China Slips Into Deflation in Warning Sign for World Economy

The lifting of Covid-19 pandemic curbs has been followed by an unusual bout of falling consumer prices instead of a surge

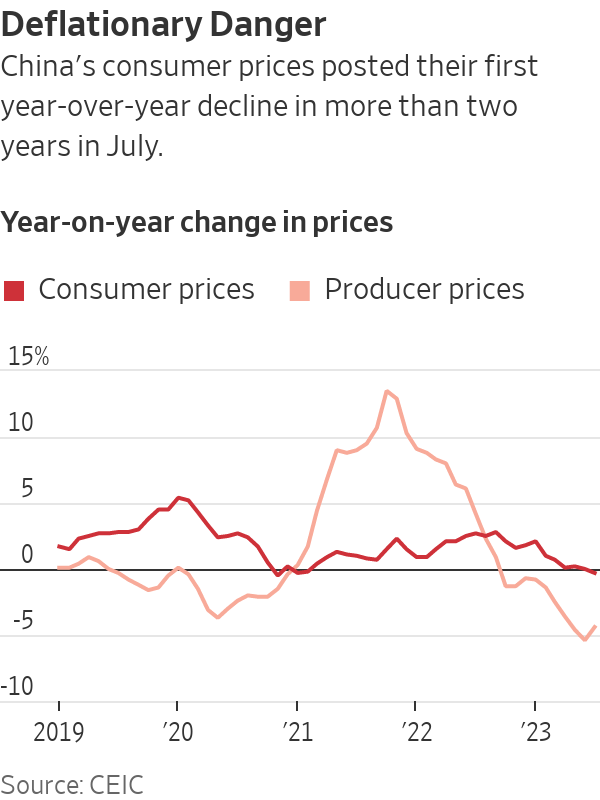

HONG KONG—China’s consumer prices tipped into deflationary territory in July for the first time in two years, as a deepening economic malaise in the world’s second-largest economy enters a potentially dangerous new phase.

The data released Wednesday adds to a darkening picture for China, where the economic recovery has been losing momentum because of a host of problems. A drop in exports is accelerating, youth unemployment has hit record highs and the housing market is mired in a protracted downturn.

Now, the country is suffering an unusual bout of falling prices on a range of goods, from commodities such as steel and coal to daily essentials and consumer products such as vegetables and home appliances. It is the opposite of what happened in most of the rest of the world when Covid-19 restrictions eased, with many countries still trying to tame inflation.

Chinese consumer prices fell 0.3% in July compared with a year earlier. This could be transitory, however. Stripping out volatile food and energy prices, so-called core inflation rose to 0.8% in July, the highest level since January, from 0.4% in June.

The danger is that if the expectation of falling prices becomes entrenched, it could further sap demand, exacerbate debt burdens and even lock the economy into a trap that will be hard to escape using the stimulus measures Chinese policy makers have traditionally turned to.

Deflation is particularly risky for countries with high debt burdens such as China, since it will add to debt servicing costs for borrowers and likely prompt them to spend and invest less.

China’s total debt reached nearly three times the size of its gross domestic product in 2022, higher than that in the U.S., according to the Bank for International Settlements.

“The reality looks increasingly grim,” said Eswar Prasad, a Cornell University economist who once headed the International Monetary Fund’s China division. “The government’s approach of downplaying the risks of deflation and stalling growth could backfire and make it even harder to pull the economy out of its downward spiral.”

For now, Chinese policy makers say they are sanguine about falling prices, dismissing suggestions that deflation is here to stay.

Dong Lijuan, a statistician at China’s National Bureau of Statistics, on Wednesday said consumer prices will likely rebound gradually later this year as the high base effect begins to fade.

China’s predicament stands in contrast to those of the U.S. and other Western countries, where soaring inflation prompted central banks, including the Federal Reserve, to raise interest rates in an effort to cool growth without triggering a recession.

In the U.S., consumer prices rose 3% in June compared with a year earlier, the slowest pace of increase in more than two years, while annual inflation in the European Union stood at 6.4%, easing from 7.1% in May.

Falling prices in China may help ease inflationary pressure elsewhere around the globe, as Chinese exports become cheaper. They also pose a risk: a flood of low-price Chinese-made goods could hurt foreign competitors and lead to job losses in developed countries.

For China, the absence of inflation reflects an imbalance in the economy characterised by ample supply and dormant domestic demand, which economists say is partly the result of Beijing’s paltry social security support for households.

Wang Lei, who works at a video gaming company in Beijing, said his and his wife’s overall expenditures have fallen compared with last year’s. Seeing colleagues and friends get laid off spooked him into reining in any unnecessary expenditures, apart from renovating an apartment that he purchased two years ago.

“It’s better to save more and be cautious now,” said 40-year-old Wang. “The economic outlook is not certain.”

China’s central bank has trimmed interest rates several times this year, but fiscal and monetary policy makers haven’t launched any larger-scale stimulus measures, in part because of constraints such as elevated debt levels.

Prices charged at the factory gate, which have been contracting on a year-over-year basis since last October, fell 4.4% in July from a year earlier, narrowing from June’s 5.4% decline, according to data published by China’s National Bureau of Statistics on Wednesday.

But it was the consumer-price reading, which has remained positive even as producer prices turned negative, that marked the bigger shift.

After flatlining in June, last month’s 0.3% decrease in consumer prices represents the first negative print since February 2021, when the reading was thrown off by year-over-year comparisons to the early days of the pandemic when supply chains and food prices were in disarray.

Apart from a single month in the first year of the pandemic, both consumer and producer prices haven’t been in deflationary territory at the same time since 2009, at the depths of the global financial crisis.

July’s negative consumer inflation result was mainly driven by a drop in food prices from a year earlier, when food prices were pushed up by extreme weather conditions, a spokeswoman for China’s statistics bureau said Wednesday. Prices of pork, a staple of Chinese dinner tables, plunged 26% in July from a year earlier. Vegetable prices also fell last month.

Even so, consumer inflation isn’t likely to pick up much this year, economists say. The reason is consumer confidence, or rather the lack of it, as households continue to feel the lingering impact of three years of Covid uncertainty, regulatory uncertainty and ongoing concern about the health of the property market. The real-estate sector, one of China’s main drivers of growth for decades, is in a deep funk, with fresh worries stoked this week by default concerns around one of China’s biggest property developers.

Unlike many countries in the West, where government cash handouts to consumers during the pandemic fuelled a spending boom on physical goods such as furniture and personal electronics, Beijing so far has offered no such direct support to its households.

On top of that, a renewed downturn in the housing market has curbed Chinese consumers’ appetite for consumption, since many households have treated apartment units as their main store of wealth, and are highly sensitive to fluctuations in home prices, said Wei Yao, chief China economist at Société Générale.

“The problem is there’s no obvious driver to power recovery at the moment,” she said.

Even if consumer prices begin to pick up again, Chinese factory owners and exporters are likely to struggle with pricing power for some time, eroding their profit margins and hurting their willingness to expand production or hire more workers.

While producer price deflation eased in July, the 4.4% drop was worse than 4.1% expected by economists polled by the Journal.

During the pandemic, many factories in China ramped up production to accommodate a surge of overseas orders. Now, as demand in the West fades, producers of automobiles, consumer goods and other products are being saddled with excess inventory, forcing many to slash prices to reduce stockpiles.

One manufacturer of robot vacuum cleaners based in the southern Chinese city of Shenzhen is looking to sell more overseas, in part because domestic rivals are offering cheaper options and the sluggish recovery in consumer demand has eroded sales at home, according to a company executive.

The ultimate challenge for Chinese policy makers is how to forestall a self-reinforcing spiral in which a fall in prices leads to reduced production, lower wages and suppressed demand.

Economists expect China’s central bank to lower interest rates further in the coming months, though many are skeptical that such moves alone can dispel deflationary pressures.

That is because confidence among businesses and households has been slow to recover, resulting in limited appetite for them to invest and spend more. Such an environment renders moderate stimulus measures largely ineffective, argues Arthur Budaghyan, chief emerging markets strategist at BCA Research.

“The Chinese government has to do something very big to confront deflation,” he said. “I don’t think they’ve done enough yet.”

—Grace Zhu and Xiao Xiao in Beijing contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

The G80 Sport makes its entrance, displaying dynamic design details and elevated automative capabilities.

Juma Al Majid LLC, the exclusive dealer for Genesis in the UAE, has launched the G80 – a cutting-edge luxury sedan. Merging tradition with innovation, this model embodies Genesis‘ relentless pursuit of superior design, state-of-the-art technology, and unmatched luxury.

The new G80 marks a significant milestone in introducing Korean automotive excellence to the UAE, highlighting the brand’s commitment to providing exceptional experiences.

Meticulously crafted, the redesigned G80 adheres to the ‘Athletic Elegance’ design philosophy synonymous with Genesis. This luxury vehicle features refined details and cutting-edge specifications, combining comfort and style to elevate every driving experience to new heights.

“The debut of the all-new G80 in the UAE market propels our vision to converge advanced technology and refined elegance”, stated Suliman Al Zaben, Director of Genesis, UAE. “This launch is a step forward for Genesis in the UAE market and strengthens our efforts to offer ultimate luxury, innovation, and unique design to our incisive customer base.”

With a new dual-mesh design, the G80’s exterior enhances the sophisticated appearance of the Two-Line Crest Grille, paired with iconic Two-Line headlamps featuring Micro Lens Array (MLA) technology. This highlights Genesis’ commitment to harmonizing advanced technology with elegant design. The five 20-inch double-spoke wheels exude a dynamic aesthetic, resembling sleek aircraft lines, complementing the car’s parabolic side profile. Rear diffusers conceal mufflers adorned with distinctive V-shaped chrome trim inspired by the Crest Grille, embodying an eco-conscious ethos in today’s technology-driven era.

The G80 reinforces Genesis’ design philosophy in its interiors, inspired by the uniquely Korean concept of the Beauty of White Space, integrated with state-of-the-art technology to create cosmetic brilliance for users. The 27-inch-wide OLED display seamlessly combines the cluster and AVN (Audio, Video, Navigation) screen in a horizontal layout, extending to the center fascia, showcasing its flair for innovative technology. The touch-based HVAC (Heating, Ventilation, and Air Conditioning) system offers ease of control, while the redesigned crystal-like Shift By Wire (SBW) ensures a comfortable grip, infusing a sense of luxurious convenience.

With its dual-layered Crest Grille and expanded air intakes, the G80 Sport package delivers a dynamic and sporty spirit. Exclusive interior options, such as a D-cut steering wheel and carbon accents, enhance its sporty allure. Equipped with Rear Wheel Steering (RWS) and Electronic Limited Slip Differential (E-LSD), the G80 Sport 3.5 twin turbo model is built for stable control during high-speed maneuvers.

Fitted with advanced safety and convenience features, this luxury sedan includes Remote Smart Parking Assist 2, Lane Following Assist 2, and a Fingerprint Authentication System. The three-zone HVAC system provides customized climate control for all passengers. With two powertrain options – a 2.5 turbo engine delivering 300 horsepower and 43.0 kgf·m of torque, and a 3.5 twin turbo engine producing 375 horsepower and 54.0 kgf·m of torque – superior driving dynamics ensure a silent and luxurious driving experience.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual