How AI Will Change the Workplace

We asked some top thinkers from different fields to weigh in on what’s ahead, as the AI explosion compels businesses to rethink, well, almost everything

Artificial intelligence has been affecting how we work for some time—helping to craft job postings and evaluate applications, judging how efficiently we complete jobs and, for gig workers, determining assignments and pay.

But in the past year, and especially the past six months, generative AI has supercharged the potential of technology to help, hinder or reorient how we work. Visual tools like DALL·E 2 and Midjourney may drastically change graphic design. Large language-model text generation, beginning in earnest with the release of ChatGPT, promises to affect every activity that involves touching a keyboard.

To learn more about how the worlds of work and AI will interact, we spoke with experts in computer science, human resources, recruiting, corporate leadership, psychology and more. Here are some of their predictions.

Automating ideas

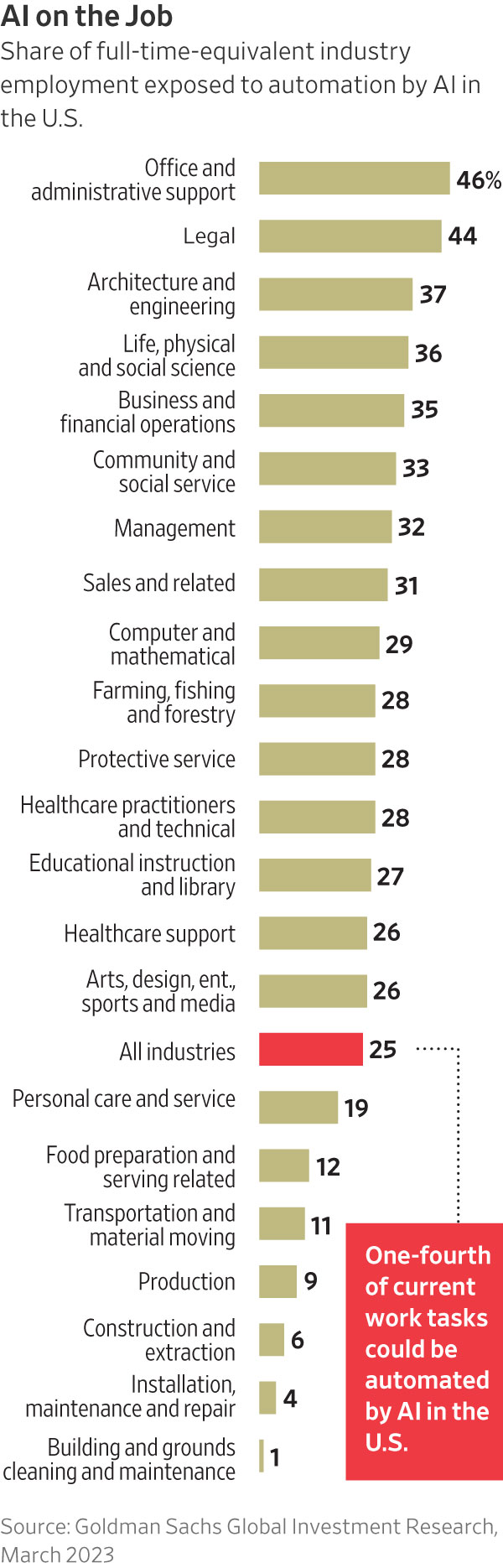

AI will continue the current process of automating parts of workers’ jobs. But while today’s automation is often described as applying to dull, dirty and dangerous tasks such as moving parts in a factory or warehouse, generative AI brings a new dynamic: Primarily, it supports knowledge work by providing the ability to create first drafts of documents, emails, presentations, images, video, product designs, etc.

So, knowledge workers might spend more time editing than creating, particularly as generative AI is embedded into all the software products they use today. For instance, instead of an email system just typing ahead a few words, it could draft several paragraphs. Customer-relationship-management software could suggest topics to discuss with a sales prospect and even a script to follow. And a salesperson could describe a presentation in natural language, and draft slides could be created, accessing corporate data and images to fill out details.

But there are some GenAI applications where the potential to have transformative impact really comes to the fore: For example, in research and development, some experiments using generative AI to support writing software code have shown very high levels of increasing productivity. But that doesn’t mean we’ll need a lot fewer software engineers, because the world needs more software. Generative AI also has the potential for improving the productivity of contact centres. There already were technologies that could automate interactions with customers; generative AI has the potential for making these interactions feel much more natural.

—Michael Chui, partner, McKinsey Global Institute

Flatter organisations

Artificial intelligence is likely to flatten many organisations due to its ability to automate work activities. Right now, most organisations have entry-level people who perform routine tasks, midlevel individuals who supervise them and high-level employees who set the direction of the organisation.

That organisational structure will no longer be necessary. AI can automate many of the tasks performed by entry-level workers. Accounting features, purchase orders and job requisitions are already being automated, and workplaces no longer need people who manually compile or analyse information.

As generative AI becomes more widely deployed, even more tasks will be automated. In addition, job supervision and assessment won’t need as much human oversight. Customers can rate employees on how well they perform basic tasks and allow people to get the services they want. Using data analytics and AI, companies can use the responses to weed out low-performing workers and reward their top individuals. The end result will be fewer layers of management and a smaller number of employees overall in the organisation.

—Darrell West, senior fellow, governance studies, Brookings Institution

How human are we? Machines will tell us

In the past, managers turned to software to judge workers on technical matters—counting keystrokes or time away from the screen. Now companies are using machines to judge how much empathy their employees show.

I was recently sent a “management tip of the day,” advice on how to prepare for a job interview conducted by an artificial intelligence—a process that is all too common these days. A good score required that I appear “natural” with the machine, defined as injecting “authenticity and humanity to the interview.” It seemed a through-the-looking-glass request. A machine would be judging me on qualities that only human beings can exhibit.

The AI judgments don’t end with interviews. It is increasingly common for corporations to use AI programs to monitor employee empathy on the job. For instance, in call centres, AI programs coach and score workers on an empathy scale to judge their performance with callers.

With the addition of ChatGPT to a full suite of office products, texts, emails and calls, there is no limit to the interactions that may be judged by pretend-empathy machines. They will pretend to understand jealousy, competition, depression and insecurity, all the messy human feelings that come up in the life of a firm.

When machines test us on how we respond to such human complexities, high scores may go to those who exhibit qualities that machines value most—consistency and a bias toward tidying up what seems messy. Those who don’t stack up may lose their jobs.

It is backward thinking: Technology redefines human empathy as what machines can understand. Having built the machines that will judge us, now we will train ourselves to please the machines.

—Sherry Turkle, author and Abby Rockefeller Mauzé Professor of the Social Studies of Science and Technology, Massachusetts Institute of Technology

A threat to ethics

We are already seeing the rise of digital assistants that speak with a human voice and can use human appearance and social intelligence to negotiate disputes, brainstorm business strategies or conduct interviews. But our research illustrates that people may act less ethically when collaborating via AI.

Traditionally, teammates establish emotional bonds, show concern for each other’s goals and call out their colleagues for transgressions. But these social checks on ethical behaviour weaken when people interact indirectly through virtual assistants. Instead, interactions become more transactional and self-interested.

For instance, in typical face-to-face negotiations, most people follow norms of fairness and politeness. They feel guilt when taking advantage of their partner. But the dynamic changes when people use an AI to craft responses and strategies: In these situations, we found, people are more likely to instruct an AI assistant to use deception and emotional manipulation to extract unfair deals when negotiating on their behalf.

Understanding these ethics risks will become an active focus of business policy and AI research.

—Jonathan Gratch, professor of computer science, University of Southern California

An edge for the aged

AI will enable older workers to be seen, even by those with ageist eyes, as young again.

Younger adults tend to excel at work that uses fluid intelligence that involves analysis and solving discrete problems quickly. Older workers are thought to exhibit greater crystallised intelligence—the capacity to leverage experience and knowledge gained over years to quickly see patterns, nuance and emotional insights, and the capacity to determine which problems should be addressed and which are just noise.

AI is likely to provide a kind of augmented intelligence to older workers, enabling experienced professionals to fully leverage their talent and skills.

For example, AI will be an invaluable collaborator with physicians, speeding the collection and organisation of critical information such as patient symptom history, genetic profiles, medication interactions, as well as past successful treatment plans for similar conditions, etc. These systems will enable physicians of all ages to gather information quickly, but older doctors will be better equipped to apply their years of experience and knowledge to validate AI diagnoses and treatment recommendations.

AI will be more than a collaborative assistant to older workers. It will also be a valuable coach. The sheer growth and velocity of knowledge and technology is making training and upskilling essential. Unfortunately, many employers don’t invest in older-worker education. Now AI applications are being deployed in workplace education to address individual learning and knowledge gaps, helping older workers remain current and competitive.

—Joseph F. Coughlin, director of AgeLab, Massachusetts Institute of Technology

Navigating new tech

Today, most organisations suffer from a “digital dexterity gap,” where the workforce is largely unable to keep pace with fast-changing technology. Organisations have more technology than their employees are comfortable using, creating barriers to efficiency and productivity growth.

AI services strip away complexity. By using conversational interfaces and natural-language processing, AI removes the need for workers to master complex computer functions and menus. People simply describe what is needed, in nontechnical language, and refine their requests to get better output.

An employee, for example, could give an AI historical data and say, “Find and rank all the variables that will determine the market potential for this new product.” Before conversational interfaces were developed, getting the information would require a lengthy and complex series of interactions.

—Matt Cain, vice president and distinguished analyst, Gartner

An opportunity for building talent

As AI takes over routine tasks, there will be a temptation to cut the whole tier of entry-level employees: Summarising documents, answering routine emails, writing basic computer code and solving simple logistical challenges are all tasks that AIs can do about as well as an inexperienced human, and at much lower cost.

But employers still need an on ramp for new hires. If you stop hiring entry-level employees, you’ll have to do all your midlevel hiring from outside the organisation. And if every organization pares back on entry-level hires, it will get harder and harder to find experienced midcareer talent anywhere.

That’s why it pays to cultivate your own long-term talent pool by hiring green employees, but rethinking how they are tasked and trained. Instead of piling your juniors with grunt work and trusting that they’ll learn through observation, assign them more challenging tasks, like drafting reports instead of just summarising them—the explosion in AI research and writing tools means that kind of work is now well within the grasp of inexperienced hires. With more active coaching and mentoring, these green employees can grow into valuable colleagues, much more quickly.

—Alexandra Samuel, digital-workplace speaker and co-author of “Remote, Inc.”

The danger of following blindly

So many jobs involve writing standard responses—thank-you notes to customers, responses to job applicants and unfortunately term papers—that AI is instantly and easily used in almost every white-collar role.

The concern isn’t that the responses produced aren’t original or creative. How creative does a performance appraisal need to be? It is that if ChatGPT writes the report, the “author” hasn’t thought about it, hasn’t weighed the arguments and then come to their own conclusions in the text. They cannot explain to someone why the report says what it does, but they now have to live with its conclusions.

What happens when the ChatGPT report fails to include proprietary information that you could have found if you searched yourself, and it changes the conclusions? How do we explain to a subordinate why the appraisal written by ChatGPT gave them a lower score compared with last year, even though their performance seemed to be the same? The temptation to use it without thinking through the arguments and explanations could lead to big mistakes.

—Peter Cappelli and Sonny Tambe, professor and associate professor, Wharton School of the University of Pennsylvania

Big-picture thinking

Workers are already using ChatGPT to craft the perfect Facebook ad or tools like Descript to edit videos, but AI will get incorporated in more upstream work. AI will be in the boardroom, brainstorming sessions and planning meetings.

Imagine an AI system that runs global simulations and impact analyses for 5,000 different budget plans. Or an AI that proactively writes new code for you when it discovers that you have a bottleneck in your sales planning. Or a proxy AI trained on customer research that allows you to have simulated conversations with your target market. We’re moving from task-oriented AI to goal-oriented AI, and enterprises are looking to leverage it safely, securely and ethically.

—Allie K. Miller, AI entrepreneur, adviser and investor

Money management and the human touch

Many asset-management companies are now offering hybrid advisory services—involving both human advisers and algorithms—to their clients. But these new services are unlikely to reduce the demand for human advisers.

Instead, automation is expanding the market for financial advisers by making it more cost effective to serve clients with lower levels of wealth. Human advisers can now cater to more clients, since certain tasks, such as addressing simple customer queries and constructing portfolios, can be automated. As a result, asset managers are now hiring more human advisers instead of laying them off.

In addition, the requirements for a financial adviser’s success are changing. As more portfolio management is turned over to algorithms, technical portfolio-allocation skills are becoming less significant. However, it is becoming more important for advisers to explain how algorithms operate and assist investors in navigating turbulent market conditions. Our research shows that human advisers are still essential for customer satisfaction and retention because of their ability to reduce clients’ discomfort from interacting with algorithms and reducing clients’ uncertainty regarding the algorithms’ performance.

—Alberto Rossi, finance professor and director of the AI, Analytics and Future of Work Initiative, Georgetown University

Navigating the corporate-benefits maze

AI-powered “concierge” systems will reduce or eliminate the frustrating search for answers that many employees endure today when seeking services from their employer. These systems will help employees make the most of their benefits, stay compliant with policies or simply find out information about their colleagues, organisation structure or customers that can sometimes be difficult to unearth in large organisations. When do my health benefits renew? What is my current deductible? What is the policy for meal expenses in New York?

What’s more, in the hybrid work environment, AI-driven concierge tools will book conference rooms, optimise the location of colleagues in the office so they can better collaborate, and help office managers manage capacity and services.

—Joe Atkinson, U.S. chief products and technology officer, PwC

Don’t forget human judgment

At its best, AI will drive better collaboration and productivity. It will help employees turn notes into documents and documents into presentations. Yet human judgment is key to unlocking AI’s power. Our data reveals that only around half of employees believe they know when to question the results of automation or AI—the other half don’t think they have that skill. But generative AI is already known to hallucinate—make up false facts—and employees who blindly follow its outputs risk failing.

So, companies must equip employees with the skills and inclinations needed to successfully use AI. Rather than acting on the AI’s meeting summary alone, employees must understand that talking to human colleagues who attended the meeting isn’t optional. They must also learn to proofread AI-produced text, confirming cited facts with outside sources. And governance structures must ensure that AI-produced content always includes a human in the loop before it is used.

—J.P. Gownder, vice president and principal analyst, Forrester

Machines get into human resources

The emergence of AI tools and data analytics is transforming the way organisations discover, assess and select talent. If trained with the right data, AI models can also compare candidate profiles to a company’s most successful employees, identify professionals with a proven record and determine who is most likely to consider a job change.

For example, for certain roles, high performers’ profiles include a broad range of skills that are relevant to multiple roles, while for other functions, optimal skill sets are much more narrow and specific. Our data indicates that the comparison of a candidate’s skills to those of high performers produces the most predictive indicator of future success, particularly on contract jobs.

Also, AI models can be further enhanced by incorporating individual performance data for employees or contractors who have previous experience with an employer. There is a wealth of such data available to talent solutions firms that employ hundreds of thousands of contractors annually.

Ultimately, though, it is important to think of AI as a tool—not a substitute—for the human art of recruiting. Assessing and selecting talent requires insight about a candidate’s communication skills, attitude and determination level and what it takes to succeed.

—M. Keith Waddell, president and CEO, Robert Half

A productivity boost

Early research suggests that while generative AI is likely to boost the productivity of all workers, it may benefit low-skilled workers more. A randomised field experiment by Microsoft reported that generative AI enabled a 55% decrease in average task-completion time for software developers, with the most benefit for older developers and those with less programming experience. Similarly, a study from MIT reports that ChatGPT’s use in professional writing raises average productivity and quality for low-ability workers more than their high-ability peers.

In an ongoing experimental study with M.B.A. students who were tasked with writing business reports, I found that ChatGPT’s availability not only increased productivity but also student satisfaction. More students expressed a desire to write when a tool like ChatGPT was available. In short, the impact of generative AI might not just be a general increase in productivity but also a narrowing of the productivity gap between low-skilled workers and high-skilled ones.

—Kartik Hosanagar, John C. Hower Professor, Wharton School of the University of Pennsylvania

A tool for hackers

It is the classic email scam: An employee receives a bogus note that appears to be from their manager, telling them to transfer funds to some account. For this to be convincing, the attacker needs to access the company’s computer systems to learn about the firm and the target, including their personal details.

AI makes this scamming much easier—and more dangerous.

By getting access to companies’ internal emails and nonpublic reports, hackers can use AI to generate very convincing messages. For example, the message might start with: “Fred, it was great to have dinner with you and your wife last Wednesday, we should do that again. Meanwhile, I need you to…”

Or how about a phone call or videoconference with your boss? Deep fakes make it possible to imitate the voice and even the image of your manager.

AI may also lead to smaller and smaller targets for scams. If it takes lots of manual labor to create customised spear-phishing emails, it is not worth it for hackers to cheat people out of $100. But if AI makes it trivial and cheap to create phoney emails, no one is too low on the totem pole to be ignored.

All this raises the level of skepticism that we must have substantially. Procedures will have to be put in place to validate the authenticity of who you are dealing with. In many cases, a phone call might be sufficient. A somewhat deeper approach might be a phone call to the boss’ administrative assistant, in addition to a boss—a bit like doing multifactor authentication on the computer. In extreme cases, a face-to-face meeting might be necessary.

—Stuart Madnick, professor of information technologies, MIT Sloan School of Management

Spotting the skill gaps

AI helps organisations build for the future by automatically detecting employee, team and organisation wide skills—and identifying ways to address gaps before management is even aware of them.

For roles like nurses, software developers and marketers, necessary skills are constantly changing, and it can be tough for organisations to keep track of what is needed. Nurses, for instance, must become familiar with an ever-increasing number of tech platforms, as well as data analysis to help patient outcomes.

As these needs evolve, AI can help keep track of what skills organisations need and predict what they might need next. For instance, a business could use AI to scan job descriptions in its industry to look for trends. The AI might notice that lots of marketing jobs now require employees to understand new types of analytics—and your employees must understand them, too, or miss out on important strategic insights.

—Mahe Bayireddi, CEO and co-founder, Phenom

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

China’s low-consuming, high-investing economy guarantees conflict with other countries

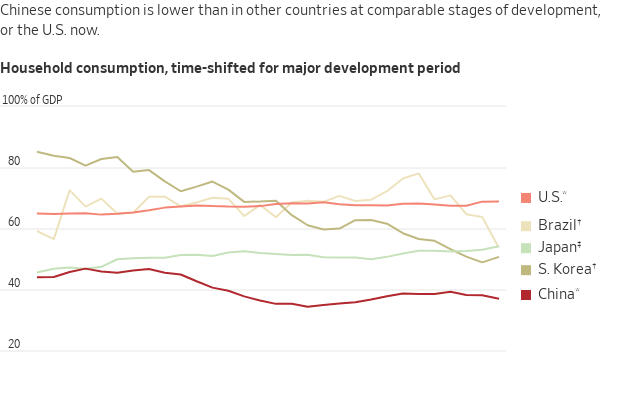

China’s economy is unusual. Whereas consumers contribute 50% to 75% of gross domestic product in other major economies, in China they account for 40%. Investment, such as in property, infrastructure and factories, and exports provide most of the rest.

Lately, that low consumption has become a headwind to China’s growth because property investment, once a major component of demand, has collapsed.

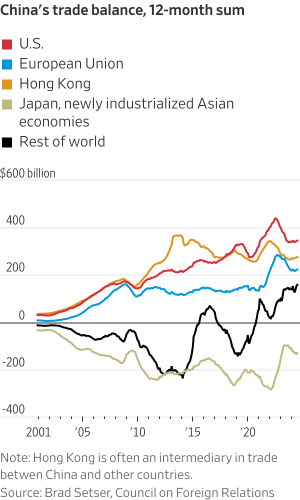

This isn’t just a problem for China; it’s a problem for the whole world. What Chinese companies can’t sell to Chinese consumers, they export. The result: an annual trade surplus in goods now of almost $900 billion, or 0.8% of global gross domestic product. That surplus effectively requires other countries to run trade deficits.

China’s surplus, long a sore spot in the U.S., increasingly is one elsewhere, too. While China’s 12-month trade balance with the U.S. has risen by $49 billion since 2019, it’s up $72 billion with the European Union, $74 billion with Japan and Asia’s newly industrialised economies, and about $240 billion with the rest of the world, according to data compiled by Brad Setser of the Council on Foreign Relations.

Logan Wright , head of China research at Rhodium Group, a U.S. research firm, said China accounts for just 13% of the world’s consumption but 28% of its investment. That investment only makes sense if China takes market share away from other countries, rendering their own manufacturing investment unviable, he said.

“China’s growth model is dependent at this point on a more confrontational approach with the rest of the world,” he said.

While many developing countries relied on investment and exports to fuel early growth, China is an outlier for how low its consumption is, and its sheer size. In a report, Rhodium estimates that if China’s consumption share equaled that of the European Union or Japan, its annual household spending would be $9 trillion instead of $6.7 trillion. That $2.3 trillion difference—roughly the GDP of Italy—is equal to a 2% hole in global demand.

The sources of this underconsumption are deeply embedded in both China’s fiscal systems and its policy choices.

Chinese incomes are highly unequal, and because the rich spend less of their income than the poor, this automatically depresses consumption. Rhodium cites data that says the top 10% of households had 69% of total savings, while a third had negative saving rates.

Other countries address such disparities by taxing the rich more heavily and boosting the spending power of lower and middle classes through cash transfers, and public health and education. China does much less of this. Just 8% of its tax revenue comes from personal income taxes, compared with 38% from value-added taxes, similar to sales taxes, which fall much more heavily on lower-income families, Rhodium estimates.

China also spends less on health and education than major market economies, forcing poor and middle-income families to spend more of their disposable income on both.

Meanwhile, suppressed wages and interest rates depress household income and spending while boosting the profits of state-owned enterprises. The limited taxing authority of local governments forces them to raise revenue by selling property for manufacturing and infrastructure, which further inflates investment.

A decade ago top Chinese policymakers shared Western economists’ perspective that, at the macro level, China needed to rebalance away from investment to consumption. In 2013, the ruling Communist Party said growth would henceforth rely on market forces and consumers.

President Xi Jinping ended up going in the opposite direction; consumption stayed weak while state control over the economy grew. He has replaced reformers with loyalists more preoccupied with sector-specific targets than overall growth.

The bedrock principle behind trade is comparative advantage: countries specialise in what they do best and then export it in exchange for imports. Xi rejects this principle. In pursuit of “independence and self-reliance,” he wants China to make as much and import as little as possible.

Officials in China boast that it is the “only country to produce in every single one of the United Nations’ industrial product categories,” notes Andrew Batson of Gavekal Dragonomics.

Even as China targets advanced products such as electric vehicles and semiconductors, it refuses to surrender market share in lower-value products: “Establish the new before breaking the old,” Xi has instructed his bureaucrats , my colleagues have reported.

As a result, Rhodium argues , “China provides fewer opportunities as an export market for emerging countries while competing head-on with them in the low-tech and mid-tech space.”

Countries that once saw China as a customer now see a competitor. “Many Chinese businesses are manufacturing intermediate goods, which we mainly export,” Rhee Chang-yong , the governor of the Bank of Korea, said last year. “The decadelong support from the Chinese economic boom has disappeared.”

Mexican Finance Minister Rogelio Ramírez de la O complained last month , “China sells to us but doesn’t buy from us and that’s not reciprocal trade.”

Ironically, foreign officials have tended to see the U.S. as the biggest threat to the world trade system, ever since President Donald Trump in 2018 imposed steep tariffs on China and narrower tariffs on other trading partners. He has promised to expand those tariffs if elected this fall.

And yet Trump’s tariffs should be seen as a reaction to China’s beggar-thy-neighbour economic model, one that has proved impervious to existing trade rules.

Still, no single country can fix the problem. Like a dike deflecting floodwaters, U.S. tariffs have diverted Chinese exports to other markets.

Those other countries are now taking action. Mexico, Chile, Indonesia and Turkey have all announced or said they are considering tariffs on China this year. This week Canada announced steep new tariffs on Chinese electric vehicles, steel and aluminum, aligning with those already announced by the U.S.

Yet the world thus far lacks a unified solution to Chinese underconsumption, because China refuses to accept that it’s a problem.

Xi has rejected fiscal support for households as “welfarism” that breeds laziness. In April, Treasury Secretary Janet Yellen complained that China’s “weak household consumption and business overinvestment” were threatening jobs in the U.S. The state news agency Xinhua called it a pretext for protectionism. Earlier this month the International Monetary Fund advised Beijing to spend 5.5% of GDP over four years buying up uncompleted homes. Beijing politely declined.

With China dug in, more friction is sure to follow, and an already fragile world trading system will be stressed to its breaking point.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Pity the investors in the three artificial-intelligence-themed ETFs that managed to lose money this year.

There are lots of embarrassing ways to lose money, but it is particularly galling to lose when you correctly identify the theme that will dominate the market and manage to buy into it at a good moment.

Pity the investors in the three artificial-intelligence-themed exchange-traded funds that managed to lose money this year. Every other AI-flavored ETF I can find has trailed both the S&P 500 and MSCI World. That is before the AI theme itself was seriously questioned last week, when investor doubts about the price of leading AI stocks Nvidia and Super Micro Computer became obvious.

The AI fund disaster should be a cautionary tale for buyers of thematic ETFs, which now cover virtually anything you can think of, including Californian carbon permits (down 15% this year), Chinese cloud computing (down 21%) and pet care (up 10%). Put simply: You probably won’t get what you want, you’ll likely buy at the wrong time and it will be hard to hold for the long term.

Ironically enough, Nvidia’s success has made it harder for some of the AI funds to beat the wider market. Part of the point of using a fund is to diversify, so many funds weight their holdings equally or cap the maximum size of any one stock. With Nvidia making up more than 6% of the S&P 500, that led some AI funds to have less exposure to the biggest AI stock than you would get in a broad index fund.

This problem hit the three losers of the year. First Trust’s $457 million AI-and-robotics fund has only 0.8% in Nvidia, a bit over half what it holds in cybersecurity firm BlackBerry .

WisdomTree ’s $213 million AI-and-innovation fund holds the same amount of each stock, giving it only 3% in Nvidia.

BlackRock ’s $610 million iShares Future AI & Tech fund was also equal weighted until three weeks ago, when it altered its purpose from being a robotics-and-AI fund, changed ticker and switched to a market-value-based index that gives it a larger exposure to Nvidia.

The result has been a 20-percentage-point gap between the best and worst AI ETFs this year. There is a more than 60-point gap since the launch of ChatGPT in November 2022 lit a rocket under AI stocks—although the ETFs are at least all up since then.

The market has penalized being equal weighted recently, instead rewarding big holdings in the largest stocks.

Jay Jacobs , U.S. head of thematic and active ETFs at BlackRock, says it is best to be market-value weighted when a theme has winner-takes-all characteristics, which he says generative AI has. When the firm’s AI fund included robotics it was spread across a lot more stocks that didn’t compete with each other, so equal weighted made more sense.

For investors, it isn’t so simple. Global X takes the opposite approach with its two $2 billion-plus AI funds, AIQ and BOTZ. BOTZ only buys stocks that focus on AI and robotics, but takes larger positions. AIQ spreads its bets on AI and tech more widely, and its 3% cap on its biggest holdings each time it rebalances means it has far less in Nvidia than BOTZ, with a cap of 8%. AIQ still managed to beat BOTZ this year, though.

So far, so confusing. The basic lesson: Picking among funds within a theme is hard, and depends on luck as well as close reading of the fund’s documents. A more advanced lesson is that it is hard to pick a theme in the first place, or to stick with it. The three problems:

1. Defining the theme is hard . Nvidia features in the anti-woke YALL ETF, which pitches itself as for “God-fearing, flag-waving conservatives.” The chip maker is also held by vegan, gender-diverse and climate-action ETFs. Its shares are clearly driven by the prospects for AI, but it is still big in computer-game and bitcoin ETFs, where its chips were originally used.

2. Timing the theme is even harder. Get in too early, and there aren’t any companies to buy. Get in when the funds are being launched, and the chances are the theme is already widely known and overpriced, as there are typically large numbers of launches during bubbles and late-stage bull markets.

“They are trendy by design,” says Kenneth Lamont, a senior researcher at Morningstar. “They play to our worst instincts, because we’re narrative-driven creatures.”

A recent example was the race to launch clean-energy and early-stage-tech ETFs during the bubble of late 2020 and early 2021. Performance since then has been miserable as prices corrected, with many of the ETFs halving or worse.

Dire timing is common across themes: According to a paper last year by Prof. Itzhak Ben-David of Ohio State University and three fellow academics, what they call “specialized” ETFs lose 6% a year on average over their first five years due to poor launch timing.

3. Long-term investing is pitched by fund managers as the goal for thematic investing, to hang on until the theme bears fruit. But even investors who really want to commit to a theme for the long run often find it hard, as so many funds are wound up, merged or change strategy when they go out of fashion.

The boom in internet funds of the late 1990s vanished after the dot-com bubble burst, with few surviving to see the internet theme blossom a decade later, while six of the 50 “metaverse” funds launched after Facebook switched to Meta Platforms in 2021 have already shut, according to Lamont.

The oldest thematic fund, the DWS Science and Technology mutual fund, started as the Television Fund in 1948 before adding electronics, and has gone through at least four other names. I only have data back to 1973, but it has lagged far behind the wider market since then, despite golden ages for television, electronics, science and now tech. (Yes, it has a lot of Nvidia.)

So what to do? At a very minimum, don’t buy based on the name of a fund. Look at the holdings, look at the index it follows and how it is structured, and consider whether it does what it says. Then think about just how expensive the idea has already become. Watch for the theme coming into fashion and getting overpriced, as that is a good time to sell (or to launch a fund).

But mostly, look at the fees: They will be many times higher than a broad market index fund, and the dismal history of poor timing suggests that for most people they aren’t worth paying.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

Boeing stock has fallen to its lowest level since 2022 after a downgrade from a Wall Street analyst put a number on one of investors’ worst fears: stock dilution.

Wells Fargo analyst Matthew Akers on Tuesday downgraded Boeing stock to the equivalent of Sell from Hold. His price target was reduced to $119 a share from $185.

That is the lowest target price on Wall Street by almost $70 a share, according to FactSet. At $119 a share, down about 30% from recent levels, Boeing would have a market value of roughly $73 billion, levels not seen since early 2020 during the Covid-19 pandemic.

Boeing stock closed down 7.3% at $161.02, while the S&P 500 and Dow Jones Industrial Average were off 2.1% and 1.5%, respectively. It was the lowest close since Nov. 4, 2022, when it finished at $160.01, according to Dow Jones Market Data.

“We think Boeing had a generational free cash flow opportunity this decade, driven by ramping production on mature aircraft and low investment need,” wrote Akers. “But after extensive delays and added cost, we now see growing production cash flow running into a undefined new aircraft investment cycle, capping free cash flow a few years out.”

At this point in its product cycle, Boeing simply should be generating north of $10 billion in free cash flow a year. However, production and quality problems have pushed output lower and added costs. Wall Street sees Boeing using almost $8 billion in cash to fund operations in 2024.

What is more, Boeing likely will need to design a new single-aisle jet in the coming years to better compete with the Airbus A321 family of aircraft. That will take tens of billions of dollars spread out over several years.

Akers sees $30 billion in equity being raised by 2026 to help cover the cost of new investment. Some of that hefty total will go toward repairing Boeing’s balance sheet. The company ended the second quarter with more than $53 billion in long-term debt, up from less than $11 billion at the end of 2018, before the pandemic and significant problems with Boeing’s 737 MAX jet.

Raising $30 billion of equity at recent prices would require issuing roughly 190 million new shares, increasing the share count by about 31%. All things being equal, a higher share count reduces earnings per share.

“If Boeing were to postpone new plane development for several more years (launch early next decade) and instead just pay down debt, we estimate free cash flow per share could grow to about ~$20 late this decade,” added Akers. That might justify a $150 share price in coming years, but postponing a new plane would mean “ ceding significant narrowbody share” to Airbus.

Narrowbody is industry jargon for single-aisle aircraft such as the 737 MAX or A320.

Raising equity and offering customers a new plane, or not offering a new jet and holding off on raising equity: Boeing doesn’t have easy choices to make in coming years.

Overall, 60% of analysts covering Boeing stock rate shares at Buy, according to FactSet. The average Buy-rating ratio for stocks in the S&P 500 is about 55%. Even though Boeing’s Buy-rating ratio is above average, it has been sliding. Coming into the year, before an emergency- door plug blew out in midair on an Alaska Air flight on Jan. 5, the ratio was north of 75%.

The average analyst price target for Boeing shares is about $214.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

Multinationals like Starbucks and Marriott are taking a hard look at their Chinese operations—and tempering their outlooks.

For years, global companies showcased their Chinese operations as a source of robust growth. A burgeoning middle class, a stream of people moving to cities, and the creation of new services to cater to them—along with the promise of the further opening of the world’s second-largest economy—drew companies eager to tap into the action.

Then Covid hit, isolating China from much of the world. Chinese leader Xi Jinping tightened control of the economy, and U.S.-China relations hit a nadir. After decades of rapid growth, China’s economy is stuck in a rut, with increasing concerns about what will drive the next phase of its growth.

Though Chinese officials have acknowledged the sputtering economy, they have been reluctant to take more than incremental steps to reverse the trend. Making matters worse, government crackdowns on internet companies and measures to burst the country’s property bubble left households and businesses scarred.

Lowered Expectations

Now, multinational companies are taking a hard look at their Chinese operations and tempering their outlooks. Marriott International narrowed its global revenue per available room growth rate to 3% to 4%, citing continued weakness in China and expectations that demand could weaken further in the third quarter. Paris-based Kering , home to brands Gucci and Saint Laurent, posted a 22% decline in sales in the Asia-Pacific region, excluding Japan, in the first half amid weaker demand in Greater China, which includes Hong Kong and Macau.

Pricing pressure and deflation were common themes in quarterly results. Starbucks , which helped build a coffee culture in China over the past 25 years, described it as one of its most notable international challenges as it posted a 14% decline in sales from that business. As Chinese consumers reconsidered whether to spend money on Starbucks lattes, competitors such as Luckin Coffee increased pressure on the Seattle company. Starbucks executives said in their quarterly earnings call that “unprecedented store expansion” by rivals and a price war hurt profits and caused “significant disruptions” to the operating environment.

Executive anxiety extends beyond consumer companies. Elevator maker Otis Worldwide saw new-equipment orders in China fall by double digits in the second quarter, forcing it to cut its outlook for growth out of Asia. CEO Judy Marks told analysts on a quarterly earnings call that prices in China were down roughly 10% year over year, and she doesn’t see the pricing pressure abating. The company is turning to productivity improvements and cost cutting to blunt the hit.

Add in the uncertainty created by deteriorating U.S.-China relations, and many investors are steering clear. The iShares MSCI China exchange-traded fund has lost half its value since March 2021. Recovery attempts have been short-lived. undefined undefined And now some of those concerns are creeping into the U.S. market. “A decade ago China exposure [for a global company] was a way to add revenue growth to our portfolio,” says Margaret Vitrano, co-manager of large-cap growth strategies at ClearBridge Investments in New York. Today, she notes, “we now want to manage the risk of the China exposure.”

Vitrano expects improvement in 2025, but cautions it will be slow. Uncertainty over who will win the U.S. presidential election and the prospect of higher tariffs pose additional risks for global companies.

Behind the Malaise

For now, China is inching along at roughly 5% economic growth—down from a peak of 14% in 2007 and an average of about 8% in the 10 years before the pandemic. Chinese consumers hit by job losses and continued declines in property values are rethinking spending habits. Businesses worried about policy uncertainty are reluctant to invest and hire.

The trouble goes beyond frugal consumers. Xi is changing the economy’s growth model, relying less on the infrastructure and real estate market that fueled earlier growth. That means investing aggressively in manufacturing and exports as China looks to become more self-reliant and guard against geopolitical tensions.

The shift is hurting western multinationals, with deflationary forces amid burgeoning production capacity. “We have seen the investment community mark down expectations for these companies because they will have to change tack with lower-cost products and services,” says Joseph Quinlan, head of market strategy for the chief investment office at Merrill and Bank of America Private Bank.

Another challenge for multinationals outside of China is stiffened competition as Chinese companies innovate and expand—often with the backing of the government. Local rivals are upping the ante across sectors by building on their knowledge of local consumer preferences and the ability to produce higher-quality products.

Some global multinationals are having a hard time keeping up with homegrown innovation. Auto makers including General Motors have seen sales tumble and struggled to turn profitable as Chinese car shoppers increasingly opt for electric vehicles from BYD or NIO that are similar in price to internal-combustion-engine cars from foreign auto makers.

“China’s electric-vehicle makers have by leaps and bounds surpassed the capabilities of foreign brands who have a tie to the profit pool of internal combustible engines that they don’t want to disrupt,” says Christine Phillpotts, a fund manager for Ariel Investments’ emerging markets strategies.

Chinese companies are often faster than global rivals to market with new products or tweaks. “The cycle can be half of what it is for a global multinational with subsidiaries that need to check with headquarters, do an analysis, and then refresh,” Phillpotts says.

For many companies and investors, next year remains a question mark. Ashland CEO Guillermo Novo said in an August call with analysts that the chemical company was seeing a “big change” in China, with activity slowing and competition on pricing becoming more aggressive. The company, he said, was still trying to grasp the repercussions as it has created uncertainty in its 2025 outlook.

Sticking Around

Few companies are giving up. Executives at big global consumer and retail companies show no signs of reducing investment, with most still describing China as a long-term growth market, says Dana Telsey, CEO of Telsey Advisory Group.

Starbucks executives described the long-term opportunity as “significant,” with higher growth and margin opportunities in the future as China’s population continues to move from rural to suburban areas. But they also noted that their approach is evolving and they are in the early stages of exploring strategic partnerships.

Walmart sold its stake in August in Chinese e-commerce giant JD.com for $3.6 billion after an eight-year noncompete agreement expired. Analysts expect it to pump the money into its own Sam’s Club and Walmart China operation, which have benefited from the trend toward trading down in China.

“The story isn’t over for the global companies,” Phillpotts says. “It just means the effort and investment will be greater to compete.”

Corrections & Amplifications

Joseph Quinlan is head of market strategy for the chief investment office at Merrill and Bank of America Private Bank. An earlier version of this article incorrectly used his old title.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

A key recommendation of the IMF’s Enhanced General Data Dissemination System (e-GDDS).

Bahrain has taken a major step in advancing data transparency with the recent launch of its National Summary Data Page (NSDP). This initiative, which went live on Thursday, fulfills a key recommendation from the IMF’s Enhanced General Data Dissemination System (e-GDDS) by publishing critical macroeconomic and financial data.

The e-GDDS is the foundational tier of the IMF’s Data Standards Initiatives, designed to promote transparency and encourage countries to voluntarily share timely data that is vital for monitoring and analyzing economic performance, the IMF noted in a statement. Bahrain’s adoption of these recommendations and the creation of the NSDP underscore the nation’s commitment to improving data accessibility and transparency.

The NSDP will serve as a centralized hub for national and international stakeholders, investors, rating agencies, and decision-makers, offering easy access to vital economic and financial data. According to the IMF’s Executive Board, this transparency is essential for tracking a country’s economic and financial developments. Additionally, the standardized data format supports cross-country economic analysis and early detection of risks, helping to prevent economic crises and promoting sustainable growth.

Bert Kroese, Chief Statistician and Data Officer at the IMF, praised this achievement, expressing confidence that Bahrain will benefit from utilizing the e-GDDS framework to further develop its statistical system. The IMF Executive Board has recently reviewed the advantages of participating in the e-GDDS, including improved sovereign financing conditions.

Bahrain’s NSDP consolidates data on national accounts, government operations, the monetary and financial sector, and the external sector in one accessible platform. With machine-readable formats and a scheduled release of data, it ensures timely and simultaneous access for all users. Data for the NSDP is provided by the Ministry of Finance and National Economy, the Central Bank of Bahrain, and the Information and eGovernment Authority.

This launch also signals Bahrain’s future intention to subscribe to the IMF’s Special Data Dissemination Standard (SDDS), further reinforcing its dedication to data transparency. The NSDP is now accessible via the IMF’s Dissemination Standards Bulletin Board.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

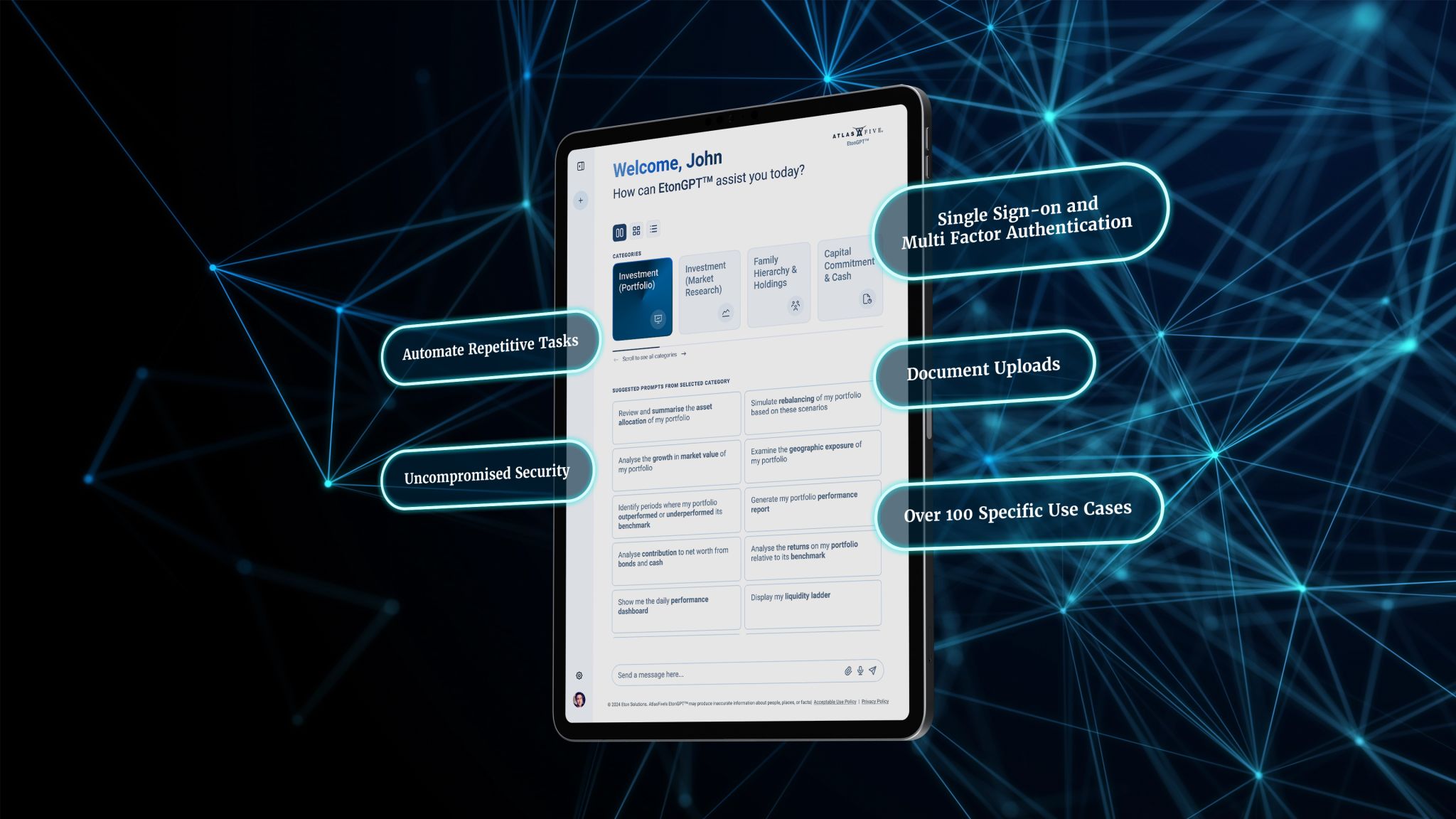

EtonGPT™ will enable wealth managers to achieve 2 to 4X increase in operational efficiency.

Eton Solutions has launched EtonGPT™, the world’s first generative AI module tailored specifically for family offices worldwide. EtonGPT™ seamlessly combines the robust transactional capabilities of Eton Solutions’ ERP platform with advanced conversational AI features.

This technology will be available exclusively to users of AtlasFive®, enabling the majority of the 750 families on the platform to leverage EtonGPT™ to enhance the productivity and efficiency of their family offices. By integrating document data with transactional data stored in AtlasFive®, EtonGPT™ streamlines operations and drives productivity improvements.

Several clients of Eton Solutions, including Shade Tree Advisors (US), Todd Family Office (New Zealand), and Aglaia Family Office (Singapore), are already utilizing this AI-powered platform to access information and conduct detailed analyses of their investment and asset portfolios. EtonGPT™ serves as both an internal search engine and a data extraction tool within the secure, cloud-based AtlasFive® ERP platform.

With pending patents, this hybrid AI platform integrates various cutting-edge AI technologies, including machine learning, expert system-based business rule engines, and large language models. It delivers superior accuracy and insights through AI-driven data extraction, summarization, inference, and transformation, empowering family offices to operate more efficiently and securely.

Satyen Patel, Eton Solutions’ executive chairman said, “Our AtlasFive® solution was the first to offer a centralized data platform that had integrated structured data processing across accounting, investment and tax functions. With the launch of EtonGPT™, the world’s first family office LLM, we are embracing cutting-edge technology and reshaping the future of family office management across the globe. AI is increasingly being deployed across businesses. While family offices have largely remained rooted in manual processes, with the integration of AI, they will undergo an unparalleled change, making them resilient and future-ready”.

“With EtonGPT™, AtlasFive® can now parse and integrate data buried in more than 250 document types such as trust plans, estate plans and partnership agreements. This combination of structured and unstructured data processing offers wealth managers the ability to gain a 2 to 4X increase in operational efficiency.”

“EtonGPT™ will offer a foundational shift platform enabling family offices to elevate their legacy, strengthen corporate governance, and provide high value to the HNWIs and UHNWIs they serve.”

Timothy C. Macherone, Chief Operating Officer of Shade Tree Advisors LLC, said, “I do not doubt that EtonGPT™ can be a potential game-changer. In deploying the AI-based technology, which involved leveraging EtonGPT™ to automate our document organization and retention processes, we reduced human involvement by 50% and met our accuracy goals. Similarly, we see countless opportunities to unlock efficiencies in our legacy processes through the use of EtonGPT™ in many verticals, including calculating and posting mark-to-markets on private investments, logging invoice information, and summarizing estate planning documents.”

Andrew Hull, Chief Executive of Todd Family Office, said, “AI is reshaping how we do everything at the Todd Family Office, and our partnership with Eton Solutions has been beneficial. We have faced challenges in fixing AI hallucinations and are worried about the potential misuse of these tech marvels. We’re working with Eton Solutions to pioneer a Responsible AI framework that harnesses the full power of AI with transparency, ethics, and trust at its core. Together, we’re setting the standard for the future of AI for family offices.”

Stephen Hunt, Chief Executive Officer of Aglaia Family Office Pte. Ltd., said, “Aglaia Family Office is proud to be pioneering the setup of automated and AI-powered consolidated portfolio reporting and analytics solutions in Asia. Our commitment goes beyond just automation—we’re focused on the responsible use of AI, ensuring that its integration into our operations enhances not only efficiency but also strengthens timeliness and accuracy. EtonGPT’s early success reassures us that, with Eton Solutions, we’re on the right path.”

As AI’s power is increasingly integrated into modern organizations, Eton Solutions recognizes cybersecurity challenges from traditional threats such as phishing, malware, and data breaches are expanding to include AI-based risks such as deepfakes, misuse, and algorithmic bias. To lessen or mitigate these risks, Eton Solutions is working with its Customer Advisory Board to introduce frameworks that encompass ethics, safety, transparency, trust, and security.

EtonGPT™ is designed to ensure a robust, secure, and ethical environment for family office operations.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The positive economic outlook and improving asset quality continue to support the willingness of financial institutions to lend

The Central Bank of the UAE (CBUAE) has reported a rise in demand for bank credit across the country, driven by economic stability and robust investments, even in the face of increasing interest rates.

In its Credit Sentiment Survey for Q2 2024, the CBUAE highlighted that the positive economic outlook and improving asset quality continue to support the willingness of financial institutions to lend.

The survey findings suggest that this strong credit demand is expected to persist into the third quarter of this year. The CBUAE also noted that the construction sector saw the highest growth in credit demand during Q2, followed by manufacturing, real estate development, and retail and wholesale trade.

Trade credit demand remained strong throughout the second quarter, with an increased appetite for lending across all loan categories and industry sectors, particularly from large government entities and major corporations.

The survey further indicated that all emirates experienced a significant rise in credit demand during Q2, with expectations that this trend will continue over the next three months, particularly in the construction, real estate, manufacturing, retail, and wholesale sectors.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The ranking is based on an online survey that garnered opinions from expatriates from over 170 countries.

InterNations has recently published its Expat Insider 2024 rankings, highlighting the top destinations for expatriates across several key sectors. The online survey gathered insights from expats residing in over 170 countries, offering a broad perspective on the global expat experience.

Qatar stands out in the rankings, securing the fourth place in the Quality-of-Life category. It also earned top-five positions in crucial areas such as Healthcare, Safety & Security, Travel & Transit, and Career Prospects, showcasing the country’s appeal as a prime destination for expatriates.

With over 12,500 expats from 175 nationalities, spanning 174 countries, participating in the survey, the data provides a detailed look at what makes Qatar a leading choice for expats.

Quality of Life

In the global Quality of Life rankings, Qatar placed fourth, following the UAE, Austria, and Spain. This ranking takes into account five subcategories: Healthcare, Travel & Transit, Safety & Security, Environment & Climate, and Leisure Options.

Healthcare

Qatar’s healthcare system received high praise from expats, placing the country second globally in this category, just behind South Korea. Expats highlighted the quality, accessibility, and affordability of medical care as key factors in their positive assessment.

Travel & Transit

Qatar’s efficient transportation network also drew attention, securing the third spot globally, following Austria and Singapore. Expats were particularly impressed with the affordability and availability of public transport, as well as the ease of navigating the country on foot or by bicycle.

Safety & Security

Safety and political stability are often key considerations for expats when choosing a destination, and Qatar ranked fifth in the Safety & Security category. With expats reporting a strong sense of personal safety, Qatar sits among the world’s safest countries, following the UAE, Switzerland, Luxembourg, and Denmark.

Environment & Climate

In the Environment & Climate category, Qatar ranked 27th globally. While the country topped in other areas, the expats surveyed shared mixed views on air quality, climate, and the balance between natural and urban environments. Costa Rica topped this particular category.

Leisure Options

For those seeking leisure and recreational activities, Qatar offers plenty, securing 13th place globally in this category. Expats appreciated the country’s culinary diversity, cultural offerings, and local nightlife. However, Spain took the lead in this segment.

Additional Rankings

Qatar also featured prominently in other surveys. In the “Best Destinations for Expats in 2024” list, Qatar ranked 17th overall. Additionally, in the “Working Abroad” survey, the country placed 19th, with notable highlights including a 5th place ranking for Career Prospects and 11th for Salary and Job Security.

These rankings reinforce Qatar’s growing reputation as a top destination for expatriates, offering a high standard of living, excellent career opportunities, and a safe, vibrant environment. The country’s continued development across sectors ensures that it remains a key player in the global expat landscape.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Building on the success of its first two editions, this year’s competition promises enhanced opportunities for startups, with a focus on leveraging LBS’s global network and resources.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Protego is now live as a fully operational subsidiary, supported by RAKBANK.

Protego, an innovative insurance aggregator platform, is set to transform the way insurance is managed in the UAE. Now fully operational as a subsidiary supported by RAKBANK, Protego offers a streamlined approach for residents to buy, manage, and claim insurance policies.

The platform provides real-time quotes, quicker coverage, secure payments, and personalized experiences across car, travel, and home insurance. By integrating seamlessly with leading insurance providers, Protego makes securing the right coverage easier and more secure than ever before.

Raheel Ahmed, RAKBANK Group CEO, shared his thoughts on this milestone: “Efficiency, convenience, and security are at the heart of modern insurance services. Protego delivers on these fronts, making it simple for users to compare a wide range of insurance options with real-time prices and policies. It’s all about providing a transparent, user-friendly experience that empowers customers to make informed decisions.”

Protego’s platform is built on cutting-edge APIs, allowing customers to access real-time quotes in just 60 seconds. With a blend of digital tools and expert guidance, Protego makes insurance straightforward, putting control directly into the hands of the customer.

Lee Koy Nien, Executive Vice President & Head Bancassurance, added: “At Protego, simplicity and transparency are our guiding principles. We’re here to demystify insurance, offering solutions that are easy to understand and tailored to individual needs. Protego is about bringing peace of mind, backed by advanced technology and the support of our expert team.”

Protego isn’t just another insurance platform it’s an ecosystem designed from the ground up, leveraging state-of-the-art technology to deliver services like AI-powered claims notifications and roadside assistance. Customers can also securely store and manage their policies through a unique digital folder and e-Vault, ensuring their important documents are always safe and accessible.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Through this strategic partnership, InvestGB and Gulf Bank’s clients will have the opportunity to invest in curated investment offerings across key real estate sectors

In its ongoing commitment to offering premier investment opportunities, Gulf Capital Investment Company (InvestGB), the fully-owned investment subsidiary of Gulf Bank, has formed a strategic partnership with Investcorp, a globally renowned alternative investment manager. This collaboration will enable InvestGB and Gulf Bank’s extensive client base to tap into Investcorp’s diverse real estate investment portfolios.

Through this partnership, clients of InvestGB and Gulf Bank will have the chance to invest in specialized offerings across critical real estate sectors, including multifamily, industrial, and student housing. Investcorp’s multifamily portfolio provides exposure to a broad range of residential properties in high-potential markets, aligning with the investment goals of InvestGB and Gulf Bank clients.

Additionally, Investcorp’s industrial portfolio offers clients the opportunity to benefit from the adaptability and significant growth of industrial assets, known for their resilience. The student housing sector presents a unique opportunity with its stable occupancy rates, granting InvestGB and Gulf Bank client’s access to this asset class.

Commenting on this partnership, Noorah AlSane, Managing Director of Real Estate Investments at InvestGB said, “This strategic partnership aligns perfectly with our commitment to providing our clients with innovative and diversified investment solutions”.

AlSane added, “Investcorp’s strong reputation and expertise in real estate make them the ideal partner for offering these exclusive investment opportunities to our valued clients.”

Mohamed AlSada, Managing Director of Private Wealth- Bahrain and Kuwait Markets at Investcorp expressed his delight on this strategic partnership, “This partnership leverages Investcorp’s global investment expertise and proven track record in these sectors, and offers InvestGB and Gulf Bank clients with access to our best-in-class real estate investment offerings.

AlSada added, “This strategic partnership with InvestGB will provide its valued clients with access to our best real estate investment offers and will ensure an array of benefits for both parties, as it allows InvestGB to benefit from Investcorp’s global expertise in the real estate investments sector and its extensive track record in real estate investment. It also provides us with the opportunity to access InvestGB’s wide client base and partner with Gulf Bank, one of Kuwait’s leading banks.”

InvestGB is a closed Kuwaiti shareholding company with a capital of 10 million Kuwaiti Dinars and provides a comprehensive range of leading and innovative services segmented into Wealth Management, Asset Management, Investments, and Investment Advisory for high-net-worth individuals and institutional investors. Guided by a seasoned team of investment professionals, InvestGB adheres to the highest ethical standards, one of its core values.

InvestGB aims to build a robust investment management platform for its clients and Gulf Bank’s clients, contributing to the Bank’s revenue and profits through a solid investment strategy and innovative offerings. The company seeks to expand its strategic relationships with top-tier firms and strengthen Kuwait’s image as a business destination for foreign investors.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The revised rules will remove the need for numerous licenses and prior approvals

The Saudi Ministry of Investment has announced new, streamlined investment rules designed to facilitate foreign investment in Saudi Arabia.

These updated regulations are part of an effort to attract more international investors by simplifying the investment process and creating a more favorable business environment.

The ministry emphasized that the revised rules will remove the need for numerous licenses and prior approvals, significantly cutting down on paperwork and reducing bureaucratic obstacles.

The full details of these new regulations are expected to be released by the end of September, with implementation scheduled for early 2025.

Approved by the Saudi Council of Ministers, this updated investment framework is a crucial component of the national investment strategy and is aligned with Saudi Vision 2030, underscoring the critical role of investment in achieving comprehensive development goals and diversifying the nation’s economic resources.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

Saudi youth will have the opportunity to receive world-class tuition at EWA’s dedicated training center.

NEOM Green Hydrogen Company (NGHC) and the Energy & Water Academy (EWA) have announced a strategic collaboration to launch a specialized vocational training program designed to equip Saudi nationals with the skills and expertise needed to support the operation, maintenance, and optimization of the green hydrogen plant. This program will also enable participants to excel in the rapidly expanding green hydrogen sector. Marking a significant milestone, this is the first green hydrogen training initiative of its kind in the Kingdom.

NGHC is on track to become the world’s largest green hydrogen producer, with full operations expected by the end of 2026. As a pioneer in this industry, NGHC is making substantial investments in the training and upskilling of its workforce within the Kingdom, ensuring they possess the necessary skills, knowledge, and hands-on experience to lead this transformative project. The partnership between NGHC and EWA is in alignment with Saudi’s Vision 2030, which aims to position the country as a global leader in renewable energy, sustainable development, and clean hydrogen production by 2030.

The comprehensive training program, supported by the Saudi Human Resources Development Fund, commenced in August at EWA in the city of Rabigh in Saudi Arabia, and is tailored for aspiring male and female technicians and engineers. The program offers a unique opportunity to gain practical knowledge and hands-on experience on-site in renewable energy technology and green hydrogen production. The program will offer:

- 2 Year Technician Training Program in Renewable Energy Technology & Green Hydrogen: This program targets recent graduates of Industrial Technical Colleges with Diploma Certificates or a Bachelor’s Degree in Science and provides specialized training in Renewable Energy technology and green hydrogen.

- 1 Year Engineers Training Program: Designed for individuals holding a Bachelor’s degree in engineering, this program provides specialized training in Renewable Energy technologies.

Trainees will also receive a stipend while on the program, combining academic rigor with practical application. Trainees will benefit from:

- World-class Instruction: EWA’s expert faculty will deliver a curriculum aligned with industry best practices.

- State-of-the-art Facilities: Access to cutting-edge equipment and technology at EWA’s dedicated training center.

- Comprehensive Support: Accommodation and meals will be provided to ensure a seamless learning experience.

- On-the-job training: Trainees will be able to apply their new skills and knowledge while taking part in the day-to-day operations of the plant.

Wesam Y. Alghamdi, CEO of NEOM Green Hydrogen Company, said: “Investing in education and training is crucial for the success of NEOM Green Hydrogen Company as we start preparing to operate the renewable energy facilities and the green hydrogen production plant and supporting the broader clean hydrogen revolution in Saudi Arabia. This program in partnership with EWA will empower a new generation of skilled professionals to lead this exciting nascent industry into the future.

“This program goes beyond traditional training, providing hands-on experience with cutting-edge technology and a comprehensive understanding of green hydrogen production, and we are confident that graduates will be highly sought-after by industry leaders.”

Tariq Al Shamrani, CEO of the Energy & Water Academy, said: “Our mission at EWA is to cultivate a generation of innovators and leaders equipped to drive Saudi Arabia’s vision for a sustainable future. This partnership with NGHC reflects our dedication to advancing education that not only meets but exceeds industry demands, ensuring our trainees are at the forefront of the global energy transition.”

The program serves as a model for industry-academic collaboration in tackling the challenges of climate change and building a more sustainable future. Aspiring technicians and engineers are encouraged to explore these unique training opportunities and join the movement towards Saudi Arabia’s economic diversification goals while supporting the global transition to clean energy solutions.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

The meeting explored ways to further strengthen bilateral relations and expand cooperation across multiple areas.

Saudi Minister of Foreign Affairs Prince Faisal bin Farhan and Qatar’s Prime Minister and Minister of Foreign Affairs Sheikh Mohammed bin Abdulrahman Al-Thani co-chaired the Executive Committee meeting of the Saudi-Qatari Coordination Council in Riyadh on Sunday. The session focused on further strengthening bilateral ties and cooperation across various sectors.

Prince Faisal opened the meeting by welcoming Sheikh Mohammed and his delegation to Saudi Arabia, wishing them a pleasant stay. He emphasized that the gathering was aimed at enhancing bilateral relations, aligning with the aspirations of the leadership and citizens of both nations, and expanding their cooperation to new horizons.

Prince Faisal highlighted the importance of the Coordination Council as a framework for advancing work in all fields, reinforcing fraternal relations, and supporting the Visions 2030 of both Saudi Arabia and Qatar, which would benefit both countries and their peoples.

In his remarks, the Qatari Prime Minister commended the efforts of the Council’s committees in updating initiatives, creating new ones, and establishing measurable and actionable milestones, complete with timelines.

Sheikh Mohammed emphasized that this meeting marked a significant step in the deepening of bilateral relations and reaffirmed the commitment of both nations to working closely together, in line with the directives of their leaders. He expressed his anticipation for the successful implementation of the Council’s plans.

“Today we are witnessing the fruits of the great efforts made by the heads of the sub committees, their working teams, liaison officers and the General Secretariat team since the beginning of the 8th session of the Qatari-Saudi Coordination Council, as this session is responsible for many files of joint cooperation between us that we seek to accomplish and continue the work process with strength and determination to achieve the desired results,” Sheikh Mohammed stated, reaffirming Qatar’s commitment to ongoing collaboration that meets the expectations of both countries’ leaderships and peoples.

The General Secretariat team presented a review of the preparatory work carried out by the Council’s subcommittees and their teams. The meeting concluded with Prince Faisal and Sheikh Mohammed signing the minutes of the Executive Committee session.

The meeting was also attended by Saudi Minister of Finance, Mohammed Al-Jadaan and Director General of the General Administration of Secretariats of Councils and Committees at the Ministry of Foreign Affairs, Eng. Fahad Al-Harthy.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Beyon Money’s Checkout Payment solution will be available on the Binance App.

Beyon Money has formed a strategic partnership with Binance, the world’s leading cryptocurrency exchange by trading volume, to offer exclusive benefits and services. This collaboration will integrate Beyon Money’s Checkout Payment solution into the Binance App, allowing customers to top up their Binance wallet directly from their Beyon Money Wallet using their mobile number registered with Beyon Money, bypassing the need for payment card details. Furthermore, the partnership will introduce special offers exclusively for Beyon Money customers.

Beyon Money CEO Roberto Mancone commented, “Beyon Money is delighted to partner with Binance to deliver its embedded Beyon Money Checkout Payment solution. This is the first C2B (Consumer to Business) wallet to wallet top up solution with high security, best User Experience, instant transfer and lowest cost for the clients of Beyon Money and Binance.”

Tameem Al Moosawi, Binance Bahrain’s General Manager said: “This collaboration between two regulated entities by the Central Bank of Bahrain marks a significant step forward in our mission to make crypto assets and payments more accessible and cost-effective for users.”

“By integrating Beyon Money Checkout Payment solution into the Binance App, we are not only seamlessly simplifying the process but also ensuring that our customers benefit from the lowest transaction fees in the market.”

Beyon Money’s Checkout solution, which enables merchants to accept payments at reduced costs, is reshaping the landscape of merchant services in Bahrain, and Middle Eastern regions. Furthermore, it continues Beyon Money’s mission to be a partner of choice within the financial ecosystem in Bahrain and beyond.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.