He Wasn’t Thinking About Renting His Arizona Home. Then Rihanna Came Knocking.

When a big event comes to town or vacation time rolls in, A-listers turn to the privacy, security and space of private homes

Spyro Malaspinas wasn’t looking to rent out his home for Super Bowl LVII in Arizona in February 2023.

The 48-year-old cybersecurity expert initially balked at the idea of leasing his 6,400-square-foot, five-bedroom house on about an acre of land in Paradise Valley, an affluent town between Phoenix and Scottsdale, which he bought for $7.3 million in 2022. Then a property management firm he hired to manage a smaller investment property he owns called and offered Mr. Malaspinas a number that sent him packing.

“The last thing I am is a real estate baron,” said Mr. Malaspinas. But, he said, “My pride’s not that big. I don’t mind moving out for $500,000 a week.” Mr. Malaspinas, who said the rental income for that week will cover his mortgage payments for two years, later learned his tenant was Rihanna.

“My [13-year-old] daughter was absolutely thrilled,” he said. Rihanna didn’t respond to requests for comment.

When celebrities, sports stars and titans of industry come to town for vacation—or in Rihanna’s case, to headline the Super Bowl halftime show—they are often willing to shell out tens of thousands of dollars or more to stay at a private residence with more space, security and privacy than even the best five-star hotels. Finding properties that meet their criteria typically falls to travel coordinators and assistants, along with business managers and local real-estate agents who tap into closely held networks of clients with luxury homes.

The process is an extremely quiet exercise in matchmaking. “You need to know who to call,” said real-estate agent Carl Gambino of Compass. “Sometimes you know your client went to France for the year and their house is sitting there,” he said. Vacant homes that are listed for sale can be a win-win for everyone involved. And sometimes, homeowners can be persuaded to move for the right price—or person.

Before President Barack Obama and first lady Michelle Obama’s summer vacation on Martha’s Vineyard in 2013, for example, real-estate agent Tom Wallace of Wallace & Co. Sotheby’s International Realty said he got a call around mid fall from a White House planner who shared specific criteria for a presidential rental, including privacy and security. As the son of a U.S. Naval Rear Admiral, Mr. Wallace said he advocated strongly that the first family stay at a compound in Chilmark, Mass., owned by Chicago investment banker David Schulte and his wife, Patricia Schulte, even though the property wasn’t on the rental market at the time.

Set on about 9.5 acres with ocean views, the property has a four-bedroom main residence, a separate two-bedroom guesthouse, a private driveway and ample space to set up security areas. “It wasn’t until we politely stepped on [Mr. Schulte’s] left toe and said, ‘Would you consider a particular guest?’ that he was polite enough to help us orchestrate making that happen,” recalled Mr. Wallace, who declined to say whether there was a nondisclosure agreement. He also wouldn’t disclose the price but said the tenants paid a fair-market rate at the time.

For his part, Mr. Schulte said it was never his intention to rent the house, which he described as a “labor of love,” but he did so out of pride and patriotism. “It’s often said, ‘Nobody can say no to the president.’ That’s pretty true,” said Mr. Schulte, who donated to Mr. Obama’s 2004 Senate campaign. The property has an infinity-edged pool, half-court basketball and access to a private beach. The Schultes, who rented to the Obamas several times, sold the property for $15 million in 2018, records show. The Obamas declined to comment.

In New York, former financial executive Jay Dweck said his house in Bedford Corners had been on and off the market for between $6.895 million and $9.975 million when Mariah Carey’s team reached out to his real-estate agent in June 2020. They asked if Mr. Dweck would consider renting it to her for the summer. “They wanted to be in on July 1,” said Mr. Dweck, who said the singer’s team indicated she might be interested in purchasing the home. Mr. Dweck agreed to the $125,000-a-month rental, and then went onto Airbnb and found himself a house in Greenwich, Conn., for $6,000 a month.

Built around 2006, the roughly 10,500-square-foot house has six bedrooms, a theatre, a 900-gallon aquarium and a violin-shaped swimming pool flanked by koi ponds. Mr. Dweck said terms of the rental agreement stipulated he would not disclose the terms or parties to the rental, meaning the entity that rented the home on the singer’s behalf. But he said Ms. Carey stayed at the house full time with her boyfriend, children and a nanny, while a chef, housekeeper and assistant came daily. The singer’s tour manager and recording engineer were occasionally present, too, and Mr. Dweck said the entire team operated like a well-oiled machine. He said the staff stocked the fridge, unpacked closets and cranked up the pool heater to 91 degrees before Ms. Carey’s arrival. “You could boil lobsters in the pool,” Mr. Dweck said. The only real collateral damage from the experience was the home’s wooden floors, which had pock marks from the singer’s high heels, and ultimately needed to be replaced for $90,000, which was taken out of the security deposit. “She’s not the kind of person where someone says, ‘Mariah, take your shoes off,’” he said. Ms. Carey didn’t respond to requests for comment.

Celebrities, athletes and business titans rent for any number of reasons, said Tomer Fridman of Compass. Summer rentals in the Hamptons and Malibu, for example, are highly-sought after with properties commanding prices from $100,000 to $1 million or more. Artists and entertainers may rent while they are renovating, filming a movie or participating in a show. Some lease luxury estates for recording projects.

In Joshua Tree, Calif., movie producer and artist Chris Hanley said his Invisible House, currently listed for $18 million, became a kind of “cultural icon” that he and his wife, Roberta Hanley, rented out to singers Diplo and Demi Lovato. Diplo did not respond to requests for comment. Ms. Lovato declined to comment.

Completed in 2019, the 5,500-square-foot house is 225 feet long with a reflective glass exterior that mirrors the landscape. Mr. Hanley said at first, the couple opened up the house to family and friends from the art and entertainment world. They also rented it out for music and fashion productions, starting at $10,000 a day. “It started to add up,” he said.

In 2020, the Hanleys put the home on Airbnb for $2,500 a night. In 2021, Airbnb CEO Brian Chesky stayed there, said Mr. Hanley, adding, “We threw in champagne.” Mr. Chesky didn’t respond to a request for comment.

In Palm Desert, Calif., real-estate investor Glen Heggstad said he got into the rental business after a location scout left her business card at his front gate. Since then, Mr. Heggstad, a Brazilian jujitsu instructor and former member of the Hells Angels motorcycle club, has rented his 4,300-square-foot contemporary villa for up to $20,000 a night during Coachella. Set on nearly 2 acres, with an infinity-edged pool and helicopter landing pad, the house has been used by singers Billie Eilish and Lizzo, who posted photos of herself by the pool on social media. Neither singer responded to a request for comment.

Mr. Heggstad said he’s also rented the house for brunches, car photo shoots and cannabis industry events. Recently, he decided to pull back from short-term rentals and weddings. “They get drunk and the in-laws fight,” he said, and because he has been burned too many times. A few years ago, he said, a guest left the house in disarray after a party and he had to fish 100 cigarette butts out of the pool.

Short of property damage, short-term rentals at the highest price points come with other quirks, including secrecy around the client’s identity, said Neal Norman of Hawai’i Life. “Typically you don’t get a straight call from those guys. It’s an assistant or travel agent. They open with, ‘I have a VIP,’ ” he said.

There is also typically very little lead time involved. “Sometimes it’s a Thursday and they want to be there for the weekend,” said Chris Cortazzo of Compass. That leaves little time to show the house, run security checks, clean the property and clear out personal belongings. “People don’t want to move in and have someone’s toothbrush there so everything has to be cleared out,” he said.

These VIPs are known to bring their preferred brand of bottled water and linens, along with flowers, air purifiers and home scents, said Mr. Norman, who said he once had a client who had their bed shipped to Hawaii for vacation.

In general, the ultra luxury rental market is as strong as it has ever been, said Tal Alexander of real-estate brokerage Official, which has agents in New York, Florida and California. In the past few months, Mr. Alexander said he’s rented five homes in New York City for $50,000 a month or more. Wealthy renters are willing to pay up for furnished homes in prime buildings and locations, he said.

Some property owners like to know their investments are generating income if they have moved or left town. “They don’t need the apartment sitting empty. It does them no good,” Mr. Alexander said.

During the 2017 Super Bowl, for example, pop star Lady Gaga stayed in a custom home in Houston after the owners relocated, said Marie Sims, whose family company, Sims Luxury Builders, completed the home around 2007. The roughly 9,700-square-foot house has five bedrooms and lots of outdoor space, Ms. Sims said. Last asking $6.5 million, the house sold in 2018, records show. Lady Gaga didn’t respond to requests for comment.

In addition to the Super Bowl, marquee events such as Art Basel and Coachella drive demand for ultra-luxe rentals, and in some cities boutique property managers and rental firms cater to the periodic influx of renters.

In Las Vegas, Bryan Ercolano, founder of vacation rental firm TurnKey Pads, said he and his business partners own a $12.5 million penthouse that they rent out for $5,000 a night during the week and $10,000 a night on weekends when there are big fights or football games. In the past, Mr. Ercolano said they have rented the 7,000-square-foot residence with four bedrooms and 10,000 square feet of terrace space to players from the Kansas City Chiefs and to Usher, who hosted an afterparty for his birthday party in the penthouse one year. The singer didn’t respond to a request for comment. Mr. Ercolano said his business is largely word-of-mouth, with referrals from casino hosts, club promoters and others. “Vegas is a very networky town,” he said. “It’s kind of who you know.”

In Georgia, the Augusta National Golf Club and Augusta Metro Chamber of Commerce partnered 50 years ago to form a rental agency—the Masters Housing Bureau—to facilitate home rentals during the Masters tournament. This year’s suggested rate for a five-bedroom house is $18,000 to $22,000 for four nights and $20,000 to $25,000 or more for seven nights, according to the bureau’s website.

For the past few years, golfer Jordan Spieth has had two houses at the Masters. He rents a “sleeping house” for himself and his family, said his agent, Jay Danzi of WME Sports, and WME rents a second “entertainment house” close by where a chef cooks meals daily. In the entertainment house, “there’s no golf on the television” said Mr. Danzi, who said his team works with the Masters Housing Bureau or WME’s internal partners to find housing. Other than the Masters, Mr. Danzi said Mr. Spieth has been traveling with his wife, baby and dog in an RV.

Patrick Michael, founder and CEO of LA Estate Rentals and Brokerage, said he got into the luxury rental business in 2008 to help real-estate developers lease unsold spec homes. His company also provides concierge services such as car rentals, personal training, restaurant reservations or even tickets to Disneyland. “Very wealthy people want to pick up the phone and say, ‘I need a masseuse at 5 p.m.,’ or ‘Can you send a cleaner tomorrow at 2 p.m.’” he said. His company currently has about 85 listings on the market, and Mr. Michael said a chunk of his business comes from athletes, who rent homes when they are in town for training or after being recently traded.

In Paradise Valley, Mr. Malaspinas said he hasn’t moved back into the house where Rihanna stayed because he’s not sure what his plans are. Since the Super Bowl, people have offered him “crazy amounts of money” to sell.

In retrospect, Mr. Malaspinas thinks he could have rented the home for even more money, though at the time he said he didn’t want to push it. “The last thing you want to be is too greedy,” he said, “and then you miss the whole thing.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

An imposing Scottish castle that has only had four owners in its more than 200-year existence has hit the market asking for offers above £8 million (US$10.45 million).

Seton Hall, as it’s known, was built in 1789 by architect Robert Adam using stone from Seton Palace, the since-demolished property that was considered to be Mary Queen of Scots’s preferred retreat, according to Savills, which brought the home to the market last month.

“Seton is an absolutely magical castle—from the moment you approach, to the inner courtyard, to the quality of interior design,” said listing agent Jessica Gwyn.

The castle—roughly 10 miles from Edinburgh—remained in the same family from the late 18th century until 2003, which “served to freeze Seton in a protective time warp,” according to the listing.

Castellated features such as slit windows and turrets can be seen from the outside, and inside “secret staircases, curved doors, curved walls, arched windows and hidden doors add to the charming sophistication of the architecture and design,” the listing said.

But the castle has since been refurbished to meet modern standards, and now also boasts a helipad, a full security system, a gym, a playroom, a silk-lined dining room and a billiards room.

The restoration project saw a team of expert stonemasons rebuild the castle’s many chimneys, turrets and rooftop parapets. Plus, ironwork was restored, the dumbwaiter reinstated and the 10,000-bottle wine cellar was brought back to life, Savills said.

Alongside the seven-bedroom home that forms the core of the castle, there are additional residences across the property, including Darnley Cottage and Bothwell Cottage—named after Mary Queen of Scots’s husbands.

The castle’s stables have been refurbished, too, and are adjacent to the “Stable Bar,” the castle’s private pub.

The owner—who Mansion Global couldn’t identify—“feels their time as custodian of this outstanding building has come to a natural conclusion and it is time for this historic home to be loved and cared for by someone else,” Gwyn said.

This article first appeared on Mansion Global

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

New amenities, from a gym to a movie theatre, and a good commuter location filled this suburban office tower

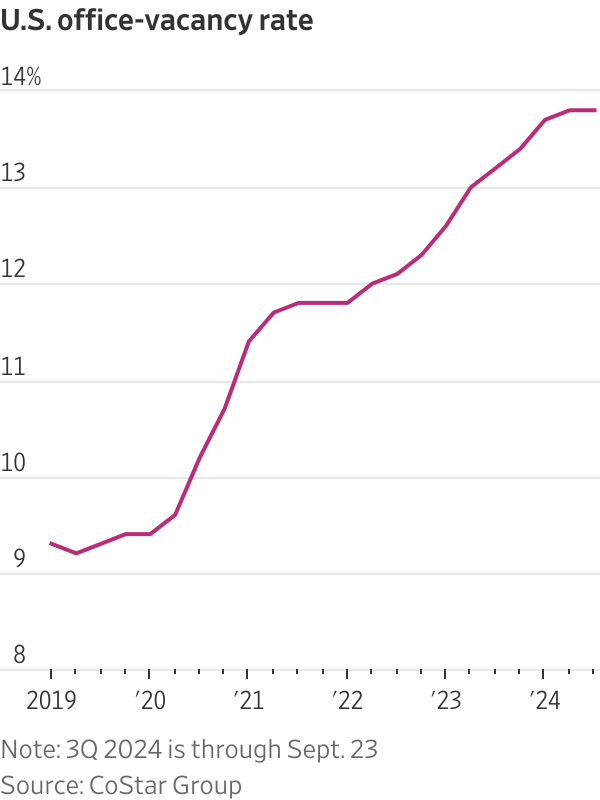

Manhattan’s office-vacancy rate climbed to more than 15% this year, a record high. About 80 miles away in Philadelphia, occupancy also is at historically low levels. But a 24-storey office tower located between the two cities has more than doubled its occupancy over the past five years.

Developer American Equity Partners bought the New Jersey office tower, known as 1 Tower Center, for $38 million in 2019. At the time, the 40-year-old building felt dated. It had no gym, tenant lounge or car-charging stations. The low price enabled the firm to spend more than $20 million overhauling and luring tenants to the 435,000-square-foot property.

Now, the suburban building is nearly fully leased at competitive rents, mopping up tenants from other buildings after the owner added a new lobby, movie theatre, golf simulator, fitness centre and a tenant lounge featuring arcade games and ping-pong tables.

“Our tenants told us what they needed in order to fill up their offices,” said David Elkouby , a co-founder of American Equity, which owns about 4 million square feet of New Jersey office space.

The new owner also liked the location at the 14-acre hotel and conference-centre complex, off the New Jersey Turnpike’s Exit 9 in East Brunswick. The site is a relatively short commute for millions of workers in central New Jersey and is passed by 160,000 vehicles daily.

The property’s turnaround shows how office buildings can thrive even during dismal times for most of the U.S. office market, where vacancies remain much higher than pre pandemic.

Success often requires an ideal location—one that shortens the commute time of employees used to working at home—and the sort of upgrades and amenities companies say are necessary to lure employees back to the workspace.

One Vanderbilt, a deluxe office tower with a Michelin-star chef’s restaurant and plenty of outdoor space in Midtown Manhattan, is fully leased while charging some of the highest rents in the country.

The 11-story Entrada office building, in Culver City, Calif., is making the same formula work on the other coast. It opened two years ago with a sky deck, concierge services and recessed balconies. A restaurant is in the works. The owner said this month that it has signed three of the largest leases in the Los Angeles area this year.

1 Tower Center shows how the strategy can be effective even in less glamorous suburban locations. The tower is prospering while neighbouring buildings that are harder to reach with outdated facilities and poor food options struggle to fill desks even at reduced rents.

The recent interest-rate cut and reports that some big companies such as Amazon .com are re-instituting a five-day office workweek have raised hopes that the office market might be getting closer to turning.

But with more than 900 million square feet of vacant space nationwide and remote work still weighing on office demand, more creditors are seizing properties that are in default on debt payments.

Rates are still much higher than they were when tens of billions of dollars of office loans were made, and much of that debt is now maturing. The recent interest-rate cut doesn’t mean “office-sector woes are now over,” said Ermengarde Jabir, director of economic research for Moody’s commercial real-estate division.

Lenders are dumping distressed properties at steep discounts to what the buildings were worth before the pandemic. Some buyers are trying to compete simply by cutting their rents.

“Most owners don’t have the wherewithal to do what is required,” said Jamie Drummond, the Newmark senior managing director who is 1 Tower Center’s leasing agent. “Owners positioned to highly amenitise their buildings are the ones who are successful.”

HCLTech, a global technology company, illustrates the appeal. It greatly expanded its presence in New Jersey by moving this year to a 40,000-square-foot space designed for its East Coast headquarters at 1 Tower Center.

The India-based company said it was drawn to the building’s amenities and design. That made possible a variety of workspaces for employees, from quiet nooks to an artificial-intelligence lab. “You can’t just open an office and expect [employees] to be there,” said Meenakshi Benjwal , HCLTech’s head of Americas marketing.

HCLTech also liked the location near the homes of its employees and clients in the pharmaceutical, financial-services and other businesses.

Finally, it didn’t hurt that the building is a short drive from nearby MetLife Stadium. The company has a 75-person suite on the 50 yard line where it entertains clients at concerts and National Football League games.

“All of our clients love to fly from distant locations to experience the suite and stadium,” Benjwal said.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

JMJ Group Holding also signed a non-binding Memorandum of Understanding (MoU) with Ennismore

JMJ Group Holding, in partnership with Qetaifan Projects, has officially launched SLS Doha The Grove Residences, an ultra-luxury residential development, at Cityscape Qatar 2024. Designed by the internationally acclaimed Zaha Hadid Architects and situated on the exclusive Qetaifan Island North, SLS Doha The Grove Residences aspires to redefine innovation, sustainability, and luxury living in Qatar.

Real estate investors and enthusiasts had the opportunity to explore SLS Doha The Grove Residences at JMJ Group Holding’s booth, part of the Qetaifan Projects pavilion at the exhibition. Guided by JMJ’s real estate advisors, visitors learned about the project’s standout features, including the spectacular design, smart home integrations, and sustainability initiatives. Visitors also explored investment incentives, such as flexible payment plans and rental assistance, and discovered how SLS Doha The Grove Residences offers a unique blend of luxury living and strong investment potential through interactive displays and models.

JMJ Group Holding also signed a non-binding Memorandum of Understanding (MoU) with Ennismore, the fastest-growing lifestyle and leisure hospitality company, to bring to life the branded residence, SLS Doha The Grove Residences. This potential collaboration enhances the project’s exclusivity, aligning SLS Doha The Grove Residences with SLS’s inimitable brand of immersive extravagance. This collaboration ensures that, alongside the exclusivity, privacy and carefully curated services associated with a branded residence, owners will also have access to an enviable array of dedicated residential amenities, all managed by Ennismore and SLS.

On the occasion, Sheikh Jabor bin Mansour bin Jabor bin Jassim Al Thani, Chairman of JMJ Group Holding, commented: “SLS Doha The Grove Residences embodies our commitment to crafting residences that harmonize luxury, innovation, and sustainability. This project sets a new benchmark for high-end living, offering exceptional design and world-class amenities. We invite investors to explore the unique opportunities SLS Doha The Grove Residences presents, as it promises not just a home but a premium lifestyle investment.”

He continued: “Signing an MOU with Ennismore further enhances this exclusive experience. A name synonymous with world-class hospitality, SLS’s expertise will ensure that residents at SLS Doha The Grove Residences enjoy unparalleled service that truly redefines luxury in Qatar.”.

Chadi Farhat, Brand COO of SLS & Head of Asia Pacific & Middle East at Ennismore, added: “We are honored to be part of SLS Doha The Grove Residences, a project that exemplifies the power of collaboration and forward-thinking design. This partnership will mark an important step for our SLS brand as we expand into the Qatari market, where the demand for high-end, innovative living is growing. This project aligns perfectly with our commitment to creating extraordinary experiences, and we see great potential in contributing to Qatar’s dynamic luxury real estate sector. We look forward to delivering our renowned service and hospitality to create an exceptional living experience for residents wishing to say farewell to the ordinary.”

Set to infuse breathtaking experiences with signature mischievous wit and a playful ambience, SLS Doha The Grove Residences Doha is comprised of 293 lavishly designed residences, from one to four-bedroom apartments, each offering panoramic views of the Lusail skyline and access to an array of premium amenities. Residents will benefit from a waterfront promenade, complete with exclusive boutiques, cafes, and restaurants, as well as access to infinity pools, a state-of-the-art wellness center, a private members’ club, and a marina. With its striking design and cutting-edge facilities, SLS Doha The Grove Residences seamlessly fuses modern architecture with environmental responsibility to deliver an exceptional living experience. Flexible pricing options are available, making SLS Doha The Grove Residences accessible to a range of buyers seeking luxury living in one of Qatar’s most prestigious locations.

Sheikh Nasser Bin Abdulrahman Al Thani, Chairman and Managing Director of Qetaifan Projects, stated, “This partnership with JMJ Group Holding is part of Qetaifan Projects’ ongoing successful collaborations locally, regionally, and internationally. Our partnership with JMJ Group Holding reflects Qetaifan Island North’s role as an attractive investment environment. We are excited to support SLS Doha The Grove Residences, a visionary project designed by Zaha Hadid Architects that caters to the market with more options and enriches Qatar’s positioning as a high-end, sustainable living leader.”

Juan Ignacio Aranguren, Associate Director at Zaha Hadid Architects, stated: “Innovation has always been at the heart of Zaha Hadid Architects’ approach to design. SLS Doha The Grove Residences project exemplifies how architecture can be a catalyst for creating vibrant, resilient communities.”

As SLS Doha The Grove Residences takes its place as a defining landmark on Qetaifan Island North, it sets a new benchmark for luxury living in Qatar. JMJ Group Holding’s collaboration with Zaha Hadid Architects and Ennismore not only elevates the project but also reflects a bold vision for the future of real estate in the region. With its innovative design, sustainable features, and world-class amenities, SLS Doha The Grove Residences is set to redefine the standard of modern living.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

Setting new standards for excellence fashioning homes that cater for every lifestyle

ONE Development has appointed AE7, a globally renowned architectural and engineering firm, as the consultant for its AED 2 billion flagship project in Dubai’s City of Arabia. AE7 will be responsible for the project’s master planning, architecture, design, AI innovation integration, and development management. Their role also includes overseeing engineering, interior design, landscape architecture, project management, and implementing sustainability practices. This highly anticipated development is expected to be unveiled soon, marking a significant step for ONE Development.

AE7 is a global top 50 multi-billion-dollar Building, Design and Construction group with a proven track-record of excellence. Established in 2009 by seven internationally renowned American design professionals with over 40 years’ experience designing and creating destinations in the USA, Asia and the Middle East with almost 20 years of experience, the company has grown into a full-service architectural group providing specialty expertise through six offices worldwide, which has designed and managed over US$40 billions of design work over the past five years.

Ali Al Gebely, ONE Development Founder & Chairman, called the appointment a collaborative milestone between two like-minded organizations, saying: “We are in the process of redefining urban living through the integration of cutting-edge AI and its technology, and our City of Arabia project is a flagship enterprise that requires the strength and resilience of a world-leading consultancy that shares our aspirations, and selecting AE7 to be the project consultant aligns with our vision to have a strong world-renowned multi-disciplinary design firm on board. ONE Development and AE7 will offer our community residents a high-tech lifestyle that not only enhances their convenience by enabling them to engage and connect with their devices, homes, surroundings and facilities for a better life, but also upholds our joint commitment to environmental responsibility. From smart home systems to energy-efficient solutions, this development is setting new benchmarks for sustainable living in Dubai.”

Tomas Gulisek, Principal and Design Director at AE7, added: “AE7 is a global design firm with a reputation for breaking traditional boundaries through innovative solutions and comprehensive services. Our partnership with ONE Development on this prestigious project will enable us to jointly reinforce our vision of how a collaboration between two dedicated organizations can result in achieving innovative design solutions that do more than just provide accommodation; we are creating spaces that foster a sense of community while respecting residents’ privacy and honoring their individuality. It’s about balancing innovation with functionality, where design elevates everyday experiences.”

ONE Development is transforming the real estate landscape, setting new standards for excellence fashioning homes that cater for every lifestyle.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Violet Tower will stand as a major addition to JVC’s rapidly evolving skyline

The Violet Tower, a prestigious new residential project by Dubai Investments in the heart of Jumeirah Village Circle (JVC), is making remarkable progress. With its foundation work nearing completion, and 99.3% of the piling work already finished, this AED 300 million development is poised to become a standout feature in JVC’s evolving skyline. The project, led by top-tier construction firms, aims to deliver contemporary urban living spaces designed for modern residents.

Having logged approximately 58,000 working hours to date, the project remains on track for key milestones. The enabling works are expected to be completed by the fourth quarter of 2024, and the entire project is projected to be ready for occupancy by Q4 2026. Notably, the construction process has upheld an impeccable safety record, with no reported incidents, highlighting the efficiency and commitment of the team involved.

Strategic Location and Cutting-Edge Design

Positioned in the heart of JVC, Violet Tower is designed to meet the growing demand for modern, well-planned residential spaces. The development will offer 287 units spread across 27 floors, ranging from studios to two-bedroom apartments. Each unit has been meticulously planned to maximize space efficiency and cater to contemporary living standards, making it an attractive option for both professionals and families seeking quality homes in a vibrant community.

In addition to its strategic location, Violet Tower, by Dubai Investments, is packed with innovative features. A distinctive steel canopy roof will crown the building, giving it a unique architectural identity. The entrance area will be multifunctional, featuring a coworking station, perfect for the growing number of remote workers in the city. Moreover, the building will offer 24/7 security, ensuring a safe and comfortable living environment for all residents.

Strong Collaborations Ensuring Quality

The success of Violet Tower is backed by partnerships with some of the region’s most reputable contractors and specialists. Al Ghurair Contracting is overseeing the main construction works, ensuring that the development adheres to the highest standards of craftsmanship and durability. Tech Foundation is managing the enabling works, while the Arab Centre has been entrusted with pile testing, guaranteeing that the project meets rigorous quality benchmarks from the ground up.

A Vision for the Future

Upon its anticipated completion in late 2026, Violet Tower will stand as a major addition to JVC’s rapidly evolving skyline. It promises to offer a unique blend of contemporary living, thoughtful design, and community integration. By addressing the rising demand for modern urban homes, Violet Tower aims to provide its residents with a lifestyle that balances convenience, comfort, and cutting-edge features.

As Jumeirah Village Circle continues to grow as one of Dubai’s premier residential hubs, Violet Tower is poised to become a key player in the district’s transformation. With its forward-thinking design, top-tier amenities, and prime location, this development is not just about building homes—it’s about shaping the future of living in Dubai.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Stromek’s scope of work will focus on ensuring the stability and sustainability of the development’s foundational elements.

Dar Global has awarded the contract for shoring, excavation, and piling works on its prestigious ‘The Astera, Interiors by Aston Martin‘ project to Stromek Emirates Foundations. Recognized for their expertise in high-quality foundational engineering, Stromek Emirates has a strong reputation for delivering exceptional construction services across the region.

With a Gross Development Value of Dh900 million (£200 million), ‘The Astera’ marks Aston Martin‘s first venture into interior design for a real estate development in the Middle East. Set on the picturesque Al Marjan Island in Ras Al Khaimah, the project will feature a mix of luxury apartments and villas, blending Aston Martin’s signature design aesthetics with Dar Global’s commitment to offering exceptional living experiences.

Stromek’s scope of work will focus on ensuring the stability and sustainability of the development’s foundational elements. The firm’s expertise will play a critical role in preparing the site for construction, ensuring that the project can proceed smoothly while adhering to the highest standards of safety and precision.

“We are thrilled to have Stromek on board for this pivotal phase of ‘The Astera’ project. Their proven track record of excellence in shoring, excavation, and piling work perfectly aligns with the standards we uphold at Dar Global,” said Ziad El Chaar, CEO of Dar Global. “This collaboration underscores our commitment to working with the best in the industry to deliver world-class luxury developments that will leave a lasting impact.”

The shoring, excavation, and piling works are expected to commence immediately, laying the foundation for what will soon be a landmark development on the Arabian Sea. Stromek’s appointment is a key milestone in the progress of ‘The Astera,’ a development that will combine iconic British design with cutting-edge engineering and craftsmanship, elevating the living experience for future residents.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

These results emphasise the transformative impact of The Ellinikon project

LAMDA Development announced remarkable financial results for H1 2023. Driven by the record-breaking profitability of Malls and Marinas, alongside rapid progress across the trailblazing Ellinikon project on the Athens Riviera, consolidated operating profit has increased by 90% year-on-year to reach €72 million.

This impressive figure includes a 30% increase in operating profitability for Malls at €41 million and a 6% increase for Marinas at €9 million. To date, The Ellinikon has generated €366 million in property sales, fueling development across key assets, including significant milestones for Riviera Tower, The Cove Residences, and Vouliagmenis Mall.

These results emphasize the transformative impact of The Ellinikon project, a 15-minute paradigm city presenting a contemporary way of life and a new landmark for 21st-century Greece. Redefining the skyline of Athens, this development features luxury residences, world-class marinas, and state-of-the-art retail spaces to produce premium opportunities for international investors, particularly those in the GCC looking to diversify into European real estate.

“In Athens, we’re creating a place that stands for progress, where lives can be truly well lived in an amazing setting. And where new generations will find greater opportunities,” remarked Odisseas Athanasiou, CEO of LAMDA Development S.A. “The Ellinikon will reposition the country on the international investment map leading to an increased tourism footprint and a significantly healthier economy.”

The Ellinikon is positioned to become a hub for luxury living and high-end commercial activity with direct appeal to GCC investors seeking to expand their international portfolio. The project has already attracted high levels of interest, with huge demand for presales in waterfront residential properties such as Riviera Tower and The Cove Residences.

Exceptional property sales have empowered rapid reinvestment to facilitate pushing forward with The Ellinikon infrastructure. In addition to the residential towers and Vouliagmenis Mall—where 57% of the leasable area is now subject to tenant agreements—this has allowed accelerated progress including the completion of construction for the AMEA Building Complex among other core works.

With the luxury real estate market in Europe attracting heightened interest from Gulf investors, The Ellinikon offers a unique combination of lifestyle, location, and long-term value. The success of the project underscores LAMDA Development’s commitment to delivering world-class properties that resonate with high-net-worth individuals and institutional investors.

Key Highlights:

- Consolidated Operating Profit: €72 million (90% increase YoY)

- Malls Operating Profitability: €41 million (30% increase)

- Marinas Operating Profitability: €9 million (6% increase)

- Total Property Sales from The Ellinikon: €366 million

- Significant Demand for Waterfront Properties

Future Outlook

The ongoing developments at The Ellinikon project indicate a strong future trajectory with further phases planned. This includes luxury residential units and commercial spaces that cater specifically to high-net-worth individuals from the GCC region.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Further project details will be announced before end of the year.

Ohana Development, a leading luxury real estate developer, has revealed plans to launch a new branded residence project in partnership with a world-renowned luxury brand. The exclusive development, located in Abu Dhabi, is designed to elevate the standards of luxury beachfront living in the UAE.

The official launch is scheduled for the first quarter of 2025, marking another addition to Ohana Development’s collection of branded residences, following the success of its Elie Saab Waterfront by Ohana project.

Engineer Husein Salem, CEO of Ohana Development said, “We are thrilled to partner with one of the world’s most renowned luxury brands, bringing unparalleled beachfront living experiences to Abu Dhabi’s bustling real estate sector. This project will combine elegant design with incredible surroundings, offering an exclusive lifestyle for residents. We look forward to sharing more details in the coming weeks.”

Ohana Development is renowned for its portfolio of world-class waterfront properties, such as the prestigious Ohana Villas, featuring exquisitely crafted pieces from the ELIE SAAB Maison collection, Ohana Hills, a residential community with breathtaking views, Ohana by the Sea, that features luxury villas, as well as the Elie Saab Waterfront by Ohana. These developments exemplify the company’s commitment to creating sophisticated, unique spaces that offer exceptional lifestyle experiences across the UAE and beyond.

Further project details will be announced before end of the year.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

South Garden is the latest addition to Wasl Gate master development

Wasl, a leader in Dubai’s real estate development and management, has announced the complete sell-out of all units in its latest project, South Garden, within just 48 hours. South Garden, a freehold residential development, is part of the larger Wasl Gate master development located in Jebel Ali.

The project benefits from its strategic location, close to Festival Plaza, which houses popular stores such as IKEA and ACE, along with other retail destinations. It is well-connected to Dubai via easy access to Sheikh Zayed Road and the Energy metro station. South Garden also provides direct access to Al Maktoum International Airport, Expo City, and key free zones, including Jebel Ali Free Zone (JAFZA), Dubai Multi Commodities Center, Dubai Internet City, Dubai World Central, and Dubai Parks and Resorts.

South Garden offers 768 residential units to suit various budgets and lifestyles. Studios starting from 399 to 508 sq. ft., one-bedroom units ranging from 824 to 1,086 sq. ft, two-bedroom units starting from 1,153 to 1,299 sq. ft., as well as three-bedroom apartments from 1,744 to 2,127 sq. ft.

Mohamed Al Bahar, Director of Business Development at Wasl, said: “We are delighted to witness this overwhelming response to the launch from investors and end users. This highlights the strength of Dubai’s real estate sector and reflects the increasing demand for well-designed and well-priced residential projects.”

South Garden is the latest addition to the Wasl Gate master development. Wasl Gate includes several other residential projects alongside South Garden, such as The Nook, Gardenia Townhomes, and Hillside Residences. The Nook offers modern apartments of various sizes, while Gardenia Townhomes features spacious three- and four-bedroom townhouses, and Hillside Residences offers a variety of modern and unique apartments with spacious living areas.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Redefining Urban Living with Innovation, Sustainability, and Exceptional Amenities.

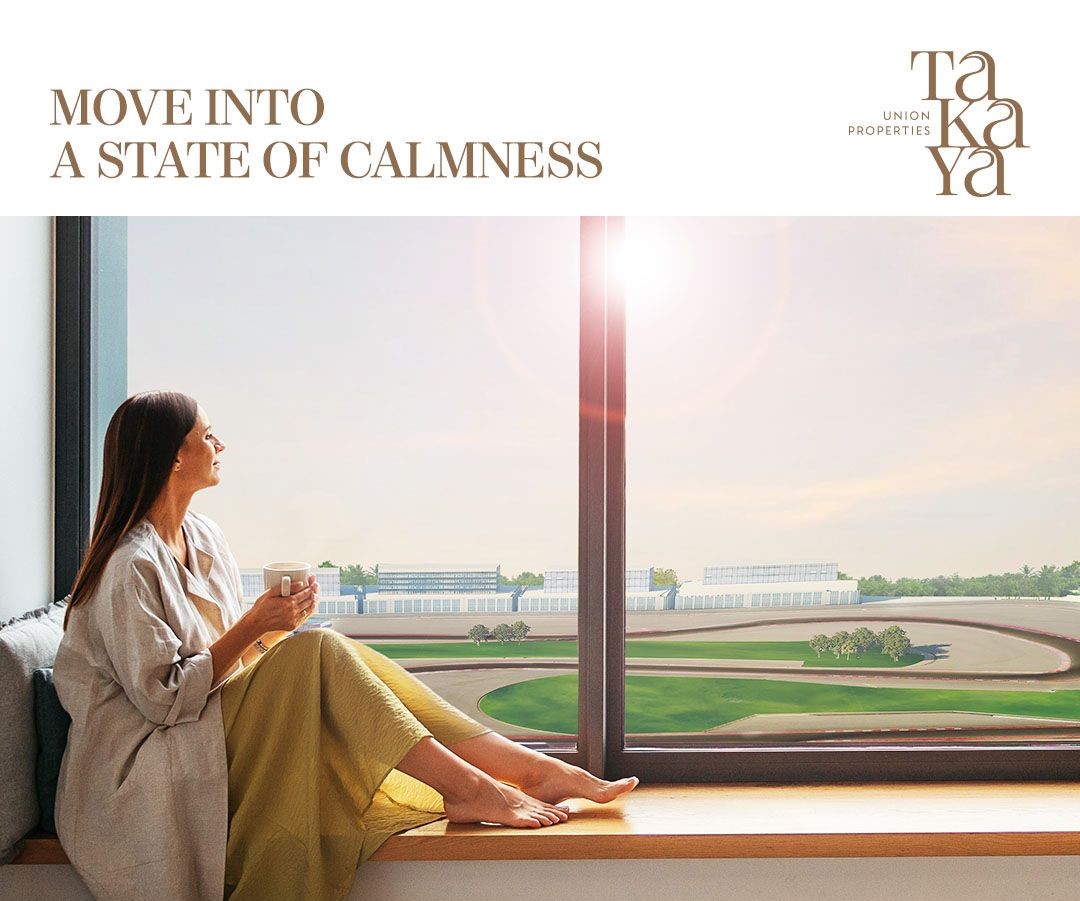

Union Properties PJSC’ has officially launched its new ‘Takaya’ project in Dubai Motor City, the Company’s latest milestone in Dubai’s Real Estate landscape designed to redefine sophisticated urban living. Takaya sets a new standard in the mid-to-high range segment, promising exceptional living experiences for its residents.

The launching ceremony was held at the Ritz Carlton DIFC, in the presence of Eng. Amer Khansaheb, Chief Executive Officer and Board Member, Union Properties. During the ceremony, Eng. Khansaheb highlighted how the project demonstrates the Company’s steadfast dedication to advancing Dubai’s Real Estate sector. The Takaya project aims to enrich the offerings provided within the Motor City’s master community, while also delivering novel and distinctive amenities that will attract investors and fulfil diverse customer needs.

The mix-use project, Takaya is constructed over a plot area spanning 436,175 sq. ft, overlooking the Dubai Autodrome, along with a stunning 500-metre retail boulevard. It comprises three residential towers with 744 affordable luxurious apartments. It also offers competitive unit sizes (studio, 1, 2, 3 BR) and pricing, making it a compelling market choice., along with penthouses, townhouses, villas, and commercial space. In contrast to other properties in the market, Takaya offers spacious living areas with attractive, post-handover payment plan. From sleek finishes to state-of-the-art amenities, the development, which is valued at approximately AED 2 billion, is set to provide a prestigious living experience for residents.

Commenting on the official launch, Eng. Amer Khansaheb stated: “We are thrilled to officially launch the eagerly awaited ‘Takaya’ project in Dubai Motor City, which reflects our unwavering commitment to innovation, sustainability and excellence. At ‘Union Properties’, we are driven by our mission of creating exceptional living experiences for customers through our several unique projects. The launch of ‘Takaya’ project is in line with our long-term growth objectives, further reinforcing our commitment to delivering superior quality and unparalleled value for customers. Our overarching objective is to create a vibrant residential community overlooking the one and only one Dubai Autodrome, which will redefine the standards of modern urban living.”

“By leveraging our extensive industry expertise and market insights, we look forward to capitalizing on new opportunities in the Real Estate market and future-ready liveable environments. The market has witnessed significant growth over the previous years, making the Motor City a global hub for property investors and homebuyers. The sector is expected to continue expanding in the coming years, further strengthening its appeal within the broader UAE market.” Eng. Khansaheb added.

Developments by Union Properties greatly contribute to Motor City market value and status by complementing current market offerings. According to DLD data, Motor City has experienced a sharp rise in Real Estate transactions and a notable acceleration of market momentum over the last three quarters. Recently launched off-plan projects in Motor City have experienced strong demand, which has a positive impact on the appreciation of property values.

Moreover, the UAE’s Real Estate market is anticipated to continue its strong performance in the coming years with projections pointing towards an astounding value of USD 0.7 trillion by 2024. Between 2024 and 2028, an annual growth rate of 3.03 per cent is expected, resulting in a market volume of USD 0.80 trillion by the latter year.

The Takaya development has been crafted with meticulous precision, ensuring maximum functionality and comfort and attention to detail meeting the highest standards of quality for residents. It is integrated with innovative smart building management systems that employ cutting-edge technologies to reduce energy consumption and operational costs. Upscale features of the development include – outdoor sports courtyards, leisure pool, kid’s pool, jogging track, kids play area, multipurpose rooms at each tower, an arcade lounge, co-working spaces, cinema/AV room, and more. Furthermore, the ground floor of each tower hosts a mix of retail outlets, food and beverage establishments, as well as other services. The development also features 150 parking spaces equipped with EV chargers.

With sustainability as one of its prime focus, ‘Union Properties’ is contributing towards mitigating the challenges posed by climate change and other environmental hazards. The integration of sustainable materials and designs ensures longevity, lowers environmental impact and reduces utility costs of the development. Takaya has been designed with high-performance facades that exceed green building guidelines and makes use of a large plot of approximately 450,000 square feet to create parks, a large central garden and other green spaces. Along with sustainability, the Company also prioritizes healthy living, and in this regard, Takaya offers sports facilities such as jogging tracks, padel, and basketball courts, lap pool and squash court, in an urban environment where open spaces are scarce, which will be a key selling point for the coming years.

Takaya’s unbeatable launch payment plan, which is 60 per cent due within three years of construction and 40 per cent due in three years post-handover, provides investors and end users with further cash flow flexibility. Union Properties’ efforts to reduce operational costs also provide the residents with a sustainable savings option, that supports value appreciation with time. The handover date for this flagship project is expected to be in Q4 2027. Looking ahead, ‘Union Properties’ continues to be driven by its mission to create unique and remarkable residential developments, as well as reshape the future of urban living. The company aims to accomplish several ambitious objectives, such as the launch of AED 6 billion projects just in the next 18 months. With a strategic vision and a strong commitment to excellence, ‘Union Properties’ is well-positioned to leverage new opportunities and play a pivotal role in Dubai’s thriving real estate sector by adding to the city’s extensive property portfolio.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

For every hotel spotlighting its historical bona fides, there are many that didn’t stand the test of time. Here, some of the most infamous.

Many luxury hotels only build on their gilded reputations with each passing decade. But others are less fortunate. Here are five long-gone grandes dames that fell from grace—and one that persists, but in a significantly diminished form.

The Proto-Marmont |

The Garden of Allah, Los Angeles

A magnet for celebrities, the Garden of Allah was once the scene-making equivalent of today’s Chateau Marmont. Frank Sinatra and Ava Gardner’s affair allegedly started there and Humphrey Bogart lived in one of its bungalows for a time.

Crimean expat Alla Nazimova leased a grand home in Hollywood after World War I, but soon turned it into a hotel, where she prioritised glamorous clientele. Others risked being ejected by guards and a fearsome dog dubbed the Hound of the Baskervilles. Demolished in the 1950s, the site’s now a parking lot.

The Failed Follow-Up |

Hotel Astor, New York City

The Astor family hoped to repeat their success when they opened this sequel to their megahit Waldorf Astoria hotel in 1904. It became an anchor of the nascent Theater District, buzzy (and naughty) enough to inspire Cole Porter to write in “High Society”: “Have you heard that Mimsie Starr…got pinched in the Astor Bar?”

That bar soon gained another reputation. “Gentlemen who preferred the company of other gentlemen would meet in a certain section of the bar,” said travel expert Henry Harteveldt of consulting firm Atmosphere Research. By the 1960s, the hotel had lost its lustre and was demolished; the 54-storey One Astor Plaza skyscraper was built in its place.

The Island Playground |

Santa Carolina Hotel, Bazaruto Archipelago, Mozambique

In the 1950s, colonial officers around Africa treated Mozambique as an off-duty playground. They flocked, in particular, to the Santa Carolina, a five-star hotel on a gorgeous archipelago off the country’s southern coast.

Run by a Portuguese businessman and his wife, the resort included an airstrip that ferried visitors in and out. Ask locals why the place was eventually reduced to rubble, and some whisper that the couple were cursed—and that’s why no one wanted to take over when the business collapsed in the ’70s. Today, seeing the abandoned, crumbled ruins and murals bleached by the sun, it’s hard to dismiss their superstitions entirely.

The Tourism Gimmick |

Bali Hai Raiatea, French Polynesia

The overwater bungalow, a shorthand for barefoot luxury around the world, began in French Polynesia—but not with the locals. Instead, it was a marketing gimmick cooked up by a trio of rascally Americans. They moved to French Polynesia in the late 1950s, and soon tried to capitalise on the newly built international airport and a looming tourism boom.

That proved difficult because their five-room hotel on the island of Raiatea lacked a beach. They devised a fix: building rooms on pontoons above the water. They were an instant phenomenon, spreading around the islands and the world—per fan site OverwaterBungalows.net , there are now more than 9,000 worldwide, from the Maldives to Mexico. That first property, though, is no more.

The New England Holdout |

Poland Springs Resort, Poland, Maine

The Ricker family started out as innkeepers, running a stagecoach stop in Maine in the 1790s. When Hiram Ricker took over the operation, the family expanded into the business by which it would make its fortune: water. Thanks to savvy marketing, by the 1870s, doctors were prescribing Poland Spring mineral water and die-hards were making pilgrimages to the source.

The Rickers opened the Poland Spring House in 1876, and eventually expanded it to include one of the earliest resort-based golf courses in the country, a barber shop, dance studio and music hall. By the turn of the century, it was among the most glamorous resort complexes in New England.

Mismanagement eventually forced its sale in 1962, and both the water operation and hospitality holdings went through several owners and operators. While the water venture retains its prominence, the hotel has weathered less well, becoming a pleasant—but far from luxurious—mid-market resort. Former NYU hospitality professor Bjorn Hanson says attempts at upgrading over the decades have been futile. “I was a consultant to a developer in the 1970s to return the resort to its ‘former glory,’ but it never happened.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Chinese consumers watching the value of their homes fall are losing the confidence to spend on designer goods

How closely is demand for $3,000 handbags tied to home prices in China? Quite closely, it turns out, which is unfortunate for luxury brands.

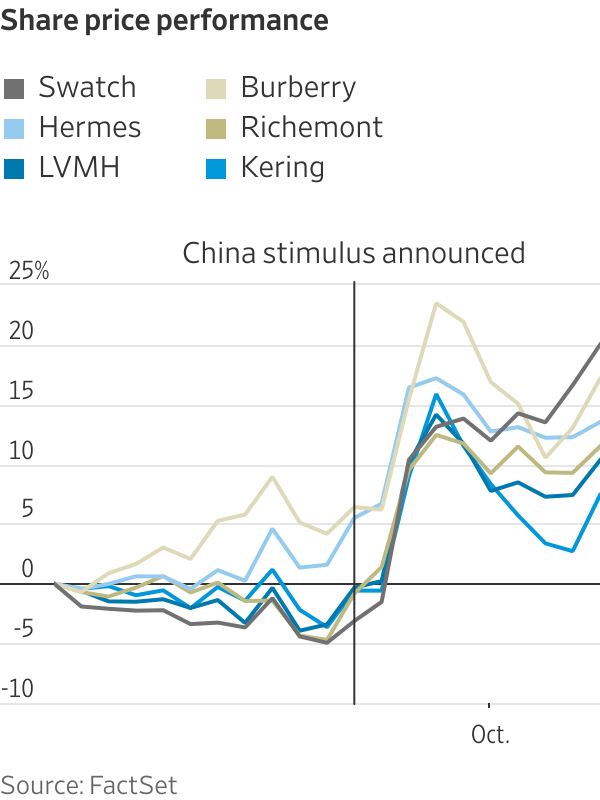

Europe’s luxury stocks fell in early trading Tuesday after China’s economic planning agency failed to announce additional measures to kickstart growth that some investors had hoped for. The sector is still up 10% on average since Beijing launched its initial stimulus plans late last month.

Beijing hopes a cut to mortgage rates, and lower down-payment requirements for buyers of second homes, will jump-start the country’s troubled housing market. A package of loans to brokers and insurers to buy Chinese shares has had initial success at lifting the stock market.

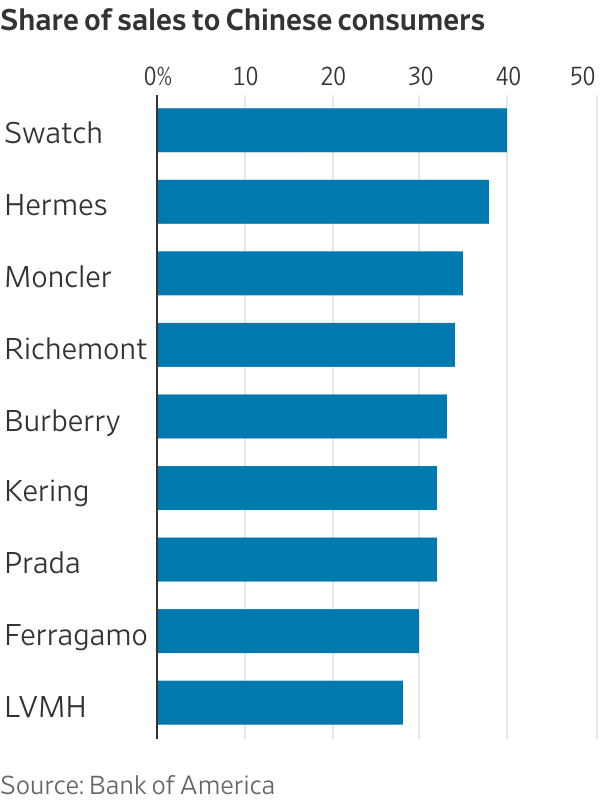

Luxury spending in China has traditionally been more correlated with its home prices than with the financial markets or overall economic growth. Around 60% of net household wealth was tied up in property before prices peaked in 2021. Barclays estimates that falling home prices have destroyed about $18 trillion in household wealth since then, which is equivalent to roughly $60,000 per family.

This, along with worries about the wider economy, is hurting consumer confidence. Retail sales rose just 2.1% in August compared with the same month last year, according to data from China’s National Bureau of Statistics. When global luxury brands start to report their third-quarter results next week, Chinese demand is expected to have slowed since they last updated investors.

Flagging sales come at an unhelpful time for Europe’s luxury companies, which rely on Chinese consumers for a third of global luxury spending. After several bumpy years during the pandemic, luxury brands and their investors hoped that a comeback in Chinese spending would compensate for a slowdown among Europeans and Americans.

This looks increasingly unlikely. Luxury sales to Chinese shoppers are expected to shrink 7% in 2024 and by 3% next year, according to UBS estimates. As luxury brands have high fixed costs, including the most expensive retail rents in the world, a slowdown with such key customers could have an outsize impact on profit margins.

The last time the luxury industry went through such a rocky patch in China, barring the pandemic, was between 2014 and 2016 when Beijing was cracking down on corruption, including officials who were gifting Louis Vuitton handbags and Rolex watches in exchange for political favours. The global luxury industry barely grew for two years during China’s anticorruption drive, which also coincided with a property-market correction in the country. It didn’t help that shoppers in other markets were also tiring of logos back then.

Europe’s luxury stocks look expensive today compared with that time. As a multiple of expected earnings, listed brands’ shares now trade at a roughly 40% premium to their 2014 to 2016 average.

To justify the higher price tag, Beijing’s housing and wider economic stimulus would need to indirectly lift luxury demand. Measures rolled out so far may not be enough to slow the slide in home prices. China’s housing market is oversupplied by around 60 million units, according to Bloomberg Economics estimates.

New incentives to kick-start consumption are expected soon but will probably target mass-market products like white goods. China already rolled out trade-in subsidies for home appliances earlier this year and a range of consumption coupons.

None of this is very helpful for sellers of expensive luxury goods. For brands to see a recovery, Chinese consumers that spend anywhere from $7,000 to $43,000 a year on luxury products would need to feel much better about their finances than they currently do. Spending by this group has fallen 17% so far this year compared with the same period of 2023, according to a report by Boston Consulting Group.

Half-finished, abandoned housing estates are a big headache for China’s government, and are also on the mind of executives in Paris and Milan. Though the fortunes of luxury bosses likely isn’t high on Chinese officials’ priority list, their fates may be intertwined.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

The roughly 50,000-square-foot mansion in Los Angeles comes up for sale following the divorce of billionaire Tony Pritzker and philanthropist Jeanne Pritzker

The Pritzker estate in Los Angeles, one of the largest homes in the country, is hitting the market for $195 million. If it sells for that price, it would set a record for the city, where the priciest home sale on record was Jeff Bezos’ $165 million purchase of the Warner Estate in 2020.

The Pritzker listing comes in the wake of a bitter divorce battle between billionaire Tony Pritzker and philanthropist Jeanne Pritzker. The former couple built the house, completing it in 2011.

The roughly 6-acre parcel is in the Beverly Hills Post Office area, just over a mile from Bezos’ home. Situated on a promontory overlooking the city, the home has 180-degree views of downtown L.A. and the ocean, according to Stephen Shapiro of Westside Estate Agency, who has the listing with colleague Kurt Rappaport .

Clad in imported white Italian limestone, the gated estate is about 50,000 square feet with 16 bedrooms, 27 bathrooms and 18 fireplaces. The primary suite has his and hers bathrooms and closets, as well as an indoor and outdoor fireplaces, a hairdressing area, a custom pop-up TV and a balcony.

The lower level of the house has a flower-prep room and a soundproofed bowling alley with custom cabinetry for the bowling balls and shoes. A large theatre has velvet curtains, stage lighting, stadium seating and a projector room. The kitchen has three Gaggenau ovens, two stainless-steel sinks and a dumbwaiter.

On the grounds, a detached two-bedroom guesthouse has a balcony, elevator and its own patio. The estate also has a lighted tennis court with a viewing pavilion. The 75-foot green marble infinity pool overlooks the city, and there is a nearby outdoor kitchen with two barbecues, a large pizza oven, and a custom swimsuit spinner.

In Los Angeles, these types of features are unusual for properties in the hills, Rappaport said. “It’s very rare to have this type of acreage with a view,” he said.

The property also has a detached two-bedroom staff apartment, multiple staff lounges and a staff kitchen.

The Pritzkers are major philanthropists and the home was designed to host large fundraisers, with a large walk-in refrigerator and an extensive underground parking structure.

Because of new restrictions on building, the estate couldn’t be recreated, Shapiro said. “You couldn’t build it today,” he said, adding: “This is the finest house I’ve ever seen.”

Tony and Jeanne Pritzker, who were married for more than 30 years and have six children, declined to comment. The son of Hyatt hotel chain co-founder Donald Pritzker, Tony is a member of one of the country’s wealthiest and more powerful families. He and his brother, J.B. Pritzker , co-founded the investment firm the Pritzker Group, with J.B. ceasing his involvement around the time he became governor of Illinois in 2019.

In 2001, Tony and Jeanne paid $9.5 million for a circa-1938 house in the Beverly Hills Post Office area, according to property records. Then, through LLCs, they purchased several parcels on a ridge adjacent to their previous home. It is unclear how much they paid for the land, but one batch of parcels was purchased in 2005 for $14.7 million, records show.

Once the land was assembled, the Pritzkers started building a new home designed by the late Ed Tuttle of Paris-based architecture firm Designrealization. The Pritzkers moved into the estate in 2011, selling their previous home to celebrity chef Wolfgang Puck for $14 million, property records show.

Jeanne and Tony separated in 2022. The Pritzkers reached a preliminary settlement in April 2024, and Jeanne moved out of the estate that month. The divorce was finalised in May 2024, according to court records. Tony has since paid $19.5 million for a penthouse at Westwood’s Beverly West condominium.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

The owners spent $73,000 on the land, plus another $475,000 building their vacation house

Lorena Ramos and Carlos Moss live and work about 7,500 feet above sea level in the high-plateau megalopolis of Mexico City. But when it came time to commission a vacation home, they took it up a notch, altitude-wise. They built a home about 2,000 feet higher in an area known as the Corridor de la Montaña, or Mountain Corridor, in the state of Hidalgo.

Ramos, a 35-year-old sales director, and Moss, a 38-year-old executive in the construction industry, bought their steep 1/3-acre lot in 2021 for about $73,000. Then they spent roughly $475,000 to build and furnish a new house, working with Mexico City architect Rodrigo Saavedra Pérez-Salas. His design, using a cantilever, suspends the two-storey structure off the side of a densely wooded slope. From the inside, it can feel like a vast, floating treehouse.

undefined They named the property after their boxer, Oruç, now 11, and initially planned to use the home to entertain friends on weekends and holidays, outfitting the lower level with a funky bar. The three bedrooms—some equipped with bunk beds—and three bathrooms can accommodate up to eight people.

But this summer, less than a year after finishing construction, they had their son, Nicolás. That means they have to make some changes to babyproof the house. “We will have to do something,” says Ramos.

The vacation home is part of the first wave of development on the site of what was once a sprawling private estate. The property sits in Mexico’s Sierra de Pachuca mountain range, part of the vast Sierra Madre Oriental that runs along the east of the country. Their area is marked by atmospheric mists and a lengthy rainy season.

For Saavedra, the architect, the hard choice wasn’t where to place the house—a clearing in the woods, in the middle of the lot, was just about the only spot—but how to access the house once it was built. The most direct route would have meant seeing a house sticking out of the woods, says the 35-year-old founder and principal of Saavedra Arquitectos. Instead, he devised what he calls “a narrative” that leads visitors over a bridge, then down and around a series of winding stairs and through a masonry door that acts as a kind of ceremonial portal to the house. When visitors first arrive on the lot, all they see is tree. As they descend and approach the house itself, they are given a tour of the exterior of the building, while glimpsing the evocative mountain terrain beyond and below.

The couple chose moody interiors to play off local conditions, with lots of exposed steel beams, steel-tinted concrete, dark wood and glass walls that let tree-filtered light stream in. A spare open stairwell and thin inner and outer railings add to the minimalist flare.

All this added atmosphere came at a cost. The couple spent about $94,000 on steel, which includes the bridge and the costly cantilever.

Intent on a sustainable home, they managed to reuse what another homeowner might regard as outright waste. They have stored firewood for the great room in leftover steel girders, fashioned into a Brutalist rack, and they used leftover wood from their board-formed concrete molds as paneling in the primary bedroom. Most recently, they have installed a rainwater collection system, with a cistern placed uphill from the house, and they now use the bounty for everything from washing to drinking.

Though Casa Oruç is surrounded by trees, Saavedra managed to build the whole 2,400-square-foot house by only cutting down a handful. This ship-in-a-bottle effect is apparent in an upstairs deck, which incorporates two oyamel firs, a species native to the mountains of central and southern Mexico. Downstairs, the bar area is built around one of the firs, set off by a glass enclosure.

The open-plan kitchen, which Ramos helped design, was a splurge of about $34,000. The couple spent about the same amount on the glass doors and windows—a cost most apparent in the primary bedroom, which has glazing on three sides.

Being nearly 9,500 feet above sea level means the couple can do without air conditioning, and even though it rarely gets below freezing, heating is a must for much of the year. They spent around $15,660 on an electrical heating system, which, depending on where they are in the house, radiates from either the floor or the ceiling. They also spent some $10,500 on two fireplaces—gas-burning for the bedroom, and wood-burning for the great room’s main sitting area. They use them for heat and for added coziness, says Moss.

The couple have kept their lot as wild as possible, putting their landscaping budget at less than $1,000. And they can tour the area’s rough and wild terrain starting right on their property, which contains a few dramatic rock formations. Though their home is nearly as far above sea level as the taller peaks of Montana’s Glacier National Park, the spot is more bucolic than dramatic. The house is high up, concedes Moss, “but not ridiculously high,” invoking a category that for him starts at about 16,000 feet.

Now, looking ahead to the end of the year, when Nicolás will start to crawl, they are set to invest around $3,000 to babyproof. This will include installing tempered glass to close off the bare-bones railings of their main terrace, located off the upper floor’s great room, and protecting the exposed inside stairwell connecting the great room above with the bar area below.

When the baby came, they hadn’t yet decided on blinds or curtains in the primary bedroom, which turned out to be a benefit. “We get to see all the different shades of light—when it’s getting dark, then when the sun comes up,” says Ramos, who appreciates these subtle changes throughout the day. Perhaps her baby does, too. “I always give Nicolás his first feed while in bed, and he loves staring outside,” she says.

Many new arrivals to this altitude might be gasping, but little Nicolás is doing just fine. He likes to “contemplate the view of the sky and tree tops from our laps,” says his mother.

Foundation and framing:

$169,725 (including masonry)

Steel (including cantilever):

$94,000

Kitchen:

$34,000

Bathrooms:

$18,500

Landscaping:

$780

Fireplaces:

$10,450

Electrical work:

$27,260

Floors (including outdoor decks):

$25,000

Glazing (glass doors and windows):

$34,000

Lighting:

$3,100

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Limited Availability Remains in the Exclusive Riyadh Development

Following the recent unveiling of Mouawad Residences, a landmark SAR 880 million (GBP 180 million) development in Riyadh, Dar Global, the London-Stock Exchange-listed international real estate company, is experiencing exceptional demand. The project, a collaboration with luxury jeweler Mouawad, marks the first collaboration between both companies in the ultra-luxury residential sector of the Saudi capital.

The surge in demand highlights the Kingdom’s burgeoning appetite for branded residences, a trend fueled by a growing class of international buyers seeking unique and exclusive living experiences. The Saudi Premium Residency program, which grants residency to owners of high-value properties, has further enhanced the Kingdom’s appeal to international investors.

“The response to Mouawad Residences has been phenomenal, exceeding our expectations,” said Ziad El Chaar, CEO of Dar Global. “This clearly demonstrates the strong demand for bespoke, ultra-luxury living in Riyadh. The project’s unique blend of contemporary design, meticulous attention to detail, and timeless elegance, all infused with Mouawad’s legacy of creative and artistic mastery, has truly resonated with discerning buyers.”

Set for handover in Q4 of 2026, the luxury development of 200 residential villas will become one of Riyadh’s most prestigious addresses. It is located near the site of World Expo 2030 in the North of the city.

“We are thrilled to partner with Dar Global on this landmark project,” said Pascal Mouawad, Fourth Generation Co-Guardian of Mouawad. “Mouawad Residences represents a natural extension of our brand, bringing our heritage of luxury and craftsmanship to the world of real estate. We are confident that this development will set a new standard for luxury living in Riyadh.”

Dar Global’s entry into the Saudi market is part of its broader strategy to introduce its internationally recognized standards of luxury to the Kingdom’s growing real estate sector. With an established track record across the Middle East and Europe, Dar Global is set to deliver unparalleled sophistication to a market increasingly defined by discerning, globally mobile buyers.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.