NBK Reinforces Commitment to Environmental Sustainability by Sponsoring KDT

National Bank of Kuwait (NBK) reinforcing its leading role in addressing environmental issues

Demonstrating its unwavering dedication to supporting sustainability and environmental conservation initiatives, NBK continues to back Kuwait Dive Team’s efforts to protect and rehabilitate the marine environment, including islands and coral reefs, and to remove harmful waste to preserve marine biodiversity.

As part of these ongoing efforts, KDT recently lifted a sunken boat from the waters of Fahaheel. Such boats pose a threat to the marine ecosystem and organisms due to their fuel and oil content, in addition to obstructing maritime navigation.

On this occasion, Talal Al-Turki, Executive Manager, head of Public Relations & Event Management at National Bank of Kuwait said, “We, at NBK, always seek to leverage our role as one of the leading corporations in social responsibility by introducing a variety of initiatives and programs across different fields, especially the environment.”

“All awareness campaigns promoted on the social media pages of the bank and KDT aim to increase awareness of the importance of the environment and environmental preservation. Additionally, these campaigns highlight KDT’s valuable contributions in the protection and restoration of the marine ecosystem, as well as encourage volunteering in serving the marine environment by preparing national cadres specialized in marine operations and maintenance of mooring buoys around coral reefs,” he mentioned.

“Our partnership with KDT aligns with our strategy to adopt environmental governance best practices, through a set of initiatives launched by the bank to promote sustainability, deepen environmental culture, and create awareness and interest in maintaining a clean, pollution-free environment,” he emphasized.

Since the beginning of this year, Kuwait Dive Team lifted 56 tons of marine debris in 33 operations, with the participation of 800 volunteers. They also removed 28 tons of harmful waste in 18 operations on the coasts, ports and islands, in cooperation with government agencies, 7 tons of abandoned fishing gear, and recovered 3 boats and a marine vessel of 21 tons. On the other hand, the team organized many awareness sessions and workshops with 300 participants to raise awareness on the importance of marine ecosystems and how to protect them.

It is worth mentioning that NBK regards environmental and climate issues as key priorities and therefore organizes awareness campaigns on its social media platforms to increase awareness on the importance of the environment and environmental conservation. Furthermore, the bank’s sponsorship of Kuwait Dive Team has significantly contributed to protecting and restoring the marine ecosystem in Kuwait through many activities, including protecting coral reefs, cleaning beaches, establishing fish colonies, and lifting sunken ships and boats.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

With Dubai ranking as the top hub in the Gulf and second in the broader region

The UAE has established itself as a premier destination for start-ups in the Middle East, thanks to its supportive investment environment, flexible business policies, and forward-looking regulations designed to foster innovation.

International reports frequently recognize the UAE for its leadership in global start-up rankings, a testament to the country’s efforts in creating a conducive environment for entrepreneurial ventures. This focus on innovation has also enhanced the UAE’s performance in global competitiveness indices.

According to recent statistics from Statista, the UAE leads the GCC in start-up activity, with over 5,600 start-ups registered by the second quarter of 2024. The fintech sector is particularly prominent, with more than 550 companies operating across the country, highlighting the UAE’s role as a regional leader in this space.

A report by the global research firm Startup Genome confirms the UAE’s steady rise in global start-up ecosystem rankings, driven by the efforts of emirates such as Abu Dhabi, Dubai, and Sharjah. These emirates have created an attractive and supportive environment for start-ups, particularly in high-growth sectors.

Abu Dhabi has been identified as the fastest-growing start-up ecosystem in the Middle East and North Africa between mid-2021 and the end of 2023, with its start-up ecosystem valued at $4.2 billion. This growth has been supported by substantial funding for early-stage ventures, with $224 million raised during this period, while venture capital investments exceeded $1 billion, largely due to the activities within the city’s global tech ecosystem, Hub71.

In Dubai, the start-up ecosystem continues to thrive, with the city ranking as the top hub in the Gulf and second in the broader region. By the end of 2023, Dubai’s start-up ecosystem was valued at over $23 billion, reflecting its position as a key driver of start-up growth. Dubai’s In5, a subsidiary of the TECOM Group, has played a pivotal role, supporting 1,000 start-ups and facilitating AED7.8 billion in funding since its inception in 2013.

Sharjah, too, has played an important role in generating business growth, with around 60,000 small, medium, and start-up companies operating across its free and industrial zones. The value of Sharjah’s start-up ecosystem reached $424 million by the end of 2023, with early-stage funding totaling $39 million.

Overall, the UAE continues to foster a dynamic and competitive start-up ecosystem, positioning itself as a leader in the region and an attractive destination for innovation-driven businesses. The country’s commitment to nurturing sustainable growth in its start-up sectors underpins its growing reputation as a global hub for entrepreneurship.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Sarcc will provide quality, modern staff accommodations

The Public Investment Fund (PIF) has announced the establishment of the Smart Accommodation for Residential Complexes Company (SARCC), a new property development and management firm. SARCC will focus on providing housing solutions for staff involved in major construction and development projects across Saudi Arabia, addressing the increasing demand for accommodations in both public and private sectors nationwide

Sarcc will be instrumental in leading the evolution of the accommodation market, through developing and operating complexes for staff in Saudi Arabia. The company will seek opportunities to invest in the sector, in order to strengthen standards for staff housing. Accommodations provided or sourced by sarcc will be designed to meet recognized international standards set by the International Finance Corporation (IFC) – part of the World Bank Group – and the European Bank for Reconstruction and Development (EBRD).

The company will foster the Saudi private sector by enabling long-term investment and partnership along the industry’s value chain, encompassing service providers across multiple sectors including construction, catering, transportation and retail.

Sarcc will contribute to attracting talent and partners to various sectors in Saudi Arabia, including major building and construction projects, by providing modern, quality accommodations with suitable amenities, facilities and services for their workforces.

Khalid Johar, Co-Head of the Local Real Estate Portfolio Department at PIF said: “The staff accommodation market represents a significant opportunity, due to growing demand in the local market. Sarcc will play an important role in meeting the increasing need for accommodation solutions in Saudi Arabia, creating new opportunities for companies in the private sector. As we see the rise in construction projects across the country, PIF is playing a key role in developing and transforming the underlying infrastructure of the nation.”

The announcement will support PIF infrastructure and services linked to construction and real estate projects across Saudi Arabia, including ROSHN Group, Saudi Downtown Company and New Murabba Development Company.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

GITEX GLOBAL concludes, reinforcing its status as the world’s largest and most dominant technology event.

GITEX GLOBAL 2024 concluded on Friday, underscoring AI’s pivotal role as a transformative tool that will continue to reshape industries and drive business and economic growth globally.

For the final time this week, 6,500 exhibitors, 1,800 startups, and 1,200 investors, alongside governments from more than 180 countries—marking the highest-ever international participation— gathered in Dubai, along with 200,000 visitors, solidifying the city’s reputation as a premier global hub.

The unparalleled event brought together the most influential names in technology from every corner of the globe, further cementing its position as the world’s largest and most impactful tech gathering.

This 44th edition of GITEX GLOBAL, held under the theme of ‘Global Collaboration to Forge a Future AI Economy’, not only set new benchmarks for innovation and business opportunities but also reinforced the event’s critical role in shaping a technology landscape increasingly defined by AI adoption.

Over the five days, numerous Memorandum of Understanding agreements were announced, with these strategic deals set to accelerate the growth of the global AI market, projected to reach USD $1,339.1 billion by 2030, according to Markets and Markets.

With the inclusion of over 40% new nations – including South Africa, Puerto Rico, Vietnam, alongside Europe’s largest-ever presence – GITEX GLOBAL has paved the way to forge new cross-regional partnerships between leading and emerging tech nations that will accelerate the growth of the AI ecosystem even further.

Each day of the mega event focused on different themes – investment, cybersecurity, data centres, futuristic tech, and AI, reflecting the central pillars of the digital economy.

With the UAE welcoming the global ecosystem, GITEX GLOBAL has enhanced its position of being at the forefront of redefining the world’s digital landscape with many organizations praising the impact of the event and its focus on key trends.

Key Industry Impact and Strategic Outcomes at GITEX GLOBAL 2024

This week, top global players such as Oracle, Dell Technologies, and Microsoft, amongst several others, made significant strides in showcasing their latest innovations in AI, cloud, cybersecurity, edge computing, and other technologies. The event catalyzed these industry giants to forge new partnerships, drive technological advancements, and contribute to the future of the global digital economy.

Nick Redshaw, Senior Vice President of Tech Cloud, Middle East and Africa, and UAE Country Leader at Oracle, highlighted the company’s commitment to supporting the UAE’s AI vision and how GITEX GLOBAL 2024 was pivotal for Oracle’s AI and cloud innovations. He said: “At GITEX, we celebrated 35 years of supporting the UAE’s growth ambitions with state-of-the-art local cloud infrastructure, latest cloud technologies, developing top talent, and expanding our local presence. Industry-leading Artificial Intelligence (AI) and multi cloud innovation that is geared to solve complex business challenges in every industry and help accelerate the UAE and wider Middle East’s AI economy was Oracle’s key focus at GITEX GLOBAL 2024.”

At the event, Oracle announced significant collaborations, with the Mohammed Bin Rashid Housing Establishment to accelerate Dubai’s housing strategy using Oracle Cloud Infrastructure, and with Mashreq Bank to support its global expansion. These partnerships highlight how GITEX GLOBAL serves as a premier platform for unveiling strategic innovations and driving digital transformation across the region.

Dell Technologies was another tech giant to have a presence and reap the benefits of participating at GITEX GLOBAL. Mohammed Amin, Senior Vice President, CEEMETA, Dell Technologies, said: “Over the last four decades, GITEX GLOBAL has been a catalyst for advancing technological innovation across the Middle East region. Dell Technologies has been a part of this growth for more than 30 years and being at GITEX allows us to connect with regional decision-makers and support them in navigating today’s rapidly changing business environment.

“This week, we had many encouraging discussions around the Dell AI Factory offerings. Our conversations with our regional customers revealed a strong commitment to AI. They have a clear vision and a solid strategy and are actively implementing innovative AI solutions to drive their business forward. At Dell, we are at the epicenter of our customers’ AI innovations and take pride in helping them become future forward in their AI journeys.”

Meanwhile, Microsoft capitalized on GITEX GLOBAL to highlight its impactful initiatives to enhance the global digital economy. Naim Yazbeck, General Manager of Microsoft UAE, stated: “We are proud to have shared the results of our latest Cloud Dividend Snapshot report for the UAE, which underscores the critical role our globally trusted cloud ecosystem plays in driving economic growth and job creation across the nation. Additionally, our announcement of the AI National Skilling Initiative, launched at the show in partnership with key government departments, demonstrates our commitment to empowering individuals and organizations with the skills needed to thrive in the new AI era. I’m confident we will continue to witness strong business impact from GITEX Global for months to come.”

Catalyzing Change Through Strategic Dialogues on Global Digital Transformation

This edition of GITEX GLOBAL served as a strategic platform to address pressing challenges and opportunities of AI, focusing on its application across critical sectors that shape the global digital future.

The event featured the first-ever World Future Economy Digital Leaders Summit and the debut of GITEX Editions, spotlighting innovation, connecting top global unicorns, and fostering dialogue on AI regulation, economic strategies, and digital finance.

Cybersecurity emerged as a key topic, emphasising the need to secure digital infrastructure amid evolving cyber threats. Future mobility took centre stage, showcasing next-generation innovations like autonomous vehicles, electric vertical take-off and landing (eVTOL) aircraft, and AI advancements in the auto-tech industry.

AI’s role in the development of hyperscale, modular, and edge data centers was a significant focus, reflecting the burgeoning demand for scalable solutions and the region’s rise as a hub for AI-powered data infrastructure. GITEX DIGI_HEALTH 5.0 also gathered industry leaders to explore how AI is revolutionizing patient care and reshaping the future of healthcare, highlighting the technology’s transformative potential in delivering improved outcomes.

Other discussions revolved around 5G and intelligent connectivity, EdTech, digital cities, and energy transitions. Together, these conferences showcased critical dialogues shaping the future of digital transformation on a global scale, featuring insights from industry visionaries – such as Jong-Soo Choi, CTO of Samsung Medical Centre in South Korea, Stéphane Ouaki Head of Department at the European Innovation Council (EIC), Dr. Mark Sagar, Co-Founder of Soul Machines from New Zealand, Heman Bekele, TIME’s 2024 Kid of the Year, Valentyn S. Volkov, PhD, co-founder of XPANCEO, and renowned cybersecurity figure, Dr. Diane Janosek, who served legal, policy & executive roles at the National Security Agency, White House & the Pentagon. Additionally, GITEX GLOBAL brought together ethical hacker, Inti De Ceukelaire, and Brett Johnson.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

In a significant move to strengthen economic relation, the Saudi Egyptian Business Council has announced several investment projects across key sectors in Egypt.

Bandar Al-Ameri, head of the council, revealed that these agreements will span industries such as renewable energy, real estate development, tourism, technology, and industry. This announcement follows ongoing discussions aimed at further deepening the economic partnership between the two nations.

The news comes after Egyptian Prime Minister Mostafa Madbouly hinted in September that Saudi Arabia was considering a $5 billion investment package in Egypt. This follows earlier comments made by Saudi Investment Minister Khalid Al-Falih in August, where he noted the kingdom’s intent to convert $10 billion in deposits held in Egypt’s Central Bank into long-term investments. This approach mirrors an earlier deal Egypt struck with the United Arab Emirates, which focused on developing Ras El-Hekma, a prime coastal area.

Although the specific details of the new Saudi investments have yet to be fully disclosed, previous discussions have linked Saudi Arabia to a variety of Egyptian projects in sectors such as renewable energy, water desalination, real estate, and tourism. Of particular interest is the potential development of the Red Sea resort of Ras Gamila in South Sinai, a site the Egyptian government has actively promoted to international developers. Another key area is Ras Banas, in southern Egypt, where a Ras El-Hekma-style development deal is reportedly in the works.

These new investments are expected to push Saudi private sector contributions in Egypt to $50 billion, with more than 7,000 Saudi companies operating in Egypt injected investments exceeding $35 billion.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

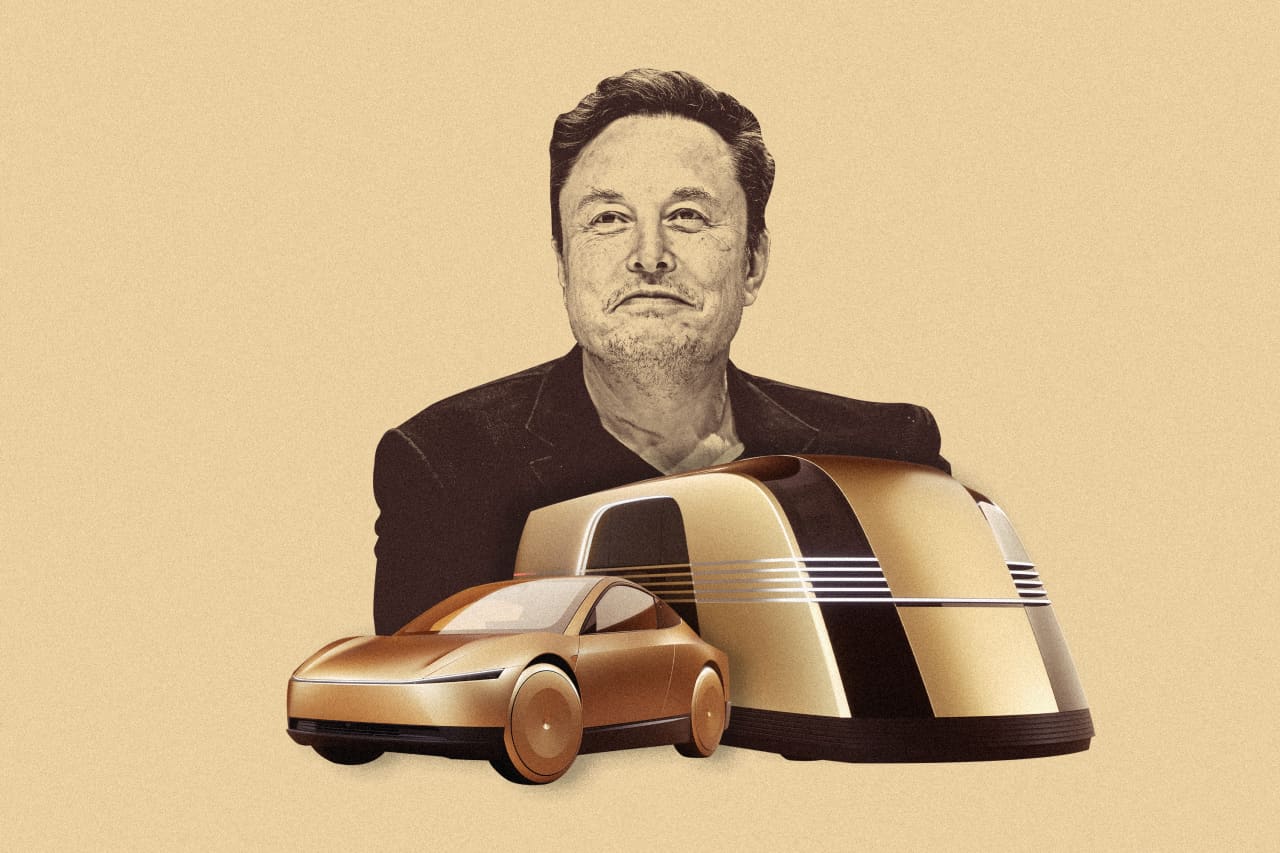

Tesla’s Robotaxi event excites faithful betting on the company’s future in robotics, while underwhelming those watching from afar.

Elon Musk , dressed in a leather jacket in front of adoring fans, looked like an ageing rock star on stage playing one of his greatest hits.

Robot cars are coming.

Those fans at Thursday’s event swooned as they always have as he pushed out timelines for delivering robot cars and showed what those vehicles could look like. But outside the Hollywood-area venue, it wasn’t exactly clear that everyone believed his vision for the future is as near as he says.

Tesla stock fell almost 9% Friday amid investors frustrated with the continued lack of details for how the company is going to make the very complicated transition from maker of cars to maker of robots.

In essence, Thursday night’s much-hyped product reveal became something of a Rorschach test: Supporters, who point to everything Musk has accomplished with electric cars and other industries, heard a glorious future with driverless cars and humanoid robots. Critics—mindful of previous missed goals and maybe peeved by his contentious politics —saw more smoke and mirrors.

“Let’s not get nuanced here,” the chief executive told the crowd as they peppered Musk with questions, a reminder that even among the faithful, time is ticking for him to play some new notes. And to deliver a big hit.

What he did show was cool. A two-seat car with doors that swung upward to open, inspired, in part, by the sci-fi movie “Demolition Man.”

Though as Musk talked about the vehicle, it wasn’t clear he had settled on a formal name. On stage, he called it the “Cybercab,” while the company released details on its website calling it the “Robotaxi.”

Whatever the name, the straight lines of the small car resembled what might be the offspring of the Cybertruck , the pickup the company brought out last year after some delays, and the new Roadster that was first revealed in 2017 and has yet to come to market. Those delays are examples of “ Elon Standard Time ,” or his practice of setting a target only to miss it.

Robot cars are coming.

The Cybercab/Robotaxi reveal also included what Musk says will be Tesla’s autonomous van, an art deco-inspired vehicle that resembled a giant toaster with an interior meant to feel like a spaceship and enough room for 20 passengers.

Like the small car, the van lacked a steering wheel—the sort of doodads currently required under regulations, though exceptions can be granted. The car could begin production “probably” in 2026, Musk said. He didn’t even suggest when the van might come.

The nearest timeline was deploying fully self-driving cars, through the company’s current offerings, next year in Texas and California.

Musk has been predicting driverless cars being just around the corner for several years, including in 2016 when he said Tesla would demonstrate a car driving itself from Los Angeles to New York City in 2017. That didn’t happen.

In 2019, he said he expected his robot taxis would arrive in 2020 . That didn’t happen.

But Tesla has pushed the envelope with its driver-assist system that is essentially a glorified cruise control—adjusting speed, keeping within a lane and other manoeuvres—but can’t technically drive the car itself. Tesla says the person behind the wheel is responsible for everything, though some drivers grow overconfident in its true abilities and act like the car is autonomous.

Musk likes to talk about how Tesla vehicles are collecting valuable real-world data that is used to train its AI systems.

After building Tesla into the world’s leading electric-car company, Musk in recent years has tried to position its future on robotics, saying it is focused on solving self-driving technology. “That’s really the difference between Tesla being worth a lot of money and being worth basically zero,” Musk said in 2022.

Despite that rhetoric, Tesla is behind in deploying cars on roadways without drivers. Alphabet ’s Waymo has deployed fully autonomous vehicles in places such as San Francisco, where paying customers can take its vehicles around the city without anyone sitting behind the wheel.

On Thursday night, Tesla demonstrated 50 vehicles, including the new two-seater, driving autonomously on private property of the Warner Bros. studios where Musk held his party for investors and supporters.

Detractors were quick to pounce.

“After over 10 years of Full Self-Driving development, Tesla is limited to a 20-30 acre geofenced 5mph 1950s Disneyland ride on a preprogrammed, premapped and heavily rehearsed route with no traffic and no pedestrians,” Dan O’Dowd , a critic of Tesla and founder of a rival software company, said in a statement. “Tesla robotaxi is nothing more than the latest work of fiction to come out of the Warner Bros. Studio.”

But Thursday night wasn’t about impressing the O’Dowds of the world. And maybe not even those watching on the livestreams through Musk’s social-media platform X—which counted more than 9 million views by Friday evening.

The real target were the hundreds of attendees at the event who spent the evening riding around in the cars and posting fawning videos of their experiences on social media, in turn, helping the event go even more viral and generating even more attention for the idea that Tesla is paving the way for a robot future.

Robot cars are coming.

Not only did party attendees enjoy rides, but they were entertained by the latest versions of Tesla’s humanoid robots Optimus, which Musk has said could one day add $25 trillion to the company’s market value.

Former Tesla board member Steve Jurvetson posted a video of himself playing rock, paper, scissors with one of the robots. “Optimus just beat me in rock paper scissors!” he tweeted .

Others shared videos of robots pouring drinks and dancing.

“The markets won’t get what happened last night at @tesla ,” Robert Scoble, a blogger and former Microsoft tech evangelist, posted on X. “I couldn’t be more impressed. @elonmusk laid out a bunch for next decade. I have been to a lot of product launches and never have been to one like this.”

Some even compared the evening to when the late Steve Jobs unveiled Apple ’s first iPhone, marking the beginning of a new technology era. It was an idea that Musk was quick to endorse.

“Yes, this marks a fork in the road,” he tweeted afterward.

Robot cars are coming.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

‘Humourbragging’ can make you seem less conceited when you’re boasting

It is a classic problem for entrepreneurs, job seekers and, well, anyone: If you brag about your accomplishments, you seem more competent—but less likeable.

The solution? Add a dash of playfulness when discussing your talents.

A team of researchers have found that “humourbragging”—referring to your accomplishments through a veil of humour—allows people to play up their skills without coming across as smug or conceited. And that makes them more likely to get hired or get their pitch accepted.

“The self-enhancing humour helps them be seen as confident without sacrificing likability,” says Jieun Pai , an assistant professor at Imperial College London who led the research .

Laughs get results

The researchers used a series of studies to test the impact of what they called humourbragging. In one instance, they sent out two résumés to 345 companies—but one version of the résumé added a dash of self-promotional humour instead of being purely serious: “The more coffee you can provide, the more output I will produce.” The résumés with the joke got an email or a callback by 156 companies, versus 125 for the others.

Another study got similar results when looking at humorous bragging on the first four seasons of “Shark Tank”—people who used humour to highlight their accomplishments were more likely to get funding than others.

In another case, the researchers found that study participants were more likely to hire a pastry chef who used some levity in selling themselves. One candidate described making a soccer-themed cake for a boy’s fifth-birthday party and capped off the story by saying they got the biggest tip the bakery has ever seen. The baker who was the hiring favourite told the same story, including the part about the tip, but ended up by saying, “I am just glad that I only had to make the soccer ball, not actually kick one.”

Pick your jokes wisely

People need to be cautious, though, when using humour to sell themselves, Pai says. Self-deprecating humour without any bragging at all, or humour intended to belittle others in any form, doesn’t have the same positive impact that humorous bragging does, according to the research. “We sometimes use self-deprecating humour, but that backfires and downplays your achievements,” she says. “It doesn’t help you be seen as more competent.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Subsidised minivans, no income taxes: Countries have rolled out a range of benefits to encourage bigger families, with no luck

Imagine if having children came with more than $150,000 in cheap loans, a subsidised minivan and a lifetime exemption from income taxes.

Would people have more kids? The answer, it seems, is no.

These are among the benefits—along with cheap child care, extra vacation and free fertility treatments—that have been doled out to parents in different parts of Europe, a region at the forefront of the worldwide baby shortage. Europe’s overall population shrank during the pandemic and is on track to contract by about 40 million by 2050, according to United Nations statistics.

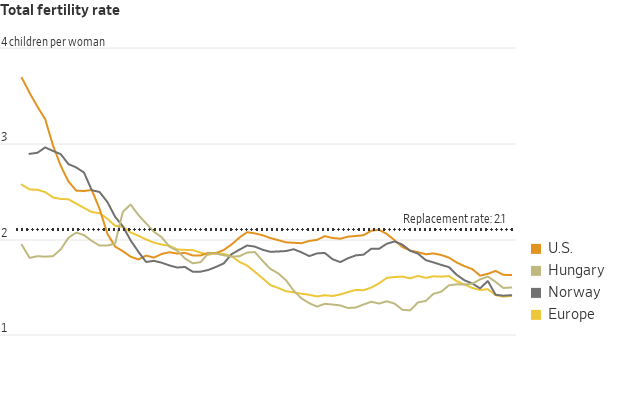

Birthrates have been falling across the developed world since the 1960s. But the decline hit Europe harder and faster than demographers expected—a foreshadowing of the sudden drop in the U.S. fertility rate in recent years.

Reversing the decline in birthrates has become a national priority among governments worldwide, including in China and Russia , where Vladimir Putin declared 2024 “the year of the family.” In the U.S., both Kamala Harris and Donald Trump have pledged to rethink the U.S.’s family policies . Harris wants to offer a $6,000 baby bonus. Trump has floated free in vitro fertilisation and tax deductions for parents.

Europe and other demographically challenged economies in Asia such as South Korea and Singapore have been pushing back against the demographic tide with lavish parental benefits for a generation. Yet falling fertility has persisted among nearly all age groups, incomes and education levels. Those who have many children often say they would have them even without the benefits. Those who don’t say the benefits don’t make enough of a difference.

Two European countries devote more resources to families than almost any other nation: Hungary and Norway. Despite their programs, they have fertility rates of 1.5 and 1.4 children for every woman, respectively—far below the replacement rate of 2.1, the level needed to keep the population steady. The U.S. fertility rate is 1.6.

Demographers suggest the reluctance to have kids is a fundamental cultural shift rather than a purely financial one.

“I used to say to myself, I’m too young. I have to finish my bachelor’s degree. I have to find a partner. Then suddenly I woke up and I was 28 years old, married, with a car and a house and a flexible job and there were no more excuses,” said Norwegian Nancy Lystad Herz. “Even though there are now no practical barriers, I realised that I don’t want children.”

The Hungarian model

Both Hungary and Norway spend more than 3% of GDP on their different approaches to promoting families—more than the amount they spend on their militaries, according to the Organization for Economic Cooperation and Development.

Hungary says in recent years its spending on policies for families has exceeded 5% of GDP. The U.S. spends around 1% of GDP on family support through child tax credits and programs aimed at low-income Americans.

Hungary’s subsidised housing loan program has helped almost 250,000 families buy or upgrade their homes, the government says. Orsolya Kocsis, a 28-year-old working in human resources, knows having kids would help her and her husband buy a larger house in Budapest, but it isn’t enough to change her mind about not wanting children.

“If we were to say we’ll have two kids, we could basically buy a new house tomorrow,” she said. “But morally, I would not feel right having brought a life into this world to buy a house.”

Promoting baby-making, known as pro natalism, is a key plank of Prime Minister Viktor Orbán ’s broader populist agenda . Hungary’s biennial Budapest Demographic Summit has become a meeting ground for prominent conservative politicians and thinkers. Former Fox News anchor Tucker Carlson and JD Vance, Trump’s vice president pick, have lauded Orbán’s family policies.

Orbán portrays having children inside what he has called a “traditional” family model as a national duty, as well as an alternative to immigration for growing the population. The benefits for child-rearing in Hungary are mostly reserved for married, heterosexual, middle-class couples. Couples who divorce lose subsidised interest rates and in some cases have to pay back the support.

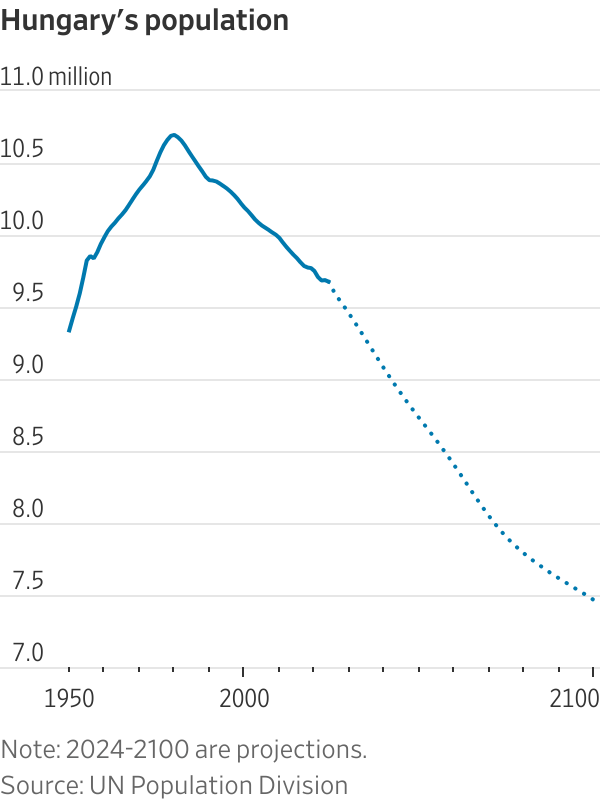

Hungary’s population, now less than 10 million, has been shrinking since the 1980s. The country is about the size of Indiana.

“Because there are so few of us, there’s always this fear that we are disappearing,” said Zsuzsanna Szelényi, program director at the CEU Democracy Institute and author of a book on Orbán.

Hungary’s fertility rate collapsed after the fall of the Soviet Union and by 2010 was down to 1.25 children for every woman. Orbán, a father of five, and his Fidesz party swept back into power that year after being ousted in the early 2000s. He expanded the family support system over the next decade.

Hungary’s fertility rate rose to 1.6 children for every woman in 2021. Ivett Szalma, an associate professor at Corvinus University of Budapest, said that like in many other countries, women in Hungary who had delayed having children after the global financial crisis were finally catching up.

Then progress stalled. Hungary’s fertility rate has fallen for the past two years. Around 51,500 babies have been born there this year through August, a 10% drop compared with the same period last year. Many Hungarian women cite underfunded public health and education systems and difficulties balancing work and family as part of their hesitation to have more children.

Anna Nagy, a 35-year-old former lawyer, had her son in January 2021. She received a loan of about $27,300 that she didn’t have to start paying back until he turned 3. Nagy had left her job before getting pregnant but still received government-funded maternity payments, equal to 70% of her former salary, for the first two years and a smaller amount for a third year.

She used to think she wanted two or three kids, but now only wants one. She is frustrated at the implication that demographic challenges are her responsibility to solve. Economists point to increased immigration and a higher retirement age as other offsets to the financial strains on government budgets from a declining population.

“It’s not our duty as Hungarian women to keep the nation alive,” she said.

Big families

Hungary is especially generous to families who have several children, or who give birth at younger ages. Last year, the government announced it would restrict the loan program used by Nagy to women under 30. Families who pledge to have three or more children can get more than $150,000 in subsidised loans. Other benefits include a lifetime exemption from personal taxes for mothers with four or more kids, and up to seven extra annual vacation days for both parents.

Under another program that’s now expired, nearly 30,000 families used a subsidy to buy a minivan, the government said.

Critics of Hungary’s family policies say the money is wasted on people who would have had large families anyway. The government has also been criticised for excluding groups such as the minority Roma population and poorer Hungarians. Bank accounts, credit histories and a steady employment history are required for many of the incentives.

Orbán’s press office didn’t respond to requests for comment. Tünde Fűrész, head of a government-backed demographic research institute, disagreed that the policies are exclusionary and said the loans were used more heavily in economically depressed areas.

Government programs weren’t a determining factor for Eszter Gerencsér, 37, who said she and her husband always wanted a big family. They have four children, ages 3 to 10.

They received about $62,800 in low-interest loans through government programs and $35,500 in grants. They used the money to buy and renovate a house outside of Budapest. After she had her fourth child, the government forgave $11,000 of the debt. Her family receives a monthly payment of about $40 a month for each child.

Most Hungarian women stay home with their children until they turn 2, after which maternity payments are reduced. Publicly run nurseries are free for large families like hers. Gerencsér worked on and off between her pregnancies and returned full-time to work, in a civil-service job, earlier this year.

She still thinks Hungarian society is stacked against mothers and said she struggled to find a job because employers worried she would have to take lots of time off.

The country’s international reputation as family-friendly is “what you call good marketing,” she said.

Nordic largesse

Norway has been incentivising births for decades with generous parental leave and subsidised child care. New parents in Norway can share nearly a year of fully paid leave, or around 14 months at 80% pay. More than three months are reserved for fathers to encourage more equal caregiving. Mothers are entitled to take at least an hour at work to breast-feed or pump.

The government’s goal has never been explicitly to encourage people to have more children, but instead to make it easier for women to balance careers and children, said Trude Lappegard, a professor who researches demography at the University of Oslo. Norway doesn’t restrict benefits for unmarried parents or same-sex couples.

Its fertility rate of 1.4 children per woman has steadily fallen from nearly 2 in 2009. Unlike Hungary, Norway’s population is still growing for now, due mostly to immigration.

“It is difficult to say why the population is having fewer children,” Kjersti Toppe, the Norwegian Minister of Children and Families, said in an email. She said the government has increased monthly payments for parents and has formed a committee to investigate the baby bust and ways to reverse it.

More women in Norway are childless or have only one kid. The percentage of 45-year-old women with three or more children fell to 27.5% last year from 33% in 2010. Women are also waiting longer to have children—the average age at which women had their first child reached 30.3 last year. The global surge in housing costs and a longer timeline for getting established in careers likely plays a role, researchers say. Older first-time mothers can face obstacles: Women 35 and older are at higher risk of infertility and pregnancy complications.

Gina Ekholt, 39, said the government’s policies have helped offset much of the costs of having a child and allowed her to maintain her career as a senior adviser at the nonprofit Save the Children Norway. She had her daughter at age 34 after a round of state-subsidised IVF that cost about $1,600. She wanted to have more children but can’t because of fertility issues.

She receives a monthly stipend of about $160 a month, almost fully offsetting a $190 monthly nursery fee.

“On the economy side, it hasn’t made a bump. What’s been difficult for me is trying to have another kid,” she said. “The notion that we should have more kids, and you’re very selfish if you have only had one…those are the things that took a toll on me.”

Her friend Ewa Sapieżyńska, a 44-year-old Polish-Norwegian writer and social scientist with one son, has helped her see the upside of the one-child lifestyle. “For me, the decision is not about money. It’s about my life,” she said.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

When a company markets its product’s long, iconic heritage, consumers are reluctant to buy a new variation

Emphasising a product’s heritage can be a powerful marketing tool. Think of brands like Coca-Cola or Converse’s Chuck Taylor All Star sneakers.

But the strategy could have a big drawback, according to research . When a brand emphasises its past, customers are less likely to buy its updates and innovations. A food company that heavily promotes its classic recipe, for instance, could have a tough time getting customers to buy a new variation on the product. The reluctance is particularly strong if people think the brand has stood the test of time and is authentic the way it is.

When you change an original product, it challenges why many people like the product in the first place, says Rosanna Smith, an associate professor at the University of Illinois Urbana-Champaign and one of the paper’s co-authors.

“We call it the curse of the original, and the question is how to update a product that is considered an icon without enraging your customers,” says Smith.

The shock of the new

In one part of the study, 418 participants read about a fictional hand-cream company and its top lotion. Participants were either told the company was established in 1917 with “deep roots in the old world French apothecary” or that it was established in 2017. Then the participants were either told the hand lotion was developed when the company was founded or was a new and improved version of the original.

All participants tried the same lotion and rated it on a nine-point scale, with nine being most favourable. When it came to the 1917 company, people rated the classic formula much higher than the new one: The original got a 6.68, while the new one averaged only 6.09. In other words, people didn’t like a venerable brand that tried to innovate as much as a brand that stuck to its roots.

Meanwhile, participants who were told the company started in 2017 rated the original and improved hand creams similarly.

“One big limitation of heritage branding is that it makes it harder to innovate,” says Smith. “But there are ways to lessen the effect.”

Back to basics

For instance, in another experiment, 602 participants read about Fratellino, a fictional Italian-food brand launched in 1911 when founder Martina Fratellino began selling tomato sauce from her front porch. The participants were told the brand would be improving its original tomato-sauce recipe.

The people were then divided into three groups. The control group was told the company was proud to introduce the new formula. The second group was told the new sauce was a bold departure from the original recipe, while the third was told the change was inspired by traditional techniques Martina used to create her tomato sauce in 1911 and that the change was a return to the company’s beginnings.

The authors found that participants in the control group rated the new tomato sauce less favourably than the original, giving it a score of 6.0, compared with 7.2 for the original. Simply doing something novel hurt the tradition-heavy company. The new product did even worse among people who heard that it was a bold departure: The new item got a 5.57, compared with 7.19 for the original.

But in the third group, where the change was framed as grounded in the product’s origins, the scores for the original and new tomato sauces didn’t significantly differ.

“Stressing the connection to the brand’s origins may have made the update seem more authentic,” says Smith.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Daily planning around ensuring their safety, and reassuring family members, is invisible labour that women do to be able to work

When Ajita Topo , a cook in an affluent neighbourhood in Delhi, leaves work in the evening, she holds her bag like a shield against her chest, keeps her fists clenched and carries a black umbrella with a very sharp end to ward off a possible attack.

She makes sure to wear lots of layers—no matter how hot it is—to deter someone from trying to grope her chest, and secures her bun with a sharp metal stick as an additional weapon.

Topo isn’t being paranoid. Last year, she was followed by two men when she left work after 10 p.m. She managed to scare them away by shouting as she passed homes with guards outside.

“Workplace, public transport, public places, we feel safe nowhere,” said Topo, the sole breadwinner for her two children. “The only solution is to stay alert at all times.”

For many women in India, taking steps to ward off a violent attack—and reassuring their families they are safe while at work and on their commutes—is an invisible form of labour that is a central element of their work life.

The killing and rape of a trainee doctor in the city of Kolkata in August was a fresh reminder for Indian women who work of the dangers lurking in public spaces where women are far less visible than men, from the deserted corners of a hospital or corporate park, in public transport or on city streets.

The 31-year-old was found dead in a seminar hall of the state-run hospital after she went on break during a night shift. A volunteer at the hospital has been arrested as a suspect. The killing prompted protests by women across the country.

Only 30% of women in India aged 15 to 64 were in the labour force in 2022, according to the International Labor Organization, as conservative values lead many families to discourage women working outside the home. In the U.S., the corresponding rate is 68%.

A decade ago, Indian laws dealing with crimes against women were overhauled in the wake of the gang-rape of a 23-year-old woman on a moving bus. But women’s rights advocates say that entrenched patriarchal attitudes haven’t budged significantly, and are at the root of frequent violence against women, both in the home and outside of it.

In other widely publicised incidents, female call centre workers have been assaulted and killed as they commuted to or from night shifts. Last year, a receptionist disappeared from the hotel where she worked and was found dead days later. Each time such a crime takes place, women experience another jolt of fear for their own safety.

Piyali Maiti , clinical director for counselling operations at 1to1help, which manages corporate assistance programs for employees, said worries sparked by the Kolkata attack have cropped up in conversations with employees and their family members in recent weeks.

Sometimes “young professionals are working out in a different city. So family members are also part of our concern group,” she said. “When we have sessions with them, they raise concerns for their child’s safety. ‘What can I do as a parent to make sure my child is safe?’”

For women working in healthcare, where they are a larger share of the workforce compared with many other occupations, but late night shifts and long hours are also common, the Kolkata attack has resonated especially deeply.

Amrita Bhattacharya , a 29-year-old medical resident at another hospital in the city, said she previously felt comfortable walking the distance—less than a mile—from her work to the hospital-provided women’s residence on her own at night. Now she asks a male colleague or friend to accompany her.

Earlier she used to chafe against rules at the residence, which include locking the facility’s doors after a certain hour.

“But now after the horrific incident, I feel being put under lock and key is a must in a society like ours,” she said. “It’s a strain to deal with such fear every day.”

Sexual-assault statistics indicate that women in India are more likely to be raped by a family member, romantic partner or friend, than an acquaintance, employer or stranger. Still, the highly publicised attacks on working women dovetail with existing beliefs held by many that a woman’s place is in the home, shaping decisions made by women and their families.

A Pew Research Center survey in 2019 found 40% of Indians think it is better for a marriage for men to provide while women take care of the home and children, significantly higher than the global median of 23%.

Some women choose to withdraw from work as soon as economic circumstances permit, while others prefer lower-paid work options close to home over travelling to more distant locations.

That perception that working in public is unsafe and homes are safe shows up in India’s newest employers—gig-work platforms. Companies that focus on deliveries have struggled to hire significant numbers of women; the lone exception is Urban Company, a platform that offers personal-care and repair services at home.

The pervasive sense that public spaces are unsafe also shapes company policy. Delivery platform Swiggy at one point limited delivery hours to before 6 p.m. for female workers. The company said in a 2021 blog post on its efforts to hire more women that it reversed the policy after realising it was barring women from earning during peak dinner hours.

Economists and researchers say the low share of Indian women in the workforce is costing India economic growth.

Economic privilege can offer an additional layer of security—such as a personal vehicle for commuting to work, or access to ride-share services that come with some inbuilt safety measures. But, nevertheless, the sense of insecurity persists.

Vidhi Pandey , a digital-marketing professional, has an almost 90-minute commute between her home in Gurgaon and her office in the Indian capital, and frequently attends evening events. If an international client is involved, her day can end at 2 a.m.

“Although my husband and mother have grown accustomed to my unconventional working hours, announcing a late night at the office still makes them lose their sleep,” said the 43-year-old.

Her mother frequently lobbies her to look for something closer to home even if it means earning less. But she has resisted the pressure. Instead, she reminds her mum of her extensive safety checklist.

When she books a cab, she makes sure to look at the driver’s performance rating and reads riders’ feedback regarding his behaviour. If she is wearing a skirt, she changes into something more covered up before getting into a taxi for her ride home.

On her phone, she keeps the Delhi Police panic button app open throughout the ride. The app, developed after the 2012 bus attack and called “Himmat” or “courage,” allows the user to quickly send an alert to the Delhi Police, with a link to the user’s location on Google Maps, as well as notifications to family and friends.

She makes sure to share her live location and trip status with her husband and at least one friend. Sometimes she keeps a phone call going with her mother or a friend throughout the car ride.

“I keep thinking about how to escape if something goes wrong,” said Pandey. “I dream of a day when our society is safe enough for me to travel alone anytime, anywhere without any fear or worry.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The inflation rate ran at an annual pace of 2.2% in the quarter compared with a rise of 3.3% in the second quarter

SYDNEY—New Zealand’s inflation rate returned to within the central bank’s target band for the first time since early 2021 in the third quarter, opening a path to more supersized interest-rate cuts in coming months.

The inflation rate ran at an annual pace of 2.2% in the quarter, near the midpoint of the desired 1% to 3% target band, with some economists warning that the Reserve Bank of New Zealand must continue lowering the official cash rate at speed as a neutral policy rate is still well off in the distance.

The annual increase in inflation compares with a rise of 3.3% in the second quarter, StatsNZ said Wednesday. Inflation rose by 0.6% in quarterly terms.

The inflation data justifies the 75 basis points of cuts announced so far since August, with the RBNZ stepping up the pace of lowering the official cash rate last week by joining the Federal Reserve in slashing by 50 basis points.

Economists warn that there is a risk that inflation will undershoot the target band in coming quarters, especially if the RBNZ backs away from more significant cuts.

The official cash rate has so far fallen to 4.75% from 5.50%, with a neutral policy rate likely closer to 3.00%, according to economists.

New Zealand’s farm-rich economy has been in and out of recession for years as the RBNZ proved to be one of the more aggressive central banks globally when combating the inflation surge that emerged after the Covid-19 pandemic.

Economic activity remains flat and in need of resuscitation, especially with growth in China, its main trading partner, in a slowdown, economists said.

Higher rents were the biggest contributor to the annual inflation rate, up 4.5%. Almost a fifth of the annual increase in the consumer-price index was due to rent prices.

Prices for local authority rates and payments increased 12.2% in the 12 months to the third quarter, StatsNZ said. Prices for cigarettes and tobacco also rose sharply in line with an annual excise-tax increase.

Still, lower prices for gasoline and vegetables helped to offset rising prices, StatsNZ added.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Organized by Dubai World Trade Centre and hosted by Dubai Chamber of Digital Economy

Global Innovators Shine at Expand North Star

AI Sparks Interesting Conversations on Human Creativity at Marketing Mania

GITEX GLOBAL Paves Way for the Evolution of Deep Tech

Tech Transfer 3.0: Bridging Innovation and Real Innovation

Spectacular Finale: Holo by Eric Prydz

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The UAE GDP is expected to grow by 4.1% in 2025.

The United Arab Emirates (UAE) is set to experience notable economic growth in the coming years, with the country’s GDP expected to expand by 3.3% in 2024, followed by further increase to 4.1% in 2025, according to the World Bank’s latest MENA Economic Update. This growth is largely driven by the expansion of the UAE’s non-oil sectors, contributing to projected increases in real GDP per capita of 2.5% in 2024 and 3.4% in 2025.

Despite the UAE’s continued efforts to diversify its economy, the report indicates that the current account surplus is expected to decline from 9.2% of GDP in 2023 to 7.5% in 2024. However, the country is projected to maintain solid fiscal surpluses, with forecasts of 4.9% of GDP in 2024 and 4.7% in 2025, demonstrating the nation’s ability to manage its fiscal position effectively.

Regional Growth Expectations

While the UAE’s outlook remains positive, the broader Middle East and North Africa (MENA) region is expected to experience modest growth. The World Bank forecasts the region’s overall GDP to rise from 1.8% in 2023 to 2.2% in 2024, driven largely by economic activity in Gulf Cooperation Council (GCC) countries, where growth is expected to rebound from 0.5% in 2023 to 1.9% in 2024. By 2025, growth in the GCC is projected to increase more to 4.2%.

However, the economic outlook for other MENA countries is less optimistic. Oil-importing nations are anticipated to see a slowdown in growth, with a projected decrease from 3.2% in 2023 to 2.1% in 2024. Similarly, non-GCC oil exporters are expected to experience a reduction in growth from 3.2% to 2.7% during the same period, reflecting differing economic conditions across the region.

Uncertainty and Challenges

The report also highlights the significant uncertainties in the region, largely due to ongoing conflicts and other regional challenges. The World Bank uses a measure that tracks the dispersion of views among private sector forecasters to assess economic uncertainty, which in MENA is currently double the average found in other emerging markets and developing economies.

Conflict-affected areas, such as the Palestinian territories and Lebanon, are particularly vulnerable. Gaza’s economy contracted by a staggering 86% in the first half of 2024, while the West Bank faces severe fiscal and private sector challenges. In Lebanon, the outlook remains uncertain and is closely tied to the ongoing regional conflicts. Additionally, countries like Jordan and Egypt have seen declines in tourism revenues and fiscal inflows, adding further pressure to their economies.

The long-term economic consequences of conflict are profound. The report estimates that, on average, GDP per capita in MENA countries affected by conflict could have been 45% higher, a significant loss equivalent to the average economic progress made in the region over the last 35 years.

Reform and Growth Opportunities

Despite these challenges, the report identifies key areas where MENA countries can promote inclusive growth through reforms. It suggests that accelerating reforms related to rebalancing the roles of the public and private sectors, closing gender gaps in the labor market, and promoting innovation are crucial for fostering sustainable growth.

One notable area of focus is the region’s low rate of female labor force participation, which stands at just 19%—the lowest in the world. Addressing this gender employment gap could lead to substantial economic benefits, with a potential 51% increase in per capita income in the typical MENA country.

Additionally, the report highlights that improving the allocation of talent, especially by mobilizing labor from the public to the private sector, could boost aggregate productivity by up to 45%. The region has the highest proportion of public sector employees globally, but a more balanced distribution of talent could significantly enhance economic efficiency and productivity.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

eeasy’s clients, supported by Fils’ enterprise sustainability infrastructure, will be equipped to enable climate-friendly purchases at the point of sale.

Fils has entered the African market through a landmark partnership with eeasy, a leading digital payments technology company operating across the Middle East and Africa, with a particular focus on Egypt. This collaboration aims to empower clients in driving climate action by giving consumers the option to offset carbon emissions with every transaction.

As a significant step in Fils’ expansion, this marks its first entry into the African market. eeasy will integrate a sustainability tracking layer into its payment technology, allowing users to precisely calculate the emissions associated with their purchases and buy carbon credits to reduce their environmental impact. With the support of Fils’ enterprise sustainability infrastructure, eeasy’s clients will be able to offer climate-conscious purchasing options, enabling consumers and businesses to contribute to environmental protection effortlessly.

At the foundation of all global commerce lies payment infrastructure, a fundamental component of all trade and consumption. Recognizing its pivotal role in addressing climate change, eeasy’s partnership with Fils will embed sustainability within businesses across the markets it operates in including Egypt. Through this alliance, eeasy’s clients will have the tools to offer carbon credit offsets with every transaction, irrespective of the payment method, enabling customers to take climate action on a universal scale.

Through strategic partnerships with leading companies Fils today has a reach of over 105+ banks, 1.5 million merchants and over 4 million consumers. Today, eeasy joins Fils extensive partner network and is paving the way for a low-carbon economy and a sustainable relationship with the environment.

“I am incredibly excited to announce our groundbreaking partnership with eeasy, a trailblazing digital payments technology innovator in the Middle East & Africa region. Fils is focused and continuing to establish a strong network connected to our stack which will fuel the growth of this sector in both the near and far future. Together, we are enabling merchants and companies with tools to fully embrace a sustainable business model and encourage their consumers to make climate-guided purchases.”, commented Nameer Khan, CEO of Fils. “This partnership also marks our first partnership in Africa, a continent eager to embrace sustainable business to protect their environment for generations to come.”

Fils’ comprehensive sustainability infrastructure utilizes blockchain technology, seamlessly ensuring traceability and transparency in the sustainability efforts of its clients. This allows businesses to showcase their authentic climate actions and combat greenwashing effectively. By using Fils’ advanced technology, merchants and businesses are able to accurately track and limit emissions for each transaction, incorporating climate action into their operations.

“We are proud to join forces with Fils, utilizing our cutting-edge digital payments technology to drive meaningful environmental initiatives. At eeasy, we acknowledge our duty to work towards a sustainable future. This partnership with Fils is a significant step toward achieving our ESG objectives, emphasizing our dedication to facilitating climate-conscious payments and delivering essential sustainability solutions to our clients” said Santhosh Jayaram, CEO of eeasy.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

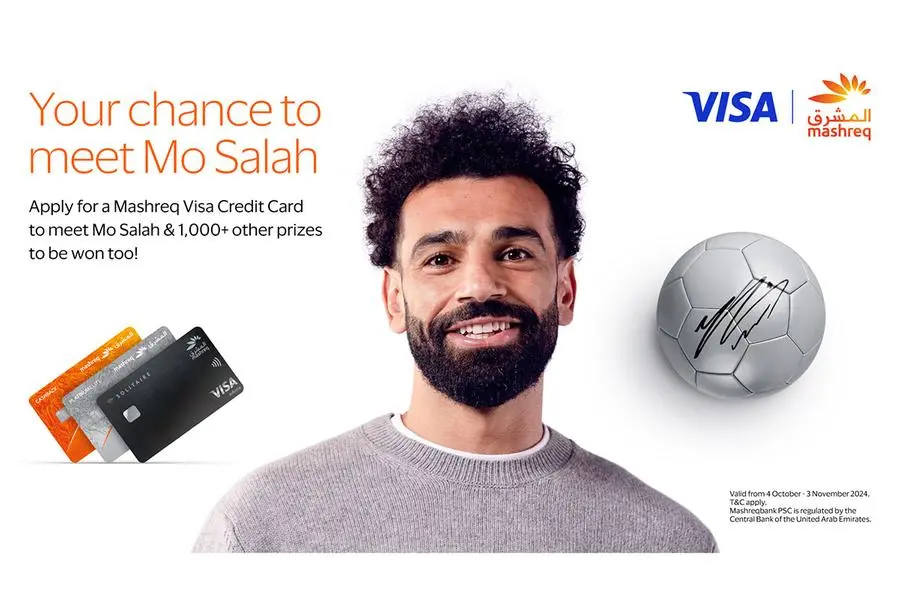

Offering customers a chance to win meet-and-greet opportunities with the football superstar Mohamed Salah

Mashreq has partnered with Visa to launch an exciting campaign for Mashreq Visa Cards in the UAE, featuring Visa’s brand ambassador, football superstar Mohamed Salah.

New and existing Mashreq Visa Credit Card holders have the chance to win a fully paid trip to the UK to meet the football legend in person, enjoy a virtual meet-and-greet with Mo Salah, or receive a prized football signed by him, among other fantastic rewards, creating an unforgettable experience for football fans.

Kartik Taneja, Head of Payments and Consumer Lending at Mashreq, said: “We are thrilled to unveil our collaboration with Visa and Mohamed Salah, representing our commitment to customer-centricity and enabling innovative card solutions for our customers. In combining Visa’s global expertise, Mashreq’s position as a visionary leader in the banking sector and Mohamed Salah’s unquestionable sporting pedigree, we aim to empower our customers with convenient and rewarding payment solutions that reflect our commitment to transforming the banking landscape across our markets.”

The latest partnership between Mashreq and Visa underscores the synergy between the two entities and the shared commitment to setting new standards of excellence and innovation in the financial services and payment industry. The featuring of Mohamed Salah reflects Mashreq and Visa’s common values of dedication, perseverance and excellence – qualities for which the sportsman is renowned – in alignment with Mashreq’s ethos of Rise Every Day.

Salima Gutieva, Visa’s VP and Country Manager for UAE, said: “Through our sponsorship assets, Visa’s clients can create unique, memorable experiences exclusively for their Visa cardholders. This campaign with Mashreq and Visa Brand Ambassador, Mohamed Salah – whose journey exemplifies the power of small steps, is also a great way to reward consumers for using their Visa cards. This supports the UAE government’s cashless agenda and extending the benefits of digital commerce to more consumers and retailers in the country.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Showcasing the effectiveness of country’s economic strategies in mitigating global inflationary pressures

According to the recent monthly statistical report by the General Authority for Statistics (GASTAT), the Saudi’s inflation rate remained stable at 1.7 percent in September 2024, compared to the same period in 2023. This consistency highlights the stability of the country’s economy, showcasing the effectiveness of Saudi Arabia’s economic strategies in mitigating global inflationary pressures.

The most significant contributor to the inflation rate was the rise in rental costs, particularly in the housing, water, electricity, gas, and other fuels category, which saw a 9.3 percent increase compared to September 2023. Housing rents alone surged by 11.2 percent, mainly due to a 10 percent rise in apartment rental prices. This category, comprising 25.5 percent of the overall Consumer Price Index (CPI), played a crucial role in sustaining inflation.

Food and beverages also experienced a 0.8 percent increase, driven by a sharp 5.2 percent rise in vegetable prices. The restaurants and hotels sector saw a 1.7 percent increase, attributed to a 1.5 percent rise in catering service prices.

In contrast, the transportation sector provided some relief, showing a decline of 3.3 percent. This was influenced by a 4.5 percent drop in vehicle purchase prices, helping to offset the impact of rising costs in other sectors.

Several other sectors experienced changes. Education costs rose by 1.6 percent, driven by a 3.8 percent increase in fees for intermediate and secondary education. However, the furnishing and home equipment sector saw a decline of 3.7 percent, with prices for furniture, carpets, and flooring falling by 7 percent. Similarly, clothing and footwear experienced a 3.2 percent decrease, primarily due to a 5.5 percent drop in ready-made clothing prices.

Other smaller sectors saw varying trends. The recreation and culture sector experienced a 0.3 percent decrease, while personal goods and services increased slightly by 0.1 percent. The communications sector and tobacco prices both saw minor decreases of 0.1 percent. Notably, the health sector showed no significant change in September 2024.

Month-on-month, the CPI edged up by 0.1 percent from August to September 2024. This slight increase was largely driven by a 0.6 percent rise in the housing, water, electricity, gas, and fuels category, particularly due to a 0.8 percent increase in actual housing rents. Additionally, food and beverage prices rose by 0.3 percent, led by a 1.6 percent rise in vegetable prices.

The Consumer Price Index, which tracks the price of a fixed basket of 490 goods and services, serves as a key measure of price changes in Saudi Arabia. The basket’s items and their respective weights were determined based on a 2018 household income and expenditure survey. These price movements reflect Saudi Arabia’s ability to maintain a stable inflation rate despite fluctuations in specific sectors, underscoring the resilience of the nation’s economic policies.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.