The Biggest Winners in America’s Climate Law: Foreign Companies

U.S. seeks to build domestic supply chains but needs overseas expertise

The 2022 climate law unleashed a torrent of government subsidies to help the U.S. build clean-energy industries. The biggest beneficiaries so far are foreign companies.

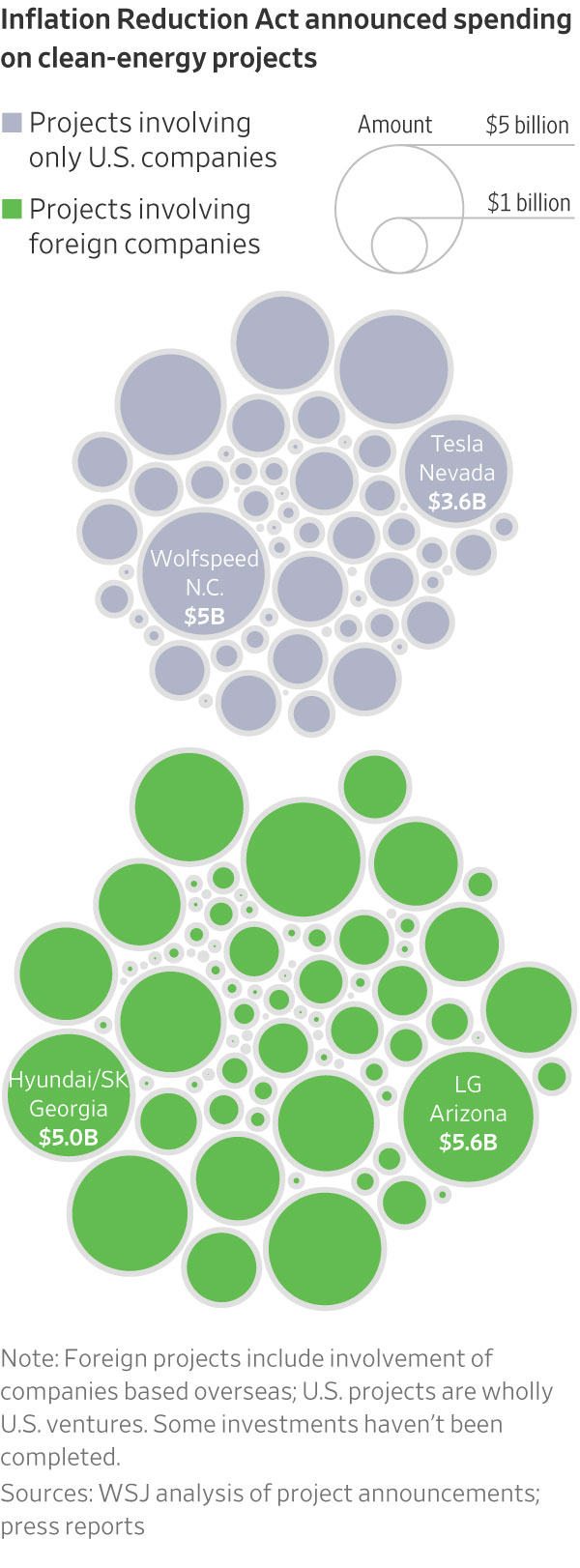

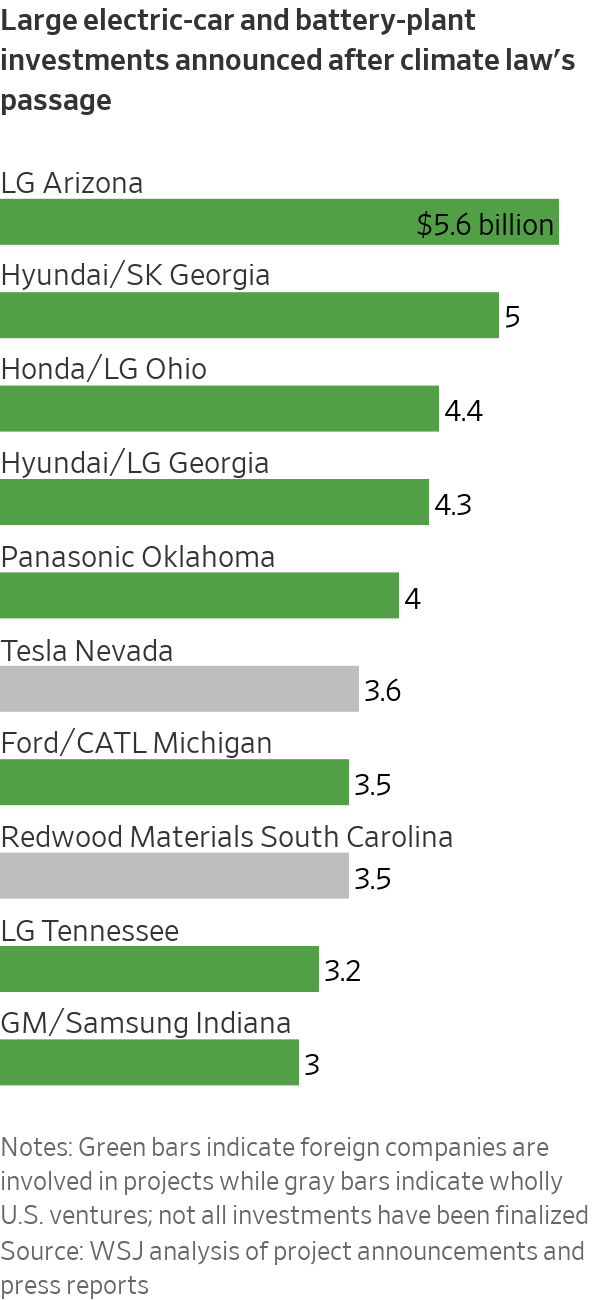

The Inflation Reduction Act has spurred nearly $110 billion in U.S. clean-energy projects since it passed almost a year ago, a Wall Street Journal analysis shows. Companies based overseas, largely from South Korea, Japan and China, are involved in projects accounting for more than 60% of that spending. Fifteen of the 20 largest such investments, nearly all in battery factories, involve foreign businesses, the Journal’s analysis shows.

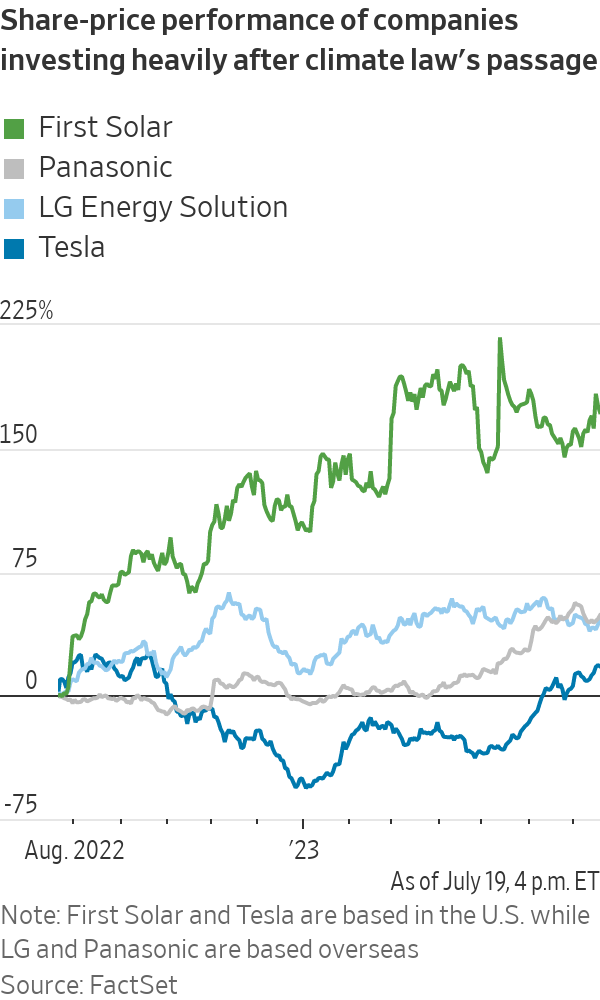

These overseas manufacturers will be able to claim billions of dollars in tax credits, making them among the biggest winners from the climate law. The credits are often tied to production volume, rewarding the largest investors.

Japan’s Panasonic, one of the few companies to publicly estimate the impact of the law, could earn more than $2 billion in tax credits a year based on the capacity of battery plants it is operating or building in Nevada and Kansas. The company, which supplies batteries to electric-vehicle maker Tesla, is considering a third factory in the U.S. that would lift that total.

The climate law is designed to build up domestic supply chains for green-energy industries, but the reality is that the technology for building batteries and renewable-energy equipment resides overseas. The incentives are leading these companies to invest in the U.S., often alongside domestic businesses.

“It’s a testament to the fact that we still live in a globalised economy,” said Aniket Shah, head of environmental, social and corporate governance—or ESG—strategy at investment bank Jefferies. “You can’t just out of nowhere put up borders and say, ‘It has to be made in America by American companies.’ ”

The Journal looked at roughly 210 clean-energy projects and company initiatives spurred by the law, including projects tracked by industry groups American Clean Power and E2 (Environmental Entrepreneurs); announcements from companies and state and local governments; and media reports. Of those, about 140 disclosed investment amounts totalling roughly $110 billion.

Projects were characterised as either wholly U.S. ventures or foreign if overseas companies are contributing significant investment or technology. Renewable-power facilities and projects already in the works before the law passed were excluded.

Forecasters estimate the climate law could unleash some $3 trillion in total clean-energy investments over the next decade. U.S. companies are also investing heavily, including Tesla, solar-panel maker First Solar and hydrogen producer Air Products and Chemicals.

Full domestic supply chains for batteries or solar panels are still years away because foreign companies dominate nearly every step in the process, from raw materials to sophisticated parts.

The large investments by overseas businesses have generally been welcomed by U.S. communities, many of which have benefited for decades from spending and jobs created by foreign automakers and other companies. But some investments from Chinese companies have fuelled a backlash as tensions between the two countries escalate.

At least 10 of the projects representing nearly $8 billion in investments included in the Journal’s analysis involve companies either based in China or with substantial ties to China through their core operations or large investors.

Some projects are facing resistance, including two in Michigan: a $3.5 billion battery factory that Ford Motor is building with technology and expertise from China’s CATL; and a $2.4 billion battery-component factory from China-based Gotion. Ford is keeping 100% ownership of the battery factory—in part to sidestep the issue of public funds flowing to CATL, according to a person with knowledge of the deal. Ford is licensing the battery-making know-how and services from CATL, the companies said.

But China hawks say the payments Ford makes to CATL mean the Chinese company reaps indirect benefits from government support.

“What we’re seeing is foreign policy conflict with climate policy and trade policy,” Shah said. “We’re going to have to decide as a country what matters more: our enmity with China or our desire to decarbonise quickly.”

Microvast, a startup that was planning to build a more than $500 million battery-component plant in Kentucky, was named as a potential recipient of a $200 million grant from the Energy Department last year. The department later rejected the application. The move followed criticism from Republicans about the company’s ties to China, which include a China subsidiary that accounts for more than 60% of its revenue.

The Energy Department didn’t give a reason for withdrawing the grant. The department takes a number of factors into account when evaluating such projects, including technology risks and the potential for foreign influence, a spokeswoman said.

Microvast, based in Stafford, Texas, says it is a U.S. company and that Chief Executive Yang Wu is an American citizen. The company recently scrapped plans for the Kentucky plant.

“We must be assured that these taxpayer dollars are not being funnelled to the Chinese,” said Cathy McMorris Rodgers (R., Wash.), chair of the House of Representatives committee on energy and commerce, during a June hearing.

Microvast is committed to its goals of investing in the U.S. through other facilities, a spokeswoman said.

The issue is expected to come to a head when the Treasury Department completes rules for electric-car tax credits. The department has proposed that cars using battery materials that were produced by a “foreign entity of concern” such as a Chinese company wouldn’t qualify for tax credits beginning in 2025.

Many expect Treasury to use a loose standard so that some cars qualify, potentially fuelling criticism from some politicians who crafted the climate law such as Sen. Joe Manchin (D., W.Va.), who has argued more lenient criteria go against the intent of the Inflation Reduction Act. Treasury is monitoring shifting markets and supply chains while making rules that advance the law’s goals, a spokeswoman said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Highlighting a significant recovery and robust growth across all key performance metrics.

Bank of Sharjah has released its results for the period ending 30 June 2024, showcasing robust performance and strong momentum since the beginning of the year. The Bank reported a net profit of AED 171 million, a significant turnaround from the AED 144 million loss in the same period last year.

This remarkable improvement is attributed to a substantial increase in net interest income, stringent credit underwriting, and reduced operating costs, marking a 233% increase over the previous year when excluding the one-time impairment charge from de-linking its Lebanese subsidiary.

The Bank’s exceptional financial results highlight the effectiveness of its strategic focus on sustainable growth, with notable improvements across all major performance metrics. Funded and unfunded income both saw increases, with net interest income rising by 108% and operating income growing by 34%.

Additionally, the cost-to-income ratio improved significantly to 40.1% due to cost discipline measures. The balance sheet remains strong with a loans-to-deposits ratio of 86.63%, indicating comfortable liquidity. The Bank also maintains strong capitalization, with a regulatory capital adequacy ratio exceeding 15% and Tier 1 and CET1 capital ratios around 14%. These positive results underscore the Bank’s underlying strength, operational efficiency, prudent risk management, and ongoing enhancement of shareholder value.

Commenting on the Bank’s results, Sheikh Mohammed bin Saud Al Qasimi, Chairman of Bank of Sharjah, stated: “We are pleased with our outstanding performance in the first half of 2024, which reflects our commitment to adding value to our customers, supporting our communities, and rewarding our shareholders. Despite the challenging geopolitical situation in the region, the UAE economy has remained resilient and continues to register healthy growth following various economic diversification initiatives that provide consistent impetus for trade, investment, and wealth creation. Bank of Sharjah has entered a new chapter with a new leadership team, focused on building new business streams, expanding our reach across the UAE and the region, and delivering exceptional service to our customers.”

He added: “Our performance in the first half of the year demonstrates the effectiveness of our new strategy, and we look forward to delivering continued growth in the years to come.”

The CEO, Mr. Mohamed Khadiri, commented “2024 has begun exceptionally well for Bank of Sharjah, with the bank achieving a record year-on-year profit. I am delighted with our stellar performance as we continue to strengthen the bank’s fundamentals. Our outstanding results reaffirm that our new business strategy is on track to deliver sustainable revenue growth, driven by business expansion, operational efficiency, prudent risk management, and talent development. This achievement is also a testament to the Bank’s success in providing high-quality financial services that meet the aspirations and growing needs of our customers.”

He further added: “Bank of Sharjah is a strong and respected brand within the local community. We are leveraging our core strengths to build a platform that will operate at its full potential across the UAE and the region. The Bank remains focused on executing our strategy and is well-positioned to maintain strong performance throughout 2024 and beyond.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual