Is Germany’s Economic Model Truly Kaputt?

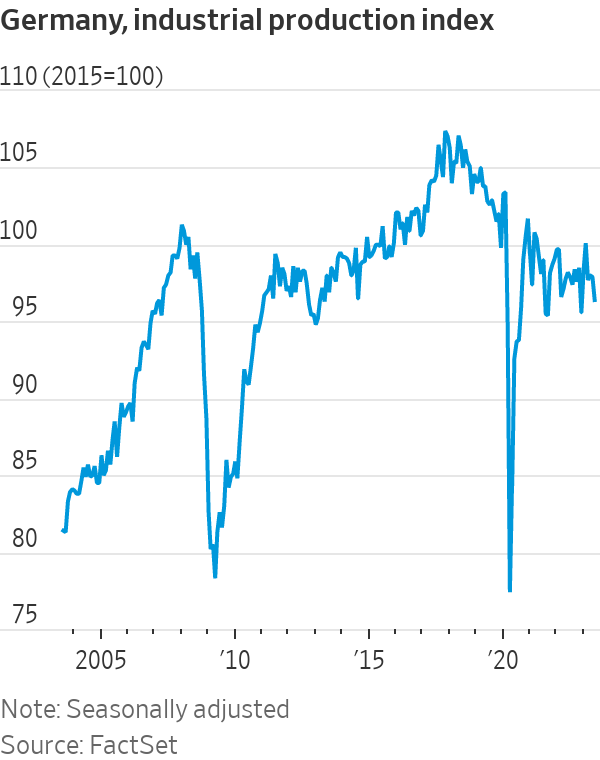

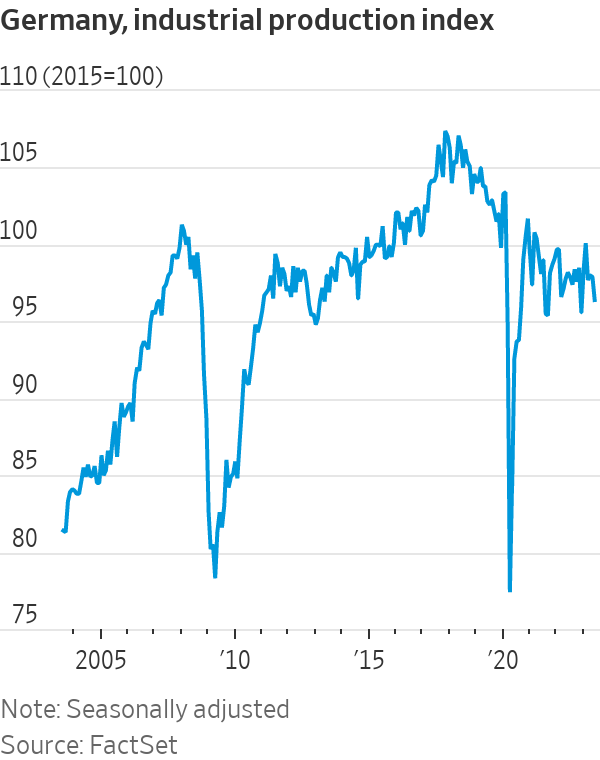

More than two decades after Germany was famously called “the sick man of the euro” by The Economist magazine, investors must wonder if the country’s industrial heart is once again critically weak. This week brought more dismal German economic data: Industrial production fell 1.5% in June from the previous month, worse than analysts expected. Though figures released on Friday showed a rise in exports, the volume of goods Germany sends abroad is still close to lows plumbed in the 2009 global financial crisis.

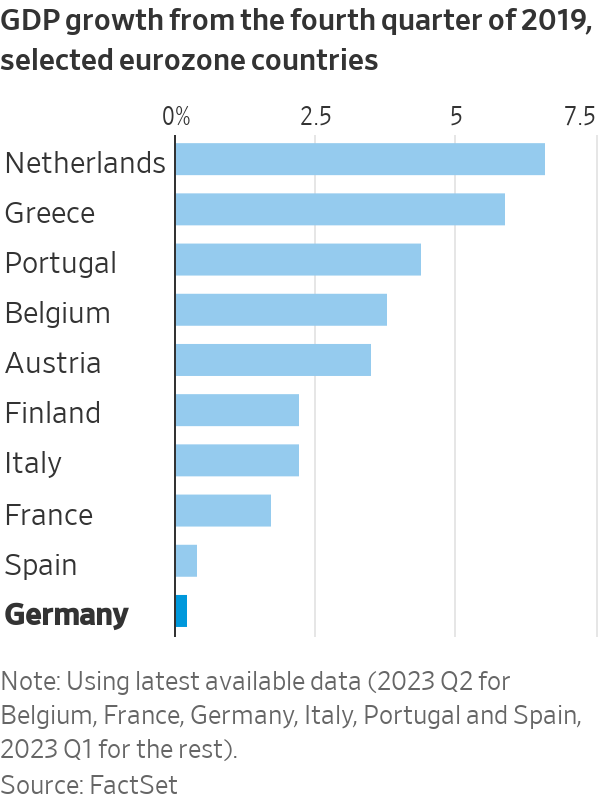

German gross domestic product has clocked three quarters of negative or zero growth , making the country the worst performer among major eurozone nations since 2019. Previously it was the top performer. How long this “slowcession” lasts is a crucial question for picking stocks in Europe. Despite the recent economic reversal, the DAX has been by far the best equity index in the eurozone over 20 years, returning almost 360%.

By comparison, investing in long-stagnant Italy yielded a paltry 140% return. German industrial output has been in decline since 2018, when global vehicle sales fell for the first time in almost a decade. A postpandemic rebalancing of spending toward services has made the situation worse. Growth in China, the fourth-largest market for German exporters, has slowed.

On Thursday, shares in Siemens —the largest industrial firm in Europe—fell 5% after it cited these two factors as the cause of a fall in orders during the second quarter. Some of the grit that has gotten into the German economic machine might be hard to dislodge . Chinese carmakers have turned from partners into fierce competitors as Volkswagen , BMW and Mercedes-Benz play catch-up in electric-vehicle technology.

It isn’t just China that is seeking to substitute imports for domestic products; the Biden administration is copying Beijing’s playbook. There is also energy. At the same time as German industry has lost Russia as its main source of cheap gas, Berlin has closed the country’s last three nuclear power plants. Angst has gripped German officials and executives in an echo of worries voiced at the start of the millennium, when unemployment surged and globalisation ravaged factories.

Back then, the response was a policy package that prioritised international competitiveness, incentivising the creation of low-pay “minijobs.” The government embraced fiscal austerity and nudged unions to push for wage restraint. The result was a 20-year decline in unemployment and a current-account surplus that reached an eye-watering 8% of GDP even as the U.S. ran huge deficits. Many economists praised German labor flexibility and fiscal austerity.

Conversely, critics pointed out that surpluses made most households worse off, and that Germany’s factory-job losses were just as large as America’s. Politics aside, it was largely a fortuitous jump in foreign demand that drove growth, allowing the nation to solidify gains in industries where it already had an advantage.

“Over the last 20 years, Germany always had an external sugar daddy: China, the eurozone and then the U.S.,” said Carsten Brzeski , chief economist at ING.

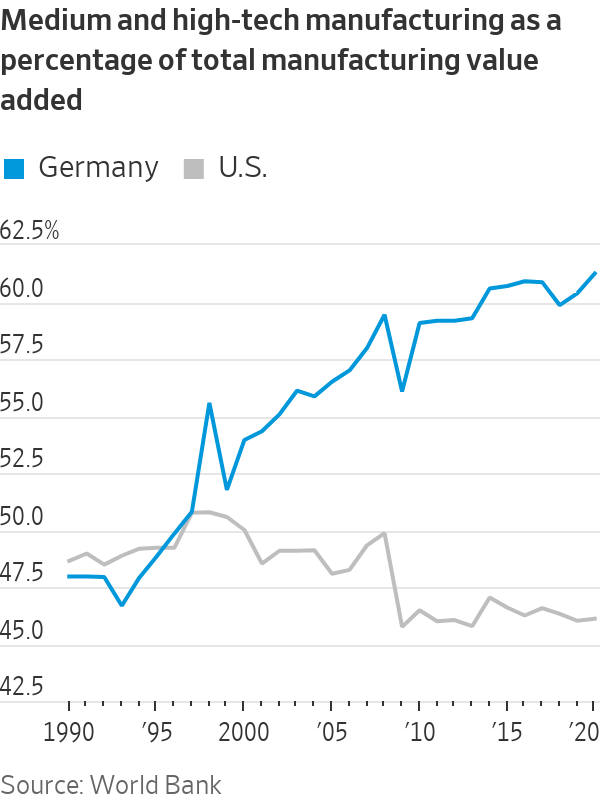

The flaw in this model was that it outsourced economic policy, leading to problematic dependencies on geopolitical rivals. It also fostered an excessive focus on old winners at the expense of new digital technologies and renewable energy. Bearish investors are right that it will take years to rectify these problems, particularly given the complexity of consensus-based German politics. Yet the German export-led model also got a lot right. As in China or South Korea, it channeled demand toward higher-productivity, higher-wage firms.

Unlike in the U.S., German manufacturing became more complex. That allowed the country’s industrial base to survive better than in other Western countries. In a world where nations are scrambling to reshore industries, Germany already has them. The readiest answer to its growth challenge isn’t to turn away from manufacturing but to double down by taking a page from Chinese and now U.S. industrial policy.

The German government is already doing this with semiconductors as part of the European Chips Act. Back in June, it signed off on 10 billion euros (around $11 billion) in subsidies for American chip maker Intel to build two plants, and earlier this week it committed €5 billion to help Taiwan’s TSMC set up a factory with local partners like Infineon.

A similar approach is needed to upgrade the country’s power generation and transmission and accelerate the transformation of carmakers and other industrial incumbents. Long-term energy guarantees could stem cost swings in the meantime. Given its political influence over the European Union, it seems hard to imagine that the bloc’s green-economy push could somehow leave Germany in a less dominant position . Historically, this is one patient that always leaves the hospital.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Highlighting a significant recovery and robust growth across all key performance metrics.

Bank of Sharjah has released its results for the period ending 30 June 2024, showcasing robust performance and strong momentum since the beginning of the year. The Bank reported a net profit of AED 171 million, a significant turnaround from the AED 144 million loss in the same period last year.

This remarkable improvement is attributed to a substantial increase in net interest income, stringent credit underwriting, and reduced operating costs, marking a 233% increase over the previous year when excluding the one-time impairment charge from de-linking its Lebanese subsidiary.

The Bank’s exceptional financial results highlight the effectiveness of its strategic focus on sustainable growth, with notable improvements across all major performance metrics. Funded and unfunded income both saw increases, with net interest income rising by 108% and operating income growing by 34%.

Additionally, the cost-to-income ratio improved significantly to 40.1% due to cost discipline measures. The balance sheet remains strong with a loans-to-deposits ratio of 86.63%, indicating comfortable liquidity. The Bank also maintains strong capitalization, with a regulatory capital adequacy ratio exceeding 15% and Tier 1 and CET1 capital ratios around 14%. These positive results underscore the Bank’s underlying strength, operational efficiency, prudent risk management, and ongoing enhancement of shareholder value.

Commenting on the Bank’s results, Sheikh Mohammed bin Saud Al Qasimi, Chairman of Bank of Sharjah, stated: “We are pleased with our outstanding performance in the first half of 2024, which reflects our commitment to adding value to our customers, supporting our communities, and rewarding our shareholders. Despite the challenging geopolitical situation in the region, the UAE economy has remained resilient and continues to register healthy growth following various economic diversification initiatives that provide consistent impetus for trade, investment, and wealth creation. Bank of Sharjah has entered a new chapter with a new leadership team, focused on building new business streams, expanding our reach across the UAE and the region, and delivering exceptional service to our customers.”

He added: “Our performance in the first half of the year demonstrates the effectiveness of our new strategy, and we look forward to delivering continued growth in the years to come.”

The CEO, Mr. Mohamed Khadiri, commented “2024 has begun exceptionally well for Bank of Sharjah, with the bank achieving a record year-on-year profit. I am delighted with our stellar performance as we continue to strengthen the bank’s fundamentals. Our outstanding results reaffirm that our new business strategy is on track to deliver sustainable revenue growth, driven by business expansion, operational efficiency, prudent risk management, and talent development. This achievement is also a testament to the Bank’s success in providing high-quality financial services that meet the aspirations and growing needs of our customers.”

He further added: “Bank of Sharjah is a strong and respected brand within the local community. We are leveraging our core strengths to build a platform that will operate at its full potential across the UAE and the region. The Bank remains focused on executing our strategy and is well-positioned to maintain strong performance throughout 2024 and beyond.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual