NOT EVEN MOLTEN LAVA CAN COOL THIS HOT HOUSING MARKET

The eastern section of Hawaii’s Big Island continues to attract home buyers searching for a cheap piece of paradise

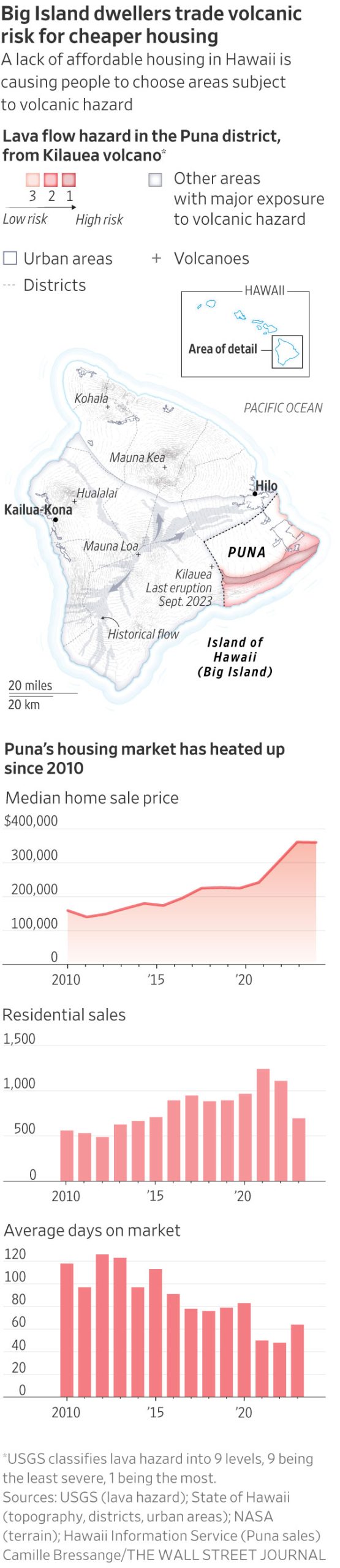

PUNA, Hawaii—In 2018, a large volcanic eruption spewed lava, rock and ash into the middle of a subdivision here, gobbling up more than 700 homes and displacing thousands of residents in a slow-motion disaster. Today, it is Hawaii’s fastest-growing region.

Land in an active lava zone, it turns out, is relatively cheap. Lured by a shot at attainable homeownership in paradise, island dwellers and mainland transplants alike have been flocking to this area in the shadow of Kilauea, driving up prices in the Puna District. Still, the area remains one of the last affordable refuges on the cheapest island in Hawaii, America’s most expensive state.

“In terms of the last bastion of affordability, Puna is it,” said Jared C. Gates, a Realtor who was raised on Oahu and came to the Big Island for college in the 1990s. He purchased his first home in 2005, a modest fixer-upper in Puna, on his salary as a waiter.

Over the past few years, he has been getting more business in Leilani Estates, the neighborhood where the 2018 eruption began.

None of the homes that were inundated by lava have been rebuilt. Many homeowners have sold their properties to Neighbours or the county in a federally funded buyback program, but that land remains vacant for now. The land has been so transformed that it is hard for remaining owners to know even where their property begins and ends.

“It took out roughly a third of the subdivision; totally surreal,” Gates said last fall. “And houses are selling there again.”

Among Gates’s listings that day was a three-bedroom, two-bath home with lush landscaping, two blocks from the mile-wide lava field where heat and steam still radiate from vents in the petrified landscape. “It’s a beaut,” he said. “It will sell.”

Three weeks later it did, for $325,000, cash.

The story of how serene-looking slices of suburbia came to inhabit an active volcanic rift zone is well-known here. In the 1960s, land speculators—aided by a new county government hungry for tax revenue—bought thousands of acres and carved it into lots of an acre or more that were snapped up by investors.

There were virtually no requirements that developers pave roads, place utility lines or build other essential infrastructure. To this day, there is no wastewater treatment plant or hospital. Many of the district’s 51,000 residents rely on filtered rainwater and cesspools to dispose of sewage.

Early buyers included Native Hawaiians looking for an affordable place to call home and mainland hippies intent on off-grid living. As home prices rose in Hawaii and across the nation, however, more working families and mainland retirees went hunting for deals on the Big Island.

County Councilwoman Ashley Kierkiewicz, who represents Puna, said rush-hour traffic on the rural, two-lane highway that connects Puna to Hilo, the county seat roughly 20 miles away, is so bad that she leaves her home 1.5 hours early to get to work.

County officials say rules tied to federal funding bar local government from building affordable housing in lava zones 1 and 2, which are the riskiest and make up most of lower Puna. State law also prohibits them from spending most local money on private subdivisions, meaning that roads are largely maintained by owner associations.

Hawaii County Mayor Mitch Roth said that while the county has added a new firehouse, police station and park facilities there in recent years, the county has limited funds to make major investments in high-risk areas.

“Are we going to invest public money in a high-risk place…knowing that whatever you build could be taken out by lava at any time?” said Roth.

The lack of some modern conveniences has scarcely slowed the flow of newcomers.

Like many places in the U.S., an influx of remote workers during the pandemic has helped send the housing market here into overdrive.

Among the recent arrivals are David Booth and his partner, Juan Polanco. The former Phoenix residents had been brainstorming tropical locations where they could slash their living expenses and ease into retirement.

“The attraction to the Big Island was affordability,” said Booth, 61, who now works remotely. He and Polanco, 59, paid cash for a 1,500-square-foot home that had been split into three units with separate entrances. “You can’t have this on any other island for this price point.”

The property sits on a 1-acre lot in Hawaiian Paradise Park, a subdivision located in the less-risky lava zone 3. Homes with repeated sales in the neighborhood have seen a nearly 800% appreciation in price since 2000, according to data from the University of Hawaii Economic Research Organization.

Properties in lava zones 1 and 2—some with sweeping oceanfront views—were far cheaper, Booth said. In the end, the risk of losing their nest egg to a natural disaster, and the difference in insurance rates, were deal breakers.

They are getting used to bringing in their drinking water and dealing with vicious fire ants. The slow-paced lifestyle and prospect of early retirement are worth it, he said.

They have listed the two other units as vacation rentals, and their first guests arrive next week.

“We are overwhelmed with the amount of beauty here and just how much more relaxed we feel,” said Booth. “We’re building a whole new life here.”

Three years ago, Travis Edwards, 48, was driving delivery trucks and living with his mother in Southern California’s Inland Empire.

He was sick of the traffic, wildfires and car thefts, he said. Upon retiring, his mother sold her house and paid cash for a 1-acre lot with two units in Leilani Estates, surrounded by avocado and citrus trees. Lava insurance rates in lava zone 1, the riskiest area that encompasses the entire subdivision, were so high that they simply stopped paying for it, he said.

He mostly shrugs off the dangers, reasoning that they would be reckoning with fires and earthquakes on top of a lower quality of life back in Southern California.

“It’s just paradise,” said Edwards, who now drives limousines part-time. “The rest of the world doesn’t exist when you’re here.”

Rising prices on the east side have left Puna native Chantel Takabayashi feeling stuck. A single mother of three, she works 16 hours a day as a state prison guard in Hilo. She would like to buy a home closer to work and better schools but has been priced out of most neighborhoods she has considered.

“I make pretty decent money and I work long, endless hours, and I still can’t afford better housing,” she said.

Liz Fusco, who manages more than 100 rental properties for Hilo Bay Realty in Pahoa, said that during the pandemic, she saw three-bedroom homes in parts of Puna that once fetched $1,500 a month rent for as much as $2,300.

Most of the applicants were mainlanders, she said, with stellar rental histories, plenty of income and pristine credit. Units that would typically take more than a month to rent were getting leased in three days.

Tina Garber, who has lived in the Puna area for 21 years, has been displaced twice in the past 18 months after the homes she was renting went up for sale.

Currently, she is paying $750 a month—three-quarters of her monthly income as a housecleaner—for a 400-square-foot studio surrounded on three sides by cooled lava. Her landlord just told her it will be listed for sale in April.

“People that come over here with money, they do not realize that it is so hard to make it here,” Garber said. “They think, ‘Oh, a good deal in Hawaii.’ But it puts a lot of pain and suffering on local folks.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

The G80 Sport makes its entrance, displaying dynamic design details and elevated automative capabilities.

Juma Al Majid LLC, the exclusive dealer for Genesis in the UAE, has launched the G80 – a cutting-edge luxury sedan. Merging tradition with innovation, this model embodies Genesis‘ relentless pursuit of superior design, state-of-the-art technology, and unmatched luxury.

The new G80 marks a significant milestone in introducing Korean automotive excellence to the UAE, highlighting the brand’s commitment to providing exceptional experiences.

Meticulously crafted, the redesigned G80 adheres to the ‘Athletic Elegance’ design philosophy synonymous with Genesis. This luxury vehicle features refined details and cutting-edge specifications, combining comfort and style to elevate every driving experience to new heights.

“The debut of the all-new G80 in the UAE market propels our vision to converge advanced technology and refined elegance”, stated Suliman Al Zaben, Director of Genesis, UAE. “This launch is a step forward for Genesis in the UAE market and strengthens our efforts to offer ultimate luxury, innovation, and unique design to our incisive customer base.”

With a new dual-mesh design, the G80’s exterior enhances the sophisticated appearance of the Two-Line Crest Grille, paired with iconic Two-Line headlamps featuring Micro Lens Array (MLA) technology. This highlights Genesis’ commitment to harmonizing advanced technology with elegant design. The five 20-inch double-spoke wheels exude a dynamic aesthetic, resembling sleek aircraft lines, complementing the car’s parabolic side profile. Rear diffusers conceal mufflers adorned with distinctive V-shaped chrome trim inspired by the Crest Grille, embodying an eco-conscious ethos in today’s technology-driven era.

The G80 reinforces Genesis’ design philosophy in its interiors, inspired by the uniquely Korean concept of the Beauty of White Space, integrated with state-of-the-art technology to create cosmetic brilliance for users. The 27-inch-wide OLED display seamlessly combines the cluster and AVN (Audio, Video, Navigation) screen in a horizontal layout, extending to the center fascia, showcasing its flair for innovative technology. The touch-based HVAC (Heating, Ventilation, and Air Conditioning) system offers ease of control, while the redesigned crystal-like Shift By Wire (SBW) ensures a comfortable grip, infusing a sense of luxurious convenience.

With its dual-layered Crest Grille and expanded air intakes, the G80 Sport package delivers a dynamic and sporty spirit. Exclusive interior options, such as a D-cut steering wheel and carbon accents, enhance its sporty allure. Equipped with Rear Wheel Steering (RWS) and Electronic Limited Slip Differential (E-LSD), the G80 Sport 3.5 twin turbo model is built for stable control during high-speed maneuvers.

Fitted with advanced safety and convenience features, this luxury sedan includes Remote Smart Parking Assist 2, Lane Following Assist 2, and a Fingerprint Authentication System. The three-zone HVAC system provides customized climate control for all passengers. With two powertrain options – a 2.5 turbo engine delivering 300 horsepower and 43.0 kgf·m of torque, and a 3.5 twin turbo engine producing 375 horsepower and 54.0 kgf·m of torque – superior driving dynamics ensure a silent and luxurious driving experience.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual