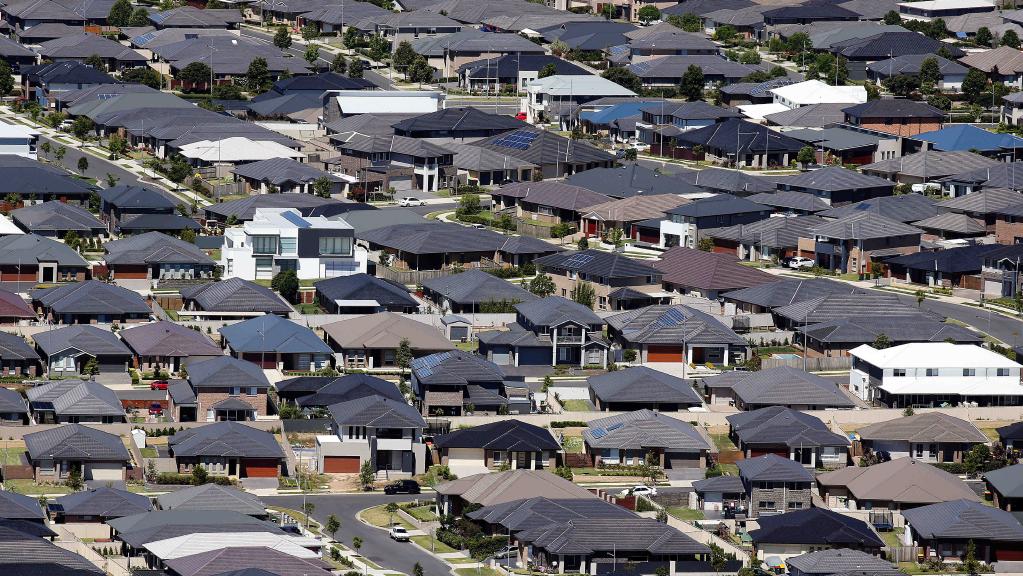

Fewer properties but consistent clearance rates point to a busy weekend

There’s plenty of activity for motivated buyers on the Australian east coast

The number of auctions scheduled across Australia has fallen week-on-week, new figures show.

Data from CoreLogic shows that the number of properties across the combined capitals is down -7.7 percent for the first weekend in August, with a total of 1,821 expected to go under the hammer. However, figures are still a significant improvement on last year, up 23.8 percent on the same week in 2022 when 1,471 auctions took place and the clearance rate was just 56.6 percent.

Melbourne has experienced the biggest fall, with a -9.0 percent decrease on last week. However, the eastern capital will still see the most properties go to market, with 792 homes scheduled compared with 748 homes in Sydney. The difference is that Sydney figures have remained steady, with just one less home up for sale this week compared with the previous week. Auction figures in both cities are considerably higher than this time last year with data showing an increase of more than 25 percent.

In the smaller capitals, it’s a mixed bag. Brisbane is experiencing its quietest week since Easter with 86 homes scheduled, a significant drop from the previous week when 173 homes went to auction while Adelaide has 105 homes set to go to market (nine less than last week). However, the nation’s capital is set for a busy weekend, with 81 homes scheduled in Canberra – the highest number of homes in nine weeks.

Figures in Perth are typically lower, with just seven auctions scheduled. It’s a similar story in tightly held Tasmania, with just two properties going to market this weekend.

Clearance rates from last week continue to show a steady winter auction market, the 64.9 percent of properties put to market resulting in a sale. This time last year, the clearance rate was just 54 percent.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Villa prices saw particularly strong growth, with capital values increasing by 33.4 percent year-on-year

Dubai’s real estate market showed strong performance in the second quarter of 2024, with notable increases across the residential, office, and retail sectors, according to a new ValuStrat real estate report for Q2 2024.

Villa prices experienced particularly strong growth, with capital values rising by 33.4 percent year-on-year.

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat said: “The Dubai real estate market has shown impressive growth and resilience in recent months. The ValuStrat Price Index for Residential Capital Values increased by 6.4 percent quarterly and 28.2 percent annually, reaching 178.2 points.

“Despite severe flooding caused by record rainfalls in April, the quick and effective response from developers and authorities helped to control the damage, ensuring that market activity and property valuations remained robust in the subsequent months.”

The office sector also performed well, with the VPI for office capital values surging by 31.7 percent annually and 9.4 percent quarterly, reaching 212.5 points—the highest quarterly increase in a decade.

In the retail sector, Emaar Properties reported 98 percent occupancy in their prime mall assets, while overall mall occupancy stood at 96 percent during the first quarter of 2024. The hospitality sector also saw growth, with total international guests reaching 8.12 million as of May 2024, a 9.9 percent increase compared to the same period last year. Hotel occupancy reached 81 percent, rising by 1.4 percent year-on-year.

Despite these positive indicators, Tuaima added, “The decline in transaction volumes calls for a closer examination of market dynamics as stakeholders navigate this evolving landscape.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual