Homeowners Don’t Want to Sell, So the Market for Brand-New Homes Is Booming

High mortgage rates are dissuading sellers, leaving new construction the only game in town; ‘there was no inventory’

LEHI, Utah—After mortgage rates shot up last year, Ivory Homes, one of Utah’s largest builders, suddenly had few buyers for the hundreds of homes it had under construction. So Clark Ivory, the chief executive, laid off 9% of his staff, and by January he had slashed construction by nearly 80% from its 2022 peak.

Then, much to his surprise, sales of new homes started picking up. By May, even though mortgage rates weren’t really budging, sales for all home builders were at their highest level since early 2022.

Millions of American homeowners have been reluctant to sell because they can’t afford to give up the low mortgage rates they have now. Only 1.08 million existing homes were for sale or under contract at the end of May, the lowest level for that month in National Association of Realtors data going back to 1999.

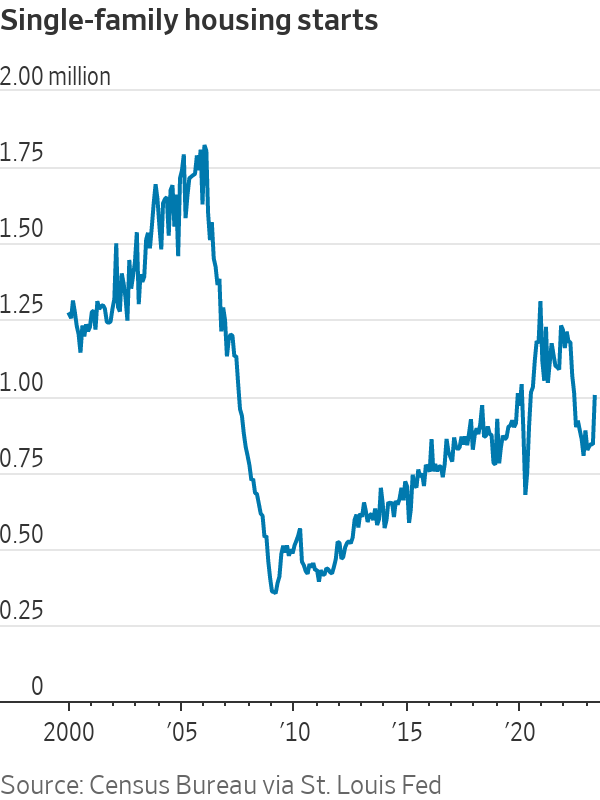

For many would-be buyers—in Utah and in many other markets—new construction has become the only game in town. Newly built homes accounted for nearly one-third of single-family homes for sale nationwide in May, compared with a historical norm of 10% to 20%. Existing-home sales in May fell 20% year-over-year, while new single-family home sales that month rose 20% on an annual basis.

That divergence is yet another example of how this housing market is behaving like no other. “It’s such a rare thing,” said Rick Palacios Jr., director of research at Irvine, Calif.-based John Burns Research & Consulting, who predicts the disparity will widen in coming months.

So far, the home-building revival, coupled with financial incentives offered by builders, is providing only minor relief to prospective buyers. Builders aren’t erecting enough homes to offset the shortage of existing ones on the market, meaning buyers in many places still face bidding wars. On a national basis, home prices have only declined a small amount from their record highs in spring 2022. Interest rates have risen in recent weeks to their highest level this year.

For builders like Ivory, though, it has been a lifeline. Builder confidence, which declined every month in 2022, has risen for seven straight months to its highest level since June 2022, according to the National Association of Home Builders.

Investors believe the home-building industry—one of the most sensitive to changes in interest rates—has already gone through its recession and is coming out the other side

Publicly traded home builders have reported stronger-than-expected results this year. The S&P Homebuilders Select Industry stock index is up 39.8% this year as of Tuesday’s close, outpacing the S&P 500’s 18.6% gain. Share prices for D.R. Horton, Lennar and PulteGroup, the three largest home builders, have performed even better.

The pandemic stoked an especially broad housing boom in 2020 and 2021. Many buyers sought larger spaces to spend more time at home, while others wanted to move closer to family. Ultralow interest rates made it inexpensive to finance their purchases.

Home-building activity surged. Mountain West states such as Utah became an attractive destination during the pandemic for people leaving expensive West Coast cities in search of a lower cost of living and an outdoors lifestyle. Home prices in the Salt Lake City area soared 53% between January 2020 and May 2022, on a seasonally adjusted basis, according to Freddie Mac’s home-price index.

Family-owned Ivory Homes, which was founded by Ivory’s father, Ellis Ivory, has been one of Utah’s top home builders for decades. Clark Ivory, 58 years old, became CEO in 2000.

In 2006, around the peak of the last boom, Ivory got worried about speculative investing. Ivory Homes started buying less land and paying off debt. To avoid selling to flippers, the company required buyers to sign an agreement that they were purchasing their homes as primary or secondary residences and that they wouldn’t sell for at least a year.

U.S. home prices fell 27% between mid-2006 and early 2012, sending ripples throughout the global economy and world financial markets. Ivory Homes stayed profitable between 2008 and 2012, Ivory said.

The pandemic-driven housing boom, Ivory said, didn’t involve as much speculation. Lending standards have improved, and investors have been buying homes to rent out to tenants, not to flip. During the pandemic boom, builders also faced obstacles they didn’t last time around, which kept them from overbuilding: supply-chain issues and labor shortages added weeks or months to their construction timelines. Ivory said his biggest concern, however, is affordability.

In the spring of 2022, rapidly rising mortgage rates abruptly slowed buying. Prices in Utah and around the U.S. had risen so rapidly that many buyers were priced out.

“It was the third weekend in May last year, and literally the lights just turned off,” said Ryan Smith, president of home building for Denver-based Oakwood Homes, a unit of Berkshire Hathaway that builds in Colorado, Utah and Arizona. “From there, the fight was on” to keep buyers from canceling.

Ivory Homes had 1,089 homes under construction in last year’s first quarter, including 513 that hadn’t yet been sold. “If I made one big mistake in the way I managed through Covid, it was trying to keep up” with demand, Ivory said. “I should have said to myself, ‘We can’t handle this.’ ”

In the second half of 2022, builders cut prices to attract buyers for their unsold homes or to persuade buyers already under contract not to back out.

Demand rebounded this year in the first quarter. By April, builders forecast a 7% increase in sales for 2023, according to a survey by John Burns Research & Consulting, reversing their forecast of a 9% drop when surveyed in November.

In Daybreak, a master-planned community about a 30-minute drive from Salt Lake City, developer Larry H. Miller Real Estate initially expected to sell 100 to 125 lots this year to home builders, including Ivory Homes. Now it expects to sell 160, according to Brad Holmes, the developer’s president.

“There was no inventory on the existing market, so everybody was being pushed to a new home,” he said.

Ivory Homes has adjusted its building plans to meet current buyers’ tastes and budgets. It is building in a master-planned community called Holbrook Farms in Lehi, a fast-growing city about 30 miles south of Salt Lake City. Lehi and nearby communities are home to the area’s many tech businesses—a major market for Ivory Homes and other builders.

Last fall, Ivory Homes was building three-story homes with three or four bedrooms in Holbrook Farms to sell for up to $625,000. Called E-Villas, they had open kitchens and were targeted at first-time buyers.

As demand slowed late last year, Ivory said, the company decided: “We have to hit a lower price point.” It redesigned the E-Villas to offer a two-story version with three bedrooms, priced below $450,000.

Now the two-story homes are now selling better than the three-story ones, he said.

Builders nationwide are focusing on cutting costs and building smaller homes with lower price tags. Nationally, the proportion of new homes sold in May for under $300,000 rose to 17%, the highest level since December 2021.

Home builders also began offering sweeter terms to buyers. About 52% of builders provided incentives in July, up from 43% in July 2022, according to a NAHB survey. Many builders are paying to lower buyers’ mortgage rates, often by a percentage point or more, to help make the monthly payments more affordable.

Some buydowns reduce rates for only the first few years of a loan, but many builders, including Ivory Homes, are offering to lower the mortgage rate for the life of the loan. The temporary buydowns require buyers to qualify for the highest mortgage rate the loan will reach.

The arrangements benefit buyers and sellers alike. Builders would rather pay for lower mortgage rates than cut prices, because price cuts can affect the value of other homes in the neighbourhood. For buyers, a lower mortgage rate can reduce a monthly payment more than a price cut.

Salt Lake City housing prices aren’t rising at the frenetic pace of 2021 and early 2022. In June, average new-home prices in the metro area fell 11% from the year-earlier period, factoring in the value of incentives, according to a John Burns Research & Consulting survey.

First-time home buyers that tour Holbrook Farms are factoring in a mortgage rate of nearly 7%, according to John Savage, an Ivory Homes sales consultant. With a rate buydown from the builder, their purchasing power can go up by $100,000, he said.

Katherine Luke and Muhammad Salman had been looking to buy their first home in the Salt Lake City area for more than two years. They didn’t find many existing homes on the market within their budget that didn’t need renovations. Earlier this year, they started looking at new homes instead.

“For the price point, it does seem like it makes more sense than trying to renovate an older home,” Luke said. There is more to choose from in the new-home market, she said.

The couple bought a new four-bedroom house from Ivory Homes in early July for about $600,000. They opted for a temporary buydown that reduces their mortgage rate for the first two years of the loan, and they hope to refinance to a lower rate as soon as they can.

“I’m hoping we made the right decision,” Luke said. “I don’t know if it was the right time to buy, but rents keep going up.”

Buyers remain sensitive to small changes in mortgage rates, and an increase in the average to above 7% could slow demand, builders say. The average rate for a 30-year fixed mortgage was 6.96% in the week ended July 13, the highest since November, according to Freddie Mac. A recession, higher unemployment or uncertainty about the presidential election also could spook buyers.

Some regional and local banks have been tightening credit for small businesses, which could also threaten some builders’ ability to borrow money for new projects. And while builders’ costs have come down somewhat, largely due to a big decline in lumber prices, they are still higher than pre pandemic levels. Federal student-loan payments are set to resume in the fall, which could make it more difficult for first-time home buyers to save for down payments.

Yet others who delayed their home-buying plans in 2022 have grown comfortable with current mortgage rates, real-estate agents and builders say.

“People still need a house, because they got married last year, they graduated college last year, and they’re tired of waiting,” said Barry Gittleman, chief executive of Murray, Utah-based builder Hamlet Homes.

And after two years of robust home sales and high margins during the recent housing boom, builders can afford to keep offering rate buydowns to entice buyers.

“We’re all relieved now that we had a really good first half of the year,” Ivory said. “This is not a market to be scared about.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Villa prices saw particularly strong growth, with capital values increasing by 33.4 percent year-on-year

Dubai’s real estate market showed strong performance in the second quarter of 2024, with notable increases across the residential, office, and retail sectors, according to a new ValuStrat real estate report for Q2 2024.

Villa prices experienced particularly strong growth, with capital values rising by 33.4 percent year-on-year.

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat said: “The Dubai real estate market has shown impressive growth and resilience in recent months. The ValuStrat Price Index for Residential Capital Values increased by 6.4 percent quarterly and 28.2 percent annually, reaching 178.2 points.

“Despite severe flooding caused by record rainfalls in April, the quick and effective response from developers and authorities helped to control the damage, ensuring that market activity and property valuations remained robust in the subsequent months.”

The office sector also performed well, with the VPI for office capital values surging by 31.7 percent annually and 9.4 percent quarterly, reaching 212.5 points—the highest quarterly increase in a decade.

In the retail sector, Emaar Properties reported 98 percent occupancy in their prime mall assets, while overall mall occupancy stood at 96 percent during the first quarter of 2024. The hospitality sector also saw growth, with total international guests reaching 8.12 million as of May 2024, a 9.9 percent increase compared to the same period last year. Hotel occupancy reached 81 percent, rising by 1.4 percent year-on-year.

Despite these positive indicators, Tuaima added, “The decline in transaction volumes calls for a closer examination of market dynamics as stakeholders navigate this evolving landscape.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual