input prices rising only slightly since May, while prices charged for goods and services fell, according to the Qatar Financial Centre (QFC) report.

This headline figure marked the strongest improvement in business conditions in the non-energy private sector since July 2022 and was above the long-term trend.

The report noted that new incoming work expanded at the fastest rate in 13 months, with significant growth in manufacturing and construction and sharp growth in other sectors. Despite the rising demand for goods and services, companies managed to further reduce the volume of outstanding work in June.

Companies attributed positive forecasts to new branch openings, acquiring new customers, and marketing campaigns. Prices for goods and services fell for the sixth time in the past eight months as firms offered discounts to boost competitiveness and attract new customers.

Qatari financial services companies also recorded further strengthening in growth, with the Financial Services Business Activity and New Business Indexes reaching 13- and nine-month highs of 61.1 and 59.2, respectively. These levels were above the long-term trend since 2017.

Yousuf Mohamed Al-Jaida, QFC CEO, said the June PMI index was higher than in all pre-pandemic months except for October 2017, which was 56.3. “Growth has now accelerated five times in the first half of 2024 as the non-energy economy has rebounded from a moderation in the second half of 2023,” he said.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual