Home Buyers Get Ahead of Supply-Chain Issues by Purchasing the House and Everything Inside

One couple in California paid $30,000 for all of the seller’s furniture so they wouldn’t have to ‘sit in an empty house’

Last year, Gerardo and Rita Luna upgraded from their roughly 2,700-square-foot home in Oxnard, Calif., to a much larger house in nearby Santa Paula, paying $2.4 million. The couple, who own four automotive repair facilities, said they had been looking for a quieter place, where they wouldn’t be able to “shake their neighbors’ hands through the window,” Mr. Luna said. The Santa Paula estate, on 6 acres, fit the bill perfectly.

The only problem: how could they possibly furnish such a large property? They didn’t have nearly enough furniture to fill the nearly 7,000-square-foot house, and what they did have didn’t fit the French Country style of their new home. Plus, they knew that global supply-chain issues would likely make buying new furniture difficult and time-consuming. Instead, Mr. Luna proposed an unusual solution: They offered to buy all of the seller’s furniture, although the heavy draperies and plaid upholstery didn’t exactly fit their taste.

“We knew that it would take us perhaps years to fill the house with furniture,” said Mr. Luna, 45. “So, even though it didn’t totally fit our vibe, we felt it made sense. We didn’t want to sit in an empty house.”

The seller was downsizing to a new home nearby and agreed to sell her furniture to the Lunas for about $30,000, “pennies on the dollar,” compared with the original prices, said the Lunas’ real-estate agent, Victoria Adam of LIV Sotheby’s International Realty.

It’s a good thing she did. A new dining table the Lunas ordered for the house took six months to arrive, while a new sofa took three. “In the meantime, we had a sofa to sit on,” Mr. Luna said.

In the past, it was common for properties in second-home or resort communities to be sold with the furniture included, but primary homes were traditionally delivered empty. Since the onset of the pandemic, however, more home buyers are making offers to purchase properties fully furnished, real-estate agents said. With supply-chain delays and other logistical issues leaving buyers waiting months or even years for their new furniture, agents said, purchasing the sellers’ furniture is much more appealing than it used to be.

Developer Rick Rosemarin said he encountered this desperation firsthand last year, when he was trying to sell a roughly $10 million estate he built in Greenwich, Conn. It turned out that one would-be buyer who toured the modern estate was just trolling for furniture. The buyer said the house wasn’t for him, but asked if he could purchase all the furniture for another home he was buying. “That was hysterical,” said Mr. Rosemarin, 37.

While Mr. Rosemarin wouldn’t part with the furniture—it took him close to a year to furnish the house with supply-chain delays—he said didn’t blame the man. “The time frame for some of these deliveries was a joke,” Mr. Rosemarin said. “To this day, we still have a table we ordered in 2021 that hasn’t been delivered.”

When he did sell the property in December 2022, the buyers—a family from overseas—wanted most of the furniture, and paid a premium for it, Mr. Rosemarin said, although he declined to say how much. “They initially wanted to order their own for a few rooms, but when they found out from their interior designer how long it would take, they ended up buying more from us.”

Buyers are also increasingly asking to purchase the rental furniture that many owners use to “stage” their homes for sale. Home-stager Robert Sablic of Quadra said his company recently furnished a four-bedroom apartment asking $45 million at Manhattan’s One57 condominium. “Shark Tank” star Robert Herjavec made an offer to buy the condo for $34.5 million, but only if the rental furniture was included.

Such instances used to be unusual, Mr. Sablic said, since high-end buyers often preferred to have all new furniture rather than used pieces that had been shifted from place to place by the staging company. They also present a challenge for stagers, who want to keep their clients happy but also have to quickly re-source and purchase new items for their own inventory, while dealing with supply-chain issues themselves.

Andrew Bowen, partner at ASH Staging, said as a result of the surge in demand, his company recently started renting staged furniture to buyers for a year, so that they could have a place to sit and sleep while waiting for their own items to arrive.

Other buyers, however, simply fall in love with the sellers’ furniture.

Last year, real-estate agent Joan Herlong made a deal to sell a house in suburban Simpsonville, S.C., for about $9 million, a record for the area. The only glitch: the buyers loved the sellers’ eclectic, colorful furniture, which wasn’t for sale. The sellers planned to take everything with them to a new home they were building in nearby Greenville.

Once the deal was in contract, the buyers convinced the sellers to part with their furniture, Ms. Herlong said. She said she doesn’t know how much they paid for the furniture, but believes it could have been a seven-figure sum. Thinking it might be fun to “order all new stuff,” the sellers moved out with only a few suitcases, she said, leaving nearly their whole lives behind.

“Sometimes people don’t want to just buy your house, they want to buy your whole lifestyle,” Ms. Herlong said. The sellers did, however, draw the line when the buyer wanted their pet cows, too. “I’m not a cattle broker,” Ms. Herlong quipped.

When New York City media executive Andy Plesser, 71, started hunting for a weekend home in Connecticut’s Litchfield County, he wasn’t planning on buying a fully furnished house. But when he saw the home of Eric and Liz Macaire, he fell for their furnishings.

Mr. Macaire, 60, a restaurateur, and Ms. Macaire, a 54-year-old interior designer, had curated the home with items such as a set of 1940s bowling benches, a yellow settee that once belonged to Ms. Macaire’s socialite aunt, and an antique dough maker from a Paris flea market. There was also a pair of 19th century English “half moon” tables, an antique gold-framed beveled mirror and a cubist painting above the fireplace. “They were things that couldn’t easily be replicated or replaced,” said Mr. Plesser. He bought the house in November 2022 for $1.25 million, and made an unsolicited offer to buy all the furniture.

The Macaires were amenable to selling everything but a few sentimental items for $17,000, said Lenore Mallett of William Pitt Sotheby’s International Realty, a real-estate agent who worked on the deal. They were downsizing anyway, Mr. Macaire said, and some of the pieces would have been challenging to move. “It’s a compliment that people want the pieces we chose,” Mr. Macaire said.

While he didn’t buy the furniture for convenience so much as admiration for the sellers’ tastes, Mr. Plesser said it was also nice to have the pieces in place immediately, rather than waiting for new furniture to be delivered.

Dallas real-estate agent Cindi Caudle of Briggs Freeman Sotheby’s International Realty sold a roughly $2 million, two-bedroom pied-à-terre last year at the HALL Arts Residences condominium. The buyer, from California, wanted all the staged furniture, including small details like the Hermès blankets and decorative bowls on the countertop. When the deal closed, Ms. Caudle said she removed what she thought were throwaway staging items, including plastic lemons from a wooden bowl; they hadn’t used real lemons to avoid them going bad. When the buyer arrived in his new home, however, he quickly called Ms. Caudle to ask that the lemons be returned.

“I thought I was doing him a favour, that he wouldn’t want those nasty things,” she said. Instead, “I felt like the lemon thief. The lemon thief who came in the middle of the night.”

Sometimes, disputes over furniture and other add-ons can threaten to derail a deal. Greenwich real-estate agent Amanda Miller of Houlihan Lawrence said she almost had a multimillion-dollar deal fall through over a dispute about outdoor furniture cushions. “It can be the couch that breaks the deal, sometimes,” she said. To avoid these kinds of snafus, agents recommend sealing the deal for a property first, then turning to negotiations over furniture.

“Sometimes, folks can get emotional and stuck over stupid things, like a bureau or something,” said Evelyn Tilney of Kienlen Lattmann Sotheby’s International Realty in New Jersey. “I like to keep them separate so that if the furniture falls through, it doesn’t jam up the whole deal.”

Agents said they also recommend a separate bill of sale for the furniture, since mortgage lenders don’t want to have to determine the value of the furniture for the purposes of financing.

Ms. Herlong said she once had an eccentric buyer make an offer contingent on the seller parting with his two dogs. The lender’s appraiser wanted to charge extra for researching the resale market for Jack Russell terriers.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Gross rental yields range from 5% to 8% for prime apartments and 3% to 5% for prime villas

Average asking rents in apartments listed on Qatar real estate platform hapondo have increased in key neighborhoods across Qatar, with the prime apartment markets, including The Pearl, West Bay and Legtaifiya, and Lusail, witnessing the most significant rental rate hike seen during the third quarter of the year, according to the online marketplace.

The average rent for a one-bedroom listed on hapondo in West Bay increased by more than 7% to QAR 9,760/month and by 4.5% to QAR 7,980/month in Marina District, Lusail. In the two-bedroom apartment category, both West Bay and Marina have also seen significant increases in rent quarter-on-quarter.

Meanwhile, rents in The Pearl have remained stable at QAR 8,490/month (one-bedroom) and QAR 11,500/month (two-bedroom). In Fox Hills, the average 1BR rent remained at the QAR 5,800/month level while the average 2BR rent shrunk by nearly 3%.

Unlike Q2 when rents in West Bay and Marina decreased, the latest quarter saw better performance for one-bedroom apartment rents in prime markets and in select downtown areas such as Al Sadd (6.6%) and the Old Airport (3%).

However, several neighbourhoods saw a decrease in 2BR apartment rents, with the largest seen in Al Mansoura, Doha Jadeed, and Najma where the average rents of available apartments listed on hapondo declined by approximately 8%.

Meanwhile, the median rents in key neighbourhoods for medium-size villas (3- to 5-bedrooms) have moved upwards. The Pearl’s median rent increased from QAR 29,930/month to QAR 30,900/month. Median rents of listed mid-size villa properties in hapondo have increased by an additional QAR 500/month to QAR 1,000/month in West Bay, Al Hilal, and Ain Khaled while rents remained stable in Al Mamoura, Old Airport, and Al Waab.

Abdullah Al Saleh, CEO of hapondo’s parent company Sakan, comments: “The rental market continues to be strong in Qatar, especially in the prime residential sector where gross rental yields range from 5% to 8% for prime apartments and 3% to 5% for prime villas. In hapondo, a significant portion of our users search for apartments in The Pearl and West Bay, and they look for villas in places such as Al Waab and West Bay Lagoon, signifying the market’s interest in quality spaces and convenient living.”

With more than 85% of the population considered expatriates, the population in Qatar grew from 2.86 million in June 2024 to 3.05 million in August, according to data from the National Planning Council.

In Q3, the Qatar Real Estate Price Index also bounced back from a 2-year low performance in April. The Index recovered from 202.46 points in April to 215.05 points in August, signifying a gradual recovery of selling prices across the country.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Off-plan and under construction properties dominate at nearly 73%

Dubai’s property market recorded 18,038 transactions in September 2024 – a new all-time monthly high – with almost three quarters (73%) for properties under construction having been sold off-plan, according to new insight from leading real estate intelligence and data authority, Property Monitor.

Property Monitor’s monthly analysis of Dubai’s real estate market shows that September transactions surpassed the previous record of 17,139 – set in May this year – by almost 900, highlighting continued growth – and confidence – in the sector, which is on track for 30% year on year growth by the end of the year. 2024 sales have now passed 131,000 just under 2% less than for the whole of 2023.

With 17,151 sales, residential transactions accounted for more than 95% of the September total.

Top of the off-plan sales charts was Emaar, with 2,343 registrations, followed by DAMAC Properties with 1,516 and Sobha with 810, according to the research.

September also set a new record for the highest priced apartment sale of 2024: AED275 million for a five-bedroom apartment at The One on Palm Jumeirah. The lowest recorded sale price was AED124,000 for a studio in Dubai South.

Property prices rose by 1.14% in September compared to August, at an average AED1,448 per sq ft. The median price for an apartment was AED1.3 million, for a townhouse AED2.76 million and a villa AED7 million, according to Property Monitor’s insight.

The research also shows a surge in mortgage activity, with transaction up 16.6% month-on-month. Almost 4,200 registrations took place in September as investors took advantage of lower interest rates.

Henry Bacha, Chief Executive Officer, Property Monitor, said: “September 2024 was yet another ground-breaking month for Dubai’s real estate sector, setting new records in both sales transactions and prices. Our findings underpin the ongoing success and evolution of the property market, which continues to flourish and looks set to end the year on another high, with 30 per cent growth compared to last year. A robust pipeline of new projects and easing mortgage rates continue to drive demand for both off-plan and ready properties.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

The seven-building, low-rise development is the latest expansion of the prestigious Eden House brand, developed by H&H and sold exclusively by Dubai Sotheby’s International Realty

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

Marcus has over 20 years of experience in sales strategies and market analysis

The Metropolitan Group has appointed Marcus Andersson as the new head of Penthouse.ae, a Dubai-based full-service real estate agency specializing in serving the needs of Ultra High Net Worth Individuals (UHNWIs).

With his extensive experience and proven track record in the international real estate market, Marcus will play a pivotal role in driving the growth of Penthouse.ae and strengthening its position as a leader in Dubai’s super-luxury real estate sector.

Marcus has over 20 years of experience in sales strategies and market analysis, having worked across four countries. His entrepreneurial spirit and successful ventures, including the establishment of three companies focused on real estate investments, have resulted in impressive sales exceeding USD 1 billion.

“We are excited to have Marcus take the lead at Penthouse.ae as we continue to expand our footprint in the super luxury real estate sector in the UAE,” said Nikita Kuznetsov, CEO of Metropolitan Group. “His deep understanding of the real estate market, coupled with his passion for excellence will be invaluable in driving Penthouse.ae’s continued success. As Dubai’s super-luxury real estate market continues to flourish, Marcus’s expertise will be instrumental in meeting the evolving demands of our discerning clientele.”

Commenting on his appointment, Marcus Andersson said, “I am excited to lead our exceptional team in this vibrant market. Dubai’s super-luxury real estate sector is witnessing remarkable growth, and I look forward to leveraging my expertise to unlock new opportunities for our clients. Together, we will elevate Penthouse.ae’s status as a premier player in the super-luxury segment.”

Under Marcus’s leadership, Penthouse.ae will continue to offer a curated portfolio of luxury properties, including penthouses, villas and mansions, located in the most prestigious neighborhoods of Dubai.

Marcus’ appointment comes at a time of significant growth for Dubai’s super-luxury real estate sector. The city’s strong economy, strategic location and world-class lifestyle offerings have made it a highly sought-after destination for HNWI’s and investors. Penthouse.ae, with its focus on exclusive properties and exceptional services, is well-positioned to capitalize on this thriving market.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The project blends luxury living with smart investment opportunities.

This project marks the official sales launch and signifies a new milestone in Jad Global’s development journey. The company plans to launch additional projects in Jumeirah Garden City over the coming months, with total investments exceeding AED 1 billion.

The project offers a suite of premium amenities designed to elevate the resident experience, including an infinity pool, a spacious social clubhouse, a fully equipped fitness center with state-of-the-art facilities, and electric vehicle charging stations.

Jumeirah Garden City’s strategic location, bolstered by modern infrastructure and a planned metro station, ensures it remains a top destination for lucrative real estate investments and high-quality living.

Commenting on the occasion, Mohammed Al Sheikh, Co-Founder of Jad Global, said, “Our team has successfully developed numerous landmark projects across Dubai, cementing the city’s reputation as a global hub for luxury real estate. Our extensive experience in the sector allows us to deliver iconic projects that reflect Dubai’s spirit of innovation and ambition.”

He added, “171 Garden Heights represents our renewed commitment to creating vibrant communities that align with Dubai’s vision of a sustainable and forward-thinking future. This project aims to surpass expectations and bring additional value to Dubai’s dynamic real estate market.”

All units in “171 Garden Heights” come fully furnished with exquisite designs, providing residents with an unparalleled living experience. The project offers an ideal opportunity for both long-term residence and short-term holiday rentals, delivering attractive investment prospects with flexible leasing options and high returns.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The capital’s real estate market is benefiting from various economic and demographic factors that are shaping its growth trajectory.

Abu Dhabi’s real estate market continues to demonstrate resilience, with both affordable and luxury property segments performing well throughout the third quarter of 2024. According to the latest market report by Bayut, the UAE’s leading property portal, the capital’s real estate market is benefiting from various economic and demographic factors that are shaping its growth trajectory.

Trends in Property Purchases

Among those seeking affordable apartments, Al Reef, Al Ghadeer, and Masdar City emerged as the top locations during Q3 2024. Buyers have been particularly drawn to these areas due to their strategic locations and competitive pricing, offering value-driven investment opportunities.

For those in the market for luxury apartments, Al Reem Island, Al Raha Beach, and Yas Island have remained prominent choices. These areas are known for their upscale living environments, premium amenities, and proximity to some of Abu Dhabi’s key attractions. Saadiyat Island recorded the highest price increase for luxury apartments, with prices per square foot rising by up to 8%, driven by sustained demand.

In the villa market, Al Reef, Khalifa City, and Al Shamkha attracted the most attention in the affordable segment, with prices seeing steady growth. In the luxury villa segment, Yas Island, Al Raha Gardens, and Saadiyat Island led the market, benefiting from the allure of exclusive living spaces near Abu Dhabi’s iconic landmarks. Yas Island villas, in particular, saw price increases of nearly 5%, reflecting the area’s desirability.

Return on Investment (ROI) Trends

For property investors, ROI remains a critical consideration, and Bayut’s data points to strong yields across Abu Dhabi. Al Reef and Al Ghadeer offer attractive returns of 8.86% and 8.20% respectively for affordable apartments, while premium properties on Yas Island and Al Reem Island show returns of up to 7.22%. The affordable villa segment, particularly in Hydra Village and Abu Dhabi Gate City, continues to yield solid returns, with rates reaching 8.06%.

In the luxury villa market, Yas Island once again tops the charts with an ROI of 6.50%, closely followed by Al Raha Gardens at 6.42%.

Popular Off-Plan Projects

The off-plan property market in Abu Dhabi is also gaining momentum, with projects catering to both affordable and luxury buyers. For affordable apartments, Royal Park in Masdar City has garnered significant attention due to its competitive pricing and strategic location. Meanwhile, City of Lights in Al Reem Island continues to attract luxury apartment buyers with its modern architecture and premium waterfront views.

In the villa market, Bloom Living has become a popular choice among families seeking affordable housing with ample green spaces. On the luxury side, Saadiyat Lagoons on Saadiyat Island is a top contender, known for its exclusive waterfront properties and proximity to cultural landmarks.

Rental Market Trends

The rental market in Abu Dhabi has seen dynamic shifts across both affordable and luxury segments in Q3 2024. In the affordable apartment segment, areas like Khalifa City, Al Khalidiya, and Al Shamkha have witnessed significant tenant interest. Rents for 1- and 2-bedroom flats in Al Khalidiya and Tourist Club Area saw the highest increases, driven by a surge in demand.

In contrast, tenants seeking luxury apartments have focused on Al Reem Island, Al Raha Beach, and the Corniche Area, where rents have risen by 2% to 11%. Saadiyat Island remains a hotspot for luxury rentals, with noticeable price hikes in 1- and 2-bedroom apartments.

In the villa rental market, Mohammed Bin Zayed City, Khalifa City, and Madinat Al Riyadh continue to attract tenants looking for affordable housing. However, some areas, such as Shakhbout City and Al Reef, reported slight price decreases. On the luxury side, Yas Island, Al Raha Gardens, and Al Mushrif saw strong demand. Notably, 6-bedroom villas in Al Karamah experienced a price drop, while similar units in Al Mushrif saw a 12.4% increase.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and Head of Dubizzle Group MENA, said: “The Abu Dhabi real estate market is continuing to stay strong this year, thanks to increased transparency and solid investments from both local and international players. If we look at just the last quarter, we have had over 3.5 million visits on our platform for listings in Abu Dhabi, showing just how strong the demand for properties in the capital is even during summer months. The government’s efforts to enhance data accessibility and push forward digital initiatives, like AI-powered services and the comprehensive DARI real estate platform, have definitely contributed to this.

Looking to the future, we can anticipate even better outcomes. The Abu Dhabi Real Estate Centre (ADREC) is set to attract more foreign investments by streamlining regulations and maintaining a strong focus on transparency. By embracing global standards and leveraging trends like smart city projects and sustainability, Abu Dhabi is positioned for even more growth in its real estate sector.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

An imposing Scottish castle that has only had four owners in its more than 200-year existence has hit the market asking for offers above £8 million (US$10.45 million).

Seton Hall, as it’s known, was built in 1789 by architect Robert Adam using stone from Seton Palace, the since-demolished property that was considered to be Mary Queen of Scots’s preferred retreat, according to Savills, which brought the home to the market last month.

“Seton is an absolutely magical castle—from the moment you approach, to the inner courtyard, to the quality of interior design,” said listing agent Jessica Gwyn.

The castle—roughly 10 miles from Edinburgh—remained in the same family from the late 18th century until 2003, which “served to freeze Seton in a protective time warp,” according to the listing.

Castellated features such as slit windows and turrets can be seen from the outside, and inside “secret staircases, curved doors, curved walls, arched windows and hidden doors add to the charming sophistication of the architecture and design,” the listing said.

But the castle has since been refurbished to meet modern standards, and now also boasts a helipad, a full security system, a gym, a playroom, a silk-lined dining room and a billiards room.

The restoration project saw a team of expert stonemasons rebuild the castle’s many chimneys, turrets and rooftop parapets. Plus, ironwork was restored, the dumbwaiter reinstated and the 10,000-bottle wine cellar was brought back to life, Savills said.

Alongside the seven-bedroom home that forms the core of the castle, there are additional residences across the property, including Darnley Cottage and Bothwell Cottage—named after Mary Queen of Scots’s husbands.

The castle’s stables have been refurbished, too, and are adjacent to the “Stable Bar,” the castle’s private pub.

The owner—who Mansion Global couldn’t identify—“feels their time as custodian of this outstanding building has come to a natural conclusion and it is time for this historic home to be loved and cared for by someone else,” Gwyn said.

This article first appeared on Mansion Global

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

New amenities, from a gym to a movie theatre, and a good commuter location filled this suburban office tower

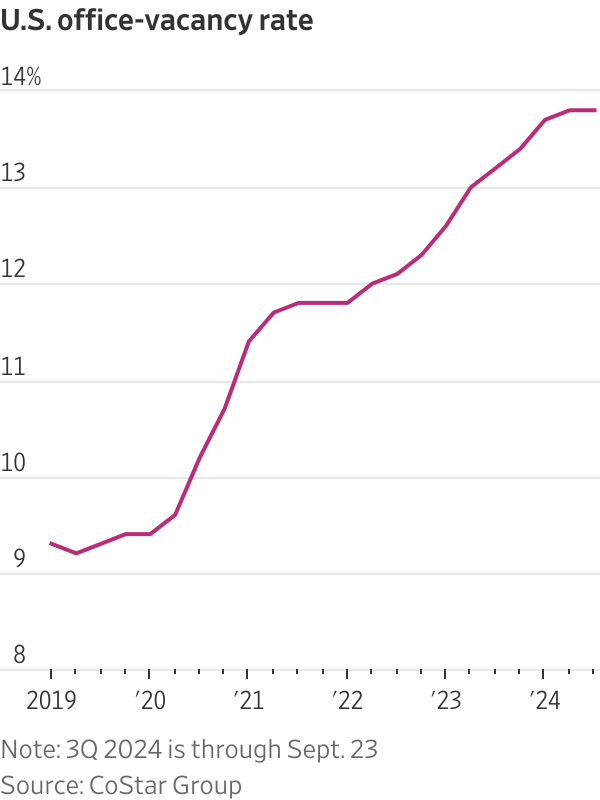

Manhattan’s office-vacancy rate climbed to more than 15% this year, a record high. About 80 miles away in Philadelphia, occupancy also is at historically low levels. But a 24-storey office tower located between the two cities has more than doubled its occupancy over the past five years.

Developer American Equity Partners bought the New Jersey office tower, known as 1 Tower Center, for $38 million in 2019. At the time, the 40-year-old building felt dated. It had no gym, tenant lounge or car-charging stations. The low price enabled the firm to spend more than $20 million overhauling and luring tenants to the 435,000-square-foot property.

Now, the suburban building is nearly fully leased at competitive rents, mopping up tenants from other buildings after the owner added a new lobby, movie theatre, golf simulator, fitness centre and a tenant lounge featuring arcade games and ping-pong tables.

“Our tenants told us what they needed in order to fill up their offices,” said David Elkouby , a co-founder of American Equity, which owns about 4 million square feet of New Jersey office space.

The new owner also liked the location at the 14-acre hotel and conference-centre complex, off the New Jersey Turnpike’s Exit 9 in East Brunswick. The site is a relatively short commute for millions of workers in central New Jersey and is passed by 160,000 vehicles daily.

The property’s turnaround shows how office buildings can thrive even during dismal times for most of the U.S. office market, where vacancies remain much higher than pre pandemic.

Success often requires an ideal location—one that shortens the commute time of employees used to working at home—and the sort of upgrades and amenities companies say are necessary to lure employees back to the workspace.

One Vanderbilt, a deluxe office tower with a Michelin-star chef’s restaurant and plenty of outdoor space in Midtown Manhattan, is fully leased while charging some of the highest rents in the country.

The 11-story Entrada office building, in Culver City, Calif., is making the same formula work on the other coast. It opened two years ago with a sky deck, concierge services and recessed balconies. A restaurant is in the works. The owner said this month that it has signed three of the largest leases in the Los Angeles area this year.

1 Tower Center shows how the strategy can be effective even in less glamorous suburban locations. The tower is prospering while neighbouring buildings that are harder to reach with outdated facilities and poor food options struggle to fill desks even at reduced rents.

The recent interest-rate cut and reports that some big companies such as Amazon .com are re-instituting a five-day office workweek have raised hopes that the office market might be getting closer to turning.

But with more than 900 million square feet of vacant space nationwide and remote work still weighing on office demand, more creditors are seizing properties that are in default on debt payments.

Rates are still much higher than they were when tens of billions of dollars of office loans were made, and much of that debt is now maturing. The recent interest-rate cut doesn’t mean “office-sector woes are now over,” said Ermengarde Jabir, director of economic research for Moody’s commercial real-estate division.

Lenders are dumping distressed properties at steep discounts to what the buildings were worth before the pandemic. Some buyers are trying to compete simply by cutting their rents.

“Most owners don’t have the wherewithal to do what is required,” said Jamie Drummond, the Newmark senior managing director who is 1 Tower Center’s leasing agent. “Owners positioned to highly amenitise their buildings are the ones who are successful.”

HCLTech, a global technology company, illustrates the appeal. It greatly expanded its presence in New Jersey by moving this year to a 40,000-square-foot space designed for its East Coast headquarters at 1 Tower Center.

The India-based company said it was drawn to the building’s amenities and design. That made possible a variety of workspaces for employees, from quiet nooks to an artificial-intelligence lab. “You can’t just open an office and expect [employees] to be there,” said Meenakshi Benjwal , HCLTech’s head of Americas marketing.

HCLTech also liked the location near the homes of its employees and clients in the pharmaceutical, financial-services and other businesses.

Finally, it didn’t hurt that the building is a short drive from nearby MetLife Stadium. The company has a 75-person suite on the 50 yard line where it entertains clients at concerts and National Football League games.

“All of our clients love to fly from distant locations to experience the suite and stadium,” Benjwal said.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

JMJ Group Holding also signed a non-binding Memorandum of Understanding (MoU) with Ennismore

JMJ Group Holding, in partnership with Qetaifan Projects, has officially launched SLS Doha The Grove Residences, an ultra-luxury residential development, at Cityscape Qatar 2024. Designed by the internationally acclaimed Zaha Hadid Architects and situated on the exclusive Qetaifan Island North, SLS Doha The Grove Residences aspires to redefine innovation, sustainability, and luxury living in Qatar.

Real estate investors and enthusiasts had the opportunity to explore SLS Doha The Grove Residences at JMJ Group Holding’s booth, part of the Qetaifan Projects pavilion at the exhibition. Guided by JMJ’s real estate advisors, visitors learned about the project’s standout features, including the spectacular design, smart home integrations, and sustainability initiatives. Visitors also explored investment incentives, such as flexible payment plans and rental assistance, and discovered how SLS Doha The Grove Residences offers a unique blend of luxury living and strong investment potential through interactive displays and models.

JMJ Group Holding also signed a non-binding Memorandum of Understanding (MoU) with Ennismore, the fastest-growing lifestyle and leisure hospitality company, to bring to life the branded residence, SLS Doha The Grove Residences. This potential collaboration enhances the project’s exclusivity, aligning SLS Doha The Grove Residences with SLS’s inimitable brand of immersive extravagance. This collaboration ensures that, alongside the exclusivity, privacy and carefully curated services associated with a branded residence, owners will also have access to an enviable array of dedicated residential amenities, all managed by Ennismore and SLS.

On the occasion, Sheikh Jabor bin Mansour bin Jabor bin Jassim Al Thani, Chairman of JMJ Group Holding, commented: “SLS Doha The Grove Residences embodies our commitment to crafting residences that harmonize luxury, innovation, and sustainability. This project sets a new benchmark for high-end living, offering exceptional design and world-class amenities. We invite investors to explore the unique opportunities SLS Doha The Grove Residences presents, as it promises not just a home but a premium lifestyle investment.”

He continued: “Signing an MOU with Ennismore further enhances this exclusive experience. A name synonymous with world-class hospitality, SLS’s expertise will ensure that residents at SLS Doha The Grove Residences enjoy unparalleled service that truly redefines luxury in Qatar.”.

Chadi Farhat, Brand COO of SLS & Head of Asia Pacific & Middle East at Ennismore, added: “We are honored to be part of SLS Doha The Grove Residences, a project that exemplifies the power of collaboration and forward-thinking design. This partnership will mark an important step for our SLS brand as we expand into the Qatari market, where the demand for high-end, innovative living is growing. This project aligns perfectly with our commitment to creating extraordinary experiences, and we see great potential in contributing to Qatar’s dynamic luxury real estate sector. We look forward to delivering our renowned service and hospitality to create an exceptional living experience for residents wishing to say farewell to the ordinary.”

Set to infuse breathtaking experiences with signature mischievous wit and a playful ambience, SLS Doha The Grove Residences Doha is comprised of 293 lavishly designed residences, from one to four-bedroom apartments, each offering panoramic views of the Lusail skyline and access to an array of premium amenities. Residents will benefit from a waterfront promenade, complete with exclusive boutiques, cafes, and restaurants, as well as access to infinity pools, a state-of-the-art wellness center, a private members’ club, and a marina. With its striking design and cutting-edge facilities, SLS Doha The Grove Residences seamlessly fuses modern architecture with environmental responsibility to deliver an exceptional living experience. Flexible pricing options are available, making SLS Doha The Grove Residences accessible to a range of buyers seeking luxury living in one of Qatar’s most prestigious locations.

Sheikh Nasser Bin Abdulrahman Al Thani, Chairman and Managing Director of Qetaifan Projects, stated, “This partnership with JMJ Group Holding is part of Qetaifan Projects’ ongoing successful collaborations locally, regionally, and internationally. Our partnership with JMJ Group Holding reflects Qetaifan Island North’s role as an attractive investment environment. We are excited to support SLS Doha The Grove Residences, a visionary project designed by Zaha Hadid Architects that caters to the market with more options and enriches Qatar’s positioning as a high-end, sustainable living leader.”

Juan Ignacio Aranguren, Associate Director at Zaha Hadid Architects, stated: “Innovation has always been at the heart of Zaha Hadid Architects’ approach to design. SLS Doha The Grove Residences project exemplifies how architecture can be a catalyst for creating vibrant, resilient communities.”

As SLS Doha The Grove Residences takes its place as a defining landmark on Qetaifan Island North, it sets a new benchmark for luxury living in Qatar. JMJ Group Holding’s collaboration with Zaha Hadid Architects and Ennismore not only elevates the project but also reflects a bold vision for the future of real estate in the region. With its innovative design, sustainable features, and world-class amenities, SLS Doha The Grove Residences is set to redefine the standard of modern living.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Setting new standards for excellence fashioning homes that cater for every lifestyle

ONE Development has appointed AE7, a globally renowned architectural and engineering firm, as the consultant for its AED 2 billion flagship project in Dubai’s City of Arabia. AE7 will be responsible for the project’s master planning, architecture, design, AI innovation integration, and development management. Their role also includes overseeing engineering, interior design, landscape architecture, project management, and implementing sustainability practices. This highly anticipated development is expected to be unveiled soon, marking a significant step for ONE Development.

AE7 is a global top 50 multi-billion-dollar Building, Design and Construction group with a proven track-record of excellence. Established in 2009 by seven internationally renowned American design professionals with over 40 years’ experience designing and creating destinations in the USA, Asia and the Middle East with almost 20 years of experience, the company has grown into a full-service architectural group providing specialty expertise through six offices worldwide, which has designed and managed over US$40 billions of design work over the past five years.

Ali Al Gebely, ONE Development Founder & Chairman, called the appointment a collaborative milestone between two like-minded organizations, saying: “We are in the process of redefining urban living through the integration of cutting-edge AI and its technology, and our City of Arabia project is a flagship enterprise that requires the strength and resilience of a world-leading consultancy that shares our aspirations, and selecting AE7 to be the project consultant aligns with our vision to have a strong world-renowned multi-disciplinary design firm on board. ONE Development and AE7 will offer our community residents a high-tech lifestyle that not only enhances their convenience by enabling them to engage and connect with their devices, homes, surroundings and facilities for a better life, but also upholds our joint commitment to environmental responsibility. From smart home systems to energy-efficient solutions, this development is setting new benchmarks for sustainable living in Dubai.”

Tomas Gulisek, Principal and Design Director at AE7, added: “AE7 is a global design firm with a reputation for breaking traditional boundaries through innovative solutions and comprehensive services. Our partnership with ONE Development on this prestigious project will enable us to jointly reinforce our vision of how a collaboration between two dedicated organizations can result in achieving innovative design solutions that do more than just provide accommodation; we are creating spaces that foster a sense of community while respecting residents’ privacy and honoring their individuality. It’s about balancing innovation with functionality, where design elevates everyday experiences.”

ONE Development is transforming the real estate landscape, setting new standards for excellence fashioning homes that cater for every lifestyle.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Violet Tower will stand as a major addition to JVC’s rapidly evolving skyline

The Violet Tower, a prestigious new residential project by Dubai Investments in the heart of Jumeirah Village Circle (JVC), is making remarkable progress. With its foundation work nearing completion, and 99.3% of the piling work already finished, this AED 300 million development is poised to become a standout feature in JVC’s evolving skyline. The project, led by top-tier construction firms, aims to deliver contemporary urban living spaces designed for modern residents.

Having logged approximately 58,000 working hours to date, the project remains on track for key milestones. The enabling works are expected to be completed by the fourth quarter of 2024, and the entire project is projected to be ready for occupancy by Q4 2026. Notably, the construction process has upheld an impeccable safety record, with no reported incidents, highlighting the efficiency and commitment of the team involved.

Strategic Location and Cutting-Edge Design

Positioned in the heart of JVC, Violet Tower is designed to meet the growing demand for modern, well-planned residential spaces. The development will offer 287 units spread across 27 floors, ranging from studios to two-bedroom apartments. Each unit has been meticulously planned to maximize space efficiency and cater to contemporary living standards, making it an attractive option for both professionals and families seeking quality homes in a vibrant community.

In addition to its strategic location, Violet Tower, by Dubai Investments, is packed with innovative features. A distinctive steel canopy roof will crown the building, giving it a unique architectural identity. The entrance area will be multifunctional, featuring a coworking station, perfect for the growing number of remote workers in the city. Moreover, the building will offer 24/7 security, ensuring a safe and comfortable living environment for all residents.

Strong Collaborations Ensuring Quality

The success of Violet Tower is backed by partnerships with some of the region’s most reputable contractors and specialists. Al Ghurair Contracting is overseeing the main construction works, ensuring that the development adheres to the highest standards of craftsmanship and durability. Tech Foundation is managing the enabling works, while the Arab Centre has been entrusted with pile testing, guaranteeing that the project meets rigorous quality benchmarks from the ground up.

A Vision for the Future

Upon its anticipated completion in late 2026, Violet Tower will stand as a major addition to JVC’s rapidly evolving skyline. It promises to offer a unique blend of contemporary living, thoughtful design, and community integration. By addressing the rising demand for modern urban homes, Violet Tower aims to provide its residents with a lifestyle that balances convenience, comfort, and cutting-edge features.

As Jumeirah Village Circle continues to grow as one of Dubai’s premier residential hubs, Violet Tower is poised to become a key player in the district’s transformation. With its forward-thinking design, top-tier amenities, and prime location, this development is not just about building homes—it’s about shaping the future of living in Dubai.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Stromek’s scope of work will focus on ensuring the stability and sustainability of the development’s foundational elements.

Dar Global has awarded the contract for shoring, excavation, and piling works on its prestigious ‘The Astera, Interiors by Aston Martin‘ project to Stromek Emirates Foundations. Recognized for their expertise in high-quality foundational engineering, Stromek Emirates has a strong reputation for delivering exceptional construction services across the region.

With a Gross Development Value of Dh900 million (£200 million), ‘The Astera’ marks Aston Martin‘s first venture into interior design for a real estate development in the Middle East. Set on the picturesque Al Marjan Island in Ras Al Khaimah, the project will feature a mix of luxury apartments and villas, blending Aston Martin’s signature design aesthetics with Dar Global’s commitment to offering exceptional living experiences.

Stromek’s scope of work will focus on ensuring the stability and sustainability of the development’s foundational elements. The firm’s expertise will play a critical role in preparing the site for construction, ensuring that the project can proceed smoothly while adhering to the highest standards of safety and precision.

“We are thrilled to have Stromek on board for this pivotal phase of ‘The Astera’ project. Their proven track record of excellence in shoring, excavation, and piling work perfectly aligns with the standards we uphold at Dar Global,” said Ziad El Chaar, CEO of Dar Global. “This collaboration underscores our commitment to working with the best in the industry to deliver world-class luxury developments that will leave a lasting impact.”

The shoring, excavation, and piling works are expected to commence immediately, laying the foundation for what will soon be a landmark development on the Arabian Sea. Stromek’s appointment is a key milestone in the progress of ‘The Astera,’ a development that will combine iconic British design with cutting-edge engineering and craftsmanship, elevating the living experience for future residents.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

These results emphasise the transformative impact of The Ellinikon project

LAMDA Development announced remarkable financial results for H1 2023. Driven by the record-breaking profitability of Malls and Marinas, alongside rapid progress across the trailblazing Ellinikon project on the Athens Riviera, consolidated operating profit has increased by 90% year-on-year to reach €72 million.

This impressive figure includes a 30% increase in operating profitability for Malls at €41 million and a 6% increase for Marinas at €9 million. To date, The Ellinikon has generated €366 million in property sales, fueling development across key assets, including significant milestones for Riviera Tower, The Cove Residences, and Vouliagmenis Mall.

These results emphasize the transformative impact of The Ellinikon project, a 15-minute paradigm city presenting a contemporary way of life and a new landmark for 21st-century Greece. Redefining the skyline of Athens, this development features luxury residences, world-class marinas, and state-of-the-art retail spaces to produce premium opportunities for international investors, particularly those in the GCC looking to diversify into European real estate.

“In Athens, we’re creating a place that stands for progress, where lives can be truly well lived in an amazing setting. And where new generations will find greater opportunities,” remarked Odisseas Athanasiou, CEO of LAMDA Development S.A. “The Ellinikon will reposition the country on the international investment map leading to an increased tourism footprint and a significantly healthier economy.”

The Ellinikon is positioned to become a hub for luxury living and high-end commercial activity with direct appeal to GCC investors seeking to expand their international portfolio. The project has already attracted high levels of interest, with huge demand for presales in waterfront residential properties such as Riviera Tower and The Cove Residences.

Exceptional property sales have empowered rapid reinvestment to facilitate pushing forward with The Ellinikon infrastructure. In addition to the residential towers and Vouliagmenis Mall—where 57% of the leasable area is now subject to tenant agreements—this has allowed accelerated progress including the completion of construction for the AMEA Building Complex among other core works.

With the luxury real estate market in Europe attracting heightened interest from Gulf investors, The Ellinikon offers a unique combination of lifestyle, location, and long-term value. The success of the project underscores LAMDA Development’s commitment to delivering world-class properties that resonate with high-net-worth individuals and institutional investors.

Key Highlights:

- Consolidated Operating Profit: €72 million (90% increase YoY)

- Malls Operating Profitability: €41 million (30% increase)

- Marinas Operating Profitability: €9 million (6% increase)

- Total Property Sales from The Ellinikon: €366 million

- Significant Demand for Waterfront Properties

Future Outlook

The ongoing developments at The Ellinikon project indicate a strong future trajectory with further phases planned. This includes luxury residential units and commercial spaces that cater specifically to high-net-worth individuals from the GCC region.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

Further project details will be announced before end of the year.

Ohana Development, a leading luxury real estate developer, has revealed plans to launch a new branded residence project in partnership with a world-renowned luxury brand. The exclusive development, located in Abu Dhabi, is designed to elevate the standards of luxury beachfront living in the UAE.

The official launch is scheduled for the first quarter of 2025, marking another addition to Ohana Development’s collection of branded residences, following the success of its Elie Saab Waterfront by Ohana project.

Engineer Husein Salem, CEO of Ohana Development said, “We are thrilled to partner with one of the world’s most renowned luxury brands, bringing unparalleled beachfront living experiences to Abu Dhabi’s bustling real estate sector. This project will combine elegant design with incredible surroundings, offering an exclusive lifestyle for residents. We look forward to sharing more details in the coming weeks.”

Ohana Development is renowned for its portfolio of world-class waterfront properties, such as the prestigious Ohana Villas, featuring exquisitely crafted pieces from the ELIE SAAB Maison collection, Ohana Hills, a residential community with breathtaking views, Ohana by the Sea, that features luxury villas, as well as the Elie Saab Waterfront by Ohana. These developments exemplify the company’s commitment to creating sophisticated, unique spaces that offer exceptional lifestyle experiences across the UAE and beyond.

Further project details will be announced before end of the year.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

South Garden is the latest addition to Wasl Gate master development

Wasl, a leader in Dubai’s real estate development and management, has announced the complete sell-out of all units in its latest project, South Garden, within just 48 hours. South Garden, a freehold residential development, is part of the larger Wasl Gate master development located in Jebel Ali.

The project benefits from its strategic location, close to Festival Plaza, which houses popular stores such as IKEA and ACE, along with other retail destinations. It is well-connected to Dubai via easy access to Sheikh Zayed Road and the Energy metro station. South Garden also provides direct access to Al Maktoum International Airport, Expo City, and key free zones, including Jebel Ali Free Zone (JAFZA), Dubai Multi Commodities Center, Dubai Internet City, Dubai World Central, and Dubai Parks and Resorts.

South Garden offers 768 residential units to suit various budgets and lifestyles. Studios starting from 399 to 508 sq. ft., one-bedroom units ranging from 824 to 1,086 sq. ft, two-bedroom units starting from 1,153 to 1,299 sq. ft., as well as three-bedroom apartments from 1,744 to 2,127 sq. ft.

Mohamed Al Bahar, Director of Business Development at Wasl, said: “We are delighted to witness this overwhelming response to the launch from investors and end users. This highlights the strength of Dubai’s real estate sector and reflects the increasing demand for well-designed and well-priced residential projects.”

South Garden is the latest addition to the Wasl Gate master development. Wasl Gate includes several other residential projects alongside South Garden, such as The Nook, Gardenia Townhomes, and Hillside Residences. The Nook offers modern apartments of various sizes, while Gardenia Townhomes features spacious three- and four-bedroom townhouses, and Hillside Residences offers a variety of modern and unique apartments with spacious living areas.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.