RTA Announces New 1.6km-long Al Khaleej Street Tunnel

The Dubai Roads and Transport Authority (RTA) has issued a contract for the construction of a new tunnel along Al Khaleej Street.

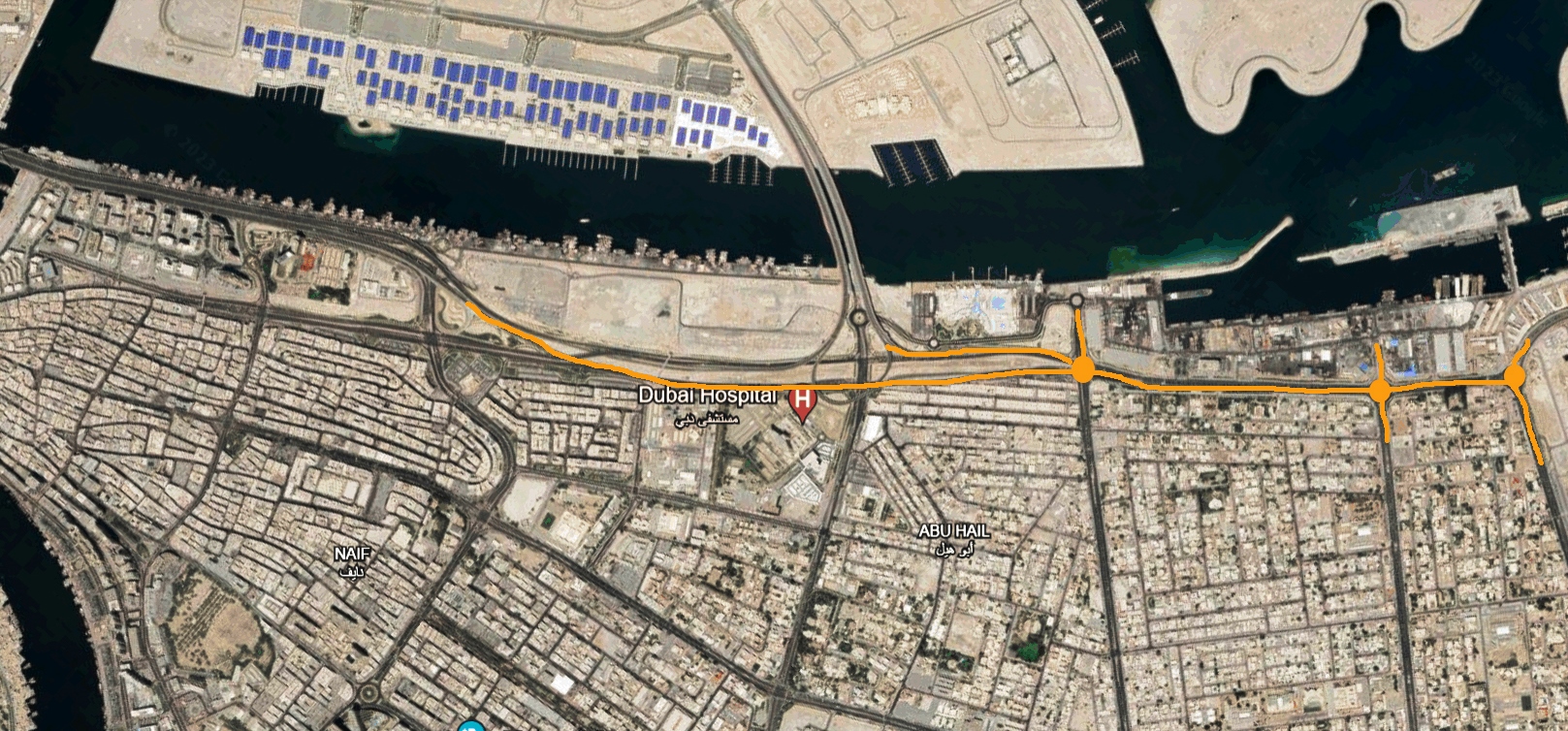

The new 1,650-metre, six-lane tunnel will span from the end of the ramp of Dubai’s Infinity Bridge in Deira to the intersection of Al Khaleej and Cairo Streets. This tunnel is a key component of the Al Shindagha Corridor Improvement Project, a large-scale initiative by Road and Transport Authority (RTA) that spans 13 kilometres. It involves enhancing Sheikh Rashid Road, Al Mina Street, Al Khaleej Street, and Cairo Street, and includes the upgrade of 15 intersections.

The project serves about one million residents and aims to reduce travel times from 104 minutes to just 16 minutes by 2030, according to Mattar Al Tayer, Director General and Chairman of RTA’s Board of Executive Directors.

New Dubai Al Khaleej Street Tunnel

The upcoming tunnel will feature three lanes in each direction, capable of handling up to 12,000 vehicles per hour, significantly easing traffic flow. It aims to provide a smoother commute from Infinity Bridge towards Deira and vice versa.

The project also includes converting the intersection of Cairo and Al Wuheida Streets from a roundabout to traffic signals, improving Cairo Street, and linking the bridge ramp from Dubai Islands to the new tunnel.

Al Tayer added the new phase “will serve the residents of Abu Hail, Al Wuheida and Al Mamzar along with development projects like Dubai Islands, Dubai Waterfront, Waterfront Market and Hamriya Port.”

Current RTA Dubai Projects

In addition to the Al Khaleej Street Tunnel, the RTA is currently enhancing Sheikh Rashid Street with a 4.8 km project. This project includes the construction of three bridges totaling 3.1 km in length to support more than 19,400 vehicles per hour.

The bridges are strategically designed to improve traffic flow across significant intersections, with the first bridge being 1.3 km long and accommodating up to 10,800 vehicles per hour. The second, at 780m, supports 5,400 vehicles per hour, and the third, measuring 985m, facilitates 3,200 vehicles per hour.

Furthermore, the project extends to upgrading 4.8 km of roadways along several streets, the construction of two pedestrian bridges, and the enhancement of infrastructure such as street lighting, drainage, and irrigation systems.

The RTA has successfully completed multiple phases of the larger Al Shindagha Corridor Improvement Project, including the opening of several bridges and intersections along Sheikh Rashid Road and connecting roads. They have also completed bridge constructions to Dubai Islands and along Al Khaleej Street.

Additionally, improvements at the Falcon Intersection have been finished, featuring two major bridges on Al Khaleej Street and supporting infrastructure to accommodate over 24,000 vehicles per hour. The ongoing work includes further tunnels and intersections as part of this expansive project.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Villa prices saw particularly strong growth, with capital values increasing by 33.4 percent year-on-year

Dubai’s real estate market showed strong performance in the second quarter of 2024, with notable increases across the residential, office, and retail sectors, according to a new ValuStrat real estate report for Q2 2024.

Villa prices experienced particularly strong growth, with capital values rising by 33.4 percent year-on-year.

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat said: “The Dubai real estate market has shown impressive growth and resilience in recent months. The ValuStrat Price Index for Residential Capital Values increased by 6.4 percent quarterly and 28.2 percent annually, reaching 178.2 points.

“Despite severe flooding caused by record rainfalls in April, the quick and effective response from developers and authorities helped to control the damage, ensuring that market activity and property valuations remained robust in the subsequent months.”

The office sector also performed well, with the VPI for office capital values surging by 31.7 percent annually and 9.4 percent quarterly, reaching 212.5 points—the highest quarterly increase in a decade.

In the retail sector, Emaar Properties reported 98 percent occupancy in their prime mall assets, while overall mall occupancy stood at 96 percent during the first quarter of 2024. The hospitality sector also saw growth, with total international guests reaching 8.12 million as of May 2024, a 9.9 percent increase compared to the same period last year. Hotel occupancy reached 81 percent, rising by 1.4 percent year-on-year.

Despite these positive indicators, Tuaima added, “The decline in transaction volumes calls for a closer examination of market dynamics as stakeholders navigate this evolving landscape.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual