In Istanbul’s Grand Bazaar, Demand for Gold and Dollars Soars

Turks are pouring money into foreign currency, jewellery and other assets as the lira weakens

ISTANBUL—Deep in the stone warren of Istanbul’s 560-year-old Grand Bazaar, a cluster of traders selling gold and dollars pace the alleyway, murmuring into phones and smoking. The tension rises as demand grows. A shout comes from the crowd: “I’ve got it ready!”

Turks are pouring money into foreign currency, gold, cryptocurrency, jewellery and other assets that they see as a safer bet than the Turkish lira, which has lost more than 80% of its value in the past five years.

“There’s an atmosphere of panic,” said Mustafa Demiray, 39, a currency trader standing on the edge of the crowd and clutching two phones. “People think the price [for dollars] will go up, so there’s a higher demand right now.”

The collapse of the lira is the result of an era of economic mismanagement by Turkish President Recep Tayyip Erdogan, economists say. The Turkish leader in recent years has pressured the central bank into cutting interest rates despite the country’s high rate of inflation—the opposite of what central banks would usually do.

Erdogan has attempted to adjust course since winning a close election in May in which his opponents attacked him over Turks’ purchasing power, with many people cutting back on meat, fish and even vegetables.

The country’s newly appointed central-bank governor, Hafize Gaye Erkan, and Finance Minister Mehmet Simsek have raised interest rates, but too slowly to get inflation under control, analysts say.

The Turkish lira continued to slide after the central bank’s July meeting, in which officials decided to raise interest rates by a mere 2.5 percentage points, a move that slowed the pace of the rate increases and put the lira under further pressure. The decision disappointed some economists and investors who hoped Simsek and Erkan would be more aggressive about tackling inflation.

Erkan on July 27 raised the bank’s year-end inflation forecast to 58% from 22.3%, while predicting that price increases would slow next year. Analysts said the upward revision was an acknowledgment that the bank’s current stance was unlikely to tame inflation, which is running at 38%.

Erkan said the bank would lift rates further, and would adopt a holistic approach to tackling inflation, including using other policy instruments such as quantitative tightening.

Investors and analysts are concerned that Erkan and Simsek don’t have a genuine mandate from Erdogan to do what is needed to stabilize the Turkish economy. Erkan pushed back on those questions on July 27.

“The central bank of the Republic of Turkey is an independent institution,” she said. “We will continue the increases in interest rates alongside the quantitative tightening alongside the selective credit tightening because that’s what the current situation demands.”

Turkey’s economic turmoil has put pressure on the traders at the Bazaar, who have played a central role in the economy since the vast covered marketplace was built during the days of the Ottoman Empire, more than five centuries ago. The small and midsize shops in the Bazaar are part of a sprawling global network of businesses and banks dealing in gold and currency.

Mehmet Akif Turker, a 44-year-old gold trader, sat in his office at the Bazaar on a recent morning, his phone and two slabs of gold on the desk in front of him. The high demand for gold should be good for his business, he explained, but the turmoil in the Turkish economy isn’t.

Turks and other traders must contend with a complex web of rules imposed by the government in recent years to scare up foreign currency and keep the country from tipping into insolvency. Those include a rule that forces businesses like Turker’s to convert 40% of their foreign-currency earnings into lira, traders say.

“In general, in our line of work, crisis makes money,” Turker said. “But when the dollar fluctuates so much and the market is so unstable, it can bring us profit or it can bring us losses. We are exhausted.”

Despite the government’s efforts to bring gold and other assets out from “under the mattresses” of the country’s citizens and into the financial system, Turks continue to pour money into precious metals, traders say. Industry groups estimate that between $200 billion and $300 billion worth of gold is in Turkish citizens’ private possession.

“We are a country that loves gold as a financial instrument,” said Ercan Doner, 39, who owns a shop selling gold coins and jewellery. “In order to stop their money from melting away in case of inflation, people are trying to make use of their gold investments by continuously buying and selling.”

Volatility in the economy isn’t the only driver of gold sales, vendors say. The pandemic also increased business, said Metin Kocatepe, 54, a salesman from another jewellery shop.

“After corona, people’s mentality changed. They’re more relaxed in their shopping. They say ‘maybe tomorrow I’m gonna die, I’ll buy something nice.’”

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

The U.S. dollar faces growing pressure in 2026 as expected interest rate cuts, geopolitical tensions, and shifting global capital flows reshape currency markets—while the euro, sterling, and yen take center stage in an increasingly fragmented FX landscape.

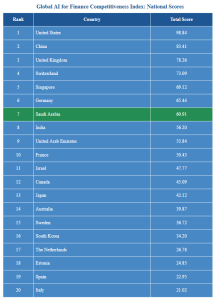

Saudi Arabia ranked 7th globally in the GAICI, emerging as the Gulf’s fastest-scaling AI-for-finance market, with Riyadh positioning itself as a regional hub for AI-driven financial services.

Saudi Arabia has been ranked 7th in the Global AI for Finance Competitiveness Index (GAICI), which was released today by Deep Knowledge Group with the Hong Kong Financial Services Development Council (FSDC) serving as an observer.

The index provides a benchmark analyzing AI competitiveness from a finance, economy and financial services perspective. It combines a global landscape overview of AI adoption in finance with an indicator-based competitiveness index that ranks 20 countries and 15 city-level finance hubs on AI-for-Finance capability and maturity.

Saudi Arabia has emerged as the Gulf’s fastest-scaling contender in AI-enabled finance, securing a remarkable 7th place globally in the index. This achievement underscores the country’s ambitious drive to integrate AI within its financial systems, fueled by state-led investments and a strategic focus on modernizing its financial infrastructure. While not yet a mature global finance hub, Saudi Arabia is quickly building the capabilities to become a key player in AI for finance. The nation’s rapid AI adoption is propelled by its institutional commitment and capital investment, positioning it as a major force in shaping the future of finance in the Gulf region.

At the heart of this transformation is Riyadh, which is fast becoming a central hub for AI-driven finance in the region. Leveraging substantial state-backed capital and a growing institutional framework, Riyadh is creating the infrastructure necessary for large-scale AI deployment across the financial services sector. From AI-enabled risk management systems to portfolio analytics, Saudi Arabia is prioritizing the development of tools that meet the demanding standards of regulated finance environments. The country’s rapid progress can be attributed to a combination of national-scale digitization programs and targeted initiatives that drive innovation while ensuring the resilience and security of financial systems.

Saudi Arabia’s AI-for-finance story is one of transformation through institutional commitment and high-impact investments. The Kingdom’s focus on building out a robust ecosystem for AI deployment, coupled with its massive capital investments, makes it a formidable competitor in the global race for AI-driven financial competitiveness. With its vast ambitions and capacity for acceleration, Saudi Arabia is carving a unique path that differentiates it from other financial hubs. While it continues to build a sustainable ecosystem of AI vendors and financial technology startups, the country is poised to become a major player in the global AI finance landscape, offering innovative solutions for risk modeling, regulatory compliance, and more.

“Saudi Arabia’s rapid scaling in AI-driven finance is a testament to its strategic vision and ability to turn ambition into action,” said Dmitry Kaminskiy, General Partner of Deep Knowledge Group. “The Kingdom’s strong institutional backing and focus on infrastructure development are setting the stage for long-term success. Prioritizing AI adoption in critical financial services, Saudi Arabia is positioning itself to become an essential player in the global AI finance ecosystem.”

The index is led by the United States (98.84) and China (83.41), followed by the United Kingdom (78.26) and Switzerland (73.09), with Singapore (69.12) next. The leaders are not defined by a single strength, but by multi-pillar performance that supports production-grade AI in finance—including deployment readiness, institutional capacity, and ecosystem breadth. The U.S. leads with large-scale capability across AI, capital markets, and financial services adoption. China ranks second on the strength of ecosystem scale and rapid implementation dynamics in AI-enabled financial services. The U.K. and Switzerland follow as high-performing financial centers where strong institutional environments and finance-grade expectations—governance, accountability, and risk discipline—support consistent AI adoption. Singapore rounds out the top tier, reflecting strong ecosystem coordination and high deployment readiness relative to its size.

“The leaders in this index are not simply ‘AI-strong’; they are strong at converting AI capacity into deployed financial systems—where governance, resilience, and market integrity are non-negotiable,” Kaminskiy continued.

Meanwhile, city-hub ranking places New York (99) and London (81) first and second, with Hong Kong (76) third—reflecting their combined advantages in market connectivity, institutional concentration, and capital formation for AI-enabled financial activity. The next positions—San Francisco (70) and Shanghai (67)—reflect the interaction between AI capability and financial-market pull. Mid-table hubs (e.g., Toronto, Singapore, Tokyo, Chicago, Riyadh) typically show strengths in one or two dimensions but less complete end-to-end breadth. Lower-ranked hubs are often constrained by thinner ecosystem density, fewer scalable deployment pathways into regulated institutions, or weaker global market connectivity. Moving up the ranking generally requires (i) strengthening capital-formation and listing pathways, (ii) expanding production-grade adoption mechanisms across regulated institutions, and (iii) increasing ecosystem breadth so that AI capabilities translate into repeatable, auditable deployments rather than isolated pilots.

Dr. King Au, Executive Director of the FSDC, remarked, “Hong Kong’s ranking among leading global finance hubs reflects the city’s excellent market connectivity and top-notch institutional quality—two conditions that matter when AI for finance must operate under finance-grade expectations.”

Dr. Patrick Glauner, Professor of AI at Deggendorf Institute of Technology, a co-author of the report, noted, “In finance, competitive advantage comes from trustworthy AI—models that are explainable, auditable, and robust under real-world constraints. The index makes clear that deployment quality matters as much as innovation.”

Additional Key Findings

- AI for finance is shifting from novelty to infrastructure: competitive advantage now reflects repeatable deployment in regulated workflows.

- Top-ranked countries pair ecosystem scale with execution capacity: strong performance typically requires strength across multiple pillars, not one-off advantages.

- The hub ranking underscores concentration: AI-for-finance activity clusters in a limited set of global financial centers with strong market infrastructure.

- Model governance and assurance are central: monitoring, auditability, and operational resilience are becoming baseline expectations.

- Data exchange and interoperability remain most common bottlenecks in mid-tier markets.

- Strategic takeaway: the next phase of competition is about institutionalization—turning tools into operating systems.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

Sharjah Islamic Bank closed 2025 with a strong financial performance, posting a net profit of AED 1.32 billion, up 26% year on year. Growth was driven by solid expansion across core activities, higher income from Islamic financing and sukuk, and a steady increase in customer deposits. The Bank maintained strong liquidity and proposed a higher cash dividend, reflecting its focus on sustainable growth, income stability, and long-term value for shareholders.

Sharjah Islamic Bank delivered a strong financial and operational performance during 2025, supported by balanced growth across its core activities. Net profit after tax reached AED1.32 billion, representing an increase of 26% compared to AED1.05 billion recorded in 2024.

Income from Islamic financing investments and sukuk increased by AED175.0 million, representing a growth rate of 4.7%, reaching approximately AED3.9 billion in 2025, compared to AED3.7 billion in the previous year.

Meanwhile, distributions to depositors and sukuk holders amounted to AED2.3 billion, compared to AED2.2 billion in 2024. This reflects the Bank’s ability to maintain a sustainable balance between financing growth and fair Shariah-compliant returns, while preserving income stability despite fluctuations in funding costs and competitive pricing pressures.

Customer deposits reached AED55.7 billion, compared to AED51.8 billion at the end of 2024, resulting in a financing-to-deposit ratio of 81.8%, compared to 73.6% in the previous year. The Bank also maintained strong liquidity levels of 22.3% of total assets, amounting to AED20.2 billion, compared to 21.6% at the end of the previous year.

In line with its commitment to delivering sustainable shareholder returns, the Board of Directors proposed an increase in cash dividend distribution to 20%, compared to 15% in the previous year, subject to shareholders’ approval at the upcoming General Assembly.

The Board also approved a proposal to increase the Bank’s capital, subject to regulatory approvals and shareholders’ consent. This capital increase will provide existing shareholders with the opportunity to subscribe to new shares, strengthen the Bank’s capital base, support future growth plans, ensure ongoing compliance with regulatory requirements, and deliver sustainable long-term returns to shareholders.

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

A new study by Stitch finds that fragmented systems and outdated infrastructure are holding back financial innovation across Saudi Arabia and the UAE — even as the region’s digital banking market accelerates. With 84% of Saudi banks planning to modernize their technology within 12 months, the shift toward unified platforms is becoming a necessity, not a choice.

Stitch, the unified platform for launching and scaling financial products globally, today released a comprehensive study examining the technology infrastructure barriers constraining financial innovation across Saudi Arabia and the United Arab Emirates.

The GCC digital banking market is set to grow from USD 12.7 billion in 2025 to USD 47.6 billion by 2032, reflecting expanding opportunities across payments, lending, deposits and related services. Yet fragmented technology infrastructure and persistent reliance on legacy systems are preventing financial institutions across the GCC from capitalizing on growth prospects.

Fragmented legacy technology is leading to missed opportunities for majority financial institutions

While vendor adoption has grown with 87% of banks now relying on external platforms, this shift has not eliminated legacy systems. Instead, modern capabilities have been layered on top of older architectures, creating increasingly complex and unmanageable technology environments. In the UAE specifically, 94% of financial institutions use external vendors, the highest adoption rate in the region, yet this proliferation has increased operational complexity.

Over half of financial institutions in Saudi Arabia and the UAE report that their current technology stack has caused them to miss business opportunities. Across institution types, 70% of exchange houses and financing companies, 76% of fintechs, 50% of banks, and 45% of other financial institutions have reported that their current technology setup has caused them to miss business opportunities. This data reveals how technology infrastructure is creating disadvantages across institutions instead of accelerating innovation.

1 in 5 describe systems as outdated, thus slowing fintech innovation

Financial institutions cite slow implementation of product launches and updates, integration challenges across vendors and systems, high costs and lack of flexibility. More than one in five institutions describe their systems as outdated or difficult to upgrade.

Across the gulf, 73% of Saudi Arabian institutions and 66% of UAE institutions report being heavily dependent on third parties for product launches and updates. This dependency is most pronounced among fintechs (80%), who rely on vendor release cycles rather than internal roadmaps. Over 60% of institutions that offer lending products currently operate exclusively on legacy systems. Lending remains one of the most risk sensitive and infrastructure heavy functions within financial institutions and modernization challenges explain why vendor adoption and cloud adoption alone have not resolved challenges.

“Everyone talks about digitization and AI adoption across the sector, but the reality is that legacy and fragmented systems still sit at the heart of all institutions. They slow things down, limit progress, and drain budgets; the hidden culprit. As the MENA region continues its unprecedented progress, modern stacks and a unified operating system unlock a new dimension of opportunity and growth,” said Mohamed Oueida, Founder & CEO of Stitch.

Technology upgrades are a priority in Saudi Arabia and UAE but barriers remain

The challenges between modernization ambition and execution constraint are visible in Saudi Arabia as companies progress to meet ambitions central to Vision 2030 economic diversification goals. The Saudi Arabian digital banking market generated revenue of USD 1,094.1 million in 2025 and is expected to reach USD 3,591.9 million by 2033. Yet 84% of Saudi Arabian financial institutions plan to modernize or upgrade their technology within the next 12 months, suggesting that current infrastructure cannot support the speed and innovation the market requires. In the UAE 78% of institutions are planning modernization within the same timeframe. However, high switching costs, long term contracts, regulatory and compliance concerns, and downtime risks are constraining the transition to modern technology platforms.

GCC financial institutions are choosing to shift to homegrown unified platforms

73% of Saudi Arabian institutions and 66% of UAE institutions agree that a single unified vendor would deliver more value than managing multiple disconnected platforms. Regional decision makers increasingly view unification as essential with a focus on outcomes rather than features.

Benefits include easier management in a single place (50%), improved customer experience (52%), faster product launches (50%) and lower running and maintenance costs (42%). For exchange houses and financing companies, 65% expect easier management and 59% specifically expect faster product launches. Among fintechs and exchange houses, which report the highest rates of missed opportunities and vendor dependency, modernization commitment reaches 93%. This suggests that institutions facing the sharpest competitive pressures are the most willing to pursue substantial infrastructure change.

Unification consolidates complexity into single platforms giving product control back to enterprises and replaces fragmented legacy systems with integrated infrastructure to prioritise innovation.

Operating globally, Stitch’s clients include MENA regional leaders such as Lulu Exchange, Alamoudi Exchange, Foodics, Yanal, Raya Financing and Tanmeya Capital, which are already leveraging unified infrastructure to accelerate product launches and reduce operational complexity across the region. Stitch enables global financial institutions to launch products in under 90 days, an 80% reduction in implementation time compared to industry norms.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

Private-equity firm Paine Schwartz Partners is backing BERO, a nonalcoholic beer brand launched by British actor and “Spider-Man” star Tom Holland.

A person familiar with the transaction said it values New York-based BERO at more than $100 million and will help support the brand’s ambitious growth plans.

BERO co-founder and Chief Executive John Herman said the company aims to more than double its sales team and significantly expand distribution to roughly triple sales this year.

BERO, which Holland and Herman launched in late 2024, reached nearly $10 million in sales in its first year and expects sales to reach almost $30 million this year, said Herman, who previously served as president of C4 Energy brand drink maker Nutrabolt.

“We weren’t just looking for capital,” Herman said. “We were looking for great partners that could help us grow.”

Paine Schwartz is investing through BetterCo Holdings, a portfolio company in the firm’s sixth flagship fund that it formed late last year to hold non-control investments in better-for-you food and beverage businesses, Paine Schwartz CEO Kevin Schwartz said.

Ultimately, Schwartz said he expects BetterCo to hold five to 10 investments.

BERO, BetterCo’s third investment, falls within the firm’s typical growth investment range of $10 million to $25 million, he said.

Earlier BERO backers include leading talent agency William Morris Endeavor Entertainment and venture-capital firm Imaginary Ventures, which also participated in the latest investment.

“This first external raise is not just a milestone, but a validation of what’s been achieved in a single year,” said Logan Langberg, a partner at Imaginary Ventures.

When they started BERO, Holland and Herman tapped as brewmaster Grant Wood, a past Boston Beer executive who went on to found Revolver Brewing, now part of Tilray Brands.

The brand currently offers four types of beer, including two IPAs. Its products are sold at Target stores, on Amazon.com and at other retail locations, such as supermarket chains Sprouts Farmers Market and Wegmans Food Markets in the U.S. and Morrisons in the U.K. BERO is also available at a number of liquor stores and bars and restaurants.

The company also offers a $55 a year premium membership that offers such perks as free shipping and access to member-only products and limited-edition releases.

To help build the brand’s name, BERO has struck a series of partnerships, becoming the official nonalcoholic beer partner of luxury sports-car maker Aston Martin and fitness studio chain Barry’s.

Nonalcoholic beers, which generally contain less than 0.5% of alcohol by volume, have become increasingly popular and account for the biggest share of alcohol-free drink sales, according to the Beer Institute, a national trade association.

Sales of such drinks are growing at a more than 20% annual rate and were expected to exceed $1 billion in 2025, according to market-research firm NielsenIQ, citing so-called off-premise channel sales it tracks, such as sales at liquor stores and grocery stores. But the bulk of those sales come from the top five brands, such as Athletic Brewing, co-founded by a former trader at Steve Cohen’s hedge fund Point72 Asset Management, NielsenIQ said.

Alcohol-free drinks, the market-research firm said, have emerged as a lifestyle choice—one based not on quitting alcohol but expanding options, with most non-alcohol buyers also buying alcoholic drinks.

“There’s a pendular swing in behaviours that [is] happening right now when it comes to people’s relationship with alcohol,” Herman said.

Corrections & Amplifications undefined Nonalcoholic beer brand BERO offers its fans a premium membership for $55 a year. An earlier version of this article incorrectly said the membership costs $50. (Corrected on Jan. 20.)

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Porsche car deliveries fell 10% in 2025 as demand was hit by a slowdown in luxury spending in China and as it ceased production of its 718 Boxster and 718 Cayman models through the year.

The German luxury sports-car maker said Friday that it delivered 279,449 cars in the year, down from 310,718 in 2024.

The company had a tumultuous year as it contended with a stuttering transition to electric vehicles and a tough Chinese market, while the Trump administration’s automotive tariffs presented a further headwind.

Deliveries in its largest sales region of North America were virtually flat at 86,229, but continued challenges in China meant deliveries in the country dropped 26% to 41,938 vehicles.

Automakers have faced intense competition in China, sparking a prolonged price war as rivals cut prices to win customers, while a lengthy property market slump and economic-growth concerns in the country has also led to buyers pulling back on luxury spending.

“Key reasons for the decline remain the challenging market conditions, particularly in the luxury segment, and the very intense competition in the Chinese market, especially for all-electric models,” the company said.

Other German brands including Audi, BMW and Mercedes-Benz have all recently reported that the challenging Chinese market hit demand last year.

In Europe, Porsche deliveries fell 13% to 66,340 cars excluding its home market of Germany, while German deliveries dropped 16%.

The company cut guidance several times last year as it warned of hits from U.S. import tariffs, investments in new combustion engines and hybrid models amid the slow uptake of EVs, and the competitive situation in China.

Porsche also last year announced plans to scale back its EV ambitions and instead expand its lineup with more gas-powered and plug-in hybrid models than it had originally planned.

However, in its statement Friday, the company said it increased its share of electrified-vehicle deliveries in the year. Around 34% of vehicles delivered worldwide were electrified, an increase of 7.4 percentage points on year, with about 22% all-electric vehicles and 12% plug-in hybrids.

That leaves its global share of fully-electric vehicles at the upper end of its target range of 20% to 22% for 2025.

In Europe, for the first time in 2025, more electrified vehicles than purely combustion engine vehicles were delivered.

The Macan topped the delivery charts in the year, while the 911 reached a record high with 51,583 deliveries worldwide, it said.

Porsche said it is investing in its three-pronged powertrain strategy and will continue to respond to increasing demand for personalization requests from customers.

“We have a clear focus for 2026,” Sales and Marketing Chief Matthias Becker said. “We want to manage supply and demand in accordance with our ‘value over volume’ strategy.

\”At the same time, we are realistically planning our volume for 2026 following the end of production of the 718 and Macan with combustion engines.”

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

Interior designer Thomas Hamel on where it goes wrong in so many homes.

The U.S. dollar faces growing pressure in 2026 as expected interest rate cuts, geopolitical tensions, and shifting global capital flows reshape currency markets—while the euro, sterling, and yen take center stage in an increasingly fragmented FX landscape.

The dollar looks set to depreciate against most currencies this year as lower U.S. interest rates make it cheaper to take protection against the risk of the currency weakening, Bank of America analysts say in a note. With U.S. rate differentials set to narrow further as the Federal Reserve cuts rates, the costs of hedging U.S. assets against a weaker dollar will also fall, they say. “We see still relatively high hedging costs as one of the key hurdles that may have prevented follow-through of hedging activity (of dollar exposures) in 2025.” The Trump administration’s push to lower housing related costs could encourage further rate cuts, they say. Fed independence risks also pose a potential dollar headwind.

Trump’s Threats to Acquire Greenland Could Hurt Dollar

President Trump’s threats to take control of Greenland from Denmark poses a significant headwind to the dollar, Commerzbank’s Thu Lan Nguyen says in a note. The move risks U.S. confrontation with European allies, which would be a “disastrous signal” for the dollar, she says. “In the event of an open conflict between the U.S. and Europe, mutual sanctions would be likely, which would seriously jeopardize the dollar’s status as the world’s reserve currency.” The only way for companies trading in Europe to avoid U.S. sanctions would be to refrain from transactions in dollars altogether, she says. Moreover, direct trade between the U.S. and Europe would probably decline significantly and reduce European companies’ demand for dollars.

Demand For Potential Digital Euro Will Determine Its Impact

A digital euro could be launched by 2029 but there are risks of demand being either too weak or too strong, Capital Economics economist Andrew Kenningham says in a note. “Weak demand would limit its scope to reduce Europe’s dependence on U.S. payments systems.” Strong demand could lead to a destabilizing shift in deposits away from the banking system, although proposed caps on individual holdings should mitigate this risk, he says. While a digital euro would be a major innovation and change in the eurozone payments architecture, it wouldn’t eliminate risks from growth of the U.S. stable coin market, he says. Policymakers have suggested dollar-denominated stable coins could be attractive to European households, potentially reducing demand for euros relative to dollars.

Sterling Could Rise as Long-Term Yields Fall on Reduced Fiscal Concerns

Sterling is likely to strengthen this year as long-term U.K. government yields fall on reduced fiscal concerns since November’s U.K. budget, Bank of America analysts say in a note. Rising term premium, the extra compensation investors demand for holding long-term gilts, was the “Achilles Heel” for sterling in 2025 as markets become more sensitive to fiscal risks, they say. Term premium has fallen since the budget and in turn propelled sterling higher. Sterling could receive further support if the U.K improves relations with the EU as this would remove some of the structural headwinds to the economy, the analysts say. Sterling rises 0.2% to $1.3407. The euro falls 0.1% to 0.8663 pounds.

Dollar’s Dominance Remains Intact

Fears of the dollar losing its dominance look overdone as there is little evidence of de-dollarization, Payden & Rygel economist Jeffrey Cleveland says in a note. “Foreign demand for U.S. assets— including Treasurys, corporates, and equities—remains strong,” he says. The dollar’s movements have been driven largely by shifting interest-rate and growth expectations as opposed to foreign selling or a collapse in confidence, he says. As long as U.S. productivity growth remains strong, the case for U.S. exceptionalism remains intact, he says. The DXY dollar index trades flat at 99.285.

U.K. Growth Data Look Positive For Sterling

Thursday’s better-than-expected economic growth data for November provide a positive sign for sterling even if the economy continues to face challenges, Commerzbank’s Michael Pfister says in a note. The data showed the economy grew 0.3% in November. Despite concerns about fiscal tightening in the November budget, the economy recorded solid growth, Pfister says. Worries about a recession and more significant interest-rate cuts were therefore probably premature, he says. “But it is also clear that monthly growth figures are just one data release.” Labor market and inflation figures are due next week with the latter particularly decisive for sterling’s performance in coming weeks, he says. Sterling rises 0.2% to $1.3402. The euro falls 0.2% to 0.8661 pounds.

Yen Interventions Might Not Happen Before BOJ Meeting

Japanese authorities might show some reservation to follow through on threats for yen interventions before the Bank of Japan’s January 23 policy decision, MUFG Bank’s Derek Halpenny says in a note. BOJ Governor Kazuo Ueda is likely to maintain a cautious stance on raising interest rates further, he says. This caution is one factor that risks the failure of potential interventions to shore up the yen. Other factors include Prime Minister Sanae Takaichi’s plans for a snap election and Federal Reserve officials signaling a pause in rate cuts. If the BOJ shows a clearer opposition to yen depreciation and signals an earlier rate rise, interventions could prove more successful, he says. The dollar falls 0.3% to 158.10 yen. (renae.dyer@wsj.com)

Euro in Favor as Funding Currency in Carry Trades

The euro is being favored as a funding currency in carry trades, where investors borrow in low interest-rate currencies to invest in higher-yielding ones, ING’s Chris Turner says in a note. The euro looks range-bound versus the dollar and one-month implied volatility for the exchange rate—a measure of expected price swings—continues to languish near 5%, LSEG data show. This encourages investors to fund carry trades out of the euro to invest in higher-yielding emerging-market currencies, Turner says. The euro could be considered less risky than funding out of the yen, where one-month dollar-yen implied volatility is 8.5% and the Bank of Japan could use interventions to shore up its currency.

Dollar Rally Loses Steam as Japanese Yen Recovers

The dollar pulls back slightly after reaching a six-week high Thursday as the Japanese yen strengthens on the prospect of interventions to prop up the currency. Japan’s Finance Minister Satsuki Katayama said Friday the country wouldn’t rule out any options to counter the yen’s recent sharp falls. The yen’s recent weakness follows news Prime Minister Sanae Takaichi, who favors loose monetary and fiscal policies, will call a snap election to strengthen her grip on power. The DXY dollar index trades marginally lower at 99.307 after hitting a high of 99.492 Thursday when the Philadelphia Fed and Empire manufacturing surveys exceeded expectations and weekly jobless claims data were lower than forecast.

Yen Strengthens After Warning From Japan’s Finance Minister

The yen strengthens against other G-10 and Asian currencies after Japanese Finance Minister Katayama said Friday that the government is ready to take action against any excessive yen movements, as the currency weakens toward levels that may trigger intervention. However, “intervention risks would be more pronounced if JPY volatility remains elevated, which could necessitate action by the Japanese authorities to preserve credibility,” DBS Group Research’s Chang Wei Liang said, before Katayama’s latest remarks. “Given the elevated political uncertainty and possible policy shifts, JPY weakness could linger for now,” the FX & credit strategist said in commentary. USD/JPY is down 0.3% at 158.20, LSEG data show.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

Infobip strengthens its leadership team with a series of internal promotions effective January 2026, reinforcing its growth and innovation strategy. The appointments support the company’s transition toward an AI-first model, enhanced revenue performance, stronger alliances, and streamlined operations as Infobip marks 20 years of innovation and global expansion.

Global cloud communications platform Infobip, today announced a series of key leadership changes, effective 1 January 2026, supporting the company’s rapid growth and innovation agenda. These appointments promote experienced leaders from within the company, reflecting Infobip’s commitment to nurture internal talent and aligning leadership with strategic goals to deliver greater value to customers and partners.

Krešo Žmak has been appointed as Chief Innovation Officer (CINO), a new position in which he will lead company-wide change initiatives ensuring that innovation efforts are tightly aligned with business goals. As AI is the driving force of innovation, a big focus will be on enabling and accelerating AI adoption across Infobip’s product portfolio and steering the organization’s broader transformation into an AI-first company.

Ante Pamuković has been named Chief Revenue Officer (CRO). In his new role as CRO, Ante Pamuković is the strategic architect for revenue driving sustainable growth through global alignment, innovation, and operational excellence. One of the key priorities will be leveraging automation through AI and Go-To-Market strategies to enhance the value and experience delivered to Infobip’s customers worldwide.

In addition, Veselin Vuković is joining the Board of Directors as Chief Alliances Officer. Veselin, who joined Infobip in 2010, has been Chief Alliances Officer since January 2025 and now takes on responsibilities as new Board member overseeing Infobip’s business operations and is responsible for approving key governance, strategic, and operational decisions.

Furthermore, Igor Dvoršak has been promoted to Senior Vice President of Operations, overseeing all VP General Managers to streamline organizational structure and enhancing regional coordination. Igor also takes responsibility for Strategy Development and Market Intelligence, enabling a more integrated approach to leveraging insights that drive operational excellence and support for regional teams.

Silvio Kutić, CEO and founder of Infobip, said: “By appointing these senior executives from within the company, we are strengthening our leadership framework to seize the opportunities ahead. Having grown with Infobip for many years, these leaders embody our company’s journey. This year, we celebrate our 20th anniversary, marking two decades of innovation and growth. To support our long-term strategy and maintain our lead, we must be prepared to continually restart and evolve, consistently adapting to the needs of our customers and the market.”

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Announced at the Future Minerals Forum in Riyadh, the strategic partnership sees Thara Future Investments acquire an equity stake in Golden Compass, supporting its expansion into a fully integrated national mining services champion. The move will drive investment in infrastructure, digitalization, advanced labs, and national talent, reinforcing mining as a key pillar of Saudi Arabia’s economic diversification under Vision 2030.

Golden Compass for Mining Services, one of Saudi Arabia’s leading providers of mining services and geological consultancy, jointly owned by Naif Alrajhi Investment and Rasi Investment, has announced the signing of a strategic partnership agreement with Thara Future Investments, marking a significant step toward building a fully integrated national mining services champion in the Kingdom. Under the agreement, Thara Future Investments will acquire a strategic equity stake in Golden Compass, supporting the company’s next phase of growth and long-term value creation.

The partnership was announced during the fifth edition of the Future Minerals Forum, held in Riyadh from January 13 to 15. It reflects the partners’ shared commitment to advancing Saudi Arabia’s mining sector as a core pillar of the national economy and a key contributor to industrial development and diversification.

In light of this strategic partnership, Golden Compass plans to implement an ambitious expansion strategy aimed at strengthening its leadership position in the mining sector. The plan includes investments in infrastructure, the enhancement of human capital, digitalization, and the further development of the company’s service portfolio.

The strategy also encompasses the expansion of drilling rigs, the establishment of a specialized data center, and the development of a state-of-the-art geochemical laboratory in partnership with the world’s leading analytical services provider, in line with the highest international standards.

In addition, the plan includes expanding the heavy equipment fleet and investing in the training of specialized national talent, reinforcing Golden Compass’s position as a national partner contributing to the advancement and alignment of the Kingdom’s mining sector strategy.

Naif bin Saleh Alrajhi, Chairman and CEO of Naif Alrajhi Investment Group, said the agreement represents a strategic step that reflects the Group’s commitment to supporting the national economy through investment in the mining sector. He described mining as the third pillar of the Saudi economy and a key driver for economic diversification and local content development, in line with Vision 2030.

He added: “This partnership will contribute to building a leading national mining entity that strengthens governance and investment frameworks while enables expansion into high-value projects within this promising sector.”

Eng. Meshary Al-Ali, Chairman of Rasi Investment and Founder & CEO of Golden Compass and, said the entry of Thara Future Investments as a strategic partner reflects strong confidence in the company’s expansion plans and long-term strategy.

“This partnership will enhance Golden Compass’ operational capabilities enabling the delivery of fully integrated services across the mining value chain, from exploration, drilling, to operations, while opening new opportunities for innovation and improving operational efficiency in support of sustainable sector development,” he said.

Al-Ali reaffirmed the company’s commitment to advancing its operational ecosystem and building highly qualified national talent capable of delivering world-class services, supporting Saudi Arabia’s ambition to become a regional (super region) and global mining hub.

Hisham Mohammed Attar, Co-founder and managing partner of Thara Future Investments, said: “Golden Compass possesses advanced capabilities that enable the delivery of a wide range of essential support services for mining operations. This partnership forms part of our broader growth and expansion strategy within the mining sector.”

The partnership comes 11 years after the founding of Golden Compass, during which the company has delivered numerous government projects and initiatives under the strategy of the mining sector partnering with the Ministry of Industry and Mineral Resources and the Saudi Geological Survey.

Since its establishment in 2015 as a specialized drilling and geological mining consultancy, Golden Compass has operated in six countries and secured strategic partnerships that have accelerated its growth and transformation.

Today, the company is positioned as a fully integrated mining services provider in Saudi Arabia, supported by outstanding operational capabilities and a comprehensive service offering.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

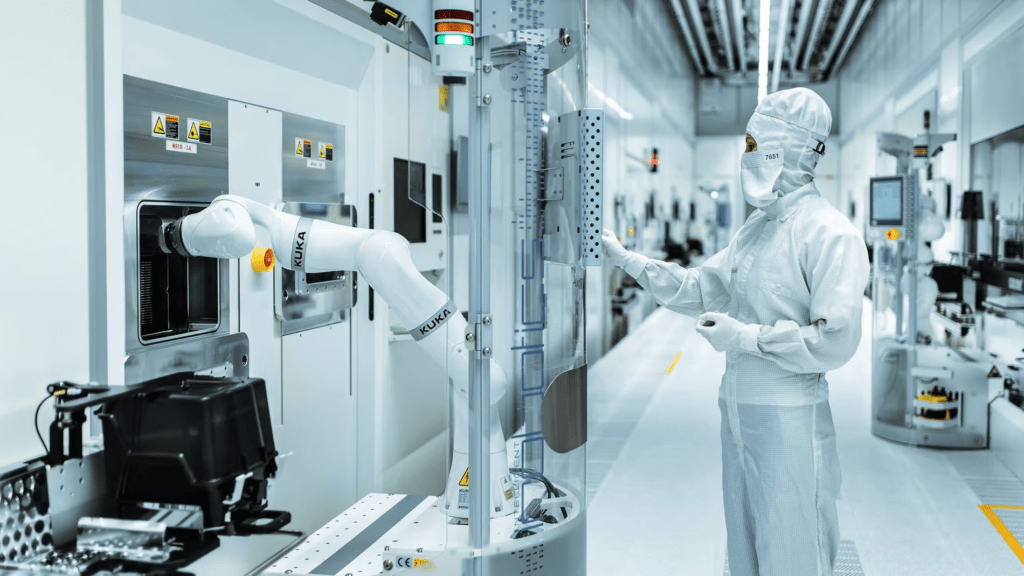

Taiwan Semiconductor Manufacturing Company (TSMC) is set to report earnings this week with investor expectations elevated, as strong AI-driven demand continues to underpin share performance. Analysts say margin expansion, heavy investment in advanced chip capacity, and progress on next-generation technologies will be key areas of focus, reinforcing TSMC’s role as a central beneficiary of the global AI boom.

Taiwan Semiconductor Manufacturing Company (TSMC) is set to report its latest earnings this week, with investor expectations running high as the world’s largest contract chipmaker remains firmly at the center of the global AI boom.

TSMC shares are already up around 8% so far in 2026, building on a rally that has seen the stock more than triple over the past three years. That surge has been driven by relentless demand for advanced chips used in AI data centers, reinforcing the company’s critical role in powering next-generation technologies.

“Forecasts point to December-quarter revenue rising by roughly 18% year-on-year, with operating margins expected to push above 50%, the highest level in around three years,” said Sam North, Market Analyst at eToro. “While top-line growth is starting to slow, margin expansion is the key story. It shows TSMC is not just growing, but doing so profitably, despite heavy investment in new capacity.”

TSMC is currently in the midst of one of the largest investment cycles in its history, with capital expenditure expected to exceed USD 150 billion over the next three years. While the scale of that spending is significant, markets have largely welcomed the move.

“Demand for cutting-edge chips is stretching capacity, and this looks structural rather than cyclical,” North added. “That’s why scale matters. TSMC is ramping up its next-generation 2nm technology, and expectations are that this node could scale quickly and become a meaningful contributor to revenue as soon as next year.”

Beyond the headline earnings figures, investor attention is likely to focus on management guidance, particularly commentary around 2026 revenue growth, margins, and capital expenditure.

“If TSMC can show it is executing steadily while scaling advanced nodes, investors are likely to be impressed,” North said. “The bottom line is that TSMC remains one of the clearest ways investors are choosing to express long-term confidence in artificial intelligence.”

Many of the most-important events have slipped from our collective memories. But their impacts live on.

Heightened geopolitical tensions have reinforced the US dollar’s role as a safe haven, lifting both the greenback and gold, while Latin American currencies outperformed despite regional uncertainty, according to Ebury, as markets now turn their focus to this week’s critical US inflation data.

The US dollar confirms that it remains a safe haven for investors worried at times of global conflict. Maduro’s capture, US seizure of unregistered oil tankers, Trump’s threats on Denmark and the Iranian protests all contributed to a sense of anxiety and the dollar rallied against its peers, as did gold. The December payroll report on Friday had little impact on markets, other than confirming that we are unlikely to see a Fed cut later this month. Notable outperformance came from Latin American currencies, in spite of the Venezuela crisis, once again showing that the world increasingly views the region as relatively isolated from global turmoil.

Enrique Díaz-Álvarez, Chief Economist at Ebury said: “Next week, markets will focus on the critical US CPI inflation report for December, which releases on Tuesday. Because the previous month’s report was plagued by insufficient data due to the federal shutdown, this week’s number packs twice as much information as usual. While data from the Eurozone will be sparse, significant November economic data, particularly monthly GDP growth, is due on Thursday. In addition, we expect unpredictable geopolitical developments on a number of fronts.”

GBP

The December PMI indices revised business activity lower, and the tone of UK data released last week was generally downbeat. As a result, Sterling underperformed somewhat most other European currencies, particularly the Euro. Nevertheless, traders continue to pare their bets on Bank of England cuts, and now expect less than two full 25bp moves in 2026. Relatively high rates should continue to support the pound.

EUR

Germany’s troubled industrial sector saw some genuinely hopeful reports last week. November industrial production surprised to the upside. Even more surprising was a blowout number for factory orders, which bodes well for future activity and may signal that the impact from the massive fiscal stimulus and defense spending package is finally starting to be felt. With inflation seemingly under control, the ECB is in a good place to keep rates steady throughout 2026. The progressive closing of the interest rate gap with the US and positive economic news should support the common currency over the next few weeks.

USD

The December employment report did not change in the least the narrative about the US labor market: steady growth and a low fire, low hire labor market. The most hopeful data point was a tick down in the unemployment rate. This confirms that this unusual economy is nowhere near a traditional recession. This week’s inflation data is perhaps the most important report in months. Much of the consensus around the path of Federal Reserve cuts has been built on the expectations that inflation is headed down, however gently, and needs to be confirmed by this week’s data.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

Saudi Arabia’s move to fully open its equity market—by abolishing the QFI framework from February 2026—marks a major shift in capital market policy, boosting Tadawul sentiment, improving liquidity prospects, and positioning the Kingdom as a stronger long-term investment destination aligned with Vision 2030.

Saudi Arabia’s decision to fully open its main equity market to all foreign investors represents a structural inflection point in the Kingdom’s capital markets. By abolishing the Qualified Foreign Investor (QFI) framework effective February 1, 2026, the Capital Market Authority is removing a long-standing gatekeeping mechanism that limited direct participation to large, institutionally vetted investors. The regulatory shift materially lowers barriers to entry, expanding the potential investor base to include smaller asset managers, hedge funds, and family offices, and aligning Saudi Arabia more closely with open-market norms in developed financial systems.

The immediate positive reaction in the Tadawul All Share Index , which rose 1.60% to 10,455.14, underscores market expectations that increased foreign participation will translate into improved liquidity, tighter spreads, and more efficient price discovery. This rebound is notable given the market’s more than 13% decline in the last year, suggesting that investors view the reform not as a symbolic gesture but as a meaningful catalyst for re-rating. Enhanced liquidity is particularly critical as the government advances a substantial pipeline of privatizations and capital-intensive Vision 2030 projects, which will require sustained access to deep and diversified pools of capital.

From a strategic perspective, the move intensifies competition with the UAE for regional financial primacy. While Emirati markets have historically benefited from more permissive foreign ownership regimes, Saudi Arabia is now offering sectoral breadth, and direct exposure to one of the fastest-growing large economies outside the oil sector. Sectorally, banks, construction firms, and materials producers are positioned to benefit most in the near term, reflecting foreign investors’ likely focus on credit expansion and infrastructure-led growth. Overall, the policy shift signals Saudi Arabia’s intent to embed its equity market more firmly within the global financial system, reducing structural frictions and enhancing its appeal as a long-term investment destination.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Four Winds Saudi Arabia Limited has announced its official membership in the Saudi–French Business Council, marking a key milestone in its international expansion strategy. The move strengthens commercial and logistics cooperation between Saudi Arabia and France, supporting Saudi Vision 2030 and reinforcing the Kingdom’s position as a growing global logistics hub.

Four Winds Saudi Arabia Limited, a leader in comprehensive and integrated moving and logistics services since 1979, announced today that it has officially obtained membership in the Saudi–French Business Council (CAFS). This milestone comes as part of the company’s ambitious strategy to expand its international partnerships and unlock new opportunities for commercial and logistics cooperation between the Kingdom of Saudi Arabia and France.

Through its membership in the Saudi–French Business Council, Four Winds Saudi Arabia Limited will play an active role in strengthening economic ties between the two countries’ business communities by delivering world-class logistics solutions that support bilateral trade and investment.

Nizar Al Mani, CEO of Four Winds Saudi Arabia Limited, said: “We are honored to join the Saudi–French Business Council, one of the leading platforms driving bilateral economic growth. This step underscores our commitment to supporting the goals of Saudi Vision 2030 by strengthening the Kingdom’s role as a global logistics hub—enhancing trade flows and streamlining supply chains between the Saudi market and European markets, particularly France.”

This new membership will enable Four Winds Saudi Arabia Limited to participate in economic meetings and forums organized by the Saudi–French Business Council, while collaborating with leading French companies in transportation, warehousing, and supply chain management. These engagements will facilitate knowledge transfer and support the localization of international best practices within the Saudi logistics sector.

Established in 2003 under the umbrella of the Federation of Saudi Chambers, the Saudi–French Business Council is a leading economic platform dedicated to strengthening trade and investment relations between Saudi Arabia and France. The Council facilitates engagement between the business communities of both countries, organizes economic forums to promote investment opportunities, and works to address challenges faced by investors and companies in both markets.

Established in 1979, Four Winds Saudi Arabia Limited, a Saudi leader in comprehensive and integrated moving and logistics services, has become a cornerstone in the moving and logistics sector, offering comprehensive and integrated services. With over four decades of expertise, the company has earned a distinguished reputation as one of the most trusted providers in the Kingdom of Saudi Arabia and Bahrain. Its partnerships and robust relations with leading international organizations—including IATA, FIATA, IAM, and FIDI—underscores its dedication to quality and customer satisfaction.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

Saudi Arabia’s non-oil private sector stayed in growth territory in December, despite a slowdown in momentum. The Riyad Bank PMI eased to 57.4 from 58.5 in November, remaining above its long-term average and signaling continued resilience amid softer new order growth and rising cost pressures.

Saudi Arabia’s non-oil private business sector remained firmly in growth territory in December although the pace of expansion eased to its slowest in four months, and new order growth continued to decelerate, a survey showed on Monday.

The seasonally adjusted Riyad Bank Saudi Arabia Purchasing Managers’ Index (PMI) fell to 57.4 in December from 58.5 in November, indicating a cooling of growth for the second consecutive month. Despite the slowdown, the headline PMI reading was slightly stronger than its long-run average of 56.9.

PMI readings above 50.0 indicate growth in activity, while those below point to contraction.

Output levels across non-oil businesses rose sharply, driven by increased new business, ongoing projects, and heightened investment spending. However, the rate of growth was the least pronounced since August.

The new orders subindex retreated to 61.8 in December from November’s 64.6 reading but the pace of expansion was the slowest in four months. Firms cited improving economic conditions and successful marketing campaigns as key drivers but expressed concerns over market saturation.

“Export demand recorded a marginal increase for the fifth consecutive month, but the latest rise was the weakest in this sequence, suggesting that external demand remains supportive but uneven,” said Naif Al-Ghaith, Riyad Bank’s chief economist.

“Overall, demand conditions point to resilience rather than acceleration as firms navigate a more competitive environment,” he added.

Employment growth remained strong, with companies continuing to expand their workforces. However, inflationary pressures intensified, with input prices rising sharply due to higher purchase costs, leading to increased output prices.

Business confidence for the year ahead was subdued, dampened by concerns over rising market competition, with only moderate expectations for future growth.

Paine Schwartz joins BERO as a new investor as the year-old company seeks to triple sales.

Saudi Arabia’s National Debt Management Center has finalised a $13 billion, seven-year syndicated loan to help finance power, water, and public utilities projects. The transaction supports the Kingdom’s medium-term debt strategy, diversifies funding sources, and advances infrastructure development aligned with Vision 2030.

Saudi Arabia’s National Debt Management Center had finalized the arrangement of a $13 billion, seven-year syndicated loan to help finance power, water and public utilities projects.

The transaction is a part of the kingdom’s medium-term debt strategy, which aims to diversify funding sources and meet financing needs over the medium to long term.

“This transaction aims to leverage market opportunities to execute alternative government financing activities that contribute to economic growth, including the financing of development and infrastructure projects aligned with Saudi Vision 2030,” the center said in a statement. Saudi Arabia, the world’s top oil exporter, is more than halfway through its Vision 2030 blueprint for economic transformation.

The strategy, introduced by de facto ruler Crown Prince Mohammed bin Salman in 2016, calls for hundreds of billions of dollars in government investments to wean the kingdom’s economy off its dependence on hydrocarbon revenue.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

The UAE Government has issued two Federal Decree Laws regulating the Capital Markets Authority and the capital markets sector, strengthening market stability, regulatory independence, and consumer protection, while aligning with international standards to reinforce the UAE’s position as a leading global financial centre.

The UAE Government has issued a federal decree law concerning the Capital Market Authority and a federal decree law concerning the Regulation of Capital Markets, as part of the UAE’s ongoing efforts to modernise the legislative and regulatory framework governing the financial sector and enhance its stability, efficiency, and competitiveness.

The Decree Laws also further alignment of the national regulatory ecosystem with the highest international standards and reinforce the independence of the Capital Market Authority and its role in safeguarding the soundness and stability of the capital markets sector and ensuring fair competition.

The two Federal Decree Laws aim to preserve the stability and integrity of the capital markets sector and define the core mandates of the Capital Market Authority, foremost among which are regulating licensed financial activities and issuers, supervising and overseeing them in accordance with international standards, issuing regulations and standards to ensure fair and effective financial practices, supporting principles of governance, monitoring and analysing system-related risks, and developing the global standing of the UAE capital markets sector as a financial centre with a strong international reputation.

The two Federal Decree Laws seek to enhance alignment with global best practices and compliance with the requirements of international organisations concerned with the financial sector, including the International Organization of Securities Commissions, the World Bank, the International Monetary Fund, and the recommendations of the Financial Action Task Force, among other requirements that contribute to improving international assessments. Additionally, the two Decree Laws support enhanced international cooperation, facilitate mutual recognition procedures, and enable the recognition of financial products across jurisdictions.

In the area of consumer protection and financial inclusion, the two Federal Decree Laws establish an integrated framework that obliges licensed persons to enable all community segments to access appropriate financial services, in line with digital transformation and financial technology developments, while supporting sustainability and leadership in financial activities and services.

The framework also provides for national awareness programmes in cooperation with the financial sector and civil society institutions, and affirms the continuation of established positive practices, particularly those related to aligning credit facilities with client income levels and protecting clients from irresponsible practices.

The Federal Decree Law concerning the Regulation of Capital Markets introduces proactive early intervention measures to address indicators of deterioration in the financial position of licensed persons, to ensure the financial stability of financial activities and services and protect clients.

These measures include activating recovery plans, imposing additional capital and liquidity requirements, adjusting strategies and administrative and operational structures, appointing temporary committees or placing licensed persons under direct administration, taking merger, acquisition, or liquidation measures when necessary, and applying special measures where a licensed person fails to rectify its position.

Pursuant to the Decree Law, the Capital Markets Authority, in its capacity as the resolution authority, plays a central role in managing financial crises through the dismissal and appointment of management, the appointment of a temporary administrator to manage the licensed person and its assets, capital restructuring, and the implementation of rescue measures to ensure the continuity of critical activities.

With regard to administrative sanctions, the Decree Laws provide for raising administrative fines in proportion to the gravity of violations and the size of transactions, and authorise the Authority to impose proportional fines of up to ten times the profit realised by the violator or the 10 times the value of the loss avoided.

It also allows for reconciliation with violators prior to the issuance of final judicial decisions and permits the publication of sanctions on the official website of the Capital Markets Authority, thereby enhancing transparency and market discipline.

Many of the most-important events have slipped from our collective memories. But their impacts live on.

Alexandre de Betak and his wife are focusing on their most personal project yet.