Riyadh Office Supply Shortage Drives 26% Rent Increase for Grade B Spaces in One Year

The shortage of office supplies in Riyadh has caused a significant 26% increase in Grade B rents over the past year.

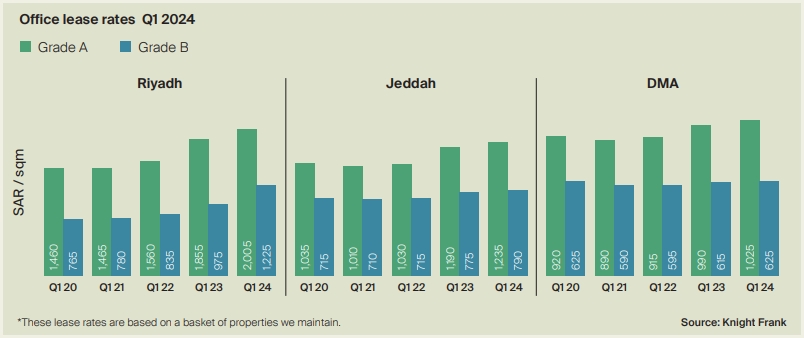

The persistent economic growth, fueled by initiatives related to Vision 2030, is driving the demand for office spaces throughout Saudi Arabia, leading to a rise in Grade A rents by 8% in Riyadh, 3.8% in Jeddah, and 3.5% in the Dammam Metropolitan Area (DMA), according to Knight Frank’s Summer 2024 Saudi Arabia Commercial Market Review.

Faisal Durrani, partner and Head of Research at Knight Frank MENA, stated, “The commercial office market has been one of the biggest beneficiaries of Vision 2030, with occupier demand rising nationally. What is extraordinary about the market dynamics is the sheer shortage of prime office options, with vacancy rates as high as 98% in Riyadh. The shortage of options has left some businesses with little choice but to settle for less-than-ideal space, as is reflected in the rapid increase in Riyadh’s grade B rents which are up a staggering 26% when compared to this time last year. In Jeddah too, a similar story is playing out, with grade A rents up 3.8% since Q1 2023, driven predominantly by public sector demand.

“On the global stage, many cities in the Gulf, including Riyadh, Jeddah, Dubai and Abu Dhabi stand out for the near-record low levels of prime office vacancy, which stands in contrast to many other global gateway locations.”

Over the past year, the DMA’s office market saw growth due to increasing demand, with Grade A rents rising to SAR 1,025 per square meter. Grade B rents also saw a modest increase of 1.6%, reaching SAR 625 per square meter. Occupancy rates in Grade A and Grade B office spaces have also increased.

HOSPITALITY MARKET

The restoration of Hajj and Umrah pilgrim quotas to full capacity in Makkah has significantly boosted the hospitality and tourism sectors. In 2023, Makkah saw 1.84 million Hajj pilgrims and approximately 26.9 million Umrah pilgrims, with international visitors making up 23 million, record-breaking numbers.

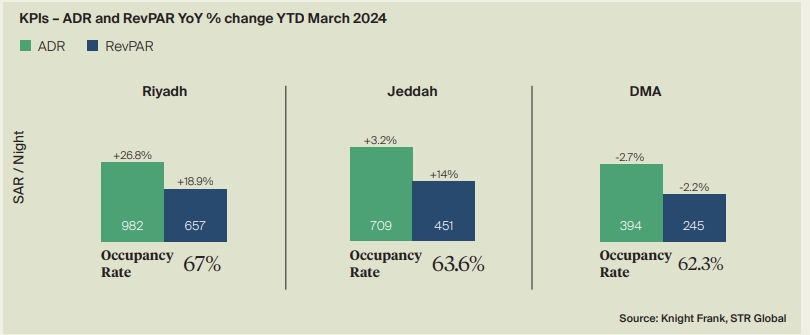

Riyadh’s hospitality sector is thriving, supported by increased corporate travel, international events, and the expansion of cultural and leisure activities. Despite a 26.8% rise in Average Daily Rates (ADR), occupancy levels have decreased slightly due to the rapid rate increase.

Turab Saleem, partner and Head of Hospitality, Tourism & Leisure Advisory, MEA, added: “The 6,840 hotel rooms are under construction, due to be delivered by 2026 in the capital could not come sooner. Even so, 85% of the under-construction stock falls into the 4- and 5-star categories, hinting strongly at the need for a greater variation in hotel accommodation options to cater to a wider range of budgets”.

Knight Frank says Jeddah has maintained and strengthened its standing as a major Middle Eastern center for hospitality. The city’s increasing appeal as a leisure and business travel destination can be attributed to strategic efforts like regulatory reforms to simplify the visa process for tourists and emerging tourist infrastructure developments like redevelopment of the Jeddah Corniche.

In addition to raising the city’s profile internationally, the 4th Jeddah Grand Prix, which took place in March 2024, had a significant impact on Jeddah’s hospitality industry. Hotels in proximity to the event venue reported occupancy rates nearing capacity. In fact, in the year to March 2024, the average occupancy levels in Jeddah rose to 63.6%, representing a 10.4% increase compared to the same period last year.

DATA CENTRES

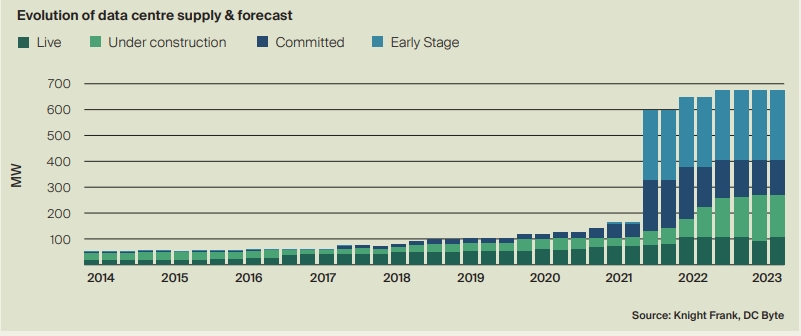

Saudi Arabia is rapidly becoming the main data hub of the region, with the fastest-growing data center market in the Middle East. Since 2014, live IT capacity in the Kingdom has increased from 40MW to 205MW, with Riyadh, Jeddah, and Dammam hosting 80% of this capacity.

Stephen Beard – Partner and Global Head of Data Centers, said: “Factors such as government initiatives, rising cloud adoption, a booming e-commerce market, improved connectivity, and the rising recognition of big data & IoT are all fueling the growth of the data centers sector.

“The roll out of 5G and the introduction of the Personal Data Protection Law in the Kingdom is expected to further boost demand. Indeed, as a result of these initiatives, we forecast US$ 30bn of CAPEX in the sector by 2030”.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Villa prices saw particularly strong growth, with capital values increasing by 33.4 percent year-on-year

Dubai’s real estate market showed strong performance in the second quarter of 2024, with notable increases across the residential, office, and retail sectors, according to a new ValuStrat real estate report for Q2 2024.

Villa prices experienced particularly strong growth, with capital values rising by 33.4 percent year-on-year.

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat said: “The Dubai real estate market has shown impressive growth and resilience in recent months. The ValuStrat Price Index for Residential Capital Values increased by 6.4 percent quarterly and 28.2 percent annually, reaching 178.2 points.

“Despite severe flooding caused by record rainfalls in April, the quick and effective response from developers and authorities helped to control the damage, ensuring that market activity and property valuations remained robust in the subsequent months.”

The office sector also performed well, with the VPI for office capital values surging by 31.7 percent annually and 9.4 percent quarterly, reaching 212.5 points—the highest quarterly increase in a decade.

In the retail sector, Emaar Properties reported 98 percent occupancy in their prime mall assets, while overall mall occupancy stood at 96 percent during the first quarter of 2024. The hospitality sector also saw growth, with total international guests reaching 8.12 million as of May 2024, a 9.9 percent increase compared to the same period last year. Hotel occupancy reached 81 percent, rising by 1.4 percent year-on-year.

Despite these positive indicators, Tuaima added, “The decline in transaction volumes calls for a closer examination of market dynamics as stakeholders navigate this evolving landscape.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual