Saudi Arabia’s $2.5 Trillion Mining Sector Transformation

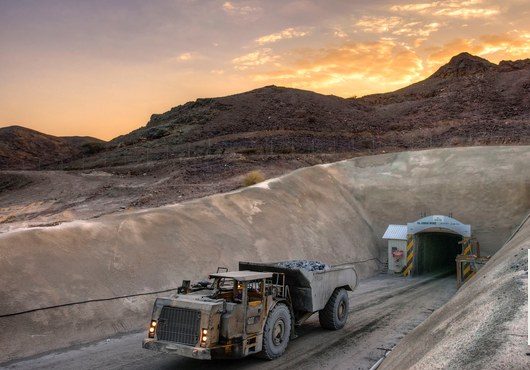

Saudi Arabia is poised for significant economic expansion by capitalizing on its vast mineral reserves estimated at $2.5 trillion.

As oil revenues fluctuate, mining presents a lucrative alternative for boosting the economy. This strategic pivot is part of Saudi Arabia’s broader Vision 2030 initiative, aimed at diversifying its economy.

Government Initiatives and Sector Investment

The Kingdom has made considerable investments in the mining sector, increasing its estimated mineral wealth and allocating about $182 million in exploration incentives by the end of 2023.

In January 2024 alone, the Ministry of Industry and Mineral Resources issued 152 new industrial licenses, indicating a strong push towards industrial growth. These licenses cover a range of activities, including the production of non-metallic mineral products and the manufacture of formed metal products, excluding machinery.

Recent discoveries, particularly significant gold reserves found along a 100km stretch in the Mansoura and Masara mines, highlight the sector’s potential. These mines are expected to yield 250,000 ounces of gold annually. This underscores the untapped opportunities within Saudi Arabia’s mineral resources.

Eng. Khalid Al Mudaifer, Vice Minister of Industry and Mineral Resources for Mining Affairs outlined several government initiatives designed to accelerate the development of the mining sector. These initiatives include creating a more business-friendly environment, implementing the new Mining Investment Law to streamline the licensing process, minimizing environmental impacts, and enhancing benefits for local communities. Additionally, a comprehensive geological survey program has been launched to support these efforts.

Government Initiatives and Sector Investment

The Saudi Industrial Development Fund is instrumental in this transformation, covering up to 75% of eligible project costs in advanced exploration and mining projects. This fund also extends its financial support to initiatives aimed at increasing local content in the sector, alongside projects in SMEs, digitalization, and renewable energy.

The Ministry’s latest report notes a 10% increase in the number of operating factories from 2022 to 2023, with the total rising to 11,549. New industrial licenses issued in 2023 surpassed 1,300, totaling investments of over $21.6 billion. This growth reflects the active expansion and development of the industrial base in Saudi Arabia, aligning with the goals of Vision 2030.

The phased development plan of the mining sector includes initial exploration and survey operations, followed by intermediate industries focusing on refining and smelting, and finally conversion industries that manufacture end products like iron and aluminum sheets, pipes, and bars.

To bolster the sector further, the Saudi Mining Services Company (ESNAD) initiative has been launched, aiming to assist mining directorates and improve monitoring and control procedures at mines. This enhances compliance with environmental, health, and safety standards and helps in resource management.

TheSaudi Geological Survey is also making significant contributions with a national geological information program, providing detailed geological maps and data to foster investment in mineral exploration across the Arabian Shield.

The logistics sector enhances the mining sector’s appeal by offering cost-effective solutions for transporting raw materials to smelters and factories in industrial cities.

These concerted efforts are anticipated to not only redefine the mining sector but also significantly elevate its contribution to the GDP by 2030. The initiatives aim to enhance the trade balance, improve legislative frameworks, create employment opportunities, and boost non-oil revenues, positioning mining as a key pillar of Saudi Arabia’s future economy.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Saudi Arabia ranked first among countries for the non-oil exports of national origin with BD201 million (22%)

Bahrain’s non-oil exports of national origin decreased by 6% to BD894 million ($2.37 billion) in Q2 2024 compared to the same period in 2023. The top 10 countries accounted for 64% of the total export value.

According to the Information & eGovernment Authority (iGA) in its Q2 2024 Foreign Trade report, Saudi Arabia was the leading destination for these exports, totaling BD201 million (22%). The US followed with BD75 million (8.4%), and the UAE with BD73 million (8.2%).

Unwrought aluminum alloys were the top exported product in Q2 2024, amounting to BD267 million (30%), followed by agglomerated iron ores and concentrates alloyed at BD159 million (18%) and non-alloyed aluminum wire at BD49 million (5%).

Non-oil re-exports

Non-oil re-exports increased by 4% to reach BD206 million during Q2 2024, compared to BD198 million for same quarter in 2023. The top 10 countries accounted for 86% of the re-exported value. The UAE ranked first with BD58 million (28%) followed by Saudi Arabia with BD39 million (19%) and UK with BD17 million (8%).

As per the report, turbo-jets worth BD65 million (32%) were the top product re-exported from Bahrain, followed by private cars with BD11 million (5%) and four-wheel drive with BD9 million (4%).

The value of non-oil imports has decreased by 4% reaching to BD1.41 billion in Q2 2024 in comparison with BD1.47 billion for same quarter in 2023. The top 10 countries for imports recorded 68% of the total value of imports.

China Bahrain’s biggest importer

China ranked first for imports to Bahrain, with a total of BD191 million (14%), followed by Brazil with BD157 million (11%) and Australia with BD112 million (8%).

Non-agglomerated iron ores and concentrates were the top product imported to Bahrain worth BD200 million (14%), followed by other aluminum oxide with BD101 million (7%) and parts for aircraft engines with BD41 million (3%).

As for the trade balance, which represents the difference between exports and imports, the deficit logged was BD310 million in Q2 2024 compared to BD322 million in Q2 2023.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual