The World Tied $3.5 Trillion-Plus of Debt to Inflation. The Costs Are Now Adding Up.

With roughly $770 billion of borrowings linked to retail prices, Britain is feeling the pinch

Governments and companies around the world spent decades loading up on trillions of dollars of debt whose interest costs rise and fall alongside inflation. But what served as cheap funding when prices were stagnant has rapidly become more expensive.

The inflation-linked headache echoes the broader challenges arising at the end of more than a decade of global easy money, in which debtors borrowed vast amounts at very low, and sometimes negative, interest rates. Investors are on alert for financial vulnerabilities after a crisis in U.S. regional banks this year, and with strains emerging in commercial property.

Borrowing costs of all sorts have risen sharply for governments, businesses and consumers, as central banks have raised key interest rates to combat price pressures. Rates have surged on inflation-linked borrowings, but these aren’t the only source of pain.

As standard bonds with fixed rates mature, they need to be replaced with more expensive new debt. Meanwhile, interest rates on loans are often floating, meaning they quickly reflect changes in policy rates.

Yields on benchmark 10-year fixed-rate bonds, a proxy for government borrowing costs, have climbed to about 4.3% for the U.K. and 3.9% for the U.S. Both were below 1% during the pandemic.

Governments will pay roughly $2.2 trillion in overall debt interest this year, Fitch Ratings estimates. The U.S. Treasury’s interest cost grew 25% to $652 billion in the nine months through June. Germany’s debt-servicing bill is expected to soar to 30 billion euros this year, or some $33.2 billion, from €4 billion in 2021.

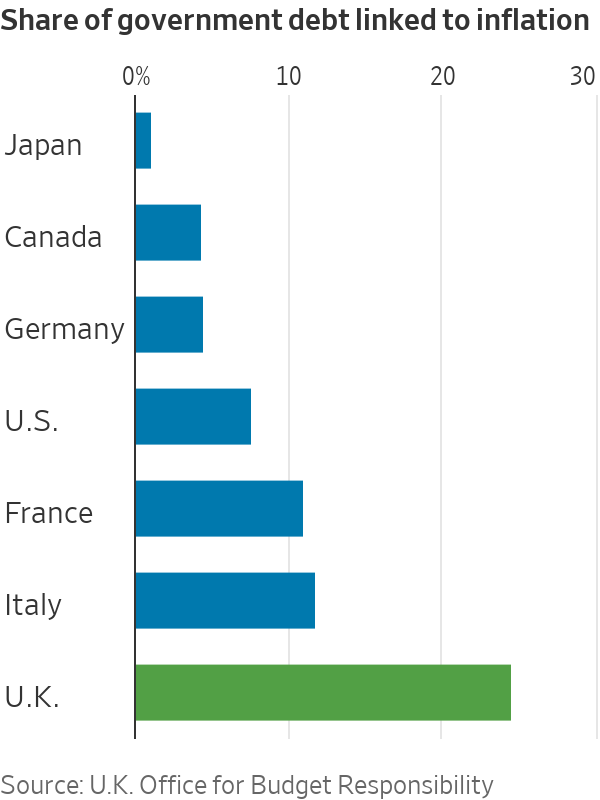

Governments had $3.5 trillion in outstanding inflation-linked debt at the end of 2022, according to the Bank for International Settlements, equivalent to about 11% of their total borrowings.

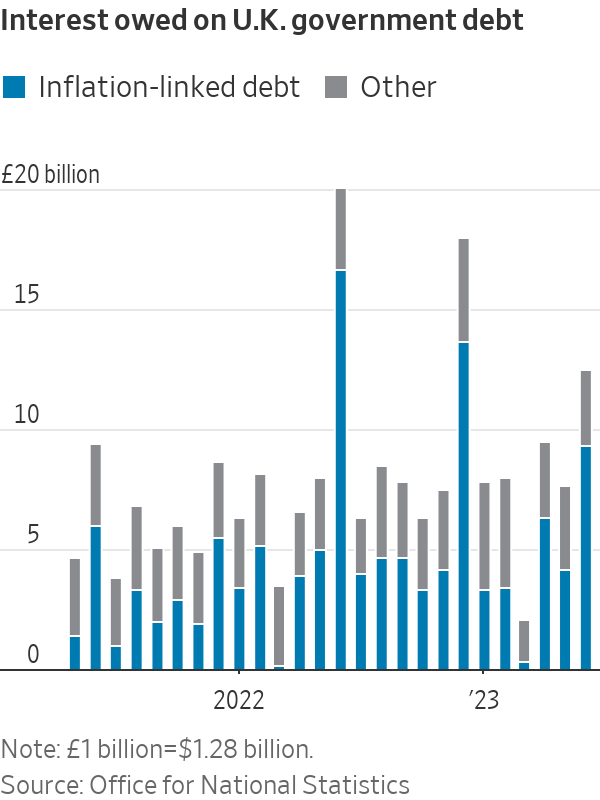

The poster child for the inflation-linked problem is Britain, which has experienced the fastest rise in debt costs in the Group of Seven advanced democracies. The U.K. first embraced such debt under Prime Minister Margaret Thatcher and in 1981 became one of the first developed economies to issue inflation-linked debt: securities that are known as linkers there and Treasury Inflation-Protected Securities, or TIPS, in the U.S. Both the amount due to investors once the bonds mature and the regular interest payments they receive move with inflation.

About a quarter of U.K. debt is now tied to inflation, trailing only a handful of emerging markets with a history of runaway prices such as Uruguay, Brazil and Chile.

“We stick out like a sore thumb,” said Sanjay Raja, chief U.K. economist at Deutsche Bank.

The U.K.’s debt woes are complicated by its longstanding reliance on a measure of price increases that has fallen out of favour: the retail price index, or RPI. Some 600 billion pounds, equivalent to roughly $770 billion, of bonds are linked to this gauge, which has consistently risen faster than more widely used consumer-price indexes. London has pledged to phase out RPI by 2030.

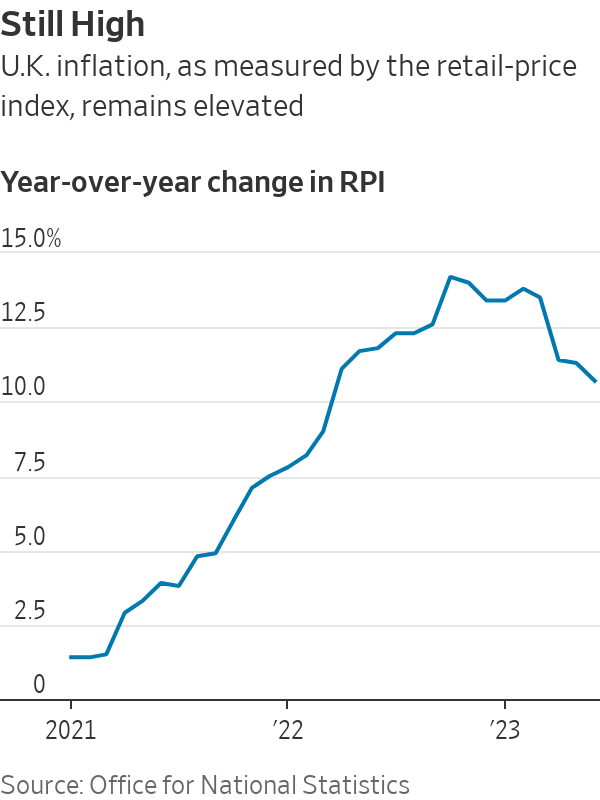

Inflation as measured by the RPI topped 14% in October and was still 11% in June compared with a year earlier. Economists expect U.K. inflation to keep falling this year, albeit more slowly than in other major economies.

In theory, higher interest payouts should be balanced by rising revenue. While higher inflation means bigger payouts to bondholders, it should also bring in more taxes.

That logic holds especially true in markets like the U.K., where inflation gauges are deeply embedded in the economy. Tax thresholds, pension and welfare payments, rail fares and cellphone bills are often linked to price indexes.

But the energy shock that fuelled recent inflation upended that math, since higher energy bills drove up RPI even as earnings and consumer spending lagged behind. The U.K. is experiencing the “wrong sort of inflation,” the U.K.’s Office for Budget Responsibility said this month. The sensitivity of U.K. debt to inflation was unprecedented, the watchdog said.

The U.K.’s debt sustainability is a focus for investors after a market meltdown last fall, triggered by then-Prime Minister Liz Truss’s tax-cutting plans.

Her successor Rishi Sunak and his Chancellor Jeremy Hunt have sought to restore market confidence with pledges to contain inflation and bring down debt. As the U.K.’s interest costs climb, and with debt now surpassing 100% of gross domestic product, those promises are getting harder to keep while maintaining investor confidence.

The debt burden also undermines Sunak’s hopes to woo voters and revive the economy with tax cuts and spending measures ahead of a general election expected to take place next year.

“We could quickly be in a situation where we’re facing some renewed sense of crisis, particularly with an economic backdrop of stagflation with really weak growth and overshooting inflation,” said Mark Dowding, chief investment officer at RBC BlueBay Asset Management in London. “Further policy missteps could easily be punished by the market.”

Higher bond yields and stickier inflation will add an extra £30 billion to the U.K.’s annual government debt bill, estimates Bank of America economist Robert Wood.

“The government has three options: You can plan for weaker spending, you could raise taxes or you could borrow more,” he said. “Certainly one could say that this rise in debt-interest costs is incompatible with cutting taxes.”

The U.K. is selling fewer linkers, which are likely to make up 11% of bond issuance this fiscal year, down from above 20% throughout the 2010s.

One veteran U.K. central banker said linkers had largely done their job as envisioned in the 1980s.

“We were coming out of a decade in which inflation had been extremely high. People were very skeptical about the ability of any government, particularly the Conservative government, to bring inflation down to a low and stable rate,” said Charles Goodhart, who was an adviser at the Bank of England between 1969 and 1985.

Fears that linkers would lead to fresh wage-price spirals as unions demanded inflation-linked increases, didn’t play out, he said. Thatcher, who called inflation “the destroyer of all,” saw linkers as “sleeping policemen,” ensuring the government wasn’t tempted to let inflation run to help inflate debt away.

“It makes the current fiscal position more difficult. But that’s what Mrs. Thatcher actually wanted,” said Goodhart. “She wanted governments to resist inflation more strongly.”

Companies are also feeling the pressure from inflation-linked borrowing. The U.K.’s largest water company, Thames Water, nearly collapsed in recent weeks as investors questioned its ability to repay £14 billion in debt, about half of which is linked to inflation. Thames Water’s debt is RPI-linked, but customer prices now track CPI, which lags behind the RPI by about 3 percentage points more slowly.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Highlighting a significant recovery and robust growth across all key performance metrics.

Bank of Sharjah has released its results for the period ending 30 June 2024, showcasing robust performance and strong momentum since the beginning of the year. The Bank reported a net profit of AED 171 million, a significant turnaround from the AED 144 million loss in the same period last year.

This remarkable improvement is attributed to a substantial increase in net interest income, stringent credit underwriting, and reduced operating costs, marking a 233% increase over the previous year when excluding the one-time impairment charge from de-linking its Lebanese subsidiary.

The Bank’s exceptional financial results highlight the effectiveness of its strategic focus on sustainable growth, with notable improvements across all major performance metrics. Funded and unfunded income both saw increases, with net interest income rising by 108% and operating income growing by 34%.

Additionally, the cost-to-income ratio improved significantly to 40.1% due to cost discipline measures. The balance sheet remains strong with a loans-to-deposits ratio of 86.63%, indicating comfortable liquidity. The Bank also maintains strong capitalization, with a regulatory capital adequacy ratio exceeding 15% and Tier 1 and CET1 capital ratios around 14%. These positive results underscore the Bank’s underlying strength, operational efficiency, prudent risk management, and ongoing enhancement of shareholder value.

Commenting on the Bank’s results, Sheikh Mohammed bin Saud Al Qasimi, Chairman of Bank of Sharjah, stated: “We are pleased with our outstanding performance in the first half of 2024, which reflects our commitment to adding value to our customers, supporting our communities, and rewarding our shareholders. Despite the challenging geopolitical situation in the region, the UAE economy has remained resilient and continues to register healthy growth following various economic diversification initiatives that provide consistent impetus for trade, investment, and wealth creation. Bank of Sharjah has entered a new chapter with a new leadership team, focused on building new business streams, expanding our reach across the UAE and the region, and delivering exceptional service to our customers.”

He added: “Our performance in the first half of the year demonstrates the effectiveness of our new strategy, and we look forward to delivering continued growth in the years to come.”

The CEO, Mr. Mohamed Khadiri, commented “2024 has begun exceptionally well for Bank of Sharjah, with the bank achieving a record year-on-year profit. I am delighted with our stellar performance as we continue to strengthen the bank’s fundamentals. Our outstanding results reaffirm that our new business strategy is on track to deliver sustainable revenue growth, driven by business expansion, operational efficiency, prudent risk management, and talent development. This achievement is also a testament to the Bank’s success in providing high-quality financial services that meet the aspirations and growing needs of our customers.”

He further added: “Bank of Sharjah is a strong and respected brand within the local community. We are leveraging our core strengths to build a platform that will operate at its full potential across the UAE and the region. The Bank remains focused on executing our strategy and is well-positioned to maintain strong performance throughout 2024 and beyond.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual