Chrysalis Éclairage to Participate in the Green & Smart Construction Business Seminar in Saudi Arabia

The Green & Smart Construction Business Seminar will take place in Riyadh and Jeddah from October 14 to 16, 2024

Chrysalis Éclairage, the French company known for its expertise in sustainable lighting solutions, announces its participation in the Green & Smart Construction Business Seminar, which will take place in Riyadh and Jeddah from October 14 to 16, 2024. Organized by Business France, this event will bring together innovative French companies and influential decision-makers from Saudi megaprojects, providing an ideal platform to establish strategic partnerships in a rapidly expanding market.

Amid significant economic transformation, Saudi Arabia is implementing ambitious reforms as part of its Vision 2030, aimed at promoting sustainable development across various sectors, including construction. Iconic projects such as NEOM, RED SEA, Diriyah Gate, and Qiddiya reflect this commitment to innovation and sustainability. These megaprojects require eco-friendly and high-performance solutions that comply with international standards.

Chrysalis Éclairage positions itself as a key player in this dynamic landscape. With over thirty years of experience in the lighting industry, the company combines tradition and innovation to provide solutions tailored to modern challenges. Its 100% French production ensures a reduced environmental impact through short supply chains and minimized carbon footprints.

French Expertise in Service of Sustainability in Saudi Arabia

With 30 years of expertise in sustainable lighting solutions, Chrysalis has continuously enhanced its technical and commercial capabilities, allowing it to design innovative and environmentally friendly solutions. These advancements enable the company to meet the growing demands of the sustainable urban lighting market, thus contributing to the transition toward greener, smarter cities.

Chrysalis Éclairage views its participation in the Green & Smart Construction Business Seminar as a strategic opportunity to strengthen its ties with Saudi economic players. As part of this mission in Saudi Arabia, the company plans to establish a local factory, which will help reduce carbon footprints while minimizing material transportation.

“Participating in the Green & Smart Construction Business Seminar in Saudi Arabia underscores our long-term commitment to providing sustainable lighting solutions tailored to the Kingdom’s major projects. This event presents a valuable opportunity to forge local collaborations, share innovative ideas, and integrate our technologies through our establishment project. We are determined to contribute to the sustainability goals of Vision 2030 by showcasing our French expertise and establishing strategic partnerships that will solidify our position in this vital market,” says Adrien Marchal, head of Chrysalis Éclairage.

Expertise and Innovations of Chrysalis Éclairage

Chrysalis Éclairage stands out for its ability to design custom luminaires that meet the specific needs of urban environments. The company offers a complete range of services, from design to manufacturing of lighting solutions. Its technical expertise is evident in its metalworking, particularly through the use of aluminum and steel, allowing the creation of aesthetically pleasing and high-performing luminaires.

Among its flagship products, the “Lolita” model stands out for its ability to be programmed and controlled remotely while integrating environmentally friendly technologies. This minimalist luminaire is designed to adapt to the varied needs of modern projects while ensuring exceptional longevity (over 100,000 hours) with minimal environmental impact.

Additionally, Chrysalis has recently been selected to illuminate the Olympic Village in Paris 2024, an emblematic project that highlights its expertise in decorative public lighting. The company will leverage its expertise to contribute to the ambitious projects in the Kingdom by incorporating environmentally friendly technologies. Recently awarded the “Decarbonons! 2024” Trophy from D’architectures (DA) for its innovative “Sélène” model, Chrysalis demonstrates its commitment to sustainable innovation.

The “Sélène” model from Chrysalis Éclairage is an innovative, portable, and eco-friendly lighting solution that has been awarded the “Decarbonons! 2024” Trophy for its innovative character. This portable lamp aligns with Chrysalis’s commitment to reducing its environmental impact, making it an ideal choice for modern urban environments aiming to combine sustainability with intelligent lighting solutions.

Commitment to Sustainability

Sustainability is at the heart of Chrysalis Éclairage’s mission. The company is committed to reducing its environmental footprint by optimizing its manufacturing processes and favoring local subcontracting (over 95% of components come from within a 300 km radius). This approach not only reduces logistics costs but also ensures superior quality in its products. The company also adopts a sustainable approach in all its projects by intervening in sensitive areas to minimize light pollution while maintaining optimal service levels for users.

Opportunities at the Green & Smart Construction Business Seminar

Chrysalis Éclairage’s participation in the Green & Smart Construction Business Seminar represents a crucial opportunity to engage directly with decision-makers of major Saudi megaprojects. These discussions will allow the company to better understand the specific needs of the local market and adapt its products accordingly. The event will also be a prime venue to showcase its advancements in sustainable lighting and strengthen its collaboration in the Saudi market. By integrating environmentally friendly technologies into its lighting solutions, Chrysalis aims to provide significant added value to Saudi initiatives while contributing to the Kingdom’s energy transition.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Dubai recorded over 48,000 property sales in Q3 2024, worth AED 120 billion

Dubai’s real estate market has maintained its upward momentum through the third quarter of 2024, with data from Bayut, a leading property portal in the UAE, offering key insights into the trends shaping this dynamic sector. The latest figures highlight the continued demand across various segments, with property prices in popular neighborhoods witnessing steady growth, spurred by robust demand and a healthy pipeline of new projects.

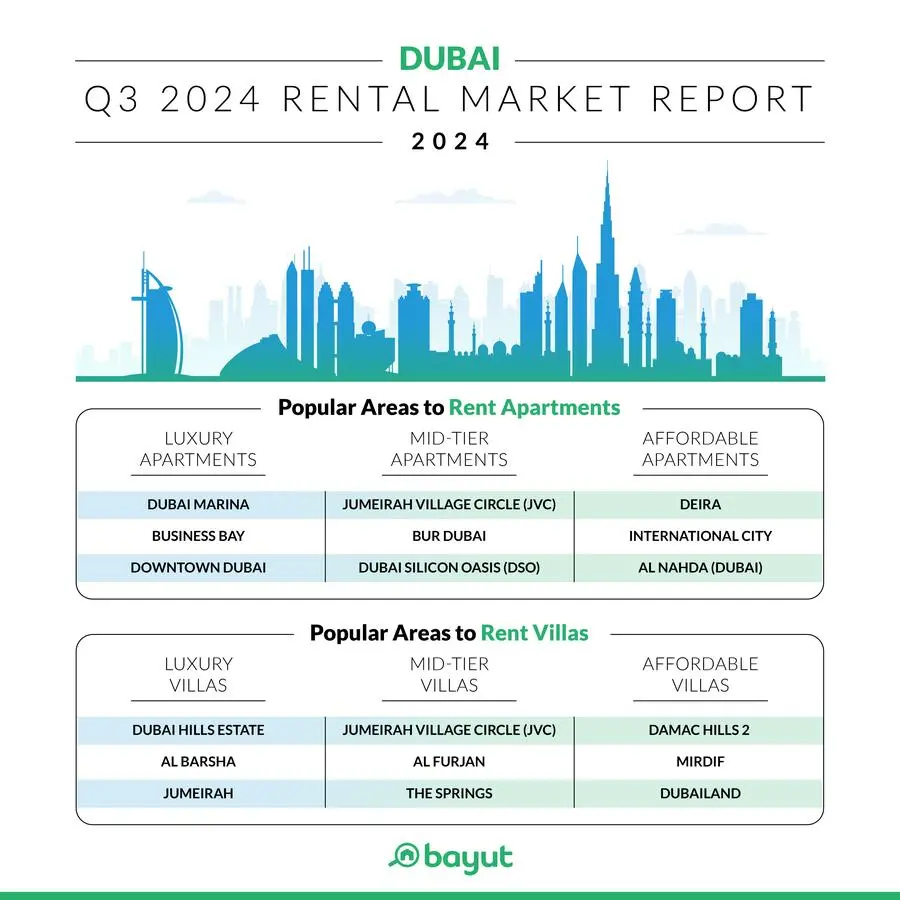

Property Buying Trends in Dubai

In Q3 2024, villa prices in some of Dubai’s prime areas saw significant appreciation, with Arabian Ranches leading the way by recording a price surge of up to 13%. Demand for villas continues to rise as more buyers seek spacious living options, a trend largely fueled by Dubai’s growing expatriate population and lifestyle preferences.

On the more affordable end of the spectrum, locations like International City, Dubai South, DAMAC Hills 2, and Dubailand have emerged as hotspots for property buyers. These areas appeal to budget-conscious investors who still want a foothold in Dubai’s expanding market. Meanwhile, the people searching of mid-range properties have shown interest in neighborhoods like Jumeirah Village Circle, Jumeirah Lake Towers, and Al Furjan, which are known for offering both modern amenities and value for money.

When it comes to the luxury segment, iconic areas such as Dubai Marina, Business Bay, and Dubai Hills Estate remain favorites. These high-end locations are in constant demand from international buyers and investors looking for prestigious properties. The Dubai Hills Estate saw the highest price hikes within the luxury sector, with a remarkable 31% increase in transactional prices.

The affordable apartment segment saw a price correction, with transaction values dropping by up to 11% in some popular areas. However, villa prices in locations like Dubailand jumped by almost 20%, underlining the rising demand for affordable homes with larger spaces. The mid-range and luxury markets also saw moderate price increases, with apartment and villa prices up by as much as 8%.

In total, Dubai recorded over 48,000 property sales in Q3 2024, worth AED 120 billion. Of these, off-plan transactions made up the lion’s share, with more than 32,000 sales valued at over AED 70 billion, while the ready market accounted for over 16,000 transactions valued at AED 51 billion.

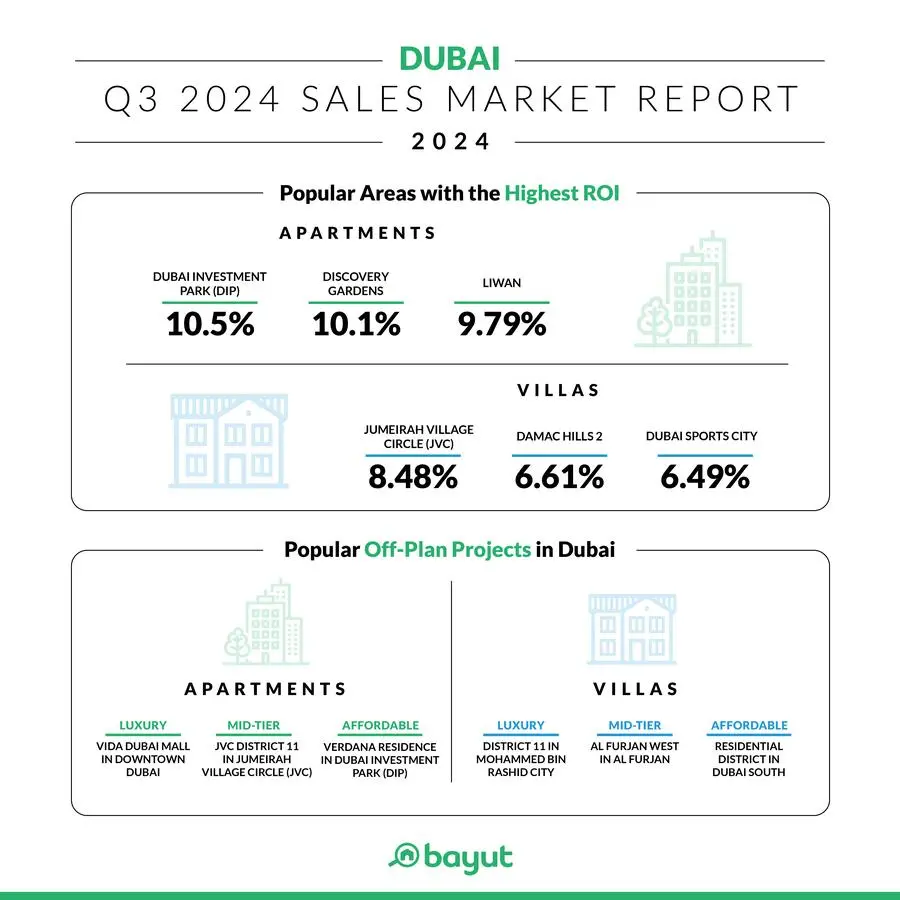

Return on Investment (ROI) Outlook

Bayut’s data paints an encouraging picture for investors focused on return on investment (ROI) across different property types. For affordable apartments, areas such as Dubai Investments Park (DIP), Discovery Gardens, and Liwan offered some of the highest returns, with yields between 9% and 11%. This makes them particularly attractive for investors looking to maximize rental income.

In the mid-tier segment, Dubai Sports City, Dubai Silicon Oasis, and Town Square delivered solid ROI figures, exceeding 8.6%. Meanwhile, luxury apartments in sought-after locations like Al Sufouh and DAMAC Hills recorded returns between 7% and 9%, which remain competitive when compared to global property markets.

Affordable villas in communities such as DAMAC Hills 2 and International City provided steady returns above 6%, while mid-tier villa neighborhoods like Jumeirah Village Circle and Dubai Sports City offered yields of up to 9%. Luxury villa communities, including Al Barari and Tilal Al Ghaf, have also proven their value to investors, with returns surpassing 6% in many cases.

Renting Trends and Demand Shifts

Dubai’s rental market has also witnessed notable increases, with Bayut reporting strong demand across all property types. Affordable apartment rentals saw a significant boost, climbing by as much as 28%, with one-bedroom flats in Deira recording the largest spike. Mid-tier apartment rentals were also on the rise, up by 12%, while luxury apartments recorded moderate growth, with some prices increasing by up to 9%.

In the villa rental market, the demand for budget-friendly options remained strong, with rental rates increasing by up to 10%. Notably, the mid-tier villa segment saw some of the largest rental hikes, with a 42% increase for four-bedroom units in Al Furjan following the handover of newly completed properties. Meanwhile, luxury villa rentals saw price increases of up to 15%, particularly for five-bedroom homes in areas like Jumeirah, where inventory is limited.

In terms of popular rental locations, affordable apartments in Deira and International City have attracted significant interest, while affordable villas in DAMAC Hills 2 and Mirdif are in high demand. Mid-range renters continue to favor Jumeirah Village Circle and Bur Dubai for apartments, while villas in JVC and Al Furjan are consistently sought after. For luxury rentals, Dubai Marina and Business Bay are top choices for apartments, while Dubai Hills Estate and Al Barsha lead the market for high-end villas.

Rental prices in general have increased across all segments, with affordable properties seeing rises of between 1% and 14%, while mid-tier and luxury rentals have also grown by as much as 10%.

Dubai Property Market Outlook

As Dubai continues to attract global investors and residents, the property market shows no signs of slowing down. The city’s appeal is bolstered by a robust economy, a thriving tourism sector, and government initiatives aimed at supporting growth. With developers managing supply efficiently and aligning it with market demand, concerns about oversupply remain minimal for the foreseeable future. This balance between demand and supply suggests that property prices, particularly in the luxury and mid-tier segments, will continue to rise steadily in the coming years.

For investors and homebuyers alike, Dubai remains an attractive destination offering strong returns, a stable market environment, and a wealth of opportunities across all price points. Whether looking to buy, rent, or invest, the market’s ongoing growth reflects the city’s broader economic success and its appeal on the global stage.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

The joint venture will focus on delivering a portfolio of extraordinary real estate developments, spanning high-end residential, commercial, and hospitality.

Modon Holding PSC and Candy Capital have officially unveiled a groundbreaking joint venture aimed at transforming the ultra-luxury real estate sector in the United Arab Emirates (UAE), the Middle East, and beyond.

This strategic partnership brings together the expertise and vision of both companies to redefine standards in design, quality, and luxury living. By launching world-class real estate projects, the venture seeks to attract the most discerning global clientele, setting new benchmarks in the industry and reshaping the high-end property market in the region.

The newly established joint venture will focus on delivering a portfolio of extraordinary real estate developments, spanning high-end residential, commercial, and hospitality. These projects will be strategically located across key markets in the Middle East region with future expansion into other major cities globally.

The collaboration combines Candy Capital creative vision and unparalleled expertise in ultra-luxury real estate alongside Modon’s robust development, operational capabilities and financial strength. Together the two entities will create landmark developments that reflect the future of luxury real estate, reinforcing their leadership position in the global property market.

H.E. Jassem Mohammed Bu Ataba Al Zaabi, Chairman of Modon Holding commented: “We are excited to announce our strategic partnership with Candy Capital. This collaboration marks another milestone for Modon, as we join forces with a leader in luxury real estate.”

Nick Candy, CEO of Candy Capital commented: “This partnership marks a significant milestone for both Modon and Candy Capital, reflecting a shared long-term vision for growth, innovation, and excellence in the ultra-luxury sector. We look forward to creating iconic developments with Modon that will redefine luxury living on a global scale”.

Bill O’Regan, Group CEO of Modon, added: “Together, we are committed to creating unparalleled living experiences that blend innovation, sustainability, and elegance. This partnership will not only enhance our portfolio but also set new standards in the luxury real estate market.

Abu Dhabi-based Modon is one of the UAE’s largest real estate development companies and creates iconic designs and experiences for living, leisure and business. Through accelerated strategic investment and innovation on an unrivalled scale, Modon provides unparalleled opportunities to shape the future and advance societies. Modon’s goal is to deliver long-term, sustainable value, laying the foundations for a new era of intelligent, connected living

On March 18, 2024, Q Holding rebranded as Modon Holding following the merger of Q Holding, Modon Properties, and ADNEC, a move aimed at expanding its market presence both within the UAE and internationally. This followed earlier mergers with ADQ Real Estate and Hospitality (ADQ) and IHC Capital Holding (IHC). As of June 30, 2024, Modon Holding reported a market capitalization of AED 45.94 billion, reflecting an impressive 114% year-on-year growth.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

London Square’s first residential launches since the developer was acquired by Aldar late last year

London Square, part of the Aldar group, has introduced two new residential collections: Twickenham Green and Twickenham Square, both located in the prestigious Borough of Richmond Upon Thames. These are the first projects launched by London Square since its acquisition by Aldar last year, presenting an opportunity for UAE investors to enter the UK housing market through a well-established London-based developer.

Jonathan Emery, Chief Executive Officer of Aldar Development, said: “Since acquiring London Square last year, we have substantially increased its landbank adding eight new development sites in prominent areas of London, while supporting new launches in prime areas. Twickenham is one of the most coveted areas to live in London, offering the highest quality lifestyle from every aspect – spectacular green spaces, excellent schools, first-class amenities and fast transport links – and both developments will appeal equally to both investors and buyers looking for a London base.”

Twickenham Green features a collection of stylish two, three, and four-bedroom mews style houses and apartments next to the River Crane, a tributary of the River Thames, with an attractive waterfront and landscaped outdoor spaces. Each home is beautifully designed with modern interior detailing, underfloor heating, spacious open-plan living areas and sleek kitchens.

The houses have their own private garden or courtyard garden, and all have a driveway, garage or off-street parking. Prices for one of the limited edition two-bedroom mews houses start from £835,000 (AED 4.07 million).

Twickenham Square features a range of elegant one, two and three-bedroom apartments, each with their own balcony or terrace, designed around a central landscaped square as well as spacious three- and four-bedroom family houses with private gardens. With exquisite interior design, every home exudes style and comfort. Prices start from £425,000 (AED 2.07 million) for apartments and £1,190,000 (AED 5.8 million) for 3-bedroom townhouses.

The homes are conveniently located near central transport connections and private and state schools. With London Waterloo just 20 minutes by train, residents will also have the capital’s renowned cultural, retail, and fine dining on their doorstep, along with world-class universities.

Voted the UK’s happiest place to live in a recent survey by UK property portal Rightmove, leafy Twickenham is renowned for its family-friendly lifestyle, reflecting London Square’s ethos of creating homes with a sense of community and green space at the heart of every development.

The area is also renowned for sport, including being the home of English rugby, at Twickenham Stadium, and Ham Polo Club, the only club of its kind in London. There are more than 76 hectares of outdoor spaces within a 30-minute walk, including the largest royal park (Richmond Park) and world-famous Kew Gardens, with its rare specimens of trees and shrubs. The River Thames also runs through Twickenham and Richmond, offering tranquil riverside walks and watersports.

All London Square homes are covered by a 10-year warranty and a two-year London Square Customer Care guarantee. Move in dates are from Q1 2026 for both developments.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

This project offers luxury residences with bold interiors and world-class amenities in a serene setting.

Just Cavalli Villas by Damac Properties represents the epitome of luxury living in Dubai’s greenest community, Akoya Oxygen. These standalone 3 and 4-bedroom villas embody the future of stylish living through their innovative and exotic designs. Situated in an international golf community, these homes challenge conventional designs with daring interiors crafted by the renowned Italian fashion designer Roberto Cavalli, reflecting his signature style of bold patterns and vibrant colors.

Innovative Design and Tranquil Surroundings

The unique design of Just Cavalli Villas is one of its key differentiators. The villas feature exotic textures, bold color schemes, and innovative use of space that are a testament to Cavalli’s daring approach to fashion and design. The interiors are adorned with distinctive motifs such as animal prints and jungle themes, translating his eclectic style into stunning architectural details. The expansive balconies and landscaped gardens offer an oasis of tranquillity amid the vibrant city of Dubai, allowing residents to enjoy serene views and peaceful surroundings.

Living in Just Cavalli Villas provides access to an array of world-class amenities designed to cater to every resident’s need. The community boasts modern gyms, a tennis court, and jogging tracks, offering an active lifestyle. The fitness club, designed with ambient lighting and wild patterns, mirrors the trendy nightspots, creating a unique workout experience. Residents can also relax at the luxurious spa and wellness centers, making every day feel like a retreat.

Prime Location and Investment Opportunity

In addition to health and fitness amenities, the Akoya Oxygen community offers a wealth of recreational options. For those seeking entertainment, the community includes dancing fountains, retail outlets, fine dining restaurants, and an open-air cinema that offers exclusive screenings.

One of the standout features of Just Cavalli Villas is its strategic location within the Akoya Oxygen community. Known for being Dubai’s first green residential address, Akoya Oxygen offers a tranquil escape from the city’s hustle while remaining well-connected to key business hubs and entertainment destinations. The villas are conveniently located near major road networks, ensuring that residents can easily access Downtown Dubai, Dubai International Airport, and other prominent landmarks.

Just Cavalli Villas by Damac Properties is not just about acquiring a home; it’s about securing a lifestyle that blends luxury, creativity, and comfort. The distinctive designs, premium finishes, and spacious layouts make these villas an ideal choice for those who desire a residence that reflects their personality and passion for bold design. Whether it’s the vibrant community of Akoya Oxygen or the avant-garde design of the villas themselves, this project promises significant returns for investors looking for a piece of Dubai’s ever-growing real estate market.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

This partnership aims to utilize Facilio’s advanced Connected CaFM platform to optimize Berkeley FM’s service offerings and boost operational efficiency across the UAE region.

Facilio has announced a major new deployment with Berkeley Services Group, a well-established integrated facilities management (IFM) company based in Dubai. This partnership aims to utilize Facilio’s advanced Connected CaFM platform to optimize Berkeley FM’s service offerings and boost operational efficiency across the UAE.

Founded in Dubai in 1984, Berkeley Services Group (BSG) has been a leader in the industry, offering a wide range of services such as building maintenance, soft services, smart solutions, landscaping, and security. Known for its strategic collaborations and technology-driven approach, BSG has become a trusted leader in IFM, setting new standards for client-focused and people-centric management solutions.

Speaking about the deployment, Fayaz Mohammad, Head of Facilities Management, Berkeley Services said, “Facilio’s platform-led approach to operations & maintenance aligns perfectly with our needs. Its scalable infrastructure, robust automation and real-time KPI reporting capabilities stand out – it not just improves our operational capabilities but also helps boost growth and profitability across verticals. By leveraging this innovative technology, we can position ourselves at the forefront of technology-driven integrated facilities management, delivering exceptional experiences to our clients across diverse industries.

“Our Connected CaFM solution will enable Berkeley to deploy services swiftly while meeting demands for high-quality service, rapid response times, and zero downtime. It is a solution that is purpose-built to solve for IFM firms such as Berkeley. Being a no-code/low-code adaptable self-serve platform, it allows them to onboard customers and expand usage to cover everything from asset management to audit and compliance management seamlessly. It not only elevates their operational capabilities but also enhances customer satisfaction and retention, drives business expansion across verticals and ensures they continue to stay at the forefront of innovation,” said Prabhu Ramachandran, CEO of Facilio.

With Facilio‘s Connected CaFM platform, Berkeley Services can now streamline their operations through a single, centralized platform, allowing them to manage all facilities and operational tasks efficiently. The platform enables cost optimization by tracking expenses and identifying potential savings, while providing 360-degree visibility into operations, allowing the team to monitor tickets raised and resolved to improve service response times and overall efficiency.

Compliance is assured with automated reporting and health, safety, and environmental (HSE) management, ensuring regulatory standards are consistently met. Additionally, the platform accelerates deployment by templatizing onboarding workflows, leading to a faster return on investment. It also holds vendors accountable by monitoring their adherence to service level agreements (SLAs), ensuring high performance and reliability. The platform’s scalable infrastructure further allows Berkeley Services to easily add new service lines through customizable modules without the need for coding or extensive IT efforts.

This deployment echoes Facilio’s success stories with other prominent FM Service providers such as Musanadah and CIT Group in Saudi Arabia, Quality FM in the UAE, and Q3 Services in the UK.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Samana Developers breaks records with sales 4 times in the last 9 months, a 600%+ surge in sales in 2023, projecting 400%+ growth in 2024.

SAMANA Developers celebrated the success of its top-performing brokers at an exclusive awards ceremony. The event took place at the Johara Ballroom in Madinat Jumeirah and was attended by a wide range of industry professionals, including real estate agents, investors, and business leaders.

This event underscored SAMANA Developers’ commitment to recognizing and rewarding the remarkable efforts of its channel partners.

SAMANA Developers honored twenty agencies for their exceptional performance, dedication, and significant contributions to the company’s ongoing success, setting an inspiring example for other professionals in the industry.

With a 4.6% market share in Dubai’s real estate market, SAMANA Developers has solidified its position among the top seven largest developers in the city. The company’s award-winning projects and commitment to quality have propelled it to new heights, with record-breaking sales four times in the past nine months and a staggering 600% surge in sales in 2023. Looking ahead, SAMANA Developers is projecting a 400% growth in sales for 2024.

Regarded for its resort-style projects and innovative designs, SAMANA Developers offers each unit with a private pool, providing residents with an unparalleled living experience. At the ceremony, Imran Farooq, CEO of Samana Developers, has wholeheartedly hailed the new Real Estate Strategy 2033. He expressed his enthusiasm for Dubai’s ambitious goal of increasing real estate transactions to Dh1 trillion by 2030, a significant leap from the Dh634 billion recorded in 2023.

Farooq believes that this strategic vision aligns perfectly with Samana Expansion Strategy, and it will not only boost the real estate sector’s contribution to the economy, reaching Dh73 billion, but also drive a significant increase in homeownership rates to 33%. He particularly applauds the focus on affordable housing programs and the commitment to transparency and global marketing, which will undoubtedly enhance Dubai’s appeal as a prime real estate destination.

Highlighting the company’s expansion, Farooq mentioned that SAMANA Developers now has over five hundred employees from thirty-five different nationalities and emphasized that his diverse workforce has played a crucial role in the company’s growth and success. He also announced the launch of SAMANA Design Studio, a new service that will offer stylish and modern interior design solutions, raising the mantra “Pioneering Lifestyle.”

In a significant announcement, Farooq also unveiled SAMANA Developers‘ new brand identity, reflecting the company’s future vision and aspirations. The new branding, inspired by progressive mindset and forward thinking, symbolizes SAMANA Developers’ commitment to innovation, sustainability, and excellence.

As the real estate market continues to evolve, SAMANA Developers remains at the forefront of the industry. With its focus on quality, customer satisfaction, and community development, the company is well-positioned to achieve even greater success in the years to come.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

This partnership serves as a key pillar in expanding financing options to create a more inclusive real estate financing market.

The Saudi Real Estate Refinance Company (SRC), a subsidiary of the Public Investment Fund (PIF), signed a Memorandum of Understanding (MoU) with the Saudi Mortgage Guarantees Services Company, “Damanat.” The MoU aims to guarantee SRC’s residential mortgage portfolios, both current and future acquisitions, which will help lower financing costs for target segments and increase the number of beneficiaries.

The signing ceremony was held under the patronage of His Excellency Mr. Majed bin Abdullah Al-Hogail, Minister of Municipal Rural Affairs and Housing, and Chairman of the Board of SRC. The agreement was signed by Mr. Majeed Fahad Al-Abduljabbar, CEO of SRC, and Mr. Hussam Radwan, CEO of Damanat. This partnership serves as a key pillar in expanding financing options to create a more inclusive real estate financing market.

The MoU also contributes to raising the attractiveness of the real estate finance market by developing the secondary market for real estate financing aimed at supporting its growth and stability, and attracting more local and international investors by enhancing the creditworthiness of the real estate financing portfolios owned by SRC, as the company is currently working with its partners to continue developing a secondary market that supports the real estate finance sector in the Kingdom.

Mr. Majeed Fahad Al-Abduljabbar, CEO of SRC, said: “This agreement reflects our commitment to contribute to achieving the goals of Vision 2030 by strengthening the real estate finance market, increasing the rate of homeownership among citizens, and attracting more local and international investors.”

Mr. Hussam Radwan, CEO of Damanat said, “This agreement is part of our efforts to provide integrated financing solutions that enable a broader segment of society to access affordable real estate financing, thereby enhancing citizens’ opportunities to own their homes and contributing to the development of the real estate sector in the Kingdom

It is noteworthy that SRC was established in 2017 by the Public Investment Fund as part of government initiatives aimed at achieving the housing program targets under the Kingdom’s Vision 2030. The company serves as a fundamental pillar in supporting the housing ecosystem by injecting liquidity into the residential real estate finance market, to ensure its continuity and stability. SRC has also obtained a license from the Saudi Central Bank in 2017 to operate in the field of real estate refinancing.

Saudi Mortgage Guarantees Services Company (Damanat), fully owned by the Real Estate Development Fund, aims to streamline the beneficiary journey by providing innovative solutions and simplified procedures, contributing to the sustainable development of the real estate finance sector.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

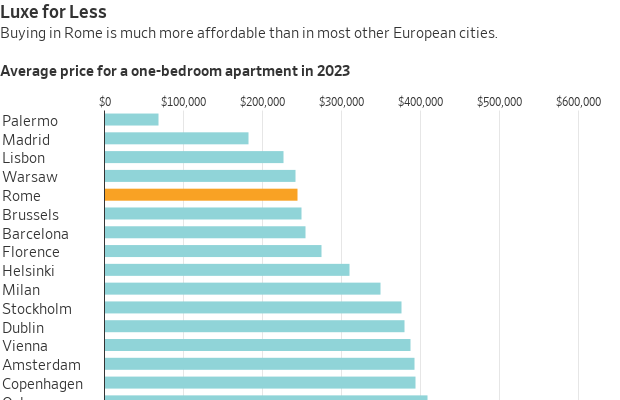

Compared with other luxury housing markets in Europe, buyers get more bang for their buck in Italy’s capital

Gianluca and Selene Santilli have all of Rome at their feet.

Their four-storey penthouse apartment in an early 20th-century villa sits atop a hill in the Italian capital’s Parioli district. With 360-degree views from sitting rooms and outdoor areas, the property provides glimpses of the dome of St. Peter’s Basilica, residential Parioli’s towering pine trees and the winding course of the Tiber River.

The 4,010-square-foot home has free-standing pavilion-like spaces that suggest an urban compound more than an individual apartment. Now, after nearly two decades in the custom-designed space, the couple have listed the four-bedroom unit with Italy/Sotheby’s International Realty. It has an asking price of $6.1 million.

A similar level of luxury in Milan, Italy’s financial and fashion capital, would cost a lot more, says Gianluca, a 67-year-old attorney. “Rome is cheap,” he says, of both the homes for sale and for rent.

Gianluca and Selene, a 64-year-old office manager, priced their home at just under $1,500 a square foot. In Milan, by comparison, a smaller three-bedroom, 2,750-square-foot unit in a decade-old high-rise, with lavish views and similarly upscale fittings, is listed for $6.445 million, or about $2,350 a square foot.

Roman-style luxury was once associated with the gargantuan villas of ancient emperors and the frescoed palaces of Baroque-era princes, but these days it conjures up another phrase: a bargain.

Affordable Luxury

Rome’s average home prices, as of August, were about $350 a square foot—less than Italy’s Florence and Bologna, and around a third less than Milan, according to Immobiliare.it, a real-estate website.

Prices in Rome peaked in 2007, and the city has been slow to encourage new development and investment, says Antonio Martino, the Milan-based real-estate advisory leader for PwC Italy. In Milan, on the other hand, an increase in supply has been outpaced by a greater increase in demand, he says.

A one-bedroom apartment in Rome is far more affordable than the average for major European cities, coming in below Barcelona, Amsterdam and Vienna, according to an affordability index compiled by Savills, the international real-estate company, which analyzed apartments outside of the historic city centres.

An average-earning Roman might need only four years’ salary to buy the apartment, while a Parisian would likely need more than twice that, according to Savills.

Rome’s luxury sector is showing new signs of life, outpacing the rest of the market, says Danilo Orlando, managing director of Savills Residential Italy. Comparing 2023 sales of homes over $1.1 million with prepandemic 2019 levels, he says, prices in Rome have increased 4% while the number of luxury-level transactions has risen 3.6%. Overall real-estate transactions were up 3% in the second quarter of this year, compared with a year earlier, says PwC’s Martino.

Orlando says that residential luxury sales in Rome are traditionally concentrated in three nearby areas that are the city’s most expensive: The Centro Storico, or the historic center, is where centuries-old palaces are often broken up into lavish multi-bedroom apartments. Parioli is a hilly district known for its Midcentury Modern flare. And a short walk away is Trieste, which has clusters of early 20th-century apartment buildings that vie in splendour with their Baroque counterparts down in the centre.

Centro Storico and Trieste

Centro Storico is by far the most expensive, says Orlando, with average prices in the premium sector reaching $1,493 a square foot in 2023. Luxury units in Parioli average about $950 a square foot, while those in Trieste are about $900 a square foot.

Tourists may flock to Centro Storico’s celebrated sites, like the Trevi Fountain, or make their way through the Villa Borghese, a massive landscaped garden that serves as a green space for both Parioli and Trieste. But they are likely to miss the three districts’ prime residential areas, which can seem discreet, if not outright hidden.

Centro Storico’s Via Giulia, running just east of the Tiber, and Via Margutta, tucked under Piazza del Popolo, are hard-to-find streets if you’re not looking for them. Via Giulia was once the address of choice for Roman nobles, and it can still lay claim to being one of the city’s most prestigious streets. A two-bedroom Via Giulia triplex, located in a building dating back to the 16th century and outfitted with vintage coffered ceilings, is listed with Italy/Sotheby’s, with an asking price of $2 million.

The centrepiece of Trieste is the Coppedè quarter, a neighbourhood of towering 1910s and ’20s apartment buildings, decorated with Moorish arches and ghoulish gargoyles, and built around a storybook-like frog fountain. Conceived by an eccentric Florentine-born architect named Gino Coppedè, the quarter combines Art Nouveau elements with a range of historical styles.

Exclusive RE/Christie’s International Real Estate has a well-maintained, four-bedroom Coppedè listing for $3.56 million. Original details in the 3,770-square-foot home include stained-glass windows, mosaic tile floors and painted ceilings.

Parioli and Pinciano

Parioli, with its many steep streets, is a bit more remote, while Trieste is flatter and more urban. For many luxury-minded Romans, a fine compromise is Pinciano, a neighborhood beneath the heart of Parioli that is as rarefied as its hilly neighbour but as accessible as Trieste.

In 2007, Dr. Claudio Giorlandino, a Roman gynaecologist, created a sprawling family home in a Pinciano building that had been commissioned just before World War I, he says, by a member of the House of Savoy, then the Kingdom of Italy’s ruling family. Designed by a noted Venetian-Jewish architect and decorated with marble recovered from a Palladian villa in northeast Italy, the building has a small number of units, with Giorlandino’s 6,200-square-foot apartment taking up a whole floor.

“I love the elegance and the extremely refined, aristocratic atmosphere,” Giorlandino, now 70, says of his neighbourhood, which borders the Villa Borghese.

Now that two of his three children are grown and living on their own, he has listed the home with Exclusive RE/Christie’s for $6.89 million.

Rome’s three most expensive districts can seem like a self-contained world, with residents moving around between them. Giorlandino, who relocated from the Centro Storico to Pinciano, is now thinking about moving back to the historic centre. The Santillis, who moved to Parioli from Trieste, are considering looking for a more compact rental still in Parioli, which they say feels insulated from the Italian capital’s notorious traffic.

“We have the historic centre nearby, but we are not in the chaos of the centre,” says Gianluca Santilli, adding that he considers “the jewels” of his unique penthouse to be the home’s three parking spaces.

Vatican views

American buyers, traditionally drawn to the Centro Storico, are also open to Parioli and to the Aventine Hill, a very steep, purely residential area on the edge of the historic centre, says Diletta Giorgolo, head of residential at Italy/Sotheby’s.

Known for its jaw-dropping views of the Vatican and for its sedate, almost suburban quality, the Aventino, as Italians call it, may be Rome’s most elusive address. Premium listings rarely come up for sale.

Lionard Luxury Real Estate currently has a ¼-acre Aventino compound, with an early 20th-century 10,800-square-foot villa, listed for $22.2 million.

Mother-daughter apartments

A new Centro Storico development proved too good to pass up for Delphine Surel-Chang, a U.S.-born student studying business in Rome, and her French mother, former actress and investor Francoise Surel, who will also relocate.

The two are putting the finishing touches on their new homes in the Palazzo Raggi, where 21st-century details are being installed in a renovated 18th-century palazzo situated between the Trevi Fountain, Piazza Navona and the Pantheon. This summer, Surel purchased a 1,460-square-foot, two-bedroom apartment for herself, and Surel-Chang says her parents helped her buy a 645-square-feet one-bedroom. The units cost $1.88 million and about $944,000, respectively. They are set to move in later this year.

Surel-Chang, 20, says she loves how the project’s contemporary elements—which she and her mother, 60, are augmenting with kitchens and bathrooms from Italy’s sleek Boffi brand—are housed in a classical setting. And she appreciates amenities like a concierge and home automation, allowing residents to control temperature, lighting and appliances via app.

She was able to customise her unit’s interiors, she says, by drawing inspiration from her two favorite local hotels, the Bulgari Hotel Roma and Six Senses Rome. She plans to furnish the unit, where she says they will stay for at least three years, with Italian Midcentury Modern pieces.

The duo bought the apartments—which are a five-minute walk from Via Condotti, Rome’s premier shopping street—for between $1,200 and $1,500 a square foot, using Italy/Sotheby’s, which also helped develop the project.

The apartments can seem like a bargain compared with similarly situated units in other major cities. For instance, a two-bedroom, 2,025-square-foot apartment in London’s Mayfair district—a five-minute walk from Bond Street, Via Condotti’s U.K. shopping district equivalent—is asking nearly $10,000 a square foot.

Affordability played a part in their choice of the Eternal City, says Surel-Chang. They considered relocating to Paris, she says, but soon realised that “for the price of an apartment in Paris, we can afford two in Rome.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Many cities are stuck with empty homes that they will likely never fill, adding to the country’s economic woes

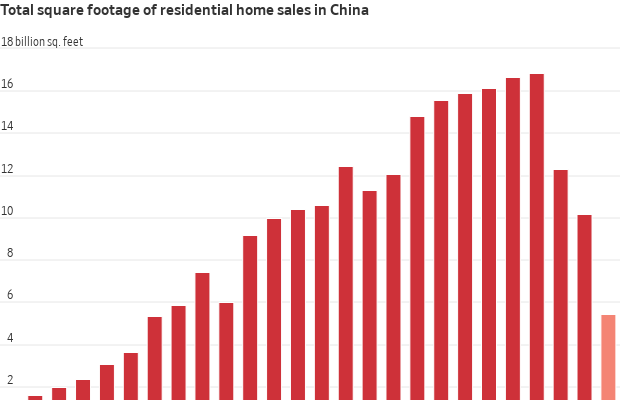

China’s real-estate bust left behind tens of millions of empty housing units. Now that historic glut of unoccupied property is colliding with China’s shrinking population , leaving cities stuck with homes they might never be able to fill.

The country could have as many as 90 million empty housing units, according to a tally of economists’ estimates. Assuming three people per household, that’s enough for the entire population of Brazil.

Filling those homes would be hard enough even if China’s population were growing, but it’s not. Because of the country’s one-child policy , it is expected to fall by 204 million people over the next 30 years.

“Fundamentally, there are not enough people to fill the homes,” said Tianlei Huang, a research fellow at the Peterson Institute for International Economics.

Some unused real estate will be bought up and lived in, especially if more government support—which economists have been calling for —convinces Chinese buyers that values will rise again. Big cities like Beijing, Shanghai and Shenzhen will almost certainly absorb their excess housing, given their dynamic economies and migrant inflows, which have helped keep their populations growing.

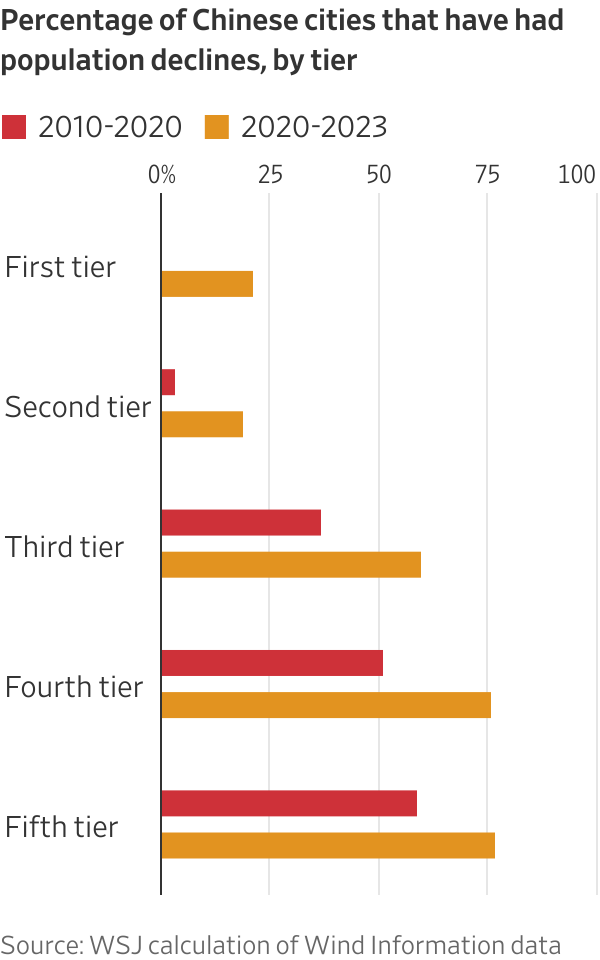

The problem is much harder to solve in smaller cities, which often have weaker economic prospects and declining populations. In China, researchers informally group cities into tiers, and many of the nearly 340 cities classified as third-, fourth- and fifth-tier—with populations from few hundred thousand to several million people—are struggling economically.

Young residents are leaving. At least 60% of China’s third-, fourth- and fifth-tier cities saw their populations shrink from 2020 to 2023, according to Wall Street Journal calculations based on official data.

Those cities have more than 60% of China’s housing inventory, according to Harvard economics professor Kenneth Rogoff . Many encouraged developers to build more—even when their populations were falling—because land sales and construction boosted economic growth and fattened local governments’ wallets.

Figuring out what to do with unneeded property is becoming more urgent as China’s economy languishes . In May, Beijing unveiled a rescue package in which the central bank would provide up to $42 billion in low-interest loans for Chinese banks to lend to state-owned firms, which would then buy empty properties and turn them into affordable housing.

By the end of June, banks had only used 4% of that quota. Economists say that even with cheap loans, it doesn’t make sense to convert empty properties, because the rents would be too low for firms to earn a profit.

Beijing recently ramped up measures to support the ailing economy and the property market, including cutting interest rates, lowering down payments for second homes and allowing home buyers to refinance their mortgages . However, economists said that more is needed to pull China’s economy out of the rut.

China’s Ministry of Housing and Urban-Rural Development and the State Council Information Office didn’t respond to questions.

Robin Xing , chief China economist at Morgan Stanley, said China’s government should introduce a more comprehensive bailout that involves buying up excess inventory in China’s 30 to 50 largest cities and turning it into public housing , without worrying about profit. Estimated cost: $420 billion.

That wouldn’t include empty homes in third-, fourth- and fifth-tier Chinese cities. Putting more money into those units, many economists say, wouldn’t make sense because there aren’t enough people to live in them anyway.

Many will become long-term burdens to cities and investors who get saddled with assets they can’t sell and which have lost their value, yet still must be maintained. Some will just wither away, economists say.

Cheap as cabbage

An abandoned development called State Guest Mansions, on the edge of Shenyang, a city in northeastern China, gives an idea of what that could look like. Construction stopped years ago, with more than 100 half-built villas in the style of grand European homes.

During a recent visit, goats roamed the complex. Grandeur Place, the building that used to house the sales showroom, looked like a post-apocalyptic opera house , with a dilapidated chandelier hanging from the ceiling. It remains unclear what will be done with the complex, whose developer has defaulted on its debt.

Shenyang at least has a growing population. In Hegang, a frigid city near China’s border with Russia, the population has declined to 940,000 from 1.09 million in 2010.

A few years ago, when Hegang’s market was hot, property enthusiasts posted online messages touting homes they said were as cheap as cabbage.

Prices now are even lower, according to an online property broker, and sales have stalled. Hegang’s inventory of unsold homes more than doubled from 2019 to 2022. Assuming a typical home size of around 1,200 square feet—the average in China in its 2020 census—only 534 residential homes in Hegang sold in 2022, according to official data on total square feet for residential real estate sold.

A 650-square-feet apartment in the city centre was recently listed for just under $9,300.

Zhou Yongzhi, a part-time stock trader who grew up there, said most high-rise apartment buildings in the city centre are dark at night. “Hegang is my hometown, and I want to see it flourish. But I don’t see much hope for it in the next 10 to 20 years,” he said.

Hegang’s government didn’t respond to requests for comment.

Rogoff, the Harvard professor, said he believes there will be some cities in China in which a quarter of the housing is empty.

In such places, “it is very hard to maintain law and order, even probably in China,” he said. “I think it’s going to be a big social and governance problem in the future.”

Complex issue

China’s property glut developed over a years long construction boom that ended in 2021, when Beijing, worried about a bubble, tightened credit for builders. It quickly became clear that developers had overbuilt .

It’s hard to determine exactly how big the problem is. China doesn’t provide an official count of empty units, so economists must devise estimates using vacancy rates, building permits and other data sources. They estimate the number is in the tens of millions—including several kinds of empty properties, each with its own challenges.

Of the up to 90 million units that are unoccupied, as many as 31 million were fully or partially built but never sold. Such properties could be bulldozed, but many are tied up in litigation related to developers’ bankruptcies. In many cases, cities and developers hope to finish them.

Another 50 to 60 million units were bought but remain empty. Many Chinese, lacking other good ways to invest their money, poured excess cash into speculative properties—often in smaller cities, where prices were cheaper—without any intention of living in them.

Approximately 74% of Chinese households in first- and second-tier cities owned more than one home across China, while nearly 20% owned three homes or more, according to a recent survey by Citi Research.

These homes are potentially more difficult to deal with because their owners still hope for appreciation. Many are in partially occupied buildings that can’t be torn down.

An additional 20 million units were sold but were left largely unbuilt by developers due to cash-flow problems and poor market conditions. The owners still want them, but developers don’t have money to finish them.

Venice on the Sea

Many builders set their sights on smaller cities when times were good. Bigger cities were getting expensive, and investors seemed willing to buy anywhere so long as prices kept climbing.

Smaller cities embraced the activity. Many issued robust population-growth forecasts, despite evidence China’s population was peaking, because it helped them secure more resources from provincial governments and justify more building projects.

In Qidong, where the Yangtze River empties into the East China Sea, local officials struggled for years to lure major investments such as factories. Selling land to developers helped them meet growth targets. Qidong’s land sales revenue more than doubled from $932 million in 2017 to $2 billion in 2021, according to data compiled by Shanghai-based Wind Information.

Developers, in turn, marketed Qidong as an ideal bedroom community for Shanghai, a two-hour drive away.

The city’s population peaked at 1.1 million in 2020 and has declined for three consecutive years. The number of local jobs has been declining since 2007.

One of the new projects, Venice on the Sea, has 40,000 units, an artificial beach and a five-star resort. Residents can enjoy faux Venetian canals and pathways dotted with Greek and Roman statues.

Xiang Dayu, a property agent there, remembers feverish demand during peak years. Some buyers openly discussed buying apartments for mistresses. Others were willing to pay without inspecting homes in person.

But most people—many from Shanghai—bought homes as investments and left them empty, Xiang says. Now, most units sit unoccupied much of the year, with occupancy rising to only around 60% during peak summer months.

Many owners are trying to sell, with dozens of units listed on auction websites or marketed on Douyin, China’s version of TikTok. In one video recently posted to Douyin, a landlord showed a property agent around a 1,030-square-foot unit, which the owner said he bought in 2016 for around $101,000 after a beach trip to Qidong with friends.

“I thought the unit had a nice view, so I bought it there and then. I never lived here, not even once, and bought it completely for investment purposes,” he said in the video. He is now trying to sell the place for around $63,100.

Venice on the Sea was built by now-bankrupt China Evergrande Group. To the north sits another massive, largely empty residential complex built by defaulted developer Country Garden . To its south is an unfinished compound developed by China Sunac Group , which also defaulted. To its west: acres of farmland.

Local government officials didn’t respond for comment.

Ghost cities

In other countries that have had overbuilt property markets, it has sometimes taken years for excess supply to be absorbed—if ever.

In Japan, a 1990s real-estate bust and a shrinking, ageing population left millions of empty homes. Tearing them down proved hard due to legal hurdles, such as when the owner can’t be located. The number of empty units grew to 9 million last year from 8.5 million in 2018, with houses littering Japan’s landscape.

In China, many owners of empty properties are likely to keep maintaining their units, since management fees in China are low and property taxes are only levied in special cases. Tough personal-bankruptcy rules in China make it hard to walk away from properties, and many want to hang on to them for a possible market rebound.

Still, some economists fear a negative spiral in which declining home prices spur more owners to try to unload empty units, depressing values for everyone.

Prices for new and existing homes in major Chinese cities fell 5.7% and 8.6% in August from a year earlier, respectively, according to National Bureau of Statistics data.

Property prices in most cities have returned to 2017 and 2018 levels, said Yi Wang, head of China real-estate research at Goldman Sachs. If prices drop to 2015 levels, many more owners might choose to sell unoccupied properties. That’s because 2015 was the beginning of the last boom, and owners who bought early won’t want to see their units’ values fall below what they paid, Wang said.

That might be inevitable, though, given China’s falling population.

“I don’t think the housing oversupply problem has a solution, really,” said Huang, of the Peterson Institute. “Fundamentally, it’s the problem of declining demographics. Ghost cities will remain ghostly.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Ballooning home insurance costs and the perennial threat of violent storms hit Tampa Bay housing market hard

ST. PETERSBURG, Fla.—Kellen Driscoll bought his home here in 2019, settling in the coastal enclave of Shore Acres. It flooded for the first time four years ago after tropical storm Eta dumped more than 3 feet of water.

Hoping it was a fluke, Driscoll tore out the affected drywall and started fresh. After all, the four-bedroom home built in 1960 had no flood history.

But then it happened again, and again. Like many others in the community, he put his home up for sale in the spring of this year. After seeing little interest, he cut the asking price.

On Friday, Hurricane Helene deposited more than 6 feet of storm surge in the neighbourhood. The rushing waters ripped the “For Sale” sign off his front lawn, and etched a waterline that reached halfway up his front door, just underneath the doorbell. He reduced the asking price for a fifth time.

“We flooded here four times in the last four years,” said Driscoll, as he threw his television sets, furniture, appliances and other belongings to the curb. “I’m just hoping I can sell the house. It’s a good neighbourhood for sure, but dealing with the floods is horrible.”

In the Tampa Bay metropolitan area, which includes St. Petersburg, a real-estate boom nearly doubled median home values from 2018 to June of this year, according to Redfin data. Young people flocked to the region, looking for a coastal lifestyle at a relatively affordable price.

The Tampa Bay metro area was the fifth most popular relocation destination in the country, according to an analysis by Redfin last year. The population has soared to more than three million.

But as Shore Acres’s young residents sorted through the storm’s wreckage, only one thing was on their minds: selling.

Ballooning home insurance costs and the perennial threat of violent storms are starting to undermine housing markets throughout much of the state. But in few places has the turnaround been more dramatic than in low-lying communities up and down the coast of Florida that frequently flood.

The Tampa Bay housing market had been softening even before Helene struck. While prices have been flat, the area experienced a 58% increase in supply in August compared with a year ago, and a 10% decrease in demand, according to Parcl Labs, a real-estate data and analytics firm.

About half the homes listed for sale in Tampa experienced price reductions as of Sept. 9, the third highest share of all U.S. major metropolitan areas.

“Tampa was already heading in this direction before the hurricane hit,” said Jason Lewris, co-founder of Parcl Labs. “This hurricane may compound the market dynamics that have been occurring there over the last few months.”

While Tampa escaped a direct hit from the eye of the hurricane, it was the worst storm to hit the area in a century. The hurricane also plowed into landlocked towns well north, causing heavy damage in the Carolinas where people were just beginning to absorb the scope of ruin.

‘Let’s roll the dice’

Bradley Tennant’s home flooded last year. But to avoid all the competition, he was waiting a year to put it up for sale.

“We saw the glut of homes for sale in the spring and thought, ‘What are the chances it’ll hit again the next year?’” said Tennant, as he cleared out the soaked contents of his waterfront home. “We went 50 years without a storm that flooded the house. So we thought, let’s roll the dice.”

While he paid around $350,000 for the house about seven years ago, Tennant says he received offers as high as $800,000 during the height of the market—before last year’s storm hit. Now he’s hoping to sell as soon as he’s able to renovate.

The area’s affordability, once a large part of its appeal, is also waning as insurance premiums soar. Jacob McFadden was paying $880 a year to insure his home when he bought it in 2020. That amount has since almost quadrupled, to $3,300.

Premiums will likely increase again now. Property damage from last week’s Category 4 storm could be as high as $26 billion, according to estimates from Moody’s Analytics.

“I don’t know how much longer I’m going to do this waterfront living,” McFadden said, standing in front of his home with a wheelbarrow and his home’s contents scattered around the front yard. “This may be the end.”

Dustin Pentz bought his home 10 years ago, and was one of the lucky few to avoid flooding. That is until Hurricane Helene. When police blocked his car from entering the neighbourhood, he paddleboarded his way home to assess the damage.

His fridge was knocked over, and the water reached up as high as his mattress. Unfortunately, his flood insurance doesn’t cover the contents of his home. A tree in his backyard fell over and hit the corner of his roof, but he was unsure that the damage would hit his $8,500 wind deductible.

“This neighbourhood’s amazing, great schools. But no one wants to deal with this all the time,” said Pentz. “It sucks because no one wants to live here anymore. There are so many houses for sale and no one’s buying.”

Working class squeezed

Down the street, Domonique Tomlinson and her husband, Leon Tomlinson, filed a claim for items they lost in last year’s flood. They didn’t want to go through the headache of filing another claim for the contents of their home this year, with a separate $5,000 deductible.

Two days before Hurricane Helene hit, they rented a moving van to haul many of their belongings to a storage unit. She bought her home four years ago for around $199,000. Because property values have increased so much in her area, she hopes to break even. But now she says she’s not so sure.

Tomlinson, who is a teacher, and her husband, who works as a manager at a grocery store, worry that people like them will be priced out of the area because they can’t afford the preventive measures and insurance.

“Basically the only people that are going to be able to live back here are rich people who can build up,” she said.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The 4,100-square-foot apartment next to Kensington Palace is also just steps from Hyde Park and is near Freddie Mercury’s home

Living next to British royals comes at a premium, and in this case, the price is £20,000 (US$26,527) per week.

The London apartment, which neighbours Kensington Palace, home to Prince William and Kate Middleton, Princess of Wales, hit the rental market on Tuesday.

Its exclusive Palace Green address also puts it near Kensington Gardens and Hyde Park.

Courtesy of Harrods Estates

“Palace Green is famous for its privacy and security, with some of the most prestigious homes in the city,” Sarah McIntyre, head of rentals at Harrods Estates, said in a statement. “The area combines luxurious amenities, lush green spaces, and a rich sense of history, making it one of the most sought-after addresses in Prime Central London.”

Located on the second floor—accessible via elevator—the apartment spans 4,126 square feet. It has four en-suite bedrooms and an additional room that could serve as either a fifth bedroom, a home office or a more informal living space, according to the listing with Harrods Estates. The spare room features a half-bath.

Interior details include parquet flooring, crown mouldings and a sleek modern kitchen. The home also has an air-cooling system—a rare amenity in the U.K.—and a spacious private terrace.

In addition to the plethora of green spaces the Kensington neighbourhood offers, the building has communal gardens for residents. It also has underground parking and 24-hour concierge services.

“The building was the first project in London to introduce hotel-style concierge services to apartment living when it was built in the 1990s,” McIntyre told Mansion Global.

Kensington has a history of notable residents, including Winston Churchill and Freddie Mercury, and it consistently tops the list for London’s priciest areas.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The figures once more emphasize the resilience of the Dubai real estate market

Dubai’s real estate market achieved a record-breaking total sales value of AED 141.9 billion in Q3 2024, marking the highest ever for a single quarter.

This surpassed the previous record of AED 124.07 billion set in Q2 of this year and reflected a 30.1% year-on-year increase in value.

A market update issued today by fäm Properties reveals there were 50,423 overall sales transactions in Q3, a 37.9% year on year increase in volume and a 16.6% rise on Q2.

The 39,058 apartment sales worth AED 70.5 billion represented 77% of the total Q3 transactions and showed a 43.9% increase in volume on the same period last year.

Meanwhile, 8,156 villas sold for AED 39.2 billion, a rise in volume of 16.6% over Q3 2023 and an increase of 18.4% on the previous quarter.

Rising property values in recent years were highlighted by a median price of AED 1,511 per sq ft, compared with the Q3 rates of AED 1,017 in 2021, AED 1,179 in 2022 and AED 1,405 last year.

Sales of 2,102 plots for AED 29.9 billion represented a 45.9% leap in volume on Q3 last year and a 42.3% increase on Q2. In commercial real estate, 1,112 sales worth AED 2.3 billion were up 12.1% in volume on Q3 last year.

“The figures once more emphasize the resilience of the Dubai real estate market and the consistent growth we’ve seen in recent years, which continues to enhance investor confidence,” said Firas Al Msaddi, CEO of fäm Properties.

“This ongoing upward trend reinforces Dubai’s status as a leading destination for real estate investment, attracting growing interest from global investors, as well as buyers from the local and regional markets.”

Dubai’s 3Q property sales over the last five years have now risen to the current peak level from AED 18.1 billion (8,600 transactions) in 2020 to AED 42.4 billion (15,900) in 2021, AED 69.5 billion (25,500) in 2022 and AED 109.2 billion (36,700) last year.

The top five performing areas of Dubai in Q3 were Jumeirah Village Circle (4,467 transactions – AED 5.33 billion), Dubai South (2,910 – AED 8.25 billion), Business Bay (2,651 – AED 7.22 billion), Wadi Al Safa 5 (2,382 – AED 5.3 billion) and Dubai Hills Estate (2,358 – AED 7.38 billion).

The most expensive individual property sold in Q3 was a luxury One at Palm Jumeirah apartment which fetched AED 275 million.

With properties worth AED1-2 million accounting for 31% of sales, 29% were below AED1 million, 18% between AED2-3 million, 14% between AED3-5 million, and 8% more than AED5 million.

Overall, first sales from developers significantly outnumbered re-sales in the secondary market – 68% over 32% in terms of volume and 63% against 37% in value.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

The Franck Muller Vanguard Tower will offer an unmatched luxury lifestyle experience, with residences starting from AED 1.25MN and a planned handover by September 2027.

Following the huge success and the sell-out of the Franck Muller Aeternitas Tower, London Gate and Franck Muller have unveiled their latest venture—the Franck Muller Vanguard Tower.

Located in the prestigious Dubai Marina, this exceptional luxury development builds on the achievements of their first collaboration and aims to revolutionize the branded real estate market in Dubai.

Combining Franck Muller‘s iconic design innovation with London Gate’s expertise in creating extraordinary living spaces, the project is valued at AED 1.6 billion. The Franck Muller Vanguard Tower promises an unparalleled luxury lifestyle, with residences starting from AED 1.25 million, and the handover is scheduled for September 2027.

According to Morgan’s 2024 report on Dubai’s Branded Residences, the number of units produced in 2024 rose almost 50% from 2022, currently accounting for 7.2% of all property transactions in Dubai.

Spanning 34 floors, the Franck Muller Vanguard Tower will feature 722 luxury units, ranging from studios to three-bedroom apartments. Studio apartments are sized between 414 and 674 sq. ft., while one-bedroom residences range from 779 to 1,010 sq. ft. Two-bedroom apartments are 1,041 sq. ft., and three-bedroom units span between 1,768 and 1,862 sq. ft. Each residence offers a meticulously designed space inspired by the sleek lines and innovative spirit of the Franck Muller Vanguard watch collection, with sweeping views of the Dubai Marina and exquisitely crafted interiors.

“We are extremely proud to unveil our latest project with our strategic partner, where architectural opulence meets timeless luxury, we bring Franck Muller’s second branded residence to Dubai with the Franck Muller Vanguard Tower. With this partnership, we aim to reinstate the standards of sophistication and elegance, creating a living experience that reflects the brand values and vision of both London Gate and Franck Muller. An exclusive branded residential project, this will stand as a testament to our commitment to crafting unparalleled and never-seen spaces that resonate with our brand partner’s essence and prestige,” said Eman Taha, CEO of London Gate.

“With London Gate our commitment to both quality and delivery always remains our top priority with every project. Three of our projects, namely Nadine 1, Nadine 2 and Maya 5, are now completed ahead of schedule. Our iconic Franck Muller Aeternitas tower is rapidly moving towards completion with 30 floors already completed,” she adds.

The Franck Muller Vanguard Tower is more than just a collection of residences – it is a destination within one of the world’s most vibrant urban settings. Offering panoramic views of the Dubai Marina, it serves as both a dream home and a top-tier investment opportunity. The unique location attracts residents who appreciate luxury, exclusivity, and unparalleled access to Dubai’s bustling tourist and business districts. The Tower is designed for those seeking a lifestyle that is both refined and dynamic. With state-of-the-art amenities, the development offers modern fitness centers with cutting-edge equipment, luxurious swimming pools and serene lounges, full concierge services, secure parking with private access and immediate proximity to Dubai’s top attractions.

“After the record-breaking success of our first project together with Aeternitas Tower, we have set a benchmark for what branded residences can achieve in Dubai. This positions our partnership with London Gate as one of the most successful collaborations between a developer and a luxury brand in the region. In less than a year, this is our second major launch, and we’re absolutely thrilled and confident to bring yet more elegance to the Dubai skyline with Franck Muller Vanguard Tower. This residential tower truly embodies the grandeur and elegance that are synonymous with our timepieces. We believe this project will resonate with our clientele and further strengthen our position in the market,” said Erol Baliyan, Managing Director, Franck Muller.

Built upon the innovative spirit that has propelled Franck Muller to the forefront of horological design, the Vanguard Tower represents a bold, new statement in residential architecture. Every aspect of the tower’s design is meticulously executed, combining modernity with enduring sophistication.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

Zen by Leva promises to elevate the 5-star experience by focusing on deeper, more meaningful journeys for its guests.

LEVA Hotels, a vibrant and innovative homegrown hospitality brand, announced the official launch of its 5-star luxury brand, Zen by Leva, coinciding with the opening of the Future Hospitality Summit in Dubai.

This new venture will offer a fresh take on luxury, with the debut property set to open in Saudi Arabia. Zen by Leva promises a refined fusion of comfort and exploration, aiming to redefine the 5-star experience by creating deeper, more meaningful guest journeys.

Since its inception in 2019, when LEVA opened its first 4-star property in Dubai, the brand has expanded rapidly, now managing 11 properties across the Middle East and Africa. A recent report by Colliers International highlights the MENA hospitality market’s potential to grow to $32 billion by 2026, driven by rising tourist numbers and regional economic diversification efforts. LEVA is well-positioned in this market, embracing innovation, technology, and personalized service to distinguish itself as a forward-looking brand. The introduction of Zen by Leva marks the next bold step in the company’s evolution within the hospitality industry.

Zen by Leva: A Luxury Brand with a Higher Purpose

Zen by Leva redefines luxury by focusing on enriching experiences that engage both the senses and the mind. More than opulence and glamour, Zen is about offering travelers soulful experiences that resonate on a personal level. In today’s market, 65% of global luxury travelers say they prefer experiences that offer personal growth and self-discovery, reflecting a shift away from traditional luxury (Skift Research). Zen by Leva is designed for guests who seek both inner journeys and external exploration, offering a carefully curated, balanced experience that reflects the best of both worlds.

JS Anand, Founder & CEO of LEVA Hotels, shared his thoughts on this exciting new chapter: “We created Zen by Leva to meet the changing desires of modern luxury travelers. Today’s guests are looking for more than just beautiful surroundings—they’re seeking meaningful experiences that resonate on a personal level. Zen represents our belief that the true luxury of tomorrow lies in enriching the soul and engaging the senses. This brand is designed to offer elevated experiences that inspire both internal reflection and external exploration.”

The First Zen by Leva Property in Saudi Arabia

The first property under the Zen by Leva banner will open in Saudi Arabia, aligning with the Kingdom’s Vision 2030 initiative, which aims to increase tourism’s contribution to the GDP from 3% to 10% by 2030. This surge in tourism is driving rapid growth in the hospitality sector, with Saudi Arabia’s hotel market expected to grow at a compound annual growth rate (CAGR) of 12% between 2022 and 2026 (KPMG Report). The new 5-star hotel will offer world-class amenities and thoughtfully curated experiences tailored to both UMRA travelers and visitors looking to explore the rich culture of the region. Designed to blend local culture with global sophistication, the property will provide an environment for guests to embark on journeys of self-discovery and outer exploration.

The essence of Zen by Leva is captured in its brand promise “Elevating Senses.” Today’s luxury travelers value experiences that engage all their senses, with 78% of global luxury consumers prioritizing personalized services that enhance their overall experience according to a report by Bain & Company. Zen by Leva focuses on enhancing guests’ sensory experiences, creating an interplay between external adventure and internal reflection. Each Zen by Leva property blends personal growth, solace, and self-discovery with sophisticated comfort and exceptional service, offering a hospitality experience that nourishes both body and soul.

Strategic Investment and Future Plans

To support the growth of the Zen by Leva brand, LEVA Hotels is committing an initial investment of $15 million, with plans to acquire 1200 keys in regions including Saudi Arabia, Egypt, Morocco, Qatar, and UAE, under the Zen brand within the next 2027. This investment reflects LEVA’s confidence in the brand’s potential and the growing demand for luxury experiences in the MENA region.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The Alba is the first mixed-use garden retreat by the sea in the world designed by Zaha Hadid Architects

OMNIYAT officially unveiled its latest architectural marvel, The Alba, during the Monaco Yacht Show. The launch event, held on September 26th, gathered an exclusive group of VVIP customers and media representatives to celebrate this groundbreaking mixed-use development on Dubai’s coastline. Valued at AED 7 billion ($1.9 billion), the project marks a significant milestone.

One of the key moments of the event was the signing ceremony between OMNIYAT’s Founder & Executive Chairman, Mahdi Amjad, and Christopher Cowdray, President of Dorchester Collection, held at the Yacht Club de Monaco to commemorate the occasion.

Speaking at the ceremony, Mahdi Amjad, Founder & Executive Chairman of OMNIYAT, said: “The Alba, Dorchester Collection, Dubai, represents OMNIYAT’s vision of reimagined luxury by the sun and sea in Dubai. With this project, we’re providing a level of residential living previously unseen in the emirate, influenced by the incredible talent and inspirational ethos of Zaha Hadid Architects and operated by our longstanding partner, Dorchester Collection.

“This project is particularly special as it offers a harmonious blend of nature and cutting-edge design. Dubai derives so much of its charm and lifestyle from its seaside location, and The Alba – featuring OMNIYAT’s signature focus on crafting privacy-centric residences – enhances this unique connection with the water by offering a personalised waterfront experience. OMNIYAT will continue to curate unique experiences, creatively collaborating with some of the world’s most visionary minds, to surpass the traditional definition of well-living.”

Christopher Cowdray, President of Dorchester Collection, commented: “The Alba is our next luxury chapter in Dubai in partnership with OMNIYAT. Each space will be a sanctuary within an exclusive enclave that will offer residents and guests both privacy and serenity in this dynamic city. This next-level lifestyle and hospitality experience will be combined with the impeccable service of Dorchester Collection; the foundation of our culture is the care we have for our guests and people, which has been celebrated globally. With panoramic views across the sea and the city’s famous landmarks, The Alba will provide redefined luxury through exceptional design in an environment where nature and wellness converge.

“Guests and residents will enjoy exclusivity in Dorchester Collection’s first garden retreat by the sea with its expansive private terraces and immersive wellness offerings, cultivating a sophisticated oasis for reawakening, reconnection and renewal.”

Zaha Hadid Architects (ZHA) redefined architecture for the 21st Century with award-winning buildings that have captured imaginations across the globe. Continuing the legacy of their founder, ZHA’s renowned architectural projects become more spatially inventive, more artistically refined, more technologically advanced and more environmentally considerate with each new design. The Alba Residences offer exclusive living that places the resident at the very center of every space. The signature OMNIYAT vision of crafting and curating the unconventional will be evident in the residences, tailored for individuals seeking a life of privacy and serenity.

The Alba, Dorchester Collection, Dubai elevates luxury living, representing OMNIYAT’s boundless vision through a seamless blend of beachfront hospitality and ultra luxury residential experiences. At the heart of The Alba’s vision is a distilled focus on ‘well-living’ – ensuring longevity, sustainability and a deep connection to nature. Each residence also has its own private amenities, including private pools, outdoor jacuzzies, and elevated sun platforms, all placed on expansive outdoor terraces.