AACCI’s Chairman, Mohamed Hage OAM, says MENA trade growth to continue

Australia’s two-way trade with MENA exceeds $25 billion

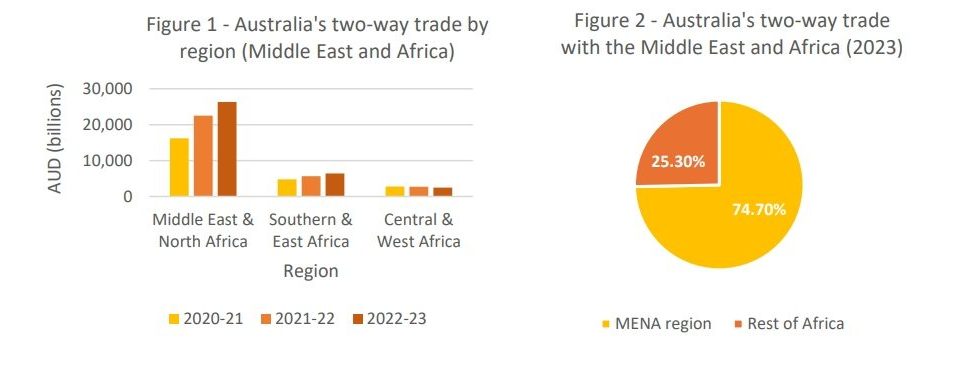

Australia’s trade with the MENA region from 2020 to 2023 showed consistent and significant growth. The trade volume increased from A$16.2 billion in 2020-21 to A$26.3 billion in 2022-23, highlighting a robust and expanding trade relationship (Refer to Figure 1). According to Mohamed Hage OAM, this thriving trade relationship is a testament to the mutual economic benefits and opportunities arising from enhanced collaboration between Australia and the MENA countries in recent years. Hage predicts that trade will continue to grow with this region as organizations become more familiar with the diverse business landscapes and uncover new opportunities for collaboration.

In 2022-23, trade with the MENA region comprised 74.7% of Australia’s total trade with Middle Eastern and African countries. This dominant share is depicted in Figure 2, emphasising the MENA region’s crucial role in Australia’s trade strategy with Middle Eastern and African countries. This substantial percentage underscores the strategic importance of MENA in Australia’s broader trade landscape, suggesting focused efforts to further strengthen these ties.

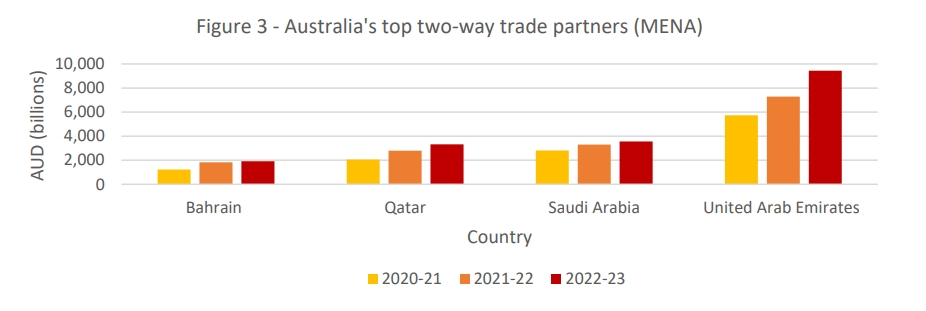

The four most significant two-way trade relationships between Australia and the MENA region are with the United Arab Emirates (UAE), Saudi Arabia, Qatar, and Bahrain. Figure 3 below demonstrates a robust and consistent increase in trade volumes with these countries from 2020 to 2023, highlighting the strengthening economic relationships between Australia and these strategically important nations. Each country exhibits unique growth patterns, reflecting varying degrees of economic engagement and potential for future trade expansion.

United Arab Emirates

The UAE stands out with the most significant growth in trade volume among the analysed countries. Australia’s trade with the UAE increased from A$5.7 billion in 2020-21 to A$9.4 billion in 2022-23, representing a remarkable 64.7% growth over three years (refer to Figure 3). This substantial increase underscores the UAE’s pivotal role as a trade hub and a key partner for Australia in the MENA region. The growth trajectory suggests a deepening of economic ties, likely driven by diversified trade in goods and services, strategic investments, and robust bilateral agreements, such as the Comprehensive Economic Partnership Agreement (CEPA) announced in December 2023.

Saudi Arabia

Saudi Arabia is another critical trade partner for Australia, with trade volumes showing consistent growth from A$2.8 billion in 2020-21 to A$3.6 billion in 2022-23, a 26.3% increase (refer to Figure 3). This steady rise reflects the solidifying trade relationship between the two countries. The trade growth is likely fuelled by Saudi Arabia‘s economic reforms under Vision 2030, which aim to diversify its economy and enhance international trade partnerships. Australia’s exports to Saudi Arabia include beef, sheep meat, barley, wheat, dairy products, cosmetics, pharmaceuticals, vehicle parts, and accessories.3

Qatar

Trade with Qatar also demonstrated significant growth, rising from A$2.1 billion in 2020-21 to A$3.3 billion in 2022-23, marking a 61.8% increase (Refer to Figure 3). This rapid expansion highlights Qatar‘s growing importance as a trade partner. The strong bilateral trade relationship is driven by Qatar’s strategic investments in infrastructure, energy, and real estate, coupled with Australia’s expertise in these sectors, as well as Australian exports including Australian exports of alumina, meat, and engineering services. The data indicates a robust economic partnership, with potential for further growth as Qatar continues to develop its non-oil economy.

Bahrain

Bahrain’s trade with Australia experienced a robust increase from A$1.2 billion in 2020-21 to A$1.8 billion in 2021-22, followed by a further rise to A$1.9 billion in 2022-23 (refer to Figure 3). This 55.6% growth over three years highlights the deepening economic ties between the two nations. In fact, Australia is Bahrain’s third-largest import source, with Australian exports mainly comprising alumina, meat, dairy products, and wheat.4

Conclusion

Australia’s trade with the MENA region, while only 2.1% of its total global trade in 2023, has shown significant growth, highlighting the potential for expanding economic ties with these countries.5

The MENA region’s abundant natural resources and strategic location offer numerous opportunities for Australian businesses to diversify and strengthen their trade portfolio. AACCI Chairman Mohamed Hage OAM stated that “some of the fastest growing economies are located in the MENA region, which is providing an increasing number of opportunities for Australian businesses. Hence, Australia’s two-way trade with the region has recently exceeded $25 billion”. By capitalising on this growth, Australia can enhance its economic resilience, reduce dependency on traditional markets, and foster stronger geopolitical and diplomatic ties.

- https://www.dfat.gov.au/sites/default/files/australias-direction-of-goods-services-trade-financial-years.xlsx

- https://www.dfat.gov.au/sites/default/files/australias-direction-of-goods-services-trade-financial-years.xlsx

- Saudi Arabia country brief | Australian Government Department of Foreign Affairs and Trade (dfat.gov.au)

- Bahrain country brief | Australian Government Department of Foreign Affairs and Trade (dfat.gov.au)

- https://www.dfat.gov.au/sites/default/files/australias-direction-of-goods-services-trade-financial-years.xlsx

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Employment grew for the 16th consecutive month as companies expanded.

According to a recent PMI report, Qatar experienced its fastest non-energy sector growth in almost two years in June, driven by surges in both existing and new business activities.

The Purchasing Managers’ Index (PMI) headline figure for Qatar reached 55.9 in June, up from 53.6 in May, with anything above 50.0 indicating growth in business activity. Employment also grew for the 16th month in a row, and the country’s 12-month outlook remained robust.

The inflationary pressures were muted, with input prices rising only slightly since May, while prices charged for goods and services fell, according to the Qatar Financial Centre (QFC) report.

This headline figure marked the strongest improvement in business conditions in the non-energy private sector since July 2022 and was above the long-term trend.

The report noted that new incoming work expanded at the fastest rate in 13 months, with significant growth in manufacturing and construction and sharp growth in other sectors. Despite the rising demand for goods and services, companies managed to further reduce the volume of outstanding work in June.

Companies attributed positive forecasts to new branch openings, acquiring new customers, and marketing campaigns. Prices for goods and services fell for the sixth time in the past eight months as firms offered discounts to boost competitiveness and attract new customers.

Qatari financial services companies also recorded further strengthening in growth, with the Financial Services Business Activity and New Business Indexes reaching 13- and nine-month highs of 61.1 and 59.2, respectively. These levels were above the long-term trend since 2017.

Yousuf Mohamed Al-Jaida, QFC CEO, said the June PMI index was higher than in all pre-pandemic months except for October 2017, which was 56.3. “Growth has now accelerated five times in the first half of 2024 as the non-energy economy has rebounded from a moderation in the second half of 2023,” he said.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual