SentinelOne and Intezer Unite to Tackle Emerging Rust Malware Threat

Empowering organizations to get and stay ahead of attackers

SentinelOne, a global leader in AI-driven security, has announced a partnership with Intezer, a leader in AI technology for autonomous security operations, to launch a project aimed at combating the growing threat of Rust malware.

This initiative seeks to illuminate the often-overlooked aspects of Rust malware, allowing threat researchers to better understand and accurately map the complex malware ecosystem before it poses a significant threat to the industry. As part of this collaboration, researchers from SentinelLabs and Intezer are working together to develop a methodology that makes reverse engineering Rust malware more accessible. They are also engaging the security community to create and release tools that directly confront this issue. The project is named 0xA11C.

“In malware analysis, the arrival of a new programming language introduces an entirely new set of challenges that obstruct our ability to quickly grasp the malicious intent of a threat actor,” said Juan Andrés Guerrero-Saade, AVP of Research, SentinelLabs. “With the current state of our tooling, Rust is practically impossible to reverse engineer, and as a result, many analysts are shying away from researching the Rust malware ecosystem. Together with Intezer, we aim to change this.”

In 2021, SentinelLabs researchers took a similar approach to address the rise of Go malware, developing a Go malware analysis methodology dubbed ‘AlphaGolang.’ Their efforts revealed that once underlying data is put back in its rightful context, reversing engineering Golang malware can often be easier than malware written with traditional programming languages.

“We’ve observed a similar trend with Rust malware,” said Nicole Fishbein, Security Researcher, Intezer. “The same features of Rust that engineers love, such as memory safety, aggressive compiler optimizations, borrowing, intricate types and traits, translate into a perplexing tangle of code that surpasses even C++ in the complexity of its abstractions. Drawing on insights derived from the development of AlphaGolang, we can gain additional clarity, into the true size of the Rust malware ecosystem and arm reverse engineers with tools to take it head on.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

This week marked significant signings for innovation and technology pioneer, Holon Global Investments Limited (Holon)

The first with ArcLive Limited (ArcLive), to effectively deliver a joint solution aimed at enhancing energy performance and sustainable data management for both domestic and commercial premises.

Launching this strategic and promising collaboration, Holon and ArcLive signed a Memorandum of Understanding (MoU) on the first day of the Dubai AI & Web3 Festival. Holon’s Managing Director Heath Behcncke and ArcLive’s Co-founder Nicholas Edwards were present to sign the agreement.

This significant event represents the coming together of two innovative forces committed to sustainability and technological advancement.

Holon, a reputed leader in green, verifiable distributed data storage and computing, operates energy-efficient, immersion-cooled edge data centers powered by renewable energy sources. Utilizing blockchain technology, Holon provides robust governance over the data stored in its systems, ensuring security and sustainability.

ArcLive specializes in the collection, storage, collation, analysis, and presentation of real-time data from various premises and buildings. By leveraging sensors and other hardware, ArcLive collects performance data to help customers analyze and improve the energy efficiency of their buildings.

This joint solution enables regulatory compliance with sustainable finance objectives and helps property owners and their lending banks achieve their decarbonization targets, all while being powered by green energy.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Together, Michael and Heath Behncke will lead the significant megashift toward recognizing data.

Holon Global Investments Limited (Holon) officially appointed Michael Clark as its Global Holon Evangelist at the highly anticipated Dubai AI & Web3 Festival.

Michael, a renowned data scholar and industry advisor, will work closely with Heath Behncke, Holon‘s Managing Director, to advance Holon’s pioneering roadmap for data custodianship, decentralized sustainable storage, and tokenization.

Together, Michael and Heath will lead the significant megashift toward recognizing data as a valuable asset – fostering a trusted, inclusive data economy that empowers individuals and benefits society at large. The partnership will explore new opportunities and joint projects to drive innovation and create lasting value.

At the festival, Michael also announced the launch of his upcoming book Data Revolution: Unlocking Human Potential, with the subtitle The Journey Never Walked set to be released mid-2025.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

OneDegree and Dubai Insurance started this partnership last year and have since provided insurance solutions to several digital asset companies.

OneDegree and Dubai Insurance Company have started offering custodial risk insurance for digital assets to their customers in the UAE, following key approval from the Central Bank of the UAE.

The partnership between OneDegree and Dubai Insurance, established last year, has provided insurance solutions for numerous digital asset companies. The addition of custodial risk insurance now completes their product range, allowing the partners to deliver a comprehensive suite of services to digital asset firms in the UAE under the “OneInfinity” brand.

Custodial risk insurance is a crucial element in the risk management strategies of digital asset exchanges, custodians, and other service providers. Many global regulators require this coverage, alongside professional indemnity and directors & officers’ insurance.

In Dubai, VARA (the Virtual Assets Regulatory Authority) mandates such protections. With this approval, specialized custodial risk insurance can now be directly offered in the UAE for the first time. It safeguards companies against the loss of digital assets due to external hacks, theft, internal fraud, and physical damage to storage media.

Robin Scott, General Manager of Middle East for OneDegree, said, “UAE has only strengthened its position as a digital asset hub since our market entry last year. There are hundreds of companies setting up across the Emirates and looking to obtain key licenses. For this they need strong, tailored insurance policies. It’s fantastic that we are now able to offer the full suite of OneInfinity digital asset products to these inspiring companies.”

Abdellatif Abuqurah, CEO of Dubai Insurance, added, “We are thrilled to work with OneDegree on this important development in the UAE. Dubai Insurance is committed to bringing the most innovative insurance products to the UAE. Custodial risk insurance is something brand new to the market but that satisfies an urgent demand as UAE cements its position as a global leader in digital assets.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

The partnership will help accelerate the adoption of WorkFusion’s Artificial Intelligence (AI) Digital Workers for anti-money laundering (AML) and anti-financial crime throughout the Middle East.

WorkFusion, a regtech company specializing in AI agents that fight financial crime, has announced a new go-to-market partnership with Advanced Financial Solutions, a member of the MDS SI Group, which has a network of 60 companies across 11 countries. This strategic alliance aims to accelerate the adoption of WorkFusion’s AI Digital Workers for anti-money laundering (AML) and anti-financial crime initiatives across the Middle East.

Advanced Financial Solutions will utilize its regional expertise, market insights, and infrastructure to introduce and implement WorkFusion’s AI agents within the Middle East’s rapidly growing financial services sector. WorkFusion’s AI Digital Workers are designed to automate document-intensive, repetitive tasks, mirroring roles in financial crime compliance, such as adverse media and sanctions screening, transaction monitoring, and Know Your Customer (KYC) processes. Organizations can employ these AI AML analysts to complement their teams, enhance efficiency, and reduce risk.

“Working together with Advanced Financial Solutions, we will introduce our AI Digital Workers to banks and financial institutions throughout the Middle East,” said Adam Famularo, CEO of WorkFusion. “AI holds the promise to shape the anti-financial crime compliance industry in the region. By incorporating AI Digital Workers as a core component of their compliance programs, banks and financial institutions will be able to leapfrog over the historical challenges that plague AML programs in other parts of the world establishing a true blueprint for modern anti-financial crime compliance operations.”

Comprised of more than 2,600 employees who have partnered with the largest firms in the world, MDS SI Group excels at providing a deep bench of expertise, local infrastructure, and successful execution. MDS SI Group’s experience in delivering advanced IT products and solutions to their customers has benefited their clients for over 40 years.

Juan Jarjour, Managing Director at Advanced Financial Solutions said “the demand for artificial intelligence-based solutions in the Middle East is growing fast and the banking sector is fast adopting new AI based technologies to significantly enhance the automation of the growing regulatory requirements related to risk & compliance management. With the introduction of WorkFusion Digital Workers solutions in the Middle East, we aim at supporting our clients in improving automation with a technology that has fast return on investment, and a proven ability to support financial institutions in their digital transformation journey.”

“At MDS System Integration Group, we are committed to leveraging cutting-edge technology to drive business excellence and innovation. Our partnership with WorkFusion through our affiliate Advanced Financial Solutions, allows us to bring advanced AI solutions to the financial sector in the Middle East, enhancing compliance and efficiency. This collaboration underscores our dedication to providing unparalleled expertise and local infrastructure to our clients, ensuring they remain at the forefront of digital transformation and financial crime prevention.” Gaby Matar, EVP, MDS System Integration Group.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The contribution of the banks is critical through the development of the bank legislation and sustainable development.

According to Dr. Fahad bin Mohammed Al Turki, Director General and Chairman of the Board of Directors of the Arab Monetary Fund, Qatar’s banking sector ranks highly among Arab countries in terms of capital adequacy ratio, which has reached 19.2 percent, showcasing the sector’s resilience and ability to absorb shocks.

Speaking at the Arab Banking Conference 2024, Al Turki commended the performance of Qatar’s banking sector, noting that it accounts for 11.9 percent of the assets in the Arab banking industry, placing it third among Arab nations. He emphasized the need for banking institutions to innovate by offering financial products that support investments in sustainable infrastructure, clean energy, and projects with social and environmental objectives.

Al Turki also highlighted the importance of incorporating sustainability standards into lending and investment practices, as well as the vital role banks play in developing banking legislation that supports sustainable development.

Regarding the financial solvency of the Arab banking sector, he noted that the average capital adequacy ratio stood at 17.4 percent by the end of the previous year, significantly exceeding the international benchmark of 10.5 percent.

In his opening remarks, Mohamed Mahmoud El Etreby, Chairman of the Union of Arab Banks, stressed that efforts to achieve the 2030 Sustainable Development Goals (SDGs) are more crucial than ever. He added that Arab countries, individually and collectively, can achieve these goals if they overcome developmental challenges and intensify their efforts towards sustainable development.

“We need to transition to sustainable development models, including in order to tackle issues such as the shortage and scarcity of water and also the desertification. We need to exert efforts in order to develop new methods to achieve sustainable developments and green economy.

“We need to reinforce and strengthen our cooperation between all the countries on the regional and international level that is likely to impact positively the ability to attract more FDI’s and also to enhance the international partnership in order to be able to harness the sustainable development,” he added.

One of the factors that could play a role in Arab countries is the FDI, which means that the requirements of sustainable development. El Etreby said, “We have been able also to achieve and make some progress in the green economy. Some Arab countries in this regard issued green bonds between 2015 and 2020, amounting in total to $14bn of these bonds and 84 percent of which were considered as sustainable and green bonds.

El Etreby added “We in the financial sector, can play an important and active role in order to achieve the long term goals and vision for our economies and growth because the financial sector can help to achieve the sustainable development goals.

The Arab financial sector has seen significant progress in recent years, with advancements in fintech and other technological tools, alongside the modernization of regulatory frameworks.

Additionally, green bonds have been introduced in the Arab world to support the achievement of the Sustainable Development Goals (SDGs). Many Arab banks have begun incorporating Environmental, Social, and Governance (ESG) metrics into their investment and lending activities, further strengthening their role in promoting sustainable development, he highlighted.

Dr. Rola Dashti, Under-Secretary-General and Executive Secretary – (ESCWA) also delivered the keynote address.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Gross banks’ assets exceed $1.17trln by end of June

The Central Bank of the UAE (CBUAE) reported a 0.5% increase in total gross bank assets, including bankers’ acceptances, from AED 4,287.0 billion at the end of May 2024 to AED 4,310.2 billion at the end of June 2024.

In its June 2024 Monetary and Banking Developments report, the Central Bank highlighted a 1.1% rise in gross credit, from AED 2,077.7 billion in May to AED 2,100.9 billion in June. This increase was driven by domestic credit growth of 0.8% and foreign credit expansion of 2.9%. The domestic credit rise was attributed to a 1.4% increase in credit to government-related entities and a 1.0% increase in private sector credit, which offset a 1.1% decrease in credit to the government sector and a 0.6% reduction in credit to non-banking financial institutions.

Bank deposits saw a 0.5% rise, reaching AED 2,692.5 billion at the end of June, up from AED 2,678.2 billion in May. The growth in deposits was largely due to an 8.4% increase in non-resident deposits, which compensated for a 0.1% decline in resident deposits. The drop in resident deposits was mainly due to a 3.0% reduction in government sector deposits and a 0.1% decline in deposits from government-related entities, though this was mitigated by a 0.4% increase in private sector deposits and a 6.6% rise in deposits from non-banking financial institutions.

In June 2024, the Central Bank reported that the M1 money supply increased by 0.6%, from AED 879.2 billion in May to AED 884.1 billion, driven by a AED 7.3 billion rise in monetary deposits, despite a AED 2.4 billion decrease in currency circulation outside banks. M2 money supply rose by 0.4%, from AED 2,160.3 billion in May to AED 2,169.4 billion in June, boosted by M1 growth and a AED 4.2 billion increase in quasi-monetary deposits. M3 increased slightly by 0.1%, from AED 2,629.7 billion in May to AED 2,632.0 billion in June, as M2 growth outweighed a AED 6.8 billion decline in government deposits.

The monetary base contracted by 0.3%, from AED 727.1 billion in May to AED 725.0 billion in June, primarily due to a 2.3% decrease in currency issued, a 42.2% reduction in banks’ current accounts and overnight deposits at CBUAE, and a 0.5% drop in monetary bills and Islamic certificates of deposit. However, the reserve account increased by 37.3%.

Foreign assets of the Central Bank surpassed AED 770 billion for the first time, growing by 0.5% from AED 766.73 billion in May to AED 770.6 billion in June 2024, a rise of AED 3.88 billion. Year-on-year (YoY), foreign assets increased by 30%, or AED 178.5 billion, reaching AED 592.11 billion in June 2023. This rise was attributed to increased bank balances and deposits abroad, which reached AED 533.86 billion, alongside an increase in foreign securities to AED 179.72 billion and other foreign assets surpassing AED 57 billion. The Central Bank clarified that these foreign assets exclude its Reserve Tranche Position (RTP) and Special Drawing Rights (SDR) holdings with the International Monetary Fund (IMF).

As of June 2024, the Central Bank’s balance sheet reached AED 806.39 billion, marking a 24.2% YoY increase from AED 649.4 billion in June 2023. The balance sheet allocation included AED 352.79 billion for cash and bank balances, AED 206.43 billion for investments, AED 208.78 billion for deposits, AED 1.71 billion for loans and advances, and AED 36.68 billion for other assets. On the liabilities and capital side, AED 396.72 billion was allocated to current and deposit accounts, AED 226.93 billion to monetary bills and Islamic certificates of deposit, AED 145.36 billion to currency notes and coins issued, AED 26.56 billion to capital and reserves, and AED 10.82 billion to other liabilities.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Collaboration to support Dubai-based sellers to establish a digital presence, expand to new markets, and reach sustainable growth.

The Dubai Department of Economy and Tourism (DET) has entered into a partnership with noon, the local digital leader, to launch an e-commerce initiative aimed at boosting the growth of small and medium enterprises (SMEs) in Dubai. This collaboration is part of the broader Dubai Traders initiative, one of the ten transformative projects announced by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, under the Dubai Economic Agenda (D33).

The initiative is designed to empower Dubai-based SMEs by helping them adopt new digital tools and platforms, enabling them to expand both domestically and internationally.

Dubai Traders aims to strengthen Dubai’s position as a global hub for entrepreneurship and SME growth by supporting these businesses in establishing an online brand presence, digitizing supply chain processes, and accessing e-commerce channels. The initiative focuses on building strong private sector partnerships with leading B2B, B2C, and specialized digital solution providers to offer a comprehensive suite of tools, incentives, and support mechanisms for SMEs to engage with online customers.

The partnership agreement was signed in the presence of H.E. Helal Saeed Almarri, Director General of the Dubai Department of Economy and Tourism, and Mohamed Alabbar, Founder of Noon. Hadi Badri, CEO of Dubai Economic Development Corporation (DEDC), and Faraz Khalid, CEO of noon, signed the agreement.

Initially, the program will prioritize the e-commerce sector, providing SMEs with the resources they need to establish a robust online presence and succeed in the digital marketplace. Through this collaboration, Dubai Traders will offer an onboarding incentive package to encourage both new and experienced sellers to join the noon platform, gaining increased visibility. Emirati sellers will receive additional benefits, including personalized support through noon’s Mahali program.

Exclusive incentives and support for Dubai Traders program participants include:

Onboarding support: A bespoke onboarding journey with dedicated day-to-day account management to expedite and facilitate the sign up and set up process

Trainings: Access to curated workshops, seminars, and sales insights throughout the selling journey

Increased seller exposure and visibility: Advertising credit packages and prioritised online product placements on noon platforms

Rapid delivery: Preferential access for eligible sellers to noon’s quick-commerce platform (15-minutes delivery model)

Hadi Badri, CEO of Dubai Economic Development Corporation at DET, commented: “SMEs are the backbone of Dubai’s economy and a critical enabler to accelerate economic growth. We welcome noon as a strategic partner in the Dubai Traders program, reflecting our joint commitment towards delivering on the objectives of the Dubai Economic Agenda D33. By directly supporting and investing in the success of local SMEs, the Dubai Traders program serves to unlock the digital potential of Dubai-based sellers and will directly contribute to growing the emirate’s digital economy and fostering innovation. By harnessing e-commerce as a powerful tool to digitise traditional SMEs, we aim to equip businesses with the essential tools to engage with new customers and share their propositions with new markets.”

Faraz Khalid, CEO of noon, commented: “One of noon.com‘s core objectives has always been to empower local entrepreneurs and foster a vibrant e-commerce environment, providing all sellers, regardless of their scale, an equal opportunity to succeed. With the introduction of the Dubai Traders initiative, we are proud to work alongside our partners at the Dubai Department of Economy and Tourism to offer Dubai-based entrepreneurs and SMEs a new avenue to extend their online presence and reach using noon’s tools and fleet.”

The partnership between DET and noon underlines the unique model of collaboration between government and the private sector in Dubai to leverage key strengths and knowledge-share and create a unique and compelling value proposition to support Dubai’s SME ecosystem. Through noon’s expertise and track-record, this collaboration marks a significant steppingstone in driving the Dubai Traders initiative’s vision, and D33 ambitions.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Majid Al-Qasabi: the e-commerce sector constitutes 8% of the total trade in Saudi Arabia.

The Saudi Minister of Commerce, Mr. Majid Al-Qasabi, has highlighted that the e-commerce sector now accounts for 8% of Saudi Arabia’s total trade.

The projections indicate that the sector’s revenues are expected to reach SR260 billion by 2025. Speaking at a meeting with business leaders and entrepreneurs at the Qassim Chamber, Al-Qasabi noted the impressive growth of financial technology companies, which surged by 95%, increasing from just 10 companies in 2018 to more than 170 today.

On the topic of consumer protection, he mentioned that new rules have been established to regulate the market, control prices, combat fraud, and address commercial cover-ups. A consumer protection system is currently under review by the Experts Authority.

Al-Qasabi also emphasized the collaborative efforts of 13 government agencies within the supervisory committee of the National Program to Combat Commercial Cover-Up, noting the use of artificial intelligence in developing the cover-up index.

When discussing support for small and medium enterprises (SMEs), he outlined six key areas the Small and Medium Enterprises General Authority is focusing on: access to financing, streamlining procedures and fees, fostering an entrepreneurial culture, providing support services, promoting innovation, and facilitating market access. He revealed that SMEs currently account for SR275 billion in credit facilities, representing 8.7% of total credit. He encouraged enterprises and entrepreneurs to take advantage of the upcoming Biban 24 Forum, scheduled for November 5 in Riyadh.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Announced in the Presence of HH Sheikh Khaled bin Mohammed bin Zayed Al Nahyan During His Visit to India.

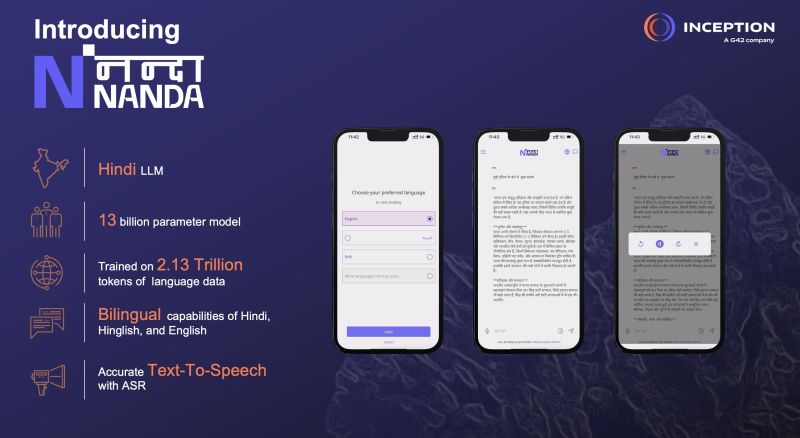

G42, a leading technology holding group based in the UAE, has announced the upcoming launch of NANDA, a state-of-the-art Hindi Large Language Model. NANDA, named after one of India’s highest peaks, is a 13-billion parameter model trained on approximately 2.13 trillion tokens of language data, including Hindi.

The model is the result of a collaboration between Inception, a G42 company, Mohamed bin Zayed University of Artificial Intelligence (the world’s first graduate research university focused on AI), and Cerebras Systems.

It was trained using Condor Galaxy, one of the most powerful AI supercomputers designed by G42 and Cerebras for training and inference tasks. The release of NANDA will be a major breakthrough for AI in India, providing more than half a billion Hindi speakers with access to generative AI technology.

“India has solidified its position as a global technology leader, driven by transformative initiatives like Digital India and Startup India under Prime Minister Narendra Modi’s leadership. As the country stands on the brink of AI-powered growth, G42 is proud to contribute to this journey with the launch of NANDA in support of India’s AI ambitions,” says Manu Jain, CEO – G42 India.

“G42 has a strong track record in the development of language and domain-specific LLMs. With NANDA, we are heralding a new era of AI inclusivity, ensuring that the rich heritage and depth of Hindi language is represented in the digital and AI landscape. NANDA exemplifies G42’s unwavering commitment to excellence and fostering equitable AI,” says Dr. Andrew Jackson, Acting CEO of Inception, a G42 company.

In August 2023, G42 launched JAIS, the world’s first open-source Arabic LLM. JAIS transformed Arabic Natural Language Processing (NLP), unlocking access to native language generative AI capabilities for over 400 million Arabic speakers globally. With models ranging from 590 million to 70 billion parameters, JAIS set a new standard for linguistic AI which G42 now seeks to replicate for other regions whose languages are still underrepresented.

Building on this success, NANDA extends G42’s mission to empower India’s scientific, academic, and developer communities by accelerating the growth of a vibrant Hindi language AI ecosystem and ensure broad access to AI across the region.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Aiming to transform the role of DCO Member States to become key innovators in the global GenAI arena

During its participation at the Global AI Summit in Riyadh, the Digital Cooperation Organization (DCO) announced the launch of its Generative AI (GenAI) Center of Excellence (CoE) initiative. This pioneering effort aims to position DCO Member States as key innovators in the global GenAI landscape by promoting collaboration and fostering sustainable, inclusive growth.

In a statement about the initiative, the DCO Secretary-General Ms. Deemah AlYahya said: “It is my distinct honor to announce the launch of the Generative AI Center of Excellence, a groundbreaking initiative spearheaded by the Digital Cooperation Organization and championed by the Kingdom of Saudi Arabia. The DCO is taking bold steps to maximizing the value of multilateral cooperation and seize the opportunities of GenAi era. The GenAI Center of Excellence provides the platform that will enable DCO Member States to produce GenAI solutions.”

AlYahya added: “At the heart of this initiative is a multilateral framework that ensures access and fosters collaboration among DCO Member States, supporting their transition from consumers of GenAI technology to active producers. This approach paves the way for DCO Member States to become global leaders in GenAI innovation and hubs of intellectual property.

The GenAI CoE initiative offers several key benefits, including fostering inclusive collaboration among governments, the private sector, and academia, ensuring that all member states can actively participate in the GenAI revolution. It also aims to drive innovation by transforming Member States into creators of GenAI solutions, building local expertise, increasing intellectual property, and accelerating technological advancements.

The DCO is dedicated to advancing AI capabilities and nurturing innovation across its Member States, ensuring that every nation can fully leverage the potential of Generative AI. Through the GenAI Center of Excellence, the DCO is providing a platform that bridges the technological divide and enhances cooperation. Together with its Member States, the DCO is shaping an inclusive AI future, where no country is left behind, and every nation is empowered to take a leadership role in the global AI landscape.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The total deposits in Islamic banking had risen by a third highlighting the confidence of the depositors.

Islamic banking in Oman has seen significant progress, demonstrating notable growth despite its relatively small share of the overall financial sector. Tahir al Amri, Executive President of the Central Bank of Oman (CBO), emphasized this during his speech at the IFN Oman Forum 2024.

Al Amri shared key statistics and developments, highlighting the sector’s contribution to the Omani economy, its role in enhancing financial inclusion, and its expanding presence both domestically and internationally.

As of June 2024, the total assets of Islamic banks and windows in Oman increased by 11.4% year-on-year, reaching RO 7.8 billion, which now accounts for a substantial 18.1% of the nation’s total banking assets. The growth in financing was equally noteworthy, with Islamic banks providing RO 6.4 billion in total financing to the economy.

“The Islamic banking sector has demonstrated robust expansion, consistently supporting the economy with healthy growth compared to the previous year,” said Al Amri. He also noted that the total deposits in Islamic banking had risen by a third, further showcasing the confidence of depositors. Despite holding a smaller market share, the sector is efficiently mobilizing funds and increasing its impact on the national economy.

The capital adequacy of Islamic banks remains robust, with a capital adequacy ratio of 15.8% and a Tier 1 capital ratio surpassing the industry average. While impaired financing slightly increased from 2.1% to 2.8%, Al Amri pointed out that this figure remains lower than the non-performing financing ratio of conventional banks, highlighting the sector’s overall stability.

Profitability also showed positive momentum, with the sector achieving an 8.7% rise in profits during 2023. Islamic banks in Oman have expanded their operations, now offering services through approximately 100 branches, which include mobile banking, digital platforms, and in-branch services.

Al Amri emphasized the increasing sophistication of the sector, as the range of products and services continues to grow, catering to the evolving needs of businesses and individuals.

Beyond financial growth, Islamic banks have been instrumental in introducing Sharia-compliant financial products, an area that continues to attract interest from both domestic and international investors. The sector has also emerged as an alternative source of funding, contributing 40% to new deposits despite its relatively smaller market share.

Looking ahead, Al Amri outlined important regulatory initiatives aimed at further boosting the sector’s growth. The Central Bank of Oman is working on frameworks to facilitate the conversion of conventional banks and their branches into Islamic entities, a trend gaining momentum in many regional markets. Furthermore, the Central Bank is developing new Sharia-compliant liquidity tools, including Islamic certificates of deposits and treasury bills, which are expected to be launched soon.

“The Islamic banking sector, though starting with a modest market share, has shown significant growth and efficiency in mobilizing funds and contributing to the national economy,” said Al Amri. He concluded by expressing confidence in the sector’s future potential, particularly in helping to diversify Oman’s economy.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

First-of-its-kind DIFC Funds Centre to support hedge fund spinouts, fund platforms and boutique wealth and asset management firms.

Dubai International Financial Centre (DIFC), the leading global financial center in the Middle East, Africa, and South Asia (MEASA) region, has unveiled a series of updates that strengthen its standing as the top destination for wealth and asset management firms.

Commenting on the announcement, Salmaan Jaffery, Chief Business Development Officer, DIFC Authority, said: “DIFC’s wealth and asset management community continues to experience rapid growth which outperforms the market and differentiates our position as the region’s preferred financial center for the sector. More than 400 firms in the sector now operate from DIFC, and to support the demand from hedge fund spinouts, fund platforms and boutique asset management firms, we are delighted to launch the DIFC Funds Centre.”

Influx of wealth and asset management firms continues – over 400 now in DIFC

DIFC continues to experience an influx of wealth and asset management firms. The Centre was home to 350 companies in the sector at the end of 2023 and this has rapidly grown to more than 400, outperforming the UAE financial free-zone market ten-fold. The Centre’s hedge fund ecosystem continues to boom with 60 pure play hedge funds now operating in DIFC, including 44 ‘billion-dollar club’ funds.

Reflecting the unparalleled breadth and depth of DIFC’s wealth and asset management ecosystem, recently authorized joiners include multi-strategy hedge funds, fund platforms, investment management regulatory hosting solutions and global asset managers. Company names include Allfunds, Aster Capital Management, Bluecrest, Eisler Capital (DIFC) Ltd, JNE Partners, Polen Capital Management, Principal Investor Management (DIFC) Limited, TCW Investments, Tudor Capital and Westbeck.

The DIFC Funds Centre – creating sector depth and supporting talent

Driven by exponential growth and an exceptional pipeline, including from hedge fund spinouts, fund platforms and boutique asset management firms, DIFC is opening a first-of-its-kind environment in the first quarter of 2025.

The DIFC Funds Centre will be ideal for companies and talent that are looking to scale-up, prefer access to a flexible range of working solutions, and enjoy peer-to-peer networking. Wealth and asset management applicants are welcome to join the waitlist now, with places being allocated on a first-come first-served basis.

The DIFC Funds Centre is the latest strategic initiative designed to develop the wealth and asset management sector, with other recent action plans including partnerships with the Alternative Investment Management Association (AIMA), Deal Catalyst, HFM and the Standards Board for Alternative Investments (SBAI).

Strong outlook for wealth and asset management in DIFC and Dubai

A report by LSEG outlines the latest trends in the global wealth and asset management landscape.

The UAE has emerged as a notable booking center, witnessing 9 per cent growth in AUM, higher than any other booking center in 2023. The report highlights how DIFC is benefitting from wealth inflows into Dubai and the wider region, including as a growing number of millionaires, centi-millionaires, family offices and prominent financial players. Dubai is home to 62 per cent of these HNWIs. The UAE is forecast to see the largest net gain of millionaires, welcoming a further 6,700 in 2024.

Dubai stands out in the report as an example of a growing fund manager and investor base. Dubai has a double advantage in terms of providing investor access due to vast pools of both public and private capital. The city is a stable, business-friendly location accessing over 40 regional sovereigns, including Dubai’s own the Investment Corporation of Dubai and Dubai Investment Fund. Clients can also tap into USD 3.5trn worth of private capital pools, since Dubai is capital of private capital – the city is home to region’s highest concentration of wealth.

The report also highlights the importance of lifestyle options that are commensurate with high-caliber talent and their families – an area that Dubai excels in.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

iACCEL GBI and TrustIn collaborate to make escrow services more accessible and user-friendly through a cutting-edge digital platform.

A new partnership between iACCEL Gulf Business Incubator (iACCEL GBI), a leading market accelerator in Dubai, and TrustIn, the Middle East’s first regulated digital escrow platform, has been announced. This collaboration aims to democratize and simplify escrow services by offering a more accessible and user-friendly digital platform.

Over the past 17 months, iACCEL GBI has onboarded over 20 startups from around the world, providing them with strong support to accelerate growth and expansion in the UAE and GCC regions.

TrustIn, certified by FSRA and ADGM, seeks to streamline the payment process through a comprehensive escrow platform that offers a seamless and cost-effective transaction experience for consumers, local businesses, and companies. By enforcing rigorous Know Your Customer (KYC) and Know Your Business (KYB) standards, TrustIn enhances the safety and transparency of financial transactions, making it a preferred choice for businesses in need of trustworthy and reliable escrow solutions.

Commenting on the partnership, Deepak Ahuja, CEO of iACCEL GBI, said, “The UAE has rapidly emerged as a global hub for innovation and trade, attracting businesses from across the world. However, one of the significant challenges within this thriving ecosystem is the risk associated with open trade, especially for SMEs and the retail market. TrustIn is stepping in to solve this problem by providing a regulated digital escrow platform that ensures transparency, security, and legal protection for all parties involved in B2B, B2C or C2C transactions. By leveraging TrustIn, businesses in the UAE can now engage in trade with greater confidence, knowing that their payments and deliveries are safeguarded. This not only fosters trust but also accelerates the growth of SMEs, reinforcing the UAE’s position as a leading destination for business and innovation and holds significant potential for expansion into other geographies. We, at iACCEL GBI, are committed to supporting them in this journey.”

Anishkaa Gehani, co-founder of iACCEL GBI, shared her thoughts on the partnership, stating, “At iACCEL GBI, we believe in empowering businesses with innovative solutions that foster growth and trust. Our partnership with TrustIn marks a significant step in making secure, transparent transactions accessible to all. By leveraging our partnership with TrustIn, we aim to ensure that businesses in the UAE and GCC confidently engage in trade, driving economic growth and innovation across the region.”

Momeen Ahmad, CEO of TrustIn, added, “Joining hands with iACCEL GBI is a significant milestone for TrustIn. We look forward to leveraging their network and capabilities to expand our footprint across the UAE and GCC. Together, we aim to make escrow services more accessible and reliable for businesses of all sizes, ultimately driving growth and innovation in the region.”

Parvez Akram Siddiqui, Co-Founder and Chief Technology Officer of Trustin, said “At TrustIn, our mission has always been to provide secure, transparent, and reliable escrow services to businesses and consumers across the Middle East. By combining TrustIn’s innovative digital escrow platform with iACCEL GBI’s vast network and market expertise, we are well positioned to revolutionize the transaction landscape in the region. This collaboration not only enhances trust and security in financial transactions but also empowers businesses to grow with confidence, knowing that their interests are protected at every step.”

Through this partnership, iACCEL GBI and TrustIn aim to revolutionize secure transactions in the Middle East and offer a seamless and secure payment gateway for businesses in the region.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

With this offering, ila becomes the first bank in Bahrain to establish a direct connection with the CBB

Bahrain’s ila Bank, powered by Bank ABC, has introduced a new investment service that allows customers to invest in government securities issued by the Central Bank of Bahrain (CBB) on behalf of the Government of Bahrain.

With this offering, ila becomes the first bank in Bahrain to establish a direct connection with the CBB, providing customers with a seamless, one-stop solution for investing at the touch of a button.

Through the ila app, customers can access a full overview of upcoming securities and place bids or purchase Government Treasury Bills, Development Bonds, and Islamic Securities (Sukuk) directly. The bank’s fully digital platform streamlines the entire process, allowing for instant investment and easy monitoring without the need for paperwork or physical visits.

Additionally, ila helps customers enhance their returns by not charging custody fees on held investments. Real-time updates on securities, deadlines, returns, and maturity dates are also available through in-app notifications.

Nada Tarada, ila Bank’s Head of Business and Customer, commented: “At ila, we are committed to meeting the financial needs of our customers in a holistic manner. Helping them save and invest is a crucial part of enabling their financial independence. We are proud to offer this investment channel to our customers in Bahrain, empowering them to invest in a range of instruments with just a click. Investing in government securities has never been as convenient and easy as it is now with ila Bank.”

Customers interested in investing in Government Securities can easily do so by selecting their preferred type of security on the ila app and submitting the purchase order directly through the app. The minimum investment amount is BD10,000.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

This reflects the success of the UAE’s sustainable tourism policies.

The UAE tourism sector continues to demonstrate robust growth in both international tourist arrivals and hotel bookings, in line with the UAE Tourism Strategy 2031. This strategy aims to attract AED100 billion ($27.2 billion) in tourism investments and increase the sector’s contribution to the GDP to AED450 billion ($122.5 billion) by 2031.

In 2023, the tourism sector reported 11.7% of the UAE’s GDP, amounting to AED220 billion ($59.9 billion), and is forecasted to rise to 12% or AED236 billion ($64.3 billion) in 2024, according to the World Travel and Tourism Council (WTTC).

The WTTC also projects the sector’s contribution to the GDP to reach approximately AED275.2 billion ($75 billion) by 2034, supported by the UAE’s world-class infrastructure, including airports, accommodations, and a range of exciting tourist attractions.

Dubai welcomed 10.62 million tourists during the first seven months of 2024, marking an 8% increase year-on-year (YoY), while Abu Dhabi’s hotels hosted more than 2.87 million guests in the first half of 2024, generating AED3.6 billion ($1 billion) in revenue—a 19.5% YoY growth.

These achievements reflect the success of the UAE’s sustainable tourism policies, boosted by its strong infrastructure, diverse range of tourist destinations, and ongoing development efforts under the National Tourism Strategy 2031.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.