Hong Kong’s Property Market Is a Mess—and the Fed Is Partly to Blame

U.S. rate increases have tamed inflation at home but caused pain elsewhere

Hong Kong’s notoriously expensive property market is often seen as a barometer of the city’s economy. It isn’t looking good.

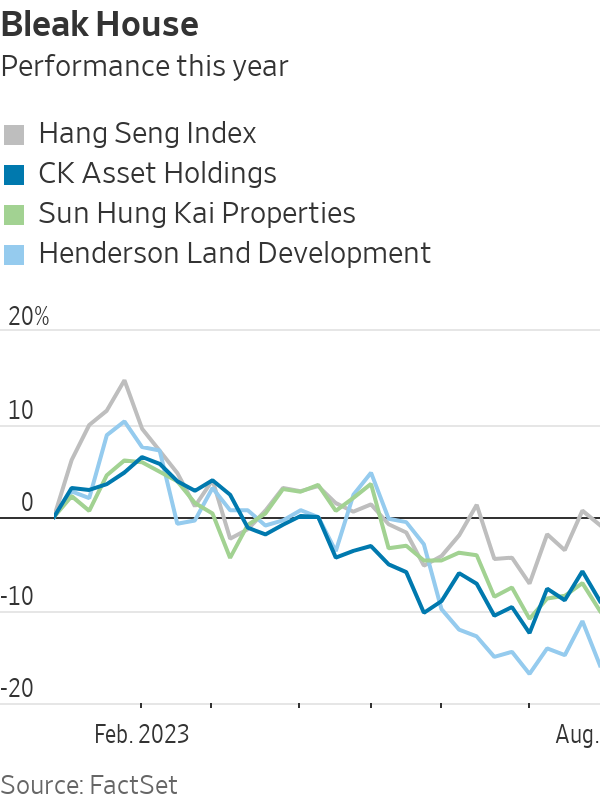

Home prices are down. Office vacancy rates have hit a record high. Commercial real-estate investment has plummeted. The shares of some big developers in the city are trading at a 30-year low to their net asset value, a measure of financial health, according to research by analysts at JPMorgan.

A key reason is high interest rates, which have increased the burden on mortgage-paying home buyers, said Cathie Chung, senior director of research at Jones Lang LaSalle, a real-estate services company. The Hong Kong dollar’s peg to the U.S. dollar forces monetary authorities in the city to track U.S. interest-rate decisions, limiting their ability to stimulate the property sector and the wider economy.

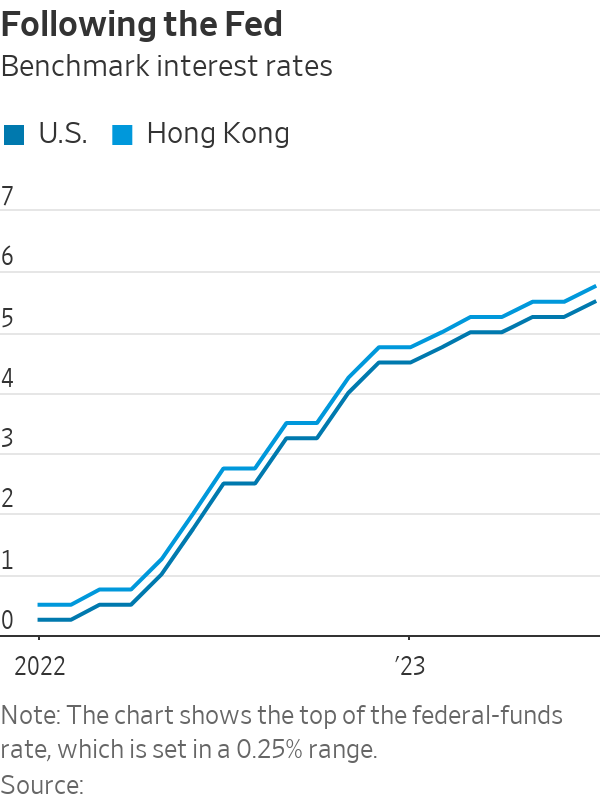

The Federal Reserve has embarked on a historic cycle of interest-rate rises since last March, raising the benchmark federal-funds rate from around zero to 5.25% to 5.50%. The Hong Kong Monetary Authority, the city’s de facto central bank, has followed these hikes, increasing its base rate to 5.75% from 0.75% over the same period.

The full impact of higher interest rates in the city still hasn’t been felt, said Asif Ghafoor, chief executive of online real-estate marketplace Spacious. Asking prices of residential properties listed on the platform have fallen 5% since the start of the year. Sales prices tend to follow suit, and are likely to fall 5% to 10% in the next six months, he said.

To prop up the market, the HKMA relaxed mortgage rules in early July for the first time since 2009, allowing home buyers to pay less upfront and borrow more for some properties if they plan to live in them. But those working in the sector think the pain is far from over.

“We expect that the recovery will be slow and long,” said Chung at Jones Lang LaSalle.

The slump in the property market has hurt the share prices of developers, a major source of wealth for some of the city’s richest families. CK Asset Holdings, Henderson Land Development, Sun Hung Kai Properties and New World Development—all still partly owned by the families of the founders—are performing much worse than the wider stock market this year. New World and Henderson Land have lost more than 15% this year, according to FactSet data.

Hong Kong is one of the world’s leading financial centres and is seen by many foreign businesses as a gateway to mainland China. It is now being hit by a slowdown in investment-banking activity—with several large banks cutting staff this year—and the shaky recovery of China’s economy, which has undermined confidence among businesses and potential home buyers in Hong Kong.

The overall vacancy rate for offices reached a record high of 15.7% in the first half of this year, compared with an average of under 5% in 2018, according to figures by CBRE. In the central business district, there was almost eight times as much empty office space as in 2018, when the area had a vacancy rate of just 1.3%.

The equivalent of $603 million was invested in commercial real estate between April and June, according to CBRE data, just a third of the first-quarter tally and the lowest quarterly figure since the end of 2008, when the global financial crisis caused a huge drop in confidence.

Hong Kong’s border with mainland China was reopened earlier this year, but companies from the mainland haven’t grabbed office space in the numbers many had hoped, said Ada Fung, head of office services at CBRE Hong Kong. Flexible working arrangements and geopolitical tensions that have made many companies pause expansion plans are also crimping demand, she said.

The drop in demand is being exacerbated by a supply glut. Developers bought land and started constructing a number of new buildings before 2019, when widespread protests rocked the city and only ended with the passing of a strict national-security law. Demand for commercial property after that was soon undermined by the spread of Covid-19.

This shift in supply and demand is finally giving potential renters the upper hand, said Fung. “It could be a healthy reset,” she said.

There are some reasons for optimism. Retail businesses have increased their demand for commercial property after the reopening of the border with China, which has brought in tourists looking to spend on luxury goods. There is also hope that a recent rise in residential rents could help home prices.

After an exodus of professionals and other residents in recent years, people have started to move to the city, including foreign students and those coming to Hong Kong through government talent schemes designed to reverse a brain drain. That is helping rents pick up after hitting a bottom in the first quarter, and could lead to more demand for properties as investments, said Cusson Leung, head of property research in Hong Kong at JPMorgan.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Villa prices saw particularly strong growth, with capital values increasing by 33.4 percent year-on-year

Dubai’s real estate market showed strong performance in the second quarter of 2024, with notable increases across the residential, office, and retail sectors, according to a new ValuStrat real estate report for Q2 2024.

Villa prices experienced particularly strong growth, with capital values rising by 33.4 percent year-on-year.

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat said: “The Dubai real estate market has shown impressive growth and resilience in recent months. The ValuStrat Price Index for Residential Capital Values increased by 6.4 percent quarterly and 28.2 percent annually, reaching 178.2 points.

“Despite severe flooding caused by record rainfalls in April, the quick and effective response from developers and authorities helped to control the damage, ensuring that market activity and property valuations remained robust in the subsequent months.”

The office sector also performed well, with the VPI for office capital values surging by 31.7 percent annually and 9.4 percent quarterly, reaching 212.5 points—the highest quarterly increase in a decade.

In the retail sector, Emaar Properties reported 98 percent occupancy in their prime mall assets, while overall mall occupancy stood at 96 percent during the first quarter of 2024. The hospitality sector also saw growth, with total international guests reaching 8.12 million as of May 2024, a 9.9 percent increase compared to the same period last year. Hotel occupancy reached 81 percent, rising by 1.4 percent year-on-year.

Despite these positive indicators, Tuaima added, “The decline in transaction volumes calls for a closer examination of market dynamics as stakeholders navigate this evolving landscape.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual