Credit Card, PayPal or Cash App? How You Pay Matters

A guide to weighing security, convenience and benefits of each payment option

Buyers have more ways to pay for things than ever before: Apple Pay, Venmo, credit cards and dozens of other options. What you choose might matter as much as the purchase itself.

Each of the different payment methods provides various conveniences, perks and protections from fraud. Credit cards have long been the default option of choice. But higher interest rates have now raised the cost of carrying a credit-card balance.

Money-transfer apps such as Venmo and Zelle processed nearly $900 billion last year, and the Consumer Financial Protection Bureau expects that number to reach $1.6 trillion by 2027.

These apps and services provide easy instant payments, usually for free. The downside is that these options offer fewer protections from scams and unfulfilled orders.

“The U.S. consumer is very driven by convenience. They may not be directly driven by security,” said James Anderson, managing director at Paze, a bank-owned digital wallet.

Payment apps are among the fastest-growing sources of fraud reports and losses, according to Federal Trade Commission data. Overall fraud losses have increased more than fivefold to $1.2 trillion since 2019. Losses tied to payment apps jumped from $5 million to $47 million over the same period, according to the FTC data.

As new payment options gain acceptance, consumers should try to educate themselves how to use these methods safely, said Seth Ruden, director of global advisory at BioCatch, a fraud-detection software company.

“The channel itself is not the villain. The bad actors are the scammers, the social engineers and exploit artists,” he said.

Here’s how to weigh the security, convenience and benefits of each payment option:

Credit and debit cards

When you swipe or tap your card or authorise a card transaction online, the merchant’s bank communicates with your bank through a card network such as Mastercard or Visa to ask permission to withdraw a certain amount. Your bank then decides whether to approve the transaction based on your available funds or credit and the likelihood the transaction is fraudulent. If approved, your bank puts a hold on the funds until they are sent to the merchant’s account, usually within a business day.

Credit cards can be the most rewarding way to pay online. Card issuers use the revenue from transaction fees to fund perks for customers such as cash-back deals, travel points, access to airport lounges and fraud protection.

A credit card can be expensive if you don’t pay your balance in full, and higher interest rates have now raised the cost of carrying a credit-card balance. Paying off a $1,000 balance in 12 months at the current average annual percentage rate of 22.16% means $103 in interest, compared with $77 roughly a year ago when the average was 16.65%, according to estimates from the Federal Reserve.

Debit cards don’t offer the same rewards as credit cards since their issuers make less money from each transaction. They do come with similar fraud and payment protections as credit cards.

Federal regulations require issuers to reimburse customers for unauthorised transactions of more than $50 and allow customers to dispute charges within 30 days. Many credit cards also provide purchase protection, meaning you can ask for reimbursements directly from your issuer if something you buy is lost, damaged or inconsistent with what was advertised.

Few people make the most of their credit-card benefits, payments experts said. After finding most people don’t bother to read the fine print when they sign up for a new card, Mastercard is now notifying customers of benefits in real-time.

“If I have to read a big booklet or call a number to understand what my benefits are, I’m not doing it,” said Chiro Aikat, executive vice president of U.S. market development at Mastercard.

Digital wallets

Digital wallets such as PayPal or Apple Pay are among the safest and easiest ways to pay online. Checking out with a wallet is typically faster than paying with a credit card directly since one doesn’t have to re-enter billing information and shipping address.

All of the protections and benefits associated with the underlying card are still in effect for wallet transactions, so it is best to connect these wallets to a credit card directly to maximise your protection, said Corie Wagner, an analyst at Security.org, a safety-product review site.

If a digital wallet gives you the option to link a bank account directly, you should read the policy agreement to make sure you understand what is protected. For example, PayPal offers an extra level of purchase protection, but Apple Pay and Google Pay don’t.

Wallets also offer additional layers of security through encryption and biometric verification and many don’t share sensitive financial data such as your 16-card number with individual merchants. “Use as many authentication factors as possible” such as Face ID or personal identification numbers, Wagner said.

Peer-to-peer payment apps

Apps such as Venmo, Cash App and Zelle were designed to help people send money to friends and family, but they are now used in more settings. They move money more quickly than card payments because, instead of waiting on banks to approve the transaction, the payment is authorised once the sender hits submit. It is almost impossible to get money back once it has been sent.

These payment methods aren’t regulated as heavily as cards, so users might still be on the hook for unauthorised payments if a swindler gets control of their accounts.

“Use it to pay people you know, and trust,” said Meghan Fintland, a Zelle spokeswoman. “They’re not meant to have the credit-card security.”

Bank transfers

Businesses are increasingly offering ways to pay with your bank account directly since Automated Clearing House, or ACH, transfers are much cheaper to process than cards. This option should only be considered in exchange for a discount, payments executives said.

Consumers should be selective in sharing their bank information with merchants since wire transfers don’t have the same protection guarantees as cards.

If a business requests a direct bank transfer instead of a card payment, choosing a slower option over the newer instant methods such as Zelle might be best. ACH transfers typically take a few days to settle, giving you a few more days to try to stop the transaction before the money leaves your account.

“The slower it is, the greater likelihood is that you’ll be able to get recourse,” Ruden, at BioCatch, said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

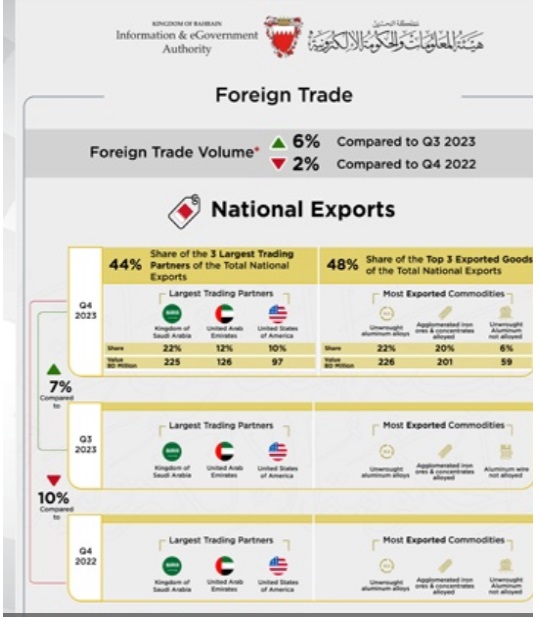

Saudi Arabia ranked first among countries for the non-oil exports of national origin with BD201 million (22%)

Bahrain’s non-oil exports of national origin decreased by 6% to BD894 million ($2.37 billion) in Q2 2024 compared to the same period in 2023. The top 10 countries accounted for 64% of the total export value.

According to the Information & eGovernment Authority (iGA) in its Q2 2024 Foreign Trade report, Saudi Arabia was the leading destination for these exports, totaling BD201 million (22%). The US followed with BD75 million (8.4%), and the UAE with BD73 million (8.2%).

Unwrought aluminum alloys were the top exported product in Q2 2024, amounting to BD267 million (30%), followed by agglomerated iron ores and concentrates alloyed at BD159 million (18%) and non-alloyed aluminum wire at BD49 million (5%).

Non-oil re-exports

Non-oil re-exports increased by 4% to reach BD206 million during Q2 2024, compared to BD198 million for same quarter in 2023. The top 10 countries accounted for 86% of the re-exported value. The UAE ranked first with BD58 million (28%) followed by Saudi Arabia with BD39 million (19%) and UK with BD17 million (8%).

As per the report, turbo-jets worth BD65 million (32%) were the top product re-exported from Bahrain, followed by private cars with BD11 million (5%) and four-wheel drive with BD9 million (4%).

The value of non-oil imports has decreased by 4% reaching to BD1.41 billion in Q2 2024 in comparison with BD1.47 billion for same quarter in 2023. The top 10 countries for imports recorded 68% of the total value of imports.

China Bahrain’s biggest importer

China ranked first for imports to Bahrain, with a total of BD191 million (14%), followed by Brazil with BD157 million (11%) and Australia with BD112 million (8%).

Non-agglomerated iron ores and concentrates were the top product imported to Bahrain worth BD200 million (14%), followed by other aluminum oxide with BD101 million (7%) and parts for aircraft engines with BD41 million (3%).

As for the trade balance, which represents the difference between exports and imports, the deficit logged was BD310 million in Q2 2024 compared to BD322 million in Q2 2023.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual