Brazil Is Key to Slowing Global Warming. But Its Carbon Market Has Struggled.

A new attempt to create a regulated cap-and-trade system that is seen as critical to corporate competitiveness and economic resilience faces political headwinds

With Brazil struggling in its efforts to create a regulated carbon market, the country’s new president is moving to scrap his predecessor’s approach and start anew. But success is still far from guaranteed.

The administration of President Luiz Inácio Lula da Silva is putting the finishing touches on a proposal laying the groundwork for a new, regulated cap-and-trade system, which he is expected to send to Congress later this month. The approach is starkly different from that of his right-wing predecessor Jair Bolsonaro, who last year issued a decree relying on the private sector to establish the basis for a carbon market, which never happened.

In either case, the system would set emission caps for certain industries and allow some companies to temporarily offset their excess pollution by buying allowances from those that cut more emissions than required. One credit would amount to one metric ton of carbon dioxide either removed from or prevented from being emitted into the atmosphere. Over time, the cap would be lowered to reduce emissions.

Financing carbon-capture projects such as reforestation could also generate carbon credits. Proponents say it is a way to protect the Amazon rainforest and other biomes, an approach that could also become an income stream to millions of impoverished residents currently making money off deforestation.

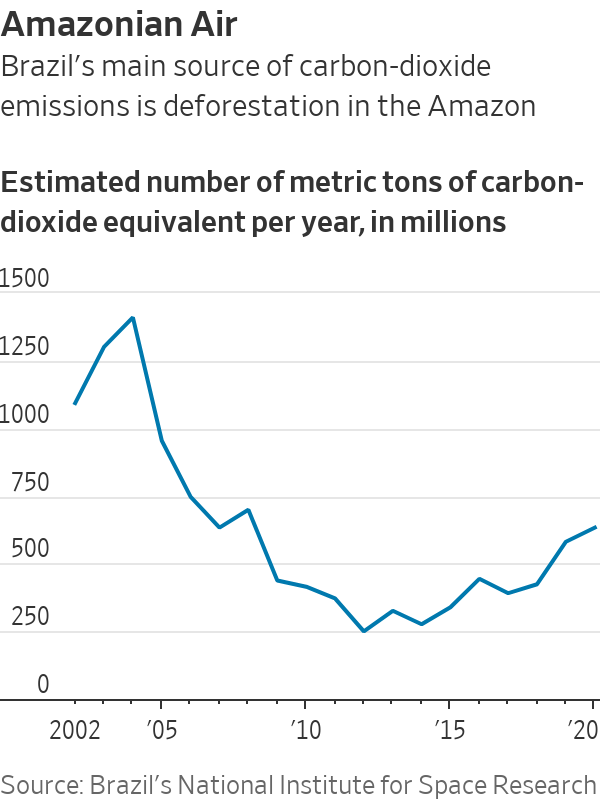

Yet despite broad support from exporters, who deem a regulated carbon market necessary to maintain key consumer markets overseas and attract investment, the initiative faces significant political hurdles at home and may not be enough to tackle the deforestation that is responsible for nearly half of the nation’s carbon footprint.

Brazil prides itself on getting nearly half of its energy and almost all of its electricity from renewable sources. It also already has an active market in voluntary carbon credits, where corporations buy credits from certified environmental projects to offset their emissions to meet self-imposed targets. But all that may still not be enough in a world increasingly worried about climate change.

“There is a global green arms race. Do we want to just sit on our achievements and watch while the tortoise outruns us?” said Gustavo Pinheiro, coordinator of the low-carbon economy portfolio at the nonprofit Institute for Climate and Society. “We need to price rising emissions,” he said, “and a regulated market is the least traumatic way to do it.”

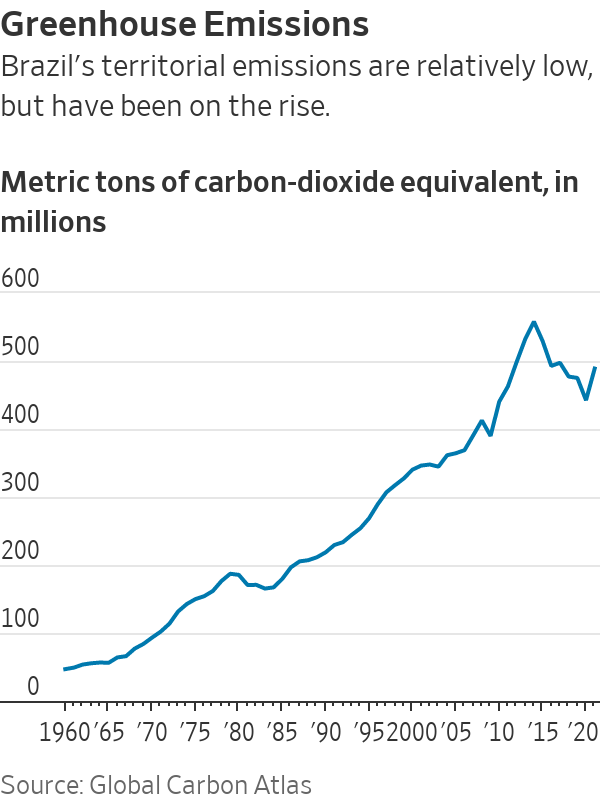

As home to nearly 60% of the Amazon rainforest, Brazil is crucial to slowing global warming. Brazil was responsible for about 1.3% of global carbon-dioxide emissions in 2021, according to European Union data, and its population, economy and footprint are expected to grow, pushing the country further away from its commitments in the 2015 Paris global climate agreement and underscoring the need for a regulated carbon market. A cap-and-trade system could also beef up the country’s troubled economy, as global trade increasingly requires cleaner supply chains, some experts say.

“Having a regulated carbon market would be good for the overall economy, [and] would put our corporations in a better position to compete,” said Luiz Gustavo Bezerra, a partner at law firm Tauil & Chequer, which is associated with Mayer Brown.

Local exporters say they could benefit from regulation compatible with rules already in place in key overseas markets, which increasingly demand low-carbon supply chains. For example, a local regulated carbon market could help exporters avoid the carbon border adjustment mechanism the EU plans to charge on some imported products from 2026.

Brazil is one of the largest exporters of iron used to make steel for a range of things, such as home appliances, vehicles and wind turbines. Iron-ore exporter Vale, which aims to have net-zero emissions by 2050 and uses an internal price of $50 per metric ton for its greenhouse-gas emissions, said in emailed answers that initiatives to price carbon are “important for the competitiveness of Brazilian industry.”

The nation is also a major global supplier of soybeans, corn and beef, products often associated with deforestation. Farming group Roncador, a producer of grains and beef, said it is worried about increasing global restrictions to products lacking environmental certificates.

“Since Brazil still doesn’t have a regulated [carbon] market, we are developing our own research and have developed our own protocol to ensure our activities have a positive impact on the environment,” the group’s Chief Executive Pelerson Penido Dalla Vecchia said.

Exporters also hope a regulated market would help repair Brazil’s abysmal environmental reputation, a product of its history of deforestation. “We have great expectations that the government will better regulate carbon markets,” said Antônio Queiroz, vice president of innovation, technology and sustainable development at Braskem, one of the world’s largest petrochemical companies.

A regulated market could also help lure green-economy investments, according to lawyer Bezerra: “We are always approached by private-equity firms looking for areas in Brazil to invest in reforestation or forest preservation.”

The country could earn up to $120 billion through 2030 on carbon credits, assuming an “optimistic scenario” of $100 a metric ton of carbon, according to a study by the Brazilian division of the International Chamber of Commerce and local carbon consulting firm WayCarbon. While that price is multiples of current voluntary market credits—lately valued at about $1—the EU credits have recently been trading around €82 a metric ton, equivalent to $88, according to OPIS.

Brazil has a goal of reforesting an area bigger than Pennsylvania, said Ana Toni, head of the National Secretariat for Climate Change: “How many countries have that?”

But carbon-capture projects based on forest preservation are typically traded in the so-called voluntary markets, often not covered by government regulation. Many have come under scrutiny recently after failing to fulfil their promises. For example, a Wall Street Journal investigation into a reforestation project in Peru found little of the money designated for rainforest preservation actually reached locals.

Despite these and other problems that bedevil this form of credit, Brazil’s Ministry of Development, Industry, Trade and Services said its proposal will allow credits from the voluntary market to be used, to a certain extent, in the new regulated one.

The da Silva administration plans to have a carbon market operating in a couple of years, Toni said. But da Silva lacks a majority in Congress, and in any case is expected to give priority to major fiscal and tax legislation ahead of the carbon-market bill.

And in a sign of the difficulties ahead, lawmakers recently passed legislation to weaken the Environmental Ministry led by sustainability advocate Marina Silva, who is backing the effort to create a regulated carbon market.

Annie Groth, head of advocacy and policy at Biofílica Ambipar Environment, a developer of carbon projects in the Amazon and other biomes, said there is hope that carbon legislation could be approved before the United Nations Climate Change Conference in Dubai beginning Nov. 30.

But she cautioned, “It’s the most optimistic scenario.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Employment grew for the 16th consecutive month as companies expanded.

According to a recent PMI report, Qatar experienced its fastest non-energy sector growth in almost two years in June, driven by surges in both existing and new business activities.

The Purchasing Managers’ Index (PMI) headline figure for Qatar reached 55.9 in June, up from 53.6 in May, with anything above 50.0 indicating growth in business activity. Employment also grew for the 16th month in a row, and the country’s 12-month outlook remained robust.

The inflationary pressures were muted, with input prices rising only slightly since May, while prices charged for goods and services fell, according to the Qatar Financial Centre (QFC) report.

This headline figure marked the strongest improvement in business conditions in the non-energy private sector since July 2022 and was above the long-term trend.

The report noted that new incoming work expanded at the fastest rate in 13 months, with significant growth in manufacturing and construction and sharp growth in other sectors. Despite the rising demand for goods and services, companies managed to further reduce the volume of outstanding work in June.

Companies attributed positive forecasts to new branch openings, acquiring new customers, and marketing campaigns. Prices for goods and services fell for the sixth time in the past eight months as firms offered discounts to boost competitiveness and attract new customers.

Qatari financial services companies also recorded further strengthening in growth, with the Financial Services Business Activity and New Business Indexes reaching 13- and nine-month highs of 61.1 and 59.2, respectively. These levels were above the long-term trend since 2017.

Yousuf Mohamed Al-Jaida, QFC CEO, said the June PMI index was higher than in all pre-pandemic months except for October 2017, which was 56.3. “Growth has now accelerated five times in the first half of 2024 as the non-energy economy has rebounded from a moderation in the second half of 2023,” he said.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual