Europe’s Gas-Guzzling Days Are Fading

In a reality check for natural-gas producers, volatile prices are prompting European homes and factories to go green faster than expected

Last year’s hottest gas market has cooled, and some of the change will stick.

Demand for natural gas in Europe hasn’t bounced back despite lower prices. The region’s TTF benchmark price is down 85% compared with a year ago, when Europe was rushing to fill its gas-storage facilities for winter after Russia cut off supply.

Prices have fallen partly because Europe’s gas storage is already full. It hit a 90% capacity target last week, more than two months ahead of a schedule set last year by the European Union.

But underlying demand is also weak. According to think tank Bruegel’s European natural gas demand tracker, use of gas in the first quarter of this year was 18% lower than the 2019-2021 average, and 19% below in the second quarter. The declines have accelerated from the 12% fall recorded last year.

Weaker economic growth is one reason why gas use hasn’t recovered. Another may be that lower wholesale prices haven’t been passed on to end users yet, according to Ben McWilliams, author of the Bruegel tracker.

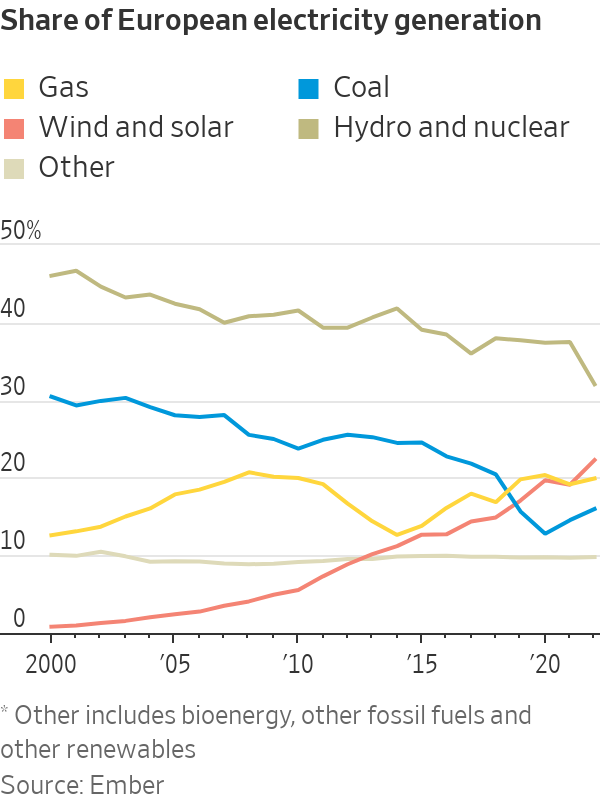

Other factors will be more permanent, notably new technologies. The European Heat Pump Association said sales of heat pumps rose 39% in 2022. They are now installed in 16% of Europe’s residential and commercial buildings, often replacing gas boilers. Heat pumps require electricity, which is often produced using gas, but this too is changing. Installations of new solar capacity rose a record 47% in 2022, and last year was the first time that renewable power generated more of Europe’s electricity than natural gas.

One uncertainty for future gas demand is whether European industries such as chemicals and fertiliser manufacturing will return to normal. The International Energy Agency thinks that up to half of the decline in Europe’s industrial gas demand last year was a result of production shutdowns. Certain companies whose business model traditionally relied on cheap Russian gas moved manufacturing to lower-cost regions such as the U.S., where gas costs roughly a quarter of the European spot price.

European gas prices will be volatile until more global liquefied natural gas supply arrives in 2025. The TTF jumped 5% on Monday because of worries about strikes at an Australian LNG terminal. Companies may be reluctant to restart their European factories until the region’s energy costs are more predictable.

Before the Ukraine war, global demand for natural gas was expected to increase 18% between 2021 and 2030, according to estimates from the Oxford Institute for Energy Studies. This forecast has since been cut to 10%. Lower growth expectations reflect the sharp cutbacks in Europe as well as the U.S. Inflation Reduction Act, which will supercharge America’s shift to renewable energy.

None of this is ideal for the U.S. LNG players who are currently pouring billions of dollars into new production. Based on projects that have already secured funding, and those in the pipeline, U.S. LNG export capacity could double by the end of this decade, according to Wood Mackenzie estimates.

True, Europe needs plenty of LNG over the next few years to replace the shortfall left by Russian pipeline gas. But the faster the region weans itself off gas, the sooner exporters will need to find a new home for at least some of their cargoes.

The expectation is that countries still using a lot of coal in power generation, such as India and Pakistan, will eventually switch to natural gas to cut their carbon emissions—assuming prices come down enough to make that transition affordable. “The window of opportunity for natural gas is tightening all around the world, although coal-reliant markets in Asia provide growth prospects over the medium-term,” says Gergely Molnar, energy analyst at IEA.

Buyers and sellers of natural gas took very different lessons from last year’s record prices, and the fuel’s reputation as a cheap, reliable form of energy took a hit. The pace of change in Europe’s gas market raises the risk of a glut.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

The G80 Sport makes its entrance, displaying dynamic design details and elevated automative capabilities.

Juma Al Majid LLC, the exclusive dealer for Genesis in the UAE, has launched the G80 – a cutting-edge luxury sedan. Merging tradition with innovation, this model embodies Genesis‘ relentless pursuit of superior design, state-of-the-art technology, and unmatched luxury.

The new G80 marks a significant milestone in introducing Korean automotive excellence to the UAE, highlighting the brand’s commitment to providing exceptional experiences.

Meticulously crafted, the redesigned G80 adheres to the ‘Athletic Elegance’ design philosophy synonymous with Genesis. This luxury vehicle features refined details and cutting-edge specifications, combining comfort and style to elevate every driving experience to new heights.

“The debut of the all-new G80 in the UAE market propels our vision to converge advanced technology and refined elegance”, stated Suliman Al Zaben, Director of Genesis, UAE. “This launch is a step forward for Genesis in the UAE market and strengthens our efforts to offer ultimate luxury, innovation, and unique design to our incisive customer base.”

With a new dual-mesh design, the G80’s exterior enhances the sophisticated appearance of the Two-Line Crest Grille, paired with iconic Two-Line headlamps featuring Micro Lens Array (MLA) technology. This highlights Genesis’ commitment to harmonizing advanced technology with elegant design. The five 20-inch double-spoke wheels exude a dynamic aesthetic, resembling sleek aircraft lines, complementing the car’s parabolic side profile. Rear diffusers conceal mufflers adorned with distinctive V-shaped chrome trim inspired by the Crest Grille, embodying an eco-conscious ethos in today’s technology-driven era.

The G80 reinforces Genesis’ design philosophy in its interiors, inspired by the uniquely Korean concept of the Beauty of White Space, integrated with state-of-the-art technology to create cosmetic brilliance for users. The 27-inch-wide OLED display seamlessly combines the cluster and AVN (Audio, Video, Navigation) screen in a horizontal layout, extending to the center fascia, showcasing its flair for innovative technology. The touch-based HVAC (Heating, Ventilation, and Air Conditioning) system offers ease of control, while the redesigned crystal-like Shift By Wire (SBW) ensures a comfortable grip, infusing a sense of luxurious convenience.

With its dual-layered Crest Grille and expanded air intakes, the G80 Sport package delivers a dynamic and sporty spirit. Exclusive interior options, such as a D-cut steering wheel and carbon accents, enhance its sporty allure. Equipped with Rear Wheel Steering (RWS) and Electronic Limited Slip Differential (E-LSD), the G80 Sport 3.5 twin turbo model is built for stable control during high-speed maneuvers.

Fitted with advanced safety and convenience features, this luxury sedan includes Remote Smart Parking Assist 2, Lane Following Assist 2, and a Fingerprint Authentication System. The three-zone HVAC system provides customized climate control for all passengers. With two powertrain options – a 2.5 turbo engine delivering 300 horsepower and 43.0 kgf·m of torque, and a 3.5 twin turbo engine producing 375 horsepower and 54.0 kgf·m of torque – superior driving dynamics ensure a silent and luxurious driving experience.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual