Fitch Maintains Kuwait’s ‘AA-‘ Rating with Stable Outlook

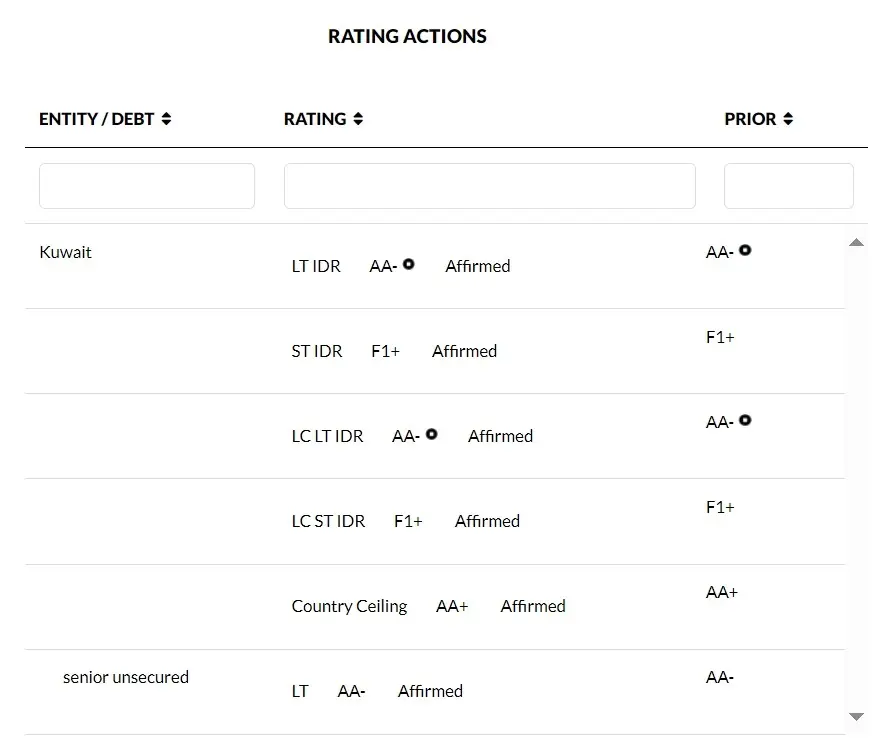

Fitch Ratings has reaffirmed Kuwait’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘AA-‘ and maintained a Stable Outlook.

Key factors influencing Kuwait’s credit rating:

Foundational strengths and challenges: Kuwait’s ‘AA-‘ credit rating draws strength from its robust fiscal and external balance sheets, which are among the strongest across Fitch-rated nations.

This favorable standing, however, faces limitations due to the country’s heavy reliance on oil revenues, an extensive welfare system, and a large public sector, which pose sustainability concerns in the long term.

Additionally, the political landscape in Kuwait complicates efforts to address enduring fiscal and economic challenges, including the passage of key legislation to permit debt issuance and define government financing strategies.

Exceptional financial reserves: Kuwait boasts impressive fiscal and external balance sheets, with its sovereign net foreign asset position predicted to average 529% of GDP in 2024-25. This figure significantly surpasses that of other Fitch-rated sovereigns and stands more than ten times the median for ‘AA’ rated countries.

A substantial portion of these assets is managed by the Kuwait Investment Authority (KIA) through the Future Generations Fund, alongside the assets of the General Reserve Fund (GRF), the government’s main treasury account.

Persistent political challenges

The dynamic between Kuwait’s elected parliament and its appointed cabinet frequently results in ministerial resignations and the dissolution of parliament. The most recent dissolution in February anticipates elections on April 4th.

Predictions suggest a parliament composition similar to prior elections, with a majority critical of government policies. This ongoing political division is expected to continue hindering policymaking in Kuwait.

Government reforms in question

Despite the introduction of a technocratic cabinet by the new Emir, Sheikh Meshal Al-Ahmed Al-Jaber Al-Sabah, and a four-year government program aiming at fiscal improvements, skepticism remains regarding the implementation of these plans. These include enhancing non-oil revenue, restructuring subsidies, and encouraging private sector participation, which echo the ambitions of previous administrations that faced parliamentary gridlock.

Economic Projections and Concerns

With assumptions of passing a liquidity law in the fiscal year ending March 2026, Kuwait’s government debt to GDP ratio is expected to increase, though remaining significantly lower than the ‘AA’ median forecast for 2025. Despite this projected increase, Kuwait’s debt levels are anticipated to stay manageable, underpinned by its substantial financial reserves.

Kuwait’s economic forecasts are particularly sensitive to fluctuations in oil prices and production levels. The country’s budget outcomes could dramatically shift with changes in these factors. Moreover, Kuwait’s governance, influenced by its political stability and regulatory quality, plays a crucial role in its ESG (Environmental, Social, and Governance) scoring, highlighting the importance of governance in its overall rating.

Rating outlook and sensitivities

Fitch’s analysis outlines both negative and positive rating sensitivities. Factors that could lead to a downgrade include sustained fiscal pressures and significant deterioration in fiscal and external positions.

Conversely, evidence of effective long-term fiscal management and transparent government funding strategies could result in a positive rating action. The final rating reflects adjustments for structural and public finance challenges, underscoring the complexity of Kuwait’s economic and political landscape.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Total income was higher by 10% year-on-year (YoY) at AED 300 million in the six-month period

United Arab Bank PJSC (UAB or “the Bank”) has announced its financial results for the six months ended 30th June 2024. UAB reported a net profit before tax of AED 152 million for H1 2024, a 26% increase compared to AED 121 million for H1 2023. The net profit after tax for H1 2024 stood at AED 139 million, up 15% from AED 121 million in the same period last year. Earnings per share rose to AED 0.07 in H1 2024 from AED 0.06 in H1 2023.

Total income increased by 10% year-on-year to AED 300 million for H1 2024, compared to AED 273 million for H1 2023, driven by a 26% increase in net interest income. The Bank’s capital position remains strong with a CET1 ratio of 13% and a total capital adequacy ratio (CAR) of 18%.

UAB‘s liquidity profile is robust, with advances to stable resources ratio of 75% and an eligible liquid asset ratio of 19%, both comfortably above regulatory thresholds. The Bank’s credit ratings were affirmed by Fitch and Moody’s at BBB+/Ba1, with stable and positive outlooks respectively.

UAB’s performance in the first half of 2024 demonstrates significant growth in total assets, increasing by 12% compared to December 2023, and reflects a strategic focus on quality and farsighted risk management. These results indicate that the Bank is well-positioned to continue its growth trajectory.

Commenting on the Bank’s performance, H.H. Sheikh Mohammed bin Faisal bin Sultan Al Qassimi, Chairman of the Board of Directors of United Arab Bank, said: “UAB’s strong performance in the first half of 2024 reflects the successful implementation of our growth strategy and reinforces our commitment to delivering sustainable value to our shareholders. We are confident that our prudent business model shall continue to deliver a solid performance and deal with the opportunities and challenges that will present themselves.”

He added: “As we move ahead into the second half of the year, we remain committed to enhancing our customers’ banking experience and contributing to the growth and prosperity of the UAE’s economy.

Shirish Bhide, Chief Executive Officer of United Arab Bank, commented: Our customer-centric approach and sustainable growth model has led to a 15% increase in net profit and a 12% growth in total assets. Our positive performance is a testament to the successful execution of our strategic priorities and clear evidence of the success of the many initiatives that have been implemented at the Bank. Going forward, we will continue investing in our growth strategy and digital capabilities, while equally focusing on developing innovative products and services that meet our customers aspirations whilst upholding the highest standards of compliance and internal controls.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual