DESPERATE CHINESE PROPERTY DEVELOPERS RESORT TO BIZARRE MARKETING TACTICS

The country’s real-estate slump is getting worse—and looks set to drag on for years

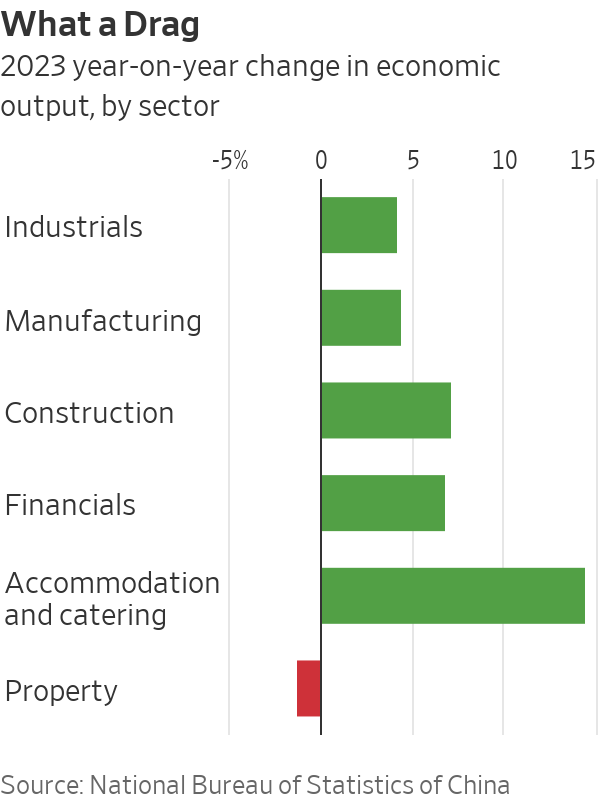

China’s real-estate crisis has dragged down the economy, caused massive layoffs and pushed multibillion-dollar companies to the point of collapse.

Economists think it is about to get worse.

Sales of newly built homes in China fell 6% last year, returning to a level not seen since 2016, according to China’s statistics bureau. Secondhand home prices in its four wealthiest cities—Beijing, Shanghai, Guangzhou and Shenzhen—declined by between 11% and 14% in December from the year before, according to the broker Centaline Property.

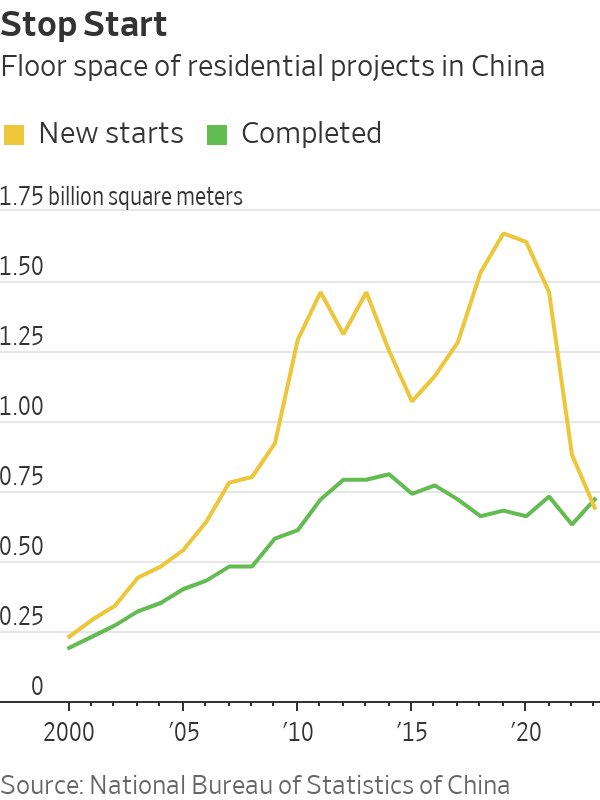

Developers are starting fewer projects. Homeowners are paying back their mortgages early and borrowing less. Once-thriving property companies are stuck in protracted negotiations with foreign investors, following defaults on about $125 billion of overseas bonds between 2020 and late 2023, according to figures from S&P Global Ratings.

Chinese developers and local governments are so desperate to attract home buyers that some have resorted to bizarre marketing strategies.

A property company in Tianjin ran a video advertisement featuring the slogan “buy a house, get a wife for free.” It was a play on words, using the same Chinese characters as the phrase “buy a house, and give it to your wife”—but presented in a sentence structure typically used to offer freebies for home buyers. In September, the company was fined $4,184 for the ad.

A residential compound in eastern China’s Zhejiang province promised last year to give home buyers a 10-gram gold bar.

Earlier this month, Sheng Songcheng, former head of the statistics department at the People’s Bank of China, told a local conference that the housing downturn would last another two years. He thinks new-home sales will fall more than 5% in both 2024 and 2025.

Wall Street economists are also ringing alarm bells about how long the real-estate slump will last.

“Not too many people are buying, can buy or want to buy,” said Raymond Yeung, chief China economist at ANZ. He said there had been a fundamental shift in the way Chinese people view the property sector, with housing no longer seen as a safe investment.

China’s real-estate sector and related industries once accounted for around a quarter of gross domestic product and the sector’s slump has been a significant drag on the world’s second-largest economy. That has increased calls for Beijing to do more to prop up the sector, but so far Chinese officials have stuck to piecemeal policies rather than introducing a landmark stimulus package.

A number of economists are making comparisons to Japan, which spent decades trying to rebound from a crash in real-estate and stock prices. China’s stock market is in a years-long slump.

China’s central bank can help make the situation less painful, but it will need to be aggressive, said Li-gang Liu, head of Asia Pacific economic analysis at Citi Global Wealth Investments. The central bank still has policy room and could take one big step to make a significant impact, he said.

Liu Yuan, head of property research at Centaline, said that without the government’s help, new-home prices will need to drop by another 50% from current levels before they reach a bottom. This is based on the assumption that the tipping point will only come when it is cheaper to buy than to rent houses, Liu said.

China’s real-estate downturn has claimed dozens of victims. More than 50 developers—mostly privately owned—have defaulted on their debt. Developers still have millions of unfinished homes that were sold but not delivered. Chinese authorities have set aside billions of dollars to help builders complete apartments but the logjam is growing.

The crisis has drained the coffers of some Chinese local governments, which previously relied on land sales as a main source of income. Economists estimate they have hidden debt worth anything from $400 billion to more than $800 billion. To quiet talk of potential defaults, the central government has set up debt-swap programs to help some of them refinance.

Some economists are optimistic. In the first half of this year, buyers of secondhand homes will gradually return to the new-home market and prop up the sector, said Helen Qiao, chief China economist at Bank of America. “Things will slowly get better from here,” Qiao said.

But most are still expecting more pain, and investors are bearish. A benchmark of Hong Kong-listed property stocks had fallen for four years in a row before the start of this year. Since Jan. 1, it is down another 15%.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Villa prices saw particularly strong growth, with capital values increasing by 33.4 percent year-on-year

Dubai’s real estate market showed strong performance in the second quarter of 2024, with notable increases across the residential, office, and retail sectors, according to a new ValuStrat real estate report for Q2 2024.

Villa prices experienced particularly strong growth, with capital values rising by 33.4 percent year-on-year.

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat said: “The Dubai real estate market has shown impressive growth and resilience in recent months. The ValuStrat Price Index for Residential Capital Values increased by 6.4 percent quarterly and 28.2 percent annually, reaching 178.2 points.

“Despite severe flooding caused by record rainfalls in April, the quick and effective response from developers and authorities helped to control the damage, ensuring that market activity and property valuations remained robust in the subsequent months.”

The office sector also performed well, with the VPI for office capital values surging by 31.7 percent annually and 9.4 percent quarterly, reaching 212.5 points—the highest quarterly increase in a decade.

In the retail sector, Emaar Properties reported 98 percent occupancy in their prime mall assets, while overall mall occupancy stood at 96 percent during the first quarter of 2024. The hospitality sector also saw growth, with total international guests reaching 8.12 million as of May 2024, a 9.9 percent increase compared to the same period last year. Hotel occupancy reached 81 percent, rising by 1.4 percent year-on-year.

Despite these positive indicators, Tuaima added, “The decline in transaction volumes calls for a closer examination of market dynamics as stakeholders navigate this evolving landscape.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual