Germany Enters Recession in Blow to Europe’s Economy

Second straight quarter of contraction in eurozone’s largest economy might prompt greater caution by central bankers

Germany slipped into recession during the first three months of the year, as households cut spending in response to sharply higher prices for energy and food.

With Europe’s largest economy now having shrunk for two quarters in a row, meeting the technical definition of a recession, the eurozone as a whole may also have also contracted in the first quarter.

The development doesn’t fundamentally alter economists’ views about the country’s immediate prospects, and any decline in output in the broader region is likely to have been modest.

Still, a recession in the eurozone would deflate some of the optimism that has built up around the currency area’s economic prospects in recent months. It could also inspire greater caution among policy makers at the European Central Bank as they prepare to raise interest rates further.

“A technical recession would be a change in the overall narrative on how resilient the eurozone economy has been over recent quarters,” said Bert Colijn, an economist at ING.

Germany’s statistics agency said Thursday that gross domestic product—a broad measure of the goods and services produced by an economy—was 0.3% lower in the three months through March than in the final quarter of last year. It had previously estimated that the economy flatlined in the first quarter, having contracted by 0.5% in the final quarter of last year.

The agency said a 1.2% fall in household consumption was the main reason for the contraction, as households saw their spending power eroded by a surge in food prices. In March, German households were paying 21.2% more for their food purchases than a year earlier.

In the months immediately following the invasion of Ukraine, economists had warned that Germany faced a high risk of sliding into recession, given its reliance on Russian supplies of natural gas. But economic data releases at the turn of the year appeared to indicate that Germany would avoid that fate.

The revised figures for the first quarter confirmed that the world’s fourth-largest economy had succumbed to recession, but one less severe than feared when the Kremlin cut gas supplies in summer 2022.

Business surveys have pointed to a return to growth in Germany during the second quarter. But the impact of higher borrowing costs and a weak expansion in many of its main export markets point to the possibility of a renewed contraction in the three months through September.

“Higher interest rates will continue to weigh on both consumption and investment and exports may also suffer amid economic weakness in other developed markets,” said Franziska Palmas, an economist at Capital Economics who expects declines in GDP during both the third and fourth quarters.

Should the estimates for growth in other eurozone members be unchanged, the new measure of GDP for Germany suggests the currency area’s economy as a whole contracted slightly in the first quarter. The European Union’s statistics agency currently estimates it grew at an annualised rate of 0.3%, after shrinking by 0.2% in the final quarter of last year.

While that change in measured output would be small, it may have an influence on the ECB’s interest rate decisions over coming months. The ECB’s economists raised their growth forecasts for this and subsequent years in March, partly in response to a picture of the eurozone economy at the turn of the year that now appears overly optimistic.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

China ranked first for imports to Bahrain, with a total of BD212 million (15%), followed by Australia with BD166 million (12%) and Brazil with 126 million (9%)

Bahrain’s non-oil exports experienced a slight increase of 1% in the third quarter of 2024, totaling BD949 million ($2.52 billion), compared to BD943 million in the same quarter last year. This data is outlined in the recent Foreign Trade report from the Information & eGovernment Authority (iGA), which identifies the main factors driving this growth.

Saudi Arabia emerged as the leading destination for Bahrain’s non-oil exports, accounting for BD201 million (21% of the total). The United States and the United Arab Emirates followed, with exports valued at BD105 million (11%) and BD81 million (9%), respectively. The report reveals that the top ten countries collectively comprised 67% of the total export value.

In terms of products, unwrought aluminum alloys topped the list with a significant contribution of BD242 million (26%). Agglomerated iron ores and concentrates followed closely at BD147 million (15%), while unwrought aluminum not alloyed contributed BD79 million (8%).

Rise in Non-Oil Re-Exports

Bahrain also experienced a 3% increase in non-oil re-exports, totaling BD190 million in Q3 2024 compared to BD184 million in the same quarter last year. The UAE was the primary market for these re-exports, accounting for BD64 million (34%). Saudi Arabia and Germany followed, with BD41 million (22%) and BD8 million (4%), respectively. The top ten re-exporting countries made up 81% of the total re-export value.

Among the leading re-exported products, turbo-jets were the most notable, valued at BD26 million (14%), followed by smartphones at BD15.3 million (8.1%) and private cars at BD14.8 million (7.8%).

Bahrain’s non-oil imports also saw an uptick, rising by 3% to reach BD1.44 billion in Q3 2024, compared to BD1.4 billion in Q3 2023. The report indicates that the top ten countries for imports accounted for 68% of the total value. China was the largest source of imports, contributing BD212 million (15%), followed by Australia with BD166 million (12%) and Brazil at BD126 million (9%).

In terms of imported goods, other aluminum oxide topped the list with BD170 million (11.8%), followed by non-agglomerated iron ores and concentrates at BD166 million (11.5%), and private cars, which amounted to BD44 million (3%).

The trade balance, reflecting the difference between exports and imports, showed a widening deficit, increasing to BD304 million in Q3 2024 from BD275 million in the same quarter of the previous year. This indicates ongoing challenges in achieving a favorable balance between Bahrain’s exports and imports as the nation continues to navigate its economic landscape.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

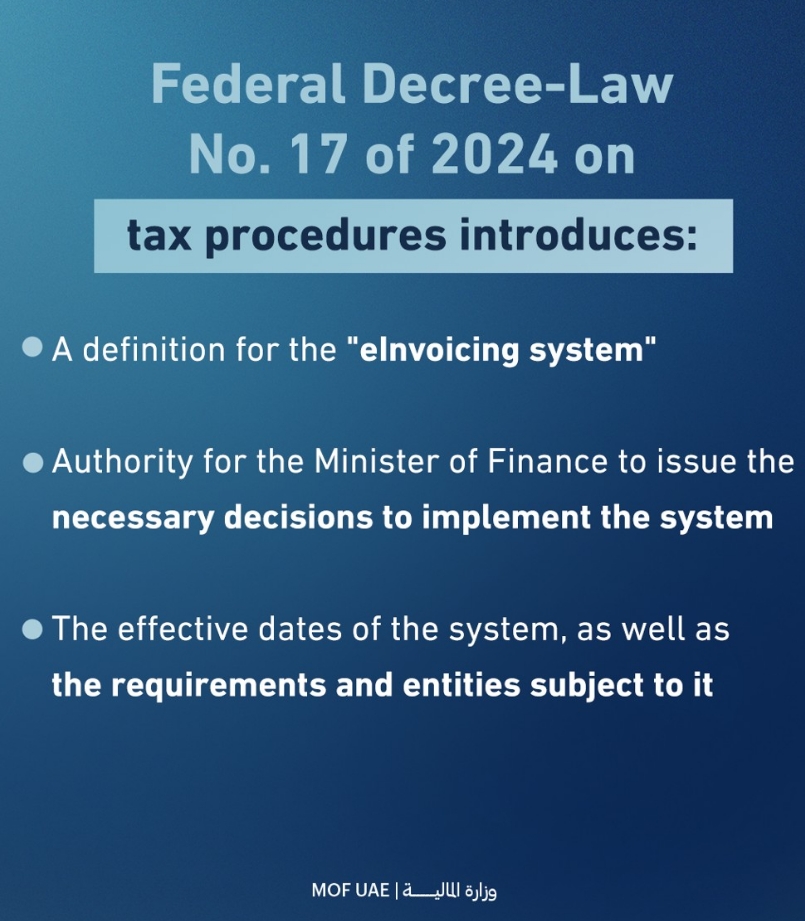

This underscores the government’s dedication to digital transformation and enhancing the operational efficiency of the national economy.

The UAE Ministry of Finance (MoF) has revealed significant legislative changes with the introduction of Federal Decree-Law No. 17 of 2024, which modifies essential elements of Federal Decree-Law No. 28 of 2022 regarding tax procedures. Additionally, Federal Decree-Law No. 16 of 2024 revises various aspects of Federal Decree-Law No. 8 of 2017 that governs Value Added Tax (VAT).

These amendments are crucial as they pave the way for the upcoming eInvoicing system, underscoring the government’s dedication to digital transformation and enhancing the operational efficiency of the national economy.

The eInvoicing framework is expected to provide considerable advantages for businesses and government bodies alike by streamlining, standardizing, and automating the invoicing process. This system will facilitate the prompt exchange of invoices and ensure efficient tax reporting to the Federal Tax Authority (FTA).

The implementation of eInvoicing in the UAE follows a decentralized five-corner model, enabling sellers and buyers to exchange invoices through Accredited Service Providers (ASPs). These ASPs will handle the transmission of tax invoice data to the FTA, bolstering tax compliance in a secure and efficient manner.

In line with international standards, the system will adopt the OpenPeppol framework, promoting best practices in eInvoicing.

With Federal Decree-Law No. 17 of 2024, the definition of the “eInvoicing system” is established, and the Minister of Finance is empowered to issue decisions necessary for the system’s implementation, including effective dates and requirements for the entities involved.

Meanwhile, Federal Decree-Law No. 16 of 2024 broadens the definitions of “tax invoice” and “tax credit note” to encompass electronic formats. It also introduces new terms for electronic invoices and credit notes. Notably, VAT refunds will be contingent upon compliance with eInvoicing regulations where applicable. Businesses required to adopt the eInvoicing system, as part of the phased implementation, will need to issue and archive electronic invoices and credit notes in accordance with established record-keeping standards.

Further announcements will provide more details about which businesses and transactions will be subject to the eInvoicing system, along with specific timelines for implementation.

The Ministry of Finance remains committed to a seamless rollout of the eInvoicing system, employing a phased approach and engaging stakeholders to optimize the benefits of this digital initiative. This strategy aligns with the UAE’s broader economic objectives and vision for the future.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

The Cube Residences is designed with the modern resident in mind, featuring premium white goods from renowned Italian brands.

After the successful launch of ‘Starlight Park’, AMWAJ Development has announced the launch of its latest innovative project – The Cube Residences, located in the prestigious Mohammed bin Rashid City, District 11 in Dubai.

The new development spans a total land area of 15,070 square feet and features a creative designed structure comprising abasement, ground floor, five residential floors, and a rooftop area that includes the pool. The project offers a total of 54 uniquely designed apartments, featuring 1- and 2-bedroom units that range from 708 sq. ft. to 1,695 sq. ft., providing spacious living spaces tailored to meet diverse needs in Dubai’s soaring real estate market.

“The Cube Residences is an amazing project that embodies our commitment to innovative design and advanced technology,” said Emad Saleh, Founder and Chairman of AMWAJ Development. “Each apartment is fully furnished and equipped with advanced home automation systems, ensuring a seamless and modern lifestyle for our residents.”

The Cube Residences is designed with the modern resident in mind, featuring premium white goods from renowned Italian brands, ensuring the highest quality and convenience.

“Dubai’s real estate market has been growing rapidly over the last few years and we felt it is time for us to capitalize on the growing demand for real estate in the UAE, we are excited to launch ‘The Cube Residences’ offering residents an unparalleled living experiences” said Murad Saleh, CEO of AMWAJ Development.

Residents will also enjoy a range of ground floor amenities including a co-working space, lounge with coffee cart, concierge reception desk, and 24/7 security. Meanwhile, rooftop amenities include a fitness club, sauna and showers, rooftop pool, and a gaming room equipped with billiard tables, arcade games, and more.

Innovative design and advanced technology are at the core of The Cube Residences, with the integration of smart home systems that offer seamless connectivity and enhance the living experience. “Our goal is to create a community that elevates the everyday lifestyle of its residents through convenience and cutting-edge technology,” said Aida El Shahabi, COO of AMWAJ Development.

The spectacular new development is strategically positioned just 15 minutes from Downtown Dubai and Dubai Mall, and 20 minutes from Dubai International Airport, making it an ideal location for modern living.

The anticipated completion date for The Cube Residences is Q4 2026. AMWAJ Development is offering flexible payment plans, with 50% due during construction and 50% upon completion, making this an attractive opportunity for potential buyers. Additionally, buyer scan benefit from the Golden Visa program, applicable for purchases of AED 2,000,000 and above.

“As we embark on our second project in the UAE, we remain committed to delivering unparalleled value to our investors and residents,” added Hassan Hijazi, Group CFO of Amwaj Development. “Our focus on innovation and sustainability reflects the evolving needs of the market, ensuring that Amwaj continues to set new benchmarks in quality while delivering strong long-term returns for our investors.

With competitive starting prices for the apartments are set at AED 1.2 million for the 1-bedroom units and AED 2.3 million for the 2-bedroom units, The Cube Residences represents an exceptional opportunity for investors looking to maximize returns and homeowners seeking quality living in a prime location.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

This represents the biggest change to the qualification in 30 years, and follows extensive consultation with training employers, members, students and partners in learning around the world.

Chartered accountancy body ICAEW has today unveiled exciting changes to its world-leading ACA qualification that will ensure it remains the best-in-class business, finance and accountancy qualification for the next generation of students. It represents the biggest change to the qualification in 30 years, and follows extensive consultation with training employers, members, students and partners in learning around the world.

From September 2025, students will study a qualification that brings technical study and workplace learning closer together than ever before, building further on the ACA’s established strengths.

Alan Vallance, ICAEW Chief Executive, said: “When I qualified as an ICAEW Chartered Accountant, I was excited to see where the ACA could take me. Many years later, it’s been my passport to working around the world, across a wide range of sectors, and for me personally, leading prestigious organizations.

“For nearly 150 years, gaining ICAEW membership has launched global careers in business, finance and accountancy, and we must ensure that it remains best in class for the next generation. These exciting changes are the culmination of the most extensive and collaborative consultation process in our history, and we can’t wait for these developments to come into place next September.”

The next generation ACA will comprise three core components. These are business, finance and accountancy modules; professional work experience; and a new specialized learning and development program.

The learning and development program will:

- deepen students’ competence in ethics, technology and sustainability to reflect the ever-changing world and workplace, through integration with professional work experience;

- adapt quickly to future changes in the workplace and profession;

- enhance students’ specialized workplace knowledge and skills through a wide range of flexible learning resources; and,

- provide students with enhanced support through a comprehensively redesigned learning journey.

The exams component will consist of 14 integrated modules, compared to the current 15, including two additional case study papers to help students bridge to the professional and advanced levels. Alongside their professional experience, students will also complete 30 units from a flexible range of online learning modules as part of specialized learning and development, designed for early career upskilling and specialization.

All existing students will be able to complete the ACA through either the current or updated qualification, and there will be no requirement to sit extra exams. ICAEW is already working with education providers and employers to support students during the transition period.

The ACA will remain the only professional finance qualification that embeds real workplace data analytics software in exams.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Fund raisers included one of the largest Saudi institutions, the Al Nahdi family office, Shurooq (the Sharjah Investment and Development Authority) and existing GII stakeholders

Leading shareholders in Gulf Islamic Investments (GII), plus new investors, have added an additional $100 million growth capital to the group’s balance sheet to develop private equity opportunities across the Kingdom of Saudi Arabia and the GCC, ahead of the forthcoming Financial Investment Initiative (FII8) in Riyadh on 29-31 October 2024.

The new raising, which was oversubscribed, brings additional growth capital for promising private equity (PE) and private credit projects across the GCC. Contributors to the fund raising included one of the largest Saudi institutions, the Al Nahdi family office, Shurooq (the Sharjah Investment and Development Authority), and existing GII stakeholders.

A leading Shari’ah-compliant global alternative investment group with over US$4.5 billion of assets under management (AUM), GII’s recent investments include two deals this year with Brookfield Asset Management in the UAE (the acquisition of GEMS Education in a consortium led by Brookfield, and the sale of GII’s UAE logistics network). GII also took a majority share in Al Meswak Dental Clinics (the largest chain of Saudi dental and dermatology centers), a significant stake in the Abeer Medical Company, a logistics joint venture with Logipoint in Jeddah, and investments through its GreenCorp food production and food processing platform in Badia Farms and Emad Bakeries in Jeddah. Additionally, GII runs two PE funds in India, and is examining further deals in the Indian PE space.

Mohammed Alhassan, co-founder and co-CEO of GII Group, commented, “This additional capital raise strengthens our balance sheet further, on the back of GII’s existing investments in GCC healthcare, food production and logistics ventures. The new growth capital will support projects in the Kingdom under Vision 2023, adding further foreign direct investment (FDI) and creating additional jobs for Saudi citizens, and other GCC projects being developed currently”.

Pankaj Gupta, GII’s co-founder and co-CEO, added “GII plans further expansion within the Arabian Gulf through acquisitions and co-investments with Saudi and other GCC investors. FII provides an important opportunity to discuss our business partnerships to invest in Saudi Arabia’s rapidly-expanding economy, bringing attractive returns and definitive benefits for our investors and shareholders, and to discuss and develop regional investment projects”.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Al Masar account will aid young customers in managing their budgets.

In line with its endeavors to promote a sound savings culture among the youth whilst adhering to Islamic Sharia principles, ahli islamic, ahlibank’s Islamic banking window, is pleased to announce the launch of its new youth segment “Al Masar”, which targets customers in the age group of 18 to 25 years. Al Masar is designed to bring a host of benefits to its young clientele, thus enhancing their experiences, while also meeting their daily needs and requirements.

Al Masar account will aid young customers in managing their budgets, as customers are provided with a uniquely designed debit card. Customers should be pleased to note there are no minimum balance charges, and ATM withdrawal fees have been waived. Moreover, the Al Masar Savings account earns a profit rate of up to 1% (based on the tier). Additionally, youth who are employed can attain credit cards, with preferential financing rates made available.

Upon opening the Al Masar account, youth customers are provided OMR 5 worth of Pearl Points. Furthermore, should customers transfer their salary to ahli islamic, they will gain an additional OMR 10 worth of Pearl Points. Complementing the youth lifestyles, certain discounts and offers can be exclusively arranged with merchants for youth account holders. These benefits have been designed to meet young customer’ expectations and support them through their journey of savings and creating promising financial future.

Commenting on the launch of the Al Masar Youth Account, Noora Sultan, AGM – Head of Retail Banking at ahli Islamic, stated, “ahli islamic seeks to cater to all segments and age groups, giving the youth various benefits, while instilling a strong culture of saving from a young age. In the upcoming years, Al Masar account will be deemed highly influential in making young people financially independent. ahli islamic is proud to have been a key contributor to that effect, setting the benchmark for customer service excellence.”

In keeping with the changing market demands, ahli islamic is set to enhance customer experience by offering a variety of distinguished services whilst adopting top-tier technologies and innovations. By providing access to high-quality products and services, ahli islamic continues placing an indelible mark upon the Sultanate as a strategic contributor to its overall growth.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The profits climb 15% to QAR 353mln as growth momentum continues

Estithmar Holding Q.S.P.C announced its financial results for the nine-month period ended September 30th, 2024.

The results reported a 15% increase in net profits compared to the same period in 2023, reaching QAR 353 million, up from QAR 307 million last year. Revenues also rose by 32%, amounting to QAR 2.9 billion. The company’s gross profits are QAR 719 million compared to QAR 568 million for the same period last year, reflecting a 26% increase. The company achieved an EBITDA of QAR 573 million, while earnings per share increased by 11% to QAR 0.099. The reported results exceeded projections, driven by the development of the company’s projects and the success of its operational policies.

The healthcare division, Apex Health recorded significant growth, driven by the ongoing development of its properties that have successfully established trust as a reliable service provider. The unique services offered by the hospitals under Estithmar Holding have led to the company’s hospitals, including The View Hospital in affiliation with Cedars-Sinai and the Korean Hospital, excelling in performance. With rapid advancements in local projects, Q3 of 2024 witnessed accelerated progress in construction of the Algerian Qatari German hospital, which is expected to transform healthcare in Algeria. Additionally, through its subsidiary Apex Health, Estithmar Holding continues to manage and operate Imam Al-Hassan Al-Mujtaba Hospital and Al-Nasiriya Teaching Hospital in Iraq.

Al Maha Island, a project by Estithmar Holding, provides a distinguished recreational tourism experience to Qatar’s residents and visitors. It attracts an average of 10,000 visitors daily, with expectations of increased numbers as the weather improves and the fall and winter seasons begin, coinciding with seasonal holidays in Qatar and neighboring countries. Q3 also witnessed the completion of all preparations for the launch of the third season of Lusail Winter Wonderland, which attracted hundreds of thousands of visitors in its previous two seasons. Construction continues for Rixos Baghdad project in the Iraqi capital and the Rosewood Maldives project. Rixos Baghdad offers a unique residential and hospitality experience in Iraq, featuring world-class facilities that reflect the luxurious essence of the global hotel brand, promising a notable leap in the tourism infrastructure in Baghdad. The Rosewood Maldives project is a luxury tourism development expected to attract interest in high-end islands and resorts tourism.

The commencement of operations in Saudi Arabia has boosted revenues and increased the sector’s contribution to profits. Local performance exceeded expectations, driven primarily by catering services. The sector’s expansion into facilities management services in Qatar and Jordan has also contributed to revenue growth by offering a comprehensive suite of services that provides an exceptional experience for clients. The sector’s results and expansions locally and regionally indicate ongoing upward growth through the end of the current year.

The specialized contracting sector continues to achieve positive results through its regional expansions, especially in Saudi Arabia, participating in major projects like NEOM, the Red Sea, and Amaala. Through its subsidiary Elegancia Arabia, Estithmar Holding has played a significant role in the urban development occurring in the Kingdom, becoming a trusted partner in world-class projects, including MEP works for primary hotels and resorts, fit out services for airports, residential facilities and others,

In Q3, Estithmar Holding listed sukuk worth QAR 500 million on London Stock Exchange, marking the first-ever listing in LSE denominated in Qatari riyals. The sukuk attracted significant interest from investors and both governmental and non-governmental institutions, with a diverse list of investors including banks, insurance companies, and asset managers. Additionally, Estithmar Holding secured a series of international partnerships and agreements aimed at enhancing and supporting the company’s developmental plans, notably a memorandum of understanding with the Italian SACE Group for financial insurance. The MOU aims to bolster Estithmar Holding’s expansion plans and support the exports of Italian companies.

Both milestones accentuate the trust Estithmar Holding is gaining regionally and internationally in its growth story.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

GCC Fixed Income markets sees $28.8bln in primary issuances, representing a 14.5% increase from the same period last year.

Kuwait Financial Centre “Markaz” has released its Fixed Income Report, revealing notable trends in primary debt issuances of Bonds and Sukuk across the Gulf Cooperation Council (GCC) countries for the third quarter of 2024. The total value of these issuances reached USD 28.2 billion through 84 transactions, marking a 14.5% increase compared to the same quarter in the previous year. Cumulatively, the first nine months of 2024 saw a total issuance of USD 102.7 billion, a significant rise from USD 79.3 billion during the same period in 2023.

Geographic Breakdown of Issuances

Issuers from the United Arab Emirates led the market in Q3 2024, raising USD 11.7 billion through 28 issuances, an increase from USD 7.8 billion from 17 issuances in Q3 2023, thereby capturing 42% of the market. Saudi Arabia followed closely with USD 11.2 billion raised through 19 issuances, constituting 40% of the market. However, for the entire first nine months, Saudi entities emerged as the frontrunners, securing USD 47.8 billion through 60 issuances, which accounted for 47% of the market. UAE entities raised a total of USD 32.1 billion during the same period, representing 31.3% of the market share.

Qatari issuers ranked third in terms of value for Q3 2024, generating USD 3.5 billion from issuances, a remarkable 236% increase from USD 1 billion in Q3 2023. Kuwaiti issuers raised USD 1.7 billion through 6 issuances, marking a 334% increase from the prior year’s figure of USD 0.3 billion, while accounting for 6% of the market. Meanwhile, Bahraini and Omani issuers raised USD 35 million and USD 20 million, respectively, both representing just 0.1% of the market.

Sovereign vs. Corporate Issuances

Corporate primary issuances across the GCC saw a dramatic increase of 233% in Q3 2024, totaling USD 26.3 billion. For the first nine months, corporate issuances reached USD 59.4 billion compared to USD 39.2 billion in the same period last year. Notably, government-related entities raised USD 12.2 billion in Q3, making up 46% of corporate issuances. In contrast, sovereign primary issuances dropped 89% in Q3 2024, amounting to USD 43.3 billion for the first nine months, a slight increase from USD 40.1 billion year-over-year.

Conventional vs. Sukuk Issuances

Conventional debt issuances surged by 270% in Q3 2024, with a total of USD 69.2 billion raised in the first nine months. Conversely, Sukuk issuances fell by 63% during the same quarter, bringing the total to USD 33.5 billion for the first nine months. Sukuk accounted for USD 6.9 billion through 17 issuances in Q3.

Sector Analysis of Issuances

The energy sector dominated the primary debt issuance landscape, raising USD 13.1 billion, which represented 47% of total GCC issuances in Q3 2024. The financial sector followed closely, generating USD 11.5 billion, accounting for 41% of the total. For the year-to-date figures, government issuers led with USD 43.3 billion, trailed by the financial sector with USD 39.4 billion.

Maturity and Issue Size Profiles

In Q3 2024, issuances with tenors of less than five years constituted 36.4% of the GCC debt capital markets, totaling USD 10.2 billion through 62 issuances. Issuances with tenors between 10 to 30 years represented 26% of the market, with USD 7.4 billion raised from 8 issuances. Issuances with a tenor of 5 to 10 years raised USD 5.9 billion through 10 transactions.

The size of primary issuances during the quarter varied from USD 8 million to USD 2 billion. The largest issuances, those over USD 1 billion, accounted for USD 14.5 billion through 9 issuances, representing 52% of the total primary issuances.

Currency and Rating Profiles

US Dollar-denominated issuances were predominant, totaling USD 24.8 billion, or 88% of the total value of primary issuances in the GCC during Q3 2024. Saudi Riyal-denominated issuances followed with USD 900 million raised through 4 transactions.

In terms of credit ratings, 79% of the primary Bonds and Sukuk issuances in Q3 were rated by agencies such as Standard & Poor’s, Moody’s, Fitch, and Capital Intelligence, with 77% of these rated as investment-grade. For the first nine months of the year, 77% of both conventional and Sukuk issuances received ratings, with 73% categorized as investment-grade.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Through this partnership, AmiViz will integrate BigID’s advanced solutions into its extensive portfolio of cybersecurity products and services.

AmiViz announced a strategic partnership with BigID, a leader in data security, compliance, privacy, and AI data management. This collaboration is set to transform how organizations in the Middle East handle their data by providing a unified platform for enhanced data visibility and control.

Through this partnership, AmiViz will integrate BigID’s advanced solutions into its extensive portfolio of cybersecurity products and services. BigID stands out in the industry, having been recognized by CNBC as one of the top 25 startups for the enterprise, and has consistently been named to both the Inc 5000 and Deloitte 500 lists. Their expertise in AI-driven data management and robust compliance solutions positions them as a technology leader in the rapidly evolving data security sector.

“The alliance with BigID aligns perfectly with our mission to empower regional enterprises with top-tier IT security solutions,” said Ilyas Mohammed, COO at AmiViz. “BigID’s unique platform enables businesses to significantly reduce their data risks, automate security, meet compliance requirements, and gain a deeper understanding of their data spread across multicloud, hybrid cloud, IaaS, PaaS, SaaS, and on-premises environments.”

BigID’s platform offers organizations the tools to proactively discover, manage, and secure their data, enhancing operational efficiencies and protecting against data breaches. With data breaches on the rise and stricter compliance regulations being implemented worldwide, there is a growing need for comprehensive data management solutions that can address complex security landscapes.

“We are excited to partner with AmiViz and extend our reach into the Middle East market,” said Nick Maxwell, SVP of Sales for EMEA and APAC of BigID. “This partnership is a testament to BigID’s commitment to global expansion and our focus on helping organizations worldwide manage and secure their most valuable asset – their data.”

The partnership is expected to drive greater data governance across industries in the Middle East, enabling businesses to thrive in an era where data security is paramount. Customers in the region can now leverage BigID’s innovative technology through AmiViz’s trusted distribution network.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The new partnership introduces seamless digital gift cards for enhanced customer convenience and shopping experience

Brands For Less Group (BFL) announces its new partnership with Resal, a top digital platform in Saudi Arabia. This collaboration will expand the Group’s presence in the Saudi market by offering digital gift cards through Resal, providing customers with easier access to the brand’s wide range of products and a seamless shopping experience.

Resal specializes in digital solutions, making it an ideal partner for BFL Group as it expands its digital offerings. By introducing BFL gift cards on Resal’s platform, customers will enjoy a fast, and user-friendly digital solution that supports an omnichannel experience. This allows them to use their gift cards seamlessly both online and in-store, giving them flexible options for a more convenient shopping experience.

As digital transformation continues to accelerate across the region, this collaboration solidifies BFL’s position as an innovative brand, addressing the growing demand for quick and efficient online transactions. By integrating digital gift cards with Resal, Brands For Less is set to better serve customers, improve satisfaction, and support long-term loyalty in Saudi Arabia’s competitive retail market.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The mobile app will streamline the subscription process, saving customers time and effort

The OQEP offering is the largest IPO in the history of the Sultanate of Oman, with approximately two billion shares offered, representing 25% of the company’s total issued share capital.

BankDhofar’s customers confirmed the ease of the subscription process via the mobile banking application, saving them time and effort without having to visit any of the various branches spread across the Sultanate of Oman.

The customers mentioned that this subscription is an opportunity to grow their money and diversify their investment portfolios. This subscription is also important for the Muscat Stock Exchange and the injection of liquidity into it, and for the revival of the national economy in general.

Abdul Aziz Al Jahouri considered the subscription in OQEP a real opportunity to grow his long-saved money, stressing that the share price was convenient for him. “I subscribed for myself and my family through BankDhofar’s mobile application, and the process was very quick and took only few seconds.”

He also noted that technology has helped reduce the time and effort for individuals, as he no longer had to visit the branch to complete the subscription process, as the application allowed him to do it from his office.

Al Jahouri decided to establish a close relationship with the bank recently in September, when he saw the bank’s announcement regarding 0% interest financing for the IPO. Although he did not need financing for the IPO, the facilities offered by BankDhofar to individuals and investors prompted him to open a new bank account.

Al Jahouri said: The IPO contributes to attracting foreign investors to the Muscat Stock Exchange, which will lead to the recovery of the national economy in general. He is optimistic that the share price will be between 420 and 440 baisas when it is listed on the MSX.

Samra Sulaiman Al Harthi praised the speed of the subscription process through BankDhofar’s mobile application: “Subscribing through the app saved time and effort from visiting branches,” she said, emphasizing that she will continue to use the application for future subscriptions.

Al Harthi expects the share price to be more than 400 baisas when it is listed on the Muscat Stock Exchange, stressing that the factor that prompted her to subscribe is the performance of the company, which is the most important company in the OQ Group, so the IPO was an opportunity for her to grow her funds and diversify her investment portfolio.

Al Harthi confirmed that this IPO contributes to the revival of the stock market and enhances liquidity, which reflects positively on the national economy.

Al Harthi has been a customer of BankDhofar for 15 years and has not thought of moving to another bank as she is satisfied with the services provided by the bank.

Hawa Mohammed Al Balushi did not hesitate to participate in OQEP’s IPO because she saw it as another opportunity to invest her money and earn an additional income on top of her main income from her full-time job.

She says: I have had a good relationship with BankDhofar for six years, and that is why I chose to subscribe through the bank’s mobile application, stressing that the subscription process was quick and easy and did not take much time.

She adds: Such IPOs certainly contribute to the development of the MSX and turn it into an emerging stock exchange in the future, as well as boosting the country’s economy in general.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The new facilities in KAFD will drive fintech collaboration and support Saudi Arabia’s Vision 2030

Visa marks a significant milestone as it celebrates 40 years of operation in Saudi Arabia with the opening of a state-of-the-art Innovation Center and a new office in the prestigious King Abdullah Financial District (KAFD). Visa’s new facilities are integral to the company’s commitment to supporting Saudi Arabia’s Vision 2030, aiming to position the Kingdom as a global hub for fintech and digital commerce innovation.

The Riyadh Innovation Center – Visa’s fourth globally, will play a pivotal role in advancing next-generation payment solutions and strengthening partnerships with local fintechs, financial institutions, government entities, and businesses.

As part of Visa’s expansive global innovation network, this facility is designed to act as a hub for co-developing cutting-edge payment solutions tailored to the Kingdom’s needs. The center features payment solutions powered by advanced technologies like Artificial Intelligence (AI), virtual reality, biometrics, and the Internet of Things (IoT), with a focus on government solutions, e-sports/gaming industry, smart cities, retail and tourism.

The Center’s capabilities will not only serve the local market but also allow Saudi-made innovations to be transferred globally, positioning the Kingdom as a driving force in the global digital economy. With Saudi Arabia projected to see double digital growth, the Innovation Center is poised to accelerate this growth, propelling the Kingdom toward its Vision 2030 goals.

“As one of Visa’s largest markets in the CEMEA region, the Kingdom of Saudi Arabia has rapidly emerged as an innovative leader in digital commerce propelled by the clear vision of the government and efforts of the local industry. Our new Innovation Center in Riyadh has been designed to bring the next generation of payment technology and will serve as a collaborative platform to co-create the future of digital commerce,” said Andrew Torre, Visa’s Regional President for CEMEA. “We are proud to build on our 40 years of supporting digital payments in Saudi Arabia with our expanded innovation capabilities that will further strengthen the Kingdom’s position as a global hub for digital commerce, transforming how payments are made across the world.”

Strategic Expansion with a New Office in King Abdullah Financial District

The new Innovation Center is part of Visa’s new office in the King Abdullah Financial District, where Visa’s payment experts and business development teams for Saudi Arabia, Bahrain and Oman will be based. This move to KAFD brings Visa closer to its key clients and partners, fostering deeper collaboration across sectors such as government, financial services, retail and fintech. The modern workspace is designed to support Visa’s growing team and expanding operations, with plans for significant headcount growth and senior talent acquisition across multiple departments, including technology, product development, and government engagement.

“Over the past 40 years, Visa has played a pivotal role in building Saudi Arabia’s payments infrastructure, transforming it into a key digital payments market globally,” said Ali Bailoun, Visa’s Vice President and Regional General Manager for Saudi Arabia, Bahrain and Oman. “The relocation of our office to the King Abdullah Financial District is a significant investment that underscores our confidence in Saudi Arabia as a thriving payments market. It strengthens our ability to collaborate and innovate with our clients and partners while ensuring we continue to support the Kingdom’s ambitious digital transformation goals in line with Vision 2030.”

Sultan Alobaida, Chief Commercial Officer of the KAFD Development & Management Company, noted, “The Saudi banking sector continues to thrive within a remarkably supportive operational climate, underpinned by a resilient and thriving financial sector, achieving a robust growth of 9.3% in 2023 and an impressive 3.9% in just the first quarter of 2024. At KAFD, we are committed to collaborating with the financial industry and international partners such as payment technology leaders like Visa to shape the financial and payments ecosystem of the future, which is integral to Saudi Arabia’s economic development and sustainable growth and in alignment with Vision 2030.”

He added, “Our strong financial presence helps bolster Riyadh’s stature as a premier global financial center, drawing a distinguished array of fintechs, banks and payment players, and we are delighted to welcome Visa to this esteemed portfolio. Their presence anchors our shared vision for the evolving financial and payments landscape in Saudi Arabia.”

Wholly owned by the Public Investment Fund, KAFD is one of the most visionary and transformative mixed-use developments that merges the worlds of business and lifestyle in the Kingdom of Saudi Arabia. It spans 1.6 million square meters of modern and innovative Grade A office spaces, world class facilities and upscale residences designed to transform how urban communities live, work, and play. A green district, KAFD is the world’s largest LEED platinum-certified business and lifestyle destination.

Visa’s 40-year journey in Saudi Arabia has been defined by ongoing investment in the Kingdom’s digital ecosystem. The company’s leadership is reflected in its role as a key enabler of digital payments, driving growth in areas such as data analytics, B2B payments, and the gaming industry. Visa’s Innovation Center and new office will further consolidate its position at the forefront of the GCC’s evolving digital landscape.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

Launching a Comprehensive Program to Identify, Develop, and Retain Top Tech Talent in Saudi Arabia

Bayt.com and the Ministry of Communications and Information Technology (MCIT) in Saudi Arabia have signed a Memorandum of Understanding (MoU). The strategic partnership marks a key milestone in advancing the Kingdom’s talent ecosystem, particularly within the technology and telecommunications sectors, in alignment with Saudi Vision 2030.

The MoU establishes the foundation for the Tech Talent Hub initiative, a program designed to strategically identify, develop, and retain top tech talent in Saudi Arabia. Through this collaboration, Bayt.com, with over 52 million job seekers, and MCIT aim to support the growth of emerging tech companies and enhance the overall talent pool in the Kingdom’s technology sector. The initiative is a significant step toward empowering both employers and job seekers, ensuring that the Saudi workforce remains competitive in an ever-evolving digital landscape.

Mr. Ibrahem AlNasser, Deputy Minister for Future Jobs and Capabilities, commented on the collaboration: “We are excited to partner with Bayt.com on this crucial initiative. The Tech Talent Hub will play a pivotal role in developing the skills and expertise necessary for Saudi Arabia to thrive in the rapidly growing technology sector. This partnership aligns with our commitment to achieving the goals of Saudi Vision 2030 by fostering innovation and building a sustainable, knowledge-based economy.”

Under this partnership, the MCIT will lead the establishment of the Tech Talent Hub in collaboration with Talentera, Bayt.com’s specialized Software recruitment platform providing an Applicant Tracking System (ATS). The Tech Talent Hub will feature a dedicated track for technology talent, and MCIT will provide key data on job seekers to enable a more targeted and effective approach to talent management. Bayt.com will contribute by offering a range of services tailored to tech companies, such as organizing workshops and providing continuous support to help develop and connect tech talent with industry needs.

Rabea Ataya, Founder and CEO of Bayt.com added: “At Bayt.com, we are deeply committed to supporting the Kingdom’s vision of becoming a global technology hub. By partnering with MCIT, we are ensuring that top tech talent in Saudi Arabia is identified, nurtured, and connected with the right opportunities. This initiative not only benefits job seekers but also empowers companies to access a highly skilled and diverse talent pool, driving the growth of the technology sector.”

The Tech Talent Hub initiative will be rolled out in three phases over the course of one year, which underscores the commitment of both Bayt.com and MCIT to drive innovation and foster the development of the technology and telecommunications workforce in the Kingdom. The Tech Talent Hub Initiative will not only support the Kingdom’s Vision 2030 goals but also enhance the career prospects of thousands of job seekers across Saudi Arabia, showcasing Bayt.com’s dedication to delivering cutting-edge recruitment solutions and strengthening its role as a key partner in the Kingdom’s economic and technological transformation.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

As Japanese animation and comics go global, opportunities abound for investors

Move over, Marvel. The next blockbuster entertainment franchise might come from Japan.

Anime is shaping up as the country’s next big export industry, beyond cars and electronics. This once-niche entertainment form is entering the worldwide mainstream , and its growth could light up investors’ portfolios.

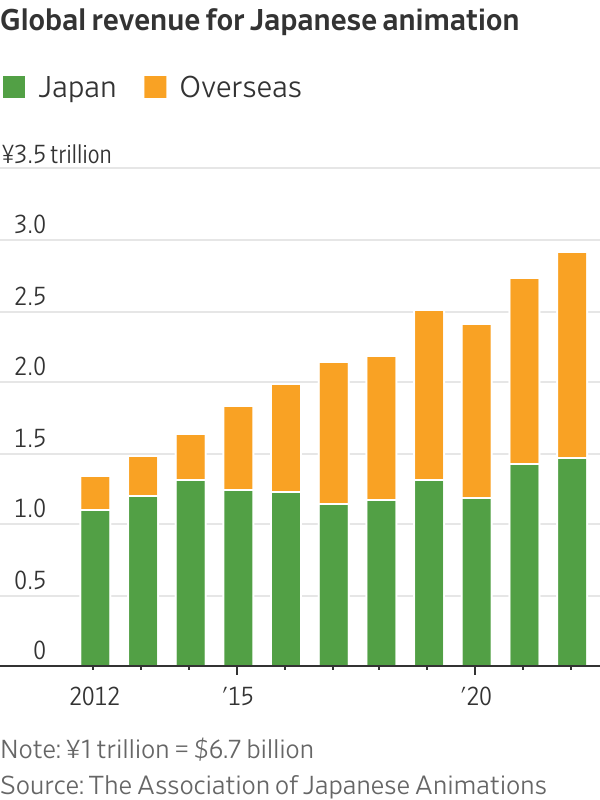

The global market for Japanese animation, known as anime, and its related products has more than doubled between 2012 and 2022 to 2.9 trillion yen, equivalent to $20 billion, according to the Association of Japanese Animations. The overseas market has been driving that growth. Markets outside of Japan made up around half of the total in 2022, compared with around 18% a decade earlier.

Streaming companies such as Netflix are certainly taking notice. Its live-action series “One Piece,” based on a Japanese comic, was its most-watched show in the second half of 2023. In fact, anime content on Netflix in the period logged 14% viewing growth from the first half of 2023, compared with a 4% drop overall, according to Jefferies. These streaming platforms will continue to introduce more anime-related content to their global audiences.

Japan’s anime and manga, the Japanese word for comics, have created many well-known characters and franchises over the years, such as Pokémon. And it looks to be getting even more mainstream. The anime market in North America has grown from $1.6 billion in 2018 to $4 billion this year, according to Jefferies. And Asia, which has long been more receptive to anime, will likely continue to grow strongly, especially in China. Anime has also been popular on Chinese streaming platforms such as Bilibili .

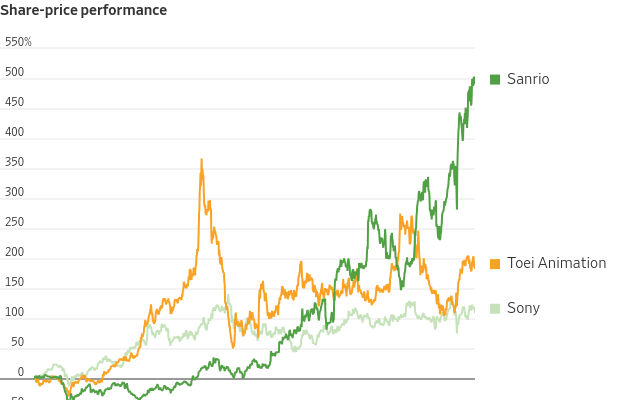

Apart from streaming, selling merchandise can be even more lucrative. Sanrio , which owns characters like Hello Kitty , has reported record profits, with its share price rising nearly sixfold over the past five years.

Sony would be another major beneficiary of this trend . The company owns animation streaming service Crunchyroll, which had 15 million subscribers as of June. That compared with around 3 million subscribers when Sony announced the acquisition of the streaming service from AT&T for nearly $1.2 billion in 2020. This contrasts with Sony’s approach in online streaming for other content: It acts more like an “arms dealer,” selling movies and shows to platforms such as Netflix and Amazon.com . That means the company could benefit more directly from the anime boom. And anime also has strong synergies with its movie and game businesses .

Anime maker Toei Animation, which owns popular franchises such as “One Piece” and “Dragon Ball,” is another listed company that would benefit. It makes anime itself, but more important for the overseas markets, it also earns licensing revenue from the copyrights to popular franchises that it owns. Sales outside of Japan accounted for more than half of its total revenue in the latest fiscal year ended in March. Season two for Netflix’s “One Piece” is already in production. Toei stock has nearly tripled since the end of 2019.

Anime has blockbuster potential, not just for audiences but for investors as well.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

More men are staying home to facilitate the complex juggle of family life and their wives’ high-powered careers

Suzanne Donohoe , a top executive at the private-equity firm EQT , started the month of September with a 10-day business trip through Asia and Europe. Back in New York, her husband, Matt Donohoe , was helping their three teenagers begin a new school year.

That was no simple task. Though the Donohoe children are close in age, each goes to a different school and has different extracurricular activities. Matt drove their 13-year-old to hockey practices in New Jersey and took all three children to Boston for a tournament. In between, there were groceries to buy, meals to prepare and homework to assist with.

It was all in a day’s work for Matt, who quit his job in 2007 to help out at home. A former emerging-markets trader with degrees from Georgetown and Columbia, he is part of a quiet but growing force of men who hold down the fort at home while their wives climb to the upper echelons of finance.

Wall Street has long struggled to elevate and retain women. A hotly competitive industry that demands long hours, frequent travel and the need to be on call constantly, it has been an unwelcoming environment for women, particularly those with children.

Women who have leadership roles in finance say that having a spouse who stays home—a househusband, if you will—can relieve that burden and allow them to rise. Even these privileged women, who have a spouse at home and often extra help beyond that, say maintaining the arrangements is a complex feat.

For the men, being a househusband can come with a stigma: Society often still assumes men will be the bigger earners and women the primary caregivers. But that is starting to change.

In 45% of U.S. opposite-sex marriages, the wife earns as much as or more than her husband, a share that has roughly tripled over the past 50 years, according to a 2023 report from Pew Research Center. Dads represented 18% of stay-at-home parents in 2021, up from 11% in 1989, another Pew study found.

There are now househusbands at the highest levels of power. Doug Emhoff , married to Democratic presidential nominee Kamala Harris, gave up his career—as an entertainment lawyer—to facilitate her political rise after she was elected vice president. On Wall Street, the list of women with husbands at home includes the chief executives of Citigroup and TIAA, the chief financial officer of the private-equity firm Vista Equity Partners, and the global co-head of Blackstone’s real-estate business, among others.

Senior female executives whose partners also work say they have to manage an intense balancing act and admit to being envious at times of their peers whose husbands don’t work.

“The prototype of the person you are competing with, the people in nearly all of the successful positions, have a stay-at-home partner,” says Suzanne Donohoe, who was a partner at Goldman Sachs and KKR before joining EQT in 2022. “The disheartening part of the message is somehow you can’t achieve if one parent isn’t at home.”

She says she doesn’t think that is the case and knows and admires people in demanding jobs who make it work with neither spouse at home.

‘Safety net for a trapeze artist’

Many couples say they started out with parallel professions but reached a point at which the woman’s career accelerated. When one person needed to devote more time to parenting, it made more sense for it to be the man.

Chip Kelly was working in tech sales at an international startup in 2009 when his wife, Natalie Hyche Kelly, who is a Visa executive, gave birth to their first child. After the couple didn’t move quickly enough to get a spot at the daycare they wanted, Chip volunteered to care for the baby and work while she slept.

He took calls while pushing their daughter in the stroller. When she went to sleep, he worked through dozens of emails. The couple had twins a few years later. Around that time, Natalie was promoted and started commuting to San Francisco four days a week from Charlotte, N.C., where the Kellys lived. Chip tried to work while caring for the twins and their older daughter when she wasn’t in preschool.

After the family moved to San Francisco, Chip realised that he was neither doing his job nor parenting as well as he wanted to. He decided to devote himself full time to the latter.

“It was kind of becoming a no-brainer because my wife’s career was going so well,” he says.

The Kellys are now starting their third year in London, where Natalie serves as the payments company’s chief risk officer for Europe. Chip considered going back to work a few years ago, but so far has decided against that because his family relies on his being at home.

“I’m like the safety net for a trapeze artist,” he says. “You don’t think about it unless they take it away.”

Kathleen McCarthy Baldwin, Blackstone’s global co-head of real estate, was nursing her second child in 2015 when her husband, Matt Baldwin, left his job as the CFO of a research firm and decided to take some time off.

“The idea of him not working made me very anxious, mostly because of my fears about what it would do to our marriage,” she says. “Would I be envious that he had more time with the children? Would he resent that I had this really exciting and demanding job?”

Matt told her he wasn’t worried. After spending a summer with their daughters at the Jersey Shore while Kathleen mostly worked in the city, Matt decided to make the change permanent.

These days, he rises at 5:30 a.m., before the rest of the house is awake. He makes oatmeal for the family four mornings a week, giving himself one morning off. On most days, Kathleen takes the girls to school while Matt goes indoor rock climbing.

After school, he and their nanny divide the responsibilities, with one taking the older daughter to sports practice, drama and guitar lessons and the other transporting the younger one to swimming lessons, violin and dance. Matt, who has become a skilled cook, usually makes dinner. Specialties include salmon, soft-cooked eggs and spicy pasta.

Kathleen says her husband’s decision to stay home created the flexibility for her to pursue other interests outside work, such as serving on the board of an anti-hunger nonprofit.

“When I talk with other women in this position, we all say our husbands are a very special breed,” she says. “They don’t define themselves by their jobs.”

Awkward moments

Not all men are as comfortable in the position.

One stay-at-home dad whose wife works in private wealth at an investment bank says he sometimes tells other men that he manages real estate—technically true because the family owns a few buildings. He says he can identify other men in his position at private-school functions when they say they “manage investments” or “run a boutique hedge fund.”

“We’re all out there, but we can’t say anything about it,” he says.

Paul Sullivan has been trying to change that. He founded a group called the Company of Dads after leaving his job as a columnist for the New York Times in 2021. Sullivan’s wife runs an asset-management firm and became very busy with work after the Covid-19 pandemic.

Sullivan already defined himself as what he dubs a “lead dad,” the go-to parent for everything from playdates and doctors’ appointments. But he found no support groups for men in his position. He reached out to senior female executives and asked them about the idea of creating one. They approved. Some said their husbands didn’t help enough. Others said their husband’s friends made fun of them, calling them names like “Mr. Mom.”

“Two things can be true at once,” Sullivan says. “Moms can be discriminated against in the workplace, and dads can be afraid to take a lead role at home.”

Sullivan now organises events for lead dads such as a Father’s Day beer fest and a March Madness get-together. He gives talks at workplaces and hosts a podcast on which he interviews therapists, parenting coaches and fatherhood advocates. He counts the husbands of Goldman Sachs partners, JPMorgan Chase managing directors and top law partners among his members.

For the Donohoes, having Matt at home has meant that he has developed a close bond with his children. Suzanne says it has given her credibility with her colleagues when she needs to attend one of their doctor’s appointments or sporting events.

There are still mix-ups. Schools often call Suzanne first if one of the children is sick or needs permission to do something even though Matt is listed first on contact forms. Once it happened when she was in London on business. She gently asked the school administrator to call her husband. He was at their apartment five minutes away.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.