DESPERATE CHINESE PROPERTY DEVELOPERS RESORT TO BIZARRE MARKETING TACTICS

The country’s real-estate slump is getting worse—and looks set to drag on for years

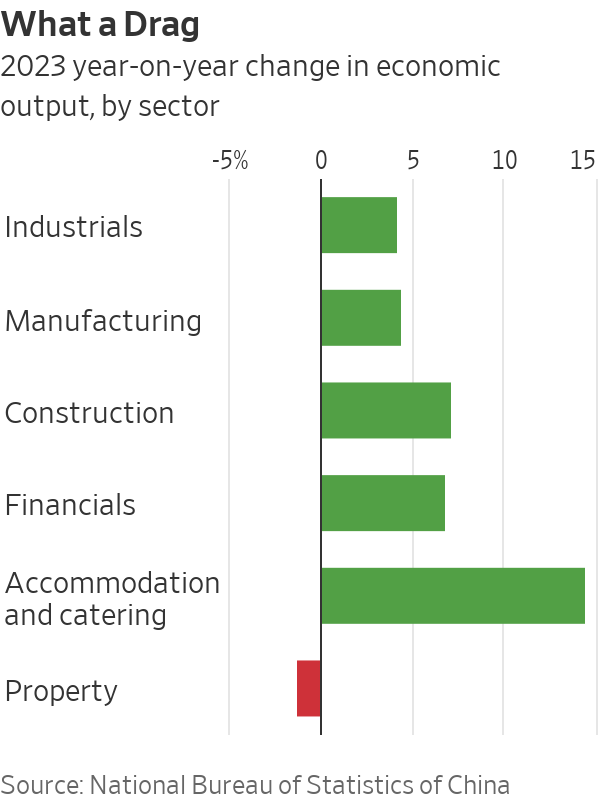

China’s real-estate crisis has dragged down the economy, caused massive layoffs and pushed multibillion-dollar companies to the point of collapse.

Economists think it is about to get worse.

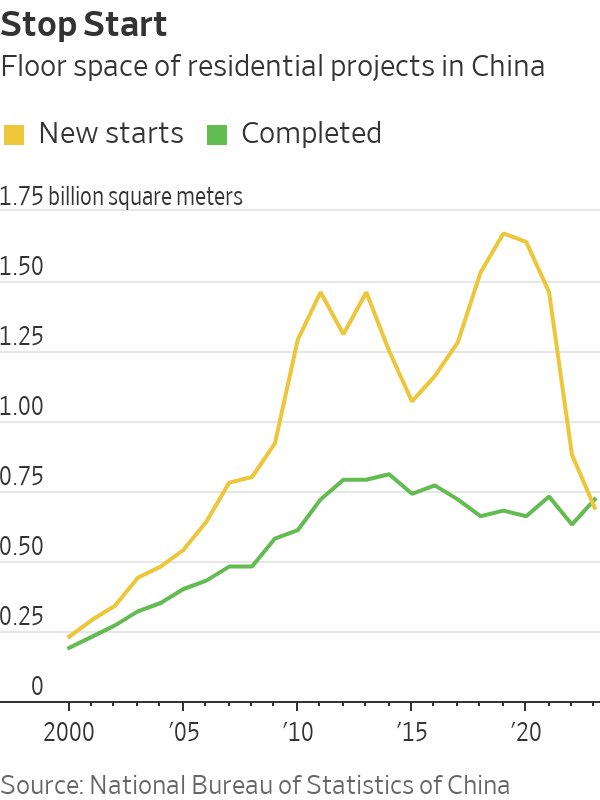

Sales of newly built homes in China fell 6% last year, returning to a level not seen since 2016, according to China’s statistics bureau. Secondhand home prices in its four wealthiest cities—Beijing, Shanghai, Guangzhou and Shenzhen—declined by between 11% and 14% in December from the year before, according to the broker Centaline Property.

Developers are starting fewer projects. Homeowners are paying back their mortgages early and borrowing less. Once-thriving property companies are stuck in protracted negotiations with foreign investors, following defaults on about $125 billion of overseas bonds between 2020 and late 2023, according to figures from S&P Global Ratings.

Chinese developers and local governments are so desperate to attract home buyers that some have resorted to bizarre marketing strategies.

A property company in Tianjin ran a video advertisement featuring the slogan “buy a house, get a wife for free.” It was a play on words, using the same Chinese characters as the phrase “buy a house, and give it to your wife”—but presented in a sentence structure typically used to offer freebies for home buyers. In September, the company was fined $4,184 for the ad.

A residential compound in eastern China’s Zhejiang province promised last year to give home buyers a 10-gram gold bar.

Earlier this month, Sheng Songcheng, former head of the statistics department at the People’s Bank of China, told a local conference that the housing downturn would last another two years. He thinks new-home sales will fall more than 5% in both 2024 and 2025.

Wall Street economists are also ringing alarm bells about how long the real-estate slump will last.

“Not too many people are buying, can buy or want to buy,” said Raymond Yeung, chief China economist at ANZ. He said there had been a fundamental shift in the way Chinese people view the property sector, with housing no longer seen as a safe investment.

China’s real-estate sector and related industries once accounted for around a quarter of gross domestic product and the sector’s slump has been a significant drag on the world’s second-largest economy. That has increased calls for Beijing to do more to prop up the sector, but so far Chinese officials have stuck to piecemeal policies rather than introducing a landmark stimulus package.

A number of economists are making comparisons to Japan, which spent decades trying to rebound from a crash in real-estate and stock prices. China’s stock market is in a years-long slump.

China’s central bank can help make the situation less painful, but it will need to be aggressive, said Li-gang Liu, head of Asia Pacific economic analysis at Citi Global Wealth Investments. The central bank still has policy room and could take one big step to make a significant impact, he said.

Liu Yuan, head of property research at Centaline, said that without the government’s help, new-home prices will need to drop by another 50% from current levels before they reach a bottom. This is based on the assumption that the tipping point will only come when it is cheaper to buy than to rent houses, Liu said.

China’s real-estate downturn has claimed dozens of victims. More than 50 developers—mostly privately owned—have defaulted on their debt. Developers still have millions of unfinished homes that were sold but not delivered. Chinese authorities have set aside billions of dollars to help builders complete apartments but the logjam is growing.

The crisis has drained the coffers of some Chinese local governments, which previously relied on land sales as a main source of income. Economists estimate they have hidden debt worth anything from $400 billion to more than $800 billion. To quiet talk of potential defaults, the central government has set up debt-swap programs to help some of them refinance.

Some economists are optimistic. In the first half of this year, buyers of secondhand homes will gradually return to the new-home market and prop up the sector, said Helen Qiao, chief China economist at Bank of America. “Things will slowly get better from here,” Qiao said.

But most are still expecting more pain, and investors are bearish. A benchmark of Hong Kong-listed property stocks had fallen for four years in a row before the start of this year. Since Jan. 1, it is down another 15%.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Sharjah’s real estate sector saw a 62% surge in foreign investments during the first nine months of 2025, reaching AED 23.2 billion, as investors from 121 countries drive strong demand — reinforcing the emirate’s global appeal and investment confidence.

Qatar’s residential rental market continues its rebound, with leasing activity and rents rising across key districts — driven by infrastructure growth, digital innovation, and tenant confidence post-World Cup, according to Tatami’s Q3 2025 report.

AMIS Development launches Derby Heights in Meydan, Dubai, a luxury residential project featuring Casamia’s design concept and set for handover in Q4 2027, redefining modern urban living.

Banyan Group will host its first Laguna Phuket Property Showcase in Dubai, unveiling a US$1B Phuket portfolio of luxury beachfront residences. With visa-free entry, direct flights, and rising GCC demand, regional investment in Phuket has surged 500% since COVID.

Banyan Group, Thailand’s pioneering luxury hospitality and residential real estate developer known for its exclusive Banyan Tree Resorts will host its first ever Laguna Phuket Property Showcase in Dubai on November 7-8 at Banyan Tree Dubai, Bluewaters.

The exclusive event marks the debut of Banyan Group’s Phuket property portfolio in the Middle East – and will present a wide variety of investment opportunities from its US$1 billion pipeline of luxury residential properties which are set to be rolled out over the next three years.

“We are delighted to bring the beauty and investment appeal of Phuket directly to our GCC clients,” says Stuart Reading, Managing Director, Banyan Group Residences. “Dubai is the perfect gateway for introducing our new branded residences to a discerning audience seeking both luxury and long-term value.”

With seamless connectivity from the Middle East, visa-friendly policies and a welcoming environment for Muslim travelers, the island of Phuket is increasingly becoming a tropical investment haven for GCC investors, attracting growing interest from the region.

Banyan Group – Asia’s Leader in Branded Residences

The Laguna Phuket Property Showcase will feature Banyan Group’s newest developments within Laguna Phuket – Asia’s most iconic 1,000-acre integrated resort, located along 3.5 kilometers of pristine beachfront on Phuket’s prestigious central west coast.

Among the highlights will be the exclusive Banyan Tree Beach Residences, some of the most luxurious condominiums and penthouses ever built in Phuket, with idyllic settings right on the beach, many with their own expansive private rooftop pools. There are also new projects under the Angsana, Garrya, and Laguna Lakelands brands.

Banyan Group Residences is ranked No. 1 in Asia and No. 5 globally for branded residential developments and continues to redefine luxury resort living in the region by bringing its five-star hospitality expertise to the management of privately owned residences, which can also generate high rental returns.

Why GCC Nationals Are Choosing Phuket

Phuket offers a lifestyle that resonates deeply with GCC nationals. The island’s tropical climate, with year-round sunshine and temperatures ranging from 30 to 33°C, provides a perfect escape from the intense heat of the Gulf. The warm sea waters and pristine beaches enhance the appeal, offering a tranquil yet vibrant environment for relaxation and leisure.

Direct flights from the Middle East to Phuket and Bangkok provide seamless access, with major carriers from the UAE and Saudi Arabia offering frequent services. GCC nationals benefit from visa-free entry to Thailand, while long-stay options such as the Thailand Privilege Visa make relocation or frequent entry simple and convenient.

Phuket’s strong Muslim community and the abundance of halal-certified dining options, mosques, and prayer facilities make the island especially welcoming for Muslim travelers and homeowners.

Banyan Group reports that sales to buyers in the GCC countries has increased 500% post-COVID, and that this now places the region in one of the top 10 markets for its luxury real estate in Phuket.

Phuket’s Thriving Real Estate Market

Phuket’s property market continues to thrive, with foreign buyers now accounting for more than 60% of condominium sales. From beachfront villas and high-end branded residences to eco-friendly homes surrounded by lush tropical landscapes, the options are as varied as they are appealing. Historically, property values in Phuket have appreciated by 5-10% annually, supported by limited supply and robust tourism demand.

The island also offers exceptional value compared to other luxury destinations. For example, USD 1 million can purchase a 213 sqm luxury home in a prime location – approximately double the size of a similarly priced property in Dubai.

For investors seeking flexibility, Banyan Group’s rental management programs allow owners to enjoy their homes part of the year while generating income through professional five-star hospitality operations.

Laguna Phuket: Asia’s Leading Integrated Resort

Developed by Banyan Group over the past three decades, Laguna Phuket is an expertly master-planned community comprising seven international hotels, over 3,000 residences, an 18-hole championship golf course, spas, restaurants, retail precincts, and a wide range of leisure amenities.

The community is home to residents from more than 70 nationalities. Over the next several years, the Group plans to add more than 5,000 new residential units, including the landmark Laguna Lakelands, an eco-friendly lakeside neighborhood surrounded by forest and walking trails.

“Laguna Phuket has grown into a vibrant international community where families, retirees, and professionals from all over the world can thrive,” said Stuart Reading, Managing Director, Banyan Group Residences. “It offers an unmatched lifestyle and everything today’s global buyers are looking for in a secure and sustainable environment.”

Phuket’s Newest Lifestyle Attraction: RAVA Beach Club

A highlight for homeowners within Laguna Phuket is the newly opened RAVA Beach Club, Thailand’s largest and longest beachfront club. The word RAVA means sound and reverberation – which personifies this expansive beachfront space operated by Banyan Tree Phuket.

Located along 150 meters of Bang Tao Beach, RAVA features three infinity pools, private cabanas, and panoramic ocean views. Residents enjoy exclusive access and a 25% discount on food and beverage offerings – further enhancing the resort lifestyle experience.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Dubai’s real estate soars in Q3 2025 with AED 138.3B in sales and record apartment demand driving growth — reaffirming the city’s status as a global property hub.

Dubai’s residential real estate market continued to demonstrate its strength and resilience in Q3 2025, recording 56,015 transactions worth AED 138.3 billion. Despite a 6.4% dip in value quarter-on-quarter, total sales volume surged 11.4%, underscoring sustained demand and investor confidence across key segments.

Apartments and off-plan stay in front

Apartment sales soared to AED 93 billion this quarter, marking the highest value ever recorded in Dubai’s residential market. Volumes climbed 22% to 48,646 units, driven largely by off-plan apartment sales, which jumped 35% quarter-on-quarter. Off-plan transactions accounted for 70% of total sales volume and 59% of value, the strongest contributions on record. This trend highlights robust investor confidence and an active wave of new project launches across the city.

Villas and townhouses recalibrate

Following an exceptional first half, villa and townhouse transactions eased 30% QoQ, and values declined 34% QoQ, a natural post-rally adjustment as launches paused and buyers became more selective. Demand for larger family homes remains healthy in established and lifestyle-led communities.

Dubai’s property market is experiencing selective ascent rather than straight-line growth. Sales volume and value rose 18% year-on-year, reaching 56,015 transactions worth AED 139.7 billion, anchored by off-plan sales. Demand is tilting decisively toward new supply, particularly apartments, where deals jumped 28% year-on-year. By contrast, villas cooled and prime transactions eased 48% QoQ, suggesting a moment of pause rather than panic,” says Louis Harding, CEO at betterhomes

Record prices and expanding supply

Dubai’s average residential prices reached a historic high of AED 1,664 per sq ft, nearly double 2020 levels. This 5.2% quarterly rise was fueled by end-user demand, liquidity in mid-market communities, and favourable global conditions, including the U.S. Federal Reserve’s 25-basis-point rate cut that boosted affordability for international investors.

Supply also strengthened, with over 28,500 units delivered so far in 2025 and more than 200,000 units expected by 2027. Apartments made up 85% of Q3 handovers, led by Jumeirah Village Circle, Business Bay, and Town Square.

Inside betterhomes’ own metrics

betterhomes saw 24% year-on-year increase in transactions and 38% growth in sales leads. In contrast to the broader Dubai property market, townhouse demand led the surge, up 91% YoY, alongside a 12% growth in villas and 5% in apartments. Investor activity climbed to 63% of total buyers, reflecting Dubai’s growing appeal as a global investment hub.

In the rental sector, leasing transactions at betterhomes soared 92% year-on-year and 29% quarter-on-quarter, underscoring the city’s enduring rental demand. Average annual rents stood at AED 196,000, with apartments accounting for the majority of leasing activity.

Outlook for Q4 and beyond

As Dubai moves into the final quarter of 2025, the market is expected to maintain its steady trajectory. The combination of sustained population growth, infrastructure expansion, and global investor interest continues to reinforce Dubai’s position as one of the world’s most dynamic and resilient property markets.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

Aston Martin partners with Valor Real Estate Development to launch Aston Martin Residences Daytona Beach Shores, an 86-unit ultra-luxury project in Florida, blending British design excellence with coastal living — marking the brand’s latest milestone in global real estate expansion.

Aston Martin today announces a new landmark real estate partnership with Valor Real Estate Development that will construct an ultra-luxury residential project in Daytona Beach, Florida – Aston Martin Residences Daytona Beach Shores – a new 86-unit development on the Atlantic coast.

Located just minutes from the iconic Daytona International Speedway and overlooking one of the world’s most famous beaches, Daytona Beach Shores marks the latest addition to Aston Martin’s established world class real estate portfolio, starting with the Aston Martin Residences in Miami to the recently completed four-bedroom town house in Tokyo’s Omotesandō neighborhood.

As with the previous Aston Martin residential projects, the new development is a close collaboration between Aston Martin’s design team and the project real estate partner. This ensures that all properties reflect the highly crafted, beautifully proportioned and cutting-edge technology of Aston Martin’s award winning automotive models, creating unique living spaces that reflect the ultra-luxury, high performance British marque.

Aston Martin Director of Brand Diversification, Stefano Saporetti said; “For Aston Martin, real estate is a seamless brand extension with our strategic vision centered on growing Aston Martin beyond the automotive world. This crucial new multi project partnership with Valor Real Estate Development in Daytona is engineered to meet client demand for exclusive, ultra-luxury living opportunities.

‘Our growing real estate portfolio creates ultra luxury living that provides discerning clientele with a truly elevated ownership proposition, permanently reinforcing the Aston Martin brand globally.’

CEO of Valor Real Estate Development, Moises Agami said; ‘For four decades, Valor Real Estate Development has stayed true to one vision: creating iconic developments that are, in a word, transformative. Daytona Beach Shores is a rising star in Florida’s luxury market; an exceptional community and city leadership with the vision and vitality we seek in world-class destinations.

‘Every drive deserves a destination, and partnered with Aston Martin’s unmatched craftsmanship, precision, and ultra luxury approach, Aston Martin Residences Daytona Beach Shores will redefine the market and set a new benchmark for oceanfront living in a location synonymous with speed.’

Aston Martin Residences Daytona Beach Shores is located at 3411 South Atlantic Avenue, providing residents with spectacular ocean views. The development lies just a short drive from the Daytona International Speedway. Founded in 1959, the circuit is the historic home of the Daytona 500 NASCAR race, as well as the 24 Hours of Daytona, one of the three races that form the Triple Crown of endurance racing, along with the 24 Hours of Le Mans and the 12 Hours of Sebring.

The historic tri-oval track, which can also be configured as a 24-hour road course, has many important associations with Aston Martin’s racing history. In 2023, the Aston Martin Vantages of The Heart of Racing scored a one-two class victory at the 61st Rolex 24 at Daytona. In January 2026, the Aston Martin THOR Team’s Valkyrie will make its Daytona debut at the 64th Rolex 24 Hours of Daytona.

Aston Martin Residences Daytona Beach Shores will consist of 86 residential units arranged across an 18-floor structure covering approximately 215,000 square feet (20,000m2). The new building, which includes two parking floors, will be topped with two penthouse floors containing a total of eight ultra-luxury double-height units.

All apartments will have access to a world-class package of residential amenities, while the mixed-use development will include fine dining and an artisan bakery. In addition, the beachside development will provide direct access to one of the world’s most famous beaches.

Aston Martin Chief Creative Officer, Marek Reichman said ‘Aston Martin’s residential projects give our design team a unique opportunity to go above and beyond. Our world-class experience with crafted materials and surfaces, high quality detail design, and dynamic, expressive forms finds a natural expression in architectural design. Every Aston Martin car is an expression of beauty, a quality that requires mastery of balance and proportion. All Aston Martin properties share this obsessive approach, providing the perfect canvas for us to express our skills.

‘Aston Martin Residences Daytona Beach Shores will allow us to take our holistic design approach to another level, with scope for the unprecedented integration of bespoke design elements, highly customizable spaces, cutting edge amenities, and a strong symbiosis with Aston Martin’s world renowned design language. Architecture and interiors are where Aston Martin’s experience and expertise in craft, performance and beauty can be expressed to the full.’

Valor Real Estate Development brings more than four decades of experience to the partnership. To date, the team has collectively developed over a billion dollars of real estate, with a renewed focus on high-end and luxury residential design in Florida. As part of this groundbreaking multi-project partnership additional landmark sites are already under review in Mexico City and Tampa Bay, Florida.

VP Valor Real Estate Development and Grupo Bosque Real, Loen Salame said; ‘For over four decades, our commitment has been to redefine living in urban locations. North American expansion remains a critical focus of our multi-project partnership, and we are excited to be exploring opportunities with Aston Martin for further landmark developments in Mexico City and Tampa Bay’.

Aston Martin Residences Daytona Beach Shores is scheduled to be completed by 2029.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

Sharjah’s real estate sector saw a 62% surge in foreign investments during the first nine months of 2025, reaching AED 23.2 billion, as investors from 121 countries drive strong demand — reinforcing the emirate’s global appeal and investment confidence.

The Sharjah Real Estate Registration Department has reported a substantial increase in foreign real estate investments during the first nine months of 2025, emphasizing the confidence of regional and international investors in Sharjah’s robust investment climate and the resilience of its property market.

According to the Department’s latest report, the total value of transactions by foreign (non-Emirati) investors reached approximately AED 23.2 billion, reflecting an impressive 62.2% year-on-year growth compared to the same period in 2024.

Foreign investors engaged in trading 13,428 properties across the emirate, emphasizing the rising demand for ownership among investors from various nationalities. During the first three quarters of 2025, Sharjah attracted real estate investors from 121 different countries, reinforcing the emirate’s increasing global appeal as a secure and stable investment destination.

UAE nationals top the list of investors, with a total investment of AED 21.1 billion across 28,561 properties. Investors from non-Arab and non-GCC countries are second, with assets valued at AED 13.1 billion across 6,116 properties.

Arab nationals ranked third, investing AED 7.5 billion in 5,855 properties, while GCC nationals (excluding Emiratis) invested AED 2.6 billion across 1,457 properties.

The data revealed a widespread increase in investments across all investor groups. Investments by UAE nationals rose by 54.3%, those from GCC countries (excluding Emiratis) by 55.2%, and Arab nationals by 45.8%.

Meanwhile, international investors saw the highest growth rate at 74.9%, compared to the same period last year, highlighting Sharjah’s success in attracting global investors seeking sustainable real estate opportunities.

The report highlighted the leading nationalities investing in Sharjah’s property sector. India topped the list with a trading volume of AED 6.1 billion, followed by Syria with AED 2 billion, and Pakistan in third place with AED 1.5 billion.

Jordan ranked fourth with AED 1.37 billion, Saudi Arabia fifth with AED 1.26 billion, and Egypt sixth with AED 1.12 billion in total investments.

These figures highlight the global diversity of investors and demonstrate ongoing confidence in Sharjah’s stable economy, transparent regulations, and supportive investment environment.

Commenting on the report, Abdul Aziz Ahmed Al Shamsi, Director General of the Sharjah Real Estate Registration Department, stated, “The strong performance of the real estate sector during the first nine months of 2025 reflects the growing momentum in Sharjah’s property market. This momentum is driven by flexible regulations that allow non-Gulf citizens to own property in designated areas, in addition to the economic stability and attractive legislative environment that characterize the emirate.”

Al Shamsi added, “The increasing diversity of investor nationalities and the expansion of the investor base demonstrate Sharjah’s emergence as a regional hub for sustainable real estate investment. The emirate continues to play a vital role in advancing the UAE’s broader sustainable development agenda, reinforcing its position as a dynamic and inclusive investment destination.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Qatar’s residential rental market continues its rebound, with leasing activity and rents rising across key districts — driven by infrastructure growth, digital innovation, and tenant confidence post-World Cup, according to Tatami’s Q3 2025 report.

Qatar’s residential rental sector is showing clear signs of recovery, with leasing activity accelerating across major neighbourhoods and average rents edging higher in select areas, according to the ‘Qatar Residential Rental Market Q3 2025 Report’ released by Qatar-based rental payment solutions firm, Tatami.

The report indicates that both apartment and villa markets have gained momentum over the past year, supported by infrastructure improvements, population growth, and shifting lifestyle preferences.

“The rebound reflects renewed tenant confidence following the post-FIFA adjustment period,” Aimen Bedawi, Co-founder & CEO of Tatami, told The Peninsula. “Improved affordability, stabilising rental values, and new supply in emerging districts such as Lusail and Msheireb have encouraged stronger leasing activity. At the same time, shifting tenant preferences toward smaller, better-managed apartments and family-oriented suburban communities are signaling a healthy normalisation of Qatar’s rental market.”

Apartment leasing strengthened across most districts, with The Pearl remaining the top destination for renters, followed by Al Sadd, Msheireb, and Fereej Bin Mahmoud. However, Lusail emerged as the standout performer, with Fox Hills recording an 81 percent surge in leasing volume.

Average apartment rents in Lusail and Msheireb increased by 9.8 percent and 3.5 percent, respectively, reflecting renewed confidence in premium urban living supported by mixed-use developments and modern amenities.

The data also highlights growing demand for villas outside Doha municipality, particularly in Umm Slal and Al Rayyan. Among the tracked neighborhoods, Muraikh led with an 84 percent increase in rental transactions, followed by Al Thumama (+42 percent), Al Gharrafa (+33 percent), and Al Wukair (+30 percent).

Average rents rose most notably in Umm Slal Mohammed (+6.3 percent), Ain Khaled (+5.3 percent), and Al Meshaf (+4.9 percent).

Bedawi stressed, “Infrastructure has been a catalyst for the suburban villa market. Areas like Umm Slal, Al Rayyan, and Al Meshaf have benefited from better road networks, access to schools, and connectivity to Doha’s employment corridors. This has made suburban living not just more practical, but also more desirable, driving consistent growth in both rental volumes and average prices over the past year.”

Lease renewals have also risen markedly, underscoring greater stability in the market. Apartment renewals increased from 5 percent to 8.2 percent of total transactions year-over-year, while villa renewals rose from 9.1 percent to 15.3 percent.

According to the industry expert, this upward trend in renewals reflects both stronger tenant satisfaction and the influence of digital innovation.

“Technology is redefining how landlords and tenants interact,” Bedawi said. “Digital platforms have become crucial touch-points that enable transparency, convenience, and trust across the leasing journey. Beyond payments, integrated property-management systems deliver real-time visibility into asset performance and tenant engagement, empowering landlords to make informed, data-driven decisions. Conversely, when tenants feel in control and valued through these seamless digital interactions, renewal rates rise, and that’s exactly what we’re seeing across Qatar’s rental landscape.”

With new supply concentrated in key urban and suburban districts, the report projects a more stable and sustainable rental environment going forward.

The combination of infrastructure-led suburban growth, digital transformation, and renewed confidence in Qatar’s post-World Cup economy positions the residential market for continued resilience and balance.

Bedawi further added, “The residential market continues to show healthy momentum, reflecting the broader confidence in Qatar’s economy. We’re now in a phase of consistent, sustainable demand, not speculative surges.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

AMIS Development launches Derby Heights in Meydan, Dubai, a luxury residential project featuring Casamia’s design concept and set for handover in Q4 2027, redefining modern urban living.

AMIS Development today announced the launch of Derby Heights, a residential project located in District 11, Meydan, Dubai. The development is set for handover in Q4 2027. The project launch took place today at AMIS sales center on Sheikh Zayed Road, Dubai.

Derby Heights introduces a refined vision of elevated living through a spatial edit by Casamia — a design narrative that brings together curated materials, tactile finishes, and refined aesthetics across the project’s shared and social spaces. The development reflects a commitment to thoughtful materiality and spatial harmony, creating an environment where design enhances everyday living.

This project paves the way for a new trend of locally branded residences in Dubai, setting a new standard for urban living—combining luxury, design, and comfort in every corner of Derby Heights.

The development offers exclusive units consisting of one-bedroom and two-bedroom apartments, each thoughtfully designed to provide a modern living experience. Located just 15 minutes from Downtown Dubai, 5 minutes from the Meydan Racecourse, and 20 minutes from Dubai International Airport, Derby Heights provides the perfect blend of privacy and proximity to key lifestyle destinations in the city.

The development features an array of exclusive amenities including a state-of-the-art gym, a rooftop infinity pool, an outdoor cinema, a grand reception area, and an outdoor kids play area—all designed to offer a refined living experience for individuals and families.

Neeraj Mishra, Founder and CEO of AMIS Development said: “We are thrilled to introduce Derby Heights to the market. This project reflects our commitment to creating spaces that redefine urban living. Through this development, we’re able to offer a unique concept with ‘a spatial edit by Casamia’, bringing a sophisticated touch to every shared space. We believe this development will set a new benchmark for luxury living in Dubai, providing a sanctuary that is both serene and conveniently located.”

Mohib Mithani, Co-Founder of Casamia, said: “We’re proud to see Casamia’s material and design sensibility represented within Derby Heights. Through A Spatial Edit by Casamia, this project brings an exquisite material philosophy to life, where every detail contributes to an atmosphere of refined comfort.”

Since its inception in October 2023, AMIS Development has swiftly made its mark as a prominent player in Dubai’s luxury real estate sector. The company’s commitment to quality, innovation, and long-term value has struck a chord with both investors and buyers, positioning AMIS as a distinguished name in the UAE’s highly competitive property market.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

TownX Real Estate has completed its Luma Park Views project in JVC nine months ahead of schedule, preparing to hand over 600 luxury apartments. Valued at AED 4 billion, the project features smart homes, sky pools, Technogym-equipped gyms, and eco-efficient designs—underscoring TownX’s commitment to quality, innovation, and timely delivery across its growing Dubai portfolio.

TownX Real Estate Development, one of Dubai’s fastest-growing real estate developers with an AED 4 billion project portfolio, has completed its marquee Luma Park Views project nine months ahead of schedule and is set to commence the handover of 600 residential units in Jumeirah Village Circle (JVC), Dubai.

Featuring one, two and three-bedroom luxury apartments with breathtaking park views, the project marks a significant milestone in TownX’s mission to deliver high-quality developments in record time.

Haider Abduljabbar, Executive Director of TownX, said: “Completing Luma Park Views nine months ahead of schedule underscores our relentless drive for excellence and efficiency. We are dedicated to pushing boundaries and setting new standards in real estate, ensuring that every project we deliver creates lasting value for our residents and investors.”

Luma Park Views offers a blend of cutting-edge technology, luxury amenities, and community-oriented design. Residents can enjoy two sky pools, two Technogym-equipped gyms, a spacious internal garden spanning 32,000 square feet, and a suite of smart home systems. The development also features advanced security systems, including face recognition technology in the lifts, as well as smart door locks, EV charging points, and temperature-controlled pools.

Equipped with Siemens appliances and smart home systems, each apartment at Luma Park Views offers a modern living experience designed for comfort, convenience, and sustainability. The development’s energy-efficient design, combined with spacious interiors and premium finishes, makes it an ideal choice for families and professionals alike.

Since its inception in 2017, TownX has focused on delivering projects ahead of schedule with exceptional attention to detail. With over 967 units delivered and 1,774 apartments currently under development, the company continues to expand its footprint in Dubai’s real estate market. Key developments delivered by TownX include Easy18, Easy19, Luma21 and Luma22 in JVC, while ongoing projects include 11 Hills Park at Dubai Science Park and Ashley Hills in Arjan.

With a focus on family-oriented communities, TownX designs spaces that cater to all generations, prioritizing high-end finishes, energy-efficient designs and spacious interiors. Above all, the company is committed to enhancing the daily lives of its residents through exceptional user experiences.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Dubai’s luxury property market surged in Q3 2025, with 103 homes sold above $10 million worth over $2 billion, up 54% year-on-year, per Knight Frank. The Palm Jumeirah led sales, while a $95.3 million mansion in La Mer marked the top deal, underscoring Dubai’s status as a global luxury hub.

Dubai’s high-end residential market has enjoyed another stellar quarter, with 103 homes sold for more than $10 million in Q3, a 24% increase on Q3 2024, according to the latest data from global property consultancy Knight Frank.

Strong demand in the luxury segment saw 17 transactions priced over $25 million – more than twice the number recorded in Q3 2024.

The latest quarterly figures pushed the number of deals in the $10 million-plus bracket to 357 in the first nine months of the year, which equates to a 26% increase on the same period in 2024, when 282 homes over US$ 10 million were sold.

Total transaction values increased at an even greater rate than the number of deals, topping $2 billion in Q3, representing year-on-year growth of 54%.

This increased activity in the ultra-luxury market saw high-value sales push up the average deal value in the $10 million-plus segment to more than $19.4 million, representing a 23.8% rise on Q3 2024.

Faisal Durrani, Partner – Head of Research, MENA, said: “The fact that the growth in total transaction values for US$ 10 million homes is rising faster that the number of deals is a stark indication of how fast prices are rising in this exclusive segment of the market. Dubai’s luxury market has cemented its status as a safe haven for international and local buyers. It looks set to be another record-breaking year for the US$ 10 million-plus homes market, following the 435 deals registered during 2024.”

The highest price achieved in the third quarter was for a seven-bedroom mansion in Asora Bay by Meraas, in the La Mer community, which sold for $95.3 million.

Will McKintosh, Regional Partner – Head of Residential, MENA, added: “Community living and exclusivity remain a big draw for high-net-worth-individuals looking to purchase in Dubai. La Mer exemplifies this with its combination of wellness-focused beachfront living, extensive amenities and proximity to prime retail and leisure destinations. Destination communities like La Mer place a strong emphasis on lifestyle and world-class amenities, which strikes a chord with domestic and international buyers.”

Dubai’s prime neighbourhoods

Knight Frank’s Prime Index for Dubai, which tracks values across 10 key luxury communities, averaged AED3,767 psf in the quarter, representing an 8.5% uplift on Q3 2024 (AED3,475 psf). Palm Jumeirah retained its crown as the busiest community for prime residential transactions in Q3 2025, accounting for 34% of the total number of deals. It was followed by Jumeirah 2, which accounted for 17% of US$ 10 million-plus purchases.

Durrani concluded: “Our analysis shows global HNWI budgets considering a home purchase in Dubai stand at US$ 32 million, topping out at US$ 45.7 million for Saudi nationals. Overall, 15% of HNWI from Saudi, the UK, India, China, Hong Kong and Singapore are prepared to spend upwards of US$ 80 million on a home in the city this year, and there remains a clear gap in the market of uber-luxury housing.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Al Ghurair unveiled Al Ghurair Collection with Wedyan, a landmark Dubai Canal residence designed by Kengo Kuma, marking his first UAE project and setting a new benchmark for luxury waterfront living.

Al Ghurair proudly introduces Al Ghurair Collection, the super-prime residential portfolio of Al Ghurair Development, the freehold real estate division of the company. Created to represent the pinnacle of Al Ghurair’s six-decade legacy, the Collection makes its debut with Wedyan, a landmark waterfront residence along Dubai Canal. Designed by world-renowned architect Kengo Kuma, in his first project in the UAE, Wedyan delivers on Al Ghurair Collection’s commitment to originality and craftsmanship to create something never seen before in Dubai.

Al Ghurair Collection is positioned as the most exclusive expression of Al Ghurair Development, reserved for residences of rare character in sought-after locations. Anchored in Al Ghurair’s track record in contributing to the evolution of Dubai, the company has active interests in banking, development, foods and mobility. The Al Ghurair family established the region’s first shopping mall and mixed-use concept in 1981, the first private insurance company in 1975 and the first private bank in 1967. The company has also been involved in major infrastructure projects such as Dubai Metro and the façade glazing of Burj Khalifa. To date, Al Ghurair has built and managed more than 20,000 residential and commercial units in Dubai, alongside nearly 1,000 hotel rooms and serviced units.

Sultan Al Ghurair, CEO of Al Ghurair Development, said: “Al Ghurair Collection marks a new chapter for us. It is a natural evolution of our commitment to the progress of the city. As Dubai has grown into one of the world’s most dynamic and successful destinations, and is increasingly drawing sophisticated residents from all over the world, the time felt right to introduce what we feel is the ultimate expression of exceptional living to be found here.

We created Al Ghurair Collection to develop buildings that don’t exist elsewhere. Our search for an architect that shares our commitment to originality and obsession with detail led us to Kengo Kuma, a visionary with a truly unique design perspective.”

John Iossifidis, Group CEO of Al Ghurair, said: “The launch of Al Ghurair Collection represents a defining milestone for Dubai’s real estate sector and reflects Al Ghurair’s future-focused strategic vision. We enter this space with the strength of a legacy built over six decades, anchored in trust, innovation, and an uncompromising commitment to quality and excellence.

Al Ghurair Collection will bring a fresh perspective to the market, powered by the integrated capabilities of our diversified business. Our mission is clear: to create visionary projects, build with purpose, and deliver spaces that provide enduring value, financially, socially, and culturally, for generations to come.”

The launch of Wedyan comes as demand for ultra-luxury property in Dubai reaches unprecedented levels. In the first half of 2025, the city recorded AED 431 billion in transactions, a 25% increase year-on-year, with sales of homes above AED 10 million growing more than fourfold in recent years. This market evolution reflects the interest discerning families from around the world have in making Dubai their permanent home.

Designed by Kengo Kuma and with its name meaning ‘valleys’, Wedyan is envisioned as a future landmark, marking his first project in the UAE. Kuma San, celebrated for cultural works such as the Japan National Stadium in Tokyo and the China Academy of Art’s Folk Art Museum, is recognised globally for an approach that harmonises architecture with nature. At Wedyan, he has applied this approach by shaping a façade inspired by the movement of water and sand. Its layered profile and textured exterior, echoes the rhythm of the desert and valleys, creating a building without precedent in the city.

Kengo Kuma said “Wedyan is a dialogue between Japanese aesthetics and the context of Dubai. Our design philosophy is to connect and create a conversation between architecture, nature and people. In this project, our purpose is to bring softness to the design and to create quietness through shadows that cascade and reflect across the façade, terraces and amenity spaces.

Collaborating with Al Ghurair has been exciting. They understand the value of design, and we share a mutual respect that naturally led to a positive harmony in bringing Wedyan to life,” he continued.

Soaring 46 storys high, Wedyan comprises 149 residences with a mix of three-, four-, and five-bedroom layouts, two full-floor penthouses and a three-story sky villa. Some of the key features include generous outdoor living spaces purposefully designed to be multifunctional, for maximum comfort and livability; additional back-of-house kitchen with separate access alongside the main kitchen, perfect for hosting catered dinner parties; and specialized glazing that protects owners’ artworks from UV rays. A selection of residences also come with standalone Japanese teahouse-inspired pavilions; easily adapted to suit residents’ needs, they could make the perfect setting for morning meditations or serve as a one-of-a-kind recording studio.

Al Ghurair Collection worked with more than 30 specialists to consider every aspect of how to live well, among them, lighting, kitchen, façade and parking consultants. The landscaping is realized in collaboration with Gustafson Porter + Bowman, integrating greenery and water features into every level of the building. Deep-planted terraces and shaded promenades create gardens in the sky, enhancing privacy. The planting palette includes species selected for their resilience, aesthetics and compatibility to Dubai’s climate, such as aloe vera, Bismarck palm and trailing ice plants. At ground level, a landscaped promenade and shimmering water accents contribute to the beauty of Dubai Canal.

Featuring every possible convenience a resident might need to live well, Wedyan offers more than 65,000 sq ft of amenity space carefully distributed across distinct levels in the building. Just below ground level, The Oasis arrival experience is lined with greenery and water features that lead into a luxury car stacker which is humidity- and temperate-controlled. The Shore and The Valley on Levels 2 and 3, are dynamic spaces for active living and leisure time with family and friends, as well as for hosting and entertainment. The Cave is a curated wellness cocoon situated on Level 17 and The Mountain located on the 36th floor is a dedicated space for private meetings. Some inspiring amenities include private treatment rooms allowing residents to bring their own trusted therapists, reformer Pilates studio, a podcast room, and boxing facilities. Filtered air and water systems are integrated throughout the building to support overall wellbeing.

Positioned on one of Dubai’s prime waterfront locations, Wedyan places residents within minutes of the city’s cultural, business, and retail districts, including Business Bay, Jumeirah, and Downtown Dubai, as well as within 20 minutes of Dubai International Airport. Al Ghurair Collection’s dedicated Sales Centre in the Mashreq HQ Tower in Downtown Dubai will welcome prospective buyers, providing an immersive introduction to Wedyan and its design ethos.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Object 1 unveiled ELAR1S Sky and ELAR1S Rise in Jumeirah Village Triangle at a gala in Atlantis The Royal, hosted by Kris Fade. Inspired by air, light, and life, the projects combine design, community, and investment appeal. Rising 43 and 24 floors with premium amenities, both towers strengthen Object 1’s position among Dubai’s top developers and JVT’s status as a key growth hub.

Object 1 marked another milestone with the launch of its series of projects, ELAR1S Sky and ELAR1S Rise, unveiled at an exclusive gala dinner at Atlantis The Royal. Hosted by radio and media icon Kris Fade, the event gathered brokers and real estate professionals for an evening that reflected the developer’s growing influence in Dubai’s real estate sector. Both towers are located in District 3 of Jumeirah Village Triangle (JVT), where Object 1 ranks among the top three developers.

The launch underscored Object 1’s vision to redefine modern living in Jumeirah Village Triangle, introducing developments that strike a balance between community living, design elegance, lifestyle convenience, and long-term investor appeal. Both projects are inspired by the elements of air, light, and life, embodying a sanctuary of balance, tranquility, and natural harmony. Within its flowing architecture, spaces for living, working, and gathering coexist seamlessly, reinforcing Object 1’s commitment to creating spaces where residents can live, connect, and thrive.

Tatiana Tonu, CEO of Object 1, said: “The launch of ELAR1S Sky and ELAR1S Rise is a proud moment for us, as it represents our vision of creating communities where design, lifestyle, and investment potential meet. We believe JVT is one of Dubai’s most promising residential hubs, and these projects are designed to deliver long-term value for both residents and investors. The overwhelming response at our launch event reflects the trust and confidence the market places in Object 1.”

ELAR1S Sky will rise 43 floors in District 3, JVT, offering 402 residences from studios to two-bedrooms, while ELAR1S Rise will add 198 residences alongside retail and office spaces across 24 floors. Together they form a vibrant ecosystem within the community, offering premium amenities such as infinity pools, lush gardens, clubhouses, gyms, outdoor fitness areas, kids’ play spaces, outdoor lounges, and integrated smart home systems, blending comfort, leisure, and family living with modern convenience.

As Jumeirah Village Triangle continues to perform strongly, the district has seen rental prices climb over 20% with yields averaging 6–8% per year, while transaction volumes rose 62% in early 2025 compared to the same period last year. Backed by Dubai Holding and RTA’s infrastructure upgrades, including the upcoming Purple Metro Line, JVT is rapidly becoming one of Dubai’s most sought-after communities. The addition of ELAR1S Sky and ELAR1S Rise strengthens this momentum, aligning with the Dubai 2040 Urban Master Plan and reinforcing Object 1’s position among the top ten developers in the city.

Both projects are anticipated for handover in 2028, adding to Object 1’s fast-growing portfolio of investor-focused and family-oriented developments across the city.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Dubai Islands by Nakheel is emerging as a prime waterfront destination, recording AED 6.1 billion in sales in H1 2025. Spanning 17 sq km with 20 km of beaches, it offers luxury living and strong investment potential with 12–15% annual growth and over 10,700 units under development.

Dubai Islands is stepping into the spotlight as one of Dubai’s most ambitious waterfront destinations, bringing a wave of new opportunities for residents, visitors, and global investors. Backed by Nakheel and aligned with Dubai’s 2040 Urban Master Plan, the multi-island development is rapidly taking shape as a hub for luxury living, cultural experiences, and long-term capital growth.

Spanning 17 square kilometers with 20 kilometers of beachfront, Dubai Islands will offer a balanced mix of luxury residences, hospitality, retail, leisure, and cultural districts across five interconnected islands, all minutes from the city and Dubai International Airport. Planned RTA bridge enhancements will further streamline connectivity, reinforcing everyday convenience for residents and visitors.

Dubai Islands H1 2025 performance

According to Betterhomes Research, Dubai’s real estate market delivered its strongest ever half-year in H1 2025, with total transactions across the emirate surpassing AED 262 billion.

Within this momentum, Dubai Islands alone recorded AED 6.1 billion in sales from 1,936 transactions between January and June 2025, positioning the destination among Dubai’s most active and sought-after coastal districts.

- Apartments:

1,895 sales totaling AED 5.63 billion.

Average price: AED 2.9 million - Villas also saw strong traction (Dubai Islands, H1 2025):

28 transactions, averaging AED 15 million per villa.

Six-bedroom residences averaged AED 44.4 million. - Price positioning:

Dubai Islands residential average: AED 2,340 per sq ft.

Comparative context: Palm Jumeirah averages AED 3,000+ per sq ft. - Yields and growth:

Coastal communities, including the Dubai Islands, are already outperforming on yields and long-term appreciation. Premium waterfront areas across the emirate achieved 12%–15% annual price growth by June 2025, underscoring Dubai Islands’ potential for above-market returns, especially for early movers.

“Dubai Islands combines a premier waterfront setting with practical city access and a pipeline of branded hospitality and lifestyle assets,” said Wassim Abdallah, Director of Development Sales and Consultancy at Betterhomes.

“That together is drawing both end-users who want a resort-style daily life and investors who prioritize yield resilience and capital growth,” he added.

Ongoing developments & key players in the Dubai Islands

Dubai Islands is anchored by Nakheel as master developer and is building momentum with a growing mix of hospitality-led and residential projects that strengthen its destination appeal. The islands already feature Rixos Dubai Islands Hotel & Residences, bringing branded, service-led living to the waterfront, alongside operational family-focused resorts such as Hotel Riu Dubai and Centara Mirage Beach Resort Dubai, which have helped establish steady leisure footfall. As infrastructure phases progress, new residential neighborhoods, primarily low- to mid-rise beachfront and waterfront addresses, are set to roll out with elevated community amenities and enhanced promenade experiences. Complementing these homes, planned cultural, retail, and marina precincts will complete a full lifestyle ecosystem of dining, wellness, and community spaces, reinforcing the Dubai Islands’ long-term liveability and investment fundamentals.

Why choose the Dubai Islands?

For end-users, Daily life feels like a private resort, with long beachfronts, pedestrian-friendly promenades, and branded hospitality on your doorstep. Connectivity is practical: close to Deira, Old Dubai, and DXB, with RTA bridges enhancing access to the rest of the city. Homes prioritize light, flow, and indoor-outdoor living, ideal for families, professionals, and second-home buyers who want water, space, and services without sacrificing city convenience.

For investors, the case rests on three forces: genuine waterfront scarcity in a regulated, globally connected market; price efficiency versus mature peers like Palm Jumeirah, allowing room for price discovery; and branded hospitality with curated placemaking that supports resilient occupancy and rental performance. With H1 2025 data showing strong sales volumes and premium price-per-square-foot benchmarks, Dubai Islands presents an attractive entry point for yield and long-term value.

What’s next for the Dubai Islands

With more than 10,700 residential units currently under construction across multiple developers, and more set to be added to the inventory, the pipeline underscores strong, sustained growth. As infrastructure advances, the Dubai Islands will welcome a new wave of flagship residential and lifestyle projects from leading developers, expanding choice for buyers and deepening the destination’s appeal. This marks a prime window for first movers to secure positions in Dubai’s newest, fully connected waterfront address.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sobha Realty reported record demand at its Downtown UAQ development, selling over 50% of units in its first three towers within a week of launch — setting a new benchmark for the northern emirates.

Sobha Realty has announced strong initial sales at its flagship Downtown UAQ | Sobha Realty master development, reinforcing rising investor confidence in Umm Al Quwain as the UAE’s next coastal growth hub.

Within just one week of its launch, the developer confirmed that over 50% of units in the first three residential towers were sold, setting a new benchmark for sales velocity in the northern emirates.

The 25-million-square-foot master development, located along Umm Al Quwain’s natural waterfront, is envisioned as the Coastal Skyline of the Future. The project integrates premium residences, commercial hubs, hospitality offerings, and lifestyle amenities to create an exceptional living experience. It is designed to balance modern living with environmental stewardship, with more than half of the total land area dedicated to open and green spaces.

The master plan spans 11 kilometers of pristine waterfront and includes over 7 kilometers of uninterrupted natural beach, two marinas, landscaped boulevards, and future-ready mobility solutions such as water taxis. It will also feature the UAQ Trade Centre, premium office space, and leisure attractions to strengthen its position as a mixed-use destination.

The first residential cluster, Sobha Aquamont, was unveiled earlier this year and comprises three towers of one-, two-, and three-bedroom waterfront apartments. The towers are designed to maximize natural light and coastal views, in line with Sobha Realty’s emphasis on luxury, craftsmanship, and sustainability.

“Umm Al Quwain is emerging as a highly attractive destination for residents and investors seeking world-class coastal living in a natural environment,” said Francis Alfred, Managing Director of Sobha Realty. “The strong sales response at Downtown UAQ reflects both the confidence in Sobha Realty’s vision and the growing appeal of Umm Al Quwain as a market poised for long-term growth.”

Adding to Sobha Realty’s expanding UAE portfolio of luxury communities, Downtown UAQ | Sobha Realty reinforces the company’s reputation for engineering excellence and sustainable urban design. It also highlights the growing momentum of mixed-use coastal projects in the UAE, which are attracting increasing interest from both domestic buyers and international investors.

By setting a new sales benchmark in its opening week, Downtown UAQ | Sobha Realty has established itself as one of the region’s most ambitious and promising waterfront destinations.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

Abu Dhabi’s real estate market surged 39% in H1 2025 to AED 52 billion, fueled by strong demand for luxury waterfront living. Key hotspots include Al Reem Island with soaring off-plan prices, Saadiyat’s culturally rich beachfront villas, Yas Island’s mix of leisure and nature, Al Maryah’s business-waterfront lifestyle, and Al Fahid’s wellness-focused community—together reflecting investor confidence in the emirate’s blend of luxury, nature, and future-ready infrastructure.

As Abu Dhabi’s real estate market evolves, investors are gravitating toward properties that offer luxury, natural surroundings, and future-proof infrastructure along the city’s waterfront. In the first half of 2025, the Abu Dhabi Real Estate Centre (ADREC) reported a record AED 52 billion in total real estate transactions, a 39% increase compared to the same period in 2024, reflecting strong investor confidence in the emirate’s high-value property sector. Waterfront districts are at the forefront of this growth, offering a rare combination of scenic mangrove-lined lagoons, pristine beaches, luxury marinas, and iconic architectural developments.

Artemiy Marinin, Project Director at MERED, identified key trends that offer compelling investment opportunities for discerning buyers:

- Al Reem Island, urban waterfront with natural serenity

Al Reem Island offers a rare combination of urban convenience and tranquil waterfront living. Lagoon-facing plots and high-rise apartments overlooking the Arabian Gulf create strong scarcity-driven demand. MERED’s latest Pritzker Prize–designed waterfront development promises to harmonize modern architecture with nature, offering landscaped oasis gardens, green terraces, and open-air spaces, making it a sought-after location for investors seeking value in a central, nature-integrated setting. Reem Island experienced a remarkable 38% year-on-year increase in off-plan property prices during Q2 2025, reinforcing its position as one of Abu Dhabi’s top-performing investment destinations.

- Saadiyat Island, cultural prestige meets pristine coastline

Saadiyat Island is renowned for its ecological and cultural appeal, with protected beaches, coral reefs, marine reserves, and landmark institutions like the Louvre Abu Dhabi. Beachfront properties, combined with strong conservation measures, support the Island’s long-term growth. Villas and residences with lagoon or sea views offer luxury living, often feature private pools and landscaped gardens. According to Knight Frank, villas on Saadiyat Island recorded the highest price growth in H1 2025, up 28% year-on-year, underscoring its status as a secure investment. The island’s combination of heritage and natural beauty makes it particularly attractive for buyers seeking integration with the capital’s culture and exclusivity.

- Yas Island, an entertainment hub with hidden natural gems

Yas Island is celebrated for its entertainment offerings, including Ferrari World, Yas Marina Circuit, and luxury hotels, yet it also offers tranquil natural features. Thoughtful planning has created a community with expansive green parks, a premier golf course, and a pristine public beach. Transaction values reached AED 5.86 billion in H1 2025, highlighting strong investor interest. Eco-conscious projects and the island’s unique mix of leisure, lifestyle, and waterfront living continue to fortify its sustainable investment potential.

- Al Maryah Island, central business waterfront with scenic promenades

Al Maryah Island serves as a key financial district while offering a distinctive waterfront lifestyle. Landscaped boardwalks, cafés, and leisure paths connect residents and professionals to the sea. Premium apartments offer unobstructed views, while green corridors and water-sensitive planning promote sustainable, resilient development. The integration of central business amenities with high-quality residential offerings makes Al Maryah Island attractive for investors seeking scenic natural appeal, business connectivity, and stable property value.

- Al Fahid Island, wellness-focused waterfront living

Al Fahid Island, strategically located between Yas and Saadiyat Islands, is Abu Dhabi’s newest luxury waterfront destination. Covering more than 6,000 residential units, the island offers an 11km coastline, offering residents a lifestyle closely connected to nature and the waterfront. Mangrove-lined streets, beachfront access, and wellness-oriented amenities foster outdoor activity and balanced living. Educational and lifestyle facilities, including the first UAE campus of King’s College School Wimbledon, scheduled to open in 2028, ensure lasting investment resilience in this forward-looking waterfront community.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

Red Sea Global (RSG) has partnered with Snowflake to deploy Cortex AI, creating the AI Destination Assistant (ADAI) that delivers real-time insights across bookings, flights, and hospitality. The platform cuts costs, eliminates data silos, and empowers staff with instant, data-driven decisions, boosting guest safety and experiences. Recognized with the AI Visionary Award 2025, RSG is advancing toward fully autonomous AI in line with Saudi Arabia’s Vision 2030.

Snowflake, the AI Data Cloud company, has been appointed by Saudi real estate developer Red Sea Global (RSG) to accelerate its digital transformation by deploying advanced AI and data solutions across its operations. With Snowflake, RSG is enhancing guest experiences, simplifying deployment of AI, and establishing scalable AI capabilities that support the Kingdom’s ambition to be a global leader in AI.

The developer and hospitality management company previously faced delays in scaling AI models, limitations in local infrastructure and operational expertise, and fragmented data across systems. By using Snowflake Cortex AI, RSG now benefits from the flexibility of a hyperscaler-agnostic platform and has moved from proof-of-concept response times of 45 seconds to near real-time insights, eliminated data silos by consolidating multiple dashboards into a single source of truth, and simplified operational deployment.

With Snowflake Cortex AI at its core, RSG has built AI Destination Assistant (ADAI), a next-generation AI solution that ingests data across bookings, mobility, flights, and hospitality services, and responds to natural language queries with trusted, accurate, and instant insights. For instance, employees can ask “how many pregnant women are coming to the destination,” to ensure its medical readiness and guest safety.

For analysts, ADAI delivers the answer, the SQL query, and additional insights, serving as an “analyst in the pocket.” This has reduced IT overhead, eliminated costly GPU infrastructure and MLOps requirements, and shrunk time to insight from weeks to seconds. Employees are no longer dependent on business intelligence teams and can make faster, data-driven decisions that improve service quality by anticipating guest needs, enabling smarter planning, higher safety standards, and better experiences.

Ali Al-Ismail, Country Manager for Snowflake KSA, said: “RSG is setting the benchmark for AI adoption in Saudi Arabia by using Snowflake Cortex AI to implement advanced large language models and agentic AI at scale. By centralizing data, removing infrastructure barriers, and empowering staff with real-time insights, RSG is unlocking measurable cost savings, productivity gains, and improved customer outcomes. We are proud to support RSG in using the AI Data Cloud to redefine hospitality management.”

Sultan Moraished, Group Head of Technology and Corporate Excellence, Red Sea Global, said: “Leveraging Snowflake has enabled RSG to address the technology and operational barriers that previously limited our data and AI capabilities. With Cortex AI powering our ADAI platform, we have moved from slow proof-of-concept models to near real-time insights that help us plan smarter, deliver greater efficiency, and enhance the overall guest experience. This is enabling us to reimagine how we manage our destinations, while contributing to the Kingdom’s Vision 2030 goals through advanced use of AI and data.”

Snowflake’s support of RSG reflects KSA’s wider push to integrate AI across industries as part of Vision 2030. According to PwC, the Kingdom is expected to gain up to US$135.2 billion from AI by 2030, the largest economic boost in the region. With the nation’s public cloud market projected to reach $13.97 billion by 2033, and 81% of CEOs already embracing AI, organizations like RSG are demonstrating how having the right data strategy is driving successful AI outcomes.

Snowflake recently honored RSG with the AI Visionary Award 2025 at the Smart Data & AI Summit (SDAIS) 2025 in recognition of its ADAI solution, which transforms business AI capabilities and elevates customer experiences. The accolade underscores the company’s role in driving future AI innovation and highlights Snowflake’s commitment to enabling future AI innovation in the Kingdom.

Looking ahead, Snowflake is working with RSG on developing autonomous actions within the platform, moving toward a fully agentic AI system that reduces manual intervention and improves responsiveness.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Worldlink Conferences will host the Modern Buildings Summit 2025 on 28–29 October in Dubai, highlighting innovations in sustainable design, smart tech, and resilient infrastructure, with top speakers and global industry leaders.

Worldlink Conferences proudly announces the Modern Buildings Summit 2025, taking place at Dusit Thani, Dubai, 28–29 October 2025. This landmark event will gather leading voices from architecture, urban planning, sustainability, and construction to explore how innovation, technology, and design are shaping the future of the built environment.

With Dubai at the forefront of modern urban development, the summit will spotlight transformative solutions in sustainable architecture, energy efficiency, smart technologies, and future-proof infrastructure.

Joining the summit are some of the most influential voices in architecture, design and sustainability.

- Faisal Rashid – Senior Director – Demand Side Management, Supreme Council of Energy

- Nabil Shahin – Managing Director, AHRI

- Alexander Ott – Partner and Head of Design, Coop Himmelb(l)au

- Benjamin Piper – Architectural Design Director, Integrity Design Consultancy

- Mahmoud Shahin – Design Director, P&T Architects

- Marcos Rosello – Founding Director, All Design

- Zain Ahmed – Senior Manager – Strategic Consulting, JLL

- Lindsey Malcolm – Sustainability Lead, Middle East, Turner & Townsend

- Sanaz Sheikhi – Senior BIM Manager, Dewan Architects + Engineers

- Philip Keil – Technical Director – Facade, AESG

- Ghina Yamak – Principal Facade Consultant, Zutari

- Loubna Al Zalek – Director of Design Development, ARM Holding

- Richard Fenne – Director, Woods Bagot

- Irmak Sener – Senior Sustainability Manager, pmk Consult

- Akshay Deshpande – Urban Design Lead, Arup

- Bhakti More – Chairperson & Professor, Manipal Academy of Higher Education

- Nima Shoja – Senior Director, Studioi

- Alexander Ott – Partner and Head of Design, Coop Himmelb(l)auMore to be announced soon!

Don’t miss out, the summit will serve as a platform for:

- Showcasing cutting-edge solutions in modern architecture and sustainable construction.

- Engaging in thought-provoking discussions on climate-responsive design, smart urban spaces, and resilient infrastructure.

- Networking with policymakers, leading architects, consultants, and developers shaping the skylines of tomorrow.

Event Details:

📍 Dusit Thani, Dubai, UAE

📅 28–29 October 2025

For sponsorship, exhibition, delegate passes and speaking opportunities, please visit.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.