EOFY sales not enough to tempt shoppers to spend more

Shoppers cut back on unnecessary spending as household budgets feel the squeeze, new data shows

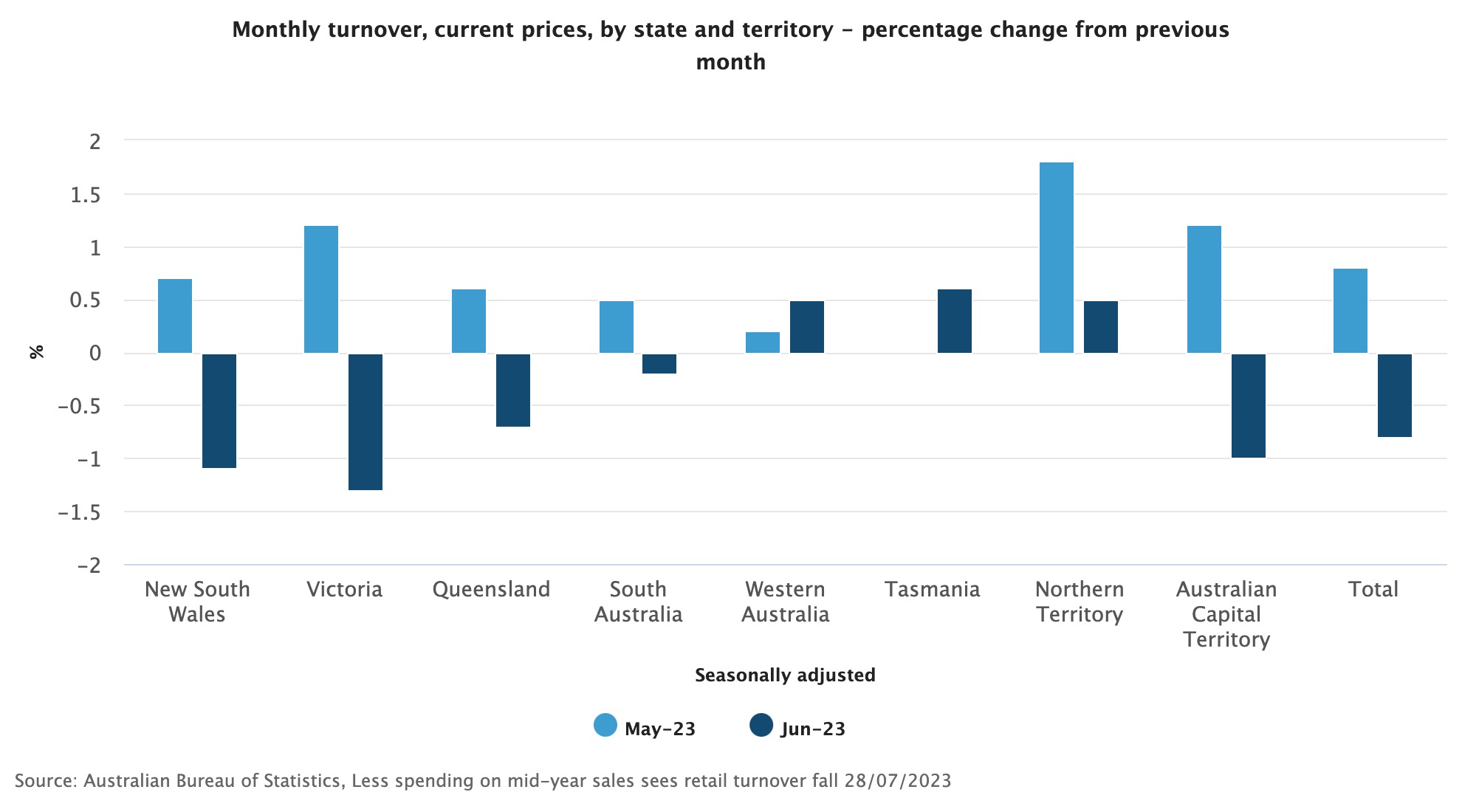

Retail spending fell at end-of-financial-year sales in June, as cost of living pressures continue to make an impact.

Data released today by the Australian Bureau of Statistics showed a drop of -0.8 percent in retail spending in June, with department stores bearing the brunt of the damage, with a fall of -5.0 percent. This was followed by other retailing (-2.2 percent) and clothing, footwear and personal accessory retailing (-2.2 percent).

In further signs of belt tightening in household budgets, spending at cafes, restaurants and takeaway services saw a marginal decrease of -0.3 percent.

The data follows on from results collated in May, where spending increased by 0.8 percent.

Head of ABS retail statistics Ben Dorber said the mixed results indicated that consumers were continuing to grapple with cost-of-living pressures.

“There was extra discounting and promotional activity in May, leading up to mid-year sales events,” he said. “This delivered a boost in turnover for retailers, but that proved to be temporary as consumers pulled back on spending in June.”

He noted that while eating out had become less frequent, food spending in general was consistent, if slightly altered.

“Over the last 12 months, growth in food-related spending has mostly been driven by rising food prices,” Mr Dorber said. “We saw in Wednesday’s release of the Consumer Price Index (CPI) that food prices rose again in the June quarter.

“Consumers are responding to these price rises by changing to cheaper brands or by simply buying less.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Compliance with these deadlines is crucial to avoid administrative penalties.

The UAE’s Federal Tax Authority (FTA) is urging Corporate Taxpayers to adhere to submission deadlines to avoid fines. Specifically, Resident Juridical Persons with licenses issued in May (regardless of the year) must submit their Corporate Tax registration applications by July 31, 2024, in line with Federal Tax Authority Decision No. 3 of 2024.

This decision aligns with the Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments, effective from March 1, 2024. The FTA stresses the importance of meeting these registration deadlines, which have been communicated through various media channels and direct outreach to registered company owners in the UAE.

Utilizing the EmaraTax Platform

Compliance with these deadlines is crucial to avoid administrative penalties. The deadlines apply to both juridical and natural persons, including Resident and Non-Resident Persons in the UAE. Detailed information on these deadlines and other relevant issuances can be found on the FTA’s official website.

According to the FTA’s Public Clarification, Resident Juridical Persons established or recognized before March 1, 2024, must submit their tax registration applications based on the month their license was issued. Those with expired licenses as of March 1, 2024, should submit their applications based on the original issuance month. For those holding multiple licenses, the earliest issuance date applies.

Administrative penalties for corporate tax violations have been in effect since August 1, 2023. To facilitate the registration process, taxpayers must use the “EmaraTax” digital platform, available 24/7, or seek assistance from accredited tax agents and government service centers.

The FTA has also emphasized the importance of providing accurate information and submitting updated supporting documents correctly with the electronic registration application, noting that registering for Corporate Tax for a juridical person requires uploading various documents, including the commercial license, the Emirates ID card, the passport of the authorized signatory, and proof of authorization for the authorized signatory.

A comprehensive video explaining the registration process through the “EmaraTax” platform is available on the FTA’s website. This platform, designed according to international best practices, aims to streamline the registration journey, submission of periodic returns, and payment of due taxes for all UAE taxpayers.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual