A surge in for-sale listings tipped to dampen home price growth

The forecast slowdown comes on the back of sharp increases in home values

The number of new for-sale listings has been stubbornly sluggish for much of the year, but there are growing signs would-be vendors are finally feeling confident to go to market.

New analysis indicates this surge in supply is likely to put the brakes on a renewed boom in property prices being seen across much of the country.

According to data from research firm CoreLogic, national home values rose 2.9 percent in the three months to July – the highest quarterly movement since January.

Across the capital cities, values were up 0.8 percent last month – down slightly from a 1.2 percent lift seen in June.

Prices are rising fastest in Sydney, with a whopping 4.5 percent jump in the three months to July.

Prices rose 4.2 percent in Brisbane in the quarter, while Adelaide and Perth each recorded a 3.2 per cent increase. Values in Melbourne were up two per cent.

“Home values are down 3.4 percent annually, but declines are quickly subsiding from an eight per cent drop in the year to March,” Eliza Owen, head of residential research at CoreLogic, observed.

Data shows the number of new listings nationally hit 33,616 in the four weeks to 30 July, trending slightly higher through the month, which she noted is unusual for this time of year.

“The flow of new listings added to the market has been rising since mid-June, in contrast to the usual seasonal trend where new vendor activity would be trending lower through the colder months.”

With more homes hitting the market ahead of the traditionally busy spring selling season, Paul Ryan, economist at data house PropTrack, said price growth could dampen in the months ahead.

“There have been some tentative signs that sellers are responding to continued strong buyer demand and higher prices by bringing more listings to market,” Mr Ryan said.

PropTrack modelling shows a low level of new listings could be responsible for as much as a quarter of the price growth seen this year, and the impact of low supply can be felt within a few months.

“This analysis suggests that a stronger flow of listings could weigh on home price growth later this year as the market gears up for the spring selling season,” Mr Ryan said.

“And importantly, it shows the impact on prices is likely to be felt quite quickly after any new listings are brought to market – within one to two months.”

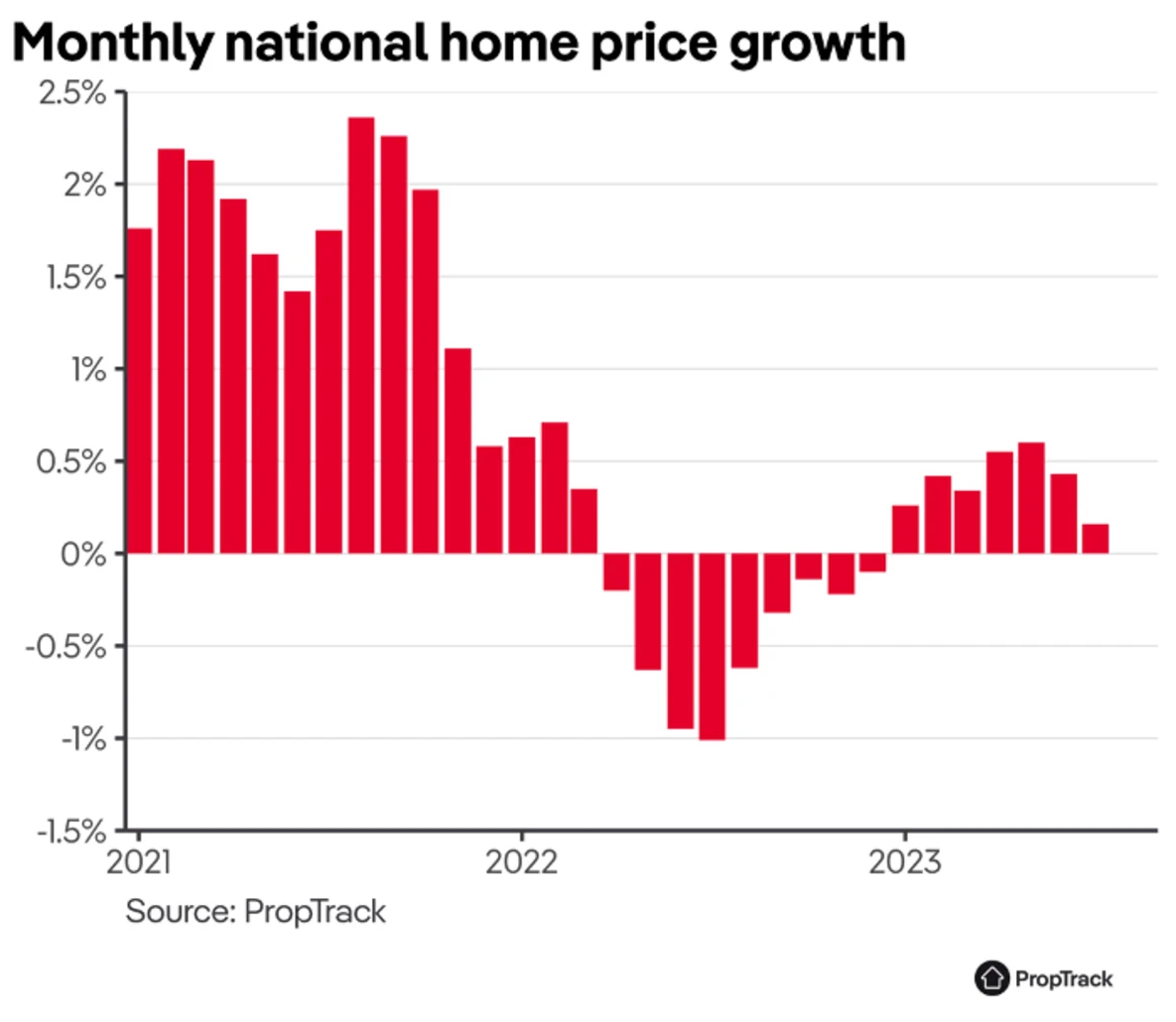

Mr Ryan said property markets have “displayed a remarkable turnaround in 2023”.

“Home prices fell persistently over 2022, down 4.1 percent from April to December, during the sharpest episode of interest rate increases ever implemented by the Reserve Bank,” he said.

“But 2023 has seen national home prices increase each month, up 2.8 percent so far this year, despite continued increases in interest rates.”

One major factor for the rapid turnaround in price movements is the low supply of new listings hitting the market, he said. Buyer demand has remained strong.

“The flow of new listings over the first half of 2023 was around 15 percent below the level seen over the same period in 2022, which represents a significant decrease.

“By contrast, the total number of homes on the market has mostly drifted upward as homes take longer to sell compared to the strong market conditions in 2021.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Villa prices saw particularly strong growth, with capital values increasing by 33.4 percent year-on-year

Dubai’s real estate market showed strong performance in the second quarter of 2024, with notable increases across the residential, office, and retail sectors, according to a new ValuStrat real estate report for Q2 2024.

Villa prices experienced particularly strong growth, with capital values rising by 33.4 percent year-on-year.

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat said: “The Dubai real estate market has shown impressive growth and resilience in recent months. The ValuStrat Price Index for Residential Capital Values increased by 6.4 percent quarterly and 28.2 percent annually, reaching 178.2 points.

“Despite severe flooding caused by record rainfalls in April, the quick and effective response from developers and authorities helped to control the damage, ensuring that market activity and property valuations remained robust in the subsequent months.”

The office sector also performed well, with the VPI for office capital values surging by 31.7 percent annually and 9.4 percent quarterly, reaching 212.5 points—the highest quarterly increase in a decade.

In the retail sector, Emaar Properties reported 98 percent occupancy in their prime mall assets, while overall mall occupancy stood at 96 percent during the first quarter of 2024. The hospitality sector also saw growth, with total international guests reaching 8.12 million as of May 2024, a 9.9 percent increase compared to the same period last year. Hotel occupancy reached 81 percent, rising by 1.4 percent year-on-year.

Despite these positive indicators, Tuaima added, “The decline in transaction volumes calls for a closer examination of market dynamics as stakeholders navigate this evolving landscape.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual