China’s Ghost Cities Are a Problem for Europe’s Luxury Brands, Too

Chinese consumers watching the value of their homes fall are losing the confidence to spend on designer goods

How closely is demand for $3,000 handbags tied to home prices in China? Quite closely, it turns out, which is unfortunate for luxury brands.

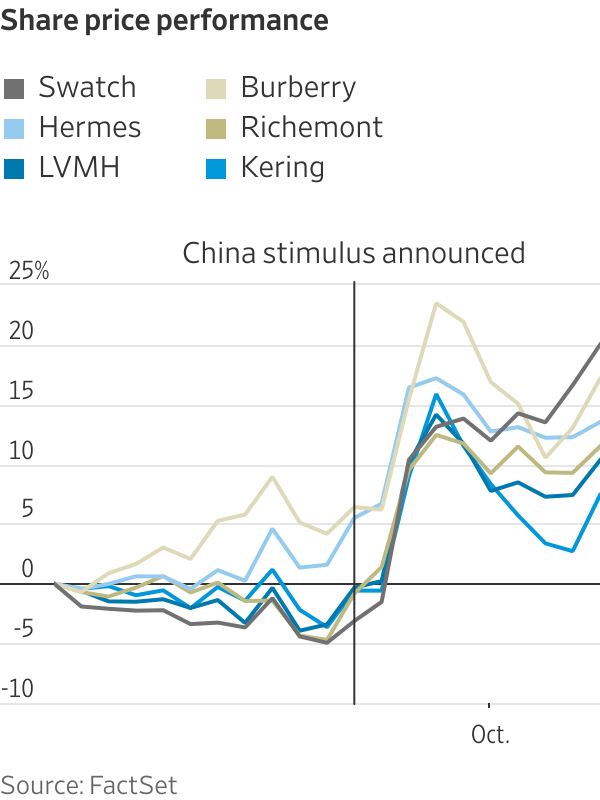

Europe’s luxury stocks fell in early trading Tuesday after China’s economic planning agency failed to announce additional measures to kickstart growth that some investors had hoped for. The sector is still up 10% on average since Beijing launched its initial stimulus plans late last month.

Beijing hopes a cut to mortgage rates, and lower down-payment requirements for buyers of second homes, will jump-start the country’s troubled housing market. A package of loans to brokers and insurers to buy Chinese shares has had initial success at lifting the stock market.

Luxury spending in China has traditionally been more correlated with its home prices than with the financial markets or overall economic growth. Around 60% of net household wealth was tied up in property before prices peaked in 2021. Barclays estimates that falling home prices have destroyed about $18 trillion in household wealth since then, which is equivalent to roughly $60,000 per family.

This, along with worries about the wider economy, is hurting consumer confidence. Retail sales rose just 2.1% in August compared with the same month last year, according to data from China’s National Bureau of Statistics. When global luxury brands start to report their third-quarter results next week, Chinese demand is expected to have slowed since they last updated investors.

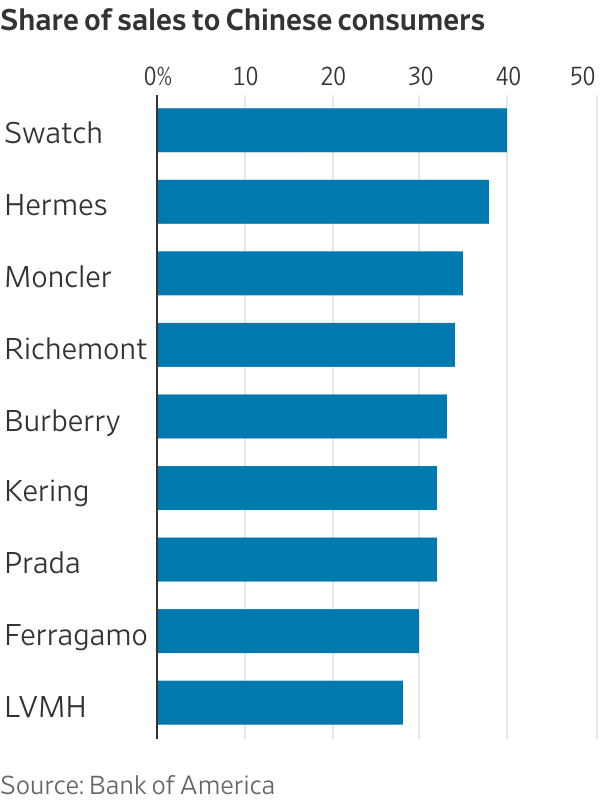

Flagging sales come at an unhelpful time for Europe’s luxury companies, which rely on Chinese consumers for a third of global luxury spending. After several bumpy years during the pandemic, luxury brands and their investors hoped that a comeback in Chinese spending would compensate for a slowdown among Europeans and Americans.

This looks increasingly unlikely. Luxury sales to Chinese shoppers are expected to shrink 7% in 2024 and by 3% next year, according to UBS estimates. As luxury brands have high fixed costs, including the most expensive retail rents in the world, a slowdown with such key customers could have an outsize impact on profit margins.

The last time the luxury industry went through such a rocky patch in China, barring the pandemic, was between 2014 and 2016 when Beijing was cracking down on corruption, including officials who were gifting Louis Vuitton handbags and Rolex watches in exchange for political favours. The global luxury industry barely grew for two years during China’s anticorruption drive, which also coincided with a property-market correction in the country. It didn’t help that shoppers in other markets were also tiring of logos back then.

Europe’s luxury stocks look expensive today compared with that time. As a multiple of expected earnings, listed brands’ shares now trade at a roughly 40% premium to their 2014 to 2016 average.

To justify the higher price tag, Beijing’s housing and wider economic stimulus would need to indirectly lift luxury demand. Measures rolled out so far may not be enough to slow the slide in home prices. China’s housing market is oversupplied by around 60 million units, according to Bloomberg Economics estimates.

New incentives to kick-start consumption are expected soon but will probably target mass-market products like white goods. China already rolled out trade-in subsidies for home appliances earlier this year and a range of consumption coupons.

None of this is very helpful for sellers of expensive luxury goods. For brands to see a recovery, Chinese consumers that spend anywhere from $7,000 to $43,000 a year on luxury products would need to feel much better about their finances than they currently do. Spending by this group has fallen 17% so far this year compared with the same period of 2023, according to a report by Boston Consulting Group.

Half-finished, abandoned housing estates are a big headache for China’s government, and are also on the mind of executives in Paris and Milan. Though the fortunes of luxury bosses likely isn’t high on Chinese officials’ priority list, their fates may be intertwined.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Redefining Urban Living with Innovation, Sustainability, and Exceptional Amenities.

Union Properties PJSC’ has officially launched its new ‘Takaya’ project in Dubai Motor City, the Company’s latest milestone in Dubai’s Real Estate landscape designed to redefine sophisticated urban living. Takaya sets a new standard in the mid-to-high range segment, promising exceptional living experiences for its residents.

The launching ceremony was held at the Ritz Carlton DIFC, in the presence of Eng. Amer Khansaheb, Chief Executive Officer and Board Member, Union Properties. During the ceremony, Eng. Khansaheb highlighted how the project demonstrates the Company’s steadfast dedication to advancing Dubai’s Real Estate sector. The Takaya project aims to enrich the offerings provided within the Motor City’s master community, while also delivering novel and distinctive amenities that will attract investors and fulfil diverse customer needs.

The mix-use project, Takaya is constructed over a plot area spanning 436,175 sq. ft, overlooking the Dubai Autodrome, along with a stunning 500-metre retail boulevard. It comprises three residential towers with 744 affordable luxurious apartments. It also offers competitive unit sizes (studio, 1, 2, 3 BR) and pricing, making it a compelling market choice., along with penthouses, townhouses, villas, and commercial space. In contrast to other properties in the market, Takaya offers spacious living areas with attractive, post-handover payment plan. From sleek finishes to state-of-the-art amenities, the development, which is valued at approximately AED 2 billion, is set to provide a prestigious living experience for residents.

Commenting on the official launch, Eng. Amer Khansaheb stated: “We are thrilled to officially launch the eagerly awaited ‘Takaya’ project in Dubai Motor City, which reflects our unwavering commitment to innovation, sustainability and excellence. At ‘Union Properties’, we are driven by our mission of creating exceptional living experiences for customers through our several unique projects. The launch of ‘Takaya’ project is in line with our long-term growth objectives, further reinforcing our commitment to delivering superior quality and unparalleled value for customers. Our overarching objective is to create a vibrant residential community overlooking the one and only one Dubai Autodrome, which will redefine the standards of modern urban living.”

“By leveraging our extensive industry expertise and market insights, we look forward to capitalizing on new opportunities in the Real Estate market and future-ready liveable environments. The market has witnessed significant growth over the previous years, making the Motor City a global hub for property investors and homebuyers. The sector is expected to continue expanding in the coming years, further strengthening its appeal within the broader UAE market.” Eng. Khansaheb added.

Developments by Union Properties greatly contribute to Motor City market value and status by complementing current market offerings. According to DLD data, Motor City has experienced a sharp rise in Real Estate transactions and a notable acceleration of market momentum over the last three quarters. Recently launched off-plan projects in Motor City have experienced strong demand, which has a positive impact on the appreciation of property values.

Moreover, the UAE’s Real Estate market is anticipated to continue its strong performance in the coming years with projections pointing towards an astounding value of USD 0.7 trillion by 2024. Between 2024 and 2028, an annual growth rate of 3.03 per cent is expected, resulting in a market volume of USD 0.80 trillion by the latter year.

The Takaya development has been crafted with meticulous precision, ensuring maximum functionality and comfort and attention to detail meeting the highest standards of quality for residents. It is integrated with innovative smart building management systems that employ cutting-edge technologies to reduce energy consumption and operational costs. Upscale features of the development include – outdoor sports courtyards, leisure pool, kid’s pool, jogging track, kids play area, multipurpose rooms at each tower, an arcade lounge, co-working spaces, cinema/AV room, and more. Furthermore, the ground floor of each tower hosts a mix of retail outlets, food and beverage establishments, as well as other services. The development also features 150 parking spaces equipped with EV chargers.

With sustainability as one of its prime focus, ‘Union Properties’ is contributing towards mitigating the challenges posed by climate change and other environmental hazards. The integration of sustainable materials and designs ensures longevity, lowers environmental impact and reduces utility costs of the development. Takaya has been designed with high-performance facades that exceed green building guidelines and makes use of a large plot of approximately 450,000 square feet to create parks, a large central garden and other green spaces. Along with sustainability, the Company also prioritizes healthy living, and in this regard, Takaya offers sports facilities such as jogging tracks, padel, and basketball courts, lap pool and squash court, in an urban environment where open spaces are scarce, which will be a key selling point for the coming years.

Takaya’s unbeatable launch payment plan, which is 60 per cent due within three years of construction and 40 per cent due in three years post-handover, provides investors and end users with further cash flow flexibility. Union Properties’ efforts to reduce operational costs also provide the residents with a sustainable savings option, that supports value appreciation with time. The handover date for this flagship project is expected to be in Q4 2027. Looking ahead, ‘Union Properties’ continues to be driven by its mission to create unique and remarkable residential developments, as well as reshape the future of urban living. The company aims to accomplish several ambitious objectives, such as the launch of AED 6 billion projects just in the next 18 months. With a strategic vision and a strong commitment to excellence, ‘Union Properties’ is well-positioned to leverage new opportunities and play a pivotal role in Dubai’s thriving real estate sector by adding to the city’s extensive property portfolio.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

For every hotel spotlighting its historical bona fides, there are many that didn’t stand the test of time. Here, some of the most infamous.

Many luxury hotels only build on their gilded reputations with each passing decade. But others are less fortunate. Here are five long-gone grandes dames that fell from grace—and one that persists, but in a significantly diminished form.

The Proto-Marmont |

The Garden of Allah, Los Angeles

A magnet for celebrities, the Garden of Allah was once the scene-making equivalent of today’s Chateau Marmont. Frank Sinatra and Ava Gardner’s affair allegedly started there and Humphrey Bogart lived in one of its bungalows for a time.

Crimean expat Alla Nazimova leased a grand home in Hollywood after World War I, but soon turned it into a hotel, where she prioritised glamorous clientele. Others risked being ejected by guards and a fearsome dog dubbed the Hound of the Baskervilles. Demolished in the 1950s, the site’s now a parking lot.

The Failed Follow-Up |

Hotel Astor, New York City

The Astor family hoped to repeat their success when they opened this sequel to their megahit Waldorf Astoria hotel in 1904. It became an anchor of the nascent Theater District, buzzy (and naughty) enough to inspire Cole Porter to write in “High Society”: “Have you heard that Mimsie Starr…got pinched in the Astor Bar?”

That bar soon gained another reputation. “Gentlemen who preferred the company of other gentlemen would meet in a certain section of the bar,” said travel expert Henry Harteveldt of consulting firm Atmosphere Research. By the 1960s, the hotel had lost its lustre and was demolished; the 54-storey One Astor Plaza skyscraper was built in its place.

The Island Playground |

Santa Carolina Hotel, Bazaruto Archipelago, Mozambique

In the 1950s, colonial officers around Africa treated Mozambique as an off-duty playground. They flocked, in particular, to the Santa Carolina, a five-star hotel on a gorgeous archipelago off the country’s southern coast.

Run by a Portuguese businessman and his wife, the resort included an airstrip that ferried visitors in and out. Ask locals why the place was eventually reduced to rubble, and some whisper that the couple were cursed—and that’s why no one wanted to take over when the business collapsed in the ’70s. Today, seeing the abandoned, crumbled ruins and murals bleached by the sun, it’s hard to dismiss their superstitions entirely.

The Tourism Gimmick |

Bali Hai Raiatea, French Polynesia

The overwater bungalow, a shorthand for barefoot luxury around the world, began in French Polynesia—but not with the locals. Instead, it was a marketing gimmick cooked up by a trio of rascally Americans. They moved to French Polynesia in the late 1950s, and soon tried to capitalise on the newly built international airport and a looming tourism boom.

That proved difficult because their five-room hotel on the island of Raiatea lacked a beach. They devised a fix: building rooms on pontoons above the water. They were an instant phenomenon, spreading around the islands and the world—per fan site OverwaterBungalows.net , there are now more than 9,000 worldwide, from the Maldives to Mexico. That first property, though, is no more.

The New England Holdout |

Poland Springs Resort, Poland, Maine

The Ricker family started out as innkeepers, running a stagecoach stop in Maine in the 1790s. When Hiram Ricker took over the operation, the family expanded into the business by which it would make its fortune: water. Thanks to savvy marketing, by the 1870s, doctors were prescribing Poland Spring mineral water and die-hards were making pilgrimages to the source.

The Rickers opened the Poland Spring House in 1876, and eventually expanded it to include one of the earliest resort-based golf courses in the country, a barber shop, dance studio and music hall. By the turn of the century, it was among the most glamorous resort complexes in New England.

Mismanagement eventually forced its sale in 1962, and both the water operation and hospitality holdings went through several owners and operators. While the water venture retains its prominence, the hotel has weathered less well, becoming a pleasant—but far from luxurious—mid-market resort. Former NYU hospitality professor Bjorn Hanson says attempts at upgrading over the decades have been futile. “I was a consultant to a developer in the 1970s to return the resort to its ‘former glory,’ but it never happened.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

The roughly 50,000-square-foot mansion in Los Angeles comes up for sale following the divorce of billionaire Tony Pritzker and philanthropist Jeanne Pritzker

The Pritzker estate in Los Angeles, one of the largest homes in the country, is hitting the market for $195 million. If it sells for that price, it would set a record for the city, where the priciest home sale on record was Jeff Bezos’ $165 million purchase of the Warner Estate in 2020.

The Pritzker listing comes in the wake of a bitter divorce battle between billionaire Tony Pritzker and philanthropist Jeanne Pritzker. The former couple built the house, completing it in 2011.

The roughly 6-acre parcel is in the Beverly Hills Post Office area, just over a mile from Bezos’ home. Situated on a promontory overlooking the city, the home has 180-degree views of downtown L.A. and the ocean, according to Stephen Shapiro of Westside Estate Agency, who has the listing with colleague Kurt Rappaport .

Clad in imported white Italian limestone, the gated estate is about 50,000 square feet with 16 bedrooms, 27 bathrooms and 18 fireplaces. The primary suite has his and hers bathrooms and closets, as well as an indoor and outdoor fireplaces, a hairdressing area, a custom pop-up TV and a balcony.

The lower level of the house has a flower-prep room and a soundproofed bowling alley with custom cabinetry for the bowling balls and shoes. A large theatre has velvet curtains, stage lighting, stadium seating and a projector room. The kitchen has three Gaggenau ovens, two stainless-steel sinks and a dumbwaiter.

On the grounds, a detached two-bedroom guesthouse has a balcony, elevator and its own patio. The estate also has a lighted tennis court with a viewing pavilion. The 75-foot green marble infinity pool overlooks the city, and there is a nearby outdoor kitchen with two barbecues, a large pizza oven, and a custom swimsuit spinner.

In Los Angeles, these types of features are unusual for properties in the hills, Rappaport said. “It’s very rare to have this type of acreage with a view,” he said.

The property also has a detached two-bedroom staff apartment, multiple staff lounges and a staff kitchen.

The Pritzkers are major philanthropists and the home was designed to host large fundraisers, with a large walk-in refrigerator and an extensive underground parking structure.

Because of new restrictions on building, the estate couldn’t be recreated, Shapiro said. “You couldn’t build it today,” he said, adding: “This is the finest house I’ve ever seen.”

Tony and Jeanne Pritzker, who were married for more than 30 years and have six children, declined to comment. The son of Hyatt hotel chain co-founder Donald Pritzker, Tony is a member of one of the country’s wealthiest and more powerful families. He and his brother, J.B. Pritzker , co-founded the investment firm the Pritzker Group, with J.B. ceasing his involvement around the time he became governor of Illinois in 2019.

In 2001, Tony and Jeanne paid $9.5 million for a circa-1938 house in the Beverly Hills Post Office area, according to property records. Then, through LLCs, they purchased several parcels on a ridge adjacent to their previous home. It is unclear how much they paid for the land, but one batch of parcels was purchased in 2005 for $14.7 million, records show.

Once the land was assembled, the Pritzkers started building a new home designed by the late Ed Tuttle of Paris-based architecture firm Designrealization. The Pritzkers moved into the estate in 2011, selling their previous home to celebrity chef Wolfgang Puck for $14 million, property records show.

Jeanne and Tony separated in 2022. The Pritzkers reached a preliminary settlement in April 2024, and Jeanne moved out of the estate that month. The divorce was finalised in May 2024, according to court records. Tony has since paid $19.5 million for a penthouse at Westwood’s Beverly West condominium.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

The owners spent $73,000 on the land, plus another $475,000 building their vacation house

Lorena Ramos and Carlos Moss live and work about 7,500 feet above sea level in the high-plateau megalopolis of Mexico City. But when it came time to commission a vacation home, they took it up a notch, altitude-wise. They built a home about 2,000 feet higher in an area known as the Corridor de la Montaña, or Mountain Corridor, in the state of Hidalgo.

Ramos, a 35-year-old sales director, and Moss, a 38-year-old executive in the construction industry, bought their steep 1/3-acre lot in 2021 for about $73,000. Then they spent roughly $475,000 to build and furnish a new house, working with Mexico City architect Rodrigo Saavedra Pérez-Salas. His design, using a cantilever, suspends the two-storey structure off the side of a densely wooded slope. From the inside, it can feel like a vast, floating treehouse.

undefined They named the property after their boxer, Oruç, now 11, and initially planned to use the home to entertain friends on weekends and holidays, outfitting the lower level with a funky bar. The three bedrooms—some equipped with bunk beds—and three bathrooms can accommodate up to eight people.

But this summer, less than a year after finishing construction, they had their son, Nicolás. That means they have to make some changes to babyproof the house. “We will have to do something,” says Ramos.

The vacation home is part of the first wave of development on the site of what was once a sprawling private estate. The property sits in Mexico’s Sierra de Pachuca mountain range, part of the vast Sierra Madre Oriental that runs along the east of the country. Their area is marked by atmospheric mists and a lengthy rainy season.

For Saavedra, the architect, the hard choice wasn’t where to place the house—a clearing in the woods, in the middle of the lot, was just about the only spot—but how to access the house once it was built. The most direct route would have meant seeing a house sticking out of the woods, says the 35-year-old founder and principal of Saavedra Arquitectos. Instead, he devised what he calls “a narrative” that leads visitors over a bridge, then down and around a series of winding stairs and through a masonry door that acts as a kind of ceremonial portal to the house. When visitors first arrive on the lot, all they see is tree. As they descend and approach the house itself, they are given a tour of the exterior of the building, while glimpsing the evocative mountain terrain beyond and below.

The couple chose moody interiors to play off local conditions, with lots of exposed steel beams, steel-tinted concrete, dark wood and glass walls that let tree-filtered light stream in. A spare open stairwell and thin inner and outer railings add to the minimalist flare.

All this added atmosphere came at a cost. The couple spent about $94,000 on steel, which includes the bridge and the costly cantilever.

Intent on a sustainable home, they managed to reuse what another homeowner might regard as outright waste. They have stored firewood for the great room in leftover steel girders, fashioned into a Brutalist rack, and they used leftover wood from their board-formed concrete molds as paneling in the primary bedroom. Most recently, they have installed a rainwater collection system, with a cistern placed uphill from the house, and they now use the bounty for everything from washing to drinking.

Though Casa Oruç is surrounded by trees, Saavedra managed to build the whole 2,400-square-foot house by only cutting down a handful. This ship-in-a-bottle effect is apparent in an upstairs deck, which incorporates two oyamel firs, a species native to the mountains of central and southern Mexico. Downstairs, the bar area is built around one of the firs, set off by a glass enclosure.

The open-plan kitchen, which Ramos helped design, was a splurge of about $34,000. The couple spent about the same amount on the glass doors and windows—a cost most apparent in the primary bedroom, which has glazing on three sides.

Being nearly 9,500 feet above sea level means the couple can do without air conditioning, and even though it rarely gets below freezing, heating is a must for much of the year. They spent around $15,660 on an electrical heating system, which, depending on where they are in the house, radiates from either the floor or the ceiling. They also spent some $10,500 on two fireplaces—gas-burning for the bedroom, and wood-burning for the great room’s main sitting area. They use them for heat and for added coziness, says Moss.

The couple have kept their lot as wild as possible, putting their landscaping budget at less than $1,000. And they can tour the area’s rough and wild terrain starting right on their property, which contains a few dramatic rock formations. Though their home is nearly as far above sea level as the taller peaks of Montana’s Glacier National Park, the spot is more bucolic than dramatic. The house is high up, concedes Moss, “but not ridiculously high,” invoking a category that for him starts at about 16,000 feet.

Now, looking ahead to the end of the year, when Nicolás will start to crawl, they are set to invest around $3,000 to babyproof. This will include installing tempered glass to close off the bare-bones railings of their main terrace, located off the upper floor’s great room, and protecting the exposed inside stairwell connecting the great room above with the bar area below.

When the baby came, they hadn’t yet decided on blinds or curtains in the primary bedroom, which turned out to be a benefit. “We get to see all the different shades of light—when it’s getting dark, then when the sun comes up,” says Ramos, who appreciates these subtle changes throughout the day. Perhaps her baby does, too. “I always give Nicolás his first feed while in bed, and he loves staring outside,” she says.

Many new arrivals to this altitude might be gasping, but little Nicolás is doing just fine. He likes to “contemplate the view of the sky and tree tops from our laps,” says his mother.

Foundation and framing:

$169,725 (including masonry)

Steel (including cantilever):

$94,000

Kitchen:

$34,000

Bathrooms:

$18,500

Landscaping:

$780

Fireplaces:

$10,450

Electrical work:

$27,260

Floors (including outdoor decks):

$25,000

Glazing (glass doors and windows):

$34,000

Lighting:

$3,100

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Limited Availability Remains in the Exclusive Riyadh Development

Following the recent unveiling of Mouawad Residences, a landmark SAR 880 million (GBP 180 million) development in Riyadh, Dar Global, the London-Stock Exchange-listed international real estate company, is experiencing exceptional demand. The project, a collaboration with luxury jeweler Mouawad, marks the first collaboration between both companies in the ultra-luxury residential sector of the Saudi capital.

The surge in demand highlights the Kingdom’s burgeoning appetite for branded residences, a trend fueled by a growing class of international buyers seeking unique and exclusive living experiences. The Saudi Premium Residency program, which grants residency to owners of high-value properties, has further enhanced the Kingdom’s appeal to international investors.

“The response to Mouawad Residences has been phenomenal, exceeding our expectations,” said Ziad El Chaar, CEO of Dar Global. “This clearly demonstrates the strong demand for bespoke, ultra-luxury living in Riyadh. The project’s unique blend of contemporary design, meticulous attention to detail, and timeless elegance, all infused with Mouawad’s legacy of creative and artistic mastery, has truly resonated with discerning buyers.”

Set for handover in Q4 of 2026, the luxury development of 200 residential villas will become one of Riyadh’s most prestigious addresses. It is located near the site of World Expo 2030 in the North of the city.

“We are thrilled to partner with Dar Global on this landmark project,” said Pascal Mouawad, Fourth Generation Co-Guardian of Mouawad. “Mouawad Residences represents a natural extension of our brand, bringing our heritage of luxury and craftsmanship to the world of real estate. We are confident that this development will set a new standard for luxury living in Riyadh.”

Dar Global’s entry into the Saudi market is part of its broader strategy to introduce its internationally recognized standards of luxury to the Kingdom’s growing real estate sector. With an established track record across the Middle East and Europe, Dar Global is set to deliver unparalleled sophistication to a market increasingly defined by discerning, globally mobile buyers.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

This AED 1 billion luxury development aims to transform luxury living in Ras Al Khaimah

Major Developers and their consultants, Federal Engineering Consultants, remain optimistic about the progress of the highly anticipated Manta Bay project on Al Marjan Island. This AED 1 billion luxury development aims to transform luxury living in Ras Al Khaimah, blending modern amenities with architectural excellence inspired by the graceful manta ray.

Major Developers, known for its exclusive residential touch, has highlighted the significance of Manta Bay as their exciting venture in the UAE. The project, which complies with BARJEEL-RAK’s green building regulations, reflects the developer’s commitment to sustainability and innovative design.

Andrei Charapenak, CEO of Major Developers, said: “We are incredibly pleased with the progress made on the Manta Bay project so far. This development represents a bold step for Major Developers in Ras Al Khaimah’s thriving luxury market. We have collaborated closely with Marjan to ensure that Manta Bay will not only enhance the island’s real estate landscape but also set new benchmarks in luxury living.”

Federal Engineering Consultants, a highly regarded firm with over 35 years experience in the region and being based in Dubai since 2006, have been appointed to oversee the design and supervision of the project, including its architectural, structural, interior design (ID), and MEP (mechanical, electrical, and plumbing) aspects. Federal Engineering Consultants have been integral to ensuring Manta Bay meets international standards of design while maintaining its distinctive aesthetic appeal.

Dr. Walid Lutfy, Founder of Federal Engineering Consultants, added: “Manta Bay is shaping up to be one of the most exciting developments in the region. The combination of innovative architecture, sustainable practices, and luxury amenities makes it a project like no other. We are proud to be working alongside Major Developers to bring this vision to life. We firmly believe that Manta Bay will stand out as an exceptional icon in Al Marjan Island, Ras Al Khaimah.”

Featuring a lagoon lake alongside the first-ever attached water jogging track spanning 252 meters and covering an area of 2,500 m², Bay is set to offer an immersive island living experience. The building profile, resting on a lagoon, is anchored by the entrance’s striking Great Wall feature, all designed to echo the elegance and allure of the manta ray. The development also stands out for its sustainability with its manta ray aquarium farm, supporting marine conservation efforts as they are endangered. Additionally, the development will introduce the world’s first-ever rooftop sky beach, setting a new standard in luxury architectural innovation.

Major Developers and Federal Consultants are confident that Manta Bay’s strategic location on Al Marjan Island, combined with Ras Al Khaimah’s expanding infrastructure and increasing demand for luxury properties, will make it a landmark project that not only enhances the region’s real estate market but also attracts attention from high-end investors across the globe.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The round was led by Partners for Growth (PFG), BECO Capital, anb seed, Rua Ventures, Alinma Bank (Alinma Pay), Vision Ventures, and Aqar platform.

Ejari, a Saudi-based prop-tech and fintech platform offering a Rent Now, Pay Later (RNPL) solution, has closed a $14.65 million (SAR 55 million) funding round. The round was led by Partners for Growth (PFG), BECO Capital, anb seed, Rua Ventures, Alinma Bank (Alinma Pay), Vision Ventures, and Aqar platform, Saudi Arabia’s leading property listing platform.

Existing investors, including Salica Oryx Fund and several angel investors, also participated. The round comprised a mix of debt and equity, with the debt provided by California-based Partners for Growth. Alinma Bank’s participation came through its investment technology arm, Alinma Pay.

Founded in 2022 by Yazeed Al-Shamsi, Fahad Albedah, Mohammed Alkhelewy and Khalid Almunif and based out of Riyadh, Ejari provides a unique Rent Now, Pay Later (RNPL) solution for the Saudi real estate rental market where an estimated +70% of rentals are paid on an annual or bi-annual basis, addressing the need for more flexible payment options in the Saudi market.

The platform offers much-needed flexibility to tenants, creating a shift in how rental payments are structured. In less than a year, Ejari has generated over $30 million in demand for its RNPL service and now operates in 17 cities across 8 regions in Saudi Arabia.

Ejari Co-Founder and CEO Yazeed Alshamsi commented: “”We’ve assembled a top-tier group of capital providers on both the equity and debt sides, featuring investors that include leading VCs from Saudi Arabia, the region, and internationally, along with two VC funds associated with Saudi banks and Saudi’s largest real estate marketplace along with our existing investors Salica Oryx Fund. This marks a major milestone in our journey to transform the Saudi rental market. With this new investment, we’re poised to enhance our technology, expand our product offerings, and deliver exceptional value to our clients. Our mission is to democratize access to the rental market and lower barriers for tenants, and this funding brings us closer to that goal. We are deeply grateful for the trust our investors have placed in us and are excited about the future”.

Al-Shamsi further highlighted the strong growth prospects in Saudi Arabia’s real estate sector: “Recent announcements such as the 2030 Riyadh Expo, the 2034 World Cup, and initiatives under Vision 2030, like the Ministry of Investment’s Regional HQ program, are set to drive significant demand for our RNPL service and the broader real estate market. These developments, combined with favorable macroeconomic trends such as increased foreign investment, economic diversification, and population growth, will create substantial opportunities for sustained growth in the sector.”

This new capital will allow Ejari to strengthen its market share within the residential RNPL space, enhance its product and service offerings, and solidify its position as the leading player in the Saudi rental market’s growing RNPL segment.

Khalid S. Al-Ghamdi, CEO of anb capital stated: “We are delighted to announce our partnership with Ejari, marking another investment by anb seed. This investment is more than a financial commitment; it’s a pledge to accelerate the Kingdom’s economic diversification through technological innovation and create a more inclusive economy, thereby enhancing the quality of life for Saudi citizens in accordance with the objectives of Vision 2030. We are shaping a future where financial accessibility and innovation go hand in hand, propelling Saudi Arabia towards even greater growth and prosperity.”

Kais Al-Essa, the Founding Partner and CEO of Vision Ventures commented: “We are always interested in technologies and services that make people’s lives easier. Ejari’s solution provides people with an easy way to pay rental of properties while enabling them to acquire better properties than they were previously able to afford. Ejari’s founding team had a deep understanding of the market and its trends as well as Ejari’s role going forwards. We are glad to back Ejari’s founders and expect them to achieve great results.”

Abdulaziz Shikh Al Sagha, General Partner at BECO Capital, commented: “We’re excited to support Ejari in providing much-needed flexible rental payment options in Saudi Arabia. The founding team’s strong expertise and clear vision make them exceptionally well-positioned to drive meaningful impact in the market and we look forward to working closely with them as they continue to scale.”

Armineh Baghoomian, Head of Europe, Middle East and Africa and Co-Head of Global ABL/Fintech from Partners for Growth (PFG), a private credit provider commented: “PFG is pleased to support Ejari by providing structured, asset-backed credit as they deliver an in-demand rent-now-pay-later product in Saudi Arabia, not just today but as they continue to scale and grow. We have formed a relationship with Ejari’s experienced and tight knit leadership team and have confidence in their plans and ability to navigate and become a main player in the RNPL Middle Eastern market.”

Investors

- Partners for Growth (PFG), private credit provider

- BECO Capital

- anb seed

- Alinma Bank (Alinma Pay)

- Rua Ventures

- Vision Ventures

- Salica Oryx Fund

- AQAR App

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Dubai recorded over 48,000 property sales in Q3 2024, worth AED 120 billion

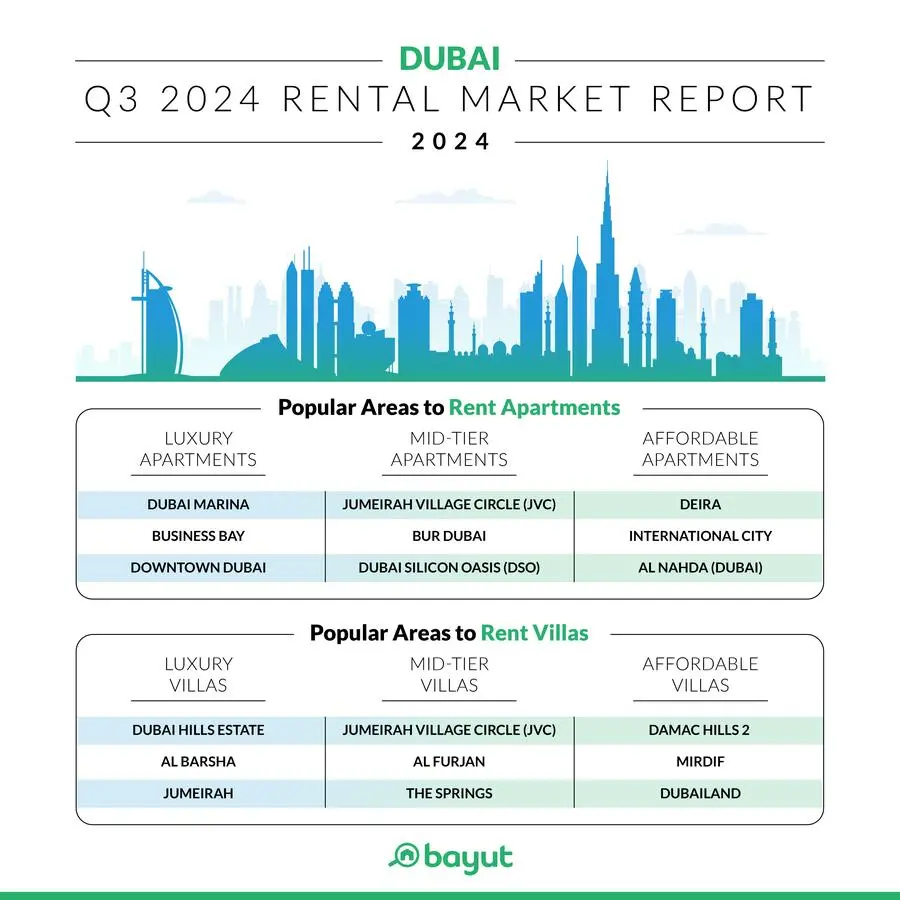

Dubai’s real estate market has maintained its upward momentum through the third quarter of 2024, with data from Bayut, a leading property portal in the UAE, offering key insights into the trends shaping this dynamic sector. The latest figures highlight the continued demand across various segments, with property prices in popular neighborhoods witnessing steady growth, spurred by robust demand and a healthy pipeline of new projects.

Property Buying Trends in Dubai

In Q3 2024, villa prices in some of Dubai’s prime areas saw significant appreciation, with Arabian Ranches leading the way by recording a price surge of up to 13%. Demand for villas continues to rise as more buyers seek spacious living options, a trend largely fueled by Dubai’s growing expatriate population and lifestyle preferences.

On the more affordable end of the spectrum, locations like International City, Dubai South, DAMAC Hills 2, and Dubailand have emerged as hotspots for property buyers. These areas appeal to budget-conscious investors who still want a foothold in Dubai’s expanding market. Meanwhile, the people searching of mid-range properties have shown interest in neighborhoods like Jumeirah Village Circle, Jumeirah Lake Towers, and Al Furjan, which are known for offering both modern amenities and value for money.

When it comes to the luxury segment, iconic areas such as Dubai Marina, Business Bay, and Dubai Hills Estate remain favorites. These high-end locations are in constant demand from international buyers and investors looking for prestigious properties. The Dubai Hills Estate saw the highest price hikes within the luxury sector, with a remarkable 31% increase in transactional prices.

The affordable apartment segment saw a price correction, with transaction values dropping by up to 11% in some popular areas. However, villa prices in locations like Dubailand jumped by almost 20%, underlining the rising demand for affordable homes with larger spaces. The mid-range and luxury markets also saw moderate price increases, with apartment and villa prices up by as much as 8%.

In total, Dubai recorded over 48,000 property sales in Q3 2024, worth AED 120 billion. Of these, off-plan transactions made up the lion’s share, with more than 32,000 sales valued at over AED 70 billion, while the ready market accounted for over 16,000 transactions valued at AED 51 billion.

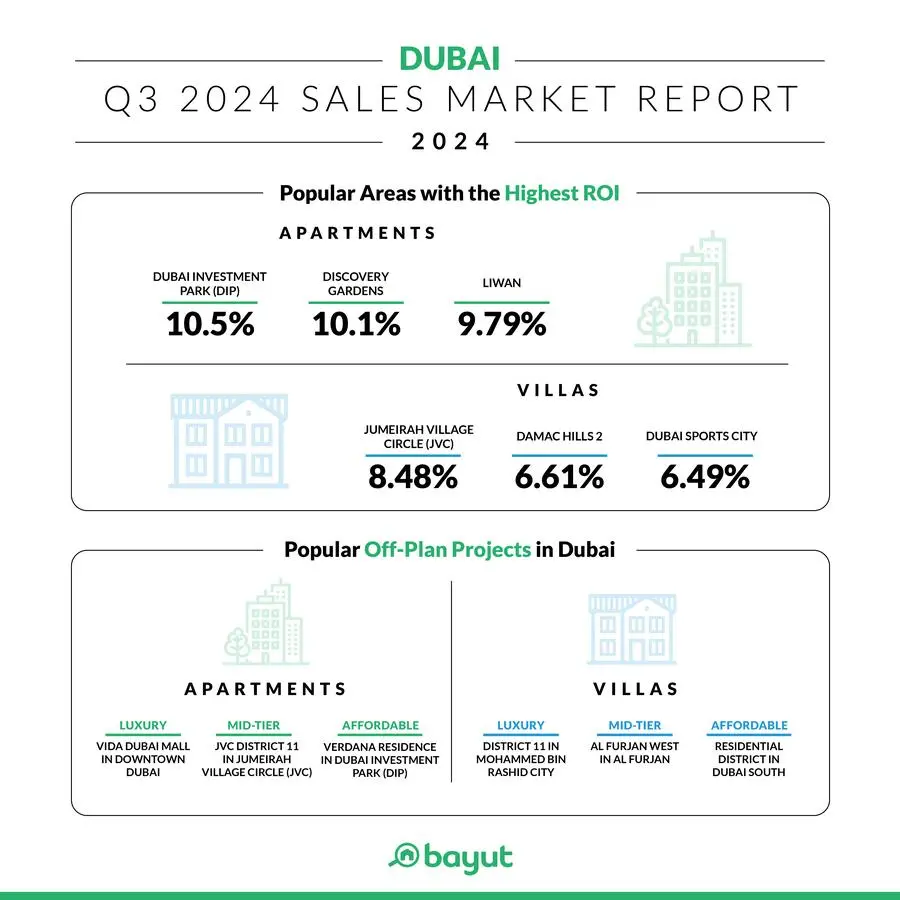

Return on Investment (ROI) Outlook

Bayut’s data paints an encouraging picture for investors focused on return on investment (ROI) across different property types. For affordable apartments, areas such as Dubai Investments Park (DIP), Discovery Gardens, and Liwan offered some of the highest returns, with yields between 9% and 11%. This makes them particularly attractive for investors looking to maximize rental income.

In the mid-tier segment, Dubai Sports City, Dubai Silicon Oasis, and Town Square delivered solid ROI figures, exceeding 8.6%. Meanwhile, luxury apartments in sought-after locations like Al Sufouh and DAMAC Hills recorded returns between 7% and 9%, which remain competitive when compared to global property markets.

Affordable villas in communities such as DAMAC Hills 2 and International City provided steady returns above 6%, while mid-tier villa neighborhoods like Jumeirah Village Circle and Dubai Sports City offered yields of up to 9%. Luxury villa communities, including Al Barari and Tilal Al Ghaf, have also proven their value to investors, with returns surpassing 6% in many cases.

Renting Trends and Demand Shifts

Dubai’s rental market has also witnessed notable increases, with Bayut reporting strong demand across all property types. Affordable apartment rentals saw a significant boost, climbing by as much as 28%, with one-bedroom flats in Deira recording the largest spike. Mid-tier apartment rentals were also on the rise, up by 12%, while luxury apartments recorded moderate growth, with some prices increasing by up to 9%.

In the villa rental market, the demand for budget-friendly options remained strong, with rental rates increasing by up to 10%. Notably, the mid-tier villa segment saw some of the largest rental hikes, with a 42% increase for four-bedroom units in Al Furjan following the handover of newly completed properties. Meanwhile, luxury villa rentals saw price increases of up to 15%, particularly for five-bedroom homes in areas like Jumeirah, where inventory is limited.

In terms of popular rental locations, affordable apartments in Deira and International City have attracted significant interest, while affordable villas in DAMAC Hills 2 and Mirdif are in high demand. Mid-range renters continue to favor Jumeirah Village Circle and Bur Dubai for apartments, while villas in JVC and Al Furjan are consistently sought after. For luxury rentals, Dubai Marina and Business Bay are top choices for apartments, while Dubai Hills Estate and Al Barsha lead the market for high-end villas.

Rental prices in general have increased across all segments, with affordable properties seeing rises of between 1% and 14%, while mid-tier and luxury rentals have also grown by as much as 10%.

Dubai Property Market Outlook

As Dubai continues to attract global investors and residents, the property market shows no signs of slowing down. The city’s appeal is bolstered by a robust economy, a thriving tourism sector, and government initiatives aimed at supporting growth. With developers managing supply efficiently and aligning it with market demand, concerns about oversupply remain minimal for the foreseeable future. This balance between demand and supply suggests that property prices, particularly in the luxury and mid-tier segments, will continue to rise steadily in the coming years.

For investors and homebuyers alike, Dubai remains an attractive destination offering strong returns, a stable market environment, and a wealth of opportunities across all price points. Whether looking to buy, rent, or invest, the market’s ongoing growth reflects the city’s broader economic success and its appeal on the global stage.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The joint venture will focus on delivering a portfolio of extraordinary real estate developments, spanning high-end residential, commercial, and hospitality.

Modon Holding PSC and Candy Capital have officially unveiled a groundbreaking joint venture aimed at transforming the ultra-luxury real estate sector in the United Arab Emirates (UAE), the Middle East, and beyond.

This strategic partnership brings together the expertise and vision of both companies to redefine standards in design, quality, and luxury living. By launching world-class real estate projects, the venture seeks to attract the most discerning global clientele, setting new benchmarks in the industry and reshaping the high-end property market in the region.

The newly established joint venture will focus on delivering a portfolio of extraordinary real estate developments, spanning high-end residential, commercial, and hospitality. These projects will be strategically located across key markets in the Middle East region with future expansion into other major cities globally.

The collaboration combines Candy Capital creative vision and unparalleled expertise in ultra-luxury real estate alongside Modon’s robust development, operational capabilities and financial strength. Together the two entities will create landmark developments that reflect the future of luxury real estate, reinforcing their leadership position in the global property market.

H.E. Jassem Mohammed Bu Ataba Al Zaabi, Chairman of Modon Holding commented: “We are excited to announce our strategic partnership with Candy Capital. This collaboration marks another milestone for Modon, as we join forces with a leader in luxury real estate.”

Nick Candy, CEO of Candy Capital commented: “This partnership marks a significant milestone for both Modon and Candy Capital, reflecting a shared long-term vision for growth, innovation, and excellence in the ultra-luxury sector. We look forward to creating iconic developments with Modon that will redefine luxury living on a global scale”.

Bill O’Regan, Group CEO of Modon, added: “Together, we are committed to creating unparalleled living experiences that blend innovation, sustainability, and elegance. This partnership will not only enhance our portfolio but also set new standards in the luxury real estate market.

Abu Dhabi-based Modon is one of the UAE’s largest real estate development companies and creates iconic designs and experiences for living, leisure and business. Through accelerated strategic investment and innovation on an unrivalled scale, Modon provides unparalleled opportunities to shape the future and advance societies. Modon’s goal is to deliver long-term, sustainable value, laying the foundations for a new era of intelligent, connected living

On March 18, 2024, Q Holding rebranded as Modon Holding following the merger of Q Holding, Modon Properties, and ADNEC, a move aimed at expanding its market presence both within the UAE and internationally. This followed earlier mergers with ADQ Real Estate and Hospitality (ADQ) and IHC Capital Holding (IHC). As of June 30, 2024, Modon Holding reported a market capitalization of AED 45.94 billion, reflecting an impressive 114% year-on-year growth.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

London Square’s first residential launches since the developer was acquired by Aldar late last year

London Square, part of the Aldar group, has introduced two new residential collections: Twickenham Green and Twickenham Square, both located in the prestigious Borough of Richmond Upon Thames. These are the first projects launched by London Square since its acquisition by Aldar last year, presenting an opportunity for UAE investors to enter the UK housing market through a well-established London-based developer.

Jonathan Emery, Chief Executive Officer of Aldar Development, said: “Since acquiring London Square last year, we have substantially increased its landbank adding eight new development sites in prominent areas of London, while supporting new launches in prime areas. Twickenham is one of the most coveted areas to live in London, offering the highest quality lifestyle from every aspect – spectacular green spaces, excellent schools, first-class amenities and fast transport links – and both developments will appeal equally to both investors and buyers looking for a London base.”

Twickenham Green features a collection of stylish two, three, and four-bedroom mews style houses and apartments next to the River Crane, a tributary of the River Thames, with an attractive waterfront and landscaped outdoor spaces. Each home is beautifully designed with modern interior detailing, underfloor heating, spacious open-plan living areas and sleek kitchens.

The houses have their own private garden or courtyard garden, and all have a driveway, garage or off-street parking. Prices for one of the limited edition two-bedroom mews houses start from £835,000 (AED 4.07 million).

Twickenham Square features a range of elegant one, two and three-bedroom apartments, each with their own balcony or terrace, designed around a central landscaped square as well as spacious three- and four-bedroom family houses with private gardens. With exquisite interior design, every home exudes style and comfort. Prices start from £425,000 (AED 2.07 million) for apartments and £1,190,000 (AED 5.8 million) for 3-bedroom townhouses.

The homes are conveniently located near central transport connections and private and state schools. With London Waterloo just 20 minutes by train, residents will also have the capital’s renowned cultural, retail, and fine dining on their doorstep, along with world-class universities.

Voted the UK’s happiest place to live in a recent survey by UK property portal Rightmove, leafy Twickenham is renowned for its family-friendly lifestyle, reflecting London Square’s ethos of creating homes with a sense of community and green space at the heart of every development.

The area is also renowned for sport, including being the home of English rugby, at Twickenham Stadium, and Ham Polo Club, the only club of its kind in London. There are more than 76 hectares of outdoor spaces within a 30-minute walk, including the largest royal park (Richmond Park) and world-famous Kew Gardens, with its rare specimens of trees and shrubs. The River Thames also runs through Twickenham and Richmond, offering tranquil riverside walks and watersports.

All London Square homes are covered by a 10-year warranty and a two-year London Square Customer Care guarantee. Move in dates are from Q1 2026 for both developments.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The Green & Smart Construction Business Seminar will take place in Riyadh and Jeddah from October 14 to 16, 2024

Chrysalis Éclairage, the French company known for its expertise in sustainable lighting solutions, announces its participation in the Green & Smart Construction Business Seminar, which will take place in Riyadh and Jeddah from October 14 to 16, 2024. Organized by Business France, this event will bring together innovative French companies and influential decision-makers from Saudi megaprojects, providing an ideal platform to establish strategic partnerships in a rapidly expanding market.

Amid significant economic transformation, Saudi Arabia is implementing ambitious reforms as part of its Vision 2030, aimed at promoting sustainable development across various sectors, including construction. Iconic projects such as NEOM, RED SEA, Diriyah Gate, and Qiddiya reflect this commitment to innovation and sustainability. These megaprojects require eco-friendly and high-performance solutions that comply with international standards.

Chrysalis Éclairage positions itself as a key player in this dynamic landscape. With over thirty years of experience in the lighting industry, the company combines tradition and innovation to provide solutions tailored to modern challenges. Its 100% French production ensures a reduced environmental impact through short supply chains and minimized carbon footprints.

French Expertise in Service of Sustainability in Saudi Arabia

With 30 years of expertise in sustainable lighting solutions, Chrysalis has continuously enhanced its technical and commercial capabilities, allowing it to design innovative and environmentally friendly solutions. These advancements enable the company to meet the growing demands of the sustainable urban lighting market, thus contributing to the transition toward greener, smarter cities.

Chrysalis Éclairage views its participation in the Green & Smart Construction Business Seminar as a strategic opportunity to strengthen its ties with Saudi economic players. As part of this mission in Saudi Arabia, the company plans to establish a local factory, which will help reduce carbon footprints while minimizing material transportation.

“Participating in the Green & Smart Construction Business Seminar in Saudi Arabia underscores our long-term commitment to providing sustainable lighting solutions tailored to the Kingdom’s major projects. This event presents a valuable opportunity to forge local collaborations, share innovative ideas, and integrate our technologies through our establishment project. We are determined to contribute to the sustainability goals of Vision 2030 by showcasing our French expertise and establishing strategic partnerships that will solidify our position in this vital market,” says Adrien Marchal, head of Chrysalis Éclairage.

Expertise and Innovations of Chrysalis Éclairage

Chrysalis Éclairage stands out for its ability to design custom luminaires that meet the specific needs of urban environments. The company offers a complete range of services, from design to manufacturing of lighting solutions. Its technical expertise is evident in its metalworking, particularly through the use of aluminum and steel, allowing the creation of aesthetically pleasing and high-performing luminaires.

Among its flagship products, the “Lolita” model stands out for its ability to be programmed and controlled remotely while integrating environmentally friendly technologies. This minimalist luminaire is designed to adapt to the varied needs of modern projects while ensuring exceptional longevity (over 100,000 hours) with minimal environmental impact.

Additionally, Chrysalis has recently been selected to illuminate the Olympic Village in Paris 2024, an emblematic project that highlights its expertise in decorative public lighting. The company will leverage its expertise to contribute to the ambitious projects in the Kingdom by incorporating environmentally friendly technologies. Recently awarded the “Decarbonons! 2024” Trophy from D’architectures (DA) for its innovative “Sélène” model, Chrysalis demonstrates its commitment to sustainable innovation.

The “Sélène” model from Chrysalis Éclairage is an innovative, portable, and eco-friendly lighting solution that has been awarded the “Decarbonons! 2024” Trophy for its innovative character. This portable lamp aligns with Chrysalis’s commitment to reducing its environmental impact, making it an ideal choice for modern urban environments aiming to combine sustainability with intelligent lighting solutions.

Commitment to Sustainability

Sustainability is at the heart of Chrysalis Éclairage’s mission. The company is committed to reducing its environmental footprint by optimizing its manufacturing processes and favoring local subcontracting (over 95% of components come from within a 300 km radius). This approach not only reduces logistics costs but also ensures superior quality in its products. The company also adopts a sustainable approach in all its projects by intervening in sensitive areas to minimize light pollution while maintaining optimal service levels for users.

Opportunities at the Green & Smart Construction Business Seminar

Chrysalis Éclairage’s participation in the Green & Smart Construction Business Seminar represents a crucial opportunity to engage directly with decision-makers of major Saudi megaprojects. These discussions will allow the company to better understand the specific needs of the local market and adapt its products accordingly. The event will also be a prime venue to showcase its advancements in sustainable lighting and strengthen its collaboration in the Saudi market. By integrating environmentally friendly technologies into its lighting solutions, Chrysalis aims to provide significant added value to Saudi initiatives while contributing to the Kingdom’s energy transition.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

This project offers luxury residences with bold interiors and world-class amenities in a serene setting.

Just Cavalli Villas by Damac Properties represents the epitome of luxury living in Dubai’s greenest community, Akoya Oxygen. These standalone 3 and 4-bedroom villas embody the future of stylish living through their innovative and exotic designs. Situated in an international golf community, these homes challenge conventional designs with daring interiors crafted by the renowned Italian fashion designer Roberto Cavalli, reflecting his signature style of bold patterns and vibrant colors.

Innovative Design and Tranquil Surroundings

The unique design of Just Cavalli Villas is one of its key differentiators. The villas feature exotic textures, bold color schemes, and innovative use of space that are a testament to Cavalli’s daring approach to fashion and design. The interiors are adorned with distinctive motifs such as animal prints and jungle themes, translating his eclectic style into stunning architectural details. The expansive balconies and landscaped gardens offer an oasis of tranquillity amid the vibrant city of Dubai, allowing residents to enjoy serene views and peaceful surroundings.

Living in Just Cavalli Villas provides access to an array of world-class amenities designed to cater to every resident’s need. The community boasts modern gyms, a tennis court, and jogging tracks, offering an active lifestyle. The fitness club, designed with ambient lighting and wild patterns, mirrors the trendy nightspots, creating a unique workout experience. Residents can also relax at the luxurious spa and wellness centers, making every day feel like a retreat.

Prime Location and Investment Opportunity

In addition to health and fitness amenities, the Akoya Oxygen community offers a wealth of recreational options. For those seeking entertainment, the community includes dancing fountains, retail outlets, fine dining restaurants, and an open-air cinema that offers exclusive screenings.

One of the standout features of Just Cavalli Villas is its strategic location within the Akoya Oxygen community. Known for being Dubai’s first green residential address, Akoya Oxygen offers a tranquil escape from the city’s hustle while remaining well-connected to key business hubs and entertainment destinations. The villas are conveniently located near major road networks, ensuring that residents can easily access Downtown Dubai, Dubai International Airport, and other prominent landmarks.

Just Cavalli Villas by Damac Properties is not just about acquiring a home; it’s about securing a lifestyle that blends luxury, creativity, and comfort. The distinctive designs, premium finishes, and spacious layouts make these villas an ideal choice for those who desire a residence that reflects their personality and passion for bold design. Whether it’s the vibrant community of Akoya Oxygen or the avant-garde design of the villas themselves, this project promises significant returns for investors looking for a piece of Dubai’s ever-growing real estate market.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

This partnership aims to utilize Facilio’s advanced Connected CaFM platform to optimize Berkeley FM’s service offerings and boost operational efficiency across the UAE region.

Facilio has announced a major new deployment with Berkeley Services Group, a well-established integrated facilities management (IFM) company based in Dubai. This partnership aims to utilize Facilio’s advanced Connected CaFM platform to optimize Berkeley FM’s service offerings and boost operational efficiency across the UAE.

Founded in Dubai in 1984, Berkeley Services Group (BSG) has been a leader in the industry, offering a wide range of services such as building maintenance, soft services, smart solutions, landscaping, and security. Known for its strategic collaborations and technology-driven approach, BSG has become a trusted leader in IFM, setting new standards for client-focused and people-centric management solutions.

Speaking about the deployment, Fayaz Mohammad, Head of Facilities Management, Berkeley Services said, “Facilio’s platform-led approach to operations & maintenance aligns perfectly with our needs. Its scalable infrastructure, robust automation and real-time KPI reporting capabilities stand out – it not just improves our operational capabilities but also helps boost growth and profitability across verticals. By leveraging this innovative technology, we can position ourselves at the forefront of technology-driven integrated facilities management, delivering exceptional experiences to our clients across diverse industries.

“Our Connected CaFM solution will enable Berkeley to deploy services swiftly while meeting demands for high-quality service, rapid response times, and zero downtime. It is a solution that is purpose-built to solve for IFM firms such as Berkeley. Being a no-code/low-code adaptable self-serve platform, it allows them to onboard customers and expand usage to cover everything from asset management to audit and compliance management seamlessly. It not only elevates their operational capabilities but also enhances customer satisfaction and retention, drives business expansion across verticals and ensures they continue to stay at the forefront of innovation,” said Prabhu Ramachandran, CEO of Facilio.

With Facilio‘s Connected CaFM platform, Berkeley Services can now streamline their operations through a single, centralized platform, allowing them to manage all facilities and operational tasks efficiently. The platform enables cost optimization by tracking expenses and identifying potential savings, while providing 360-degree visibility into operations, allowing the team to monitor tickets raised and resolved to improve service response times and overall efficiency.

Compliance is assured with automated reporting and health, safety, and environmental (HSE) management, ensuring regulatory standards are consistently met. Additionally, the platform accelerates deployment by templatizing onboarding workflows, leading to a faster return on investment. It also holds vendors accountable by monitoring their adherence to service level agreements (SLAs), ensuring high performance and reliability. The platform’s scalable infrastructure further allows Berkeley Services to easily add new service lines through customizable modules without the need for coding or extensive IT efforts.

This deployment echoes Facilio’s success stories with other prominent FM Service providers such as Musanadah and CIT Group in Saudi Arabia, Quality FM in the UAE, and Q3 Services in the UK.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

Samana Developers breaks records with sales 4 times in the last 9 months, a 600%+ surge in sales in 2023, projecting 400%+ growth in 2024.

SAMANA Developers celebrated the success of its top-performing brokers at an exclusive awards ceremony. The event took place at the Johara Ballroom in Madinat Jumeirah and was attended by a wide range of industry professionals, including real estate agents, investors, and business leaders.

This event underscored SAMANA Developers’ commitment to recognizing and rewarding the remarkable efforts of its channel partners.

SAMANA Developers honored twenty agencies for their exceptional performance, dedication, and significant contributions to the company’s ongoing success, setting an inspiring example for other professionals in the industry.

With a 4.6% market share in Dubai’s real estate market, SAMANA Developers has solidified its position among the top seven largest developers in the city. The company’s award-winning projects and commitment to quality have propelled it to new heights, with record-breaking sales four times in the past nine months and a staggering 600% surge in sales in 2023. Looking ahead, SAMANA Developers is projecting a 400% growth in sales for 2024.

Regarded for its resort-style projects and innovative designs, SAMANA Developers offers each unit with a private pool, providing residents with an unparalleled living experience. At the ceremony, Imran Farooq, CEO of Samana Developers, has wholeheartedly hailed the new Real Estate Strategy 2033. He expressed his enthusiasm for Dubai’s ambitious goal of increasing real estate transactions to Dh1 trillion by 2030, a significant leap from the Dh634 billion recorded in 2023.

Farooq believes that this strategic vision aligns perfectly with Samana Expansion Strategy, and it will not only boost the real estate sector’s contribution to the economy, reaching Dh73 billion, but also drive a significant increase in homeownership rates to 33%. He particularly applauds the focus on affordable housing programs and the commitment to transparency and global marketing, which will undoubtedly enhance Dubai’s appeal as a prime real estate destination.

Highlighting the company’s expansion, Farooq mentioned that SAMANA Developers now has over five hundred employees from thirty-five different nationalities and emphasized that his diverse workforce has played a crucial role in the company’s growth and success. He also announced the launch of SAMANA Design Studio, a new service that will offer stylish and modern interior design solutions, raising the mantra “Pioneering Lifestyle.”

In a significant announcement, Farooq also unveiled SAMANA Developers‘ new brand identity, reflecting the company’s future vision and aspirations. The new branding, inspired by progressive mindset and forward thinking, symbolizes SAMANA Developers’ commitment to innovation, sustainability, and excellence.

As the real estate market continues to evolve, SAMANA Developers remains at the forefront of the industry. With its focus on quality, customer satisfaction, and community development, the company is well-positioned to achieve even greater success in the years to come.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

This partnership serves as a key pillar in expanding financing options to create a more inclusive real estate financing market.

The Saudi Real Estate Refinance Company (SRC), a subsidiary of the Public Investment Fund (PIF), signed a Memorandum of Understanding (MoU) with the Saudi Mortgage Guarantees Services Company, “Damanat.” The MoU aims to guarantee SRC’s residential mortgage portfolios, both current and future acquisitions, which will help lower financing costs for target segments and increase the number of beneficiaries.

The signing ceremony was held under the patronage of His Excellency Mr. Majed bin Abdullah Al-Hogail, Minister of Municipal Rural Affairs and Housing, and Chairman of the Board of SRC. The agreement was signed by Mr. Majeed Fahad Al-Abduljabbar, CEO of SRC, and Mr. Hussam Radwan, CEO of Damanat. This partnership serves as a key pillar in expanding financing options to create a more inclusive real estate financing market.

The MoU also contributes to raising the attractiveness of the real estate finance market by developing the secondary market for real estate financing aimed at supporting its growth and stability, and attracting more local and international investors by enhancing the creditworthiness of the real estate financing portfolios owned by SRC, as the company is currently working with its partners to continue developing a secondary market that supports the real estate finance sector in the Kingdom.

Mr. Majeed Fahad Al-Abduljabbar, CEO of SRC, said: “This agreement reflects our commitment to contribute to achieving the goals of Vision 2030 by strengthening the real estate finance market, increasing the rate of homeownership among citizens, and attracting more local and international investors.”

Mr. Hussam Radwan, CEO of Damanat said, “This agreement is part of our efforts to provide integrated financing solutions that enable a broader segment of society to access affordable real estate financing, thereby enhancing citizens’ opportunities to own their homes and contributing to the development of the real estate sector in the Kingdom

It is noteworthy that SRC was established in 2017 by the Public Investment Fund as part of government initiatives aimed at achieving the housing program targets under the Kingdom’s Vision 2030. The company serves as a fundamental pillar in supporting the housing ecosystem by injecting liquidity into the residential real estate finance market, to ensure its continuity and stability. SRC has also obtained a license from the Saudi Central Bank in 2017 to operate in the field of real estate refinancing.

Saudi Mortgage Guarantees Services Company (Damanat), fully owned by the Real Estate Development Fund, aims to streamline the beneficiary journey by providing innovative solutions and simplified procedures, contributing to the sustainable development of the real estate finance sector.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.