Australia set for a bumper spring selling season

It’s an unusually busy end to the traditionally quiet winter season as some grapple with ‘fixed rate cliff’ concerns

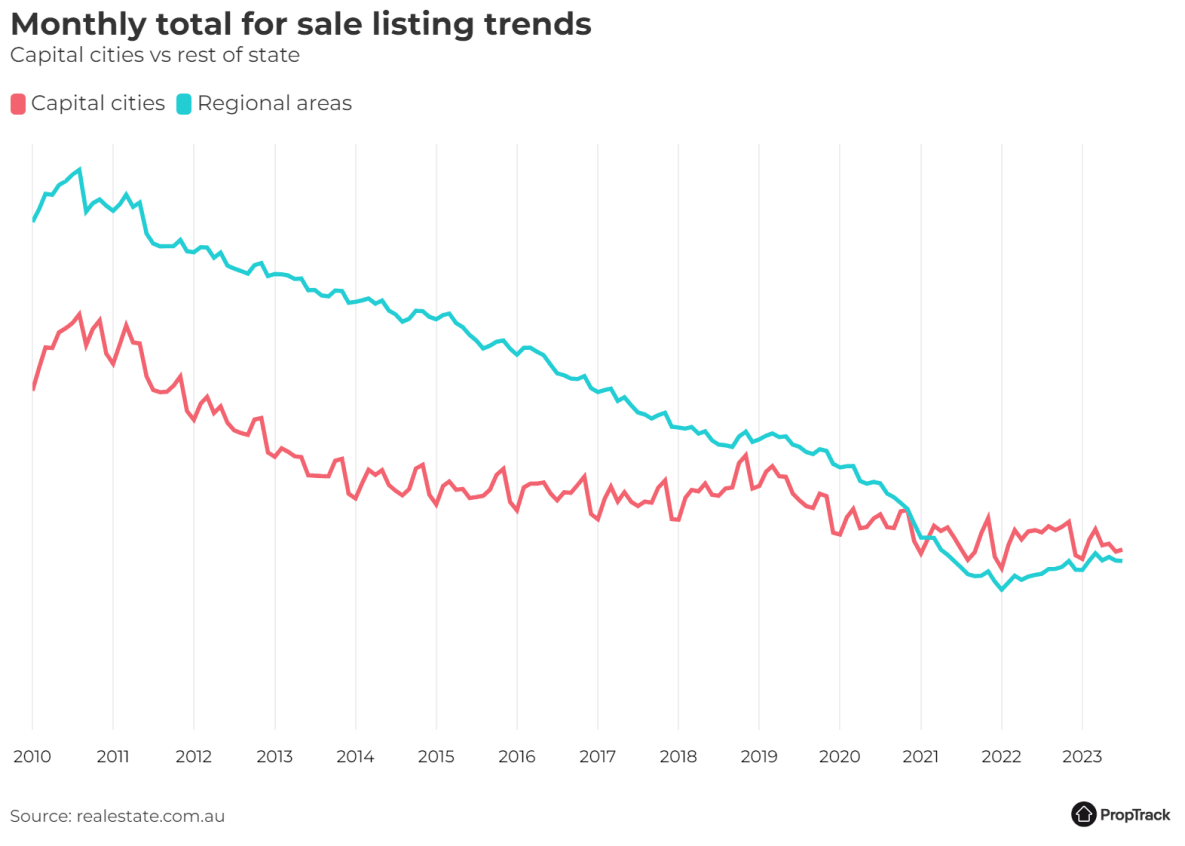

Property markets across the country are heating up ahead of the traditionally busy spring real estate season as seller uncertainty begins to thaw, with the trend expected to continue.

The latest PropTrack Listings Report shows the number of homes being brought to market surged by 9.2 per cent year-on-year in Sydney and 9.1 per cent in Melbourne.

While other capital cities were flat, the total volume of properties for sale edged upwards by 0.4 per cent in July.

“While part of the reason for that growth is that last July was a slower month, it is not the whole story,” PropTrack economist and report author Angus Moore said.

“There were more new listings in both Sydney and Melbourne in July than has been typical on average for this time of year over the past decade.”

Activity is likely to continue increasing over coming months after what was a particularly quiet start to the year, he said.

Seller activity would typically be low during the colder months. According to CoreLogic data, new listings historically drop by about five per cent between autumn and winter.

“In contrast, through the winter season to-date, new listings have risen by 13.2% this year, driven mostly by a 17.9% rise across the capital cities compared with a 4.6% rise in the flow of new listings across the combined regional areas of the country,” CoreLogic executive research director Tim Lawless said.

That apparent surge in vendor confidence can be attributed to recent rising home prices in almost all capital cities, Mr Lawless said.

July marked the seventh consecutive month that home prices nationally increased – now up 2.8 per cent across the year, according to PropTrack data.

But for some vendors, Mr Lawless said listing now could be a matter of necessity.

“Anecdotally, we may also be seeing more homeowners needing to sell amid a peak in the ‘fixed rate cliff’, elevated interest rates and high cost of living pressures.

“Data on mortgage arrears continues to show a historically small portion of borrowers are behind on their mortgage repayments, however we are likely to see mortgage stress becoming more evident through the second half of the year.”

The trend in rising listings will be a critical factor to monitor in coming months, he said.

“The spring season is shaping up to be a busy one, making up for the relatively sedate spring and early summer selling season last year.

“Through the recent recovery phase to-date, low available supply levels have been the key factor supporting value growth.

“A rise in stock levels could signal a further easing in the pace of capital gains across Australian housing markets as buyers benefit from a broader selection of available housing.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Villa prices saw particularly strong growth, with capital values increasing by 33.4 percent year-on-year

Dubai’s real estate market showed strong performance in the second quarter of 2024, with notable increases across the residential, office, and retail sectors, according to a new ValuStrat real estate report for Q2 2024.

Villa prices experienced particularly strong growth, with capital values rising by 33.4 percent year-on-year.

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat said: “The Dubai real estate market has shown impressive growth and resilience in recent months. The ValuStrat Price Index for Residential Capital Values increased by 6.4 percent quarterly and 28.2 percent annually, reaching 178.2 points.

“Despite severe flooding caused by record rainfalls in April, the quick and effective response from developers and authorities helped to control the damage, ensuring that market activity and property valuations remained robust in the subsequent months.”

The office sector also performed well, with the VPI for office capital values surging by 31.7 percent annually and 9.4 percent quarterly, reaching 212.5 points—the highest quarterly increase in a decade.

In the retail sector, Emaar Properties reported 98 percent occupancy in their prime mall assets, while overall mall occupancy stood at 96 percent during the first quarter of 2024. The hospitality sector also saw growth, with total international guests reaching 8.12 million as of May 2024, a 9.9 percent increase compared to the same period last year. Hotel occupancy reached 81 percent, rising by 1.4 percent year-on-year.

Despite these positive indicators, Tuaima added, “The decline in transaction volumes calls for a closer examination of market dynamics as stakeholders navigate this evolving landscape.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual