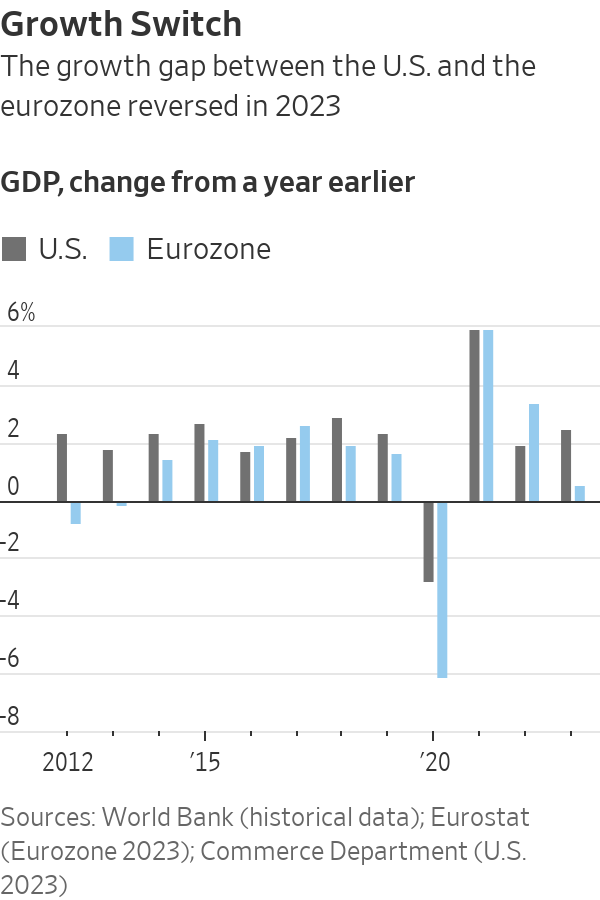

EUROPE’S STAGNATING ECONOMY FALLS FURTHER BEHIND THE U.S.

Thanks to robust growth and its relative insulation from geopolitical crisis, the U.S. economy has left Europe behind.

Europe’s economy stagnated in the final three months of last year, expanding a divide between a booming U.S. economy and a European continent that is increasingly left behind.

The fresh economic data showed higher borrowing costs had compounded the earlier impact of higher energy prices in the wake of Russia’s invasion of Ukraine.

By contrast, the U.S. economy has been expanding robustly and enjoyed its strongest performance relative to the eurozone since 2013—with the exception of the Covid-19 pandemic.

One factor that is threatening to weigh further on the European economy is its proximity to geopolitical flashpoints. Russia’s war on Ukraine sent energy prices rocketing in 2022, hitting European manufacturers. The U.S., as an energy producer, was comparatively unaffected, and its natural-gas industry even benefited when it became Europe’s energy supplier of last resort after Russia throttled gas deliveries to the region.

Now the crisis in the Middle East, which has gummed up cargo traffic through the Red Sea, is adding costs to European importers and disrupting European supply chains. There too, the U.S. hasn’t suffered as much since it has alternative routes for goods coming from Asia.

Europe’s Stoxx 600 index rose 12.64% last year, a little over half the performance of the S&P 500, which rose 24.23% over the same period.

The European Union’s statistics agency Tuesday said gross domestic product in the eurozone was unchanged in the final three months of last year. That followed a decline in the three months through September. During 2023 as a whole, Eurostat recorded growth of just 0.5%, while the U.S. economy expanded by 2.5%.

Still, the divergence between the giant economic blocs is more a story of surprising U.S. strength than unanticipated weakness in the eurozone. The U.S. grew much faster than economists had expected it would at the start of 2023, while the eurozone was about as badly hit by high energy prices and rising interest rates as had been expected. Economists forecast the growth gap will narrow somewhat in the course of the year.

Europe’s policymakers don’t expect the stagnation in output to extend deep into 2024. Instead, they see a pickup in activity as wages rise faster than prices, reversing the declines in real incomes that followed the war in Ukraine and a rise in energy and food bills.

“We have the conditions for recovery that are coming into place,” said European Central Bank President Christine Lagarde Thursday. “I’m not suggesting that it’s going to pick up radically, but it’s coming into place from what we see.”

Helping Europe is the fact that energy prices are falling from post-invasion highs faster than policymakers had expected. That should help boost household spending on other goods and services and lower costs for Europe’s hard-pressed factories.

With inflation easing, the ECB is expected to lower its key interest rate later this year, which would also jolt growth by easing the pressure on household spending and business investment.

Yet the eurozone faces fresh threats too, mainly from the conflict that began with the attack on Israel by Hamas on Oct. 7. Disruptions to shipping in the Red Sea have pushed freight costs sharply higher and led to delays for European manufacturers that rely on Asian suppliers for parts. A further escalation of the conflict could reverse the decline in energy costs and stall the anticipated recovery.

The International Monetary Fund now expects the eurozone to grow by 0.9% this year, a downgrade from its previous 1.2% growth estimate, according to the Fund’s quarterly World Economic Outlook report published on Tuesday. By contrast, it sees the U.S. growing by 2.1% against its earlier 1.5% forecast.

Strong U.S. growth and an estimated 4.6% increase in China’s GDP according to the IMF should more than offset Europe’s disappointing performance and translate into a soft landing for the world economy this year. The IMF now sees the world economy growing at 3.1% this year, the same rate as last year and faster than the 2.9% growth projected in October.

“We find that the global economy continues to display remarkable resilience,” Pierre-Olivier Gourinchas, IMF Chief Economist, told reporters, pointing to the speed at which inflation had receded as a positive surprise.

He warned, however, that geopolitical distortions could reignite price increases. Core inflation—which excludes volatile energy and food prices—isn’t quite back to the pre pandemic trend, particularly for services sector prices, he said.

IMF economists also cautioned that financial markets have been overly optimistic in anticipating early rate cuts by central banks. They project policy interest rates to remain at current levels for the U.S. Federal Reserve, the European Central Bank, and the Bank of England until the second half of 2024, before gradually declining as inflation moves closer to targets. Some investors and analysts expect a Federal Reserve rate cut in the first half of this year.

Back in Europe, Tuesday’s GDP data showed Germany was the weakest of Europe’s large economies at the end of last year, with output falling in the final quarter. However, revised figures showed it avoided a contraction in the three months through September.

“The economy remains stuck in the twilight zone between recession and stagnation,” said Carsten Brzeski, an economist at ING Bank.

While Italy’s economy expanded slightly, the French economy flatlined for the second straight quarter. Ireland, which had been a major source of growth for the eurozone over the previous decade, saw its GDP fall by 1.9% in 2023 as a pandemic-driven boom in its key pharmaceutical industry ended.

In a rare bright spot, Spain finished the year with another strong quarter and matched the U.S. growth rate over 2023 as a whole, thanks to a surge in international tourism as the last of the Covid-19 restrictions were lifted.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Saudi Arabia ranked first among countries for the non-oil exports of national origin with BD201 million (22%)

Bahrain’s non-oil exports of national origin decreased by 6% to BD894 million ($2.37 billion) in Q2 2024 compared to the same period in 2023. The top 10 countries accounted for 64% of the total export value.

According to the Information & eGovernment Authority (iGA) in its Q2 2024 Foreign Trade report, Saudi Arabia was the leading destination for these exports, totaling BD201 million (22%). The US followed with BD75 million (8.4%), and the UAE with BD73 million (8.2%).

Unwrought aluminum alloys were the top exported product in Q2 2024, amounting to BD267 million (30%), followed by agglomerated iron ores and concentrates alloyed at BD159 million (18%) and non-alloyed aluminum wire at BD49 million (5%).

Non-oil re-exports

Non-oil re-exports increased by 4% to reach BD206 million during Q2 2024, compared to BD198 million for same quarter in 2023. The top 10 countries accounted for 86% of the re-exported value. The UAE ranked first with BD58 million (28%) followed by Saudi Arabia with BD39 million (19%) and UK with BD17 million (8%).

As per the report, turbo-jets worth BD65 million (32%) were the top product re-exported from Bahrain, followed by private cars with BD11 million (5%) and four-wheel drive with BD9 million (4%).

The value of non-oil imports has decreased by 4% reaching to BD1.41 billion in Q2 2024 in comparison with BD1.47 billion for same quarter in 2023. The top 10 countries for imports recorded 68% of the total value of imports.

China Bahrain’s biggest importer

China ranked first for imports to Bahrain, with a total of BD191 million (14%), followed by Brazil with BD157 million (11%) and Australia with BD112 million (8%).

Non-agglomerated iron ores and concentrates were the top product imported to Bahrain worth BD200 million (14%), followed by other aluminum oxide with BD101 million (7%) and parts for aircraft engines with BD41 million (3%).

As for the trade balance, which represents the difference between exports and imports, the deficit logged was BD310 million in Q2 2024 compared to BD322 million in Q2 2023.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual