The UAE and Kuwait: A journey of financial and economic integration between two brotherly countries

Agreements that elevate relations to new heights

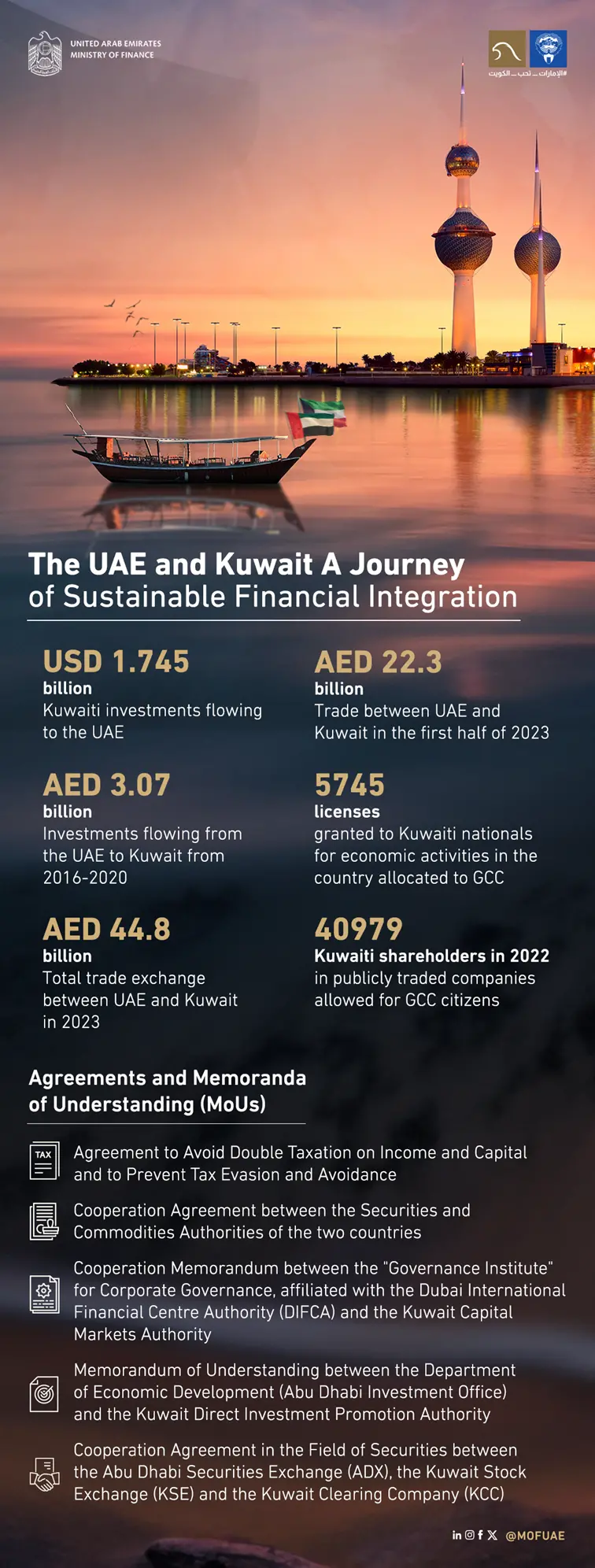

The relationship between the United Arab Emirates and Kuwait is an exceptional example of two countries eager to enhance cooperation across various fields, including the financial sector. They are bound by several agreements and Memoranda of Understanding (MoUs) that contribute to increasing the volume of investments and trade exchange to higher levels. The latest of these agreements was signed by the finance ministries of both countries during the World Governments Summit 2024. The agreements cover the avoidance of double taxation on income and capital and the prevention of tax evasion and avoidance, which are part of the journey towards economic and financial integration and the free movement of capital between the two countries.

Among the most prominent MoUs in the financial field is the cooperation agreement between the Securities and Commodities Authority of the two countries. Additionally, a tripartite cooperation agreement in the field of securities was signed in February 2022 between the Abu Dhabi Securities Exchange (ADX), the Kuwait Stock Exchange (KSE), and the Kuwait Clearing Company (KCC). Statistics from the UAE’s Securities and Commodities Authority indicate that the total number of Kuwaiti shareholders in publicly traded companies allowed for GCC citizens increased from 3 individuals in 2000 to 40,979 individuals in 2022. Furthermore, data compiled by the Federal Competitiveness and Statistics Center show that the cumulative number of licenses granted to Kuwaiti nationals amounted to 5,745 licenses in 2022 out of 30,508 licenses for economic activities in the country allocated to GCC citizens, with an increase of 302 licenses in the year 2021-2022.

In line with both countries’ efforts to promote innovation as a work approach, the UAE Ministry of Finance signed a memorandum of understanding in April 2017 with the Sabah Al-Ahmad Center for Giftedness and Creativity, located in Kuwait, to enhance cooperation with the Ministry. The aim is to establish an environment conducive to innovation in various fields and enable employees to practice and use innovative methods in institutional work through developing projects and achieving economic partnerships with relevant entities in the field of innovation at local and international levels.

To enhance effective corporate governance practices for listed companies in Kuwait and raise awareness of their importance among these companies and all state institutions, the “Governance Institute” for Corporate Governance, affiliated with the Dubai International Financial Centre Authority (DIFCA) and the Kuwait Capital Markets Authority signed a cooperation memorandum in October 2019. An MoU was signed in September 2021 to stimulate investment and enhance cooperation between the Kuwait Direct Investment Promotion Authority, the Abu Dhabi Department of Economic Development (ADDED) and the Abu Dhabi Investment Office (ADIO), which also signed an agreement in February 2022 with the COFE App to benefit from the Abu Dhabi Investment Office’s innovation program and establish a headquarters for the COFE App in Abu Dhabi city.

Since the signing of the agreement to establish the “Joint Committee” for bilateral cooperation in 2006 in Kuwait City, the two countries have taken steps that have contributed to strengthening bilateral relations between the UAE and Kuwait and propelling them towards broader horizons of cooperation and coordination. According to the UAE embassy in Kuwait, the investments flowing from the UAE to Kuwait amounted to about $837.8 million (3.07 billion dirhams) during the period from 2016-2020, while the value of Kuwaiti investments flowing to the UAE reached $1.745 billion (6.4 billion dirhams). Financial and insurance activities are the most significant sectors of Kuwaiti investment in the UAE, whereas the financial and banking sector is one of the most important sectors of UAE investment in Kuwait. The UAE also hosts two branches of Kuwaiti commercial banks out of seven Gulf banks permitted to operate in the UAE.

The trade between the UAE and Kuwait in the first half of 2023 reached 22.3 billion dirhams, while statistics compiled by the Federal Authority for Identity, Citizenship, Customs, and Port Security indicate that the total trade exchange between the UAE and Kuwait amounted to 44.8 billion dirhams during 2023, and 44.1 billion dirhams during 2022, a growth of 15% compared to 2021.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Total income was higher by 10% year-on-year (YoY) at AED 300 million in the six-month period

United Arab Bank PJSC (UAB or “the Bank”) has announced its financial results for the six months ended 30th June 2024. UAB reported a net profit before tax of AED 152 million for H1 2024, a 26% increase compared to AED 121 million for H1 2023. The net profit after tax for H1 2024 stood at AED 139 million, up 15% from AED 121 million in the same period last year. Earnings per share rose to AED 0.07 in H1 2024 from AED 0.06 in H1 2023.

Total income increased by 10% year-on-year to AED 300 million for H1 2024, compared to AED 273 million for H1 2023, driven by a 26% increase in net interest income. The Bank’s capital position remains strong with a CET1 ratio of 13% and a total capital adequacy ratio (CAR) of 18%.

UAB‘s liquidity profile is robust, with advances to stable resources ratio of 75% and an eligible liquid asset ratio of 19%, both comfortably above regulatory thresholds. The Bank’s credit ratings were affirmed by Fitch and Moody’s at BBB+/Ba1, with stable and positive outlooks respectively.

UAB’s performance in the first half of 2024 demonstrates significant growth in total assets, increasing by 12% compared to December 2023, and reflects a strategic focus on quality and farsighted risk management. These results indicate that the Bank is well-positioned to continue its growth trajectory.

Commenting on the Bank’s performance, H.H. Sheikh Mohammed bin Faisal bin Sultan Al Qassimi, Chairman of the Board of Directors of United Arab Bank, said: “UAB’s strong performance in the first half of 2024 reflects the successful implementation of our growth strategy and reinforces our commitment to delivering sustainable value to our shareholders. We are confident that our prudent business model shall continue to deliver a solid performance and deal with the opportunities and challenges that will present themselves.”

He added: “As we move ahead into the second half of the year, we remain committed to enhancing our customers’ banking experience and contributing to the growth and prosperity of the UAE’s economy.

Shirish Bhide, Chief Executive Officer of United Arab Bank, commented: Our customer-centric approach and sustainable growth model has led to a 15% increase in net profit and a 12% growth in total assets. Our positive performance is a testament to the successful execution of our strategic priorities and clear evidence of the success of the many initiatives that have been implemented at the Bank. Going forward, we will continue investing in our growth strategy and digital capabilities, while equally focusing on developing innovative products and services that meet our customers aspirations whilst upholding the highest standards of compliance and internal controls.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual