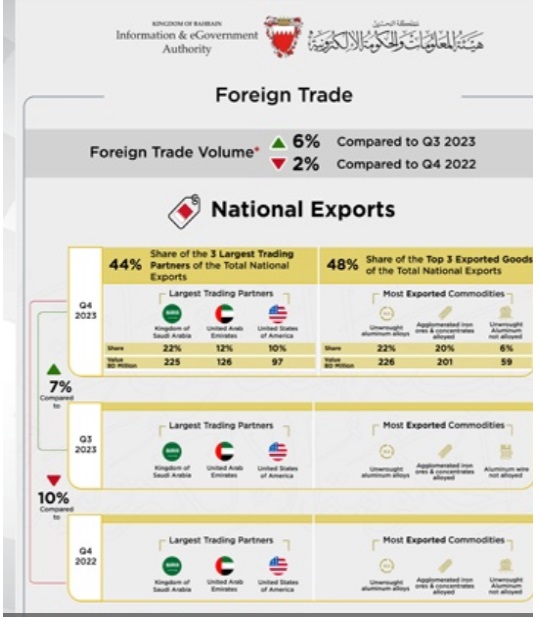

Bahrain Exports for Products of National Origins reach BD1.013 billion during Q4 2023

The Information &eGovernment Authority (iGA) has published its Foreign Trade report for Q4 2023, which encompasses data on Trade Balance, Imports, Exports of products with national origin, and Re-exports.

As per the report, the value of imports has increased by 5%, reaching BD1.476 billion during Q4 2023 in comparison with BD1.410 billion for the same quarter in 2022. The top 10 countries for imports marked 69% of the total value of imports.

According to the report, China ranked first for imports to Bahrain, with a total of BD207 million, followed by Brazil being the second with BD136 million, and The United Arab Emirates as the third with BD119 million.

Agglomerated Iron Ores and Concentrates Alloyed are marked as the top product imported to Bahrain with a total value of BD160 million, while Other Aluminum Oxide was second with BD110 million, followed by Parts for Aircraft Engines being third with BD42 million.

On the other hand, the value of Exports of Products with National Origin marked a decrease by 10% to a value of BD1.013 billion during Q4 2023, compared to BD1.121 billion for the same quarter in 2022. The top 10 countries accounted for 69% of the total export value.

The Kingdom of Saudi Arabia ranked first among countries for the exports of Products with National Origin with BD225 million.

The United Arab Emirates was second with BD126 million and the United States of America was third with BD97 million.

Unwrought Aluminum Alloys are marked as the top products exported during Q4 2023 with BD226 million, followed by Agglomerated Iron Ores and Concentrates Alloyed being the second with a value of BD201 million and Unwrought Aluminum Not Alloyed third with BD59 million.

The total value of re-exports decreased by 6% to reach BD188 million during Q4 2023, compared to BD200 million for the same quarter in 2022. The top 10 countries in re-exports accounted for 81% of the re-exported value.

The United Arab Emirates ranked first with BD52 million, followed by the Kingdom of Saudi Arabia as second with BD44 million, and Luxembourg third with BD10.13 million.

As per the report, Turbo-Jets was the top product re-exported from Bahrain with a value of BD25 million, followed by Four-Wheel Drive BD12 million, and Private Cars came third with BD8 million.

As for the Trade Balance, which represents the difference between exports and imports, the deficit amounted to BD276 million dinars in Q4 2023, Compared to a deficit of 88 million dinars in Q4 2022, which led to an increase in the deficit by 212%.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Total income was higher by 10% year-on-year (YoY) at AED 300 million in the six-month period

United Arab Bank PJSC (UAB or “the Bank”) has announced its financial results for the six months ended 30th June 2024. UAB reported a net profit before tax of AED 152 million for H1 2024, a 26% increase compared to AED 121 million for H1 2023. The net profit after tax for H1 2024 stood at AED 139 million, up 15% from AED 121 million in the same period last year. Earnings per share rose to AED 0.07 in H1 2024 from AED 0.06 in H1 2023.

Total income increased by 10% year-on-year to AED 300 million for H1 2024, compared to AED 273 million for H1 2023, driven by a 26% increase in net interest income. The Bank’s capital position remains strong with a CET1 ratio of 13% and a total capital adequacy ratio (CAR) of 18%.

UAB‘s liquidity profile is robust, with advances to stable resources ratio of 75% and an eligible liquid asset ratio of 19%, both comfortably above regulatory thresholds. The Bank’s credit ratings were affirmed by Fitch and Moody’s at BBB+/Ba1, with stable and positive outlooks respectively.

UAB’s performance in the first half of 2024 demonstrates significant growth in total assets, increasing by 12% compared to December 2023, and reflects a strategic focus on quality and farsighted risk management. These results indicate that the Bank is well-positioned to continue its growth trajectory.

Commenting on the Bank’s performance, H.H. Sheikh Mohammed bin Faisal bin Sultan Al Qassimi, Chairman of the Board of Directors of United Arab Bank, said: “UAB’s strong performance in the first half of 2024 reflects the successful implementation of our growth strategy and reinforces our commitment to delivering sustainable value to our shareholders. We are confident that our prudent business model shall continue to deliver a solid performance and deal with the opportunities and challenges that will present themselves.”

He added: “As we move ahead into the second half of the year, we remain committed to enhancing our customers’ banking experience and contributing to the growth and prosperity of the UAE’s economy.

Shirish Bhide, Chief Executive Officer of United Arab Bank, commented: Our customer-centric approach and sustainable growth model has led to a 15% increase in net profit and a 12% growth in total assets. Our positive performance is a testament to the successful execution of our strategic priorities and clear evidence of the success of the many initiatives that have been implemented at the Bank. Going forward, we will continue investing in our growth strategy and digital capabilities, while equally focusing on developing innovative products and services that meet our customers aspirations whilst upholding the highest standards of compliance and internal controls.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual